THE INFLUENCE OF EARNINGS MANAGEMENT

ON FIRM VALUE AND GOOD CORPORATE

GOVERNANCE AS MODERATING VARIABLE

(Empirical Studies Real Estate and Properties Companies Listed in Indonesia Stock Exchange Period 2012-2014)

Created by:

Muhammad Anugrah Asshiddiq

1111082100007

DEPARTEMENT OF ACCOUNTING

INTERNATIONAL CLASS PROGRAM

FACULTY OF ECONOMICS AND BUSINESS

SHEET STATEMENT

AUTHENTICITY SCIENTIFIC WORKS

Signature below:

Name : Muhammad Anugrah Asshiddiq Student ID : 1111082100007

Faculty : Economics and Business

Department : Accounting (International Program) Hereby declare that in the writing of this thesis, I;

1. Not use other people’s ideas without being able to develop and accountable. 2. Do not do plagiarism of other people’s works manuscript.

3. Do not use other people’s work without mentioning the original source or without the owner’s permission.

4. Do not manipulate and falsify the data.

5. Own work and able to work responsible for this work.

If in the future there is a demand from the other side of my work, and have been accountably proved, was indeed found evidence that I have violated the above statement, and then I am ready to be sanctioned according to rules applicable in the Faculty of Economics and Business Syarif Hidayatullah State Islamic University Jakarta.

Thus statement truly made with sincerely.

Jakarta, April 2016

CURRICULUM VITAE

MUHAMMAD ANUGRAH ASSHIDDIQ

Accounting Departement

Economic and Business Faculty

UIN Syarif Hidayatullah Jakarta

anugrah_asshiddiq@yahoo.co.id

PERSONAL IDENTITY

Name : Muhammad Anugrah Asshiddiq

Gender : Male

Place & Date of Birth : Tangerang, Januari 21th 1994

Religion : Islam

Nationality : Indonesia

Address : Bukit Waringin B7 no. 21, Kedung Waringin, Bojonggede, Kab. Bogor, Jawa Barat Indonesia

Phone/Mobile : +62877-7245-8513

E-mail Address : anugrah_asshiddiq@yahoo.co.id - angrh.asshddq@gmail.com

FORMAL EDUCATION

College : Accounting Departement, Economic and Business Faculty, UIN Syarif Hidayatullah Jakarta

v

The Influence of Earnings Management on Firm Value and Corporate Governance as Moderating Variable

(Empirical Studies in Real Estate and Properties Companies listed in Indonesian Stock Exchange Period 2012-2014)

ABSTRACT

The objective of this research is to examine the influence of the earnings management concerning to the firm value and to examine whether the corporate governance mechanism is the moderating variable between influence of earnings management toward the firm value. The variable examined in this research is earnings management measured with discretionary accrual by modified Jones model, firm value, board of director, managerial ownership and institutional ownership.

The sample which is used in this research are real estate and properties companies listed in Indonesian Stock Exchange on period 2012-2014. This research is using purposive sampling method to determine the sample and it produce 12 companies as research sample. Regression analysis method used descriptive statistic and multiple regression.

The result of this research shows earning management, size of company and board of director, managerial ownership institutional, ownership as moderating on earnings management simultaneously or together have ability to effect the firm value. Partially board of director, managerial ownership and institutional ownership is a moderating. Beside that the result also indicates that size of company have significant effect positive to firm value. Board of director, managerial ownership, and institutional ownership have significant effect negative to firm value. Other variable do not have significant influence to firm value.

vi

Pengaruh Manajemen Laba Terhadap Nilai Perusahaan dan Corporate Governance sebagai Variabel Moderating

(Studi Empiris di Real Estate dan Properti Perusahaan yang terdaftar di Bursa Efek Indonesia Periode 2012-2014)

ABSTRAK

Tujuan dari penelitian ini adalah untuk menguji pengaruh manajemen laba menyangkut dengan nilai perusahaan dan untuk menguji apakah mekanisme corporate governance adalah variabel moderasi antara pengaruh manajemen laba terhadap nilai perusahaan. Variabel yang diteliti dalam penelitian ini adalah manajemen laba diukur dengan akrual diskresioner oleh dimodifikasi model Jones, nilai perusahaan, dewan komisaris, dewan direktur dan komite audit.

Sampel yang digunakan dalam penelitian ini adalah perusahaan real estate dan properti yang terdaftar di Bursa Efek Indonesia pada periode 2012-2014. Penelitian ini menggunakan metode purposive sampling untuk menentukan sampel dan menghasilkan 41 perusahaan sebagai sampel penelitian. Metode analisis regresi digunakan statistik deskriptif dan regresi berganda.

Hasil penelitian ini menunjukkan manajemen laba, ukuran perusahaan dan dewan direktur, kepemilikan manajerial, kepemilikan institusional sebagai moderator pada manajemen laba secara bersamaan atau bersama-sama memiliki kemampuan untuk mempengaruhi nilai perusahaan. Secara parsial dewan direktur, kepemilikan manajerial dan kepemilikan institusional adalah pemoderasi. Selain itu hasilnya juga menunjukkan bahwa ukuran perusahaan berpengaruh signifikan positif terhadap nilai perusahaan. Direksi, kepemilikan manajerial, dan kepemilikan institusional berpengaruh signifikan negatif terhadap nilai perusahaan. variabel lainnya tidak berpengaruh signifikan terhadap nilai perusahaan.

Kata kunci: manajemen laba, good corporate governance, nilai perusahaan,

vii FOREWORD

Assalammu’alaikum Wr. Wb.

All praise to Allah SWT, the Most Gracious and the Most Merciful, the

Cherisher and Sustainer of the worlds; who always gives the writer all the best of

this life and there is no doubt about it. Shalawat and Salaam to the

Prophet Muhammad SAW and his family. With blessing and mercy from Allah

SWT, the writer can complete this thesis to fulfill one of the requirements in

accomplishing bachelor degree.

The writer is also well-aware that without advice and support from various

parties, this thesis will not be realized properly. Therefore, the writer would like to

take her opportunity to express her deep and sincere gratitude to the following:

1. Beloved parents and sister, my father Andi Nasri Hamzah, my mother Iin

Aryanti and also my sister Aliyah Khairunissa who have given all their

efforts morally and material to my college study. For also being such a

great parents and sister that always give me support and advice to finish

this thesis. Thank you for your love and prayers that never end. All

this efforts is dedicated to you all. May Allah SWT always give His

viii

2. Dr. Arief Mufraini, Lc., M.si. as the Dean of Economic and Business

Faculty.

3. Yessi Fitri, SE., Ak., M.Si and Hepi Prayudiawan,SE ,Ak ,MM., as the Lead and Secretary of Accounting Department.

4. Prof. Dr. Azzam Jasin, MBA as the thesis supervisor I. By his

advice, direction, and guidance I can write this thesis properly. Thank

you so much for your time and kindness to help me in finishing this thesis.

5. Atiqah, SE, MS. Ak as the thesis supervisor II. Also by her advice,

direction, and guidance I can write this thesis properly. Thank you so

much for your time and kindness to help me in finishing this thesis.

6. All the lectures who have taught me many things patiently. Thank you for

all the knowledge that will lead me to a better future. May your charity and

deeds are always recorded by Allah SWT.

7. All the staffs in Economic and Business Faculty. Especially to Mr. Bonyx

who always reminds me to finish my thesis and provide me all the

procedures I need in making this thesis.

8. All my dear friends in Accounting International Program 2011 for every

foolish things, jokes, support and motivation that you have done. My

'Gang Kubur' mates and 'Warkop' mates for every moment we spend

together. And especially to my Oktaviani Dewi Masitho who always have

time for me in your activity. Thank you for your pray, help, support and

ix

9. Senior and junior thank you for support an help me in wite this thesis, and

all of you that I cannot mention one by one. Thank you for sharing joy

moments.

The writer realizes that this thesis is still far from perfection due to limited

knowledge of the writer. All the suggestions and constructive criticism are

welcomed in order to make this thesis better. Hope, this thesis will be useful for

any researcher or reader. May Allah SWT always bless every step in our life.

Wassalamu’alaikum Wr. Wb.

Jakarta, April 2016 The Writer

x

TABLE OF CONTENTS

Certifivation of Comprehensive Exam ... i

Certifivation From Supervisor ... ii

Sheet Statement Authenticity Scientific Work ... iii

Curriculum Vitae ... iv

Abstract ... v

Abstrak ... vi

Foreword ... vii

Table of Content ... x

List of Tables ... xiv

List of Figures ... xvi

List of Appendix ... xvii

Chapter I INTRODUCTION A. Background ... 1

B. Problem Identification ... 9

C. Research Objectives ... 9

D. Benefits of Research ... 10

Chapter II LITERATURE REVIEW A. Theory Development ... 11

1. Agency Theory ... 11

2. Good Corporate Governance (GCG) ... 14

xi

b. Good Corporate Governance’s

Legal Basis in Indonesia ... 16

c. Basic Principle of Good Corporate Governance ... 17

d. The purpose and Benefits of Good Corporate Performance ... 20

3. Board of Director ... 22

4. Ownership Structure ... 23

a. Institutional Ownership ... 24

b. Managerial Ownership ... 26

5. Earnings Management ... 27

6. Company Performance Analysis ... 30

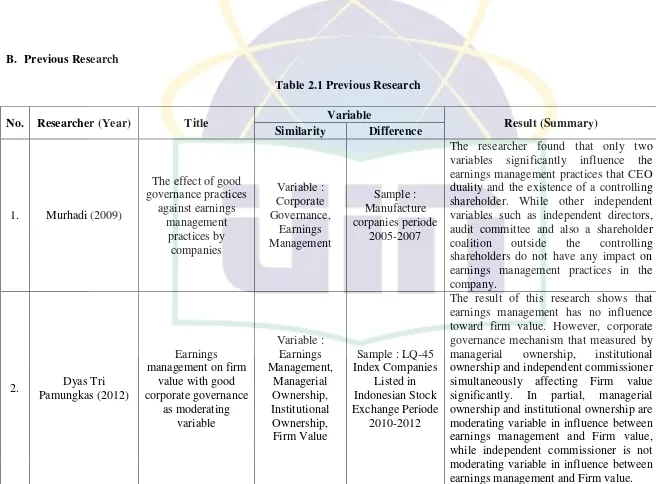

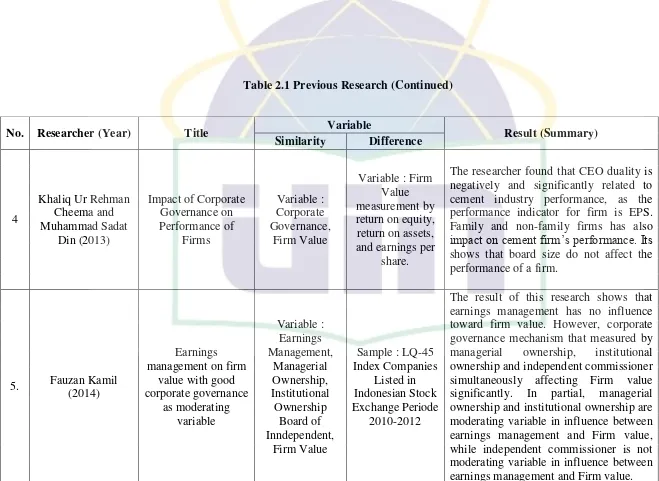

B. Previous Research ... 34

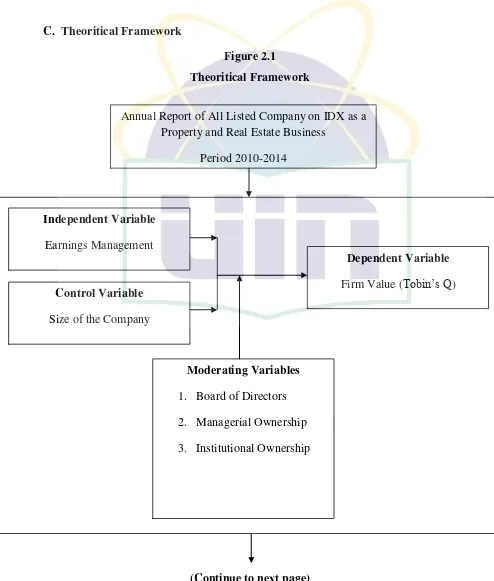

C. Theoritical Framework ... 36

D. Hypothesis ... 38

Chapter III RESEARCH METHODOLOGY A. Scope of Research ... 41

B. Sampling Method ... 41

C. Data Collection Method ... 42

D. Analyze Method ... 43

1. Descriptive Statistical Analysis ... 43

2. Classical Assumption ... 44

a. Normality Test ... 44

b. Multicollinearity Test ... 45

xii

d. Heteroscedasticity Test ... 46

3. Hypothesis Testing ... 47

a. Coefficient of Determination (R2) ... 47

b. Multiple Regression Analysis ... 48

c. Simultaneous Significance Test (F-Test) ... 48

d. Partial Significance Test (t-Test) ... 49

e. Moderated Regression Analysis... 49

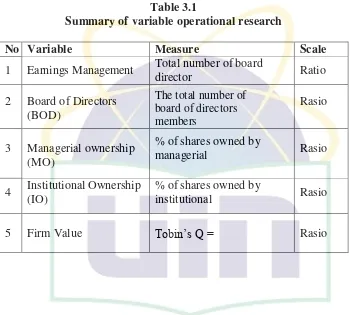

E. Definition of Operational Variable ... 50

1. Independent Variable ... 50

2. Dependent Variable ... 52

3. Moderating Variable ... 53

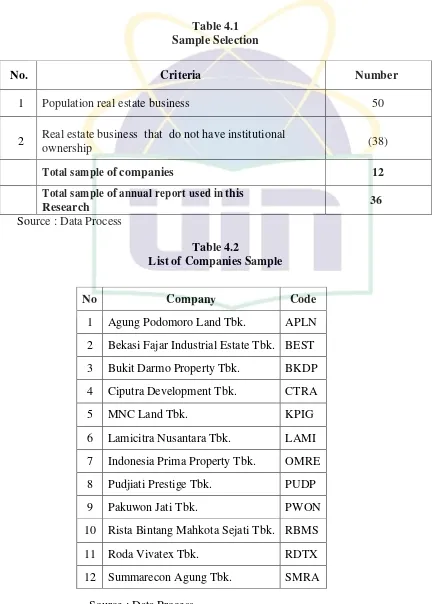

Chapter IV ANALYSIS AND DISCUSSION A. General Description of Research Object ... 55

B. Analysis and Discussion ... 57

1. Descriptive statistic ... 57

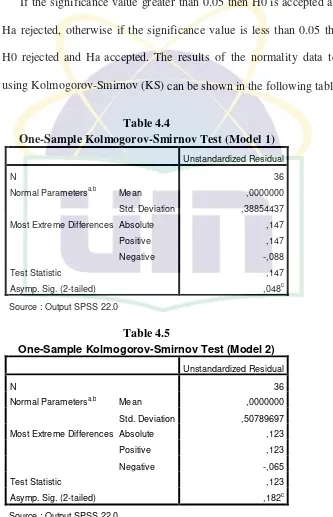

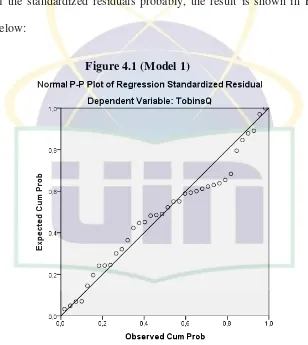

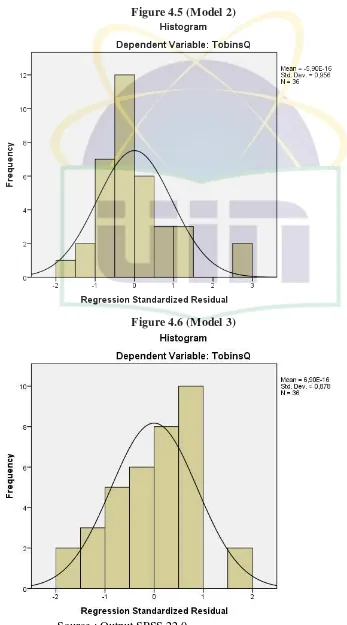

2. Classic Assumption Test ... 59

a. Normality Test ... 59

b. Multicollinearity Test ... 66

c. Autocorrelation Test ... 68

d. Heterocedasticity Test ... 70

3. Hypothesis Testing ... 72

a. Coefficient of Determination (R2) ... 72

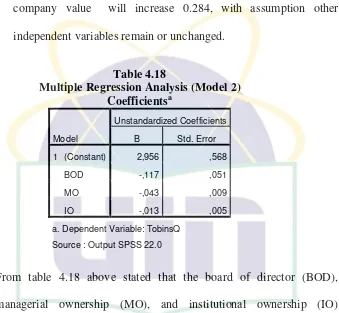

b. Multiple Regression Analysis ... 75

xiii

d. Significant Partial Test (t-Test) ... 83

e. Moderate Regression Analysis ... 89

Chapter V CONCLUSIONS AND RECOMMENDATIONS A. Conclusion ... 92

B. Recomendation ... 93

REFERENCE ... 95

APPENDIX I ... 101

xiv

LIST OF TABLE

NO DESCRIPTION PAGE

2.1 Previous Research ... 34

3.1 Summary of Variable Operational Research ... 54

4.1 Sample Selection ... 56

4.2 List of Companies Sample ... 56

4.3 Descriptive Analysis ... 57

4.4 One Sample Kolmogorov-Smirnov Test (Model 1) ... 60

4.5 One Sample Kolmogorov-Smirnov Test (Model 2) ... 60

4.6 One Sample Kolmogorov-Smirnov Test (Model 3) ... 61

4.7 Multicollinearity Test (Model 1) ... 66

4.8 Multicollinearity Test (Model 2) ... 67

4.9 Multicollinearity Test (Model 3) ... 67

4.10 Autocorrelation Test (Model 1) ... 69

4.11 Autocorrelation Test (Model 2) ... 69

4.12 Autocorrelation Test (Model 3) ... 70

4.13 Criteria of Correlation Coefficient ... 73

4.14 Model Summary (Model 1) ... 73

4.15 Model Summary (Model 2) ... 74

4.16 Model Summary (Model 3) ... 74

4.17 Multiple Regression Analysis (Model 1) ... 75

4.18 Multiple Regression Analysis (Model 2) ... 77

4.19 Multiple Regression Analysis (Model 3) ... 79

xv

4.21 Simultaneous Significant Test (Model 2) ... 82

4.22 Simultaneous Significant Test (Model 3) ... 82

4.23 Partial Test Result (Model 1) ... 83

4.24 Partial Test Result (Model 2) ... 84

xvi

LIST OF FIGURE

NO DESCRIPTION PAGE

2.1 Theoritical Framework ... 36

4.1 Normality Test (Model 1) ... 62

4.2 Normality Test (Model 2) ... 63

4.3 Normality Test (Model 3) ... 63

4.4 Histogram (Model 1) ... 64

4.5 Histogram (Model 2) ... 65

4.6 Histogram (Model 3) ... 65

4.7 Scatterplot (Model 1) ... 71

4.8 Scatterplot (Model 1) ... 71

xvii

LIST OF APPENDIX

NO DESCRIPTION PAGE

1 CHAPTER I

INTRODUCTION

A. Background

At this time the people of the world economy is facing a massive transition

process in the field of economy, namely globalization. globalization leading to

free trade and open investment climate lead to greater competition, as a result

the company is required to operate in a more competitive and productive in

improving firm value.

The performance is an overview of the implementation of an activity's

achievements in realizing the objectives of the company. Where one of the

important objectives of the establishment of the company is maximizing

shareholder wealth through increased value of the company (Brigham and

Houston, 2001). The company's financial performance is a reflection of

the financial condition of a company are analyzed with the tools of

financial analysis, so that it can be known about either the bad financial state

of a company that reflects the achievements of the work in a given period.

With the company's financial performance is also called a determination that

measures concerning both the company in bad work achievement can be seen

from its financial condition in a certain period.

