DAFTAR PUSTAKA

Agarwal, Vikas., Naveen D. Daniel, & Narayan Y. Naik. 2006. Why is Santa so

Kind to Hedge Funds? The December Return Puzzle!. Working Paper:

Georgia State University, Purdue University, & London Business School.

Atmaja, Lukas Setia. 2013. Anomali December Effect.

Diakses dari

Brown, S, J., dan J. B. Warner., “Using Daily Stock Returns: The Case of Event

Studies”, Journal of Financial Economics 14, 1985.

Chen, Hongui, dan Vijay Singal. 2003. Financial Analysts Journal: “A December

Effect with Tax-Gain Selling?”. Working Paper, Virginia Tech.

Fama, E. F., “Efficient Capital Market: A Review of Theory and Empirical

Work”, Journal of Finance 25 (1970), hal. 383-417.

Fama, E. F., “Efficient Capital Market: II”, Journal of Finance 46 (December

1991), hal. 1575-1617.

Fischer, Dominique. 2009.

Has Santa Claus a Good Long-Term Memory?.

University of Malaysia.

Hirsch, Yale. 1972. Founder of Santa Claus Rally Effect since 1972. Diakses dari

Hircsh, Yale. 2012. The Santa Claus Rally: It’s Not Make Believe. Diakses dari

Jogiyanto, 2008. Teori Portofolio dan Analisis Investasi. Edisi Kelima.

Yogyakarta: Penerbit BPFE

Raharjo, Adi., Fathul Mubaraq, & Faisal Mundir. 2013. December Effect of Stock

Market Return in Indonesia Stock Exchange 1998-2012: International

Journal of Science and Research (IJSR), India Online ISSN: 2319-7064.

Sharpe, W.F. 1969. Efficient Capital Markets: A Review of Theory and Empirical

Work: Discussion. The Journal of Finance, Vol. 25, No. 2, Papers and

Proceedings of the Twenty-Eighth Annual Meeting of the American

Finance Association New York. pp. 418-420.

