FINANCIAL AND NON FINANCIAL FACTORS

INFLUENCING INDONESIAN COMPANIES’ TAX

AGRESSIVENESS

Ardy

1, Ari Budi Kristanto

2ABSTRACT

Tax aggressiveness conveys benefit in promoting taxpayers’ efficiency, but also bringing the risk at once. The efficiency can be reached through minimizing the tax payment. On the other hand, tax payers’ reputation and firm value may be weakened if the tax aggressiveness is put into opportunistic objective. This paper aims to investigate whether the financial and non-financial factors influence the tax aggressiveness. Financial factors comprise leverage and liquidity. Moreover, the nonfinancial factors cover the proportion of independent commissioners, audit committee and family ownership. Furthermore, the tax payers’ aggressiveness is measured by Effective Tax Rate. The research formulates five hypotheses which are tested using linear regression methods. Moreover, this research employs 72 firm years as samples, which cover manufacturing companies listed in the Indonesian Stock Exchange during 2010 until 2013. Those samples are sorted out by purposive sampling method. The samples are chosen using the purposive sampling method based on certain designated criteria. The result shows that financial factors consist of leverage and liquidity, and nonfinancial factor of audit committee positively influences the tax aggressiveness. While the proportion of independent commissioners and family ownership do not have significant influence toward tax aggressiveness. This finding implies that Indonesian companies tend to aggressive in avoiding the tax for the financial motives rather than non financial motives.

Keywords : leverage, liquidity, independent commissioners, audit committee, family ownership, tax aggressiveness

1

Mr. Ardy, alumnus of Economics and Business Faculty, SatyaWacana Christian University 2

INTRODUCTION

Corporations’ effort to reduce their tax burden may bring them to become aggressive, using either legally manner (tax avoidance) or illegal (tax evasion) (Frank et al., 2009). The aggressive behavior may have a higher risk than the others. The risks canbe taxsanctions or fines, the decline in stock prices (Sari and Martani 2010) and bad reputation if the tax aggressivenessisregarded as illegal manner.The stakeholders consisting tax authority, investors, auditors and other community groups require the indicatorsfor recognizing companies that have a higher risk profile

due to tax aggressiveness. The specific criteria in assessing tax payer’s risk will help

the tax authority to focus on high risk taxpayers. The risk profile informations are important consideration in making investment decisions for the investors. Auditor’s analysis in assessing the risk is important for an audit judgment.

Previous research by Krisnata (2012), relate the financial condition, corporate governance and earnings management toward tax aggressiveness. The indicators used in measuring financial condition are liquidity and leverage. Moreover,the corporate governance is measured by independent commissionersproportion. The results of this study indicate that liquidity does not have a significant influence toward tax aggressiveness, while leverage and earnings management have positive effect toward tax aggressiveness, and the independent commissioners proportion negativelyimpact the tax aggressiveness.

Other researches about factors influencing the tax aggressiveness try to examine the financial condition, corporate governance, and family ownership as the variables. Prakorsa (2014) conducted research on the effect of profitability to tax aggressiveness, using leverage as control variables. This study finds significant negative effect of profitability to tax avoidance, as supported by Kurniasih and Sari (2013). The result does not in line with Krisnata (2012), which find thatthe leverage does not significantly influence the tax aggressiveness.

Bradley (1994), Siahaan (2005), Krisnata (2012) and Princess (2014) conducted a similar study to relate the liquidity and tax aggressiveness. Krisnata’s (2012) and Princess’ (2014) researches find that the liquidity has no significant influence toward the aggressiveness of corporate taxes. This results does not agree to Bradley (1994) and Siahaan (2005).

The relationship between corporate’s taxation and corporate governance has

been studied by several researchers, including Sari and Martani (2010), Krisnata

(2012) and Prakorsa (2014). Sari and Martani’s (2010) findings conveys the fact that

the effects of good corporate governance implementation has not brought real benefit in Indonesian companies’ taxation. Krisnata (2012) find that independent commissioners proportion have a negative effect on the tax aggressiveness. Furthermore Prakorsa (2014) find that the audit committee has no influence toward tax aggressiveness and independent commissioners have a negative effect on the tax aggressiveness.

Chen et al.’s (2010) research indicates that the non-family companies tend to

(2014) find that Indonesian companies with higher family’s ownership are more aggressive in avoiding the tax, while Chen et al. (2010) finds the opposite result.

This research intends to continue Krisnata (2012), by adding non-financial indicators in the analysis. It is family ownership which included in the analysis, since higher agency problem in non family ownership that makes them to become more aggressive in term of tax avoidance Chen et al. (2010). When the ownership and the management are separated, there may be imperfection in contracts and supervision. This will give rise to an opportunity for managers to become opportunist, then lead to corporate governance problem (Sari and Martani 2010). Hence, this study adds the analysis to audit committee in corporate governance (as conducted by Prakorsa (2014)), to enrich the viewpoint from controllng dimension of corporate governance. In contrast to Krisnata (2012), this study does not include the analysis for earning management, as its less relevancy. Putri and Kamila (2014) find a strong reciprocal relationship between earnings management and tax aggressiveness. This research will only examine variables influencing the tax aggressiveness.

Based on the background, this research are designated to examine the influence of financial condition (leverage, liquidity) and non-financial (corporate governance, family ownership) toward tax aggressiveness, on companies listed in Indonesian Stock Exchange during 2010-2013. Furthermore, the researc result will conveys some benefits. The result is expected to become input in determining the criteria for risk-based selection of the taxpayer For the tax authorities in assessing the taxpayer compliance, to become an indicator in making investment decisions by the prospective investors and provides references for further research.

LITERATURE REVIEW & HYPOTHESIS DEVELOPMENT

Tax Agressiveness

According to Frank et al. (2009), tax aggressiveness is an behaviour aims to reduce taxable income through tax planning using both legal (tax avoidance) and illegal (tax evasion). Tax avoidance is an effort to reduce the tax expense using legal manner, without conflicting with tax regulations, by exploiting gray areas in tax regulation. Moreover, the tax evasion is an effort of taxpayers to reduce the tax expense, using illegal manner by hiding the real situation and breaking the tax rules (Pohan 2011).

The benefit tax aggressiveness are saving the tax expenditures, that bring larger return to the owner and to fund the company's investment, so that increase the the future profit (Krisnata 2012). Particularly for manager (agent), the tax aggressiveness will increase the compensation paid for them (Hidayanti 2013). Oppositely, the tax aggressiveness may bring a possibility that the company be fined by the tax administrator and stock prices decline (Sari and Martani 2010). From the government point of view, tax aggressiveness can reduce state revenue from tax sector.

Leverage refer to funding resource that require fixed cost, which is expected to provide higher return for shareholder advantage than the fixed costs (Keown 2005). The application of leverage is funding activity through debt source. The debt interest paid by the company is a fixed cost. Indonesian Law No. 36 of 2008, article 6 states that interest should be classified as deductible expense while calculating the income taxes.

The companies may fund their operating and investing needs through debt financing. The higher debt, the lower companies' taxable income. The debt financing raises interest expense which can be included in deductible expenses, so that the use of interest expense to minimize the tax payment can be recognized as an aggressive tax activity. Ozkan (2001) provide evidence that companies with high tax liability would choose to get into debt financing in order to reduce taxes. The higher leverage ratio, the higher debt financing from third parties, so that the higher interest costs. Furthermore, the interest cost can be used to reduce the tax expense. Krisnata (2012) provide evidence that leverage positively influence the tax aggressiveness.

H1: leverage is positively influence the tax aggresiveness

Liquidity and Tax Aggressiveness

Liquidity is the ability of the company to meet its short term obligations. Any failure to meet short-term liabilities will lead to questionably going concern. Liquidity can be measured by comparing the current assets and current liabilities. Low liquidity may reflect the company's problem to meet the short-term obligations. Liquidity problem may lead companies not to comply with the tax rules (Bradley (1994) and Siahaan (2005)). It may bring the company into aggressive behaviour against tax. Bradley (1994) and Siahaan (2005) provide evidence that companies which are experiencing liquidity problems will likely not to comply with the tax laws, and tend to commit tax evasion. These decisions are taken by the companies to reduce tax expenditures and to maintain the cash flow. Therefore, companies with lower liquidity ratios will tend to have higher tax aggressiveness.

