Quantitative Finance authors titles recent submissions

Teks penuh

Gambar

Dokumen terkait

On the existence of optimal portfolios for the utility maxi- mization problem in discrete time financial market models. In From stochastic calculus to mathematical finance ,

We consider the optimal portfolio problem where the interest rate is stochastic and the agent has insider information on its value at a finite terminal time.. The agent’s objective

if a country appears in a large number of dif- ferent communities in the multi-network (and thus is never isolated) then it relies on several different clusters of country-product

If poor agents pay higher tax rates than rich agents, eventually all wealth becomes concentrated in the hands of a single agent.. By contrast, if poor agents are subject to lower

With only minimal ingredients, this model is able to capture the aggregate e ff ect of idiosyncratic shocks to aver- aged economic output growth measures.. It thereby establishes

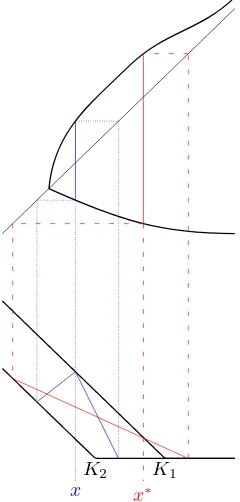

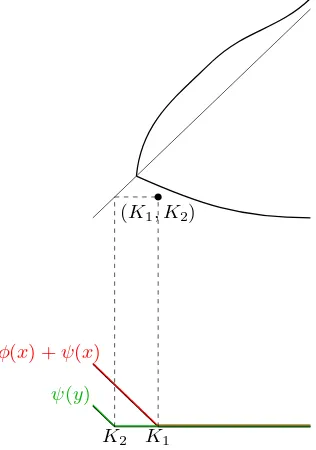

We study in this paper a class of constrained linear-quadratic (LQ) optimal control problem formu- lations for the scalar-state stochastic system with multiplicative noise, which

∗ Corresponding author, [email protected].. using the analytical approaches developed in the cross-disciplinary research fields in- volving econophysics and

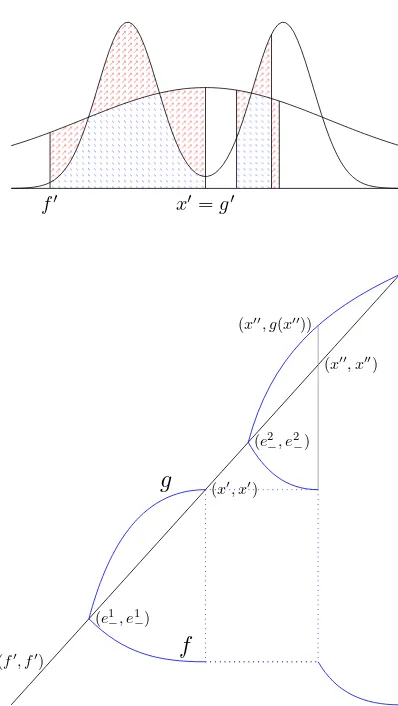

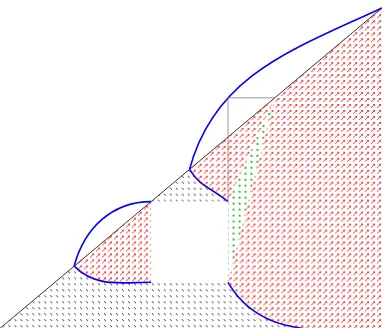

We then apply this result to the stopping problem of a geometric Brownian motion and a RDU type of payoff functional involving probability distortion, whose pre-committed stop-