Refer to Important disclosures on the last of this report

StockData

Target price (Rp) Rp10,350

Prior TP (Rp) Rp10,160

Shareprice (Rp) Rp8,925

Upside/downside (%) +16.0

Sharesoutstanding (m) 11,644

Marketcap. (US$ m) 6,836

Estimate Change; Vs. Consensus

2018F 2019F

PT Indo Premier Sekuritas [email protected] +62 21 5793 1169

Robust earnings growth

Strong 3Q18 result, above expectations.

Regaining market share dominance in noodle segment.

Further margin expansion across the board.

Maintain BUY on ICBP with higher TP of Rp10,350.

Robust 3Q18 earning, exceeding expectations.

ICBP recorded net earnings of

Rp1.2tn in 3Q18 (+36% yoy; +11% qoq) and Rp3.6tn cumulatively in 9M18

(+16% yoy), forming 84% and 85% of ours and consensus respectively. This is

mainly on the back of improvement in market share and margin expansion. Top

line also booked a moderate growth, recording Rp10tn in 3Q18 (+12% yoy; +5%

qoq) and Rp29.5tn in 9M18 (+7% yoy). We continue to like ICBP on the back of

strong 9M18 earnings and improvement in market share driven by new innovative

products.

Regaining dominance in noodle segment.

In 3Q18, the noodle segment alone

grew by +13% yoy(vs. 2Q18: +7.2%yoy; 3Q17: +8.3%yoy), the strongest

was also confirmed through our on-the-ground checks, where retailers and

consumers were saying that Indofood has had better advertising and innovative

products to attract consumers. Although volume growth in the industry has been

shrinking, without new innovations and aggressive marketing from Wings’, we

believe that ICBP can still gain more market share in the segment.

Margin expansion drove earnings growth.

Gross margin in 3Q18 continued to

improve by +80bps qoq to 33% (vs. 2Q18: 32.2%; 3Q17: 31.5%), mainly on the

back of a more muted commodity growth in 9M18. EBIT margin also improved by

+80bps qoq to 17% in 3Q17 (vs. 2Q18: 16.2%; 3Q17: 15.4%), driven by margin

expansion in the noodle, dairy and food seasonings segments. With less

competition in the noodle segment, we believe that the company will be able to

sustain their EBIT margin at the current level.

Valuation.

We maintain our revenue forecast for FY18F and FY19F, while slightly

raising our earnings forecast by 1.9%/1.5% following improvements in margin in

9M18. We reiterate our BUY call for ICBP and rolling forward our valuation to

FY19F with a higher TP of Rp10,350 (based on target P/E of 25x). We transfer

coverage from Putri Tobing to Elbert Setiadharma.

Indofood CBP

(

ICBP IJ

)

Source : ICBP,IndoPremier Share Price Closing as of : 31-October-2018

2

Refer to Important disclosures on the last of this report

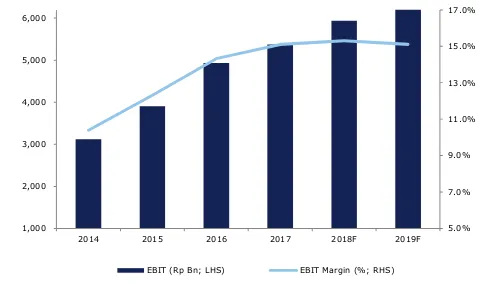

Fig. 1: ICBP quarterly sales trend Fig. 2: EBIT and EBIT margin trend

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Noodle growth trend Fig. 4: 3Q18 sales breakdown

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: 1Q18 instant noodle market share Fig. 6: 2018 new line extensions

Source: Top Brand, IndoPremier Source: Company

-4.0%

Sales (Rp Bn; LHS) Sales YOY Growth (%; RHS)

5.0%

2014 2015 2016 2017 2018F 2019F

EBIT (Rp Bn; LHS) EBIT Margin (%; RHS)

19,916

2014 2015 2016 2017 2018F 2019F

Noodle (Rp Bn) Noodle YOY Growth (%; RHS)

