Social Science

257

The Effects Of Sukuk (Islamic Bonds) In The Economy

Derry Fahrian1, Chenny Seftarita2

1*Development Economics Department, Economcs and Business Faculty, Syiah Kuala University,

Darussalam, Banda Aceh 23111, Indonesia;

2Development Economics Department, Economcs and Business Faculty, Syiah Kuala University,

Darussalam, Banda Aceh 23111, Indonesia;

*Corresponding Author: derryfahrian@outlook.com;

Abstract

This study aimed to analyze the influence of sukuk towards Gross Domestic Product (GDP) in the short term and the long term. The data used in this research is sukuk and Gross Domestic Product (GDP) quarterly data from 2009 until 2015 in the form of time series, processed and analyzed by the method of estimation of Autoregressive Distributed Lag (ARDL). The results of this study indicate that factors influencing the Gross Domestic Product (GDP) in the short term and the long term is the Gross Domestic Product (GDP) and the Sukuk. In the short term Gross Domestic Product (GDP) influencing the Gross Domestic Product (GDP) itself positively and significantly, while Sukuk influencing the Gross Domestic Product (GDP) negatively. In the long term both of Sukuk and Gross Domestic Product (GDP) influence the Gross Domestic Product (GDP) positively and significantly. The study conclude that the increase in funding sources could increase the Gross Domestic Product (GDP) in order to increase economic growth. Thus it is critical to increase the sources of financing to stimulate economic growth in Indonesia.

Key words: Sukuk, GDP, ARDL.

Introduction

Sharia finance is growing significantly from time to time, the development is not only in areas dominated by moslem population, it has now recovered the world scale. One of sharia financial instrument which is currently growing rapidly is sharia bond known as sukuk. Sukuk is an innovative solution for those who need financing source and investment. According to IFIS data quoted by the economist during the decade 2002-2010, sukuk issuance grew at an average 35% per year. Moreover, based on the results of the study that Thomson Reuters examined, world total sukuk issuance will reach $ 250 billion by 2020. (Dian Handayani).

Global sharia financial which is developing rapidly represent a great opportunity for the government to link global investors with domestic economic sector by providing financial instruments needed by financial institutions. According to Diaw (2011), sukuk provide many advantages with regard to government spending on infrastructure. Sukuk improves the relationship between markets and financial institutions due to sukuk must be based on tangible assets, and sukuk will strengthen the relationship between the real sector and the financial sector. Similarly with sukuk holders, the sukuk holders prefer to have a predictable and stable cash flow for long-term periods of time.

Social Science

258

bond, but the progress showed by sukuk that constantly increasing each period makes sukuk has the potential to increase its contribution in government financing in the future.

The increase of sources of financing, especially infrastructure financing are able to accelerate economic development and economic growth of a region. As Calderon (2011) stated that economic growth is positively and significantly correlated with the stock and infrastructure quality in an area. To increase sources of financing, especially infrastructure financing, sukuk is an alternative. This is because sukuk required the underlying assets in the form of tangible assets. So when the investors invest on sukuk, they has strengthened not only the real sector but also the financial sector in the economy. The real sector which is growing well will encourage the growth of Gross Domestic Product (GDP) of a country.

Literature Review

Islamic capital markets have witnessed the issuance of shari’a compliant financial instrument known as sukuk. Sukuk basically same like bonds, sukuk have a maturity date and holders. However, sukuk are asset-based rather than asset-backed securities, with the underlying asset being necessarily shari’a -compliant in both nature and use. The eligibility of sukuk rests on identifying an existing or a well-defined asset, service, or project. In May 2003, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOFII) officially defined sukuk as certificates of equal value representing undivided shares in ownership of tangible assets, usufructs, and it identified at least fourteen possible sukuk structures. The AAOIFI distinguishes sukuk from stocks, bonds, and from the conventional process of securization as well, emphasizing that sukuk are not debt certificate with a financial claim to cash flow.

