ANALYSIS OF FACTORS AFFECTING SHARI’AH FINANCIAL LITERACY IN RURAL AREA, CASE STUDY OF PEKALONGAN ANALISIS FAKTOR – FAKTOR YANG MEMPENGARUHI LITERASI

KEUANGAN SYARIAH DI DAERAH PEDESAAN, STUDI KASUS PEKALONGAN

UNDERGRADUATE THESIS

Arranged By:

HAFID KHOIR MAULANA 20130430321

INTERNATIONAL PROGRAM FOR ISLAMIC ECONOMICS AND FINANCE

ANALYSIS OF FACTORS AFFECTING SHARI’AH FINANCIAL LITERACY IN RURAL AREA, CASE STUDY OF PEKALONGAN ANALISIS FAKTOR – FAKTOR YANG MEMPENGARUHI LITERASI

KEUANGAN SYARIAH DI DAERAH PEDESAAN, STUDI KASUS PEKALONGAN

UNDERGRADUATE THESIS

Arranged By:

HAFID KHOIR MAULANA 20130430321

INTERNATIONAL PROGRAM FOR ISLAMIC ECONOMICS AND FINANCE

FACULTY OF ECONOMICS AND BUSINESS UNIVERSITAS MUHAMMADIYAH YOGYAKARTA

DECLARATION

Name : Hafid Khoir Maulana

Student Number : 20130430321

With this letter I declare that this thesis entitled “ANALYSIS OF FACTORS AFFECTING SHARI’AH FINANCIAL LITERACY IN RURAL AREA, CASE STUDY OF PEKALONGAN” is consideration of my own personal effort. Where any of content presented is the result of input or data from a related collaborative research program this is duly acknowledged in the text such that it is possible to ascertain how much of the work is my own. Furthermore, I took reasonable care to ensure that the work is original, and to the best of my knowledge, does not breach copyright law, and has not been taken from other sources except where such work has been cited and acknowledged within the text.

Yogyakarta, 22 April 2017

MOTTO

“Hidup sekali hiduplah yang berarti, takut mati tak usah hidup takut hidup mati

saja”

(PMDG)

“Barangsiapa yang mendatangkan sebuah kebaikan maka ia akan mendapatkan sepuluh kali lipat dari kebaikan itu”

(Al-quranul kariim)

“Walaupun ranting pepohonan dijadikan alat tulis dan air di tujuh lautan

dijadikan tintanya maka sekali-kali tiak akan pernah cukup untuk menulis tanda

kebesaran Allah”

(Al-quranul kariim)

“Bondho,bahu,pikir lek perlu sak nyawane pisan”

(KH.Ahmad Sahal)

“Patah tumbuh hilang berganti sebelum patah sudah tumbuh sebelum hilang

sudah berganti”

(KH.Imam Zarkasyi)

“No dream no future, no regret no learning and if there is nothing to believe than nothing to achieve”

DEDICATION

I dedicated this undergraduate thesis for my parents, big family of Randukuning, teachers from my kindergarten until college, my second family “HIMIE”, my organization “FIES”, my classmate of IPIEF 2013, “PIONER” generation and all

ACKNOWLEDGEMENT

All praise to Allah S.W.T the most gracious and merciful for His guidance and blessing. Peace and salutation always be to the Prophet Muhammad peace be upon him altogether with his accompanies.

After the establishment of this study on “Analysis of Factors Affecting Shari’ah Financial Literacy in Rural area, Case study of Pekalongan ”the author gives special appreciation to the parties in supporting the accomplishment of this study. In particularly they are:

1. The respectable Dr. Nano Prawoto, SE., M.Si., as Dean of Economics Faculty.

2. The respectable Alm, Dr. Masyhudi Muqorobin, SE.,Akt., M.Ec., as Director of International Program for Islamic Economics and Finance UMY.

3. The respectable Mr.Agus Tri Basuki, SE.,M.Si as my supervisor together with Mrs. Dyah Tities Kusuma W.,MIDEc. for all priceless helps, supports, advices, guidance, all material and non-material dedications. 4. Dear all IPIEF lectures and IPIEF staff: Dr. Wahdi Yudhi, Yuli Utami,

M.Ec., Dr. Abdul Hakim, Mr. Hudiyanto, Ayif Faturrahman, M.Si, Dr. Endah Saptutiningsih, Dr. Lilies Setiartiti, Mr. Hendrianto, M.Ec, Mr. Umar Fauzi, MA, Mr. Sahlan, Mrs. Linda Kusumastuti, SE

5. For my mother and Father, Rahyono S.Pd,.MSi. and Wiri S.Pd,.Sd I love you so much.

6. For my sisters, Linah Tadiya Fitriana and Juliana Rahmawati for support and accompany.

7. Mr. Suwarjo, Mrs. Subekti, Mr. Dauri, Mrs. Sau’dah and all relatives that I cannot mention one by one, may Allah bless us.

