Homogeneous risk models with equalized claim amounts

q

F. De Vylder

a, M. Goovaerts

a,b,∗aUniversiteit van Amsterdam, Amsterdam, Netherlands

bKatholieke Universiteit Leuven, CRIR, Huid Eygen Heerd, Minderbroederstraat 5, 3000 Leuven, Belgium

Received 1 June 1998; received in revised form 1 September 1999; accepted 24 November 1999

Abstract

We consider an homogeneous risk model on a fixed bounded time interval [0, t] and we denote by Nt the number of

claims in that interval. The claim amounts areX1, X2, . . . , XNt. The homogeneous model is an extension of the classical

actuarial risk model with Nt not necessarily Poisson distributed. In the model with equalized claim amounts, each amount

Xk is replaced withXk∼ = (X1+ · · · +XNt)/Nt. Let9(t, u) be the ruin probability before t in the homogenous model,

corresponding to the initial risk reserve u≥0 and let9∼(t, u) be the corresponding ruin probability evaluated in the

associ-ated model with equalized claim amounts. The essence of the classical Prabhu formula is that9(t, 0)=9∼(t, 0). By rather systematic numerical investigations in the classical risk model, we verify that9∼(t, u)≤9(t, u) for any value of u≥0 and

that9∼(t, u) is an excellent approximation of9(t, u). Then these conclusions must be valid in any homogeneous model and this is an interesting observation because9∼(t, u) can be calculated numerically, whereas no algorithms are yet

avail-able for the numerical evaluation of9(t, u) in general homogeneous risk models. © 2000 Elsevier Science B.V. All rights reserved.

Keywords: Risk model; Homogeneous risk model; Ruin probability; Prabhu’s formula

1. Homogeneous risk model on a bounded time interval [0,ttt]

Nt is the number of claims in [0, t]. The claim instants process (T1, T2, . . . , TNt) is any homogeneous point process on the fixed interval [0, t]. Its distribution is completely specified by the probabilities P(Nt=n)≥0 (n=0, 1,

2,. . .) such that6n≥0P(Nt=n)=1. The latter probabilities may be any numbers satisfying the indicated relations

(see Appendix of De Vylder and Goovaerts (1999)). The claim amounts areX1, X2, . . . , XNt. It is assumed that

X1, X2,. . . are i.i.d. random variables with distribution function F concentrated on [0,∞) and that these amounts

are independent from the claim instants. The risk reserve process is Rτ=u+cτ−Sτ(0≤τ≤t), where u≥0 is the initial

risk reserve, c>0 the premium income rate and Sτ the total claim amount in [0,τ], i.e.Sτ =X1+ · · · +XNt, where

Nτ is the number of claims in [0,τ]. Of course, Sτ=0, if Nτ=0.

q

Presented at the Second International IME Congress, University of Lausanne, Switzerland, July 1998. ∗Corresponding author. Tel.:+32-16-323-746; fax:+32-16-323-740.

E-mail address: [email protected] (M. Goovaerts)

We denote by U(t, u) the probability of nonruin before t corresponding to the initial risk reserve u≥0, and by

Un(t, u) the corresponding conditional probability of nonruin for fixed Nt=n. Then

U (t, u)=X

n≥0

P (Nt=n)Un(t, u). (1)

The homogeneous model with fixed Nt=n is defined by the probabilities P(Nt=n)=1 and P(Nt=m)=0 (m6=n).

Then Un(t, u) is the (nonconditional) probability of ruin in the homogeneous model with fixed Nt=n. In the

homogeneous model with fixed Nt=n, the claim instants areT1< T2<· · ·< Tnand the random vector (T1,. . ., Tn) has a constant density on the subsetWtn = {(t1, . . . , tn)|0 < t1 < t2 <· · ·< tn < t}of Rn. The Lebesgue

volume of Wtnis tn/n!. Hence the density of (T1,. . ., Tn) equals n!/tnon Wtn. Then, by the foregoing assumptions,

the distribution of the random vector (T1,. . ., Tn, X1,. . ., Xn) is completely specified in the homogeneous model

with fixed Nt=n.