Although sukuk were first issued in the 1980s, nearly all growth has come within the past decade. According to Moody’s (2007,2008), the global outstanding volume of sukuk exceeded $90 billion in 2007. Data from the Islamic Finance Information Services (IFIS) indicate that corporate sukuk quickly gained a dominant market share on the sukuk market relative to sovereign sukuk. Indonesia, sukuk were first issued by PT.Indosat in October 2002. The bonds have suffered double oversubrider, so that PT.Indosat increase the amout of sukuk in the amount of Rp175 billion. Sukuk continuous to grow from year to year until the end of 2015, outstanding corporate sukuk reached Rp9 billion. As the development sukuk is growing constantly, the government finally issued sukuk in 2009 and in the last quarter of 2015 the amount of outstanding sukuk reached Rp201.017 billion. Sukuk which is growing countinously from time to time make sukuk has the potential to become an alternative source of financing in the future.

Bonds is related to the financial market, based on research conducted by Lucas (1998) and Favara (2003) estimated the positive role of financial markets in economic growth. This result indicates that the development of financial markets in one of the factor encouraging the economic. Hering and Chtusripitak (2000), Braun and Briones (2005) and Fink, Haiss, Kirchmer, and Moser (2006) examined the relationship between bond market and economic growth. The result shows that there is a positive relationship between the bond market and economic growth. Pataraa, Yoonbai, Chong (2013) examined the effect of bond markets on economic growth. The results conclude that (i) capital market development is positively significant assosicated with economic growth, (ii) the contribution of the bank loan portofolio reduced in line with the development of bond market, (iii) government bonds positively correlated with economic growth. Based on the studies that had carried out, the study conclude that bond market is needed to encourage the economic growth of an area.

Research Method

To examine the effect of Sukuk on Gross Domestic Product (GDP), this research estimated the variables with ARDL (Auto Regressive Distributed Lag) model. ARDL model contains the dynamic effects of specific models by including lag value of variable for transform data into the model (Laurenceson and Chai, 2003). ARDL model generally expressed in the following equation (Bekhet and Matar, 2013) :

This study aimed to investigate the effect of Sukuk on Gross Domestic Product (GDP) in Indonesia. The general equation of ARDL model must be transform becomes :

𝐺𝐷𝑃 = 𝛽0+ ∑ 𝛽1𝐺𝐷𝑃𝑡−𝑖+ ∑ 𝛽2𝑆𝐵𝑆𝑁𝑡−𝑖+

𝑘

𝑖=0 𝑘

𝑖=1

Social Science

259

The data used in this study is quarterly data from 2009 to 2015 that collected from website of Bank Indonesia and The Asia Regional Integration Center.

Results and Discussion

To determining the best equation that will be used on ARDL model, Unit Root-Test is necessary to find out whether the variables are stationer at level I(0) or at first difference I(I). Software used in this stationary test is Eviews 9.

Table 1. Stationary Test

No Variabel PP

At level 1st 2nd

1 GDP -4,4947

(0,0070)

- -

2 SBSN -2,7679

(0,2200)

16,6339 (0,0000)

-

Based on stationary test on table 1, it can be seen that the ordo of each variable are different. The Gross Domestic Product (GDP) variable is stationer at level I(0), while the Sukuk variable is stationer at first difference I(I).

To determine the best model will be used on ARDL estimation model, determining the optimal lag of the equation is need to be done. According to Azuma (2014) the amount of lag selected is the equation with the smallest value of Akaike Information Criterion (AIC) or Auto Correlation Function (ACF).

Table 2. Optimal Lag Test

Lag AIC SC

1 58,34815 58,59009

2 58,14527* 58,48656*

3 58,33389 58,77566

Based on the result on table 2, it can be seen that the amount of optimal lag for the Gross Domestic Product (GDP) and Sukuk variables is the second lag. Based on optimal lag test, ARDL equation that will be used in this study is ARDL with two lag.

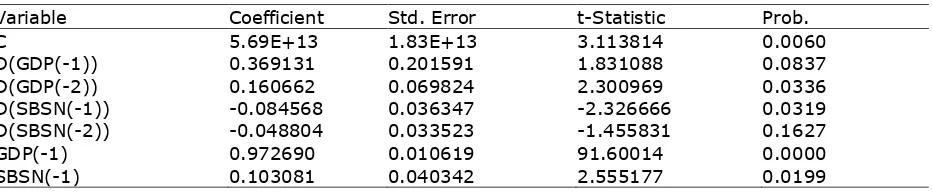

Table 3. Auto Regressive Distributed Lag (ARDL) Estimation

Variable Coefficient Std. Error t-Statistic Prob.

C 5.69E+13 1.83E+13 3.113814 0.0060

D(GDP(-1)) 0.369131 0.201591 1.831088 0.0837

D(GDP(-2)) 0.160662 0.069824 2.300969 0.0336

D(SBSN(-1)) -0.084568 0.036347 -2.326666 0.0319 D(SBSN(-2)) -0.048804 0.033523 -1.455831 0.1627

GDP(-1) 0.972690 0.010619 91.60014 0.0000

SBSN(-1) 0.103081 0.040342 2.555177 0.0199

Social Science

260

and Sukuk variable will be in equilibrium state in the long term, it is necessary to estimate short term equation with ECT (Error Correction Term). ECT is used to determine the level of speed adjustment in the short-term to long-term equilibrium. When ECT estimated coefficient is negative and significant, indicates that the variable will be in equilibrium state in the long-term. The value of estimated coefficient of ECT showed the speed of adjustment level in correcting the imbalance of the variables to be back to the balance point (equilibrium) (Bekhet and Matar in Fahmi, 2015).

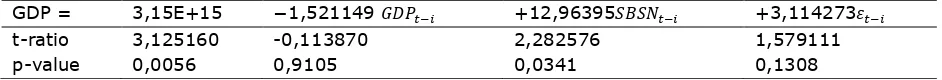

Based on the optimal lag, short-term estimation results are obtained as follows:

Table 4. Short-Term Estimation

GDP = 3,15E+15 −1,521149 𝐺𝐷𝑃𝑡−𝑖 +12,96395𝑆𝐵𝑆𝑁𝑡−𝑖 +3,114273𝜀𝑡−𝑖

t-ratio 3,125160 -0,113870 2,282576 1,579111

p-value 0,0056 0,9105 0,0341 0,1308

Based on the results of short-term estimation on table 4, obtained that the value of the ECT variable is positive and not significant with estimated coefficient 3.114273 and p-value (0.1308 > 0.05). This results indicate that the variable Gross Domestic Product (GDP) will not adjusted short-term balance towards long-term. To find out whether Sukuk variable joinly with Gross Domestic product (GDP) variable correlated with Gross Domestic Product (GDP) in the short-term, this study use wald-test.

Table 5. Short-Term Wald Test

Variabel Wald-Test

GDP 10,89446

(0,0278)**

Based on the Wald-test contained on table 5, it can be seen that p-value shown significant result (0.0278 < 0.05), which means that the variable Sukuk has significant effect on Gross Domestic Product (GDP) in the Short-Term. Based on ARDL estimation result on table 3, in the short-term changes of Gross Domestic Product (GDP) variable in a period will affect Gross Domestic Product (GDP) itself on the next quarter and the next two quarter with estimate coefficient 0.369131 and 0.160662 with 90% and 95% confidence level. While change of Sukuk in a period will affect Gross Domestic Product (GDP) on the next quarter negatively and significant with estimate coefficient -0.084568 and 95% confidence level. This result indicates that increase Sukuk in a quarter will reduce Gross Domestic Product (GDP) in the next quarter. This mechanism allegedly associated with the decision of investors to invest in sukuk, when investors shift their investment to sukuk, the investment that increase Gross Domestic Product (GDP) in the short-time would be switched on sukuk that will reduce Gross Domestic Product (GDP) in the short-time. This is due to mainly sukuk, especially mudharaba based sukuk are based on project that take time to become productive.

Table 6. Long-Term Estimation

GDP = -6,72E+12 + 1,020009 𝐺𝐷𝑃𝑡−𝑖 −0,064733𝑆𝐵𝑆𝑁𝑡−𝑖

t-ratio −0,216548 −0,113870 −0,877820

p-value 0,8304 0,0000 0,3887

Table 7. Long-Term Wald-Test

Variable Wald-Test

GDP 134920,1

(0,000)*

Social Science

261

contribution of sukuk to Gross Domestic Product (GDP) is relative small. This result allegedly caused by the lack of sukuk issuance by government and corporation.

Conclusions

The results of thi study indicate that; (i) Gross Domestic Product (GDP) is affected by Gross Domestic Product (GDP) itself and sukuk in the short-term and long-term; (ii) in the short-term, changes of Gross Domestic Product (GDP) in a period will affect Gross Domestic Product (GDP) itself in the next quarter and the next two quarter. The changes of 1 trillion Gross Domestic Product (GDP) in a period will increase Gross Domestic Product (GDP) in the next quarter amounted to 369.131 million rupiah and the next two quarter amounted to 160.662 million rupiah; (iii) in the short-term, changes of SBSN in a period will affect Gross Domestic Product (GDP) in the next quarter. The changes of 1 trillion rupiah sukuk will decrease Gross Domestic Product (GDP) in the next quarter amounted to 84.568 million rupiah; (iv) in the long-term, Gross Domestic Product (GDP) is affected by the Gross Domestic Product (GDP) and sukuk. The increase of 1 trillion rupiah sukuk will increase Gross Domestic Product (GDP) amounted to 103.081 million rupiah.

References

Adhidarma, G., & Purbasari, D. (2015). Memahami Hubungan antara Investasi dan GDP. Retrieved from Macroeconomic Dashboard Fakultas Ekonomika dan Bisnis UGM: http://macroeconomicdashboard.feb.ugm.ac.id/memahami-hubungan-antara-investasi-dan-gdp/

Afshar, T. A. (2013). Compare and Contrast Sukuk (Islamic Bond) with Conventional Bond, Are They Compatible? The Journal of Global Business Management, Volume 9, Number 1, February 2013. Ariyanti, F. (2016, Mei 17). Menkeu Bambang: RI Penerbit Sukuk Terbesar Di Dunia. Retrieved from http://m.liputan6.com/bisnis/read/2508878/menkeu-bambang-ri-penerbit-sukuk -terbesar-di-dunia

Calderon, C., & Serven, L. (2006). The Effects of Infrastructure Development on Growth and Income Distribution. Working Paper S.3400.

Economic Indicators: Gross Domestic Product (GDP). (2016, February 8). Retrieved from Investopedia: http://www.investopedia.com/university/releases/gdp.asp

Godlewski, C. J., Turk-Ariss, R., & Weill, L. (2013). Sukuk Vs. conventional bonds: A stock market perspective. Journal of Comparative Economics 41, 745-761.

Handayani, D. (2015, November 23). Ketika Sukuk Menarik Minat Dunia. Retrieved from http://www.kemenkeu.go.id/Artikel/ketika-sukuk-menarik-minat-dunia

Hariyanto, E. (2015, November 11). Reputasi Sukuk Global Indonesia. Retrieved from http://www.kemenkeu.go.id/Artikel/reputasi-sukuk-global-indonesia

Kenourgios, D., Naifar, N., & Dimitriou, D. (2016). Islamic financial markets and global crises: Contagion or decoupling? Economic Modelling 57, 36-46.

Malikov, A. (2011). How Does Sovereign Sukuk Impact on The Economic Development of Developing Countries? An Analysis of Infrastructure Sector. ResearchGate.

Malikov, A. (2014). How Does Sovereign Sukuk Impact On The Economic Development Of Developing Countries? An Analysis Of Infrastructure Sector. Bosnia and Herzegovina: ResearchGate. Mohamed, H. H., Masih, M., & Bacha, O. I. (2015). Why do issuers issue Sukuk or conventional bond?

Evidence from Malaysian listed firms using partial adjustment models. Pacific-Basin Finance Journal 34, 233-252.

Purnamawati, I. (n.d.). Perbandingan Sukuk dan Obligasi (Telaah Dari Perspektif Keuangan dan Akuntansi). Jurnal Akuntansi Universitas Jember, 62-71.

Sudirman, & Bakri. (2015). Syariah Obligation: Prospects and its Challenges in Indonesia. Al-Ulum Volume 15 Number 1, 91-106.

Sukirno, S. (1994). Teori Pengantar Makroekonomi Edisi Ketiga. Jakarta: Rajawali Pers.

sylvester, O., & Enabulu, G. O. (2011). The Effect of Stock Market on Economic Growth In Nigeria.

JORIND (9), 287-295.

Thumrongvit, P., Kim, Y., & Pyun, C. S. (2013). Linking The Missing Market: The Effect of Bond Markets on Economic Growth. Internaional Review of Economics and Finance 27, 529-541.

Trad, S. A., & Bhuyan, R. (2015). Prospect of Sukuk in the Fixed Income Market: A Case Study on Kwait Financial Market. International Journal of Financial Research Vol.6, No.4, 175-186.