H2: Liquidity is negatively influence the tax aggressiveness

Corporate Governance and Tax Aggressiveness

Good corporate governance is defined as a regulating and controlling system of company to create added value for all stockholders (Desai and Dharmapala 2007). Corporate governance works as an effective mechanisms to minimize the agency conflicts, emphasising the legal mechanisms preventing the expropriation on minority shareholders (Kurniasih and Sari, 2013). There are five basic principles of

corporate governance: transparency, accountability and responsibility,

independence, and fairness (Warsono, et al (2010) in Hidayanti (2014)).

ownership, and / or family relationship with the other commissioners, directors and / or controlling shareholders, or other relationship which could affect its ability to act independently.

Board of commissioners holds an important role in overseeing the directors’ performance. Independent board members are considered to have better oversight for free from the company's internal interests. Higher independent board members may lead to strict supervision over the company. Board of directors shall establish an audit committee consisting of at least three members, appointed, dismissed, and responsible to the board of commissioners (Pohan 2008). The audit committee is

designated to assist and strengthen the board of commissioners’ function in

overseeing the financial reporting, risk management, audit and corporate governance implementation. The audit committee emphasis on providing oversight on issues related to financial policy, accounting and internal control (Hanum and Zulaikha 2013). The effective function of audit committee may lead to better control over the operation and financial statements, also support the good corporate governance (Andriyani 2008).

In regard to tax aggressiveness, managements are motivated to maximize net income, as earnings based manager bonus scheme. Reducing tax payment is one of the way to increase net income, so that the managers are encouraged to become aggressive in tax. The aggressive behavior using illegal manner (tax evasion) may

bring negative consequences for shareholders such as breaking the corporate’s

credibility if such action is detected by the authorities. Therefore, it is necessary to

supervise the management. Through independent directors’ and audit committees’

supervision role, expectably tax aggressiveness can be anticipated. The higher

independent commissioners ratio, the less manager’s tax aggressiveness (Krisnata

study 2012). The existence of audit committee may minimize the tax avoidance because it provides insight over accounting system, financial reporting and its notes, internal control, and independent auditor (Annisa and Kurniasih 2012).

H3: Independent commissioner is negatively influence the tax aggressiveness

H4: Audit committee is negatively influence the tax aggressiveness.

Family Ownership and Tax Aggressiveness

Chen et al. (2010) were conducted a research to determine whether the family owned firms are more tax aggressive than non-family owned firms. This study provide evidence that the family businesses have lower tax aggressiveness than the non-family businesses. Family owners are more willing to pay higher taxes, rather than paying the tax penalty and facing possible decline of their firm value resulting.

H5: family ownership is negatively influence the tax aggressiveness.

RESEARCH METHOD

Population and Sample

The research population are all manufacturing companies listed in Indonesia Stock Exchange during 2010 until 2013. The samples are selected using purposive method to get representative samples. The sample selection criteria are: (1) listed on the Stock Exchange during 2010-2013, (2) the data are available to obtain information about tax, leverage, liquidity, corporate governance and ownership, (3 ) have positive earnings from the period 2010-2013 consecutively, (4) the ETR is lower than Indonesian income tax rate. Based on these criteria, there are 72 firmyears used as sample.

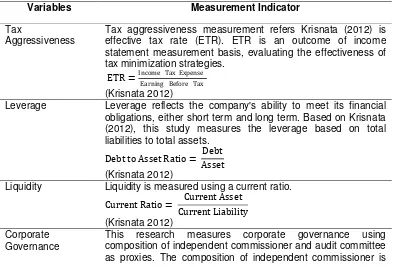

Research Data and Variables

The research data are secondary data obtained from annual reports and financial statements of listed companies during 2010-2013 available in Indonesia Stock Exchange website.

Tax aggressiveness measurement refers Krisnata (2012) is effective tax rate (ETR). ETR is an outcome of income statement measurement basis, evaluating the effectiveness of tax minimization strategies.

ETR =Income Tax Expense

Earning Before Tax (Krisnata 2012)

Leverage Leverage reflects the company's ability to meet its financial obligations, either short term and long term. Based on Krisnata (2012), this study measures the leverage based on total liabilities to total assets.

