Lampiran 1

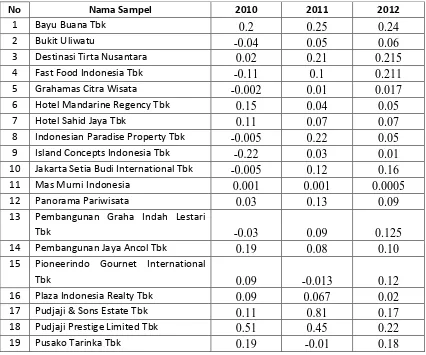

Tabel Net Working Capital to Total Assets (X1)

No Nama Sampel 2010 2011 2012

1 Bayu Buana Tbk 0.2 0.25 0.24

2 Bukit Uliwatu -0.04 0.05 0.06

3 Destinasi Tirta Nusantara 0.02 0.21 0.215

4 Fast Food Indonesia Tbk -0.11 0.1 0.211

5 Grahamas Citra Wisata -0.002 0.01 0.017

6 Hotel Mandarine Regency Tbk 0.15 0.04 0.05

7 Hotel Sahid Jaya Tbk 0.11 0.07 0.07

8 Indonesian Paradise Property Tbk -0.005 0.22 0.05

9 Island Concepts Indonesia Tbk -0.22 0.03 0.01

10 Jakarta Setia Budi International Tbk -0.005 0.12 0.16

11 Mas Murni Indonesia 0.001 0.001 0.0005

12 Panorama Pariwisata 0.03 0.13 0.09

13 Pembangunan Graha Indah Lestari

Tbk -0.03 0.09 0.125

14 Pembangunan Jaya Ancol Tbk 0.19 0.08 0.10

15 Pioneerindo Gournet International

Tbk 0.09 -0.013 0.12

16 Plaza Indonesia Realty Tbk 0.09 0.067 0.02

17 Pudjaji & Sons Estate Tbk 0.11 0.81 0.17

18 Pudjaji Prestige Limited Tbk 0.51 0.45 0.22

Lampiran 2

Tabel Retained Earnings to Total Assets (X2)

No Nama Sampel 2010 2011 2012

1 Bayu Buana Tbk 0.81 0.68 0.51

2 Bukit Uliwatu 0.49 0.47 0.43

3 Destinasi Tirta Nusantara 0.004 0.13 0.12

4 Fast Food Indonesia Tbk 2.64 2.39 2.23

5 Grahamas Citra Wisata 0.06 0.69 0.83

6 Hotel Mandarine Regency Tbk 0.29 0.23 0.14

7 Hotel Sahid Jaya Tbk 0.34 0.29 0.39

8 Indonesian Paradise Property Tbk 0.94 0.45 0.42

9 Island Concepts Indonesia Tbk 1.23 0.44 0.49

10 Jakarta Setia Budi International Tbk 0.46 0.4 0.35

11 Mas Murni Indonesia 0.39 0.36 0.34

12 Panorama Pariwisata 0.09 1.34 0.05

13 Pembangunan Graha Indah Lestari

Tbk 1.16 1.11 1.07

14 Pembangunan Jaya Ancol Tbk 0.27 0.23 0.16

15 Pioneerindo Gournet International

Tbk 1.01 0.07 0.54

16 Plaza Indonesia Realty Tbk 0.16 0.16 0.17

17 Pudjaji & Sons Estate Tbk 0.2 0.18 0.22

18 Pudjaji Prestige Limited Tbk 0.49 0.41 0.42

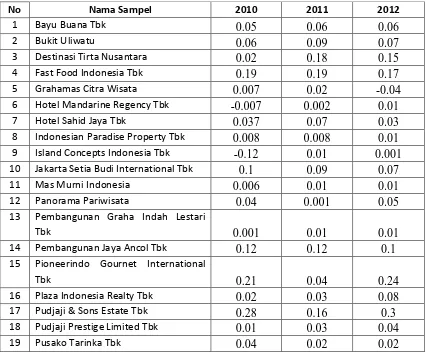

Lampiran 3

Tabel Earnings Before Interest And Taxes to Total Assets (X3)