Noodles

Nutrition and Special Foods Wings Group (Mie

3

Refer to Important disclosures on the last of this report

Fig. 7: Earnings Revision

Source: Company, IndoPremier

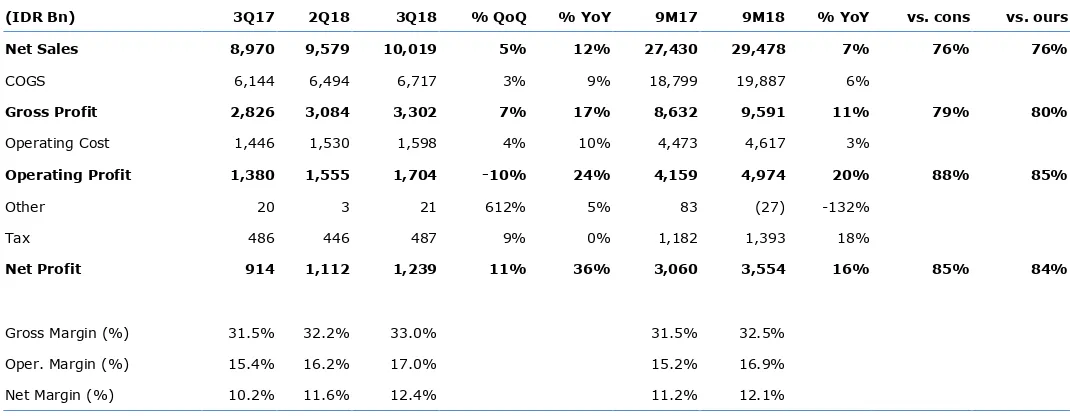

Fig. 8: Results Summary

(IDR Bn) 3Q17 2Q18 3Q18 % QoQ % YoY 9M17 9M18 % YoY vs. cons vs. ours

4

Refer to Important disclosures on the last of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Cash & Equivalent 8,372 8,945 10,433 13,159 15,672

Receivable 3,720 3,871 3,888 4,260 4,678

Inventory 3,110 3,262 3,329 3,674 4,093

Other Current Assets 369 501 449 475 505

Total Current Assets 15,571 16,579 18,099 21,569 24,948

Fixed Assets - Net 7,114 8,120 8,350 8,527 8,652

Goodwill 1,424 1,424 1,424 1,424 1,424

Non Current Assets 3,160 2,851 2,943 2,443 2,334

Total Assets 28,901 31,619 32,448 35,595 38,990

ST Loans 563 1,148 567 563 563

Payable 2,692 2,904 0 2,940 3,275

Other Payables 2,611 2,525 2,770 3,057 3,406

Current Portion of LT Loans 604 250 234 233 91

Total Current Liab. 6,470 6,827 6,234 6,793 7,334

Long Term Loans 877 954 506 273 182

Other LT Liab. 3,054 3,513 3,055 3,055 3,055

Total Liabilities 10,401 11,294 9,795 10,121 10,571

Equity 6,585 6,765 6,568 6,568 6,568

Retained Earnings 10,979 12,799 15,191 17,851 20,632

Minority Interest 936 760 893 1,054 1,218

Total SHE + Minority Int. 18,500 20,324 22,652 25,473 28,418

Total Liabilities & Equity 28,901 31,618 32,447 35,594 38,989

5

Refer to Important disclosures on the last of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 3,629 3,543 4,423 4,966 5,347

Depr. & Amortization 510 623 720 773 825

Changes in Working Capital (333) (402) (1) (278) (302)

Others (305) 80 (380) (723) (817)

Cash Flow From Operating 3,501 3,843 4,762 4,738 5,053

Capital Expenditure (728) (1,320) (1,042) (450) (841)

Others 89 (757) 1,644 640 828

Cash Flow From Investing (639) (2,077) 602 190 (13)

Loans (824) 308 (1,046) (238) (233)

Equity 0 0 0 0 0

Dividends 1,545 1,942 1,898 2,145 2,403

Others 119 309 (665) 57 87

Cash Flow From Financing 840 2,559 188 1,964 2,257

Changes in Cash 3,702 4,325 5,551 6,892 7,297

FinancialRatios

Gross Margin (%) 31.5 31.1 31.5 31.0 30.0

Operating Margin (%) 14.3 15.1 15.3 15.1 14.2

Pre-Tax Margin (%) 14.5 14.6 15.2 15.5 15.2

Net Margin (%) 10.4 10.7 11.0 11.3 11.1

ROA (%) 13.0 12.5 13.4 14.1 13.9

ROE (%) 20.6 19.6 20.0 20.0 19.2

ROIC (%) 21.6 20.2 21.2 22.4 22.5

Acct. Receivables TO (days) 36.6 38.9 36.4 34.9 34.9

Acct. Receivables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Inventory TO (days) 8.3 7.7 8.1 8.4 8.4

Payable TO (days) 37.7 41.6 38.1 34.8 34.6

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 11.0 11.6 5.8 4.2 2.9

Interest Coverage Ratio (x) 0.0 0.0 0.0 0.0 0.0

Net Gearing (%) (34.2) (31.7) (40.3) (47.5) (52.2)

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS