Decision Support Systems Design on Sharia

Financing using

Yager’s

Fuzzy Decision Model

¹Aries Susanto, ²Lisa Latifah,

3Nuryasin,

4Aida Fitriyani

1,2,3Department of Information SystemsSyarif Hidayatullah State Islamic University Jakarta, Tangerang Selatan, Indonesia

4Department of Informatics Engineering

Bhayangkara University, Jakarta, Indonesia

Abstract- Financing based on Islamic banking is one of our most desirable communities. In analyzing customer financing filing takes a relatively long time because the assessment process is carried out based on the subjectivity of the leaders and decision makers no accurate calculations in determining the customer is acceptable or not in the filing of financing. Absence of Decision Support Systems to assist in calculating eligibility chief marketing customer financing led to the assessment process lasts longer and inaccurate. The purpose of this study to help the performance of the head of marketing in giving a decision based on the assessment criteria that apply are using Decision Support System. The Decision Support System using Fuzzy MADM with Yager model and assessment criteria 5C (Character, Capacity, Capital, Collateral and Condition), system development methods Rapid Application Development (RAD) and Unified Modeling Language (UML) as tools of system design. Decision Support System is expected to help the performance of the head of marketing in making a decision on the filing of financing customers quickly and accurately.

Keywords- Islamic banking; fuzzy MADM; Yager model; information systems; decision support systems; problem solving; finance

I. INTRODUCTION

Nowadays, technology development has a lot to offer for people like convenience who run activities [6]. Profit-based organizations (companies) as well as non-profit organizations (including government agencies) feel many benefits of technological advances [3]. Presence technology can aim to achieve better results with the level of effectiveness and high accuracy.

Similarly, in the decision-making process in the sharia-based banking treasure activities, information is needed in this era of globalization because all the parties are required to move quickly and precisely in taking a decision and action.

Such business activities that is collecting funds from public in the form of deposits such as time deposits, savings or other forms and distributing the funds in the form of loans [5]. One of the funds distributed in the form of loans to customers using the Murabaha-based contract [13].

Customers who want to do the financing treasure first analyzed whether the customer is feasible or not get a loan financing in accordance with the applicable criteria in treasure starting from the marketing to select files and analyze data

customers to do the process of scoring by head of marketing financing.

The process of granting scoring to have an appropriate decision in the sharia-based banking still subjective nature so that the decision makers often have difficulty in processing customer data to perform calculations feasibility assessment customers. That is why it needs a system that can generate data assessment ranking system which prospective customers financing most recommended to facilitate the performance of the head of marketing in its assessment of Murabaha-based finance to prospective customers. With this assessment, the expected head of marketing can work quickly and of course, customers do not have to wait long processing time if the admissions process whether or not a loan fund for designated financing.

Based on the issues described above, the need for Decision Support System to select prospective customers filing Murabaha-based financing for the results of the assessment carried out more quickly and precisely so that it can help the performance of the management of a sharia-based banking treasure.

Therefore, this study proposed a review on Decision Support System based on Murabaha method using Fuzzy MADM (Multi Attribute Decision Making)-based Yager model which is expected to help provide solutions to the assessment of prospective customers filing financing to management in future.

II. THEORETICAL BACKGROUND

A. Basic Concepts of Information Systems

B. Decision Support Systems (DSS)

Decision Support System is an information system that can help identify opportunities decisions or provide information to assist in making a decision [9]. It has a specific objectives and principles such as assisting managers in making decisions on semi-structured problems, providing support for consideration of the manager, and improving the effectiveness of the decisions a manager [3].

Moreover, Decision Support System is also a system designed to assist management in the process of making decisions and to improve the process and quality of the decision-making results. The system is not intended to replace the role of the decision makers, but the system is made to produce alternative offered decision-makers in their duties [3].

