Informasi Dokumen

- Penulis:

- Yudha Baladhika

- Pengajar:

- Agus Widodo, S.E., M.Si., Ak

- Sekolah: Universitas Sebelas Maret

- Mata Pelajaran: Diploma III Perpajakan

- Topik: Optimalisasi Penerimaan Pajak Hotel Dan Pajak Restoran Di Kabupaten Sukoharjo

- Tipe: Tugas Akhir

- Tahun: 2013

- Kota: Surakarta

Ringkasan Dokumen

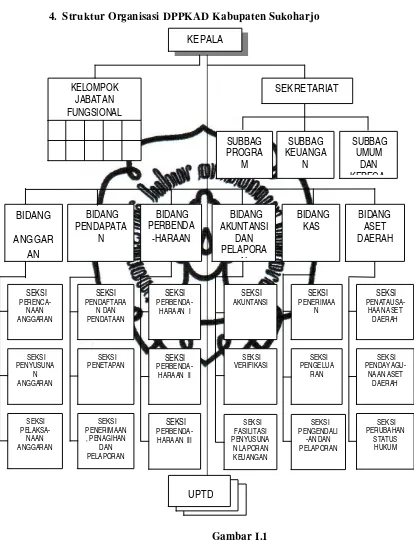

I. INTRODUCTION

This section provides an overview of the DPPKAD Sukoharjo, detailing its historical establishment, primary functions, vision, mission, organizational structure, and job descriptions. Understanding the organizational context is crucial for analyzing tax optimization strategies in the region. The historical background highlights the evolution of the agency, while the mission and vision statements outline its commitment to effective financial management and regional development. The organizational structure clarifies roles and responsibilities, emphasizing the importance of efficient tax collection and management. This foundational knowledge sets the stage for exploring the challenges and opportunities in optimizing hotel and restaurant tax revenues.

II. PROBLEM BACKGROUND

This section discusses the significance of regional autonomy in Indonesia and the role of local taxes in enhancing local government revenues. It emphasizes the need for effective management of hotel and restaurant taxes, which are underutilized despite their potential contribution to local revenue. The analysis highlights systemic issues such as taxpayer awareness and procedural inefficiencies that hinder optimal tax collection. By framing the problem within the context of regional development goals, the section underscores the urgency of addressing these challenges to improve local governance and financial sustainability.

III. RESEARCH PROBLEM FORMULATION

The formulation of research problems focuses on two key questions: the extent of hotel and restaurant tax contributions to local revenue and the utilization of existing tax potential. These questions guide the research direction and objectives, aiming to provide insights into the effectiveness of current tax strategies. By investigating these issues, the research seeks to identify gaps in tax collection practices and propose actionable recommendations for enhancing revenue generation. This section is essential for establishing a clear research agenda that aligns with the educational objectives of the study.

IV. RESEARCH OBJECTIVES

The research aims to ascertain the contribution of hotel and restaurant taxes to the local revenue of Sukoharjo and evaluate the effectiveness of current strategies in maximizing this potential. By achieving these objectives, the study seeks to provide valuable insights for policymakers and stakeholders in the region. Understanding the dynamics of tax contributions is critical for informed decision-making and strategic planning in local governance. This section highlights the educational value of the research, emphasizing its relevance to public administration and financial management disciplines.

V. RESEARCH BENEFITS

This section outlines the anticipated benefits of the research for various stakeholders, including the author, DPPKAD, and future researchers. For the author, the study represents an opportunity to deepen knowledge in taxation and apply theoretical concepts to practical challenges. For DPPKAD, the findings will serve as a valuable resource for policy formulation and implementation aimed at optimizing tax revenues. Additionally, the research aims to contribute to the academic discourse on local taxation, providing a foundation for future studies in this area.

VI. RESEARCH METHODOLOGY

The research employs a combination of literature review and field studies, utilizing observational and interview methods to gather data. The literature review provides a theoretical framework, while field studies offer practical insights into tax collection practices. This mixed-method approach enhances the reliability and validity of the findings, allowing for a comprehensive analysis of the issues at hand. By detailing the methodologies used, this section reinforces the rigor of the research process and its alignment with academic standards.

VII. LITERATURE REVIEW

This section discusses key concepts related to optimization, potential, and taxation. Definitions of optimization emphasize achieving desired outcomes efficiently, while the concept of potential relates to the capacity of local governments to generate revenue. The review of general taxation principles provides a foundational understanding of the tax system in Indonesia, highlighting the importance of local taxes in financing regional development. By synthesizing these concepts, the literature review establishes a theoretical basis for analyzing the specific context of hotel and restaurant taxes in Sukoharjo.

VIII. ANALYSIS AND DISCUSSION

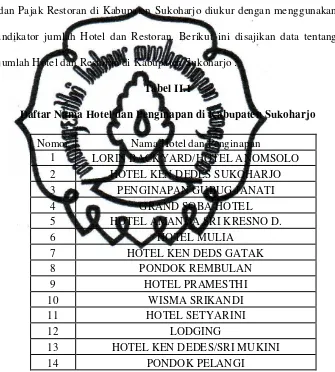

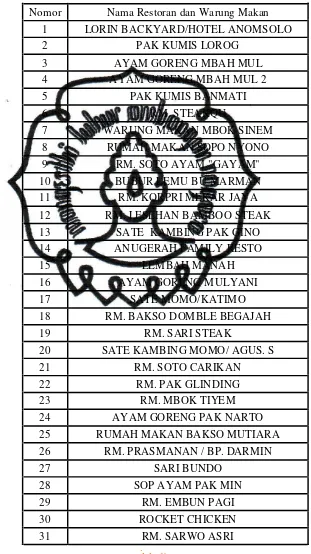

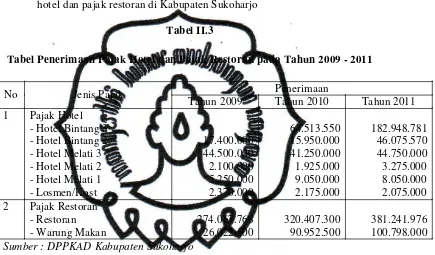

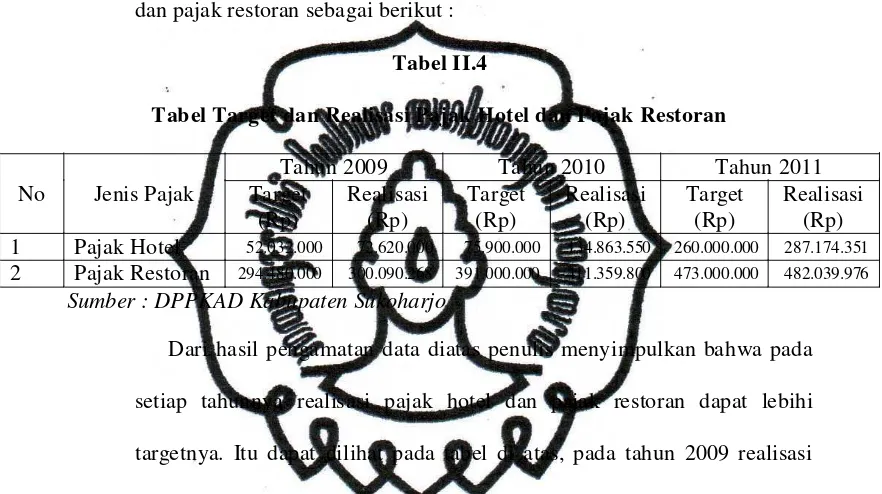

The analysis section delves into the potential of hotel and restaurant taxes in Sukoharjo, evaluating factors such as collection procedures, resources, and taxpayer compliance. It examines the current state of tax revenues and identifies barriers to effective collection. The discussion highlights the need for improved awareness among taxpayers and enhanced administrative practices to maximize revenue potential. By analyzing these factors, the section provides a comprehensive overview of the challenges facing local tax authorities and offers insights for strategic improvements.

IX. FINDINGS

This section presents the key findings of the research, categorizing them into strengths and weaknesses of the current tax collection system. It highlights areas of success, such as existing frameworks and potential for revenue growth, while also addressing significant weaknesses, including low taxpayer awareness and insufficient infrastructure. The findings serve as a basis for developing targeted recommendations for enhancing tax collection strategies. This section is crucial for translating research insights into practical applications for local governance.

X. CONCLUSION

The conclusion summarizes the key insights gained from the research and reiterates the importance of optimizing hotel and restaurant tax revenues for local development. It emphasizes the need for strategic reforms in tax collection practices to enhance revenue generation and improve public services. The conclusion also reflects on the implications of the research for policymakers and academic discourse, reinforcing the relevance of the study to broader discussions on local governance and financial management. This section encapsulates the educational outcomes of the research.

XI. RECOMMENDATIONS

This section provides actionable recommendations based on the research findings, focusing on enhancing taxpayer awareness, improving administrative procedures, and leveraging technology for tax collection. Recommendations aim to address identified weaknesses and capitalize on existing strengths, fostering a more effective tax system in Sukoharjo. By offering practical solutions, this section serves as a guide for DPPKAD and other stakeholders in their efforts to optimize tax revenues. The recommendations underscore the educational value of the research by linking theory to practice.

Referensi Dokumen

- Peraturan Daerah Kabupaten Sukoharjo Nomor 7 tahun 2011 tentang Pajak Daerah ( Pemerintah Kabupaten Sukoharjo )

- DPPKAD Kabupaten Sukoharjo ( DPPKAD )