2. Nonruin probability before timetttin the homogeneous model

Letτ, y1, y2,. . . be any numbers. The numbers z0=1, z1, z2,. . . are defined recursively as follows:

The first numbers zkare

z0=1, z1= −y1, z2= −

Ik+1(y1, . . . ,yk+1,τ )=

We recall that X1, X2,. . . are the i.i.d. claim amounts with distribution function F and that u≥0 is the initial risk

reserve. We define

We notice that this is relation (2) with capital letters everywhere. The first random variables Zkare

Z0=1, Z1= −Y1= −(X1−u)+,

the proof, are finite. Later in this paper, the lemma is only used with the particular function

ϕ(X1, . . . ,Xn)=1(X1+ · · · +Xn≤u+ct),

where 1(.) is the indicator function of a proposition. Then all expectations are integrals with respect to dF(x1)· · ·dF(xn)

of a bounded function on a bounded integration domain of Rn, and they are finite indeed.

and

E[Zkϕ(X1, . . . ,Xn)]=0 (k=2,3, . . . ,n) (9)

if all involved expectations are finite.

Proof. The proof results from the adequate use of the following remark. Let us consider an expectation such as

E[f(X1,. . ., Xk)ϕ(X1,. . ., Xn)], where k≤n. By the i.i.d. assumption on X1, X2,. . ., we may replace X1,. . ., Xn

We now consider (9) for k=3. Then the expectation is the sum of the two terms

E

A general proof by induction is direct. It is based on (7). In the last member of that relation, the first two terms

must be treated jointly; all other terms can be treated separately.

In Theorem 1, F∗nis of course the distribution function of the total claim amountX1+· · ·+Xnin the homogeneous

model with fixed Nt=n. The function Inis the n-tuple integral defined by (3). Of course U0(t, u)=1 because ruin

cannot occur if there are no claims.

In the general homogeneous model on [0, t], we denote by Ft the distribution function of the total claim amount St=X1+X2+ · · · +XNt in [0, t].

a. In the homogeneous model with fixed Nt=n,

b. In the homogeneous model with fixed Nt=n and u=0,

c. (Prabhu’s formula) In the general homogeneous model on [0, t] with u=0,

U (t ,0)=

probability Un(t, u) equals

Un(t ,u)=n!t−n

These relations are equivalent to the relations

x1≥0, . . . ,xn≥0, x1+ · · · +xn≤u+ct , (16)

b. Let us now assume that u=0. By Lemmas 1 and 2, In(Y1,. . ., Yn, ct) can be replaced with (ct)n

n! −

(Yn/n)(ct)n−1 (n−1)! =(ct)

n(n!)−1

1−Yn

ct

in (13). This proves the first relation (14). The second relation (14) is obvious. Then the last relation (14) results from an integration by parts.

c. (15) results from (1), (12) and (14).

General expectations such as E[ϕ(X1,. . ., Xn)] are almost impossible to evaluate numerically, fastly and precisely

enough, if n is large. In particular, (13) is not useful for the practical evaluation of Un(t, u).

On the contrary, expectations such asE[ϕ(X1+ · · · +Xn)] can be calculated. Indeed, they are reduced to single

integrals

E[ϕ(X1+ · · · +Xn)]= Z

I

ϕ(y)dF∗n(y).

In practice I is a bounded interval and F the discretized, i.e. F is hold back as a long vector in the computer program. Then F∗ncan be calculated iteratively and only two successive long vectors F∗kand F∗(k+1)(k=1,2,. . .,

n) must be stored simultaneously in the process at each stage.

If the discretized F hasνcomponents, then the direct calculation of

E[ϕ(X1, . . . ,Xn)]= Z

· · ·

Z

D

ϕ(x1, . . . ,xn)dF (x1)· · ·dF (xn)

may need the evaluation ofνnterms, to be summed up. In the case of U

n(t, u) the evaluation ofϕ(x1,. . ., xn) goes

via relations such as (4). All this must be done for values n=0, 1, 2,. . ., n0and then U(t, u) should result from

(1). In some casesνand n0may be pretty large, sayν=1000 and n0=100. Clearly this rudimentary procedure is

hopeless, even with the fastest computers available today.

3. Homogeneous model with equalized claim amounts

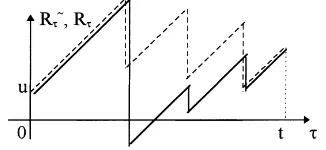

We now start from an homogeneous model with time interval [0, t], called the initial model, and we replace each claim amount Xkwith the average amountXk∼=(X1+ · · · +XNt)/Nt. This model with equalized claim amounts is also called the associated model. The claims instants Tk(k=1, 2,. . ., Nt) are the same in both models:Tk∼=Tk. The

superscript∼is used systematically for the components of the associated model with equalized claim amounts. We notice that the risk reserveRτ∼(0≤τ ≤t )cannot be determined from observations during time interval [0,τ]. The

complete trajectory Rs(0≤s≤t) is necessary in order to fixRτ∼. The distribution of the trajectoriesRτ∼(0≤τ ≤t )

results from the distribution of the trajectories Rτ(0≤t≤t). Hence, the associated model is clearly defined. In Figs.

1–4, we represent sample functions of the processes Rτ (full lines) andRτ∼(stippled lines). All four following

cases a, b, c and d can occur.

a. No ruin in the initial model, no ruin in the associated model (Fig. 1), b. Ruin in the initial model, ruin in the associated model (Fig. 2), c. No ruin in the initial model, ruin in the associated model (Fig. 3), d. Ruin in the initial model, no ruin in the associated model (Fig. 4).

Due to compensations between occurrences of these cases, the following question is relevant: is U∼(t, u) close to

U(t, u)? The most surprising answer is that in case of an initial risk reserve u=0, the compensation is perfect: U∼(t, 0)=U(t, 0) (Theorem 2b). This throws a new light on Prabhu’s formula. The numerical investigations of Section 5

Fig. 1. No ruin in initial model. No ruin in associated model.

Fig. 2. Ruin in initial model. Ruin in associated model.

Fig. 3. No ruin in initial model. Ruin in associated model.

