Refer to Important disclosures in the last page of this report

Stock DataTarget price (Rp) Rp2,900

Prior TP (Rp) Rp3,075

Share price (Rp) Rp2,180

Upside/downside (%) +33.0

Shares outstanding (m) 10,590

Market cap. (US$ m) 1,520

Republic of Indonesia 60.0%

Estimate Change; Vs. Consensus

2018F 2019F PT Indo Premier Sekuritas stephan.hasjim@ipc.co.id +62 21 5793 1168

Slowing profit growth as rate rises

9M18 profit up 12%, still within our expectation, despite rising rates.

Surprisingly resilient 3Q NIM (+53bps) mitigated provisioning jump.

PSAK 71 implementation led to our higher credit cost assumption.

We lower our earnings and TP (to Rp2,900) but keep BUY rating.

Modest results.

BBTN’s net profit of Rp2.23tn in 9M18 (+11.5%) was still within

our expectation, despite accounting for only 66% of our FY18F forecasts, given its

usually stronger 4Q earnings. Quarterly profit was up 10% qoq in 3Q18, despite a

doubling of loan provisioning, driven by the bank’s strong core profit growth in 3Q

(+27% qoq). Excluding provisions, which increased by 45% yoy, BBTN’s core

profit grew robustly by 19% in 9M18, which was by far the strongest core profit

growth in Indonesia’s banking industry, driven by: 1) strong asset growth (loans:

+19%; deposits: +16%); and 2) resilient NIMs (only -15bps) in the face of rising

rates, and despite its strong operating cost growth (+18%).

Resilient NIMs

. In our calculation, BBTN’s NIM widened to 4.55% in 3Q (2Q:

4.02%; 1Q: 3.89%), which was above its 2017 levels, surprisingly in light of the

bank’s mostly fixed-rate lending and weak deposit franchise. BBTN’s rising asset

yields in 3Q (+67bps qoq) outpaced its cost of funds (+12bps only). However, we

still assume NIMs to narrow to 4.03% in FY18F (-49bps yoy) and to decline by

10bps each year in next 2 years. We expect NIM pressure to be mitigated by new

subsidy schemes such as KPR SSB (interest subsidy is linked to 12mth SBI rate)

and new KPR FLPP scheme (with funding ratio of 75%:25%), which should lower

BBTN’s vulnerability to rising rates while also lowering opex growth.

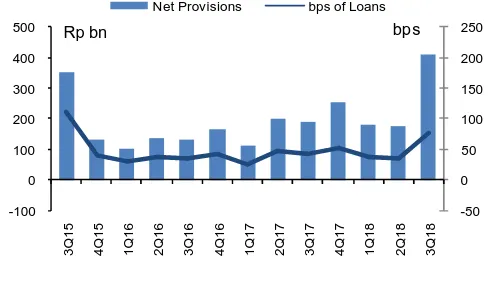

Asset quality

. BBTN’s asset quality was stable with NPL of 2.65% and provision

coverage of 46%, which was above its comfort level of 35-40%. In spite of this,

the bank doubled its credit cost to 83bps in 3Q (2Q: 41bps) in anticipation of a

provision gap arising from implementation of new accounting rule PSAK 71 (vs.

PSAK 55 used at present), which if directly adjusted in equity capital would lower

capital adequacy ratio by 1.5% (CAR was 18% in 3Q18). As such, we increase our

annual credit cost assumption by 10bps to 50bps for FY18F to FY20F as we expect

the bank to cover most of the provisioning gap under PSAK 71 through direct

adjustments to its equity and only partially by increasing provisioning.

Valuation

. We cut our earnings forecasts by 3-5% for FY18-20F, due to higher

provisioning assumption, and lower our TP to Rp2,900 (from Rp3,075). Our TP is

based on GGM-derived target FY18F P/B of 1.26x, assuming LT ROAE of 13.5%

(from 13.8%), LT growth of 8.5%, cost of equity of 12.5%. We estimate LT ROAE

based on DuPont analysis, assuming LT ROAA of 1.13% and asset/equity leverage

of 12x. However, we maintain our BUY rating given the stock’s low valuation.

Bank Tabungan

(

BBTN IJ

)

26 October 2018

Results Note

BUY

(Unchanged)

Year To 31 Dec 2016A 2017A 2018F 2019F 2020F

Operating income (RpBn) 9,268 10,805 12,116 13,698 15,616

PPOP (RpBn) 3,881 4,637 5,027 5,737 6,670

Source: BBTN, IndoPremier Share Price Closing as of : 25-October-2018

2

Refer to Important disclosures in the last page of this report

Fig. 1: Net Interest Income (Rp bn) and NIMs (%) Fig. 2: Non-Interest Income (Rp bn; % of Gross Income)

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Operating Expense (Rp bn) and Cost/Income Ratio (%)

Fig. 4: Pre-Provision Profit (Rp bn; % of Average Assets)

