Topic: Submission of internship report on "Loan Management of Mutual Trust Bank: A Study on the Main Branch". I have tried to show every reality that I have recovered through my entry level position in Main Branch, Dhaka in Mutual Trust Bank Ltd. Despite the fact that I have seen some limitations in the definition of this report, I am completely satisfied with the creation of this report, which has contributed fundamentally to my understanding of how the exercises of credit leaders are carried out and the practices of related data. the money in Mutual Trust Bank Ltd.

I further certify that to my knowledge the work set forth in this examination is unique and that no part or whole of the report has been submitted to another college or foundation or any degree or any certificate or any other reason. This is to ensure that it is the temporary job, provide details on "Credit Management of Mutual Trust Bank Limited: An Inquiry into Main Branch." For incomplete Mutual Trust Bank Limited: An Inquiry on Main Branch." For incomplete satisfaction of the level of Bachelor of Business Administration (BBA), major in Finance from the Daffodil International University completed by Wasifa Noor Siddiqua ID under my guidance and supervision this report None part of the entry level position report has not been submitted accordingly for any level of confirmation, title or recognition before.

The company had also previously received a certificate of commencement of business on the same day and on 5th October 1999 it was granted a license by the Bangladesh Bank under the Banking Companies Act 1991 and commenced banking operations on 24th October 1999. Currently, Mutual Trust Bank Limited has 112 branches, more than 165 ATMs in our country. This report depends on the layaway framework of the board and the fixation is given at the main branch of Mutual Trust Bank. In some areas, the bank's operations are good compared to the previous year, but the bank's position has worsened in some areas.

The supervisory group and the best dimension expert and officials of the bank should therefore be concerned about the administration ability of the bank that can benefit more and more for its partners.

INTRODUCTION

BACKGROUND OF THE STUDY

SCOPE OF STUDY

It was difficult to collect information relevant to my report considering the fact that the general population of this bank was so busy with their obligations that they could not be competent to give me time to mess up but they give me their valuable time so that the means of giving the necessary information and assistance in the whole report.

OBJECTIVES OF THE STUDY

METHODOLOGY

PRIMARY SOURCES

SECONDARY SOURCES

RATIONALE OF THE STUDY

LIMITATIONS OF THE STUDY

ORGANIZATION

HISTORY OF MTBL

OBJECTIVES OF MTBL

To improve the housing preference of the team with limited earnings through the provision of consumer credit. To finance the industry, change and trade in any traditional way and using the buyer friendly deposit service. To inspire young entrepreneurs for investment and thereby improve the country's entrepreneurship quarter and make a contribution to monetary development.

VISION

MISSION

CORE VALUES

To give impetus to foreign exchange business such as buying and promoting foreign currencies, issuing checks to vacationers, issuing global credit cards etc. Employees – We depend on the employee's inherent merits and respect our relationship as part of this renowned economic institution. As a bank, we make decisions solely through the fruitful performance of our tasks; we expect and understand this judgment structure.

We are tasked with providing the least demanding dimension of administration in addition to meeting the strict needs of administrative models and good business evidence. We can see things from new perspectives; we are available to exchange and are not sure with methods of how we have achieved problems before.

HIERARCHY OF POSITION STRUCTURE OF MTBL

Organ gram of MTBL

PRODUCTS & SERVICES OF MTBL

OPERATIONAL NETWORK ORGANOGRAM

INANCIAL PERFORMANCE

FINANCIAL INCLUSION GROWTH

SWOT ANALYSIS OF MTBL

CREDIT

FACTORS CONSIDERED FOR CREDIT

SIGNIFICANCE OF CREDIT

CREDIT MANAGEMENT

Most importantly, I would like to thank the almighty ALLAH for giving me the solidarity to perform my duties as an understudy and complete the report within the stipulated time. In the midst of carrying out this research I have been extremely lucky to get real help, support, guidance, aid, suggestions and direction from various righteous people who are really involved in this field. Mohammed Masum Iqbal, Daffodil International University for her consistent and patient direction, strengthening motivation and profitable recommendations.

Mohiuddin Chowdhury, Assistant Vice President of the Archives, who helped me immensely in preparing my report. I may also like to pay tribute to Mahajabeen Zaman, Assistant Officer (General) Archives, the persons who helped me a lot in understanding and doing office work at the Archives and also arranging reports. Finally, I would like to thank everyone who helped me lead entry-level position work and develop this report.

On September 29, 1999, the company was defined as a joint-stock company under the Companies Act 1994. Despite the fact that for banks and money foundations, loans are the leading key factor to be controlled. After investigating in the general review, it is usually discovered that executive-led credit must be a breakthrough process that enables banks to proactively monitor advanced portfolios to limit mishaps and obtain the appropriate dimension of returns for investors.

I also look at a key part of the lending industry and dissect their current situation depending on productivity. Credit organization is a dynamic order where a long-term arrangement without any doubt undoubtedly understood is expected to divide the store among different controls and limit the opportunities and increase the arrival on the contributed reserve. The comprehensive performance in the FICO assessment depends on the banks' approach to reserve funds, arranging credit, control, supervision and follow-up of the home loan and advances.

CREDIT POLICY OF MTB

Continuous supervision, monitoring and follow-up are particularly necessary to ensure highly coordinated reimbursement and limit non-payment. Consequently, in breaking down MTB's store board, it is necessary to examine its store strategy, FICO scoring system, and impressive reserve fund portfolio.

PRINCIPLES OF CREDIT

Expand the store office based on adequate pre-financing studies and customer repayment capacity.

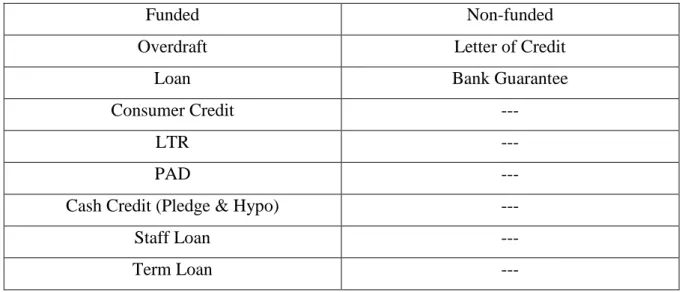

TYPE OF CREDIT ACTIVITIES

CLASSIFICATION ON THE BASIS OF TIME

APPLICATION BASED CATEGORIES OF LOAN

Transient small scale credits are the credits that do not exceed BDT taka 25 thousand) only and repayable within a year. This kind of advance is given out for business anyway, the amount borrowed never again exceeds BDT. The amount that is claimed directly here serves the reason for possible (fractional) working capital for small and medium business ventures.

Retail credits are given as an option for private use than for large business purposes.

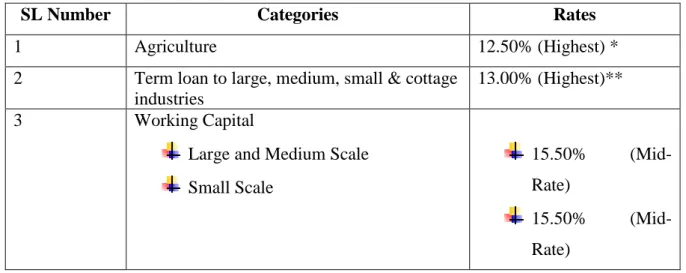

RATES OF INTEREST AND LENDING

CREDIT POLICY OF MTBL

SANCTION OF CREDIT MANAGEMENT OF MTBL

CLASSIFICATION OF LOANS

SECURITY OF LOAN

APPROVAL PROCESS

LENDING PROCEDURE

At this stage, the loan examination is critical as it requires the determination of the right and subjective of the borrower. Select the borrower, the limited individual of mutual trust bank in the first meeting with the individual to judge their capacity. Appropriate documentation is critical at this stage for the credit bureau's security to be extended to MTBL to exchange the advance risk in the event of borrower default.

RECOVERY PROCEDURE

In the event that the borrower has not paid the required advance on time, the initial segment of the bank at that point is private correspondence with him. All things considered, the bank can issue an admonition to the borrower for repayment of advance. Recovery strategy of Mutual Trust Bank is the last mixture of the time, effort of cash.

ANALYSIS OF CREDIT

PROBLEMS IDENTIFIED

RECOMMENDATIONS

CONCLUSION

To achieve the previously mentioned goals of the bank, the fund task is of primary importance, since the best offer of full pay for the money-related fund is produced from the one that is established the greatest danger in it, and even the very presence of monetary organization depends of reasonable administration of its reserve fund portfolio. Given the rapidly changing, powerful worldwide economy and the growing concern for globalization, progress, unification and disintermediation, it is indispensable that the Mutual Trust bank controlled has a solid stock hazard for the director's protection strategies and methods that are sensitive to these changes.