Table 1

Uniform F,η=0.05, t=1

u 9 9∼

0 0.527 0.527

1 0.0925 0.0920

2 0.00827 0.00832

3 0.00049 0.00050

4 0.00002 0.00002

Table 2

Uniform F,η=0.05, t=5

u 9 9∼

0 0.777 0.777

1 0.346 0.320

2 0.113 0.105

3 0.0297 0.0281

4 0.00646 0.00622

5 0.00119 0.00117

6 0.00019 0.00019

Table 3

Uniform F,η=0.05, t=10

u 9 9∼

0 0.835 0.835

1 0.473 0.433

2 0.221 0.199

3 0.0900 0.0814

4 0.0321 0.0294

5 0.0101 0.00940

6 0.00284 0.00269

7 0.00072 0.00070

8 0.00016 0.00016

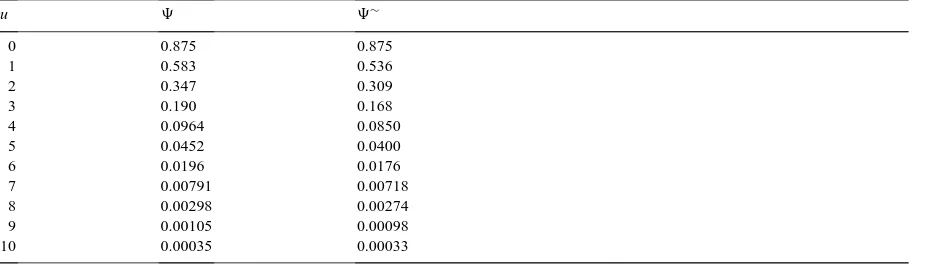

Table 4

Uniform F,η=0.05, t=20

u 9 9∼

0 0.875 0.875

1 0.583 0.536

2 0.347 0.309

3 0.190 0.168

4 0.0964 0.0850

5 0.0452 0.0400

6 0.0196 0.0176

7 0.00791 0.00718

8 0.00298 0.00274

9 0.00105 0.00098

Table 5

Uniform F,η=0.25, t=1

u 9 9∼

0 0.505 0.505

1 0.0822 0.0810

2 0.00734 0.00685

3 0.00038 0.00040

4 0.00002 0.00002

Table 6

Uniform F,η=0.25, t=5

u 9 9∼

0 0.710 0.710

1 0.265 0.239

2 0.0742 0.0670

3 0.0172 0.0158

4 0.00335 0.00316

5 0.00056 0.00054

6 0.00008 0.00008

Table 7

Uniform F,η=0.25, t=10

u 9 9∼

0 0.753 0.753

1 0.343 0.300

2 0.130 0.111

3 0.0441 0.0379

4 0.0134 0.0117

5 0.00368 0.00328

6 0.00091 0.00083

7 0.00021 0.00019

8 0.00004 0.00004

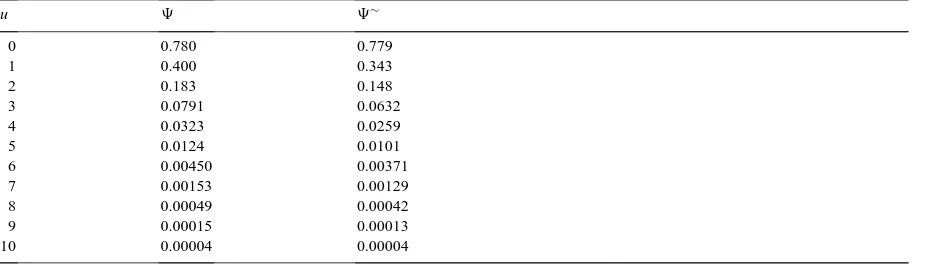

Table 8

Uniform F,η=0.25, t=20

u 9 9∼

0 0.780 0.779

1 0.400 0.343

2 0.183 0.148

3 0.0791 0.0632

4 0.0323 0.0259

5 0.0124 0.0101

6 0.00450 0.00371

7 0.00153 0.00129

8 0.00049 0.00042

9 0.00015 0.00013

Table 9

Exponential,η=0.05, t=1

u 9 9∼

0 0.470 0.470

2 0.122 0.120

4 0.0293 0.0290

6 0.00671 0.00667

8 0.00146 0.00147

10 0.00031 0.00031

Table 10

Exponential,η=0.05, t=5

u 9 9∼

0 0.735 0.735

2 0.370 0.325

4 0.168 0.146

6 0.0702 0.0618

8 0.0274 0.0245

10 0.0100 0.00915

12 0.00349 0.00325

14 0.00117 0.00111

16 0.00038 0.00036

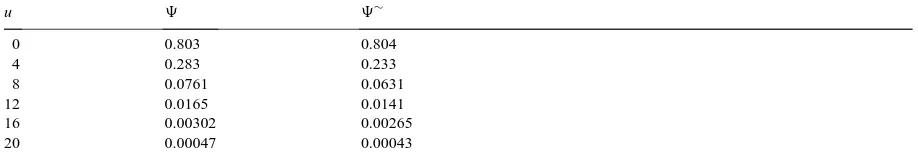

Table 11

Exponential,η=0.05, t=10

u 9 9∼

0 0.803 0.804

4 0.283 0.233

8 0.0761 0.0631

12 0.0165 0.0141

16 0.00302 0.00265

20 0.00047 0.00043

Table 12

Exponential,η=0.05, t=20

u 9 9∼

0 0.852 0.853

4 0.408 0.328

8 0.164 0.129

12 0.0565 0.0447

16 0.0168 0.0136

20 0.00436 0.00368

24 0.00103 0.00089

Table 13

numerically in that case only (as far as we know). By arguments of De Vylder and Goovaerts (1999, Section 6) the validity of results in the classical model can often be extended to any homogeneous model.

By the discussion at the end of foregoing Section 2 and by next formula (19) combined with the (∼)-version of (1), the nonruin probability U∼(t, u) can be calculated in any homogeneous model.