8. My high school Pondok Modern Darussalam Gontor especially my graduate Pioner Generation.

TABLE OF CONTENT

DECLARATION ... iii

MOTTO ... iv

DEDICATION ... v

AKNOWLEDGEMENT ... vi

TABLE OF CONTENT ... vii

Table of Figures ... viii

Table of Pictures ... ix

INTISARI ……… ... x

ABSTRACT ………..……. ... xi

CHAPTER I ………. ... 1

INTRODUCTION ……….…….. ... 1

Background ……….………. ... 1

Problem Limitation ………..………… ... 8

Research Question ……….………….. ... 8

Research Objective ……….………. ... 9

Research Benefits ……….…… ... 9

Research Plan ……….……. ... 10

CHAPTER II ……….……….. ... 11

LITERATURE RIVEW ……….………. ... 11

Theoretical Framework ………...……… ... 11

History of Islamic Economic in Indonesia …………..……….. ... 11

Financial Literacy ……….………. ... 12

Shari’ah Financial Institution………...…. ... 14

Factors of Financial Literacy ……….…... 15

Shari’ah Financial Product……….... ... 17

Financial Institution and Financial Literacy Classification ….…….. ... 18

Financial Literacy Consumer Attitude ……….. ... 20

Financial Literacy of Islamic Consumption Theory ………..… ... 21

Rural Area ………. ... 22

Literature Review ……….... ... 23

Research Framework ………...…… ... 34

Hypothesis ………...……… ... 35

CHAPTER III ………. ... 36

METHODOLOGY ………... ... 36

Research Object ………... 36

Type of Data ………...…… ... 36

Collecting Sample Technique ………...…..… ... 37

Population ………...……..…... 37

Sampling Method ………...………... ... 37

Data Collection ………..………. ... 38

Operational Definition of Variables ………...………… ... 40

Dependent Variable ……….………. ... 40

Independent Variables ……….………. ... 41

Quality Test of Research Instrument ……….………. ... 41

Validity Test ………. ... 41

Reliability Test ………. ... 42

Data Analysis ………....…….. ... 43

Descriptive Statistic ………... 43

Logistic Regression ……….. ... 43

CHAPTER IV ………..…. ... 45

RESEARCH OVERVIEW ………...…. ... 45

Research Overview ………...…. ... 45

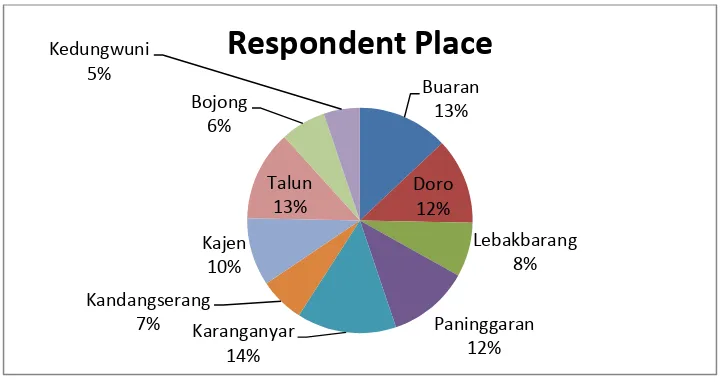

Amount of Respondent ………... 45

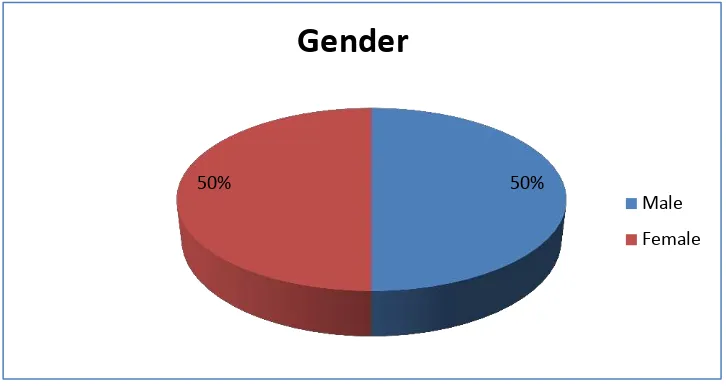

Gender ………..…… ... 47

Age Range of Respondent ………....…… ... 48

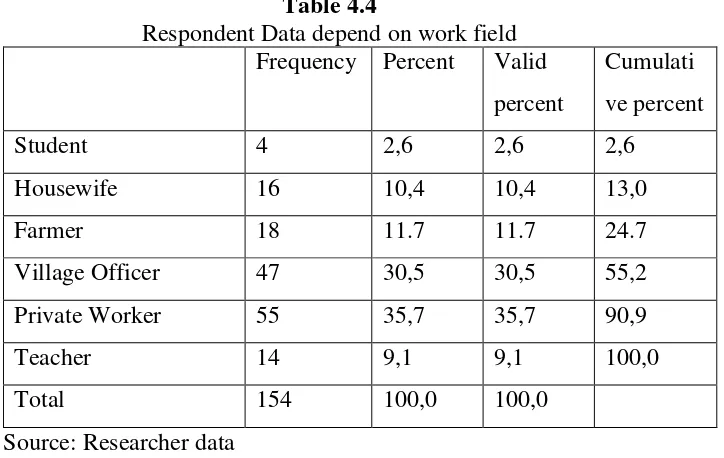

Work Field ………..…... 50

Income ………... ... 52

Education ………..…... ... 54

Financial Institution Relationship ……… ... 55

CHAPTER V ………....……. ... 58

DISCUSSION ………..………. ... 58

Instrument Data Quality Test ……….. ... 58

Validity Test ……….. ... 58

Reliability Test ……….. ... 62

Ordinal Logistic Test ………. ... 64

Discussion ………...………….… ... 68

Shari’ah Financial Literacy Level of Rural People in Pekalongam .. ... 68

Financial Literacy and Income ……….. ... 72

Financial Literacy and Education ………... ... 73

Financial Literacy and Work Field ………...…… ... 74

CHAPTER VI ………. ... 76

CONCLUSION ……….. ... 76

Conclusion ……….……… ... 76

Suggestion ……….. ... 76

Research Limitation ………... ... 77

BIBLIOGRAPHY ……….………. ... 78

APPENDIX ………..……….. ... 80

List of Table Table 1.1 Literacy and Utility Index ……… ... 4

Table 1.2 Percentage of Poor People ………... ... 6

Table 2.1 Literature Review ……… ... 6

Table 3.1 Pekalongan Population ………... ... 30

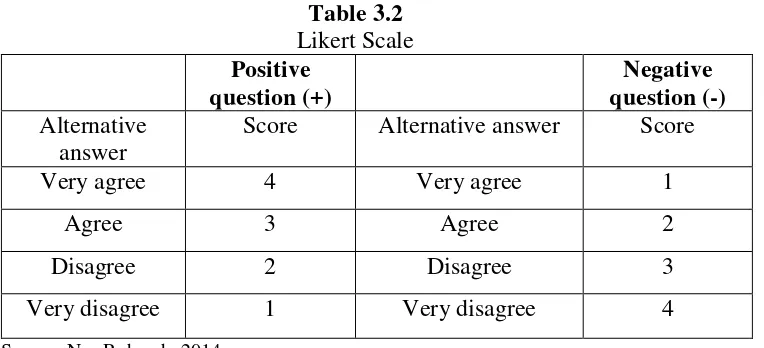

Table 3.2 Likert Scale ………... ... 36

Table 3.3 Score Conversion ……….... ... 38

Table 4.1 Respondent Amount ………... ... 45

Table 4.2 Respondent Gender ……… ... 46

Table 4.3 Age Range Table ……….... ... 47

Table 4.4 Respondent Work Field ………... 49

Table 4.5 Respondent Income Data ……….... ... 50

Table 4.7 Respondent Education ……… ... 54

Table 5.1 Respondent Relationship ……… ... 56

Table 5.2 Validity Test ………... ... 57

Table 5.3 Validity Test ………... ... 58

Table 5.4 Validity Test ………... ... 58

Table 5.6 Validity Test ………... ... 60

Table 5.7 Validity Test ………... ... 61

Table 5.8 Fitting Model ……….. ... 62

Table 5.9 Variability Test ………... ... 63

Table 5.10 Ordinal Regression Test ………... ... 64

Table 5.11 Parallel Line Test ………. ... 66

Table 5.12 Score Conversion ………. ... 67

Table 5.13 Shari’ah Financial Literacy Frequency .………... ... 67

List of Figure Figure 1.1 Pekalongan Map ……… ... 7

Figure 2.2 Frame Work ……….. ... 33

Figure 4.1 Respondent Diagram ………... 46

Figure 4.2 Gender ……….. ... 47

Figure 4.3 Age Range ……… ... 48

Figure 4.4 Work Field ……….... ... 50

Figure 4.5 Income ……….. ... 51

Figure 4.6 Education ……….. ... 53

Figure 4.7 Relation ……….... ... 54

INTISARI

Saat ini literasi keuangan menjadi salah satu isu yang sangat popular di antara kalangan para peneliti dan banyak orang yang melakukan penelitian dengan inti topic literasi keuangan, namun masih sedikit daripara peneliti yang terfokus kepada literasi keuangan syariah. Berdasarkan fakta ini, maksud peneliti dalam penelitian ini adalah untuk mengetahui tingkat literasi keuangan syariah penduduk pedesaan di kabupaten Pekalongan dan untuk mengetahui faktor – faktor yang mempengaruhi literasi keuangan syariah. dengan menggunakan data primer metode statistic deskriptif dan uji regresi ordinal peneliti mencoba untuk menemukan hubungan antara pendapatan, pendidikan, pekerjaan dan hubungan responden dengan institusi keuangan dari total 154 responden dalam 10 kecamatan di kabupaten Pekalongan.

