THE IMPACT OF INVESTOR SENTIMENT-BASED EQUITY MUTUAL FUND ON EXCESS RETURN AND VOLATILITY

PERIOD JANUARY 2011 – DECEMBER 2014

THESIS

Presented as Partial Fulfillment of the Requirement for the Degree of Sarjana Ekonomi (S1)

In International Business Management Program Faculty of Economics University Atma Jaya Yogyakarta

Compiled by:

Yessica Rehulina Sembiring Student ID Number: 11 12 19121

FACULTY OF ECONOMICS

ACKNOWLEGEMENT

First of all, I would like to express my profound gratitude for The Almighty God, Jesus Christ, for seeing me through this thesis. This thesis arrangement is one of the requirements for the Degree of Sarjana Ekonomi (S1) in International Business Management Program Faculty of Economics Universitas Atma Jaya Yogyakarta.

In my writing process, it can be separated from some obstacles, but because of help and support of people around me, I am able to finish my thesis. Immeasurable appreciation and deepest gratitude for the help and support are extended to the following persons who have contributed in making this thesis:

1. Mrs. Sukmawati Sukamulja MM.,Dr.,Prof, as my supervisor, I would to express my deepest gratitude for her supports, advices, guidance, valuable comments and suggestions. Sharing her knowledge and helped in the writing process of this thesis.

2. Drs. Budi Suprapto, MBA.,Ph.D as the dean of faculty of economics Universitas Atma Jaya Yogyakarta.

3. All staff of faculty of economics Atma Jaya Yogyakarta who has educated me both directly and indirectly along my writing process.

5. My friend in IBMP 2011: Ari, Niko, Cik Eka, Gede, Harun, Dea, Tata, Merin, Stella, Debby, Endah, Yosua, Jimmy, Bambang, Felicia, Dhevika, Oki, Michael, Elvera, who always support me and cheer me up during my writing process. We are fight together for this point from early semester, guys! Lets end this together too.

6. All KPBB staffs: Bu Narti, Pak Andre, Mas Vincent, and student staffs who have been my best family and supported me as well. I am very thankful for you.

7. My beloved friends of KKN 66 Group 36 Pedukuhan Temuireng: Felix, Koh Ivan, Angga, Wendy, Tika, Ochi, Momon and Melati. Thank you for your supports and togetherness during our time in Tepus.

8. My friends: Togi, Oman, Lia, Pilo, Vita, Prilly, Dani, Raelda, Etenk. Thank you for always support me wherever you are now.

9. All of the party that has directly and indirectly helped the writer in finishing the study in International Business Management Program Universitas Atma Jaya Yogyakarta.

The author realizes that there are still many shortcomings in the preparation of thesis. Therefore, any suggestions and critics will be gladly accepted. The author hopes this thesis will be very useful for readers.

