www.elsevier.com / locate / econbase

Which vintage of data to use when there are multiple vintages

of data?

Cointegration, weak exogeneity and common factors

*

K.D. Patterson

Department of Economics, University of Reading, Reading, Berks RG6 6AA, UK

Received 26 October 1999; accepted 25 April 2000

Abstract

Multiple vintages of data on the same variable are a pervasive feature of published data. This creates problems for empirical research, which requires a single observation series for each variable. This paper adopts an explicitly multivariate approach to solve this and related problems. Based on common factors and weak exogeneity, I show which vintage, or linear combination, of vintages should be used and how to test for cointegration with multiple vintages of data. 2000 Elsevier Science S.A. All rights reserved.

Keywords: Preliminary data; Common factor; Weak exogeneity

JEL classification: C8; C31

1. Introduction

It is well known that much macroeconomic data undergoes a process of revision once timely but initial Figs. have been published; for example, initial data may be based on incomplete samples or returns, which are subsequently updated. This is a feature of data produced by many government agencies in the developed countries. Economists have had a continuing interest in the revision process and its implications for econometric modelling. Contributions to this literature have been made by, amongst others, Howrey (1978, 1984), Conrad and Corrado (1979), Harvey et al. (1983), Bell and Wilcox (1993), Patterson and Heravi (1991a,b), Patterson (1994, 1995). Patterson and Heravi (1991a) and Siklos (1996) have considered the relationship amongst different vintages of data, including whether, on a bivariate basis, preliminary and final vintages of data are cointegrated, and Patterson (1994) suggested a state space model to forecast as yet unavailable future vintages of data.

*Tel.:144-1189-875-123 (ext. 4439 / 4064); fax: 144-1189-750-236. E-mail address: [email protected] (K.D. Patterson).

This paper considers two important issues as yet not addressed. Given multiple vintages of I(1) data, which one should be used or, perhaps, which combination of vintages should be used? The typical implicit response in most empirical work is that it does not matter or (surely one must) use the ‘final’ vintage. The methodology of this paper enables a systematic answer to this question related to the concepts of weak exogeneity and common factors. Second, given multiple vintages of I(1) data, how should we test for stationarity of the revisions? This paper shows that once an explicitly multivariate framework is adopted, the answer to these questions is straightforward. The concepts are illustrated with an application to the U.S Index of Industrial Production, USIIP, a leading coincident indicator of business cycle activity.

2. Preliminaries and notation

Data published by official agencies, for example, the BEA in the US and the NOS in the UK, typically undergoes a process of sequential revision. That is the first publication or vintage of a series is revised in a subsequent issue of the same publication and becomes the second vintage of the data series. The second vintage is then revised in a subsequent publication to become the third vintage, and so on until the ‘final’ vintage, denoted the mth, is published. These revisions can be substantial as in the case of UK aggregate consumption expenditure — see Patterson (1994) — or more moderate as in the case of the UK Index of Industrial Production — see Patterson (1995). To recognise the

distinction amongst multiple vintages of what is ostensibly the same data series, let a superscript v

v

indicate the vintage of data. Thus, y is thevth vintage of the (generic) variable y for time period t. y

t t

1 2 m

without a superscript is the m by 1 vector of different vintages of data, that is y t5( y , y , . . . , y )t t t 9.

The exposition here is for m54 to match the empirical analysis of the USIIP in Section 3. A total

v m v v11

revision is defined as yt 2yt and a sequential revision is defined as yt 2yt . To anticipate the

empirical analysis below, lower case letters denote the logarithm of the variable of interest.

3. Number of cointegrating vectors and common factors

This section describes an analytical framework for considering multiple data vintages on an I(1) variable. The first point to note is that if there are m vintages of data, a natural null hypothesis is that

1 2 m

there should be m21 cointegrating vectors in yt5( y , y , . . . , y )t t t 9. Obversely this implies that there is

one common trend — see Stock and Watson (1988) — and, hence, one common factor — see Gonzalo and Granger (1995), which is expressible in terms of observable variables. The logic for this proposition is simple. If the cointegrating rank is m, then the data set comprises m I(0) and not I(1)

variables. If the cointegrating rank is m22 or less, then there are two or more common trends, which

would be puzzling given that y is ostensibly a single economic variable, and the feature of commont

trends is that they do not cointegrate.

Denote the cointegrating rank as r, then for r5m21 cointegrating vectors to be identified there

should be at least r21 independent restrictions on each vector — see Johansen and Juselius (1992).

Thus, in total a minimum of (r21)(m21) (independent) restrictions need to be placed on the m21

of this number are overidentifying and can be tested using the technique described in Johansen and 2

Juselius (op cit.), with a likelihood ratio test statistic asymptotically distributed asx (s), where s is the

number of overidentifying restrictions.

An interesting set of restrictions arises from the following line of argument. All pairs of vintages should cointegrate. One could, for convenience, regard all vintages as pairwise cointegrating with the final vintage, this then implies that vintage i pairwise cointegrates with vintage j. The analogy with

m21 spreads cointegrating m yields on assets of different maturities — see for example, Hall et al.

(1992) — is an obvious one.

The cointegration framework is standard with the m-variate cointegrating VAR, CVAR, given by

p21

Dyt5m1Pyt211

O

GiDyt2i1et (1)i51

Where cointegration implies P5ab9, with a and b each of rank r, 0,r,m. Normalising the ith

column ofb on the ith vintage, i51, 2 3, and imposing the just identifying restrictions, theb9matrix

is

1 b21 0 0

0 1 b 0

b9 5

3

324

(2)0 0 1 b43

In this case m54, hence r53 and r2152. It is evident that pairwise cointegration provides a

necessary set of 2 identifying restrictions for each cointegrating vector.

One might also expect the sequential revisions to be stationary so that b215b325b435 21, with

stationarity of the total revision implied by these conditions. There are now three testable restrictions conditional on the identifying conditions. Although there is contrary evidence on stationarity in some studies — see for example, Patterson and Heravi (1991a) and Siklos (1996) — none exploit the multivariate methodology proposed here.

4. Weak exogeneity and common factors

Weak exogeneity is of particular interest in the context of multiple vintages of data and can be

tested by imposing zero row restrictions ona; further, weak exogeneity also has implications for the

existence and nature of the common factor interpretation. Of particular interest is whether the final vintage can be taken as weakly exogenous for the preliminary vintages, so that the implied error

m

correction equations can be conditioned, without loss of efficiency, on y . In the present context thist

corresponds to the restriction that the mth row of a is a 133 zero vector, the test statistic is

2

asymptotically distributed as x (3) — see Johansen (1992) for the general principles involved.

˜

space ofb9. The second equation relates the I(1) common factors to observable variables. y are I(0)t

9

components. Gonzalo and Granger (op cit.) show that B15a', where ' indicates the orthogonal

9

complement such that a a' 50. The third equation is the P–T decomposition. All of this is

particularly simple and intuitive in the case of multiple data vintages. Here m2r51, so there is 1

common factor. B is a 11 3m row vector of weightings on the m vintages of data in y , which renderst

the common factor observable. Further, if the final vintage is weakly exogenous for the parameters of

interesta andb, then the mth row ofa has 0 in each cell.a'is then easily constructed with 0 in each

of the first m21 rows and a single non-zero element in the mth row, which can be normalised at 1.

The implication of weak exogeneity in this case is that the final vintage is the common factor.

5. Illustration

The data chosen to illustrate the ideas of Sections 3 and 4 are monthly on the US index of industrial production from 1966m1 through to 1993m2, a total of 325 observations. Because of the importance

1

of the USIIP as a state of the economy indicator, timely publication is important, with y publishedt

just 1 month after the observation to which it refers. Later vintages incorporate revisions to the previous vintage for the same observation period. Although there are some occasional revisions past

v54, the revisions process is effectively complete by this point and we take the final vintage as

m54.

The time series plot of USIIP clearly reveals the need for a trend in the data space if the trend stationary alternative to a unit root is to be allowed in the maintained regression model. Standard ADF tests with trend do not lead to rejection of the I(1) null at conventional significance levels, a result confirmed using Johansen’s test that switches the null to stationarity of each vintage, which is firmly rejected.

5.1. Specification of the CVAR

The system lag length was chosen by examining system information criteria, with AIC and SIC

indicating p52, and ensuring that residuals were consistent with the absence of serial correlation.

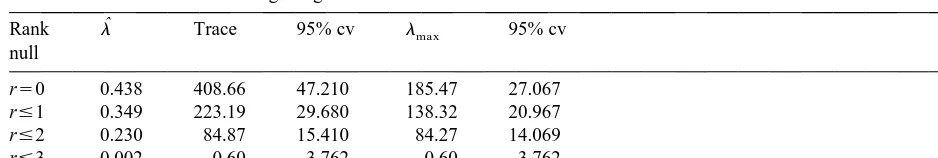

Linear trends are allowed in the data but not in the cointegration space [based on the formal hypothesis tests described in Hansen and Juselius (1995)]. Table 1 summarises the standard test statistics for cointegrating rank.

Both the trace andlmax test statistics lead to firm rejection of the null that r#2, but non-rejection of

ˆ

r#3. Further, inspection of the estimated eigenvaluesl shows one virtually 0 and 3 non-zero. These

results are unequivocal: r53, and hence k2r51, so that there is 1 common trend and hence 1

common factor ‘driving’ the 4 vintages of data.

Two restrictions on each cointegrating vector are necessary for identification. With the identification

Table 1

Johansen test statistics for cointegrating rank ˆ

Rank l Trace 95% cv lmax 95% cv

null

r50 0.438 408.66 47.210 185.47 27.067 r#1 0.349 223.19 29.680 138.32 20.967

r#2 0.230 84.87 15.410 84.27 14.069

r#3 0.002 0.60 3.762 0.60 3.762

we impose the restrictions that the sequential revisions are stationary. There are now three restrictions on each cointegrating vector. The appropriate test statistic, with p-value in parentheses, is 1.82[0.61],

2

distributed asx (s) under the null, where s592(2)(3)53, and hence the restrictions are not rejected.