Debt to Asset Ratio = Debt Asset

(Krisnata 2012)

Liquidity Liquidity is measured using a current ratio.

Current Ratio = Current Asset Current Liability

(Krisnata 2012) Corporate

Governance

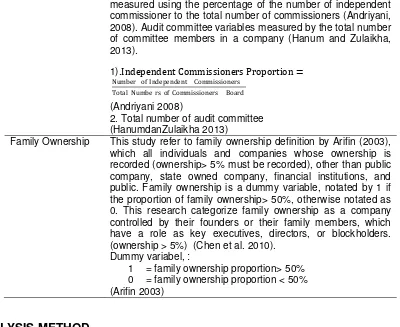

measured using the percentage of the number of independent commissioner to the total number of commissioners (Andriyani, 2008). Audit committee variables measured by the total number of committee members in a company (Hanum and Zulaikha, 2013).

1).Independent Commissioners Proportion =

Number of Independent Commissioners Total Numbe rs of Commissioners Board (Andriyani 2008)

2. Total number of audit committee (HanumdanZulaikha 2013)

Family Ownership This study refer to family ownership definition by Arifin (2003), which all individuals and companies whose ownership is recorded (ownership> 5% must be recorded), other than public company, state owned company, financial institutions, and public. Family ownership is a dummy variable, notated by 1 if the proportion of family ownership> 50%, otherwise notated as 0. This research categorize family ownership as a company controlled by their founders or their family members, which have a role as key executives, directors, or blockholders. (ownership > 5%) (Chen et al. 2010).

Dummy variabel, :

1 = family ownership proportion> 50% 0 = family ownership proportion < 50% (Arifin 2003)

ANALYSIS METHOD

The research data is analyzed using multiple regression analysis. Before the regression analysis is run, the data should pass the classic asumption tests consist of normality test, auto correlation test, multicolinearity test and heteroscedasticity test. The normality test is using the Jarque-Bera test. To detect the presence of autocorrelation, the research uses Breusch-Godfrey test. To test the multicolinearity, the research refers to correlation matrix of the independent variables. At last, ARCH test is used to test the heteroscesdaticity.

RESULT AND DISCUSSION

Classic Asumption Tests

Initially, there are 108 samples obtained for the research, but there is normality problem in the data. Hence, the outlier data were taken out so that the samples remain at 72 firmyears. The model also free from autocorrelation, multicollineraity, and heteroscedasticity problem.

Table 2

Descriptive Statistics Figure

ETR LEV LIQ COM AUD FAM

Mean 0,2167 0,4121 6,1028 0,3928 3,2083 0,6389

Maximum 0,25 0,81 247,44 0,75 5 1

Minimum 0,16 0,04 0,48 0,25 2 0

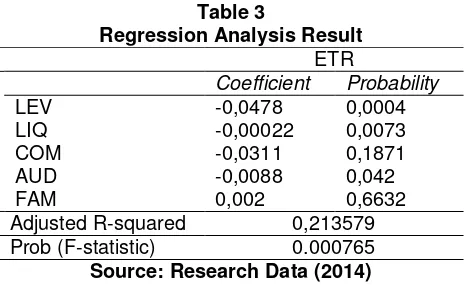

Table 1 provides descriptive statistics of research data. Tax aggressiveness (measured by ETR) are averaged at 0.216667. It means that, on average, companies can reduce their tax burden to 21,66% ( 3.33% lower than corporate income tax). Leverage ratios are averaged at 0.4121, which indicate that the average sample finance each dollar owned asset from 41% debt. Liquidity ratios are averaged at 6.1028. This shows that, on average, the companies were able to settle each dollar current liabilities by USD 6.1 current assets owned. Independent commissioner is measured by the number of independent directors to total board of commissioners. The average value of independent commissioner in the samples is 0.3928. It shows that at average, the proportion of independent board to non independent member is 39.28%. The audit committee ehich is measured by number of audit committees, are averaged at 3.2083. This indicates that the companies’ audit committee numbers exceed the government redulation (2 members required). Family ownership are averaged at 0.6389, which indicates that 63,89% average

leverage would result the lower ETR. On other word, more debt financing a company has, the more tax aggressiveness they would be. This conveys that the H1 stating leverage is positively influence the tax aggresiveness, is supported by the research data. The more debt financing from third party used by the company, the smaller

Table 3 shows significant negative effect of liquidity toward ETR, indicated by probability value of 0.0073 (less than 0.05) and negative regression coefficien. It

means that the higher company’s liquidity would make the lower ETR. On the other

words, if a company’s liquidity is higher, the more tax aggressiveness they would be.

tend to have tax aggressiveness. The presumption that the cash availability would lead to make the company become less aggressive, can not be verified. The company may also have other priorities requiring cash availability, such as maintaining the dividend policy. This is supported by the Dewi (2014) which find posittive influence of liquidity toward dividend policy. The high receivables and inventory balance may also lead the companies to prioritize cash and cash equivalents to meet the needs that is more important than taxes. This situation may occur in PT Kedaung Indah Can Tbk, whith its inventories amounted to 67.84% of total assets and the cash value of 12% of total current assets, which become aggressive by successfully lowered the ETR.

Independent Commissioners Proportion and Tax Aggressiveness

The statistical tests show that the proportion of independent commissioners

have no significant effect to the tax aggressiveness. This research can not provide evidence to support H3. This finding may be resulted by independent directors which are not well performed in supervisory function, since the background of commissioners may not from finance area (Hari 2012). This situation can be found, in PT Tiga Pilar Sejahtera Food Tbk., PT Voxels Electric Tbk. and PT Mayora Indah Tbk. This finding supports the previous research by Reza (2012) and Zulaikha (2013), which can not provide evidence of influence between independent commissioners and tax aggressiveness.

Audit Committee and Tax Aggressiveness

The statistical tests indicates that the audit committee numbers have significant

influence toward ETR, in negative direction (probability value of 0.0298, regression coefficient of -0.008). The more the number of audit committee, the lesser ETR. In other words, more audit committee members the more aggressive a company is. This indicates that the H4 which states that the audit committee would negatively affect the tax aggressiveness is not supported by the research evidence. Numerous audit committee members do not necessarily supressed the tax aggressiveness. Numerous of audit committee may be encouraging the company to operate efficiencly. This may included the efficiency in tax expenditure. This situation occurs in PT Charoen Pokphand Indonesia Tbk. which has a number of five audit committee members, then the company can suppressed the income tax expense by 4% and book-tax different by 7%.

Family Ownership and Tax Aggressiveness

The statistical tests indicates that family ownership does not significantly

capital structure positively affect the firm value (Nilmalasari 2011, Nofrita 2013, Hermuningsih 2013).

CONCLUSION

Based on the research findings, it can be concluded as follows:

1. Leverage and liquidity are positively influence the tax aggressiveness. 2. The audit committee has a positive influence on the tax aggressiveness.

3. The proportion of independent commissioners and the family ownership do not significantly affect the tax aggressiveness.

Leverage has a positive effect on the tax aggressiveness. This finding support

previous study by Ozkan (2001) and Krisnata (2012). Liquidity has a positive effect on the tax aggressiveness, which is not support Bradley (1994) and Siahaan (2005). The audit committee positively affects the tax aggressiveness, which is support Reza (2012). The proportion of independent directors and family ownership do not affect the tax aggressiveness. This evidence about independent directors proportion support Zulaikha (2013), but do not support Krisnata (2012). The finding on family ownership supports previous research by Hidayanti and Laksito (2013), but does not support Chen et al. (2010).

Tax aggressiveness aims to reduce taxable income through tax planning, either

using legal (tax avoidance) or illegal (tax evasion) manners. Companies which is behave aggressively can be considered by the tax authorities as taxpayers who have a higher risk. This taxpayer risk is considered in the risk based selection done by the authorities. For tax authorities (the risk-based selection criteria were primarily for taxpayer wich report loss and overpaid in their tax returns) may also consider leverage, liquidity and the audit committee as a additional consideration in determining the risk. For inverstors, they can consider these three variables in assessing the tax aggressiveness related risks in their investment decisions.