Keyword: Shari’ah financial literacy, Descriptive statistic, Ordinal

ABSTRACT

Financial literacy today become the one of famous issues among researcher and much of people done their research with financial literacy as the concern

topic, however few of them which concern on shari’ah financial literacy.

Based on this fact, researcher aims from this research is to know the shari’ah

financial literacy level of rural people in Pekalongan regency and to know

the factors influencing shari’ah financial literacy. Using primary data with

descriptive statistic and ordinal regression test researcher try to find the relation between income, education, work field and financial relationship of the respondent from the total of 154 respondents in 10 districts of Pekalongan regency.

1 CHAPTER I INTRODUCTION

A. Background

Total population number in Indonesia showed a growth rate relatively high

as an average of 1.78% per year compared to the world population growth

was 1.61% from year 1971 to 2010. In 2010 Indonesia has reached 237.64

million of total population, the community needs in term of financial product

and services are also expected increase from year to year. Data from BPS

(2012) show the number of people in productive age which from 15 to 54

years reached 59.98% or 142.54 million. This population growth is a potential

side for financial services institutions for offering their products and services.

The potential of Indonesian societies that will take financial product and

services advantages in the future are expected to be increased, considering

from year 2000 due to 2012 GDP per capita of Indonesia is increased from

Rp. 6.72 million to Rp. 33.24 million and Indonesia financial services sector

also contribute as the important role who were doing financial intermediation

Rp. 7.534.81 trillions per December year 2012. However, the role is not

optimal (OJK 2013).

The Pew Forum on Religion & Public Life (2010) set 10 Countries with

the largest Muslim population, Which placed Indonesia at the first rank with

12,7% from the world total population this statement is strengthen by Data

2

people or (87,18%) is Muslim. From its population, 150 million people have

an opportunity to access the financial product and services but in fact, only

2% who are able to access this is known by watching on Islamic banking

market share.

With the largest Muslim population Country Indonesia has the advantages

as potential place for the development of Cultural, Governmental and

Financial instrument which based on the Islamic principles. Indonesian

muslim people awareness of financial institution need which based on the Islamic principles appear in the end of 90’ Century, The emergences of

Shari’ah banks is the sign of Islamic financial system starting point in

Indonesia and also giving the refreshment air for Muslim people and as the

main foundation of Islamic financial establishment.

In the last two decade Islamic financial Institution caught by stagnation

this statement followed with the data from Otoritas Jasa Keuangan per September 2015 which shows the shari’ah financial market share in Indonesia

only 5% from the total of financial asset. Year 2013 Global Islamic Economic

Index placed Indonesia in the tenth grade when measuring the development of

Islamic Economic whole the world.

As consequences of the changing structure of an economy, financial

knowledge has become not just a convenience but an essential survival tool.

A lack of financial knowledge can contribute to the making of the poor

financial choices that can be harmful to both individual and communities

3

One of factors affecting the low of Shari’ah financial market share in

Indonesia is the low of Shari’ah financial literacy that remain in the society

(Rahmawati, 2016). The use of financial product and services has done to

fulfill individual need for consuming so individual preferences in using the shari’ah financial services determined by knowledge and understanding,

ability or skills and individual confidence to fulfill the financial need that is

called financial literacy.

Financial literacy defined as the ability to understand finance according to

(Mason and Wilson, 2000) in Sardiana, (2016) financial literacy meant as the

ability of a person to get, to understand and to evaluate relevant information

on decision-making for understanding its consequences. Financial literacy

makes a person able to make a decisions based on relevant information

therefore, the understanding of information becomes important in every

decision making process for each individuals (Sardiana, 2016). According to

Chen and Volpe, (1998) the ability to manage personal finance has become increasingly important in today’s world people must plan for long term

investment for their retirement and children’s education, they must also

decade the short term savings and borrowing for a vacation, a down payment

for a house, a car loan and other big ticket item.

It is important to know financial literacy if people want to avoid financial

scum and now days there are financial advisers and planners who look after their client’s interest also consumers bombarded with varieties of financial

4

our duty (Ahmad, 2010 in Chong, 2014). This is especially important to

middle class, where the majority of consumers of financial product belong.

According to OJK National Survey of Financial Literacy year 2013, show

financial knowledge (financial literacy) is 21, 84% or 1:5 from the total

population of Indonesia with the well literate category. Where the financial

inclusion is 59, 74% which dominated by financial product and services 57,

28%, followed by Insurance 11, 81%, funding 6, 33%, pawnshop 5, 04%,

retirement fund 1, 53% and capital market 0, 11%.

Table 1.1

Literacy Index and Utility Index of Financial Sector

Classified Finance Insurance Funding Pension

Fund

Source: National Financial Literacy Survey, 2013

Based on survey of OJK 2013, in term of society financial literacy

improvisation Indonesian society financial literacy defied into four, those are

1. Well literate (21, 84 %), those who have knowledge and believe related

financial institution products and services include advantages and risk,

right and obligation related to financial products and services, and capable

5

2. Sufficient literate (75, 69 %), those who have knowledge and believe

related financial institution products and services include advantages and

risks, right and obligation related to financial products and services.

3. Less literate (2, 06 %), those who only have a knowledge related financial

institution products and services.

Not literate (0, 41%), those who does not have knowledge and believe

related financial institution products and services include advantages and risk,

right and obligation related to financial products and services.

Financial literacy has the long term purpose for the whole of the society:

1. Increase the people literacy which less literate or not literate to the well

literate.

2. Increase the amount of financial product and services users.

People have to understand advantages and risks than believe that financial

product and services that they choose will increase their welfare than they can

determine the suitable financial product and services as they need.

For the society, financial literacy will give a benefit such as:

1. Able to determine and harness the suitable financial product and services,

and have the capability for maintaining the good financial planning.

2. Avoid people from the uncertainty investment in the financial instrument.

3. Understand the advantages and risk of financial product and services.

Financial literacy also contributed many benefit for the financial sector,

financial institution and the society need each other therefore, if the society

6

products and services. Pekalongan as one of the part of central Java labeled as

batik city and recognized at the national level. If the focus of people are

concern to the industrial product such as batik and sarong here writer try to

show how is the condition of other sector and how the poor people at

Pekalongan which is most of them work as a farmer and life in the rural area.