The resulting estimates, with t statistics in parentheses, are shown on the left-hand-side of Table 2.

4

5.2. Weak exogeneity of y and interpretation of the common factort

4

Weak exogeneity of y is suggested by the t statistics on the last row oft a on the left-hand-side of

4

Table 2. Jointly testing weak exogeneity of y and the overidentifying restrictions gives a test statistic,t

2

distributed as x (6) under the null, of 4.40[0.62]; hence, the restrictions are easily not rejected.

Hypotheses on weak exogeneity of the other vintages (separately as m2r51) are each rejected with

4

p-value ,0.05. Without the overidentifying restrictions, weak exogeneity of y is also easily acceptedt 2

with a test statistic, distributed as x (3) under the null, of 2.40[0.49]; and p-values ¯0 for weak

4

exogeneity of the other vintages. Imposing weak exogeneity of y gives the estimates reported on thet

right-hand-side of Table 2. This model is interesting because it implies that each vintage is error correcting on the next revision with significant own error correction coefficients but insignificant and, numerically, virtually zero coefficients on the other revisions.

The common factor and P–T decomposition are now easily obtained. Given weak exogeneity and the identifying restrictions we have:

Estimates ofab9 with and without weak exogeneity of yt

1 0 0 21

Hence, the common factor and permanent component is simply the final vintage, y , that ist

4

9

ft5a'yt5y ; and the transitory components are the 3 (total) revisions relative to the final vintage. Int

summary the P–T decomposition is:

4 4 4 4 1 4 2 4 3 4

yt5( y , y , y , y )t t t t 9 1( yt 2y , yt t 2y , yt t 2y , 0)t 9

In a sense this is the best that data users can hope for when data is subject to revision. What it says is that the underlying common factor is the final vintage and not a linear combination of the final and preliminary vintages. The latter situation is certainly possible and may well occur with more heavily revised data.

6. Concluding remarks

The methodology outlined here shows how to answer a number of practical questions related to the existence of multiple vintages of data on the same variable. First, we anticipate that there will be

m21 cointegrating vectors in m vintages of data. Second, and of particular interest, is whether the

final vintage is the common factor driving all preceding vintages. The answer to this question depends upon the weak exogeneity of the final vintage and its implications for the dual to cointegration of the common factor. In principle, the common factor can be a linear combination of some or all vintages. In the illustration used here, the common factor and permanent–transitory decomposition led to a very simple interpretation — the common factor is the final vintage and the transitory components are the stationary revisions. This is the best of all possible situations in a world of data revisions, but that will not necessarily always be the case.

Acknowledgements

The author gratefully acknowledges support from a British Academy Grant.

References

Bell, W.R., Wilcox, D.W., 1993. The effect of sampling error on the time series behaviour of consumption data. Journal of Econometrics 55, 235–264.

Conrad, W., Corrado, C., 1979. Application of the Kalman Filter to revisions in monthly sales estimates. Journal of Economic Dynamics and Control 1, 177–198.

Gonzalo, J., Granger, C.W., 1995. Estimation of common long-memory components in cointegrated systems. Journal of Business and Economic Statistics 13, 27–35.

Hall, A.D., Anderson, H.M., Granger, C.W.J., 1992. A cointegration analysis of Treasury bill yields. The Review of Economics and Statistics 74, 116–126.

Harvey, A.C., McKenzie, C.R., Blake, D.P.C., Desai, M.J., 1983. Irregular data revisions. In: Zellner, A. (Ed.), Applied Time Series Analysis of Economic Data (US Bureau of the Census, Washington, DC).

Howrey, E.P., 1978. The use of preliminary data in economic forecasting. The Review of Economics and Statistics 60, 193–200.

Howrey, E.P., 1984. Data revision, reconstruction and prediction: an application to inventory investment. The Review of Economics and Statistics 66, 386–393.

Johansen, S., 1992. Weak exogeneity and the order of cointegration in UK money demand data. Journal of Policy Modelling 14, 313–324.

Johansen, S., Juselius, K., 1992. Testing structural hypotheses in a multivariate cointegration analysis of the PP and the UIP for UK. Journal of Econometrics 53, 211–244.

Patterson, K.D., Heravi, S.M., 1991a. Data revisions and the expenditure components of GDP. The Economic Journal 101, 877–901.

Patterson, K.D., Heravi, S.M., 1991b. Are different vintages of data on the components of GDP cointegrated? Economic Letters 35, 409–413.

Patterson, K.D., 1994. A state space model for reducing the uncertainty associated with preliminary vintages of data with an application to aggregate consumption. Economic Letters 46, 215–222.

Patterson, K.D., 1995. A state space approach to forecasting the final vintage of revised data with an application to the index of industrial production. Journal of Forecasting 14, 337–350.

Siklos, P.L., 1996. An empirical exploration of revisions in US national income aggregates. Applied Financial Economics 6, 59–70.