THE NETWOK TIANGLE AND SCIETAL SECTOR INSTITUfIONS

METHODOLOGICAL APPROACH ON ISLAMIC MICROFINANCE TO MICRO

ENTEPENEURS IN INDONESIA

Muiay isyah

Faculty of Economic and Business IN Sf idaatullah Jta

BSTACT

Isac iae pt s sd y Musim ig s, h ae y 'isd in e sse

ad at if all in e atm m Isac uk ad iae ysm wh e ro s. s

ar aim to fs n e e f Isac iae ad is al to e iaig for e ro

es in Muslim ss sh as in IS. e jie f e ar s to ie aiss f

Isac iae ysm y ,g an w f e arsts ad prs f Isac iae

S'sm ad is istital ks at ae idd in ,g iaal sus to or s� eirs in Muslim scits suh as I S. In , to ,n hat Isac ia: s e rmt

ftie ss to ro s' iaal s, fsig n dr aiuts hat e apial t ae

sig ad sw as, y sig e pt f sl istits win e Nk Tae

�l h. Te asiiliy f iig a iacig ysm wh e k ae ad sal

istits pt xpaid at Isac iae d fuae usul is to e c h ad y auatm in e Muslim d ;aly in Id5.

Keyword· k tnag, Isac ia, ro s

1.

INTRODUCTION

Islamic icrofinance represents the convergence of two rapidly grong industies, microfnance and Islamic finance. Islamic finnce as a worldwide phenomenon, which is nvolving Islamic banking, variety of institutions and instnunents, plas in1portant role to the microfinance sstem especially when it comes to providing finncial access for the poor. The paper t1y to determine various aspects about Islaic microfinance to micro entreprenew-s, and how Islamic banking and microfinance could be the ey to provide fin,mcil access for millions of poor or micro entrepreneurs especially in Muslim developing countries and societies such as Indonesia.

TE NEWORK TRIANGEL D SOGETAL SETOR INSTilONS EHOOOLOGICAL APPROAGI ON ISLAICIROFINNE TO IRO ENTREPRENERS IN INDONESIA

of how Islamic microf innce represent effective solutions to rucro entrepreneus financial needs, focusing on their activities that lack capital but are promising.

2.

METHODOLOGY

his paper uses quaitative methodology to gather an in-depth undestanding about networks and societal sector institutions in relation with the financing for micro entrepeneurs by Islamic microf inance system and how its influence in the Muslim world in general nd in the context of Indonesian society.

In order to study the issue by using the qualitative methodology, this paper divides into four sections. The fist section includes a bief description of Islamic banking and different investment modes used by Islic banks. Second section includes a brief dscussion about icro fnance as a contetual review and Islamic microfinance as a different concept. The third section includes a brief description about the concept of networks and societal sector institutions. he last section of the paper includes discussions about vaious issues of how Islic microf inance pomotes different network relationships and the influence of societal sector institutions in Islamic microfinance. In each sections also includes desciptions within the context of Indonesian society that might provide compaison and cetain differences within the general context.

The result of this qualitative study reflects the view of how Islamic bng and microf inance system, if properly in1plemented, will help in promote and complement the development of micro entrepreneurs in the Muslin1 world including Indonesia.

3. ANALYSIS a. Islamic Banking

In the past few decades, Islamic bnking ,nd institutions have developed in many counties including the United States and United Kingdom. In certain countries such as Iran, Sudan, and Pakistan, most of their financial inte1mediaries confo1111 to the principles of Islaic law, as defined by local authorities. In most other counties such as Indonesia, whee Muslims constitute the majority of the population, Islamic transactions and institutions make up a small pat of the total and must compete with conventional financial institutions. Because of this reason, many involved n Islamic banking, would like to minize the differences between

Islanuc and conventional banking. However, the basic pri

nciple of Islam.ic banking is different with the conventional one because all financial transactions dealings with the Islamic banking system have to avoid nterest. As interest is prohibited n Islam, Islanuc bank cannot be justified or sin1plyconverge with the conventional ones.

1. An Islaic Banc: A Bank ithout Inteest

Jumal Erikonomi Vol. 12 No. 2 Agustus 2013

-·-An Islamic bank my be defined as a financial ntemediy whose objectives and operations s ell as pnciples and practices mst confom to the pnciples of Islmic law; and consequently, is conditioned to operate all its activities without interest (Alam, 2001). The introduction of Islic banking in modem wold is bsed on the principles of Islamic econ0mics. A, 0L,1,rved by Mola et.al. (1988), the ·aim of Islaic econoi�, is not oly the elimination of interest-bsed transactions but also the establishment of just and blanced social order free from all kinds of exploitation.

Schaf (1983) explained that Islamic banks could make a seful contibution to economic growth and development paticularly in a situation of recession, stagflation and low-growth level because the core of their operation is oriented towards productive investment. Practical and mmediate co-opeation possibiliy eists between Islmic banks and enteprises all over the world. he possibiliy of introducing an inteest-free financing system through Islamic banking principle, Scharf (1983) also argues that the establislunent of Islamic financial sstem bsed on the prnciple of shaiah is not only feasible but also profitable.