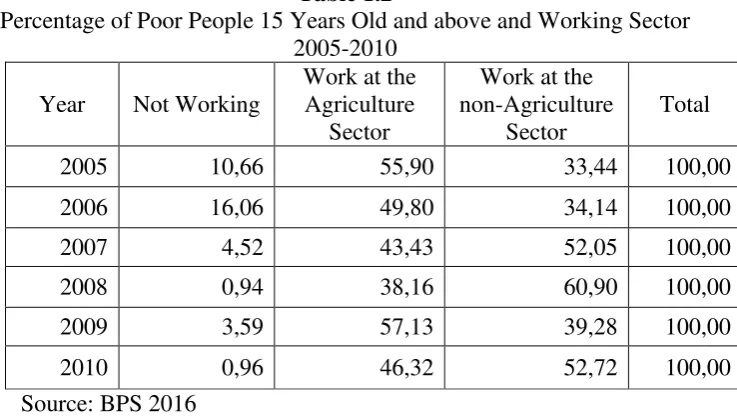

Table 1.2

Percentage of Poor People 15 Years Old and above and Working Sector 2005-2010

From above data we know most of poor people are work at the agriculture

sector which mean being a farmer, and most of people who doing an

agriculture living in the rural area with the available land. The general way to

attempted is agricultural which influence by the nature around the area such

7

Figure 1.1: Pekalongan Regency Map

According to the background above related to the lack of financial literacy

at the Indonesian society writer would like to to analyze the condition whether people are unfamiliar with the shari’ah financial literacy or in

contrary, especially in Pekalongan and writer concern on those who living at

the rural which came up with the title: “ANALYSIS OF FACTORS

AFFECTING SHARI’AH FINANCIAL LITERACY IN RURAL AREA,

STUDY CASE OF PEKALONGAN”.

B. Problem Limitation

Study limitation aims to restrict the analysis problem may occur. This

study restricted to the following limitation:

1. The dependent variable in this research is shari’ah financial literacy

2. The independent variables is income, education, work field and financial

institution relationship

3. This research used primary data and the data collection used in this

8

4. Respondent are Pekalongan people who are living in rural area.

C. Research Question

Based on the explanations that have been described above therefore, the

problems in this research are:

1. Does income affect on rural people shari’ah financial literacy in

Pekalongan?

2. Does education affect on rural people shari’ah financial literacy in

Pekalongan?

3. Does work field affect on rural people shari’ah financial literacy in

Pekalogan?

4. Does financial institution relationship affect on rural people sharaia

financial literacy in Pekalongan?

D. Research Objectives

The specific purpose of this research is to study of shari’ah financial

literacy at the specific. Based on research question, thus the objective of this

paper is:

1. To analyze the relation between shari’ah financial literacy and the income

of people who lived in the rural area of Pekalongan.

2. To analyze the relation between shari’ah financial literacy and the work

field of rural people in Pekalongan.

3. To analyze the relation between shari’ah financial literacy and the

9

4. To analyze the relation between shari’ah financial literacy and the

education in the rural area of Pekalongan.

E. Research Benefits

This study contributes useful information for parties which are interested in shari’ah literacy there are some benefits for government, financial

institution and academicians such as:

1. To the government, give benefit for government in term of conducting the

social project in financial literacy education to support financial institution.

2. To financial institution, give benefit for financial institution in term of

expanding their financial product.

3. To scholar and academicians, give benefit to provide some additional

information for further research.

F. Research Plan

The organization of the research is conducted, as follows:

1. Chapter I, Introduction. This chapter will explain the purposes and

objectives of this research, the background of this research and aims to

explore the objects of research.

2. Chapter II, Literature Review. This chapter included the theory related

with this study, also include the previous research from the expert who

was conduct similar research before with the difference object, included

10

3. Chapter III, Data Research and Methodology. Chapter three explain briefly

the data which conduct in this research, and explain Analysis quantitative

descriptive and ordinal regression methodology step to analysis the study.

4. Chapter IV, Overview. Chapter four will explain the general description and overview the Shari’ah financial literacy in rural area of Pekalongan.

5. Chapter V, Research Finding. This chapter will explain in detail the result

of analysis which conducts by an Analysis of quantitative descriptive and

ordinal regression.

6. Chapter VI, Conclusion. In this chapter will conclude the result of test in

chapter four, the recommendation for the next research and the policy

1

CHAPTER II

LITERATURE REVIEW

A. Theoretical Framework

1. History of Islamic Economic In Indonesia

Indonesia Financial System divided into two, financial system and

Non-bank financial institution. Non-Non-bank financial institution is financial that

based on the legislation law which collected the fund from the society in term

of depository financial institution and distribute in term of credit or in others

and give the services for the payment way, such as public bank and society

bank for credits. Non-bank financial institution is financial institution which

the activities not in order to collect the direct fund from the society in term of

saving, such as: pension fund, insurance, venture fund, and pawn shop.

Historically the Indonesia financial legislation system has some changing

which at first is 27 October 1988 change since 1992, those are:

a. Law No 7 Year 1992 About Finance

b. Law No 2 Year 1992 About Insurance

c. Law No 11 Year 1992 About Pension

d. Law No 8 Year 1995 About Funding Market

e. Law No 10 Year 1998 About Changing of Law No 7 Year 92 about

Finance

2. Financial Literacy

Financial literacy is an active process in which communicating

information is only the beginning and empowering consumers to take action

to improve their financial well- being is the ultimate goal (Abdullah and

Chong 2014). Financial literacy according to (Miller et.al. 2009 in Chong

2014) is the combination of consumers or investors understanding of financial

product, concept, their ability and confidence to appreciate financial risk and

opportunities to make informed choices, to know where to go for help, and to

take other effective actions to improve their financial well-being.

Financial literacy is process or activities for improving the knowledge,

confidence and skill in whole society than they can manage their financial

needs (OJK). Financial literacy defined as the ability to understand finance

according to (Mason and Wilson (2000) in Anna Sardiana (2016) financial

literacy meant as the ability of a person to get, to understand and to evaluate

relevant information on decision-making for understanding its consequences.

Nevertheless, studies on financial literacy have not come up with a

consensus definition of financial literacy. However, (Remund, 2010 in Ma’ruf, 2015) was able to pin point that many conceptual definitions of

financial literacy fall into five categories:

1) Knowledge of financial concept

2) Ability to communicate about financial concept

4) Skill in making appropriate financial decisions

5) Confidence in planning effectively

In addition according to Remund 2010 in Ma’ruf, 2015, financial literacy

is a measure of the degree to which one understands key financial concepts

and possesses the ability and confidence to manage personal finances through

appropriate, short term decision making and sound, long range financial

planning, while mindful of life events and changing economic condition.

3. Shari’ah Financial Literacy

Shari’ah financial literacy is related to knowing product and financial

services able to differ between shari’ah and conventional bank also can

influence manner of the people in order to take economic decision according

to shari’ah. Shari’ah finance is kind of finance based on shari’ah or Islamic

principles. Shari’ah which mean “road to the water springs”, filled with moral

goals and tough of truth. Therefore shari’ah is more than the role of law. The

fact, shari’ah represented the argument that every people and governance

obey to the justice under the law (Rahmawati, 2012).

Abdul Hamid and Bordin, (2001) in Azmi and Anderson, (2015) state a

study conducted in Malaysia in 1994, regarding knowledge in Islamic

banking showed that almost 100 percent Muslim population was aware of the

Islamic bank , however out of this 27,3 percent completely understood the

differences between Islamic bank and conventional banks and only 38,7

4. Shari’ah Financial Institution

Financial institution is a business entity which the wealth basically such as

financial asset or financial claims compared to the non-financial assets or rill

assets, financial institution give the credits to the costumers and plant their

fund in term of securities (Siamat, 2001). Shari’ah finance is a financial form based on shari’ah or Islamic law principles. Indeed, shari’ah represented an

idea that all of people and governance is submissive under the justice of law.

This is one of term which summarized the way of life that Allah’s tough to

his creature include all of things related to business contract until worship, term of “suitable with the shari’ah” in picturing all allowed things in Islam

(Abdullah and Chee, 2012). In general, shari’ah bank is financial institution

which the basic business is give the people credits and other services in line of payment and the operation of cash flow suited with the shari’ah principles

Sudarsono (2008).

The movement of modern Islamic financial institution started with a local

saving bank non-interest that operated in Mit Ghamir village, blank of Nil

river Egypt at 1696 by Dr. Hamid An-nagar in Muhammad (2011).

The need of Islamic private bank in rural and international, followed by

the existence of other supporting institution such as insurance, pawn shop and

baitul mal wa tamwil. That based on Islamic principles and lately Dow jones came out what we called by Islamic Index which cover the stock index that

5. Factors of Financial Literacy

The social research center, (2011) in Sari, (2015) factors which describe

the differences of financial literacy level:

a. Age, there are positive affect on the attitude as an indicator of financial

literacy at 25-34 years old which at 18-24 there is no influence. This is in

line with the more knowledge of financial products they have the more

financial transaction used for their needs.

b. Financial knowledge have a positive relation to mathematics ability,

people who has the knowledge will be able to control their financial

expenses. This show with the general financial knowledge and

mathematics ability people able to choose the suitable financial products,

watching the financial condition, and know the latest condition of financial

situation.

c. Financial attitude has the positive and negative relation to the finance

indicators.

d. House hold income, has the positive significant relation to financial

control which mean more income lead to the better financial control.

e. Education and work field has a relation with some of the financial

indicators, because in some point that education and work field is

Bushan and Medhury, (2013) in Margaretha and sari, (2105) found

financial literacy level influenced by gender, education level, income, kind of

job or nature of employment, and work field, where not influenced by

geography and age (Margaretha and Sari, 2015)

a. Financial literacy and income

Financial literacy increases trough with the income increases

(Scheresbergh, 2013) in Margaretha (2015). There is a significant

influence between financial literacy and the income of people

(Margaretha and Sari, 2015). Amount of income has the significant influence with the level of shari’ah financial literacy (Rahmawati, 2016).

b. Financial literacy and education

More the education of people will influence to the more understanding of

financial literacy (Nidar and Bestari, (2012) in Margaretha and Sari

(2015). Financial literacy and education have the significant relationship

(Margaretha and Sari, 2015). Variable of education level positively affect

on financial literacy (Amaliyah and Witiastuti, 2015). The Educational

background has the significant influences with the shari’ah financial

literacy (Rahmawati, 2016).

c. Financial literacy and work field

Financial literacy level is influenced by work field (Bushan and

Medhury, 2013) in Sari (2015). Education and work field has a relation

d. Financial literacy and financial institution relationship

The respondent relationship trough financial institution has the significant influences to the shari’ah financial literacy (Rahmawati,

2016).

6. Shari’ah Financial Products

For the sufficient of capital and financing, shari’ah bank has the different

requirement with a conventional bank. In general, the devices of shari’ah

bank consist of three categories:

a. Financing products

b. Funding products

c. Services products

Financing products:

a. Wadi’ah (giro).

b. Mudarabah (saving and deposit). Funding products:

a. Profit sharing (mudarabah dan musarakah).

b. Buy and sell (murabahah, istisna’, salam, dan ijarah). c. Services (rahn, wakalah, kafalah, hawalah, qard)

Non- Bank (services) products:

Islamic banks have the purposes those are, guide the society economic

activities for interaction in term of Islamic value, to build the balance and

justice system in term of economic investment, to develop the social living

standard with the easiness for poor people, poverty alleviation, to maintain

the economic stability and become savior of the society from konventional

bank dependency (Sudarsono, 2008).

7. Financial Institution and Financial Literacy Classification a. Depository financial institution or depository intermediary.

Financial institution collecting the fund directly from the society in term of

deposits such as giro, saving, or time deposit which accepted from

depositor or unit of surplus such as: Corporation, Government and

household with the surplus income after the consumption expenses.

b. Non-Depository financial institution or non-bank financial institution.

Financial institution included of this category is financial institution

which the business activity where characteristically has a contract or

contractual institution which is collecting the fund from the society with

offering the contract for consumers protection from the uncertainty risk

such as insurance and pension program than called by insurance company

According to Chen and Volpe (1998) in Farah and Sari (2015) financial

literacy categorized into three groups bellow:

a. < 60% which is those people who have the low financial literacy.

b. 60%–79%, which mean people who have the medium financial literacy.

c. 80% which mean those are people who have the high financial literacy.

Based on the Indonesia financial literacy national strategy, people

financial literacy are classified into 4, those are:

a. Well Literate, Those who have knowledge and believe related financial

institution products and services include advantages and risk, right and

obligation related to financial products and services, and capable to use

financial product and services.

b. Sufficient Literate, Those who have knowledge and believe related

financial institution products and services include advantages and risk,

right and obligation related to financial products and services.

c. Less Literate, Those who only have the knowledge related financial

institution products and services.

d. Not Literate, Those who does not have knowledge and believe related

financial institution products and services include advantages and risk,

8. Financial Literacy Consumer Attitude

The consumer attitude toward a products or services, according to the

theory of three component attitude model determined by three attitude

components:

a. Cognitive

b. Affective

c. Conative

From the three components that can affect the attitude are confident and

feelings. Engel (1995) in Anna (2016) said on some product or services

attitudes only depend on the confidence while other products or services

attitude depend on evaluation of product or services. Meanwhile, the

relationship between attitude or conative or interest can be described as a

cause and effect relationship where the attitude of person can affect to certain

moralities (Mardiana, 2016).

An attention describes the conative attitude components that related to

some preferences to perform regarding specific attitude. Based on some

interpretations, conative components can be included the attitude (real)

behavior itself.

9. Financial Literacy of Islamic Consumption Theory

In Islamic consumption analysis that people manner of consumption not

only to fulfill their body needs but also for fulfill their spirit needs. So in term

of manner of consumption a Muslim always pay their attention to the Islamic

what is the purposes behind the consumption, how is the moral and manner as

a Muslim when they consume something and how is the consumption of a

Muslim is related to their society.

Islamic economy aims to realize the long term of economic growth and

maximizing the welfare or falah. Falah mean the personal needs of people is fulfilled trough the company of social balance and concern at the family

values also attitude (Chapra, 2000) in Sudarsono, (2008). For the

consequences some of basic attitude is needed in the economy to achieve the

concept of falah (Naqwi, 1994) in Sudarsono, (2008), those are first, the existence of god (Allah) as the control center of the economic activities

because of the limited knowledge of people in contrary with god. Second,

balances in term do not very excessive, balance of distribution nor the

individual and social needs. Third, in term of freedom of choices but it is

bordered with the obligation of each people (Sudarsono, 2008).

