LAMPIRAN Lampiran 1

Daftar Bank Umum Syariah

No Populasi Kriteria Sampel

1 2

1 PT. Bank Muamalat Indonesia √ √ 1

2 PT. Bank Victoria Syariah - √ -

3 PT. Bank BRI Syariah √ √ 2

4 PT. B.P.D. Jawa Barat Banten Syariah - √ -

5 PT. Bank BNI Syariah √ √ 3

6 PT. Bank Syariah Mandiri √ √ 4

7 PT. Bank Syariah Mega Indonesia √ √ 5

8 PT. Bank Panin Syariah √ √ 6

9 PT. Bank Syariah Bukopin √ √ 7

10 PT. BCA Syariah √ √ 8

11 PT. Maybank Syariah Indonesia - √ -

Lampiran 2

Logaritma Natural Murabahah, Mudharabah, Musyarakah, NPF dan ROA

Tahun Bank Mrb Mdr Msr NPF ROA

2010

BRI Syariah

12,5335 11,5934 11,9717 3,0802 0,2633 2011 12,7299 11,7861 12,0604 3,4732 0,1491 2012 12,8530 11,9440 12,2515 3,0086 0,9799 2013 12,9544 11,9816 12,4890 3,9493 1,0571 2010

Syariah Mandiri

12,2960 12,6275 12,6618 7,6796 1,7958 2011 13,2961 12,6694 12,7347 2,9213 1,5761 2012 13,4401 12,6192 12,7817 2,5273 2,0750 2013 13,5212 12,5686 12,8481 3,9954 1,4172 2010

Mega Syariah

12,4680 9,4566 11,1640 3,3417 1,8655 2011 12,5334 9,0628 10,8536 3,5248 1,3281 2012 12,7292 6,9710 10,5604 2,9462 3,0998 2013 12,8371 6,9710 10,6385 2,7978 2,2459 2010

BNI Syariah

12,4071 10,9411 11,7958 3,7730 0,5744 2011 12,4973 10,9558 11,9633 4,5092 1,0542 2012 12,6819 11,4628 11,9916 2,0859 1,2939 2013 12,9070 11,8584 12,0456 1,8467 1,2212 2010

Muamalat

12,8160 12,1350 12,7766 3,2810 1,0798 2011 13,0085 12,1756 12,9126 2,1749 1,1443 2012 13,2128 12,3096 13,1141 2,1822 1,1634 2013 13,2990 12,3545 13,2783 1,3594 1,1950 2010

BCA Syariah

11,0315 10,9613 10,6794 0.0942 1,0242 2011 11,5323 10,1109 11,2895 0,1056 0,7354 2012 11,6434 11,1005 11,5338 0,0063 0,6841 2013 11,7830 11,3051 11,7300 0,1016 0,8210 2010

Panin Syariah

10,6099 11,0034 10,9087 0.4574 0.8272 2011 11,5824 11,4307 10,6872 0,8573 1,2205 2012 11,8870 11,8436 11,3617 0,1803 2,3159 2013 12,0943 11,8234 11,8190 1,0311 0,7196 2010

Bukopin Syariah

Lampiran 3

Statistik Deskriptif

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

Piutang Murabahah 32 10.6099 13.5212 12.434684 .6837190

Pembiayaan Mudharabah 32 6.9710 12.6992 11.316640 1.4014102

Pembiayaan Musyarakah 32 10.5604 13.2783 11.871465 .7747079

Non Performing Financing 32 .0063 7.6796 2.544567 1.7117216

Return On Asset 32 .1491 3.0998 1.170563 .6351238

Valid N (listwise) 32

One-Sample Kolmogorov-Smirnov Test

One-Sample Kolmogorov-Smirnov Test

Piutang Murabahah

Pembiayaan Mudharabah

Pembiayaan Musyarakah

Non Performing

Financing Return On Asset

N 32 32 32 32 32

Normal Paramete rsa,b

Mean 12.434684 11.316640 11.871465 2.544567 1.170563

Std.

Deviation .6837190 1.4014102 .7747079 1.7117216 .6351238 Most

Extreme Difference s

Absolute

.082 .238 .096 .090 .156 Positive .056 .162 .091 .085 .156 Negative -.082 -.238 -.096 -.090 -.102 Kolmogorov-Smirnov

Z .464 1.347 .544 .509 .881

Asymp. Sig. (2-tailed)

.983 .053 .929 .958 .419 a. Test distribution is Normal.