Decision Support System needs an architecture to make a decision is appropriately taken and can give a best alternate for a needed decision by managers. It may consist of four components or subsystems are [12] such as:

1. Data Management Subsystem

Data management subsystems which include a database containing the relevant data for a situation that is set by a software called the Database Management System (DBMS).

2. Model Management Subsystem

A software package which include financial models, statistics, and management science or various other quantitative models that can provide analytic and management capabilities for the right software. This software is often called the Model Base Management System (MBMS).

3. User Interface Subsystem

This subsystem allows the user to be able to communicate and give orders to the SPK. These subsystems are managed by a User Interface Management System (UIMS).

4. Knowledge-Based Management Subsystem

These subsystems can provide some of the skills necessary to solve a problem and provide a knowledge that can improve the operation of the components of the other SPK. These components form a Decision Support System that can be connected to the internet.

C. Fuzzy MADM (Multi Attribute Decision Making) Method

Fuzzy (MADM) is a method used to find the optimal alternative of a number of alternatives to certain criteria [14]. The essence of Fuzzy MADM is to determine the weight values for each attribute, followed by ranking process that will select the alternative that has been given. On the other hand, concepts of Yager’s fuzzy decision model is frequently used in Fuzzy MADM-based calculation [10].

This is a standard form of Fuzzy MADM. Let A=

{a1……an } is the set of alternatives and presented

with a fuzzy set of attributes (cj ), j=1 ,……, m. Weights

which shows the level of importance of attributes denoted by -j (wj) The value of alternative performance ai with attributes

(cj) is expressed by the degree of membership mc(xi). The final

decision is taken by the intersection of all the attributes of

fuzzy. Optimal alternative is defined such that those

alternatives contributed the highest degree of membership in vector D [10] [14].

Fig. 1. Fuzzy-based ranking decision function

D. Yager’s Fuzzy Model Solution Procedures

There are several steps to select a decision using Yager’s

model as follows [14]:

Make a comparison matrix.

Normalized to determine the weight vector. Calculating the value of lambda max, CI and CR. Convert the quality criteria in the value of crisp.

Calculate and create value matrix C by means of crisp

values constitute the vector row.

Specifiy the minimum value of each attribute (vector D). Determine the greatest value of the vector D as a result.

E. Yager’s Fuzzy Model Considerations

Beside Yager model has several strengths which may result an appropriate decision for managers such as to make a rating on each alternative based on the aggregation degree of compatibility on all the criteria, to create a shape of mathematically simple and easily understood by decision-makers, and to assert from the objective and subjective aspects, Yager has also some weaknesses such as not efficient enough to solve the problem of making decisions which data is still imprecise, uncertain and unclear. It is also assumed that a final decision on the alternatives expressed with real numbers, so the ranking stage might be less surrogate on some specific issues and selection phase has focused on the problem of aggregation [14].

III. RESEARCH METHODOLOGY

Fuzzy MADM Yager models chosen as a model of analysis in this study because classical MADM methods such as analytic hierarchy process (AHP), elimination and choice expressing reality (ELECTRE), simple additive weighting (SAW), and technique for order preference by similarity to ideal solution (TOPSIS) [14]. We expected that this model will derive the best criteria for making an appropriate decision.

A. Data Collection

We used types of method on data collection such as observation at a Rural Sharia Bank in Jakarta, interview with persons in charge at Murabaha-based financing department, and literature review of Information Systems and DSS.

IV. RESULTS AND DISCUSSION

By following several steps as discussed above to select a decision, we have several calculation using Fuzzy MADM Yager as follows:

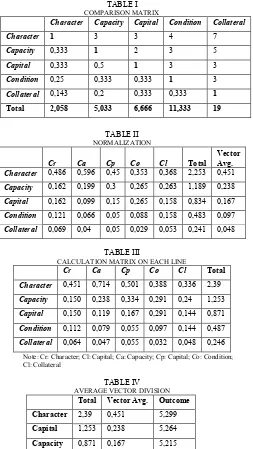

TABLE I COMPARISON MATRIX

Character Capacity Capital Condition Collateral

Character 1 3 3 4 7

Capacity 0,333 1 2 3 5

Capital 0,333 0,5 1 3 3

Condition 0,25 0,333 0,333 1 3

Collateral 0,143 0,2 0,333 0,333 1

Total 2,058 5,033 6,666 11,333 19

TABLE II NORMALIZATION

Cr Ca Cp Co Cl Total

Vector Avg.

Character 0,486 0,596 0,45 0,353 0,368 2,253 0,451

Capacity 0,162 0,199 0,3 0,265 0,263 1,189 0,238

Capital 0,162 0,099 0,15 0,265 0,158 0,834 0,167

Condition 0,121 0,066 0,05 0,088 0,158 0,483 0,097

Collateral 0,069 0,04 0,05 0,029 0,053 0,241 0,048

TABLE III

CALCULATION MATRIX ON EACH LINE

Cr Ca Cp Co Cl Total

Character 0,451 0,714 0,501 0,388 0,336 2,39

Capacity 0,150 0,238 0,334 0,291 0,24 1,253

Capital 0,150 0,119 0,167 0,291 0,144 0,871

Condition 0,112 0,079 0,055 0,097 0,144 0,487

Collateral 0,064 0,047 0,055 0,032 0,048 0,246

Note: Cr: Character; Cl: Capital; Ca: Capacity; Cp: Capital; Co: Condition; Cl: Collateral

TABLE IV AVERAGE VECTOR DIVISION

Total Vector Avg. Outcome

Character 2,39 0,451 5,299

Capital 1,253 0,238 5,264

Capacity 0,871 0,167 5,215

Condition 0,487 0,097 5,020

Collateral 0,46 0,048 5,583

By using the outcomes from above tables, we may then

calculate with Yager’s formula to get total criteria.

Total Criteria (n)

CI calculation:

CR calculation:

= 0,043

The next step to do is converting the value criteria into crisp

values intended for the system to process the understandable values by the system, especially in the decision-making method that uses a Fuzzy MADM. The result after conversion process is shown on the below table:

TABLE V

QUALITY VALUE OF CRITERIA Customer

Nasabah

Character Capacity Capital Condition Collateral

A Good Good Average Very

Good

Average

B Average Very Good

Very Good

Good Average

C Very Good Baik

Good Average

Baik

Bad Good

D Average Good Very Good

Good Good

The values are then converted into determined weight crisp

values and will give the following values:

TABLE V CRISP VALUE CONVERSION Customer

Nasabah

Character Capacity Capital Condition Collateral

A 0.8 0,8 0,6 1 0,6

B 0,6 1 1 0,8 0,6

C 1 0,8 0,6 0,4 0,8

D 0,6 0,8 1 0,8 0,8

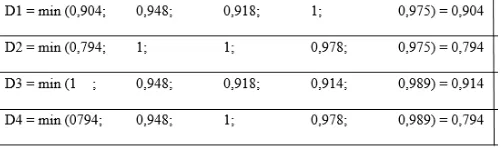

Matrix C is then formulated to find the highest to the lowest value of each criterion and prospective customer. The calculation of the value of C by constituting crisp values of the weight vectors shown in the below table of normalization.

TABLE V CRISP VALUE CALCULATION

Nilai C Lisa Latifah Fachry Suny

CI( 0,904 0,794 1 0,794

C2( 0,948 1 0,948 0,948

C3( 0,918 1 0,918 1

C4( 1 0,978 0,914 0,978

Finally we can have optimal alternative through the highest degree of membership in vector D by transposing matrix C

results as follows:

TABLE VI

MINIMUM VALUE OF ATTRIBUTES

V. CONCLUSIONS

Vector D value is the result of an assessment using Fuzzy MADM Yager model to determine the most prospective customers with better eligibility through the highest given. By using vectors value D which have been calculated from the sum of each value of the criteria {0.904; 0.794; 0.914; 0.794}, the most prospective customer is customer C (D3) with a value 0.914. He/she is chosen as the most prospective customer to be given Murabaha financing.

