BANK INDONESIA AND CASH

Under the mandate of Act of the Republic of Indonesia

No. 23 of 1999 concerning Bank Indonesia as amended by Act

of the Republic of Indonesia No. 3 of 2004, the functions

of regulating and safeguarding the smooth operation of the

payment system are carried out by BI, the sole institution

authorised to issue and circulate the rupiah currency and

to revoke currency as legal tender, withdraw from

circulation and destroy currency withdrawn from circulation

(Article 20). In this regard, the supply of rupiah currency

begins with a macro (national) assessment of estimated

additional demand.

The estimation of nationwide additional demand for cash

takes account of economic conditions in order to facilitate

economic activity (money endogeneity). The estimation

approach used is the currency outside banks (COB) model,

which has adopted the Error Correction Model (ECM) for the

two-step Engle Granger. The ECM model is essentially a

concept for an econometric time series for synchronising

short run equilibrium with the conditions for long run

equilibrium through a process of adjustment. At the same

time the selection of independent variables in the COB

equation is more adhoc1 and assumed to be influenced by

macroeconomic variables such as GDP, inflation, interest

rates and the exchange rate.

The larger the GDP, the greater the demand for COB.

However, interest rates are assumed to have a negative

influence on COB demand. Higher interest rates will result

in lower consumption/increased savings, which weakens demand

for COB. The third factor, the exchange rate, is assumed to

have a positive impact on COB demand. Rupiah depreciation

will encourage the public to boost their present levels of

consumption to minimise future loss of purchasing power.

This will increase public demand for cash, and thus demand

for COB will rise. In addition to these macro variables,

influence on demand for COB is also assumed to come from

non-economic variables, such as celebration of religious

festivities (especially Eid-ul-Fitr and Christmas).

After selecting the variables to be used in the COB

demand equation, the next step is to perform an estimate of

the long term equation using quarterly data on GDP,

inflation, interest rates and the exchange rate beginning in

1990. The estimate thus obtained for the long-term equation

is as follows:

COB Long-Term Equation (real)

Log(cur /cpi) = -7.39 + 1.00log (GDP) – 0.06log (ir) + 0.17log (ER)

(15.42) (-3.55) (11.61)

R2=0.96

Graph 1. Fitted Value and Actual National COB Graph 2. Rolling Regression of the Long-Term Coefficient

In most cases, the estimate of the long-term equation

has the expected signs. Economic growth and the exchange

rate have a positive influence and are statistically

significant for COB demand, while interest rates have a

negative impact and are statistically significant for COB

demand. From the estimate for the long-term equation, a new

variable is established that comprises the difference

between fitted value and actual value. The new variable

(Error Correction lag 1) is then included in the short-term

equation to be estimated in conjunction with other

variables. The estimate obtained for the short-term equation

is as follows:

COB Short-Term Equation (real)

d(log(cur/cpi)) = 0.008 + 0.89d(log(GDP(-2))) + 0.07d(log(ER)) – 0.07d(log(IR(-3)))

(3.43) (2.71) (-3.16)

+ 0.04 dumleb – 0.07 dumfis – 0.40 EC (-1)

(3.76) (-4.57) (-5.80)

R2=0. 76

dw=1.59

in which:

GDP : Gross Domestic Product

CPI : Consumer Price Index (end of period for the quarter under review)

IR : 1-month Time Deposit Rate (average over 3 month period)

ER : USD/rupiah exchange rate (average over 3 month period)

Dumleb : Lebaran Dummy

(for Eid-ul-Fitr)

Dumfis : Fiscal Dummy, each Q1=1 commencing in 2000, others 0

C U R ( B a s e i n e ) CUR 140000

120000 100000 80000 60000 40000 20000 0

9 0 9 2 9 4 9 6 9 8 0 0 0 2 04

E l P D B E l I R El ER %

1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 1.2

The estimates obtained for the long-term and short-term

equations are then used simultaneously to project national COB.

The results of the COB in-sample forecast for both equations are

presented in Graph 1. To ascertain whether any change takes place

in the characteristics (preferences) of cash demand, a stability

test is conducted on the coefficient of the estimate. Rolling

regression is used on the COB model, yielding information that

the coefficient values for factors influencing cash demand are

relatively stable (Graph 2).

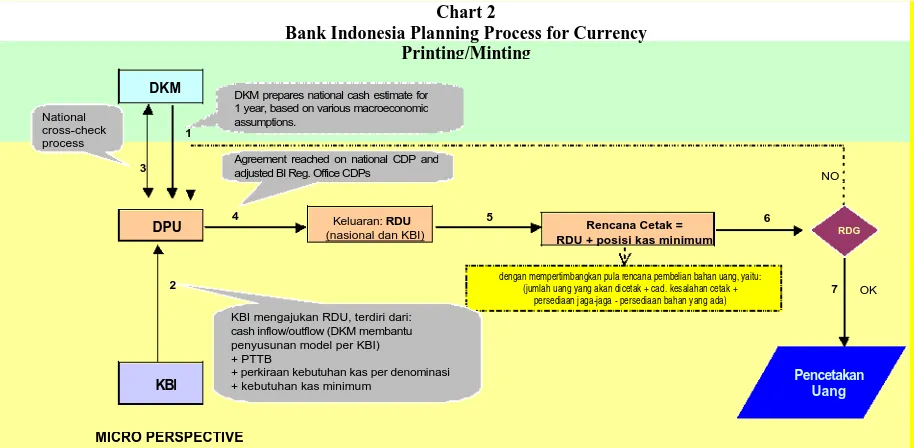

The estimate generated by the model will then inform the

Directorate of Currency Circulation in projecting national

cash demand in order to put together the national Currency

Distribution Plan (CDP). The CDP is an aggregation of CDPs

produced bottom up by Bank Indonesia Regional Offices2. After

harmonising the national model-based estimate (DKM) with the

national estimate based on the aggregation of data provided

by Bank Indonesia Regional Offices, a national CDP will take

shape. The national CDP will then be compared with the

minimum cash position of the Currency Distribution Section to

obtain the data for the Printing/Minting Plan. Based on the

Printing/Minting plan, BI will calculate the volume of

currency material to be purchased. This process is depicted

2 The CDPs at the Bank Indonesia Regional Offices are calculated beginning with the factors in cash outflow and

in schematic form in Chart 2. It is important to note that

the DKM model estimates submitted to the Currency

Distribution Section are estimates of COB, which excludes

cash-in-vault held by banks. In this context, differences can

arise between the numbers generated by the COB model and the

additional currency in circulation to be printed by the

Currency circulation section (Table 2).

[Translation of chart]

DKM = Directorate of Financial and Monetary Statistics

DPU = Directorate of Currency Circulation ---> Output: CDP (national and reg. office) --->

Printing/Minting Plan = CDP + Minimum Cash Position ---> Board of Governors’ Meeting

Also takes account of planned purchase of currency materials, i.e. (total amount to be printed/minted +

allowance for defective printing/minting + buffer – existing stock of material)

BI Reg. Offices submit CDPs consisting of cash inflow/outflow (DKM assists in development of individual Reg. Office models),

+ PTTB

+ estimated cash needs per denomination

BI Reg. Offices PRINTING/MINTING OF CURRENCY

Table 2 National

cross-check process

Chart 2

Bank Indonesia Planning Process for Currency Printing/Minting MICRO PERSPECTIVE 3 DKM DPU KBI 2 1

KBI mengajukan RDU, terdiri dari: cash inflow/outflow (DKM membantu penyusunan model per KBI) + PTTB

+ perkiraan kebutuhan kas per denominasi + kebutuhan kas minimum

4

DKM prepares national cash estimate for 1 year, based on various macroeconomic assumptions.

Keluaran: RDU (nasional dan KBI)

5

dengan mempertimbangkan pula rencana pembelian bahan uang, yaitu: (jumlah uang yang akan dicetak + cad. kesalahan cetak +

persediaan jaga-jaga - persediaan bahan yang ada) Rencana Cetak = RDU + posisi kas minimum

6 Pencetakan Uang NO 7 RDG OK Agreement reached on national CDP and

Differences between COB and Currency in Circulation

Currency Outside Banks (COB) Currency in Circulation *

Definition

Cash outside banks is cash in non-bank public circulation as reflected in the M0 money component.

All cash liabilities out side Bank I ndonesia that form part of Bank I ndonesia monetary aggregates, as reflected in the base money component (including cash held in commercial bank vaults).

Component All cash outside Bank I ndonesia and commercial

bank vaults. Money creation accounts (40x) subtracted by

1. minting of commemorative coins (402). 2

Bank I ndonesia cash accounts, i.e: Wholesale cash (010), daily cash (011), uncounted bank cash deposits (012), mobile cash and cash courier services (013), currency unfit for circulation (014), remise (016).

3 Currency used as specimens for sorting guidelines (294).

4 linkage accounts (291).