10. Rural Area

The 1996 census defines “rural areas” as sparsely populated lands lying

outside urban areas which urban have the minimum populations of 1.000 and

population densities of 400 or more people per square kilometer (Statistic

Canada, 1999) in Canada Statistic, (2002).Rural and small town refers to the

population living outside the commuting zones of larger urban center

specifically outside census metropolitan area (Medelson and Bollman, (1998)

Law number 2 year 1999, Rural area is the unity of society law which have

an authority to manage and organize society needs based on the origin custom

that recognized by the national governance system and include in the area.

Law number 6 year 2014, Rural is rural and custom rural or called by

another name next called by rural, is unity of society law which has the limit

of area obligated to manage and organize the government jobs, society needs

according to society initiative, origin right, and or traditional right which

recognized and be respected by the governance national system of republic of

Indonesia.

B. Literature Review

Financial literacy is first and foremost about empowering and enlightening

consumers so that they are knowledgeable about finance in a way that is

relevant to their lives and enables them to use this knowledge to evaluate

product and informed decisions. As the consequences of the changing product

of economy, financial knowledge has become not just convenience but an

essential survival tool. A lack of financial knowledge can contribute in

making of poor financial choices that can be harmful to both individual

communities. Mounting evidence shows that those who are less financially

literate are more likely to have problems with debt, are less likely to save, are

more likely to engage in high cost mortgages, and are less likely to plan for

retirement. Without a certain level of financial literacy, consumers might not

purchase the financial products and services they need and might be

consumers, and to understand and appropriately manage the variety of risk

(Kefela, 2011:9) Financial literacy called as the ability of people to get,

understand, and evaluate the relevant information for the decision making

with the understanding of financial consequences that appear Krisna (2010),

in Amaliyah and Witiastuti (2015).

Looking to the economic condition today, financial literacy contribution is

important. People need the basic knowledge of finance and skill for

processing the effective financial resources for the welfare of their life,

especially for the entrepreneur which is commonly face with the financial

decision making and more which related to the financial corporation. Less of

access will lead to the low of access to the financial institution (Amaliyah and

Witiastuti, 2015).

The research result shows that Islamic financial literacy significantly

affected to the shari’ah financial services usage. At the more research, the

knowledge indicators shows half of them are significant to the financial literacy preference usage, ability indicator and self not affect on shari’ah

financial literacy preferences (Sardiana, 2016).

The financial crisis has also led to the renewed focus of the world to

Islamic finance. The Islamic financial industry has been flooded with various

different types of financial instruments and asset for not only Muslim

investors but also the non-Muslim investors to choose from. Hence, an

assets are pertinent in order of invertors irrespective of whether they are

Muslim or non-Muslim to manage their portfolio. With respect to making

these Islamic financial products acceptable to wider spectrum of investors and

business people alike, the governor of central bank of Malaysia several years

ago has pointed that enhanced financial literacy on Islamic financial products

will facilitate transactions, with a clear understanding and appreciations of the

unique characteristics and features of Islamic finance and its real economic

value (Abdullah and Anderson, 2015).

Margaretha and Sari, (2015) said many people with the financial problem

in one side just not because of the low of their income rather than because of

the false in income allocation, the low of financial literacy cause unwise

income allocation therefore with the financial ability will lead to the right

choices. Financial literacy in term of understanding to the all aspect of

finance is not burden or to tide people on doing their life but with the

financial ability will lead people for the better life (Warsono, (2010) in

Margaretha and Sari, (2015).

The financial literacy index of financial institution that exist in Indonesia

at the FEB Unsoed students still low at only $4.76 for student who are well

literate and amounted to 95.24% in banking products and services and the

cause of these is they do not get the financial education from the family as a

child (80%), not taught in formal education as a child (77%), not to get the

be used to invest in products and services of financial institutions (93%)

(Lestari, 2015).

It was several years ago when the governor of central bank of Malaysia

pointed out that in order to make Islamic financial acceptable to a wider

spectrum of investors and business people alike, financial literacy on Islamic

financial products need to be enhanced, This is in order to facilitate

transactions, with a clear understanding and appreciation of the unique

characteristics and features of Islamic finance and its real economic value

(Abdullah and Chong, 2014).

Financial education is important to both the security of individuals and the

security of nation. Enlightened societies today strive to ensure social cohesion

as an integral part of economic progress, Interesting and well-paid jobs are

central pillars of social cohesion, but so are savings and the building of

capital to provide individuals with financial security, especially for their

retirement. That cohesion can be seriously undermined by major imbalanced

of wealth within nations. Major inequalities between elements of society,

especially along ethnic or racial lines, can be recipe for disaster. One way to

avoid that catastrophic scenario is to ensure that everyone participated in

wealth, both in its creation and distribution. Along with good employment

prospect, financial education can play a key role in helping individuals and

families build their assets. Just as health education in primary and secondary

schools helps children develop good life-long dietary and hygiene habits,

Moreover, well-informed financial consumers ultimately lead to better

financial markets, where rogue products are forced from the market place and

confidence is raised (Johnston, 2005).

In this few of years, in the whole part of the world financial literacy issue

is concerned to discuss. An exclusive attention to the financial literacy

because of the willingness of such country for having the good quality people

and financial good understanding, will affect to the finance and economic

condition, this financial literacy is related to the ability of people at the

management and doing the planning which related to the finance (Ma’ruf and

Desiyana, 2015).

Halal literacy and Islamic literacy are two crucial concepts where it can

lead to the behavior of person toward its decision especially in adopting the

Islamic financing, literacy has been studied widely in many fields including

in consumer behavior context. Literacy usually associated with knowledge

and it shows that knowledge is one element things that lead to the behavior of

a person in the Holy Qur’an in surah Al-an’am also states that knowledge or

literacy is necessary to that a Muslim can differentiate what is lawful and

prohibited in Islam “why should you not eat of (meats) on which Allah’s

name hath been pronounced, when he hath explain to you in detail what is

forbidden to you – except under compulsion of necessity? but many do

Consumptive life style influenced by many factors one of those is the

easiness of transaction, industries development and life style which is

adopted, these things make many people irrational in term of their

consumption moreover today money is unnecessary when people want to buy

any kind of product or services because the existence of credits card and it is

popular in the society (Margaretha and Sari, 2015)

Lisa Xu and Bilal Zia (2012) in Lestari, (2015) said that term of financial

literacy include the concept which is start from the awareness and

understanding about financial products, financial institution, and concept of

financial ability such ability to count compound interest payment and the

general financial ability such as money management and financial planning. According to Lusardi and Mitchell (2000) in Ma’ruf (2015) that gender is one

of factor in the financial literacy, they explain the gender differences in

Sweden which female is rarely make any decision at the house hold. Kefela

(2011) said financial literacy a broad concept that include both the

information and behavior it is relevant for all consumers regardless of their

wealth or income. Bank in the developing countries have to provide financial

literacy to their consumers because of the positive direct impact this can have

an access to finance and saving which in return support livelihood, economic

growth, sound financial system and poverty reduction.

The understanding of individual finance is needed with this people able to

decide any products and services that suitable with their current condition,

lead them to the negative cash flow. Therefore knowledge and the good

understanding is absolutely needed by the people in their daily life to

maximize the uses of a financial instrument, financial product that and able to

decide the correct decision in other word every people need to have the good

financial literacy (Mendari and Kewal, (2013) in Margaretha and Sari (2015).

Financial literacy topic become important among expert because of 2008

crisis, the expert said that the main cause of the economy global crisis is the

low of financial literacy. On that time people became more consumptive more

than what they able to earn for income, they have much of credits with the

high rate of credit card user because of this financial institution lost their

liquidity and bankrupt (Lestari, 2015).

In every people daily life, there are 3 financial decision commonly used

those are:

1. How much the amount they should consume in every period of time.

2. Is there any surplus of income and how to maintain this surplus for

investment

3. How to earn for consumption and this investment.

In order to achieve the financial welfare, people have to have a knowledge

and attitude through the healthy individual financial implementation.

Knowledge, manner and individual financial implementation at the financial

Term of Financial literacy is an ability of people for taking decision of their own finance. Remund (2010) in Ma’ruf (2015) explained five domain of

financial literacy is:

1. Knowledge of financial concept.

2. Ability to communicate related to financial concept.

3. Ability to maintain the individual finance.

4. Ability to take any financial decision.

5. Believe in order to plan future finance (Margaretha and Pambudhi, 2015).

According to the researchers INDEF Aviliani, the need for education to

the community of financial products both banks and nonbank very urgent to

people not be deceived by those who are not responsible. Research conducted

Gonthor, et al (2006) from Bapepam-LK in terms of understanding the capital

markets, 80% of respondents were familiar with capital markets, 50% of them

knew the capital markets of the news media, 25% of the respondents knew

and 50% claims to know enough about capital market products (Nidar and

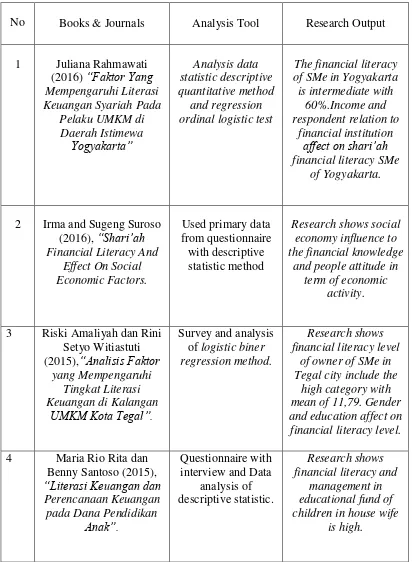

Table 2.1

Summary of Literature Review

No Books & Journals Analysis Tool Research Output

1 Juliana Rahmawati

(2016) “Faktor Yang of SMe in Yogyakarta is intermediate with

and people attitude in term of economic

activity.

3 Riski Amaliyah dan Rini

Setyo Witiastuti of logistic biner regression method.

Research shows financial literacy level

of owner of SMe in Tegal city include the

high category with mean of 11,79. Gender and education affect on financial literacy level. children in house wife

No Book and Journal Analysis Tool Research Output

This research use the primary data from majority of SMe has the

intermediary financial literacy level with 73,8%. Beside of that the ability of SMe has the intermediary level

too with 57,5%.

6 Farah Margaretha dan

Reza Arief Pambudhi (2015) “Tingkat Literasi

Keuangan Pada Mahasiswa S-1 Fakultas

Ekonomi”.

This research use the primary data from questionnaire with descriptive statistic

and chi- square analysis and ANOVA

test. student FED Unsoed is

low because well literate include 4,76 % and financial products knowledge 95,24%. Cause of it is they do not got the financial education from the child or their parent

are no concern of it .

8 Yulia Indrawati (2014),

“Determinan dan

Research show in term of aggregate financial literacy level of urban people in Jember is low

whether basic financial literacy and advanced

financial literacy.

9 Anastasia Sri Mendari & Suramaya Suci Kewal (2013), “Tingkat Literasi

Keuangan di Kalangan

Mahasiswa STIE MUSI”.

Statistic Descriptive The indication for financial decision in some cases show the low of knowledge of long investment term

No Book and Journal Analysis Tool Research Output View of banking and

Islamic banking Halal Literacy: The Way Forward in Halal literacy can help the policy maker in

12 Sardiana, Anna. 2016. The Impact of Literacy

To Shari’ah Financial

Literacy.

Descriptive research Research shows Islamic financial

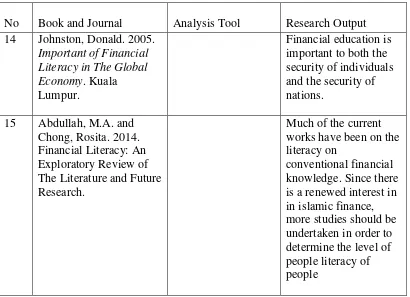

No Book and Journal Analysis Tool Research Output 14 Johnston, Donald. 2005.

Important of Financial Literacy in The Global Economy. Kuala Lumpur.

Financial education is important to both the security of individuals and the security of nations.

15 Abdullah, M.A. and

Chong, Rosita. 2014. Financial Literacy: An Exploratory Review of The Literature and Future Research.

Much of the current works have been on the literacy on

conventional financial knowledge. Since there is a renewed interest in in islamic finance, more studies should be undertaken in order to determine the level of people literacy of people

C. Research Framework

This research aims for analyzing the shari’ah financial literacy at the rural

people of Pekalongan, Central Java Province. The figure that describes how

the framework of research would be conducted can be seen as below.

D. Hypothesis

Based on the review and discussion related to the previous study, this

study developed the hypothesis:

H1: There is positive and negative significant relationship between income and the shari’ah financial literacy.

H2: There is positive significant relationship between education and the shari’ah financial literacy.

H3: There is positive and negative relationship between work field and the shari’ah financial literacy.

H4: There is positive significant relationship between financial institution

CHAPTER III

METHODOLOGY

A. Research Object

The object of this research is the relation between some variable such as income, work field, education and financial relationship trough shari’ah

financial literacy variable used in this research consist of one dependent

variable and four independent variables.

The dependent variable is:

1. Shari’ah financial literacy

And the independent variables are:

1. Income

2. Work field

3. Education

4. Shari’ah financial institution relationship

B. Type of Data

This research used a primary and secondary data with the primary data as

the based, primary data is data which obtained from the research subject. This

data is information obtain from the respondent explanation, questionnaire answers and direct interview to the respondent related to the shari’ah financial

And secondary data obtained from the journals, articles, internet and

previous study related to the research variable.

C. Collecting Sample Technique

1. Population

Population is a generalization area contained of object or subject which

has the quality and any characteristic determined by the researcher for being

studied and taking conclusion from that Sugiyono (2014). Population that will

be included in this research is people who lived in the rural area of

Pekalongan, Central Java with the different background. Population of

Pekalongan people in term of year 2010 up to 2014 is increasing by 6491

people with the growth rate of 0,75 in year 2014.