Financial intermediation in Islaic banking between the bank and the client takes place as a patner ather than debtor-creditor relationship as in conventional banks. Accordng to Alam (2000), the financial activities of modem conventional banks are based on relationships between depositors and bank on the one hand and between the borrower and the bank on the other hand. Conventional banks regard interest s the price of credit reflecting the oppommiy cost of money. Banking in an Islamic framework could not be based on the debtor-crediror relationships as interest is prohibited in Islam. This principle is appicable to two main factors of production, i.e. labor and capital. According to this principle, as no payment is allowed to labor, unless it is applied to work, no rew,u·d for capital should be allowed, unless it is exposed to business isk From these two principles of the theoretical basis of Islamic baing, it may be said that Islaic financial relationships are of a paticipatory nature {Ahmad, 199 3). Based on the interest-free financing principle, business practices especially sources and uses of bank's ftmd, there are several different modes of investments used by Islamic banks.

Investment Modes Used By Islamic Banks

Investment modes in Islamic Banking are done in several main ways (Zaher and assan, 2001):

(1). Mudaaba or capital inancing

Mudaraba is a trust based financing agreement whereby an investor (Islanuc bak) entrusts capital to an agent (Mudarib) for a project. Profits are based on a pre-anged and agreed on a ratio. This agreement is akin to the Westen style limited partnerslup, ith one paty

E NEWOK TRIANGEL AND SOOETAL SETOR INSTITUTIONS EHODOLOGICAL APPROAI ON ISLAIC IROFINNE TO IRO ENTREPRENERS IN INDONESIA

retn on its investment and the agent receives no compensation for his (her) effort".In this kind of contract, all the financial responsibilities rely on the business itself: the financial institution invests on an idea, a project nd shaes its fate.

(2).

Mushaaka or patneship inancingThis contract is very similar to a jont venture ith paticipation financing. "Two pties provide capi:al fc: a projc:: which beth ma;; c..,-.;:. Profit; are shared in pre-agreec. he peculiar aspect ratios but losses are bone in propotion to equity paticipation" of this contract is not the shing the profit and losses, but sharing the management and the decision making process.

(3). Muabaha or mak-up ( coss-plus poit based inancing)

his constitutes one of the most well known Islamic products, consisting in a cost-plus profit financing transaction in which a tangible asset is purchased by an Islamic institution at the request of its customer from a suppier. he Islamic institution then sells the asset to its customer on a deferred sale basis with a mark-up reflecting the institution's profit. ( 4). Ijaah (leasing) and Ijaa wa-Iqtina (leasing puchase)

hese concepts are very close to the Westen idea of leasing. In the fist case, the finncial institution leases an asset to its customer agreeing on lease payments for a cetain period but excluding the option of ownership for the client. In the second case, the client has the option ownership by buying the asset from the financial institution. The conditions govening both tpes of leasing are that assets must have a long or secure productive life, and must not be handled in an un-Islanuc way, meaning that the lease payments must be agreed on in advance to avoid any speculation.

(5). Bai-Muajjal or cost plus sales under defen-ed payment

The Bai-Muajjal mode of investment is as W.e as Murabaha mode of investment with an exception that the sale under this cost-plus sale modes investment is made on a credit basis rather thn cash (Alam, 2002).

( 6). Bai-Salam or advance puchase.

Under bai-Salam mode of nvestment the bank puchases industrial and agriculture products in advance from ther customes. The_ main features of thie mode ar

e: the p1�ce is nonnally paid ith the execution of an arangement, and according to the terms of egreement the bank receives the goods in due ti.me (Alan1, 2002).

(7).

Quard E Hasan or inte1est fee loan given to the needy people.110

i

I�

Junal Etikonomi Vol. 12 No. 2 Agustus 2013 __

to help needy peple in a society in order to make them self-sufficient and to raise their income and standars of iving (Alam, 2002).

2. Islamic Banking In Indonesia

Indonesia, with the world's lgest population of Muslims, has come to Islamic banking a.,. a slow stat and lach: bel.nd cou,pare to �1alays�a a.1! ;ingapo.�. he fist Islamic cooperatives were established in Indonesia in 1990, followed by al banks n 1991 and an Islamic commercial bank (IB) in 1992.

According to Timberg (2004), Islamic bankng in Indonesia has some nusual characteristics. Like most microfinance institutions in Indonesia, Islamic institutios, micro or otherwise, are geneally private, for-pofit institutions based on the intemediation of depositor funds secured on a competitive market. In this they are different from microfinance institutions n almost every other county in the world. They typically have no explicit social goal other than profit mation and conf oity with Islam, though n some cases a social element is present, as we ill see. Social impacts re thus the result of the market impacts of the Islamic nstitutions. Many Islamic institutions in Indonesia, particularly Bait Maal Wat Tamwil (BT, Islamic financial cooperatives) are located in

l

areas and provide agricultural financing. Nonetheless, the focus of Indonesian Islamic financial institutions is typically urban and geared toward the financing of trading operations.a. Islamic Commecial Banks

The market leades in Islic finance in Indonesia are the Islamic conunercial banks. DUi.ng the repotng period, 1991-2003, they focused on medium and large-scale finance. As of 2003, they accounted for a mere 0.74% of total assets of the banking sector. However, du.ring 2001-2003 ther share had increased from 0.17% to 0.74% and stood at 2.19% in Dec 2005 (see Table.1). Ctu-rently, there are 5 Islan1.ic commercial banks ncludng the Bank Muamalat, which has been functionng since 1992 as the fist Islaic commercial bank in Indonesia (see Table.2).