Going public is one way a business entity to obtain funds by way of selling

2 go public by selling new shares originating from authorized capital as well as

the old shares originating from the capital that has been paid (Sumantoro,

1990 : 64). In order to attract the investors, the company must provide details

of the financial statements as financial performance assessment has been

carried out. The financial condition of the company will be known from the

company's financial statements consisting of balance sheet, income statement

and other financial reports. By conducting an analysis of the financial

statement the investors know about the company financial performance

(Palupi, 2013).

Companies that go public are managed by separating the functions of

ownership (principal) with management or managerial function (agent). The

separation of these functions form an agency relationship is a relationship in

which shareholders entrust the management of the company is done by

another person or manager (agent) in accordance with the interests of the

owner (principal) by delegating some decision-making authority to the agent

(Jensen and Meckling, 1976). As a result of devolution and appointment

management (manager) has brought various consequences and impact of the

separation of powers and interests between the owner (principal) and

management (agent) that will cause agency problems (Berle and Means,1934).

The agency problem arises as a result of the opportunistic nature of the

management (agent) who tend to prefer the welfare that is contrary to the

3 considers that the company's success in achieving performance (performance)

is the result of work without seeing a large contribution from other parties

including the owners (stakeholders). In relation to the agency problem, some

experts argue that the presence of the agent and the principal is one of the

factors on which the emergence of the theory of agency.

Disharmony the objectives and interests between the agent and the

principal can lead agency cost and asymmetric information. Asymmetric

information is an imbalance between the information held by the agent and the

principal in the management of the company(Ujiyantho and Pramuka, 2007).

There are two types of asymmetry of information, namely: adverse selection

and moral hazard. Adverse selection, is a condition in which the management

has more information from the owner (principal) about the company's

prospects, while moral hazard, a condition where the owner (principal) who do

not know the activity of management (Scott, 2003). The existence of

asymmetric information that gives an opportunity for management to perform

earnings management (Richardson, 1998).

Healy and Wahlen, 1999 in Theresia, 2005) states that earnings

management is the management's efforts to change the financial statements

aimed at misleading the shareholders who want to know the performance of

the company or to influence contractual outcomes that rely on accounting

numbers that reporting. Gumanti (2000) stated that earnings management

4 financial reporting process of an organization because they are expecting a

benefit from their actions. Note that earnings management is not always

associated with an attempt to manipulate the data or accounting information,

but more likely to be associated with the selection of accounting model

(accounting methods) to set the gain that could be done because it is allowed

according to the accounting regulations. If the company is in a condition

where the management cannot achieve the profit target set, then the manager

will make modifications profit is still in accordance with the applicable

accounting standards. Management motivated to show good performance in

generating maximum profits for the company so that management tends to

select and apply accounting methods that can provide a better return

information (Halim, et al; 2005).

Earnings management action by management has lead to scandal in

financial reporting (accounting) such as Merck, Wordcom and Enron as well

as several other large companies in the United States (Cornett et al; 2006).

Some major cases in corporate financial reporting scandals involving major

companies in Indonesia including PT. Kimia Farma Tbk, and Bank Lippo

Tbk. PT Kimia Farma Tbk indicated inflate the annual net profit of 32.668

billion rupiah in 2004. While PT. Indofarma Tbk perform earnings

management practices by presenting overstated net income by presenting a

higher inventory than it should, so that cost of goods sold that year occurred

5 In this case a violation of the principle of disclosure is accurate and

transparency are consequently extremely detrimental to investors, because it

overstated profits have formed the basis of transactions by investors to do

business. With the existence of such cases, it is proved that the application of

corporate governance is still very weak, because of the practice of

manipulation of financial statements still do despite being away from the crisis

period in 1997-1998. Evidence indicates weak corporate governance practices

in Indonesia leads to deficiencies in the company's decision-making and action

(Tjager, et al, 2003 in Hardikasari, 2011).

Good corporate governance is control efforts by the company to improve

performance management by making control more focused on monitoring the

behavior of the manager, so that the action taken by the manager is

accountable to the parties with an interest in the company. Warsono, et al

(2010) states that there are five basic principles of corporate governance that

must be met and is owned by five groups of participants in the company that

the Board of Directors, Board of Executives, Board of

Commissioners/Committees, Auditors, and Stakeholders. Five principles are

Transparency, Accountability and Responsibility, Responsiveness,

independence, and Fairness.

The issue of corporate governance started to become an important

discussion, especially in Indonesia, namely after Indonesia experienced a

6 process problems that the crisis in Indonesia due to the very weak of

implementation corporate governance in enterprises in Indonesia. Since then,

both the government and investors began to give significant attention in the

corporate governance practices (Hardikasari, 2011).

The failure of some companies and the onset of the financial crisis as a

result of malpractice cases are strong evidence of poor practice of Good

Corporate Governance. According to Pangestu and Hariyanto (2004), the

characteristics of weak good corporate governance practices in southeast

Asia is (1) the existence of a concentration of ownership and the power

of insider shareholders (including the government and the parties related to

the central power); (2) the weak financial sector governance and (3) the

ineffectiveness of internal rules and the absence of the consent law for

minority shareholders to deal with majority shareholder and manager.

Therefore, based on phenomena above the author interested to analyze : “The Influence of Earnings Management on Firm Value and Good Corporate

Governance as Moderating Variable”

This research has been done by several researchers. Research conducted

by Herawaty (2008) examine the role of Corporate Governance Practices as a

variable that moderates the effect of Earnings Management to the value of the

firm. The variable examined in this research is earnings management

7 independent commissioner and audit quality. The sample which is used in this

research listed non financial company in Indonesian stock exchange on period

of 2004-2006. The analytical method used is multiple regression method. In

doing multiple regression analysis, first performed classical assumption test in

order to meet the nature of regression estimation is BLUES (Best Linear

Unbiased Estimator).

Sutrisno (2010) examine the influence of the earnings management

concerning to the firm value and to examine whether the corporate governance

mechanism is the moderating variable between influence of earnings

management toward the firm value. The variable examined in this research is

earnings management measured with discretionary accrual by modified Jones

model, firm value, institutional ownership, managerial ownership,

independent commissioner and auditor quality. The sample which is used in

the research listed non financial company in Indonesian stock exchange on

period of 2005-2009. This research is using purposive sampling method to

determine the sample and it produce 58 companies as research sample.

Regression analysis method used descriptive statistic and multiple regression.

Dyas Tri Pamungkas (2012) examine the influence of corporate

governance through managerial ownership, institutional ownership, the

proportion of independent board and audit quality as a moderating variable of

the relationship between earnings management and firm value. The samples

8 Exchange during the years 2007-2010 with a random sampling method based

some multiple criteria and obtained a sample of 140 companies.

Fauzan Kamil (2014) examine the influence of earning management to

firm value with corporate governance mechanism as moderating variable. The

populations of this research are 77 companies which listed in LQ-45 Index in

Indonesia Stock Exchange within 2010-2012 periods. In this research 12

sample are selected and used after using non-probability – purposive sampling

method. The data used in this research are secondary data, which is financial

and annual report of the companies within 2012-2014 periods, which obtained

from www.idx.co.id site, and sites of the companies that listed in this research

sample.

This research is using statistic descriptive test, linear regression test, and

multiple linear regression test to get the understanding about the connection

between variables in this research.

The difference of this research with previous research, namely:

1. Years observed in this study was in 2012-2014.

2. In this study, researchers focus to one industry that is real estate companies

which include property. The goal is to avoid bias caused by differences in

9 3. In this research use corporate governance indicators is Board of Director,

Managerial Ownership and Institutional Ownership.

B. Problem Identification

Based on the above description of the background, the problem

formulation in this research are:

1. Whether the earnings management influence the firm value?

2. Whether the corporate governance proxied by board of director influence

the relationship between earnings management on firm value?

3. Whether the corporate governance proxied by managerial ownership

influence the relationship between earnings management on firm value?

4. Whether the corporate governance proxied by institutional ownership

influence the relationship between earnings management on firm value?

C. Research Objectives

The purpose of this study was to analyze empirically the influence of

earning management on firm value and good corporate governance as

moderating:

1. To analyze influence of earnings management on firm value.

2. To analyze influence of corporate governance proxied by board of director

10 3. To analyze influence of corporate governance proxied by managerial

ownership on relation between earnings management and firm value.

4. To analyze influence of corporate governance proxied by institutional

ownership on relation between earnings management and firm value.

D. Benefits of Research

Implementation of this study is expected to provide the following benefits:

1. For the authors, this study is expected to provide insight into the influence

of earnings management on firm value and corporate governance as

moderating.

2. For companies, this study can be used as additional information or inputs

that builds primarily on the influence of earnings management on firm

value and corporate governance as moderating.

3. For others, this research is also expected to be useful for those who require

11 CHAPTER II

LITERATURE REVIEW

A. Theory Development

1. Agency Theory

Agency theory is a theory that explains the relationship between

agents as those who manage the company and the principal as the owner

of both which are bound in a contract. The owner or principal is a party to

evaluate the information and agents are running as part of management

activities and decision making (Jensen and Meckling, 1976).

Jensen and Meckling (1976) also define an agency relationship as

a contract under which one or more persons the principals engage another

person (the agent) to perform some service on their behalf which involves

delegating some decision making authority to the agent. If both

parties to the relationship are utility maximizes, there is good reason to

believe that the agent will not always act in the best interests of the

principal. The principal can limit divergences from his interest by

establishing appropriate incentives for the agent and by incurring

monitoring costs designed to limit the aberrant activities of the agent. In

addition, in some situations, it will pay the agent to expend resources

12 will harm the principal or to ensure that the principal will be

compensated if he does take such actions.

However, it is generally impossible for the principal or the agent

at zero cost to ensure that the agent will make optimal decisions from

the principal’s viewpoint. In most agency relationships, the principal

and the agent will incur positive monitoring and bonding costs

(non-pecuniary as well as (non-pecuniary), and in addition, there will be some

divergence between the agent’s decisions and those decisions which

would maximize the welfare of the principal. The dollar equivalent of the

reduction in welfare experienced by the principal as a result of this

divergence is also a cost of the agency relationship, and we refer to this

latter cost as the “residual loss”.

In reality, managers will know more about internal information and

the company's prospects in the future than shareholders. Therefore,

managers should always give a signal about the condition of the

company to the shareholder. The signal can be given by the manager

through the disclosure of accounting information such as financial report.

The financial report is a very important thing for the external users

because these entities are in the greatest condition of uncertainty (Ali,

2002). Imbalance knowledge of information will lead to the emergence of

a condition known as information asymmetry. With the existence of

13 give the opportunity to the manager to do earning management, so that it

will mislead shareholders about the company's economic performance.

Corporate governance is a concept based on agency theory that is

expected to serve as a tool to provide assurance to investors that they will

receive a return on the funds they had invested. Corporate governance is

closely related to how to make the investors believe that managers will

give benefit to them, by believing in that the manager will not misuse the

invested fund to the illegal projects. Besides that, corporate governance

also relates to how the investors control the managers (Siallagan and

Machfoedz, 2006).

Special authority in every region in Indonesia in

implementing corporate governance is based on Law no. 5 of 1974 on the

Principles of Governance in the Region, as well as explaining the

relationship between central and local government. After the

implementation of policies to implement regional autonomy in Indonesia

through Law no. 22 of 1999 as amended by Law no. 32 of 2004

on Regional Government has change a paradigm and a very basic

structure, especially the local government relations (Executive) with the

Regional Representatives Council/DPRD (Legislative). In this

relationship, the Legislative delegates authority to run the government to

14 Agency problems that arise among executives tend to maximize

utility (self- interest) in the creating or composing the local budget,

because they have the advantage of information (information asymmetry).

As a result, executives tend to do "budgetary slack". This happens due to

the executive try to secure its position in the government in the point of

view of legislative and the public / people, even for the sake of the next

election, but budgetary slack of APBD is more for personal interest

among executives (self-interest) rather than for the benefit of society.

(Latifah, 2010).

2. Good Corporate Governance

a. Concept of Good Corporate Governance

Good Corporate Governance indefinitely as a system which has

authority and as a control to add value for all of stakeholders. As

principal of corporate governance have interest for all shareholders

and stakeholders in corporate governance. Understand of corporate

governance according to the Turnbull Report in the UK (April 1999)

Corporate Governance is a company’s system of internal control,

which has principal to the management’s risk which are significant to

fulfill of its business objectives to safeguard the company’s asset and

enhancing over time the value of the shareholders’ investment. The

Implementation involved development of GCG, have two related

15 establishment of technical or structural change and organizational

systems. The software includes more psychosocial change of

paradigm, vision. In real-world business practices, most companies

more emphasize hardware aspects, such as the preparation of systems

and procedures and the establishment of organizational structures.

Gede Raka, as panelist from Indonesian Institute for Corporate

Governance (IICG), stated of Good Corporate Governance have

implied the company and not make a profit for owners, but create

value for all concerned parties. Good Corporate Governance concept

reflects to share, care, and preserve. Good Corporate

Governance should changes of system and structure and dimension

paradigm, vision, mission of organization. Changes in technical

aspects of structure and systems are required as management’s

capabilities. In this case, focuses in concern are regularity and

smoothness on the process in organization as well as members of the

company's adherence to the policy to implement the Principles Good

Corporate Governance.

The definition according to Cadbury, said that Good Corporate

Governance is direct and control the company, in order to reach

balance between power of strength and authority of company. World

Bank defines Good Corporate Governance is a collection of laws,

16 performance of corporate resources as function efficiently, in

order to generate economic value of sustainable long term for

shareholders and society as a whole.