Yogyakarta, June 15th, 2015

TABLE OF CONTENTS

TITLE PAGE ... i

APPROVAL PAGE ... ii

COMMITEE’S APPROVAL PAGE ... iii

AUTHENTICITY ACKNOWLEDGEMENT ... iv

ACKNOWLEDGEMENT ... v

TABLE OF CONTENTS ... viii

LIST OF TABLE ... ix

LIST OF FIGURES ... x

LIST OF APPENDIXES ... xi

ABSTRACT ... xii

CHAPTER 1 INTRODUCTION ... 1

1.1 Research Background ... 1

1.2 Problem Statement ... 8

1.3 Scope of the Researche ... 8

1.4 Benefit of the Research ... 9

1.5 The Objective of the Research ... 10

1.6 The Originality of Writing ... 10

1.7 Writing Structure ... 10

CHAPTER 2 THEORITICAL BACKGROUND ... 12

2.1 Review of the Literature ... 12

2.2 Review on Related Study ... 25

2.3 Hypothesis Development ... 33

CHAPTER 3 RESEARCH METHODOLOGY ... 34

3.1 Type of Methodology ... 34

3.2 Sampling ... 34

3.3 Research Data ... 36

3.4 Dta Gathering and Data Source ... 36

3.5 Research Variable ... 37

3.6 Method of Analysis ... 38

CHAPTER 4 DATA ANALYSIS ... 46

4.1 Image of Research Data ... 46

4.2 Organization of the Data ... 46

4.2.1 Descriptive Analysis ... 46

4.2.2 The Result of Data Behavioral Test ... 48

a. Stationary Test ... 49

b. Mean Model Analysis ... 48

c. Residual Variation of the Mean Model ... 50

d. ARCH-Effect Test ... 51

e. GARCH (1,1) Model Test ... 52

f. Data Analysis... 53

g. Hypothesis Testing ... 55

CHAPTER 5 CONCLUSION AND RECCOMENDATION... 58

5.1 Conclusion ... 58

5.2 Research Limitation ... 59

5.3 Recommendation ... 60

REFERENCES ... 62

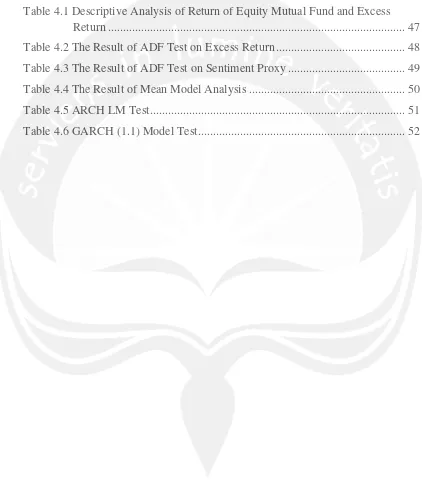

LIST OF TABLE

Table 2. 1 Summary of Previous Research ... 31

Table 3.1 Sample of Research ... 35

Table 4.1 Descriptive Analysis of Return of Equity Mutual Fund and Excess Return ... 47

Table 4.2 The Result of ADF Test on Excess Return ... 48

Table 4.3 The Result of ADF Test on Sentiment Proxy ... 49

Table 4.4 The Result of Mean Model Analysis ... 50

Table 4.5 ARCH LM Test ... 51

LIST OF FIGURE

Figure 1.1. Monthly Return of Equity Mutual Fund Period January 2011-2014 .... 6

Figure 1.2. Monthly NAV of Equity Mutual Fund Period January 2011-2014

(in million)... 6

Figure 4.1 Time Series Residual Plot Data ... 51

Figure 4.2 Data Pattern of Return Equity Mutual Fund and Excess Return

LIST OF APPENDIXES

Appendix A Descriptive Analysis of Return of Equity Mutual Fund and Excess Return

Appendix B The Result of ADF Test on Excess Return

Appendix C The Result of ADF Test on Sentiment Proxy

Appendix D The Result of Mean Model Analysis

Appendix E Time Series Residual Plot Data

Appendix F ARCH LM Test

Appendix G GARCH (1.1) Model Test

THE IMPACT OF INVESTOR SENTIMENT-BASED EQUITY MUTUAL FUND ON EXCESS RETURN AND VOLATILITY

PERIOD JANUARY 2011 – DECEMBER 2014

Compiled by:

Yessica Rehulina Sembiring Student ID Number: 11 12 19121

Supervisor:

J. Sukmawati Sukamulja, M.M., Dr., Prof.

ABSTRACT

The objective of this research is to analyze the impact of investor sentiment-based equity mutual fund on excess returns and volatility in Indonesia Stock Exchange (IDX) from January 2011 to December 2014. Stationarity test of Augmented Dickey-Fuller is used as basic test for a non-stationarity of each variable used, the mean model developed by Autoregressive Moving Average (ARMA) model with using Least Square method will result of mean model will be used to get the residual value to examine the homogeneity of residual variability, and to check there is non-homogeneity variance of mean model through time series plot of the residual data, the researcher will use ARCH-Effect Test. The final step is GARCH (1,1) Model Test to indicate the behavior of time series data has inconstant residual variance from time to time and contaminated by heterokedasticity because there are error variance that depend on previous error volatility. The result of GARCH (1,1) conclude that the data used the measure excess returns significantly contains ARCH and GARCH elements. Higher volatility in the markets does seem to have a positive effect on the returns since there is significant proof of positive volatility feedback which is for excess return. It is observed that there is a strong relationship between investor sentiment and market returns. This result is according to the probability value RESID(-1)^2 and GARCH(-1) are less than 5%, which are the probability value of RESID(-1)^2 and GARCH(-1) as much as 0.0000.