However, there are manufacturing industry’s sub-sectors which are not

represented in this study (sub sector of ceramic, porcelain and glass, wood and processing sectors, sectors of the pulp and paper, footwear sector, sub-sector and sub-sub-sector electronic cigarette). Some data have been eliminated caused sectoral analysis could not be done. Then, further research may use samples from different characteristics of the manufacturing sector. So the tax aggressiveness behavior in Indonesia can be seen wider.

Reference

Alim, S. 2009. ManajemenLabadenganMotivasiPajakpadaBadan Usaha Manufaktur di Indonesia. Jurnal Keuangan dan Perbankan. 13(3): 444-461.

Annisa, N. A., dan Kurniasih, L. 2012. Pengaruh Corporate Governance

TerhadapTax Avoidance”. Jurnal Akuntansi dan Auditing. 8(2): 123-136.

Arifin, Z. 2003. Masalah Agensi dan Mekanisme Kontrol pada Perusahaan dengan Struktur Kepemilikan Terkonsenstrasi yang Dikontrol Keluarga: Bukti dari Perusahaan Publik di Indonesia. Disertasi. Program Studi Ilmu Manajemen Pascasarjana Fakultas Ekonomi Universitas Indonesia. Depok.

Badertscher, B.A., Philips, J.D., Pincus, M. and Rego, S.O. 2009. Earnings management strategies and the trade off between tax benefits and detection risk: to conform or not to conform. The Accounting Review. 84(1): 63-97.

Bradley and Cassie, F. 1994. An Empirical Investigation of Factors Affecting Corpotare Tax Compliance Behavior. Disertation. The University of Alabama. USA.

Chen, S., Chen, X., Cheng, Q and Shevlin, T. 2010. Are Family Firms More Tax Aggresive than Non-Family Firms?. Journal of Financial Economics. 95: 41-61.

C. Bintang, Hari. 2012. Karakteristik Dewan Komisaris dan Manajemen Laba di Indonesia. Majalah Ekonomi. Fakultas Bisnis Unika Widya Mandala. Surabaya.

Desai, M. A., dan Dharmapala, D. 2006. Corporate tax avoidance and high-powered

incentives. Journal of Financial Economics. 79(1): 145-179.

Dewi, Ni Wayan Trisna. 2014. Pengaruh Struktur Modal ,Likuiditas dan Pertumbuhan

terhadap Kebijakan Dividen di BEI. Skripsi. Fakultas Ekonomi Universitas

Udayana. Denpasar.

Frank, M., Lynch, L., and Rego, S. 2009. “Tax reporting aggressiveness and its relation to aggressive financial reporting”. The Accounting Review. 84: 467-496.

Fontanella, A and Martani, D. 2014. Pengaruh Karakterisitik Perusahaan Terhadap

Book Tax Difference (BTD) pada Perusahaan Listed di Indonesia”. Simposium Nasional Akuntansi 17. Mataram.

Ghozali, I. 2007. Aplikasi Analisis Multivariat Dengan Program SPSS. Semarang:

Badan Penerbit Universitas Diponegoro.

Gujarati, D. 2006. Dasar-dasar Ekonometrika. Jakarta :Erlangga.

Hanum, H. R., and Zulaikha. 2013. Pengaruh Karakteristik Corporate Governance terhadap Effective Tax Rate (Studi Empiris pada BUMN yang Terdaftar di BEI 2009 - 2011). 2(2) : 1 - 10.

Hermuningsih, Sri. 2013. “Pengaruh Profitabilitas, Growth Opportunity, Struktur

Modal terhadap Nilai Perusahaan Pada Perusahaan Publik di Indonesia”.

Buletin Ekonomi Moneter dan Perbankan.

Hidayanti, Alfiyani Nur and Laksito, Henry. 2013. “Pengaruh Antara Kepemilikan

Keluarga dan Corporate Governance Terhadap Tindakan Pajak Agresif”.

Jensen, M. C. and Meckling, W. H. 1976. “Theory of the Firm: Managerial Behaviour, Agency Cost, and Ownership Structure”. Journal of Financial Economics. 3(4): 305-360.

Kamila, Putri A. 2013. Analisis hubungan agresivitas pelaporan keuangan dan

agresivitas pajak pada saat terjadinya penurunan tarif pajak. Skripsi. Fakultas

Ekonomi Universitas Indonesia. Depok.

Keown, Arthur J, David F. Scott, Martin, J William Petty and YR, John D. 2005.