Accordng to Seibel (2007), the growth of Islanuc fnance in Indonesia is mainly due to an expansion of supply, gladly accepted, rather than broad popular demand. When Bank Indonesia, the central bank, commissioned swveys in provinces with an average Muslim population of 97%, it fond that only 11 % undestood products and benefits of Islamic banlcing. It concluded that, "There is stll a gap between needs and knowledge of Islamic financial products and services. The gap could delay the success to mobze potential public fund to investment because of low switching rate from potential demand to real demand. Furrhennore, the gap ill also mke marketing and selling effort for Islamic banking products and services more ifficult1".

Junal Erionomi Vol. 12 No. 2 Astus 2013

Il

c. Islamic Financial oopeatives

ccording to Siebel (2007), the development of Islamic bnking in Indonesia has been palleled by that of Islamic financial cooperatives. hey evolved in seveal stages. he fist Islmic coopeative was established in 1990. After 1995 PIBK, an NGO, stated pomoting Islamic cooperatives. here were big jumps in numbes dng the cisis eas 1997 and 1998, followeJ bya slowing-down, stagnation and declinv(.,ee able.3).

Table.3

The Evolution of Islamic oopeatives

-�lo.

Phae Peiod Number of BMT1

lnlUal growth

1990-"1995 3002 Rapid growh promoted by PINBUK 1996

700

1997 1501

6f"l998

2470

3 Slowing-dwn of aowh 2000 2,938

Stagnation

and declt11e 2001 3,0372003 2856

Source; Seibel, 2007

In sum, the outreach of Islamic coopeatives is negligible, their overl pe1formance poor (Seibel, 2007) because;

• here is a lack of regulation, supervision and reliable reportng.

• The large majority of Islamic cooperatives is donnant or technically bankrupt.

• Their outreach is negigible, accounting for 7.2% of all financial cooperatives, but less thn

1 % of bon-ower outreach of the sector; their loan potfoEo (much of it overdue) accounts for 1.1 % of the financial cooperative sector and 0.19% of the m.icrofinance sector.

• 111e savings of the depositos are at great 1isk.

Overall there is little difference in peformance between conventionl and Islamic cooperatives, the latter having inherited most of their problems from the f01mer.

• No remedy is in sight, except in the framework of a total overhaul of the cooperative system.

E NEWOK TIANGEL AND SOQETAL SECTOR INSTITTIONS ETI-IODOLOGICL APPROA-I ON ISLAIC IROFINNE TO IRO EEPENERS IN INDONESIA

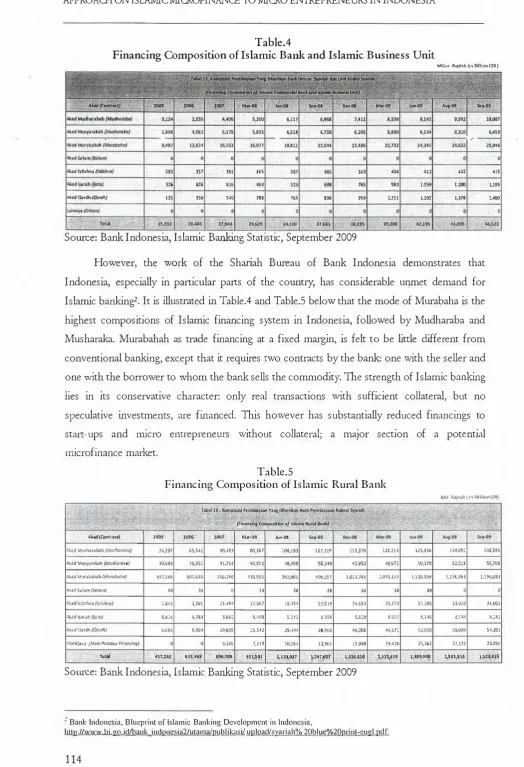

Table.4

Financing Composition of Islamic Bak and Islaic Business Unit

Mlli;u lup!-Jtl {in Sllli:,nlOR}

>d lsdsfl, /btlhn•J .337 3S1 365 359 4Jl

3!6 836 516 165 . %2 l,C59 ).10 Ahd Qardh (OardlJ Ill 2SO 540 78! 165 336 959 l,?11 l,?Ol 1,318

Soce: Bank Indonesia, Islamic Baing Statistic, September 2009

However, the work of the Shaiah Bureau of Bank Indonesia demonstrates that Indonesia, especially in particular pats of the conty, has considerable unmet demand for Islamic banking2• It is illustated in T able.4 and Table.5 below that the mode of Murabaha is the highest compositions of Islamic financing sstem in Indonesia, folowed by Mudharaba and Musharaka, Murabahah as trade financing at a fixed margin, is felt to be ittle different from conventional banking, except that it requires two contracts by the bank: one with the seller and one with the borrower to whom the bank sells the commodity. he strength of Islamic baing lies in its conservative character: only real tansactions with sufficient collateral, but no speculative investments, are financed. This however has substantially reduced fin:rncings to st,u:- ups and micro emreprenems without collateal; a mjor section of a potential microf inance market.

Table.5

Financing Composition of Islamic Rual Bank

A d {cntnxf} 1005 l�O� zo, M0! fan·OS

'1S

l.195

1,40

A,JJ i•�Utih1rJi'lh (Mu(!ha/ilti) N,2)7 61,342 0.<il 80,367 i08,t93 121,H� 1H,37S 11t,211 1}5.338 1.:r1,s11 US,$95 AA!d Mt:w.:r1lh (Mi:lr,c,uta}

,·�.uJ !.\lti:&t,oh f1.JJ�ufio)

-\�Jd SJ!im /�!or.iJ 4-id ls!i�h11J (.i';Jwc)

f\Ud !jar Jh (,/�re} �rd "lndh ;c,:H1}

f,:uu1Ja�, (,\•ulri Pitpos: ,,,.;r.C.'tJ)

. ',>totl '

:., ·'

·10,065 :Ei,351

H7,56£, S05,6B

90 ,o

l!4; l,36!