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: Net Loan Provisioning (Rp bn; bps of Average Loans) Fig. 6: Net Profit (Rp bn) and ROAA (%)

Source: Company, IndoPremier Source: Company, IndoPremier

0%

Net Interest Income Net Interest Margin

Rp bn

Other Income Other Income % of Total

Rp bn

Operating Expenses Cost-Income Ratio

Rp bn

Pre-Provision Profit Pre-Provision Profit ROAA

Rp bn

Net Provisions bps of Loans

bps

Net Profit Net Profit ROAA

3

Refer to Important disclosures in the last page of this report

Third-Quarter 2018 Results

Results (Rp Bn) 9M18 9M17 % Y-Y 3Q18 2Q18 % Q-Q

Customer Deposits 194,830 167,870 16.1 194,830 186,640 4.4

Non-Performing Loans (NPL) 5,825 5,672 2.7 5,825 5,876 -0.9

Special Mention Loans 22,593 21,589 4.7 22,593 21,127 6.9

Loan Loss Reserves (LLR) 2,710 2,270 19.4 2,710 2,452 10.5

Total Assets 272,305 231,935 17.4 272,305 268,044 1.6

Risk-Weighted Assets 122,323 119,780 2.1 122,323 124,072 -1.4

4

Refer to Important disclosures in the last page of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Interest income 17,139 19,272 22,042 26,670 31,346

Interest expense (8,975) (9,931) (11,668) (14,949) (17,985)

Net interest income 8,164 9,341 10,374 11,721 13,361

Fees and commissions 591 750 1,000 1,200 1,440

Trading income 282 403 400 400 400

Other operating income 231 311 342 377 414

Total operating income 9,268 10,805 12,116 13,698 15,616

Personnel expenses (2,122) (2,554) (3,014) (3,376) (3,781)

G&A expenses (2,466) (2,953) (3,307) (3,704) (4,149)

Other operating expenses (799) (661) (768) (880) (1,016)

Pre-provision operating profit 3,881 4,637 5,027 5,737 6,670

Provisions (708) (884) (1,086) (1,276) (1,494)

Current account with BI 10,697 12,555 14,472 17,100 20,215

Placements at BI & other banks 17,903 25,254 17,326 22,834 28,924

Short-term investments 4,172 7,706 13,871 15,258 16,784

Government bonds 9,244 8,184 8,184 8,184 8,184

Gross loans 164,446 198,991 235,274 275,257 322,311

Loan provisions (2,116) (2,356) (2,742) (3,418) (4,312)

Other assets 8,816 10,005 10,763 11,586 12,478

Total Assets 214,168 261,365 298,261 348,116 406,138

Customer deposits 159,988 192,474 222,639 263,082 311,000

Deposits from other banks 3,653 5,445 5,990 6,589 7,248

Securities and borrowings 24,304 32,856 37,347 42,187 47,196

Other liabilities 6,595 7,289 8,017 8,819 9,701

Total Liabilities 194,539 238,064 273,994 320,678 375,145

Share capital 7,349 7,349 7,349 7,349 7,349

Reserves and others 2,773 2,802 2,724 2,824 2,824

Retained earnings 9,008 11,512 14,194 17,265 20,820

Shareholders' equity 19,131 21,663 24,267 27,438 30,993

Minority interest 0 0 0 0 0

Total Liabilities & Equity 213,670 259,727 298,261 348,116 406,138

5

Refer to Important disclosures in the last page of this report

Year To 31 Dec 2016A 2017A 2018F 2019F 2020F

Growth Ratios (% yoy)

Gross loans 18.3 21.0 18.2 17.0 17.1

Total assets 24.7 22.0 14.1 16.7 16.7

Customer deposits 25.3 20.3 15.7 18.2 18.2

Net interest income 19.9 14.4 11.1 13.0 14.0

Non-interest income 23.3 32.6 19.0 13.4 14.0

Total operating income 32.3 16.1 5.6 13.4 15.3

Operating expense 20.0 14.5 14.9 12.3 12.4

PPOP 20.7 19.5 8.4 14.1 16.3

Net profit 41.5 15.6 8.6 13.4 15.3

Profitability Ratios

ROAA (%) 1.38 1.33 1.17 1.15 1.14

ROAE (%) 15.7 15.1 14.3 14.4 14.7

NIM (%) 4.71 4.52 4.03 3.93 3.83

Credit cost (bps) 35.4 41.8 42.2 42.2 43.3

Cost/income (%) 58.1 57.1 58.5 58.1 57.3

LDR (%) 102.8 103.4 105.7 104.6 103.6

CAR (%) 20.3 18.9 17.9 17.2 16.5

NPL ratio (%) 2.8 2.7 2.3 2.1 2.0

Provisions/NPL (%) 45.3 44.6 50.4 58.4 66.8

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analyst;s personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS