LAMPIRAN

Lampiran 1

KONSTRUKSI PENGAMBILAN SAMPEL

Tabel 1

Konstruksi Sampel Berdasarkan Kriteria

Konstruksi Sampel*

Jumlah perusahaan terdaftar di BEI

492

(-) Industri keuangan

76

(-) data tidak memadai (ketiadaan beta)

124

(-) tidak memiliki goodwill positif dalam neraca

54

(-) menggunakan mata uang selain rupiah dalam laporan

keuangan

22

Total perusahaan

48

Sampel final untuk mengamatan 2 tahun (2 x perusahaan)

96

*Tabel ini memperlihatkan proses pengambilan sampel final yang digunakan

dalam penelitian ini berdasarkan kriteria yang telah ditetapkan sebelumnya.

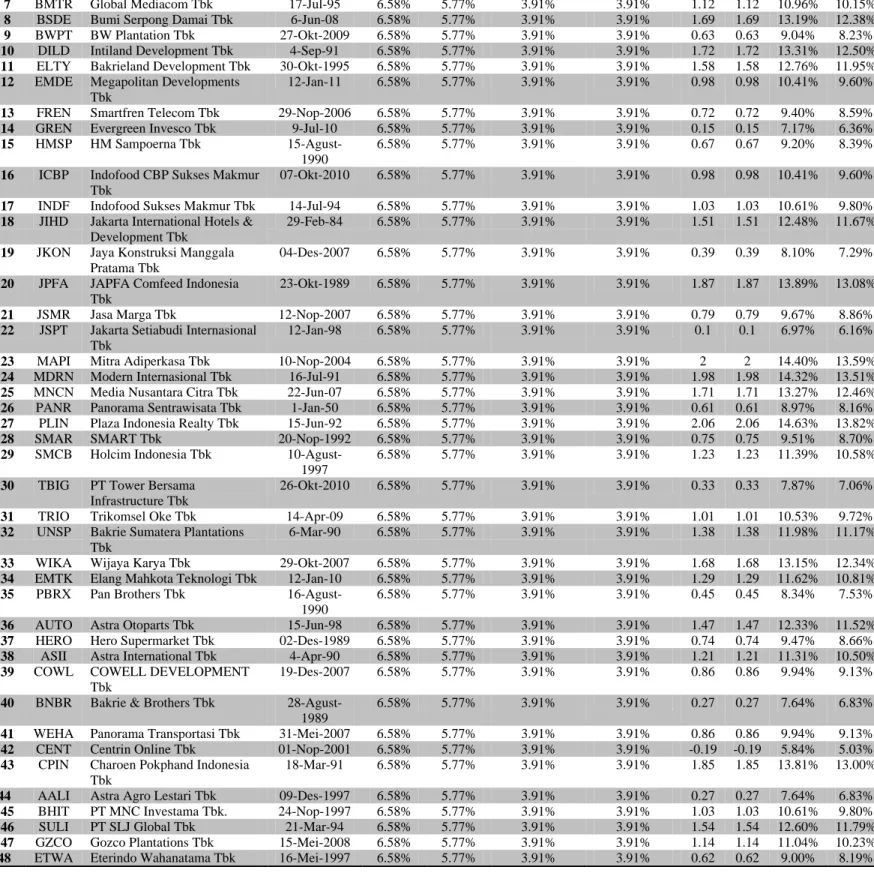

Lampiran 2

REKAPITULASI COST OF EQUITY

Tabel 2

Perhitungan Cost of Equity

No. Kode Nama Tanggal

Pendaftaran

Risk Free Rate (Rf) Market Risk Premium (MRP) Beta Cost of Equity 2011 2012 2011 2012 2011 2012 2011 2012 1 ABBA Mahaka Media Tbk 3-Apr-02 6.58% 5.77% 3.91% 3.91% 1.92 1.92 14.09% 13.28% 2 AKRA AKR Corporindo Tbk 03-Okt-1994 6.58% 5.77% 3.91% 3.91% 1.74 1.74 13.38% 12.57% 3 ANTM Aneka Tambang (Persero) Tbk 27-Nop-1997 6.58% 5.77% 3.91% 3.91% 1.31 1.31 11.70% 10.89% 4 ASGR Astra Graphia Tbk 15-Nop-1989 6.58% 5.77% 3.91% 3.91% 1.87 1.87 13.89% 13.08% 5 BIPI Benakat Integra Tbk 11-Feb-10 6.58% 5.77% 3.91% 3.91% 0.34 0.34 7.91% 7.10% 6 BMSR Bintang Mitra Semestaraya