According to decree of Minister of state-owned enterprise

No: PER-01/MBU/2011 regarding on the implementation of Good

Corporate Governance practices in state-owned enterprise is

principles underlying the process and mechanism of corporate

governance based enterprise management regulations and business

ethics.

b. Good Corporate Governance’s Legal Basis in Indonesia

In Indonesia, the implementation of good corporate governance

guidelines have been made by Komite Nasional Kebijakan

Governance (KNKG) through his new book released in 2006 entitled “Pedoman Umum Good Corporate Governance Indonesia". Devices

Regulations and Legislation Circular of Minister of State for

Investment and Development of State-Owned Enterprises 106 of 2000

and Decree of Minister of State Enterprises no. 23 2000 that regulate

and formulate the development of good practice the company's

corporate governance in the company, and then refined with

KEP-117/M-MBU/2002 which is renewed by the Regulation of Minister of

State-Owned Enterprises PER-1/MBU/2011 of Implementation

17 has also been issued Decree of Minister of State Enterprises

no.103 Year 2002 on Establishment of Audit Committee. Capital

Market Supervisory Board No. through a circular..

SE-03/PM/2000 has recommended that public companies to maintain audit

committees.

c. Basic Principles of Good Corporate Governance

Various rules and system as a regulator in management of

company’s need to be poured in form of principles that must be

adhered to the concept of Good Corporate Governance. In

generally, there are 5 (five) basic principles (KNKG, 2006),

namely:

1) Transparency

To maintain the objective of corporate must provide

information, which is material and relevant in a way that is

easily accessible and understood by stakeholders. Companies

should take the initiative to reveal not only the problem that

required by law, but also the importance for decision-making by

shareholders, creditors and other stakeholders. Corporate must

provide the information timely, adequately, clearly, accurately,

and all the important events that may affect the condition of

18 2) Accountability

Corporate must be accountable for their performance in a

transparent and fair. It must be properly managed, scalable, and in

accordance with the interests of the company to remain

stakeholder’s interests. Specify details of duties and

responsibilities of each organization and all employees.

Corporate must ensure that the organs of company and all

employees have competent accordance with the duties,

responsibilities, and roles in implementing Good Corporate

Governance. Corporate needs to ensure an effective system of

internal control to be manage in the company.

3) Responsibility

Corporate must comply with laws and regulations and

carry out responsibilities for people and the environment. So, the

business can be maintained in the long run and gained recognition

as the Good Corporate Governance. The organization must adhere

to the principle of prudence and ensure compliance with regulatory

laws, statutes and regulations. Corporate should be carried out

social responsibility. Corporate has to be responsible in

management to the principle of corporate, as well as existing of

19 4) Independency

The corporate should be managed independently, so the

individual companies do not dominate other organs and no

intervention by other parties. Each organ must avoid domination

by any party, is not affected by particular interests, independent of

other interests, influence and pressure. Each organ shall carry out

the functions and duties in accordance with the statutes and

regulations, and not dominate the other, or passing the buck

between each other. Independency state whereas the corporate are

managed by professional without any conflict interest and pressure

from any side, which will be affected to the health of corporate.

To accelerate the implementation of Good Corporate

Governance, the corporate should be managed independently, so

their organizations do not dominate to the other and no

intervention other parties. Each organization of corporate has to

avoid the domination any party, not influenced by special interest,

free from conflict and pressure, so the decision-making will be

done objectively. Each organ must perform its functions and

duties in accordance with the statutes and regulations, do not

dominate others and passing the buck between each other to

20 5) Fairness

To carry out these activities, the company should pay

attention to the interests of stakeholders based on the principle of

equality and fairness. Corporate provide equal treatment to all

stakeholders. Corporate provides the opportunity for stakeholders

to give advice and opinion for company’s performance and open

access of information in accordance with the principles of

transparency within the scope of the position.

Equality and fairness defined as fair and equal treatment in

fulfilling the right of stakeholder arising under treaties and laws,

which have applied. Fairness also includes to fulfill the right of

investors, legal system and enforcement of regulations, which

protect investors. Fairness is expected to make the entire of

company’s assets are well managed and prudent, also expect to

protect all members. Corporate should provide the opportunity for

stakeholders to provide input and expression to the interests of

companies and open access to information in accordance with

the principle of transparency in their respective positions.

d. The Purpose and Benefits of Good Corporate Governance

The essence of corporate governance is improving the company's

performance through the supervision or monitoring of the performance

21 interests of other users, based on a framework of rules and regulations

(Gunarsih, 2003). In addition to these good corporate governance also

has its benefits, namely as follows:

1) Increase the company performance through the creation process

of a better decision making, improving the operational efficiency

of the company and further improve service to stakeholders.

2) Facilitate getting a cheaper financing funds so that it can further

improve the corporate value.

3) Reduce agency cost means that the cost that should be borne by the

shareholder as a result of the delegation of authority to the

management.

4) Increase the value of shares of the company so as to enhance the

company's image to the wider public in the long run.

5) Restore investor confidence to infuse capital in Indonesia.

Whereas the purpose of good corporate governance is as follows:

1) Protecting the rights and interests of the shareholders.

2) Protecting the rights and interests of the members of stakeholders.

22 4) Improve the efficiency and effectiveness of work of the Board of

Directors and management of the company.

5) Improve the quality of the relationship the Board of Directors with

senior management of the company.

3. Board of Directors

The board of directors is a party to a corporate entity tasked with

carrying out the operation and management of the company. Members of

the Board of Directors appointed by the Annual General Meeting (AGM).

According to the limited liability company act, which can be appointed as

a board member is an individual who is able to carry out legal action and

not been declared bankrupt or become a member of the directors or

commissioners who were found guilty of causing the company to go

bankrupt, or a person who never convicted of committing adverse financial

criminal state within five years prior to appointment.

The boards of directors are fully responsible for all operations and

management of the company in order to carry out the interests in achieving

corporate goals. The board of directors is responsible for the affairs of the

company with external parties such as suppliers, customers, regulators and

legal parties. With such a large role in the management of the company,

directors basically have a significant controlling interest in resource

management companies and funds from investors. Functions, powers, and

23 on Limited Liability Company. In this law, the board has the task, among

others:

1) Leading publishing company with corporate policies.

2) Choose, assign, and supervise duties of the employee and the manager.

3) Approve the annual budget of the company.

4) Delivering a report to shareholders for the performance of the

company.

According to the general guidelines of good corporate governance

Indonesia, the number of board members must be tailored to the

complexity of the company with regard to its effectiveness in decision

making. In a company, the amount of both the board of directors and board

of commissioners vary. A large number of councils that can provide gains

or losses in the company.

4. Ownership Structure

The ownership structure is the shareholding in the company,

particularly the number of majority (either individually or together) will

determine the extent and intensity control to management. Ownership

structure is the percentage of shares held by the insider and the outsider

shareholder. Insider party i.e. shareholders who are aligned as a directors

and commissioners. Outsider party i.e. shareholders that have by the

24 ownership can be seen from the point of the concept of corporate

governance, as the owner of an external mechanism, which is strongly

associated with the commissioners and directors (Hadiprajitno, 2013).

Agency problem is problems arising from the parties involved have

different interests with each other. The ownership structure is a mechanism

to reduce the conflict between management and shareholders (Faisal,

2004). So the agency problem can be mitigated by the presence of the

ownership structure, due to the presence of structured ownership structure,

believed to have the ability to influence the future course of the company

that may affect the agency costs incurred by the company.

Ownership structure can be individual investors, government, and

private institutions. The ownership structure is divided into several

categories. Specifically ownership structure category includes ownership

by institutional ownership and managerial ownership.

a. Institutional Ownership

Institutional ownership is ownership of shares owned by domestic

institutions, foreign institutions, government institutions such as

insurance companies, banks, investment companies and other.

Institutional ownership may indicate the presence of institutional

investors that strong corporate governance mechanisms which can be

used to monitor the management of the company (Tarjo, 2008).

25 in institutions. Institutions which mean the owner of a public company

in the form of institutions, not on behalf of the owner of individual

private (Sekaredi, 2011). The majority of institutions is a Limited

Liability Company.

Ownership by institutional investors is likely to encourage more

optimal monitoring the management performance, since share

ownership represents a source of power that can be used to support or

otherwise of the management performance. Jensen and Meckling

(1976) suggest that institutional ownership has a very important role in

minimizing agency conflicts that occur between managers and

shareholders.

According Barnae and Rubin (2005), institutional shareholders

with a large stake have an incentive to monitor corporate

decision-making. The greater the institutional ownership will make sound

power and boost the institution to oversee the management and

consequently will give greater impetus to optimize the value of the

company. In addition, ongoing surveillance of both managers and

reduce agency costs.

The existences of institutional investors are considered capable of

being an effective monitoring mechanism in any decision made by the

manager. This is due to the institutional investors involved in strategic

26 According Cruthley (1999) who found that the monitoring is carried

out institutions capable substitute agency costs, thus decreasing agency

costs and increase firm value.

b. Managerial Ownership

Managerial ownership is ownership of shares of the company by a

manager or in other words the manager as well as a shareholder

(Christiawan and Tarin, 2007). According to Jansen and Meckling

(1976) one way in order to reduce the conflict between the principal

and the agent can be done by increasing managerial ownership of a

company. That means that managerial stock ownership in a company

will encourage pooling of interests between principal and agent so that

managers act in accordance with the wishes of shareholders.

Managerial share ownership can also aligns the interests between

managers and shareholders so that managers will be careful in taking

decisions because they directly share in the benefits and impact of the

decisions of making the wrong decision (Gelisha, 2011).

The greater the proportion of managerial stock ownership in the

company, the managers tend to try harder and motivated to create the

optimal performance of the company because managers have an

obligation to maximize the welfare of the shareholders, yet on the

other hand managers also have an interest to maximize their welfare

27 resulting in lower agency costs and can reduce the tendency of

managers to perform opportunistic actions.

5. Earnings Management

Earnings management is to intervene in the management of

external financial reporting process in order to achieve a certain income

level with the aim to benefit himself (or his own company). Opportunities

to distort that particular income arising from the accounting methods

provide opportunities for management to take note of a certain fact in

different ways and opportunities for management to involve subjectivity in

compiling estimates(Worthy, 1984).

Healy (1985) stated that earnings management occurs when

managers working in the company with the bonus plan tried to arrange

reported earnings in order to maximize the bonus they will receive.

Merchant (1989) defines earnings management as an action taken by

management to affect earnings that can provide information about the

economic benefits are not actually experienced companies. Scipper (1989)

defines as earnings management intervention in the financial reporting to

external parties for the purpose of personal gain.

Earnings management is the management's efforts to change the

financial statements aimed at misleading the shareholders who want to

know the performance of the company or to influence contractual

28 management is not necessarily linked to the process of manipulation by

the manager, but more likely to be associated with the process of selecting

the method of accounting (accounting method) to adjust benefits can be

obtained by the company because it is allowed by regulation accounting

earnings management, but this remains to be detrimental to shareholders

stocks because they get company information presented is not real by the

manager so that they can not accurately predict who would benefit they get

from the fund has been invested into the company (Healy dan Wahlen,

1998).

Based on the various definitions of the earnings management, some

of the characteristics of earnings management, namely: (1) carried out

based on the time dimension; (2) as an option to the company's accounting

policies for financial reporting purposes; (3) there are aspects of the

behavior of managers that manage earnings (earnings) with various

motives, for example, take advantage by asymmetry of information or to

hide poor performance.

According to Scott (2002) motivation of the company in this case

is the manager doing earnings management:

a. Bonus scheme

Managers who work in the company with the bonus plan will try to

29 b. Debt Covenant Clause

Motivation in line with the debt covenants hypothesis in a positive

accounting theory the closer a company to breach debt agreement then

the manager will tend to choose accounting methods that can "move"

the current period income so as to reduce the possibility of the

company suffered a breach of contract.

c. Political motivation

Large companies and other strategic industry tends to reduce

profits to reduce the visibility, especially during periods of high

prosperity. This action is performed to obtain the ease and facility of

government.

d. Taxation motivation

Taxation is one of the main reasons why companies reduce

reported earnings. By reducing reported earnings, the company can

minimize the taxes that must be paid to the government.

e. Substitution Chief Executive Officer (CEO)

CEO assignment that will expire or be pursuing a strategy of

maximizing retirement income to increase bonus. Similarly, the CEOs

whose performance is not good, it will tend to maximize profits in

30 f. Initial Public Offerings (IPO)

When the company goes public, the financial information contained in

the prospectus is an important source of information. This information

can be used as a signal to potential investors, the managers tried to

increase reported earnings.

6. Company Performance Analysis

The company is an entity form the scene of a unity of the various

functions and operational performance work systematically to achieve a

certain goal. The goal of a company is an objective to be achieved all

stakeholders in the company. To achieve these objectives, the parties

interested in the company should cooperate systematic way to yield

optimal performance. One way to know whether a company in carrying

out its operations in accordance with a predetermined plan and in

accordance with the objectives was to find out from the company

performance.

Performance is a picture of the level of achievement of the results

of the implementation of an operational activity. Assessment of

performance here is a method and process assessment task execution

performance of a person or group of people or work units within a

company or organization in accordance with the performance standards or

31 companies need to have a measure to gauge how the achievement of goals

and objectives within a specific time period.

Thus, the performance as a description of the achievement of the

implementation of operational activities is vital in realizing the vision and

mission of the organization. Assessment of performance is a form of

reflection obligation and responsibility to report on the performance,

activities and resources have been used, accomplished and done. To assess

whether the stated goals have been achieved is not something easy to do.

This is because it concerns the management aspects which are not few in

number. Because of this, the company performance can be accessed

through a variety of indicators or variable to measure the success of the

company. However, in general the performance appraisal company

focused on the information derived from the financial statements. General

performance of the company usually represent in the financial statements.

These financial statements are useful to help investors, creditors, potential

investors and other users in order to make investment decisions, credit

decisions, as well as the stock analysis determines a company prospects in

the future. Through performance evaluation, the company can choose a

strategy and financial structure.

Since the company performance appraisal based on financial

statements, it is to assess the performance using financial ratios. These

32 assessment of the company performance and its prospects in the future.

Ratios commonly used to assess the financial performance, among others,

is Tobin's Q. In the capital markets, managers and investors are more

interested in the market value of a company is more often using Tobin's Q

as the ratio to measure financial performance. According to Darmawati

(2011) Tobin's Q ratio can explain various phenomena in company

activities, such as the relationship between management ownership and

company value, the relationship between performance management and

profits, acquisitions, and financing policies, as well as dividends, and

compensation.

Darmawati (2011) also stated that the ratio of assessed to provide

good information, because it can explain various phenomena in corporate

events, such as the differences in investment and diversification decisions,

the relationship between management stock ownership and corporate

value. However, the use of Tobin's Q as financial ratios to demonstrate the

performance of the company has a number of drawbacks. According to

Bukhari (2011) that the market value can be the size of the firm value,

while the balance sheet, total equity capital of the company describe.

Assessment of the company not only refers to the nominal value, this is

due to the condition of the company to change at any time significantly.

Usually the pre-crisis nominal value of the company is quite high but after

33 From the above statement can be concluded that the decline in the

condition of the company after the crisis is sometimes not immediately

followed by a decrease in stock value. In fact, the nominal value of shares

requires a certain time lag to changes according to the condition of the

company after the decrease or increase in operational performance. This

does not include the risk that comes from the presence of a particular issue

or cause the movement of the stock price becomes abnormal. With such

conditions, researchers not use Tobin's q as a measure of company

performance, but researcher use profitability ratios for measured the

company performance. Profitability ratios indicate the ability of the

company assets to generate operating profits. Profitability ratios focus on

measuring the performance of the company's current and profitability

ratios are not tied to stock (Ferdiana, 2012).

Most researchers consider Tobin's Q are better able to explain the

actual state of the company. However, the high volatility of stock price

due to the influence of various macroeconomic factors can have a big

impact can affect the results of the calculation. This would not happen if

we used profitability ratios, because of these considerations this study used

as an indicator of performance, profitability ratios assessment indicates the

34 B. Previous Research

Table 2.1 Previous Research

(Continue to next page)

No. Researcher (Year) Title Variable Result (Summary)

35 Table 2.1 Previous Research (Continued)

No. Researcher (Year) Title Variable Result (Summary)

Similarity Difference

36 C. Theoritical Framework

Figure 2.1

Theoritical Framework

(Continue to next page)

Annual Report of All Listed Company on IDX as a Property and Real Estate Business

Period 2010-2014

Independent Variable Earnings Management

Control Variable Size of the Company

Dependent Variable Firm Value (Tobin’s Q)

37 Figure 2.1

Theoritical Framework (Continued) Classic Assumption Test 1. Normality

2. Multicollinearity 3. Autocolleration 4. Heterocedasticity

Moderate Regression Analysis

Analysis and Intepretation

Conclusion Hypothesis Test 6. Test Coefficient of

Determination (R2) 7. Multiple Regression

Analysis

8. Simultaneous Significance Testing ( F-Test)

38

D. Hypothesis

1. Earnings Management and Firm Value

As the manager of the company managers more aware of internal

information and prospects of the company in the future compared to the

owners (shareholders), giving rise to asymmetry of information. Managers are

required to provide a signal about the state of the company to the owner.

Given signal is a reflection of the firm value through the disclosure of

accounting information such as financial reports. The financial report is

important for external users because of the group's companies are in a

condition that at least a high degree of certainty (Ali 2002).

Asymmetry between the management and the owners give managers

the opportunity to perform earnings management to increase the firm value at

a given time so as to mislead the owners (shareholders) of the actual firm

value. Sloan (1996) examined the nature of the information content of the

accrual component and a component of cash flows is reflected in the share

price. Proved that the performance of profits derived from accrual as a

component of earnings management activities have lower persistence than

cash flow. Reported earnings greater than the operating cash flow that can

increase the firm value at this time.

39 2. Corporate Governance and Firm Value

In the perspective of agency theory, the agent is risk adverse and tend

to be selfish would allocate resources from investments that do not increase

the firm value to a more profitable investment alternatives. Problems agency

will indicate that the firm value will rise if the owner of the company can

control the behavior of the management in order not to waste resources

companies, either in the form of investments that are not feasible or in the

form of shirking. Corporate governance is a system that regulates and controls

the company that is expected to provide and enhance the company's value to

its shareholders. Thus, the implementation of good corporate governance is

believed to increase the firm value.

Klapper and Love (2002) found a positive relationship between corporate

governance and corporate performance as measured by return on assets

(ROA) and Tobin's Q. Another important discovery is that the application of

corporate governance at the enterprise level is more meaningful in developing

countries than in developed countries , It shows that companies that

implement good corporate governance would gain greater benefit in countries

with poor legal environment.

H2 : Practice corporate governance positively influence jointly and partially

40 3. Earnings Management, Corporate Governance and Firm Value

The company that organizes corporate governance system is believed

to limit opportunistic earnings management. Therefore, the higher the size of

board of director, the proportion of managerial ownership ana institutional

ownership reduce the tendency of earnings management. The negative

relationship between corporate governance and earnings management may

weaken the effect between earnings management and firm value.

H3 : Earnings management influence on the firm value weakened by the

41 CHAPTER III

RESEARCH METHODOLOGY

A. Scope of Research

This research is empirical study of hypothesis testing with using

causalities research method to determine the influence between the

independent variables (variables that effect) and the dependent variable (the

variable that is effected) with moderating variable. The independent variable

in this research is earnings management. The dependent variable in this

research is firm value and the corporate governance as moderating variable.

This study aimed to examine the influence of Earnings management

implementation towards the firm value and Corporate Governance as

moderating variable, the study on real estate and properties companies listed

in the Indonesian Stock Exchange (IDX) within 2012-2014. Corporate

governance proxies by Board of Director (BOD), Managerial Ownership

(MO), Institutional Ownership (IO), and firm value measure by Tobin’s Q.

B. Sampling Method

Sampling method is kind of method that take data from population.

Sample is a part of the number, and characteristic possessed by the population.

Research will not take all the populations, because due to limited funds,

manpower and time. So, sample can represents the population (Sugiyono,