Financial Management. 10th edition. New Jersey: Prentice-Hall Inc.

Kurniasih, T., dan Sari, M. M. 2013. “Pengaruh Profitabilitas, Leverage, Corporate Governance, Ukuran Perusahaan, dan Kompensasi Rugi Fiskal pada Tax

Avoidance”. Buletin Studi Ekonomi. 18: 58 - 66.

Murniati, Sari. 2012. Analisis Pengaruh Struktur Kepemilikan Terkonsentrasi pada

Keluarga terhadap Agresivitas Pajak Perusahaan. Skripsi. Fakultas Ilmu Sosial

dan Ilmu Politik Program Studi Administrasi Niaga Universitas Indonesia. Depok.

Nirmalasari, Astuti. 2011. Analis Faktor-Faktor yang Mempengaruhi Nilai

Perusahaan yang Dimediasi oleh Profitabilitas sebagai Variabel Intervening (Studipada Perusahaan Otomotif dan Komponen yang Listed di BEI Tahun 2004 – 2009). Masters thesis. Diponegoro University.

Nofrita, Ria. 2013. Pengaruh Profitabilitas Terhadap Nilai Perusahaan Dengan Kebijakan Dividen Sebagai Variabel Intervening (Studi Empiris pada

Perusahaan Manufaktur yang Terdaftar di BEI). Skripsi. Fakultas Ekonomi

Universitas Negeri Padang.

Pohan, A. C. 2011. Kajian Perpajakan dan Tax Planning-nya Terkini. Jakarta: Bumi

Aksara.

Pohan, H.T. 2008. Pengaruh Good Corporate Governance, Rasio Tobin Q, Perata

Laba Terhadap Penghindaran Pajak pada Perusahaan Publik. Skripsi.

Fakultas Ekonomi Universitas Trisakti.

Prakorsa, Kesit Bambang. 2014. Pengaruh Profitabilitas, Kepemilikan Keluarga dan

Corporate Governance Terhadap Penghindaran Pajak Di Indonesia. Skripsi.

Universitas Islam Indonesia.

Puspita, Silvia Ratih. 2014. Pengaruh tata kelola perusahaan terhadap penghindaran pajak. Skripsi. Universitas Diponegoro.

Putri, Lucy Tania Yolanda. 2014. Pengaruh likuiditas, manajemen laba dan

corporate governance terhadap agresivitas pajak perusahaan. Skripsi.

Universitas Negeri Padang.

Sari, D. K., and Martani, D. 2010. “Karakteristik Kepemilikan Perusahaan, Corporate

Governance, dan Tindakan Pajak Agresif”. Simposium Nasional Akuntansi 13.

Scott, William, R. 2009. Financial Accounting Theory. International Edition. New Jersey: Prentice-Hall, Inc.

Siahaan, Fadjar O.P. 2005. Faktor-Faktor yang Mempengaruhi Perilaku Kepatuhan Tax Professional dalam Pelaporan Pajak Badan pada Perusahaan Industri

Manufaktur di Surabaya. Disertasi. Program Pasca Sarjana Universitas

Airlangga.

Suyanto, KrisnataDwi. 2012. “Likuiditas, leverage, komisaris independen dan

manajemen laba terhadap agresivitas pajak”. Jurnal Keuangan dan

Perbankan. 16(2): 167–177.

Reza, Faisal. 2012. Pengaruh Dewan Komisaris dan Komite Audit terhadap

Penghindaran Pajak. Skripsi. Fakultas Ekonomi Program Ekstensi Akuntansi

Universitas Indonesia. Depok.

Ridha and Martani. 2014. “Analisis terhadap Agresivitas Pajak, Agresivitas

Pelaporan Keuangan, Kepemilikan Keluarga, dan Tata Kelola Perusahaan di

Indonesia”. Simposium Nasional Akuntansi 17, Lombok.

Rusyidi, M.K and Martani, Dwi. 2014. “Pengaruh Struktur Kepemilikan terhadap

Aggressive Tax Avoidance”. Simposium Nasional Akuntansi 17, Lombok.

Wilson, R. 2007. An examination of corporate tax shelter participants. Working

paper. University of Washington Business School.