Tbk

7 BMTR Global Mediacom Tbk 17-Jul-95 6.58% 5.77% 3.91% 3.91% 1.12 1.12 10.96% 10.15% 8 BSDE Bumi Serpong Damai Tbk 6-Jun-08 6.58% 5.77% 3.91% 3.91% 1.69 1.69 13.19% 12.38% 9 BWPT BW Plantation Tbk 27-Okt-2009 6.58% 5.77% 3.91% 3.91% 0.63 0.63 9.04% 8.23% 10 DILD Intiland Development Tbk 4-Sep-91 6.58% 5.77% 3.91% 3.91% 1.72 1.72 13.31% 12.50% 11 ELTY Bakrieland Development Tbk 30-Okt-1995 6.58% 5.77% 3.91% 3.91% 1.58 1.58 12.76% 11.95% 12 EMDE Megapolitan Developments

Tbk

12-Jan-11 6.58% 5.77% 3.91% 3.91% 0.98 0.98 10.41% 9.60% 13 FREN Smartfren Telecom Tbk 29-Nop-2006 6.58% 5.77% 3.91% 3.91% 0.72 0.72 9.40% 8.59% 14 GREN Evergreen Invesco Tbk 9-Jul-10 6.58% 5.77% 3.91% 3.91% 0.15 0.15 7.17% 6.36% 15 HMSP HM Sampoerna Tbk

15-Agust-1990

6.58% 5.77% 3.91% 3.91% 0.67 0.67 9.20% 8.39% 16 ICBP Indofood CBP Sukses Makmur

Tbk

07-Okt-2010 6.58% 5.77% 3.91% 3.91% 0.98 0.98 10.41% 9.60% 17 INDF Indofood Sukses Makmur Tbk 14-Jul-94 6.58% 5.77% 3.91% 3.91% 1.03 1.03 10.61% 9.80% 18 JIHD Jakarta International Hotels &

Development Tbk

29-Feb-84 6.58% 5.77% 3.91% 3.91% 1.51 1.51 12.48% 11.67% 19 JKON Jaya Konstruksi Manggala

Pratama Tbk

04-Des-2007 6.58% 5.77% 3.91% 3.91% 0.39 0.39 8.10% 7.29% 20 JPFA JAPFA Comfeed Indonesia

Tbk

23-Okt-1989 6.58% 5.77% 3.91% 3.91% 1.87 1.87 13.89% 13.08% 21 JSMR Jasa Marga Tbk 12-Nop-2007 6.58% 5.77% 3.91% 3.91% 0.79 0.79 9.67% 8.86% 22 JSPT Jakarta Setiabudi Internasional

Tbk

12-Jan-98 6.58% 5.77% 3.91% 3.91% 0.1 0.1 6.97% 6.16% 23 MAPI Mitra Adiperkasa Tbk 10-Nop-2004 6.58% 5.77% 3.91% 3.91% 2 2 14.40% 13.59% 24 MDRN Modern Internasional Tbk 16-Jul-91 6.58% 5.77% 3.91% 3.91% 1.98 1.98 14.32% 13.51% 25 MNCN Media Nusantara Citra Tbk 22-Jun-07 6.58% 5.77% 3.91% 3.91% 1.71 1.71 13.27% 12.46% 26 PANR Panorama Sentrawisata Tbk 1-Jan-50 6.58% 5.77% 3.91% 3.91% 0.61 0.61 8.97% 8.16% 27 PLIN Plaza Indonesia Realty Tbk 15-Jun-92 6.58% 5.77% 3.91% 3.91% 2.06 2.06 14.63% 13.82% 28 SMAR SMART Tbk 20-Nop-1992 6.58% 5.77% 3.91% 3.91% 0.75 0.75 9.51% 8.70% 29 SMCB Holcim Indonesia Tbk

10-Agust-1997

6.58% 5.77% 3.91% 3.91% 1.23 1.23 11.39% 10.58% 30 TBIG PT Tower Bersama

Infrastructure Tbk

26-Okt-2010 6.58% 5.77% 3.91% 3.91% 0.33 0.33 7.87% 7.06% 31 TRIO Trikomsel Oke Tbk 14-Apr-09 6.58% 5.77% 3.91% 3.91% 1.01 1.01 10.53% 9.72% 32 UNSP Bakrie Sumatera Plantations

Tbk

6-Mar-90 6.58% 5.77% 3.91% 3.91% 1.38 1.38 11.98% 11.17% 33 WIKA Wijaya Karya Tbk 29-Okt-2007 6.58% 5.77% 3.91% 3.91% 1.68 1.68 13.15% 12.34% 34 EMTK Elang Mahkota Teknologi Tbk 12-Jan-10 6.58% 5.77% 3.91% 3.91% 1.29 1.29 11.62% 10.81% 35 PBRX Pan Brothers Tbk

16-Agust-1990

6.58% 5.77% 3.91% 3.91% 0.45 0.45 8.34% 7.53% 36 AUTO Astra Otoparts Tbk 15-Jun-98 6.58% 5.77% 3.91% 3.91% 1.47 1.47 12.33% 11.52% 37 HERO Hero Supermarket Tbk 02-Des-1989 6.58% 5.77% 3.91% 3.91% 0.74 0.74 9.47% 8.66% 38 ASII Astra International Tbk 4-Apr-90 6.58% 5.77% 3.91% 3.91% 1.21 1.21 11.31% 10.50% 39 COWL COWELL DEVELOPMENT

Tbk

19-Des-2007 6.58% 5.77% 3.91% 3.91% 0.86 0.86 9.94% 9.13% 40 BNBR Bakrie & Brothers Tbk

28-Agust-1989

6.58% 5.77% 3.91% 3.91% 0.27 0.27 7.64% 6.83% 41 WEHA Panorama Transportasi Tbk 31-Mei-2007 6.58% 5.77% 3.91% 3.91% 0.86 0.86 9.94% 9.13% 42 CENT Centrin Online Tbk 01-Nop-2001 6.58% 5.77% 3.91% 3.91% -0.19 -0.19 5.84% 5.03% 43 CPIN Charoen Pokphand Indonesia

Tbk

18-Mar-91 6.58% 5.77% 3.91% 3.91% 1.85 1.85 13.81% 13.00% 44 AALI Astra Agro Lestari Tbk 09-Des-1997 6.58% 5.77% 3.91% 3.91% 0.27 0.27 7.64% 6.83%

45 BHIT PT MNC Investama Tbk. 24-Nop-1997 6.58% 5.77% 3.91% 3.91% 1.03 1.03 10.61% 9.80% 46 SULI PT SLJ Global Tbk 21-Mar-94 6.58% 5.77% 3.91% 3.91% 1.54 1.54 12.60% 11.79% 47 GZCO Gozco Plantations Tbk 15-Mei-2008 6.58% 5.77% 3.91% 3.91% 1.14 1.14 11.04% 10.23% 48 ETWA Eterindo Wahanatama Tbk 16-Mei-1997 6.58% 5.77% 3.91% 3.91% 0.62 0.62 9.00% 8.19%

Tabel di atas memperlihatkan perhitungan cost of equity masing-masing

perusahaan yang menjadi sampel penelitian. Cost of Equity dicari dengan

menggunakan rumus CAPM (capital asset pricing model), dengan rumus sebagai

berikut.

E (Ri) = Rf + β (MRP)

Keterangan:

E (Ri) : Tingkat pengembalian yang diinginkan

Rf

: Tingkat suku bunga investasi yang dapat diperoleh tanpa resiko

(tingkat suku bunga SBI). Diambil dari website www.bi.go.id,

berdasarkan tingkat suku bunga rata-rata tahun penelitian.

β

: Faktor resiko yang berlaku spesifik untuk masing–masing bank.

Data beta masing-masing perusahaan diambil dari

www.reuters.com

MRP : (Market Resk Premium). Sumber data diambil dari survey

Damodaran tentang MRP negara-negara di dunia pada tahun 2012

dari

http://people.stern.nyu.edu/adamodar/pdfiles/papers/ERP2012.pdf

Tabel 3

Tingkat Suku Bunga Berdasarkan BI

Bulan

Suku Bunga

2011

2012

Januari

6.50%

6.00%

Februari

6.75%

5.75%

Maret

6.75%

5.75%

April

6.75%

5.75%

Mei

6.75%

5.75%

Juni

6.75%

5.75%

Juli

6.75%

5.75%

Agustus

6.75%

5.75%

September

6.75%

5.75%

Oktober

6.50%

5.75%

November

6.00%

5.75%

Desember

6.00%

5.75%

Total

79.00%

69.25%

Rata2

6.58%

5.77%

Sumber: www.bi.go.id

Lampiran 3

PERHITUNGAN COST OF DEBT

Tabel 4

Rekapitulasi Perhitungan Cost of Debt

No. Nama Jumlah Utang (D) Beban Bunga (i) Tingkat Bunga

(D/i)

Tax Rate 1-Tax Rate Cost of Debt 2011 2012 2011 2012 2011 2012 2011 2012 2011 2012 2011 2012 1 Mahaka Media Tbk 294,206,068,052 305,768,880,547 13,373,306,280 13,490,984,819 4.55% 4.41% 25.00% 25.00% 75.00% 75.00% 3.41% 3.31% 2 AKR Corporindo Tbk 4,746,103,316,000 7,577,784,981,000 4,166,026,000 10,811,641,000 0.09% 0.14% 20.00% 20.00% 80.00% 80.00% 0.07% 0.11% 3 Aneka Tambang (Persero) Tbk 4,429,191,527,000 6,876,224,890,000 22,723,138,000 234,500,820,000 0.51% 3.41% 25.00% 25.00% 75.00% 75.00% 0.38% 2.56% 4 Astra Graphia Tbk 569,502,000,000 606,917,000,000 542,000,000 3,323,000,000 0.10% 0.55% 25.00% 25.00% 75.00% 75.00% 0.07% 0.41% 5 Benakat Integra Tbk 641,695,000,000 755,441,000,000 88,195,000,000 55,709,000,000 13.74 % 7.37% 25.00% 25.00% 75.00% 75.00% 10.31% 5.53% 6 Bintang Mitra Semestaraya Tbk 294,712,783,200 308,191,103,983 8,527,877,196 11,277,602,757 2.89% 3.66% 25.00% 25.00% 75.00% 75.00% 2.17% 2.74% 7 Global Mediacom Tbk 4,295,815,000,000 5,699,770,000,000 372,916,000,00 0 326,137,000,000 8.68% 5.72% 25.00% 25.00% 75.00% 75.00% 6.51% 4.29% 8 Bumi Serpong Damai

Tbk 4,530,152,109,517 6,225,013,628,292 152,713,472,88 8 89,473,238,552 3.37% 1.44% 25.00% 25.00% 75.00% 75.00% 2.53% 1.08% 9 BW Plantation Tbk 2,163,128,698,000 3,246,802,118,000 68,498,485,000 70,355,188,000 3.17% 2.17% 25.00% 25.00% 75.00% 75.00% 2.37% 1.63% 10 Intiland Development Tbk 1,892,907,650,386 2,140,815,833,510 48,300,574,331 81,792,350,715 2.55% 3.82% 25.00% 25.00% 75.00% 75.00% 1.91% 2.87% 11 Bakrieland Development Tbk 6,805,878,160,103 6,071,418,710,164 47,394,828,534 473,801,491,002 0.70% 7.80% 25.00% 25.00% 75.00% 75.00% 0.52% 5.85% 12 Megapolitan Developments Tbk 374,772,103,253 362,440,053,575 14,534,389,741 11,166,374,075 3.88% 3.08% 25.00% 25.00% 75.00% 75.00% 2.91% 2.31% 13 Smartfren Telecom Tbk 9,027,606,756,073 9,355,398,812,684 347,425,729,71 6 367,979,998,582 3.85% 3.93% 25.00% 25.00% 75.00% 75.00% 2.89% 2.95% 14 Evergreen Invesco Tbk 566,946,300,470 581,076,926,718 8,341,189,595 10,648,589,185 1.47% 1.83% 25.00% 25.00% 75.00% 75.00% 1.10% 1.37% 15 HM Sampoerna Tbk 9,027,088,000,000 12,939,107,000,00 0 9,545,000,000 20,471,000,000 0.11% 0.16% 25.00% 25.00% 75.00% 75.00% 0.08% 0.12% 16 Indofood CBP Sukses Makmur Tbk 4,513,084,000,000 5,766,682,000,000 46,544,000,000 53,675,000,000 1.03% 0.93% 25.00% 25.00% 75.00% 75.00% 0.77% 0.70% 17 Indofood Sukses Makmur Tbk 21,975,708,000,000 25,181,533,000,00 0 882,016,000,00 0 933,888,000,000 4.01% 3.71% 20.00% 20.00% 80.00% 80.00% 3.21% 2.97% 18 Jakarta International

Hotels & Development Tbk 1,050,554,569,000 1,076,060,487,000 47,189,716,000 38,887,636 4.49% 0.00% 20.00% 20.00% 80.00% 80.00% 3.59% 0.00% 19 Jaya Konstruksi Manggala Pratama Tbk 1,347,596,317,577 1,542,127,841,271 26,376,879,386 35,250,718,206 1.96% 2.29% 25.00% 25.00% 75.00% 75.00% 1.47% 1.71% 20 JAPFA Comfeed 4,481,070,000,000 6,198,137,000,000 331,404,000,00 437,531,000,000 7.40% 7.06% 20.00% 20.00% 80.00% 80.00% 5.92% 5.65%

Indonesia Tbk 0 21 Jasa Marga Tbk 12,555,380,912,000 14,965,765,873,00 0 32,556,507,000 90,906,859,000 0.26% 0.61% 25.00% 25.00% 75.00% 75.00% 0.19% 0.46% 22 Jakarta Setiabudi Internasional Tbk 1,255,753,036,014 1,500,018,745,925 33,370,909,000 30,127,931,000 2.66% 2.01% 25.00% 25.00% 75.00% 75.00% 1.99% 1.51% 23 Mitra Adiperkasa Tbk 2,621,209,018,000 3,817,911,733,000 123,418,316,00 0 165,069,599,000 4.71% 4.32% 20.00% 20.00% 80.00% 80.00% 3.77% 3.46% 24 Modern Internasional Tbk 633,475,393,678 747,255,823,658 33,033,393,510 57,383,961,631 5.21% 7.68% 20.00% 20.00% 80.00% 80.00% 4.17% 6.14% 25 Media Nusantara Citra

Tbk 1,963,727,000,000 1,663,780,000,000 134,904,000,00 0 38,294,000,000 6.87% 2.30% 25.00% 25.00% 75.00% 75.00% 5.15% 1.73% 26 Panorama Sentrawisata Tbk 503,585,205,000 731,463,523,000 26,180,639,000 38,698,224,000 5.20% 5.29% 25.00% 25.00% 75.00% 75.00% 3.90% 3.97% 27 Plaza Indonesia Realty

Tbk 1,935,307,318,000 1,717,982,629,000 57,830,490,000 47,306,247,000 2.99% 2.75% 25.00% 25.00% 75.00% 75.00% 2.24% 2.07% 28 SMART Tbk 7,386,347,000,000 7,308,000,000,000 276,506,000,00 0 250,070,000,000 3.74% 3.42% 25.00% 25.00% 75.00% 75.00% 2.81% 2.57% 29 Holcim Indonesia Tbk 3,423,241,000,000 3,750,461,000,000 121,241,000,00 0 119,586,000,000 3.54% 3.19% 30.63% 27.87% 69.37% 72.13% 2.46% 2.30% 30 PT Tower Bersama Infrastructure Tbk 4,174,997,000,000 10,072,090,000,00 0 246,597,000,00 0 467,482,000,000 5.91% 4.64% 25.00% 25.00% 75.00% 75.00% 4.43% 3.48% 31 Trikomsel Oke Tbk 3,410,301,506,712 3,506,469,551,540 173,853,493,58 1 225,087,039,559 5.10% 6.42% 25.00% 25.00% 75.00% 75.00% 3.82% 4.81% 32 Bakrie Sumatera Plantations Tbk 9,644,732,756,000 11,068,929,244,00 0 464,017,632,00 0 553,701,443,000 4.81% 5.00% 20.00% 20.00% 80.00% 80.00% 3.85% 4.00% 33 Wijaya Karya Tbk 6,103,603,696,000 8,131,203,824,000 15,696,279,000 36,228,187,000 0.26% 0.45% 25.00% 25.00% 75.00% 75.00% 0.19% 0.33% 34 Elang Mahkota Teknologi Tbk 2,361,844,476,000 2,311,678,445,000 139,048,746,00 0 78,434,894,000 5.89% 3.39% 25.00% 25.00% 75.00% 75.00% 4.42% 2.54% 35 Pan Brothers Tbk 830,702,000,088 1,178,597,390,919 29,212,953,895 34,894,964,875 3.52% 2.96% 25.00% 25.00% 75.00% 75.00% 2.64% 2.22% 36 Astra Otoparts Tbk 2,241,333,000,000 3,396,543,000,000 55,549,000,000 99,586,000,000 2.48% 2.93% 25.00% 25.00% 75.00% 75.00% 1.86% 2.20% 37 Hero Supermarket Tbk 2,297,397,000,000 3,619,007,000,000 26,197,000,000 42,054,000,000 1.14% 1.16% 25.00% 25.00% 75.00% 75.00% 0.86% 0.87% 38 Astra International Tbk 78,481,000,000,000 92,460,000,000,00 0 710,000,000,00 0 1,021,000,000,0 00 0.90% 1.10% 20.00% 20.00% 80.00% 80.00% 0.72% 0.88% 39 COWELL DEVELOPMENT Tbk 221,859,863,217 644,554,039,238 2,475,684,262 7,562,146,144 1.12% 1.17% 25.00% 25.00% 75.00% 75.00% 0.84% 0.88% 40 Bakrie & Brothers Tbk 19,613,262,083,000 13,046,034,152,00

0 978,489,079,00 0 1,029,361,680,0 00 4.99% 7.89% 20.00% 20.00% 80.00% 80.00% 3.99% 6.31% 41 Panorama Transportasi Tbk 183,819,033,243 301,192,327,415 15,705,913,369 24,902,705,614 8.54% 8.27% 25.00% 25.00% 75.00% 75.00% 6.41% 6.20% 42 Centrin Online Tbk 15,100,322,284 24,654,856,055 893,644,840 236,963,329 5.92% 0.96% 25.00% 25.00% 75.00% 75.00% 4.44% 0.72% 43 Charoen Pokphand Indonesia Tbk 2,658,734,000,000 4,172,163,000,000 34,510,000,000 51,559,000,000 1.30% 1.24% 20.00% 20.00% 80.00% 80.00% 1.04% 0.99% 44 Astra Agro Lestari Tbk 1,778,337,000,000 3,054,409,000,000 25,778,000,000 31,750,000,000 1.45% 1.04% 25.00% 25.00% 75.00% 75.00% 1.09% 0.78%

45 PT Bhakti Investama Tbk. 6,665,467,000,000 8,827,432,000,000 488,077,000,00 0 400,105,000,000 7.32% 4.53% 25.00% 25.00% 75.00% 75.00% 5.49% 3.40% 46 PT SLJ Global Tbk 1,654,048,778,442 1,475,195,895,066 74,366,736,121 48,156,958,167 4.50% 3.26% 25.00% 25.00% 75.00% 75.00% 3.37% 2.45% 47 Gozco Plantations Tbk 1,327,475,994,963 1,587,372,557,439 67,032,815,309 79,442,606,567 5.05% 5.00% 25.00% 25.00% 75.00% 75.00% 3.79% 3.75% 48 Eterindo Wahanatama Tbk 398,012,966,050 523,207,574,539 6,158,721,572 9,708,630,934 1.55% 1.86% 20.00% 20.00% 80.00% 80.00% 1.24% 1.48%

Perhitungan cost of debt didasarkan Cost of Debt setelah pajak dihitung

dengan cara mengalikan tingkat bunga tahunan yang harus dibayar perusahaan

atas pinjaman baru (1- Tingkat pajak). Adapun hasil perhitungannya dapat dilihat

pada tabel di atas.

Lampiran 4

PERHITUNGAN ROIC

Tabel 5

No.

Kode

Nama

NOPAT tanpa pengaruh Goodwill

Impairment Loss (NOPAT + Goodwill

Impairment Loss)

Average Invested Capital

ROIC

2011

2012

2011

2012

2011

2012

1

ABBA

Mahaka Media Tbk

2,409,122,541

10,438,184,574

52,013,864,661

42,691,656,081

4.63%

24.45%

2

AKRA

AKR Corporindo Tbk

580,398,681,600

664,284,616,800

2,648,065,372,000

3,091,731,314,500

21.92%

21.49%

3

ANTM Aneka Tambang

(Persero) Tbk

1,509,658,818,750

671,898,042,000

4,887,813,233,000

5,501,478,476,000

30.89%

12.21%

4

ASGR

Astra Graphia Tbk

126,678,750,000

170,293,500,000

256,281,500,000

357,829,500,000

49.43%

47.59%

5

BIPI

Benakat Integra Tbk

5,550,000,000

8,988,750,000

263,084,000,000

247,205,500,000

2.11%

3.64%

6

BMSR Bintang Mitra

Semestaraya Tbk

39,855,666,526

4,956,633,825

-21,519,367,465

54,518,631,165 -185.21%

9.09%

7

BMTR Global Mediacom Tbk

1,417,979,250,000

1,841,535,750,000

5,557,430,000,000

8,902,673,000,000

25.52%

20.69%

8

BSDE

Bumi Serpong Damai

Tbk

720,416,534,774

1,073,666,191,907

169,648,621,105

-649,055,267,882 424.65% -165.42%

9

BWPT BW Plantation Tbk

362,220,059,250

312,968,502,000

177,460,368,000

397,511,629,500 204.11%

78.73%

10

DILD

Intiland Development

Tbk

140,725,908,878

227,747,878,675

1,195,194,416,027

820,577,490,532

11.77%

27.75%

11ELTY

Bakrieland

Development Tbk

214,822,611,436

588,813,557,581

4,150,276,789,742

2,996,454,989,677

5.18%

19.65%

12

EMDE Megapolitan

Developments Tbk

7,885,654,168

4,869,762,764

-134,608,951

61,717,821,400

5858.19%

-

7.89%

13

FREN

Smartfren Telecom

Tbk

-1,666,221,029,387

-1,201,948,052,673

4,014,209,887,094

6,931,041,128,331

-41.51%

-17.34%

14

GREN Evergreen Invesco Tbk

10,215,825,695

12,762,951,704

430,926,355,272

463,509,234,681

2.37%

2.75%

15

HMSP HM Sampoerna Tbk

8,103,962,250,000

10,012,837,500,000

7,565,494,500,000 10,412,751,500,000 107.12%

96.16%

16

ICBP

Indofood CBP Sukses

Makmur Tbk

1,956,561,000,000

2,131,545,000,000

3,487,349,500,000

4,212,777,000,000

56.10%

50.60%

17

INDF

Indofood Sukses

Makmur Tbk

5,481,984,800,000

5,496,475,200,000 11,529,530,000,000 13,548,768,000,000

47.55%

40.57%

18

JIHD

Jakarta International

Hotels & Development

Tbk

19

JKON

Jaya Konstruksi

Manggala Pratama

Tbk

164,808,873,589

208,289,447,446

53,439,832,464

246,233,975,538 308.40%

84.59%

20

JPFA

JAPFA Comfeed

Indonesia Tbk

877,768,000,000

1,334,603,200,000

4,074,675,500,000

5,018,192,000,000

21.54%

26.60%

21

JSMR

Jasa Marga Tbk

1,747,848,651,000

2,231,426,937,750 -2,893,931,386,500 -4,718,296,663,000

-60.40%

-47.29%

22

JSPT

Jakarta Setiabudi

Internasional Tbk

200,420,070,597

223,581,470,001

644,065,075,203

488,184,552,115

31.12%

45.80%

23

MAPI

Mitra Adiperkasa Tbk

497,812,020,000

609,032,342,400

1,387,305,441,500

1,676,843,286,500

35.88%

36.32%

24

MDRN Modern Internasional

Tbk

83,214,328,438

97,279,308,230

414,392,007,971

535,399,466,745

20.08%

18.17%

25MNCN Media Nusantara Citra

Tbk

1,186,177,500,000

1,661,110,500,000

3,739,559,000,000

5,449,972,500,000

31.72%

30.48%

26

PANR Panorama

Sentrawisata Tbk

37,655,639,250

55,288,777,500

229,534,324,000

311,002,036,000

16.41%

17.78%

27

PLIN

Plaza Indonesia Realty

Tbk

141,621,645,000

335,490,560,250

1,391,015,625,000

1,083,769,912,500

10.18%

30.96%

28

SMAR SMART Tbk

1,697,565,750,000

2,446,241,250,000

6,756,054,500,000

8,096,446,500,000

25.13%

30.21%

29

SMCB Holcim Indonesia Tbk

1,171,691,210,200

1,470,339,034,100

7,360,109,440,585

8,774,031,500,000

15.92%

16.76%

30

TBIG

PT Tower Bersama

Infrastructure Tbk

530,614,500,000

960,291,750,000

222,333,500,000

-50,127,500,000 238.66%

1915.70%

-31

TRIO

Trikomsel Oke Tbk

524,783,401,859

620,315,086,508

883,104,338,202

1,288,442,430,862

59.42%

48.14%

32

UNSP

Bakrie Sumatera

Plantations Tbk

718,329,171,200

288,631,551,200

4,974,094,476,000

7,550,176,452,048

14.44%

3.82%

33

WIKA

Wijaya Karya Tbk

490,305,875,250

634,062,465,750

3,571,991,572,000

3,491,210,832,000

13.73%

18.16%

34

EMTK Elang Mahkota

Teknologi Tbk

897,794,430,750

1,022,353,839,000

943,365,767,000

1,410,915,995,500

95.17%

72.46%

35

PBRX

Pan Brothers Tbk

73,779,685,450

105,839,910,206

407,066,055,978

587,087,482,122

18.12%

18.03%

36

AUTO Astra Otoparts Tbk

389,661,000,000

356,650,500,000

1,604,046,500,000

1,842,678,000,000

24.29%

19.36%

37

HERO Hero Supermarket Tbk

287,861,250,000

330,924,000,000

973,093,000,000

1,160,327,500,000

29.58%

28.52%

38

ASII

Astra International

Tbk

14,265,600,000,000

15,896,000,000,000

7,390,500,000,000 15,350,000,000,000 193.03% 103.56%

39

COWL COWELL

DEVELOPMENT Tbk

23,358,703,292

60,719,768,211

-56,419,873,314

41,054,510,528

-41.40% 147.90%

40

BNBR Bakrie & Brothers Tbk

5,525,145,843

4,688,152,852

9,968,497,143,000

3,552,425,800,000

0.06%

0.13%

41

WEHA Panorama

Transportasi Tbk

17,934,559,586

25,352,517,200

112,731,333,924

170,084,805,216

15.91%

14.91%

42

CENT

Centrin Online Tbk

1,464,211,513

-4,638,145,265

29,869,986,131

40,387,944,869

4.90%

-11.48%

43

CPIN

Charoen Pokphand

Indonesia Tbk

2,407,370,400,000

2,772,894,400,000

4,841,261,000,000

7,420,935,500,000

49.73%

37.37%

44

AALI

Astra Agro Lestari Tbk

2,396,745,750,000

2,590,296,750,000

2,693,158,500,000

3,423,109,500,000

88.99%

75.67%

45

BHIT

PT Bhakti Investama

Tbk.

1,455,258,750,000

2,054,073,750,000

6,089,946,500,000 10,362,928,500,000

23.90%

19.82%

46

SULI

PT SLJ Global Tbk

-126,395,899,282

-155,704,231,904

41,702,818,071

-213,000,454,335 -303.09%

73.10%

47

GZCO Gozco Plantations Tbk

78,233,666,702

64,495,395,666

237,443,552,561

305,092,191,422

32.95%

21.14%

48