LAMPIRAN

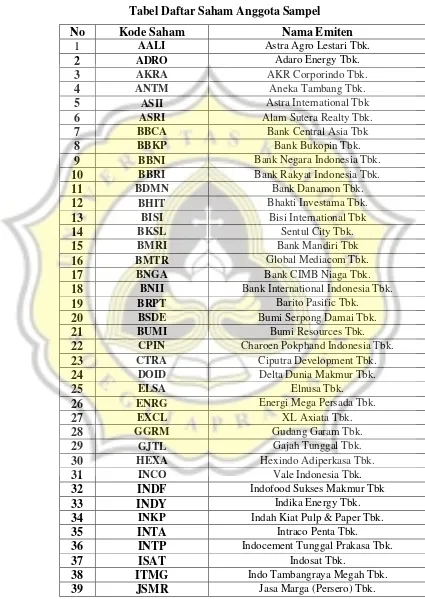

Tabel Daftar Saham Anggota Sampel

No

Kode Saham

Nama Emiten

1

AALI Astra Agro Lestari Tbk.2

ADRO Adaro Energy Tbk.3

AKRA AKR Corporindo Tbk.4

ANTM Aneka Tambang Tbk.5

ASII Astra International Tbk6

ASRI Alam Sutera Realty Tbk.7

BBCA Bank Central Asia Tbk8

BBKP Bank Bukopin Tbk.9

BBNI Bank Negara Indonesia Tbk.10

BBRI Bank Rakyat Indonesia Tbk.11

BDMN Bank Danamon Tbk.12

BHIT Bhakti Investama Tbk.13

BISI Bisi International Tbk14

BKSL Sentul City Tbk.15

BMRI Bank Mandiri Tbk16

BMTR Global Mediacom Tbk.17

BNGA Bank CIMB Niaga Tbk.18

BNII Bank International Indonesia Tbk.19

BRPT Barito Pasific Tbk.20

BSDE Bumi Serpong Damai Tbk.21

BUMI Bumi Resources Tbk.22

CPIN Charoen Pokphand Indonesia Tbk.23

CTRA Ciputra Development Tbk.24

DOID Delta Dunia Makmur Tbk.25

ELSA Elnusa Tbk.26

ENRG Energi Mega Persada Tbk.27

EXCL XL Axiata Tbk.28

GGRM Gudang Garam Tbk.29

GJTL Gajah Tunggal Tbk.30

HEXA Hexindo Adiperkasa Tbk.31

INCO Vale Indonesia Tbk.32

INDF

Indofood Sukses Makmur Tbk33

INDY

Indika Energy Tbk.34

INKP Indah Kiat Pulp & Paper Tbk.35

INTA

Intraco Penta Tbk.36

INTP

Indocement Tunggal Prakasa Tbk.37

ISAT

Indosat Tbk.40

KIJA

Kawasan Industri Jababeka Tbk.41

KLBF

Kalbe Farma Tbk.42

LPKR

Lippo Karawaci Tbk43

LSIP

London Sumatra Indonesia Tbk.44

MAIN

Malindo Feedmill Tbk.45

MAPI

Mitra Adiperkasa Tbk.46

MEDC

Medco Energi International Tbk.47

MLPL

Multipolar Tbk.48

MNCN

Media Nusantara Citra Tbk.49

PGAS

Perusahaan Gas Negara Tbk.50

PNBN

Bank Pan Indonesia Tbk51

PTBA

Tambang Batubara Bukit Asam Tbk.52

PWON

Pakuwon Jati Tbk.53

SGRO

Sampoerna Agro Tbk54

SMCB

Holcim Indonesia Tbk.55

SMGR

Semen Indonesia Tbk.56

SSIA

Surya Semesta Internusa Tbk.57

TBLA

Tunas Baru Lampung Tbk.58

TINS

Timah (Persero) Tbk.59

TLKM

Telekomunikasi Indonesia Tbk.60

TRAM

Trada Maritim Tbk.61

UNTR

United Tractors Tbk.62

UNVR Unilever Indonesia Tbk.Tabel ANOVA

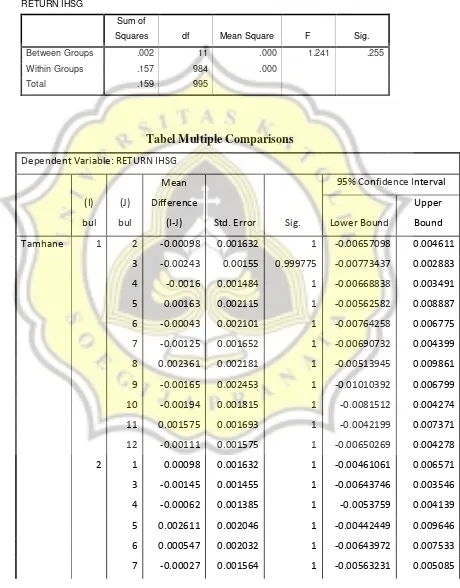

RETURN IHSG

Sum of

Squares df Mean Square F Sig.

Between Groups .002 11 .000 1.241 .255

Within Groups .157 984 .000

Total .159 995

Tabel Multiple Comparisons

Dependent Variable: RETURN IHSG

(I) bul

(J) bul

Mean Difference

(I-J) Std. Error Sig.

95% Confidence Interval

Lower Bound

Upper Bound

Tamhane 1 2 -0.00098 0.001632 1 -0.00657098 0.004611

3 -0.00243 0.00155 0.999775 -0.00773437 0.002883 4 -0.0016 0.001484 1 -0.00668838 0.003491 5 0.00163 0.002115 1 -0.00562582 0.008887 6 -0.00043 0.002101 1 -0.00764258 0.006775 7 -0.00125 0.001652 1 -0.00690732 0.004399 8 0.002361 0.002181 1 -0.00513945 0.009861 9 -0.00165 0.002453 1 -0.01010392 0.006799 10 -0.00194 0.001815 1 -0.0081512 0.004274 11 0.001575 0.001693 1 -0.0042199 0.007371 12 -0.00111 0.001575 1 -0.00650269 0.004278

2 1 0.00098 0.001632 1 -0.00461061 0.006571

8 0.003341 0.002115 0.999723 -0.003947 0.010629 9 -0.00067 0.002394 1 -0.00893798 0.007593 10 -0.00096 0.001735 1 -0.00690667 0.004989 11 0.002555 0.001607 0.999654 -0.00295354 0.008065 12 -0.00013 0.001482 1 -0.00521084 0.004946 3 1 0.002426 0.00155 0.999775 -0.00288259 0.007734 2 0.001446 0.001455 1 -0.00354605 0.006437 4 0.000827 0.001288 1 -0.00358427 0.005239 5 0.004056 0.001981 0.943744 -0.00276554 0.010878

6 -0.00206 0.002436 1 -0.01040926 0.006281 7 -0.00288 0.002062 0.999993 -0.00996928 0.004201 8 0.00073 0.002506 1 -0.00786064 0.009321 9 -0.00328 0.002746 1 -0.01270201 0.006136 10 -0.00357 0.002195 0.999382 -0.01109382 0.003955 11 -5.5E-05 0.002095 1 -0.0072493 0.007139 12 -0.00274 0.002001 0.999996 -0.00962716 0.004141 6 1 0.000434 0.002101 1 -0.00677526 0.007643 2 -0.00055 0.002032 1 -0.00753276 0.00644 3 -0.00199 0.001966 1 -0.00876357 0.004779 4 -0.00116 0.001915 1 -0.00777215 0.005442 5 0.002064 0.002436 1 -0.00628117 0.010409 7 -0.00082 0.002048 1 -0.00785673 0.006216 8 0.002794 0.002494 1 -0.00575744 0.011346 9 -0.00122 0.002735 1 -0.01060263 0.008165 10 -0.00151 0.002181 1 -0.00898435 0.005974 11 0.002009 0.002081 1 -0.00513757 0.009156 12 -0.00068 0.001986 1 -0.00751311 0.006155 7 1 0.001254 0.001652 1 -0.00439933 0.006907 2 0.000274 0.001564 1 -0.00508469 0.005632