Directory UMM :Data Elmu:jurnal:I:International Review of Law and Economics:Vol20.Issue2.Jun2000:

Teks penuh

Gambar

Dokumen terkait

In contrast to such evidence, empirical studies examining the unconditional value-relevance of board composition have concluded that having more outside directors on the board does

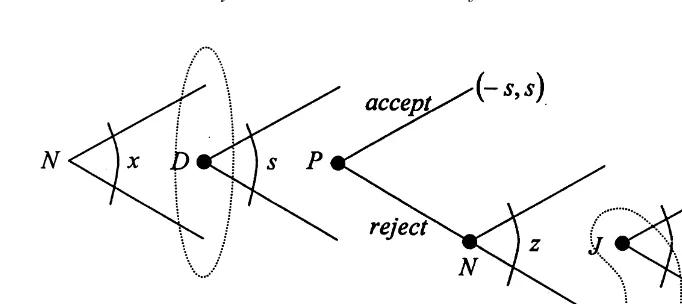

Some of our results are: (a) for a defendant clearly in the majority, awarding peremptory challenges is unlikely to be optimal because of increased wrongful acquittal costs; (b) for

In this article, we characterize the marginal effects of an increase in product liability for several indicators of industry structure: output per firm (for various cost types),

This article analyzes for the pharmaceutical market in the United States, the United Kingdom, Germany, and Japan: (a) the determinants of generic entry; (b) the determinants of

In what is probably the most realistic case, neither strict adherence to the per se rule nor a complete compliance defense, as in case 3 no categorical prediction could be

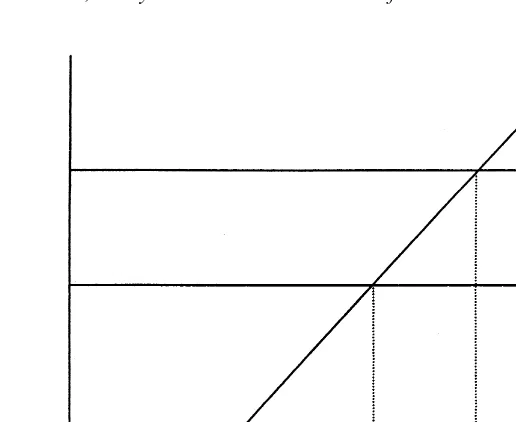

This paper has combined the standard asymmetric information model of litigation and settlement with techniques from the self-selection literature to derive the conditions under which

We will demonstrate that the maximum ODE-stable set is characterized by the combination of the following three conditions: (1) the autoregressive coefficient matrix in the

We show that (1) joint ownership can be superior to the other ownership structures by overcoming vertical externality of double marginalization; (2) collusive outcomes, however,