&.�.- �J$)

�i Et 9.96�

��7�Sl GlS,�6_9

Sotuce: Bank Indonesia, Islamic

41.114 •\O,lll ·1S;3S$ 50,HO 42.952 :s,:.

716.HO 71S,Q�S 90296S �9:,1$1 l,OH./43 l,Oll,17/

39 3S ,S 38 u

13,4" 11,i61 lSA�H 12.0l� 2<1.6Sl 1s.n>

!.6E: > • .:�o 5)11 6.SS! S.S!8 6.55/

l'l,038 ?,,5.11 !),.J,44 )0,S66 40,30$ li,Sll

S.lU6 7,119 !0,26� 13,361 l7,9S.i !9,4!0

$90,79. � !S1�-�1 ),1:n�o,�,

. /S l,,.247;S1 ·c,.,._ 1,2ss.i1� .�03li,JU

Banking Statistic, September 2009

1 Bank Indonesia, Bluep1int of Islamic Banking Development in Indonesia,

http://www.bi.go.ibank indonesia2/utama/publikas/ upload/sva1iah% 20blue%20p1int-cngl.pdf.

114

10.110 52,Sll 52,}0G

l.ll0/SS1 1.1n.so� U9633

H

27.?Si 33,0!0 3•,65,

S.14� e.1 ... 1 8,lSl SUOl $5,0JI >.t.]01

.5,762 17,132 23,0SS

!

i"

Junal Etikonoi Vol. 12 No. 2 Agustus 2013

-Althogh Indonesian-banking sstem hs a slow stat and lack behind Malaysia, along with Singapore, Bank Indonesia's official still believes that Indonesia could improve its Islamic

banking sstem and l become the lgest one in SEAN regions. As its growth ate in 2009

has increased up to 35.6%, while the global Islamic banking system growth is oly about 15%

to 20% (Nibra, 2009). he deputy Director of Shaiah Division of Bank Indonesi, Mula E.

Sirega,., has predicted that away fowrd, Islamic banking sstem in Indonesia will be improved. heefore, there is a need of mapping stategy in order to aim the right target of Islamic bank's market share, by implementing good coporate govenance in Islamic banking operation

petaining to human capital and I T (Nib, 2009).

Mico Finance

1. Micoinance: A onteual Review3

Microfinance emerged in the 1970s as social innovatos began to offer financil sevices to the working poor - those who were previously considered "unbankable" becase of their lack of collateral. The most common microf inance product is a microcredit loan- usually less than US$ 100. his tiny loans are enough for hardworng micro-entrepreneus to stan or expand small businesses, or buying wholesale products to sell in a market. Income from these businesses provides bener food, housing, health cre and education for entire families, and most important, additional ncome provides hope for a bener future.

Microfinance institutions (Fis) eist in many forms, credit unions, commercial banks and most often, non govemental organizations (NGOs). Many microfinance institutions use social collateral in the fon1 of peer groups to ensure loan repament. Microcredit loan cycles ar

e usually shorter than traditional comercial loans - tpically six months to a year with paments plus interest, due weekly. Shaner loan cycles and weekly payments help the borrowes stay cuTent and not become overwhelmed by lge paments. The global repayment rate for rnicrocredit lons is higher than 95%, which allows MFis to re-lend these funds to even more clients. During the past 30 yeas, microfinance has been proven to be a powerful poverty alleviation tool. It is one of the development tools with the potential to be financially self-s uself-starung.

Even though the industy has demonstrated that MFis can self-sustaining business, most

still rely on a .ted pool of donor dollars. Without access to ca.ital, groth traditionally stops

once initial grant money is distributed as microcredit loans. Even after more than 30 years of industry effot, 80 percent of the woring poor are stil without access to microfinance services. At current growth rates, the gap will not closed for decades. Fis must access lge amounts of capital to expand their operations and provide lons and other financial products to

3

Alnm, Mohammed Nu1ul (2009), Micofinance: An Innovative Solution, slamic Banking. Net11"0rki11g all(f Micro

E NETWORK RIANGEL AND SOOETAL SECTOR INSITmONS EHODOLOGICAL APPROA-I ON ISLAIC IROFINANE TO IRO EREPRENES IN IDONESIA

damatically more clients. These lge amounts of capital are accessible only through the formal capitl markets, and curently most Fis have neither the track record nor the clearly aticulated bsness plan to atact this funding. Thus, for micofnance to achieve its potetial as global povety alleviation tool, the microf inance industy mst grow scale.

2. Islamic Micoinance

Islar,,;; icrofo,ance 1cf,1tS1,u.s the cunfluence of icrofinan .. e and Islaic finance. According to Kaim et. al. (2008), Islamic microfinance has the potential to not only respond to unmet demand but also to combine the Islamic social pnciple of cang for the less fotunate with microfinance's power to provide fnancial access to the poor.

Between the most complete reseaches on the topic, Dhumale and Sapcanin

{1999)

dfted a techical note in which they tied to anale how to combine Islamic bking ith

icrofinnce. They took into consideration the three main instruments of Islaic finance, mudaaba, mushaka and mabha, trng to use them as tools to design a successful icrofinance pogam (Segado, 2005):

a ). Mudaaba model: the micofinance program and the microenteprise are patners, with the program investing money and the micro entrepreneus investng in labor. The micro entrepreneur is rewarded for his/her work and shares the profit while the progam only shares the pofit. Of corse the model presents a series of difficulties, given most of all by

the fact that micro entreprenems usully do not keep accurate accountabiliy which makes it

more difficult to establish the exact share of profit. As stated before the, these models are complicated to U1derstand, manage and handle which implies that those who are involved need specific tng on the issues. For this reason, and for an easier management of the profit shring scheme, the muda.raba model might be more straightforward for businesses ·with a longer profit ccle.

b).Muabaha model: under such contract, the microfinance program bus goods and resells them to the microente.prises for the cost of the goods plus a markup for administrative costs. TI1e borower often pays for the goods in equal nstallments, and the microfinance program owns the goods until the last installment is paid.

c ). Mushaaka model: a profit sharing joint venture, designed to limit production or commercial activities of long duation. Under this contact, the bank and the micro entreprenems contribute capital jointly, managerial expertise and other essential services at agreed portions. Profit and losses are shed according to the contract agreed upon. An individual parrner does not become liable for the losses caused by others.

Musharaka model is the most favoable finance model for micro entrepreneurs. Khalifa

& Shazali

{1988) caried out a study on the possibility of using mshaaka as the financial mode

for the Financial Oganizations (FOs) in the Islamic Financial Sstem (IFS) in Sudan, they

Jumal Etkonomi Vol. 12 No. 2 Asts 2013

argues that the mushaka finance model is considerable as an optimum isk mnagement stategy for the smll-scle fanes, since it does not equire collateal. Mushaka model is used by ral bsed Smal ottage Industies (SQ) ownes in Sudan, in many different field such as agriculture, industy, tade, manufacturing, marketng, amal production and sevices (Alam, 2007: p.13)4.

3. Micr0in«1C� an� Islamic .Micofo.1 . n:. i.1 Indofo!sia a. Micoinance in Indonesia

In Indonesia, micro fnance services are implemented by micro finance institutions that can be divided into two categories, i.e., bank and non-bank sectors. BRI (Peoples Bank of

Indonesia) and BPR Rural Bank) belong to bank sector, while non-bak sector cn be

classified into two nds: non-formal and formal. Formal category includes cooperative,

Lembaga Dana dan Kredit Pedesaan (LDKP/ rral credit financing institution), pawnshop, and

Badan Kredit Desa (BKD/ ural credit association). LDKP gets formal status fomal Pemda

.

(local govement) while BKD is supevised by BRI on behaf of BI (Central Bank of Indonesia). Classified into non-formal categoy, micro finance institutions are caried out by NGOs and self-help groups (Ismawan and Budiantoro, 2003).

he demand driven for micro finance development is so great, considering that 98.5% business entity in Indonesia or 41.8 million of business units are still in micro categoy, of which less than 10 million of business Lmits get finance sevices from fom1al market. The rest

are mostly trapped into iformal market called moneylenders. The interest rates chged by moneylenders are so high (ranging from 20%-50% per month). Different from many other

countries in which microfinance

is

developed by NGOs, .n Indonesia microfinancedevelopment role is hold by govenment. Unfornmately, the main weal.ness of government project is that it is not sustainable. Psychologically in encountering such a project, the people consider it as grant so that sometimes it is not repaid. Ftuthemore, the interest applied is subsidized which results in negative impact or disto1tion on microfinance (commecialization) industy (Ismawan and Budiantoro, 2003).

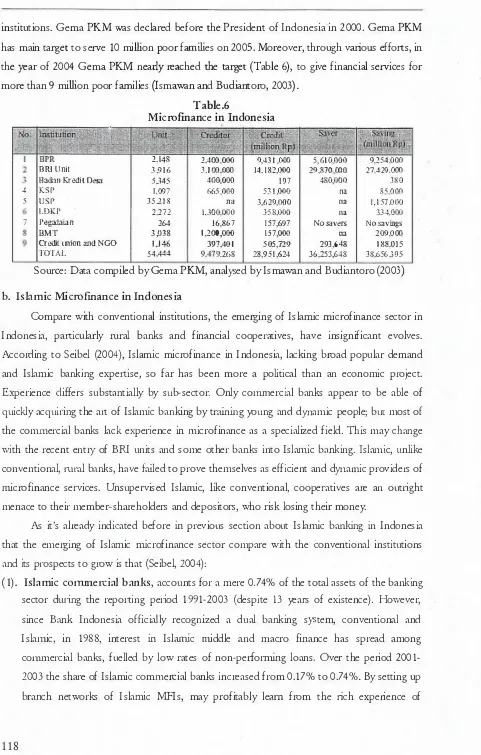

onsidering vaious nds of icrof inance in Indonesia, eventually it is often called as

microf inance laboratory in the world, and great need of development, a forum to develop microfinance is required. The objective of the forum is to build microf inance as industry to reach the poor widely. For that reason, Gema PKM 11e Indonesian Movement for Microfinance Development) as a forum consisting of 7 stal.eholdes, i.e., government, finance

institutions, NGOs, private sector, academicins/ researchers, mass orgzations, and hmdng

TE NETWOK TRIANGEL AND SOOETAL SETOR INSTI10NS EHODOLOGIAL APPROA1 ON ISLlC IROFINANE TO IRO E1REPRENERS IN INDONESIA

institutions. Gema PKM was declared befoe the President of Indonesia in 2000. Gema PKM has main taget to seve 10 miion poor famies on 2005. Moreover, through vios effots, in the ear of 2004 Gema PKM nearly reched the taget (Table 6), to give financial sevices for moe than 9 milion poor fmilies Ismawan and Budiantoro, 2003).