No Nama Sampel 2010 2011 2012

1 Bayu Buana Tbk 0.05 0.06 0.06

2 Bukit Uliwatu 0.06 0.09 0.07

3 Destinasi Tirta Nusantara 0.02 0.18 0.15

4 Fast Food Indonesia Tbk 0.19 0.19 0.17

5 Grahamas Citra Wisata 0.007 0.02 -0.04

6 Hotel Mandarine Regency Tbk -0.007 0.002 0.01

7 Hotel Sahid Jaya Tbk 0.037 0.07 0.03

8 Indonesian Paradise Property Tbk 0.008 0.008 0.01

9 Island Concepts Indonesia Tbk -0.12 0.01 0.001

10 Jakarta Setia Budi International Tbk 0.1 0.09 0.07

11 Mas Murni Indonesia 0.006 0.01 0.01

12 Panorama Pariwisata 0.04 0.001 0.05

13 Pembangunan Graha Indah Lestari

Tbk 0.001 0.01 0.01

14 Pembangunan Jaya Ancol Tbk 0.12 0.12 0.1

15 Pioneerindo Gournet International

Tbk 0.21 0.04 0.24

16 Plaza Indonesia Realty Tbk 0.02 0.03 0.08

17 Pudjaji & Sons Estate Tbk 0.28 0.16 0.3

18 Pudjaji Prestige Limited Tbk 0.01 0.03 0.04

Lampiran 4

Tabel Market Value of Equityto Total Liabilities (X4)

No Nama Sampel 2010 2011 2012

1 Bayu Buana Tbk 1.8 0.83 0.9

2 Bukit Uliwatu 1.09 1.47 1.67

3 Destinasi Tirta Nusantara 1.84 1.15 1.25

4 Fast Food Indonesia Tbk 1.22 1.24 1.91

5 Grahamas Citra Wisata 1.51 1.8 3.08

6 Hotel Mandarine Regency Tbk 2.38 1.28 1.16

7 Hotel Sahid Jaya Tbk 1.27 1.08 1.48

8 Indonesian Paradise Property Tbk 1.01 2.77 2.41

9 Island Concepts Indonesia Tbk 0.11 0.22 0.31

10 Jakarta Setia Budi International Tbk 1.09 1.28 1.2

11 Mas Murni Indonesia 10.99 7.11 5.06

12 Panorama Pariwisata 0.43 2.68 0.39

13 Pembangunan Graha Indah Lestari

Tbk 6.93 5.44 4.53

14 Pembangunan Jaya Ancol Tbk 1.31 2.11 1.21

15 Pioneerindo Gournet International

Tbk 0.53 0.51 1.39

16 Plaza Indonesia Realty Tbk 0.99 1.18 1.29

17 Pudjaji & Sons Estate Tbk 0.9 1.45 1.82

18 Pudjaji Prestige Limited Tbk 3.49 2.40 2.38

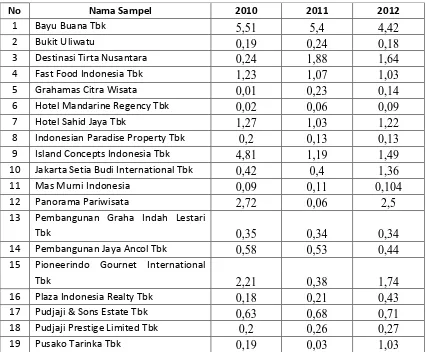

Lampiran 5

Tabel Sales to Total Assets (X5)

No Nama Sampel 2010 2011 2012

1 Bayu Buana Tbk 5,51 5,4 4,42

2 Bukit Uliwatu 0,19 0,24 0,18

3 Destinasi Tirta Nusantara 0,24 1,88 1,64

4 Fast Food Indonesia Tbk 1,23 1,07 1,03

5 Grahamas Citra Wisata 0,01 0,23 0,14

6 Hotel Mandarine Regency Tbk 0,02 0,06 0,09

7 Hotel Sahid Jaya Tbk 1,27 1,03 1,22

8 Indonesian Paradise Property Tbk 0,2 0,13 0,13

9 Island Concepts Indonesia Tbk 4,81 1,19 1,49

10 Jakarta Setia Budi International Tbk 0,42 0,4 1,36

11 Mas Murni Indonesia 0,09 0,11 0,104

12 Panorama Pariwisata 2,72 0,06 2,5

13 Pembangunan Graha Indah Lestari

Tbk 0,35 0,34 0,34

14 Pembangunan Jaya Ancol Tbk 0,58 0,53 0,44

15 Pioneerindo Gournet International

Tbk 2,21 0,38 1,74

16 Plaza Indonesia Realty Tbk 0,18 0,21 0,43

17 Pudjaji & Sons Estate Tbk 0,63 0,68 0,71

18 Pudjaji Prestige Limited Tbk 0,2 0,26 0,27

Lampiran 6 Discriminant

Notes

Output Created 14-Apr-2014 14:15:40

Comments

Input Active Dataset DataSet0

Filter <none> Weight <none> Split File <none> N of Rows in

Working Data File

57

Missing Value Handling Definition of Missing

User-defined missing values are treated as missing in the analysis phase.

Cases Used In the analysis phase, cases with no user- or system-missing values for any predictor variable are used. Cases with user-, system-missing, or out-of-range values for the grouping variable are always excluded.