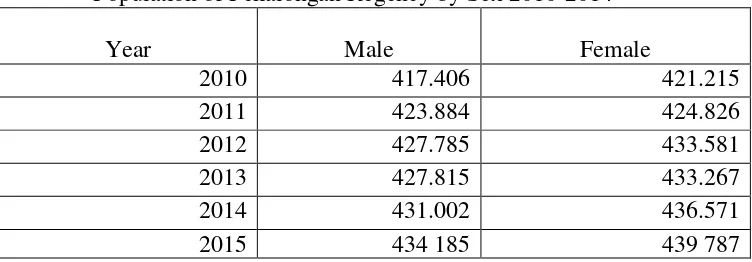

Table 3.1

Population of Pekalongan Regency by Sex 2010-2014

Year Male Female

2010 417.406 421.215

2011 423.884 424.826

2012 427.785 433.581

2013 427.815 433.267

2014 431.002 436.571

2015 434 185 439 787

Source: BPS 2015

2. Sampling Method

Sample is a part of amount and characteristic own by the population.

Sample taken from the population have to represent of population (Sugiyono,

Sample taking technique used in this research is simple random sampling. Simple random sampling technique is a simple technique because member

taking sample from the population is random without paying attention to the

society level. This way is taken if the member of population considered as

homogeny (Sugiyono, 2014).

Sample random sampling is choosing process of unit sampling in such a

way than every unit of sampling in the population has the same chance for

being choosing in to the sample. Taking sample with this way can be done

with the lottery or random table (Sanusi, 2012)

Amount of sample used in this research is 154 respondents which separate

in 10 districts from the total of 19 in Pekalongan Central Java Province. The

minimum respondent that delivered by long is 100 than writer decided that in

this research use more than the minimum amount of respondent (Gudono,

2014) in Rahmawati, (2016).

D. Data Collection

Data collection technique in this research is using the questionnaires.

Questionnaire is data collection technique with giving the bunch of written

questions or statements for the respondent to answer (Sugiyono, 2014).

Questionnaire used in this research is likert scale. Likert scale is an ordinal measurement used to measure manner, opinion, and people perception related

to social phenomenon. Therefor for knowing the measurement of respondent

researcher use the likert scale (likert’s summated ratings) Sugiono in Basuki

(2015). Result range that given is 1 up to 4.

Likert Scale is scale based on additional respondent attitude in responding

the questions related to indicators from the concept or measured variable. In

this condition, respondent asked to agree or disagree in each of questions

(Sanusi, 2012). This range used for standardize the appraisal of respondent,

directly stuffed by the people who lived in the Pekalongan rural area.

Table 3.2

Score Alternative answer Score

Very agree 4 Very agree 1

Agree 3 Agree 2

Disagree 2 Disagree 3

Very disagree 1 Very disagree 4

Source: Nur Rohmah, 2014

For interpreting the result of research data collected is conversed to the

likert scale category using the guidance result conversion as below:

Table 3.3

Guidance of Score Conversion

Score Conversion Formula Category

1 X>Mi+1 (SDi) High

2 Mi-1 SDi ≤X≤Mi + 1 (SDi) Moderate

3 X<Mi-1 (SDi) Low

Explanation:

X = Total Score

SDi = Ideal Standard Deviation

= 1/6 (ideal maximum score – ideal minimum score)

Mi = Mean Ideal

= ½ (ideal maximum score + ideal minimum score)

E. Operational Definition of Variables 1. Dependent Variable

In this research the bound variable is shari’ah financial literacy, which is

ability of people for managing the finance in corresponding with shari’ah

principles. For measuring shari’ah financial literacy variable, questionnaire

will be spread with the questions and statements related to shari’ah financial

literacy.

2. Independent Variables

Unbound variables that used in this research is: (1) Income which this

variable explain the respondents earning each month that will classified into

four groups: < 1 million, 1 million - 5 million, 5 million - 10 million & >10

million; (2) Education: This variable explain educational level of respondents,

which classified into: Elementary School, Junior High School, senior High

School, Diploma, Strata 1, Strata 2; (3) Work Field: explain the jobs of

respondents which stay in this ten districts. (4) Financial institution

F. Quality Test of Research Instrument 1. Validity Test

Validity Test is used for measuring the legitimacy and validity of the

questionnaires. Called valid if the question can express the something that

will measure with the questionnaire Ghazali (2001). The validity measure

used in this research is construct validity by SPSS version 15.0. Construct

validity is validity that asking whether the question point at the instrument is

suitable with the related knowledge concept (Nurgiyantoro, 2009) in

Rahmawati, (2012).

Validity determination related to the questions with seeing the column

corrected column correlation, significant examination is using r table in significant level 0.05. If result of r arithmetic ≥ r table so item called valid, if

r arithmetic < r table so item called not valid. In this research using 0, 1330 as

the data measurement of validity, based on the total respondent which is 154

respondents as a sample of the citizen of Pekalongan.

2. Reliability Test

Reliability test is a test to measure questionnaires as indicator of variable

or construction. A questionnaire called reliable if the respondent answers

related to the question is consistent or stabile from time to time.

Reliability measurement used in this research by the cronbach alpha > 0.07 that categorized as the sufficient level of reliability Nunnally, (1994) in

the result of the reliability test on data at the level of moderate Basuki,

(2017).

3. Hypothesis Test

a. F - Test (Simultaneous Test) for the first hypothesis. This test used to know if the independent variable has the significant influences to the

dependent variable together. With the comparison result of F count and F

table in error degree at 5% its mean if result of F count > from F table,

than all of the independent variables has the significant influences together

to dependent variable or the first hypothesis is accepted.

b. T - Test (Partial Test) for the second hypothesis. This test used to know if the independent variable has the significant influences to the dependent

variable. With the comparison result of t count of every independent variables and t table in error degree at 5% its mean if result of t count > from t table, than the independent variables has the significant influences to dependent variable or the first hypothesis is accepted.

G. Data Analysis

1. Descriptive Statistic

Descriptive statistic is statistic used for data analysis by describing or

drawing the collected data as it is without any additional and intentional to

conclude the collected data applied for general or generalization. (Sugiyono,

2014). Descriptive statistic give the description related to the data looked

from the mean, standard deviation, varian, maximum, minimum, sum, range,

Descriptive research is research design in order to arrange the systematic

picturing related to scientific information which came from object or subject

of research. Descriptive research focused in the systematic explanation with

the fact obtainable from the research, if researcher intent to describing the

data from one of variable of research, the researcher can use the descriptive

statistic (Sanusi, 2012).

2. Logistic Regression

Logistic regression is closely similar with discriminant analysis which we

want to test the probability of dependent variable is it explained by the

independent variable, truly in this such of case can be solved by using discriminant analysis but normal multivariate distribution assumption can’t be

filled because of independent variable is mixed between matric variable and

non- matric variable. In this case logistic regression used because no need to

use normality test of the independent data (Ghozali, 2011).

Such as an multinominal logistic regression, if the category of dependent

variable is an ordinal (rating) for an example the condition of bank healthy,

healthy enough, unwell and not healthy where healthy have the higher value

than healthy enough, and healthy enough have the higher value than not

healthy so logistic analysis must be using ordinal regression or called PLUM