BRl Unit

Bad:m Krooit aa

4 .SP

5 USP

.DKP

7 Pegadaan

BMT

Crdil lllion d NGO

[image:12.596.81.562.35.790.2]TOTAL

Table.6

Micoinance in Indonesia

2J4S 2,400,00 9,431,00

3.916 3,I00,000 14.132,00

5r145 400,00 ))7

1.097 ,65,00 531,00

35,218 na 3,629,00 2.272 1�100,000 ]58.00

14 16,867 157,697

3,038 1,200,00 157,00 U6 397401 505,729

54,444 9,479,26.S 28,95 f.(,24

5,6!0,000 9,254,00

29.870.000 27,429.000

480,000 JSO

na 85.000

na 1,157,00

M 3J4,000

No savs N-0 avings a 209,000 293,643 188,015

JG,251,643 JS.,656,395 Source: Data compiled by Gema PKM, analsed by Ismawan and Budiantoro (2003)

b. Islamic Micoinance in Indonesia

ompare with conventional institutions, the emerging of Islaic icofinance sector in Indonesia, paticularly rural banks and financial cooperatives, have insignificant evolves. According to Seibel (2004), Islamic microfinance in Indonesia, lacking broad popular demand and Islamic banking expetise, so far has been more a political than an economic project. Experience differs substantially by sub-sector. Only conunercial banks appear to be able of

quickly acquiring the art of Islam_ic banking by tng young and dnamic people; bur most of

the commercial banks lack experience in microf inance as a specialized field. I1s may change

with the recent entry of BRI units and some other banks into Islamic banking. Islamic, unlike conventional, rnral banks, have fled to prove themselves as efficient and dynarnic providers of microfinance services. Unsupervised Islaic, like conventional, cooperatives are an outiight menace to their member-shreholdes and depositos, who risk losing their money.

As it's already indicated before n previous section about Islamic bing in Indonesia that the emerging of Islamic icrof inance sector compare with the conventional institutions and its prospects to grow is that (Seibel, 2004):

(1). Islamic conunecial banks, accounts for a mere 0.74% of the total assets of the banking sector dwing the reporting period 1991-2003 (despite 13 years of existence). However, since Bank Indonesia officilly recognized a dual banking sstem, conventional and

Islamic, in 1988, interest n Islamic middle and macro finance has spread among conunercial banks, fuelled by low rates of non-peforming loans. Over the period 2001-2003 the share of Islamic commercial banks increased from 0.17% to 0.74%. By setting up branch networks of Islamic Fis, may profitably len from the ich experience of

Jumal Etionomi Vol. 12 No. 2 Agusrus 2013

Departmental as well as nterdepartmental links within the orgazation are essential to promote the organzational efficiency and an intenal netwok plas an impotnt role in this respect by providng faclities to gow strong ties among ndividuls and groups in the ogzation.

c). Pesonal Network is a relation between pesons that is based on both social and business

activities. :Ccordng to Johannisson & Gustafsson

(1984),

pesonal networs rv_onstitutedby relationships based on trust and thus established through an elaborate leng pocess, encompassing both the joint history of the paties involved nd their assumed future.

d). Industial Networks is a elationship that takes place among all actos that are involved in making the industrial functions efficient and effective. Axelsson and Easton

(1994)

define industrial network in the following words, 'A network is a model or metaphor, which describes a number, usually a lge number, of entities, which are connected. In the case of industrial as opposed to, say, social, comunication or electrical networks, the entities are actos involved in the economic processes which convert esouces to fshed goods and services for consumption by end uses whether they be ndividuals or oganzation'.s

explicated by Johansson & akansson(1993,

cf. xelsson & Easton1994),

there are three classes of viables such as actos, activities and resources in industrial networs.e). Social Network

A social network consists of social tie or relations, which are from and chaacterzed by social norms, based on culture, family, relatives and friends and acquaintances. Social network

s

it is obseved by Anderson & arlos(1976),

'rests on the premise that a peson's social conduct, decision, process, orientation and attachment should be viewedin

the context of his network relationship'. A Social network can also be defined as a relationship that enables one to collect infonm1tion about the conduct and behavior of others in society.111e concept of different neworks as indicated before is shown

in

the figure.I below.Personal Network �,

lndusllial N!twork

�-T

Actors.

Activities

t

Resource

Figue. I

Concept of Networks • .

1

Social Network

-

t

NETWORKS

lnstnnnental Network Personal Network Symbolic Network

-l lnterorganizational Network I

I

3). Islamic Micoinance Netwok Relationships

Jumal Etikonomi Vol. 12 No. 2 Agustus 2013

-a). Islamic Micoinance Sysem Pomotes Difeent Netwoks

s it's indicated before from the previous section, Islamic microfinance promotes different network relationship such us:

(1).

Pesonal netwos are constituted by relationships based on tst. It means pesonal.dationsh:ps are d..:ep:1 noted .1 the mutual suppot, :.Spiration nd help each other.

Because in order to obtain the loan from the organation within Islamic microfinance ss!em, the setting of group is normally done with small scale industry ownes of the sme nature or related to the sme nits of productions.

(2).

Symbolic networs develop as the lending procedures of the Islamic microfinance sstemdevelops network relationships between sml scale industy ownes of siilar nature and backgronds that deeply ooted in the same religious, moal, political or ethnic goals that tie membes together.

(3). Social networks establish based on the personal and symbolic relationships close ties, trust and lllity among relatives, friends and vaious social groups intensifing the social networks within the small scale industy sstem. Thus it is concluded that like other networks, social networks also influence the institutionalization of the new saving habts among the rnral-based small scale industry owners.

(4). Intra-organzational network relationships are promoted immediately by the close ties an1ong workes within the organzations.

(5).

Inter-organizational network relationships establish smce the individual savmgs are organized and managed through group savings, an individual smll scale industry owner develops another relationship with other small scale indusuy owners. Furthe1more, since the entire saving activity and accumulation of required customers' deposits are supervised by the Islamic microfinance sstem organizations, ther extenal network relationships are extended to different organizational units in the smll scle industry system. Thus the small scale industry ownes not only extend their network relationships with the lending organizations within the Islamic microfinance system but also with clff erent small scale industry owners within the sstem. The newly develop saving habit of the small scale industry sstem ov.rners intensify both intra- and i.nter organiz.,tionl network relationships.TIE NEWORK TRIANGEL D SOOETAL SETOR INSTITIJTIONS EHODOLOGICAL PPROAI ON ISLIC IROFINANE TO IRO ENBEPRENES IN INDONESIA

ucro entrepreneus uuts in dfferent micro enterprises sstem, but also enable making the proper use of their borowed funds.

b ). The Iluence of Societal Sector Institutions in Islamic Micoinance

In promoting the network between the lendes and the borowers relates to the relationship between the Islic microf inance sstem and smal scale industy sstem, Alam

(2007) �escibes the network tr;anglc shuwn .1 the folk, Mng Ggr1-. i1is netwurk tingle does

not only consist of deeper lender-borower relationships ith different small scale industy sstem, but also of intense extenal network relationships ith vaious individuls and socials goups m society.

It is known that the process of evey individual small scale industry owner in the sstem of accumulating their pesonal savings in dfferent goups and depositing the same with the organizations in the Islamic icrofinance sstem intensifies and develops the degree of trstful pesonal networks. hat personal network are constituted by relationships based on trust which means that personal relationships are deeply rooted in the mutual suppot, inspiration and help to each other.

It is also known that the organizations in the Islamic microfinance sstem use both formal and formal procedures to collect information regarding small scale ndustry tmits n different small scale industry system. The organizations in the Islamic icrof inance sstem must colect information about borrowers from different sources like religious, social and local influential leaders. Thus, the info1al procedw·e makes the Islamic microfinance system Lmits famiiar to different groups of people n society and promotes various network relationships.

It also stimulates small scale industry owners to ncrease their network relationships with various individuals and social groups who act as informants to the organizations in the Islamic microfinance system. The extension of the network relations of the smll scale industry sstem to these groups fonning a triangle network consisting of the Islamic microf inance system, small scale industy sstem and the groups of local, social and religious leades.

c). Islamic Micoinance Newoks in Indonesia

Different from Islamic microfinance sstem in almost every other county, especially Sudn, Bangladesh, Turkey and Cprus, the informal procedure is not implemented in

Indonesia. Islamic microfinance sstem in Indonesia is still using the fo1mal procedure, same with the conventional ones. Formal means of maintaining lender-borower relationships and also collecting infonnation about customers is a westen practice that is uncommon m developing nations like Indonesia, due to their poor socio-economic infrastructure.

Many Islamic microf inance institutions in Indonesia are still using social collateral to

ensw·e loan repayment. In order to be qualfied for loans, the individual customes are not required to make groups and save a cenain amoLmt of money and deposit the same with the

Jumal Etionomi Vol. 12 No. 2 Agustus 2013

W

organizations in the Islamic icrofinance sstem in. In the lending procede, before give the lending funds, the financing organizations only relay on the documents and do not need to

obseve deeply the capacity of the smal scale indsty units who borow the funds.

After lenng the funds, the finncng organiations also do not need to execise proper supevsios and contol on the activities of the borowes, thus they could not zing the financing pob!,.,s.

Unlike formal, informal was of collecting information about the small scale industy units, characte�s the Islaic icrofinance sstem, since the information about the small scale industry units is collected from ifluential local leades or social and religious leades. Ths procedure stimulates small scle industry ownes to increse their network relationships with vaios individuals and social groups who act as informants to the organizations in the Islamic

icof inance sstem.

The financial orgnizations in a proper Islamic microfinance sstem also reqre the individual customer to setting of groups and save certain amount of money to be deposits with the fnancng organizations. This procedure immediately estabish trustful pesonal networks in the mutual support among group membes and develop the symbolic network, which deeply rooted from the same background that tie membes together.

In this financng mode, the financing organizations also tke initiative to guide customers to develop saving habits and take active part in educating cstomes to make proper use of the borrowed funds. With their teachings, close monitoring and direct supevisions of borrowes activities, the financing organizations promotes intense relationships with the borrowes. The dfferent financing modes and the distinguished lending policies followed by the organizations in the Islanlic financing system assist micro ente1prises in different sector of economy in developing the lender-borrower relationships between the exchange patners. Thus, the lending modes n the proper Islamic microfinance sstem intensify both intra- nd inter organizational network relationships. T11is integrated network relationships wl attract many customes especialy at nual areas where the micro enterprises in different small scale industry systems are found satisfied with the fnancing policy of this financing sstem.

Unfonunately, the intensity of the link between Islamic microfinance sstem, smll scale ndustry sstem and the groups of local, social and religious leaders is not well implemented and extended in Islamic microfinance sstem in Indonesia.

4. CONCLUSION

From the above discussion it is concluded that the Islamic microfinance sstem in Indonesia is not properly implemented. The microfinance institutions like Islamic bans,

E NEWOK TRINGEL AND SOOETAL SECTOR INS1IONS EHODOLOGICAL APPROAGI ON ISLAIC I.OFINANE TO IRO ENTREPRENERS IN INDONESIA

themselves as effective and efficient provides of microfinance services. Furthermore, the establishment of institutionalize network relationships between economic actors within the

Islamic microfinance sstem is not establish and extended.

If poperly mplemented, the Islanuc microfinance sstem will be repesenting as the

effective solutions for mico entrepreneus needs. Apt from giving credit to customes, org.a:ic:; it. the Islamic icrofina.:e sstem normally take :ctive pat in educating

customes regarding newly developed finncing procedures and other important aspects in the exchange activities. he oganizations in this financing sstem also take initiatives to guide customes in developing savng habits (lam, 2002), pomoting production activities and in investing funds in different projects. The organizations within the Islamic microfinance system with ther teachings to borrowers not only guide them to make proper use of the borrowed funds but lso to develop entrepreneuships mentaliy among them. Therefore, the ntense lender-borrower relationships promote the inter-organizational network relationships.

The setting of goups and saving habits also intensifies the trustful personal network relationships that are deeply rooted in the mutual support, inspiration and help to each other. It also ultmately develop the symbolic network among group members that is deeply rooted in religious, moral, political and ethnic goals, which tie the members together. This sot of close contact promotes intra-orgational relationships.

From this pespective it is concluded that if properly implemented, the lending modes of organizations in the Islamic microf inance system intensify both intra- and inter organizational network relationships s an integated network, which promote effective solutions to complement with the development of micro entreprenes in the Muslim world including in Indonesia.

REFERENCES

Alam, Mohammed Nurul (2009), Islamic Banking, Networking and Micro Enteprise, papes presented at Post Graduate Studies t IEF, T1isakti University, Jal«-uta Indonesi, November 22-26, 2009

Alam, Mohammed Nmul (2007), Nlico-Credit to Micro-Entreprenes by Islamic Bnks:

Promotes Different Networks, paper presented at Post Graduate Studies at IEF, Trisati University, J akata Indonesia, May 27-29, 2007

Alam, Mohammed Nul ( ... ), TI1e Islam.ic Banking Sstem in Different Socio-Cuhu! Environment Context (A comparative sudy of Islanuc banks in Bangladesh, Tw-key, Cpns and Sudan

Alam, Mohammed Nl (2002), Institutionalization and Developmet of Saving abits Through Bai-Muajjal Mode of Financing: A Unique Means of Mobilizing Rtu! Savings Towards Productive Sources, paper to be presented in the Second University Tenaga Business Management Conference, tobe held in August 2002, at the University Tenaga National, Malasia

Jnal Etkonoi Vol. 12 No. 2 Agstus 2013

J

Alam, Mohmed Nurul (2000), 'Islaic Banking Sstems: A Challenge in the modem Financial Market', Intenational Journal of Islamic Financial Services. Vol. 1, No.4, Jan Mch; 2000. ISSN, 0972-138:

Bank Indonesia (2009),

e

Blit

f

Isonc Baki

gDt n Isa,

http://www.bi.go.id/bank indonesia2/ utaml publikasi/ upload/ siah%20blue%20pint-engl.pdf. -:

Choudhuy, M.A & Sofan S.H 2009, "omplementng ommunity, Business And Microenterpise By he Islamic Epistemological Methodolog: A ase Study Of Indonesia", Intenational Jounal of Islamic and Middle Easten Finance, issue 2 (Referee)

Ismawan, Bambang And Setyo Budiantoro (2003),

Map,g

Miar n Isa,

Jumal Ekonomi RaatKaim, Nih, Michael T zi and :avier Reille (2008), Islamic Microfinance: An E

,g

Mamt Nde,

CGAP Focus Note No.49, Agust, 2008, http://ww.cgap.org/ p/ site/

cl

template.re/ 1.9 .5029 /Nibra (2009),

Bak Isa: Isac Baki

gS

;tm in Isa ml! B�

e

La5t in A SEAN,

www.pkesinteraktif.com

Segado, Chiaa (2005), CSe Study

"Is lame M iar Ad Sally Rspsie I

.ss

", MedaProject, Microfnance At he Univesity Of Toino, August 2005

Seibel, Hans Dieter (2007), Islamic Microfinance:

Te Jal:

f

Institutal Disiy,

Revisedversion of a paper presented during a Smposimn on Islamic Micro-Finance at

thevard Law School, 14 April 2007.

Seibel, Hans Dieter (2004),

Isamc M iinar in Indosia,

Division 4100 Economic Development and Employment Sector project 4136 Financial Sstems Development,September 2004, revised August 2005

Timberg, 1110ms A(2004), "Islamic Baning And Its Potential Impact", Risk Management:

Islamic Financial Policies, Nathan Associates, Inc.