Histogram

Scatterplot

Uji Autokorelasi

Model Summaryb

Model

R R Square

Adjusted R Square

Std. Error of the

Estimate Durbin –Watson

1 .573a .329 .229 .5575956 1.449

a. Predictors: (Constant), Non performing financing, Pembiayaan Mudharabah, Piutang Murabahah, Pembiyaaan Musyarakah

Uji Multikolinieritas

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

T Sig.

Collinearity

Statistics

B Std. Error Beta Tolerance VIF

1 (Constant) -.951 2.045 -.465 .646

Piutang

Murabahah .578 .288 .622 2.009 .055 .259 3.860

Pembiayaan

Mudharabah -.101 .152 -.222 -.662 .514 .221 4.529

Pembiyaaan

Musyarakah -.326 .371 -.397 -.877 .388 .121 8.250

Non performing

financing -.024 .067 -.066 -.366 .717 .772 1.295

a. Dependent Variable: Return On Asset

Uji Analisis Regresi Berganda

Model Summary Model

R R Square

Adjusted R Square

Std. Error of the Estimate

1 .573a .329 .229 .5575956

a. Predictors: (Constant), Non performing financing, Pembiayaan Mudharabah, Piutang Murabahah, Pembiyaaan Musyarakah

Uji t-Statistik Coefficientsa Model Unstandardized Coefficients Standardized Coefficients

T Sig. B Std. Error Beta

1 (Constant) -.951 2.055 -.465 .646

Uji F-Statistik

ANOVAb

Model Sum of Squares Df Mean Square F Sig. 1 Regression 4.110 4 1.028 4.405 .025a

Residual 8.395 27 .311

Total 12.505 31

a. Predictors: (Constant), Non performing financing, Pembiayaan Mudharabah, Piutang Murabahah, Pembiyaaan Musyarakah

b. Dependent Variable: Return On Asset

Uji R2

Coefficientsa

Model

Unstandardized Coefficients

Standardized Coefficients

T Sig.

Collinearity Statistics B Std. Error Beta Tolerance VIF 1 (Constant) -.951 2.045 -.465 .646

Piutang

Murabahah .578 .288 .622 2.009 .055 .259 3.860 Pembiayaan

Mudharabah -.101 .152 -.222 -.662 .514 .221 4.529 Pembiyaaan

Musyarakah -.326 .371 -.397 -.877 .388 .121 8.250 Non performing

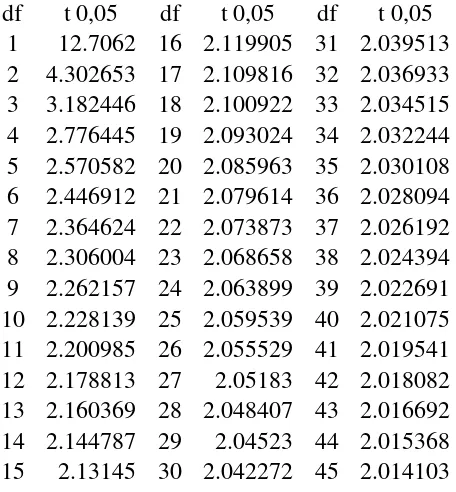

Lampiran 4

Tabel t Sig 0,05

df t 0,05 df t 0,05 df t 0,05 1 12.7062 16 2.119905 31 2.039513 2 4.302653 17 2.109816 32 2.036933 3 3.182446 18 2.100922 33 2.034515 4 2.776445 19 2.093024 34 2.032244 5 2.570582 20 2.085963 35 2.030108 6 2.446912 21 2.079614 36 2.028094 7 2.364624 22 2.073873 37 2.026192 8 2.306004 23 2.068658 38 2.024394 9 2.262157 24 2.063899 39 2.022691 10 2.228139 25 2.059539 40 2.021075 11 2.200985 26 2.055529 41 2.019541 12 2.178813 27 2.05183 42 2.018082 13 2.160369 28 2.048407 43 2.016692 14 2.144787 29 2.04523 44 2.015368 15 2.13145 30 2.042272 45 2.014103