4. Nonruin probability beforetttin case of equalized claim amounts

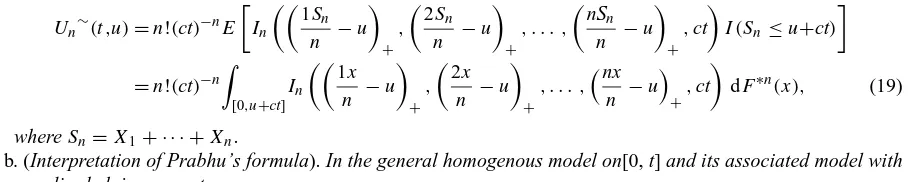

Theorem 2.

a. In the homogeneous risk model with fixed Nt=n and equalized claim amounts,

Un∼(t ,u)=n!(ct)−nE

b. (Interpretation of Prabhu’s formula). In the general homogenous model on[0, t] and its associated model with

equalized claim amounts,

a. The second relation (19) is obvious because F∗nis the distribution function of Sn. For the first relation (19) it is

enough to repeat the proof of Theorem 1a. Nowx1+· · ·+xkmust everywhere be replaced withk(x1+· · ·+xn)/n

Table 15

Exponential,η=0.25, t=10

u 9 9∼

0 0.729 0.729

4 0.204 0.153

8 0.0463 0.0351

12 0.00886 0.00698

16 0.00148 0.00120

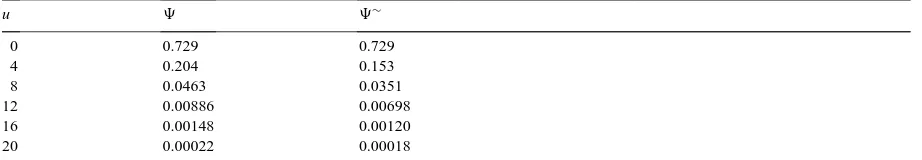

20 0.00022 0.00018

Table 16

Exponential,η=0.25, t=20

u 9 9∼

0 0.764 0.765

4 0.272 0.187

8 0.0859 0.0568

12 0.0241 0.0163

16 0.00603 0.00427

20 0.00137 0.00101

24 0.00028 0.00022

28 0.00005 0.00004

Table 17

Pareto,η=0.05, t=1

u 9 9∼

0 0.531 0.531

10 0.0124 0.0124

20 0.00275 0.00277

30 0.00119 0.00118

40 0.00066 0.00065

b. It is sufficient to consider the model with fixed Nt=n and equalized claim amounts and to prove that

Un∼(t ,0)= Z

[0,ct] h

1− x

ct i

dF∗n(x) (21)

because then (20) results from (15), (1) and the (∼)-version of (1). Now (kx/(n−u))+=kx/n because u=0. Then, by (5),

In 1x

n , 2x

n, . . . ,

nx

n,ct

=(ct)

n

n! −

(x/n)(ct)n−1 (n−1)!

and then (21) results from (19).

We denote by9(t, u)=1−U(t, u) and9∼(t, u)=1−U∼(t, u) the ruin probabilities before time t corresponding to the initial risk reserve u≥0. Sometimes different values of the premium income rate c are considered simultaneously. Then we write more explicitly9(t, u, c) and9∼(t, u, c).

4.1. Conjecture

In any homogeneous risk model with time interval [0, t] and its associated model with equalized claim amounts,

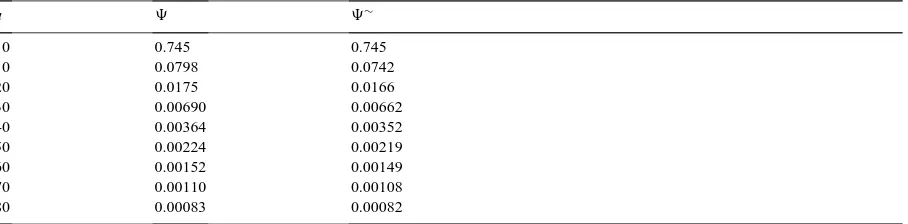

Table 18

Pareto,η=0.05, t=5

u 9 9∼

0 0.745 0.745

10 0.0798 0.0742

20 0.0175 0.0166

30 0.00690 0.00662

40 0.00364 0.00352

50 0.00224 0.00219

60 0.00152 0.00149

70 0.00110 0.00108

80 0.00083 0.00082

Table 19

Pareto,η=0.05, t=10

u 9 9∼

0 0.802 0.803

20 0.0409 0.0365

40 0.00802 0.00741

60 0.00323 0.00305

80 0.00173 0.00166

100 0.00108 0.00104

120 0.00074 0.00072

Table 20

Pareto,η=0.05, t=20

u 9 9∼

0 0.845 0.847

20 0.0908 0.0758

40 0.0185 0.0161

60 0.00707 0.00634

80 0.00369 0.00338

100 0.00226 0.00211

120 0.00153 0.00144

140 0.00110 0.00106

160 0.00084 0.00080

Table 21

Pareto,η=0.25, t=1

u 9 9∼

0 0.496 0.496

10 0.0117 0.0117

20 0.00270 0.00270

30 0.00117 0.00116

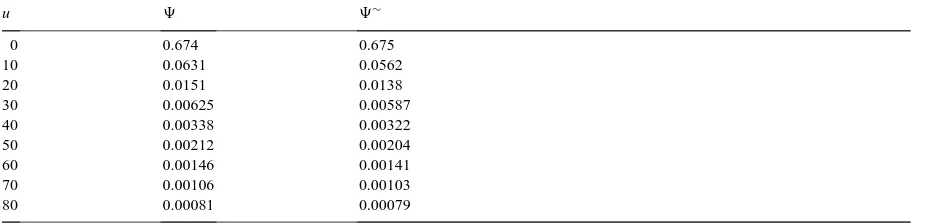

Table 22

Pareto,η=0.25, t=5

u 9 9∼

0 0.674 0.675

10 0.0631 0.0562

20 0.0151 0.0138

30 0.00625 0.00587

40 0.00338 0.00322

50 0.00212 0.00204

60 0.00146 0.00141

70 0.00106 0.00103

80 0.00081 0.00079

Table 23

Pareto,η=0.25, t=10

u 9 9∼

0 0.720 0.721

20 0.0307 0.0256

40 0.00694 0.00612

60 0.00294 0.00269

80 0.00162 0.00151

100 0.00102 0.00097

120 0.00071 0.00068

Table 24

Pareto,η=0.25, t=20

u 9 9∼

0 0.751 0.753

20 0.0566 0.0415

40 0.0138 0.0109

60 0.00585 0.00490

80 0.00322 0.00279

100 0.00204 0.00181

120 0.00140 0.00127

140 0.00103 0.00094

160 0.00079 0.00073

Table 25

Uniform,η=0.25, t=10

u 9sqrt 9∼

0 0.743 0.743

1 0.366 0.308

2 0.126 0.128

3 0.0637 0.0561

4 0.0292 0.0227

5 0.0108 0.00735

6 0.00296 0.00170

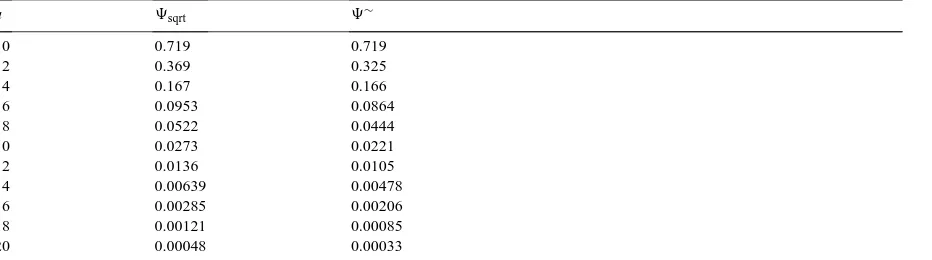

Table 26

Exponential,η=0.25, t=10

u 9sqrt 9∼

0 0.719 0.719

2 0.369 0.325

4 0.167 0.166

6 0.0953 0.0864

8 0.0522 0.0444

10 0.0273 0.0221

12 0.0136 0.0105

14 0.00639 0.00478

16 0.00285 0.00206

18 0.00121 0.00085

20 0.00048 0.00033

Table 27

Pareto,η=0.25, t=10

u 9sqrt 9∼

0 0.711 0.711

10 0.109 0.103

20 0.0332 0.0292

30 0.0135 0.0121

40 0.00710 0.00652

50 0.00436 0.00407

60 0.00295 0.00279

70 0.00214 0.00204

80 0.00162 0.00155

90 0.00127 0.00122

100 0.00102 0.00099

110 0.00084 0.00082

This Conjecture is based on the numerical study of Section 6. By (1) and its (∼)-version, it is equivalent to the proposition:9n∼(t, u)≤9n(t, u)for all n=1, 2,. . .. Of course,91∼(t, u)=91(t, u). The proof of92∼(t, u)≤

92(t, u)is rather direct by (13) and (19) and by the arguments of the proof of Lemma 2. The proof of the general

case is still missing.