Syntax DISCRIMINANT

/GROUPS=Y(1 4)

/VARIABLES=X1 X2 X3 X4 X5 /ANALYSIS ALL

/SAVE=CLASS SCORES PROBS /METHOD=MAHAL

/PIN=.05 /POUT=.10 /PRIORS EQUAL /HISTORY

/STATISTICS=MEAN STDDEV UNIVF BOXM COEFF RAW CORR COV GCOV TCOV

/PLOT=COMBINED SEPARATE /PLOT=CASES

/CLASSIFY=NONMISSING POOLED.

Resources Processor Time 0:00:01.841

Elapsed Time 0:00:03.776

Modified Dis1_1 Discriminant Scores from Function 1 for Analysis 1

Dis2_1 Discriminant Scores from Function 2 for Analysis 1

Dis3_1 Discriminant Scores from Function 3 for Analysis 1

Dis1_2 Probabilities of Membership in Group 1 for Analysis 1

Dis2_2 Probabilities of Membership in Group 2 for Analysis 1

Dis3_2 Probabilities of Membership in Group 3 for Analysis 1

Dis4_2 Probabilities of Membership in Group 4 for Analysis 1

Number of unweighted cases written to the working file after classification

57

Analysis Case Processing Summary

Unweighted Cases N Percent

Valid 57 100.0

Excluded Missing or out-of-range group codes

0 .0

At least one missing discriminating variable

0 .0

Both missing or out-of-range group codes and at least one missing

discriminating variable

0 .0

Total 0 .0

Total 57 100.0

Tests of Equality of Group Means

Wilks' Lambda F df1 df2 Sig.

NWC TO TA .841 3.335 3 53 .026

EBIT TO TA .940 1.136 3 53 .343

EQ TO TL .861 2.860 3 53 .045

S TO TA .813 4.059 3 53 .011

Pooled Within-Groups Matricesa

NWC TO TA RE TO TA EBIT TO TA EQ TO TL S TO TA

a. The covariance matrix has 53 degrees of freedom.

Covariance Matricesa

EQ TO TL .010 -.031 -.005 .372 -.199

a. The total covariance matrix has 56 degrees of freedom.

Analysis 1

Box's Test of Equality of Covariance Matrices Log Determinants

KEBANGKRUTAN Rank

Log

Pooled within-groups 4 -4.183 The ranks and natural logarithms of determinants printed are those of the group covariance matrices.

Test Results

Box's M 228.563

F Approx. 5.746

df2 923.743

Sig. .000

Tests null hypothesis of equal population covariance

matrices.

Stepwise Statistics

Variables Entered/Removeda,b,c,d

Step

Min. D Squared

Exact F

Entered Statistic

Between

At each step, the variable that maximizes the Mahalanobis distance between the two closest groups is entered.

a. Maximum number of steps is 10.

b. Maximum significance of F to enter is .05. c. Minimum significance of F to remove is .10.

d. F level, tolerance, or VIN insufficient for further computation.

Variables in the Analysis

Step Tolerance

RE TO TA .898 .011 .463 3,00 and 4,00

S TO TA .624 .000 .635 1,00 and 2,00

EQ TO TL .605 .000 .961 3,00 and 4,00

Variables Not in the Analysis Step Tolerance Min. Tolerance

Sig. of F to

Summary of Canonical Discriminant Functions Eigenvalues

Functio

n Eigenvalue % of Variance Cumulative %

1 1.841a 95.6 95.6 .805

2 .056a 2.9 98.5 .231

3 .028a 1.5 100.0 .165

a. First 3 canonical discriminant functions were used in the analysis.

Wilks' Lambda Test of

Function(s) Wilks' Lambda Chi-square df Sig.

1 through 3 .324 58.586 12 .000

2 through 3 .921 4.295 6 .637

3 .973 1.437 2 .487

Standardized Canonical Discriminant Function Coefficients

Function

Pooled within-groups correlations between discriminating variables and standardized canonical discriminant functions

Variables ordered by absolute size of correlation within function.

*. Largest absolute correlation between each variable and any discriminant function a. This variable not used in the analysis.

Canonical Discriminant Function Coefficients Unstandardized coefficients

Functions at Group Centroids KEBA Unstandardized canonical

discriminant functions evaluated at group means

Classification Statistics

Classification Processing Summary

Excluded Missing or out-of-range group codes

0

At least one missing discriminating variable

0

Used in Output 57

Prior Probabilities for Groups KEBA

NGKR

UTAN Prior

Cases Used in Analysis

Unweighted Weighted

1.00 .250 25 25.000

2.00 .250 5 5.000

3.00 .250 17 17.000

4.00 .250 10 10.000

Total 1.000 57 57.000

Classification Function Coefficients KEBANGKRUTAN Fisher's linear discriminant functions

Casewise Statistics Case

Numb er

Highest Group

Second Highest Group

Actua

Centroid Group

P(G=g | D=d)

Squared Mahalanobi

s Distance to Centroid