Other considerations are found here is firstly, the system is simply designed to assist the head of marketing in making decisions by using fuzzy MADM Model Yager where with this method every criteria given weight value in accordance with priorities to be more desired. The system was built streamline the decision-making process time to be more efficient.

Secondly, Decision Support System was built to produce the assessment calculation based on subjective and objective assessment criteria for using 5C: Character, Capacity, Capital, Collateral and Condition.

The system can present an assessment based on a calculation of the value of each criteria such as excellent with a value of 1, 0.8, 0.6, 0.4 and 0.2 to raise to the results of the weight vector obtained from the input value of the comparison criteria resulting in a sequence of customer data that is most recommended.

VI. LIMITATIONS AND FUTURE STUDIES

The system may be developed by adding other assessment criteria, not only using the criteria 5C (Character, Capacity, Condition, Capital, Collateral), but by adding a 7P principles such as Personality, Purpose, Prospect, Payment, Profitability, Protection and Party.

Future studies are expected not only to the stage of the assessment process if the customer is accepted or not get a loan financing, but until the process of the client mortgage payments for each month process.

ACKNOWLEDGMENT

We would like to thank A’ang Subiyakto for his comments and recommendations.

REFERENCES

[1] A. Dennis, B. Haley Wixom, D. Tegarden. System Analysis and Design with UML Version 2.0, 2nd Editions. NJ: John Wiley & Sons, 2005. [2] A. Ladjamudin, System Analysis and Design (Analisis dan Desain

Sistem Informasi), Yogyakarta: Graha Ilmu, 2006.

[3] A. Mulyanto, Information Systems: Concept and Implementation (Sistem Informasi Konsep dan Aplikasi). Yogyakarta: Pustaka Pelajar, 2009.

[4] A. Susanto, H. Lee, H. Zo, A.P. Ciganek, "User acceptance of Internet banking in Indonesia: initial trust formation," Information Development, vol. 4, pp.309-322, November 2013.

[5] A. Susanto, Y. Chang, Y. Ha, "Determinants of continuance intention to use the smartphone banking services: an extension to the expectation-confirmation model," Industrial Management & Data Systems, vol. 3, pp.508-525, April 2016.

[6] A. Susanto, H. Lee, H. Zo, "Factors influencing initial trust formation in adopting Internet banking in Indonesia. In International Conference on Advanced Computer Science and Information System, pp. 305-310, December 2011.

[7] E. Turban, J.E. Aronson, and T.P. Liang. Decision Support Systems and Intelligent Systems (Sistem Pendukung Keputusan dan Sistem Kecerdasan), Yogyakarta: Penerbit Andi, 2005.

[8] J. Hartono Mustakini, System Analysis and Design (Analisis dan Desain Sistem Informasi), Yogyakarta: Penerbit Andi, 2005.

[9] J.L. Whitten, L.D. Bentley, and K.C. Dittman. System Analysis and Design Methods. Yogyakarta: Penerbit Andi, 2007.

[10] J.M. Sousa and U. Kaymak. Fuzzy Decision Making in Modeling and Control. London: World Scientific, 2002.

[11] K.E. Kendall and J.E. Kendall. Systems Analysis and Design. NJ: Pearson, 2008.

[12] Kusrini. Database: Strategy, Design, and Management (Strategi Perancangan dan Pengelolaan Basis Data). Yogyakarta: Andi, 2007. [13] M. Syafi’I Antonio, Sharia-based Banking: From Theory to Practice

(Bank Syariah dari Teori ke Praktik). Jakarta: Gema Insani, 2009. [14] S. Kusumadewi, S. Hartati, A. Harjoko, and R. Wardoyo. Fuzzy