5. Numerical illustrations

5.1. Parameters

In the classical model, we display c as c=λµ(1+η), whereηis the security loading,µthe first moment of the claimsize distribution andλthe parameter of the Poisson claim instants process. We takeλ=1 and we consider the values 1, 5, 10, 20 of t. We consider the valuesη=0.05 andη=0.25 of the security loading. For the initial risk reserve u we adopt values 0, k, 2k,. . ., mk depending on the other parameters. The integers k and m are fixed in such a way that m≤10 and that the ruin probability corresponding to the last value km is less than 1/1000.

5.2. Claimsize distributions F

Atomic concentrated at 1 F(x)=1 (0≤x≤1), F(x)=1 (x>1). Thenµ=1.

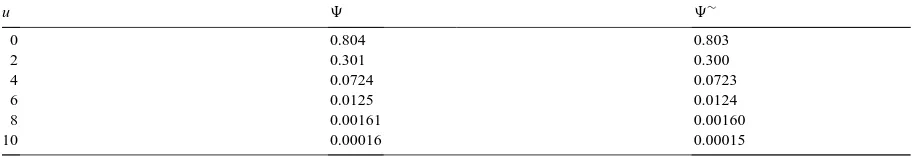

Table 28

Atomic F,η=0.05, t=5

u 9 9∼

0 0.804 0.803

2 0.301 0.300

4 0.0724 0.0723

6 0.0125 0.0124

8 0.00161 0.00160

10 0.00016 0.00015

Exponential F(x)=1−e−x (x≥0). Thenµ=1.

Pareto F(x)=(1−x−2)1 (x≥1) (x≥0). Thenµ=2.

Distribution of Nt. In the classical model, the distribution of Nt is the exponential with parameterλt. We consider

one nonclassical case. It is the homogeneous model on [0, t], t=10, with

P (Nt =n)=cexp[−(10−n)1/2] (n=0,1,2, . . . ,20), P (Nt =n)=0 (n >20),

where c results from the norm relation6n≥0P(Nt=n)=1, i.e. c=0.271940. Then ENt=10 for reasons of symmetry.

We takeλ=ENt/t=1. The nonclassical case is treated with various claimsize distributions.

5.3. Numerical calculations

The claimsize distributions are truncated and finely discretized, with conservation of first momentµ, as explained in De Vylder (1996, p. 268−271). The exact ruin probabilities in the classical model, 9(t, u)=1−U(t, u), are

calculated as explained in the same book p. 257−268, with claimsize distribution and security loading adaptations. In the associated model, the ruin probabilities are evaluated via (19) and the (∼)-version of (1). In the nonclassical case, we cannot evaluate9(t, u) numerically. Instead, we then consider the approximation9sqrt(t, u) defined by De

Vylder and Goovaerts (1999, Section 6).

5.4. Numerical anomalies

By (20),

9(t,0)=9∼(t,0),

This relation and the conjecture of Section 4 are very slightly contradicted at a few places in following tables, because the numerical values include discretization, truncation and decimalization errors and because 9∼(t, u) and9(t, u) are obtained by completely different algorithms. For instance, in Table 28 below, we should have9(t,

u)=9∼(t, u) for all values of u, because the model with equalized claims amounts is the same as the initial model when F is atomic. We have verified that with finer discretizations than those used in the tables, the contradictions disappear. Unfortunately, the finer discretizations cannot be used systematically because then the computing time would be excessive (on our 1995 P.C)

Each of Tables 1–27 (classical cases,l=1) corresponds to the table with the same number in De Vylder and

Goovaerts (1999). The atomic claimsize distribution F (Table 28), is not considered in the latter paper.

References

De Vylder, F.E., 1996. Advanced Risk Theory. A Self-Contained Introduction. Editions de l’Université de Bruxelles, Swiss Association of Actuaries.