Refer to Important disclosures in the last page of this report

Stock DataTarget price (Rp) Rp21,200

Prior TP (Rp) Rp20,500

Share price (Rp) Rp22,900

Upside/downside (%) (7.4)

Shares outstanding (m) 24,655

Market cap. (US$ m) 37,174

PT Dwimuria Investama 54.9%

Estimate Change; Vs. Consensus

2018F 2019F

PT Indo Premier Sekuritas stephan.hasjim@ipc.co.id +62 21 5793 1168

Stronger growth outlook as rate rises

Modest profit growth in 9M18 (+10%) despite strong loan growth.

However, NIM downtrend reversed in 3Q (+17bps qoq) as rate rises.

Stable asset quality and credit cost in line with our expectation.

We raised our earnings and TP slightly but keep our HOLD rating.

Modest results.

BBCA’s net profit of Rp18.5tn in 9M18 (+9.9% yoy) came in line

with our forecast and consensus expectations. We view this as modest results,

with steady, albeit moderating, profit growth reflecting its strong asset quality.

Quarterly profit jumped 20% qoq in 3Q18, driven by better NIMs, strong trading

incomes while operating cost eased after seasonally higher costs in the first two

quarters. Going forward, we expect stronger earnings growth outlook in next 2

years, given a trend reversal in rates on the back of BI’s 125bps policy rate rises

this year, which usually has positive impact on BBCA’s NIMs.

NIM trend reversal

. BBCA’s NIM of 6.51% in 9M18 (our calculation) was only

8bps lower than in the prior year, reflecting the effect of declining rates which was

mitigated by much stronger loan vs. deposit growth (17.3% vs. 6.9%). However,

with interest rates started rising this year, owing to Indonesia’s worsening current

account deficit and its weakening currency, BBCA’s NIM widened to 6.62% in 3Q

(+17bps qoq), a trend which we believe will be sustained in next 2 years given

the bank’s strong deposit mix (CASA: 78%). BBCA’s strong loan growth was

driven by corporate lending (+23%) and commercial/SME loans (+17%) while its

consumer loans grew only 9% due to slowing home mortgage loans.

Asset quality

. BBCA’s asset quality remained very strong with low and stable

NPL ratio of 1.4% and high provision coverage of 187%. Over the past year, NPL

ratios for its corporate loans improved to 1.0% (from 1.2%), commercial/SME

loans eased to 2.0% (from 2.3%) while consumer NPLs worsened to 1.3% (from

1.1%). Meanwhile, the bank’s credit cost rose to 71bps in 3Q (2Q: 51bps) but at

only 46bps in 9M18, the credit cost was still lower than last year (56bps) and it

was still in line with our forecast assumption of 54bps for FY18F. We expect the

bank’s credit cost to remain at this levels in the next 2 years.

Valuation

. We raised our earnings forecasts by 3% for FY19F/FY20F on the back

of better NIMs, and lift up TP slightly to Rp21,200 (from Rp20,500). Our

GGM-derived TP assumes LT ROAE of 22.4% (from 22.0%), LT growth of 8.5%, cost of

equity of 12.5%. We estimate BBCA’s LT ROAE based on our DuPont analysis,

assuming LT ROAA of 2.80% and asset/equity leverage of 8x. Despite BBCA’s

steady growth, high earnings quality, and its stronger earnings growth outlook in

the next 2 years on the back of rising rates, we reiterate our HOLD rating due to

the stock’s premium valuation over peer major banks in Indonesia.

Bank Central Asia

(

BBCA IJ

)

26 October 2018

Results Note

HOLD

(Unchanged)

Year To 31 Dec 2016A 2017A 2018F 2019F 2020F

Operating income (RpBn) 53,643 56,950 62,586 69,915 78,379

PPOP (RpBn) 30,264 31,760 34,877 39,434 45,136

Source: BBCA, IndoPremier Share Price Closing as of : 25-October-2018

2

Refer to Important disclosures in the last page of this report

Fig. 1: Net Interest Income (Rp bn) and NIMs (%) Fig. 2: Non-Interest Income (Rp bn; % of Gross Income)

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Operating Expense (Rp bn) and Cost/Income Ratio (%)

Fig. 4: Pre-Provision Profit (Rp bn; % of Average Assets)

Source: Company, IndoPremier Source: Company, IndoPremier

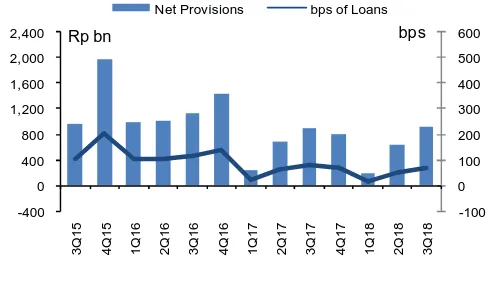

Fig. 5: Net Loan Provisioning (Rp bn; bps of Average Loans) Fig. 6: Net Profit (Rp bn) and ROAA (%)

Source: Company, IndoPremier Source: Company, IndoPremier

2%

Net Interest Income Net Interest Margin

Rp bn

Other Income Other Income % of Total

Rp bn

Operating Expenses Cost-Income Ratio

Rp bn

Pre-Provision Profit Pre-Provision Profit ROAA

Rp bn

Net Provisions bps of Loans

bps

Net Profit Net Profit ROAA

3

Refer to Important disclosures in the last page of this report

Third-Quarter 2018 Results

Results (Rp Bn) 9M18 9M17 % Y-Y 3Q18 2Q18 % Q-Q

Risk-Weighted Assets 623,734 544,478 14.6 623,734 601,841 3.6

Shareholders’ Funds 143,607 127,317 12.8 143,607 136,747 5.0

4

Refer to Important disclosures in the last page of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Interest income 50,426 53,768 57,076 67,386 77,131

Interest expense (10,347) (11,941) (11,888) (15,732) (18,868)

Net interest income 40,079 41,826 45,188 51,653 58,264

Fees and commissions 9,401 10,386 11,736 12,910 14,201

Trading income 2,210 1,772 2,400 1,600 1,600

Other operating income 1,954 2,966 3,262 3,752 4,315

Total operating income 53,643 56,950 62,586 69,915 78,379

Personnel expenses (10,630) (11,335) (12,469) (13,716) (14,950)

G&A expenses (11,229) (12,306) (13,536) (14,890) (16,230)

Other operating expenses (1,520) (1,550) (1,704) (1,875) (2,062)

Pre-provision operating profit 30,264 31,760 34,877 39,434 45,136

Provisions (4,561) (2,633) (2,743) (2,986) (3,688)

Loan recovery income 0 0 0 0 0

Operating profit 25,703 29,127 32,134 36,449 41,449

Non-operating profit 0 0 0 0 0

Exceptional items 0 0 0 0 0

Pre-tax profit 25,703 29,127 32,134 36,449 41,449

Income tax (5,207) (5,838) (6,555) (7,290) (8,290)

Minority interests (27) (11) 0 (10) (10)

Reported net profit 20,470 23,278 25,579 29,149 33,149

Balance Sheet

Cash 15,944 16,754 25,093 28,203 31,744

Current account with BI 40,597 43,473 44,083 49,369 55,380

Placements at BI & other banks 47,830 28,063 29,466 30,940 32,487

Short-term investments 44,365 76,977 85,987 96,161 107,667

Government bonds 72,019 69,388 75,278 78,700 82,293

Gross loans 427,866 480,584 551,287 632,457 695,703

Loan provisions (12,849) (13,686) (14,537) (16,072) (18,310)

Other assets 40,968 48,766 51,204 53,764 56,453

Total Assets 676,739 750,320 847,862 953,522 1,043,416

Customer deposits 530,134 581,115 651,749 731,950 823,177

Deposits from other banks 4,901 5,758 6,768 7,966 9,387

Securities and borrowings 5,121 3,651 4,016 4,418 4,860

Other liabilities 23,504 27,914 34,615 35,697 6,611

Total Liabilities 563,659 618,439 697,148 780,030 844,035

Share capital 7,105 7,090 7,090 7,090 7,090

Reserves and others 6,824 8,215 8,215 8,215 8,215

Retained earnings 98,503 115,998 135,291 158,045 183,907

Shareholders' equity 112,433 131,304 150,596 173,350 199,212

Minority interest 282 98 118 141 170

Total Liabilities & Equity 676,374 749,841 847,862 953,522 1,043,416

5

Refer to Important disclosures in the last page of this report

Year To 31 Dec 2016A 2017A 2018F 2019F 2020F

Growth Ratios (% yoy)

Gross loans 7.4 12.3 14.7 14.7 10.0

Total assets 13.9 10.9 13.0 12.5 9.4

Customer deposits 11.9 9.6 12.2 12.3 12.5

Net interest income 11.7 4.4 8.0 14.3 12.8

Non-interest income 13.2 11.5 15.0 5.0 10.2

Total operating income 13.6 13.3 10.3 13.4 13.7

Operating expense 7.7 7.7 10.0 10.0 9.1

PPOP 15.8 4.9 9.8 13.1 14.5

Net profit 13.7 13.7 9.9 14.0 13.7

Profitability Ratios

ROAA (%) 3.24 3.23 3.25 3.24 3.32

ROAE (%) 19.8 19.1 18.3 18.0 17.8

NIM (%) 7.17 6.59 6.53 6.58 6.72

Credit cost (bps) 114.7 59.4 53.8 50.4 55.5

Cost/income (%) 43.6 44.2 44.3 43.6 42.4

LDR (%) 80.7 82.7 84.6 86.4 84.5

CAR (%) 22.2 20.4 20.4 20.5 21.3

NPL ratio (%) 1.3 1.4 1.4 1.4 1.5

Provisions/NPL (%) 235.7 197.1 182.1 177.5 170.9

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analyst;s personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS