LAMPIRAN

Lampiran 1

KONSTRUKSI PENGAMBILAN SAMPEL

Tabel 1

Konstruksi Sampel Berdasarkan Kriteria

Konstruksi Sampel*

Jumlah perusahaan terdaftar di BEI

492

(-) Industri keuangan

76

(-) data tidak memadai (ketiadaan beta)

124

(-) tidak memiliki goodwill positif dalam neraca

54

(-) menggunakan mata uang selain rupiah dalam laporan

keuangan

22

Total perusahaan

48

Sampel final untuk mengamatan 2 tahun (2 x perusahaan)

96

*Tabel ini memperlihatkan proses pengambilan sampel final yang digunakan

dalam penelitian ini berdasarkan kriteria yang telah ditetapkan sebelumnya.

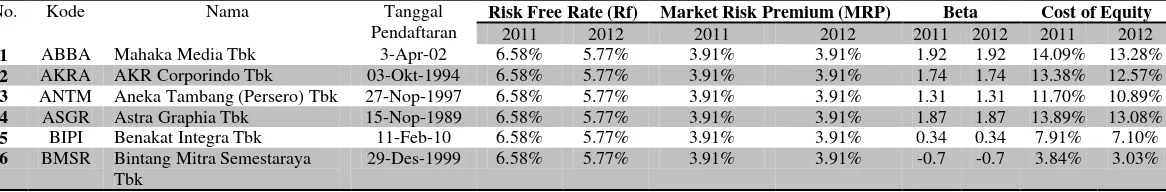

Lampiran 2

REKAPITULASI COST OF EQUITY

Tabel 2

Perhitungan

Cost of Equity

No. Kode Nama Tanggal

Pendaftaran

Risk Free Rate (Rf) Market Risk Premium (MRP) Beta Cost of Equity

2011 2012 2011 2012 2011 2012 2011 2012

1 ABBA Mahaka Media Tbk 3-Apr-02 6.58% 5.77% 3.91% 3.91% 1.92 1.92 14.09% 13.28%

2 AKRA AKR Corporindo Tbk 03-Okt-1994 6.58% 5.77% 3.91% 3.91% 1.74 1.74 13.38% 12.57%

3 ANTM Aneka Tambang (Persero) Tbk 27-Nop-1997 6.58% 5.77% 3.91% 3.91% 1.31 1.31 11.70% 10.89%

4 ASGR Astra Graphia Tbk 15-Nop-1989 6.58% 5.77% 3.91% 3.91% 1.87 1.87 13.89% 13.08%

5 BIPI Benakat Integra Tbk 11-Feb-10 6.58% 5.77% 3.91% 3.91% 0.34 0.34 7.91% 7.10%

6 BMSR Bintang Mitra Semestaraya Tbk

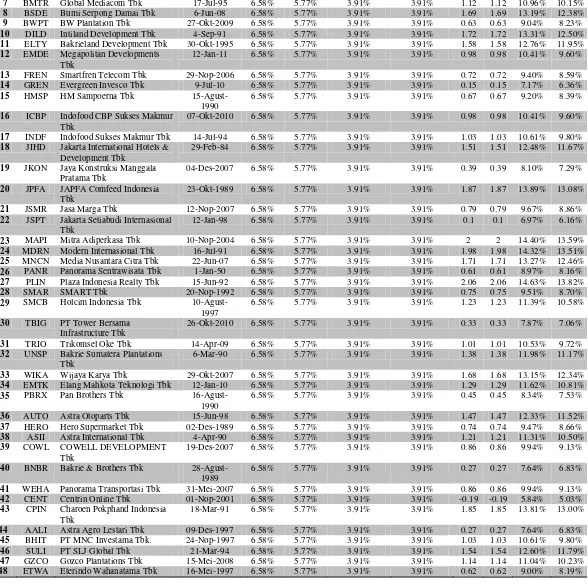

7 BMTR Global Mediacom Tbk 17-Jul-95 6.58% 5.77% 3.91% 3.91% 1.12 1.12 10.96% 10.15%

8 BSDE Bumi Serpong Damai Tbk 6-Jun-08 6.58% 5.77% 3.91% 3.91% 1.69 1.69 13.19% 12.38%

9 BWPT BW Plantation Tbk 27-Okt-2009 6.58% 5.77% 3.91% 3.91% 0.63 0.63 9.04% 8.23%

10 DILD Intiland Development Tbk 4-Sep-91 6.58% 5.77% 3.91% 3.91% 1.72 1.72 13.31% 12.50%

11 ELTY Bakrieland Development Tbk 30-Okt-1995 6.58% 5.77% 3.91% 3.91% 1.58 1.58 12.76% 11.95%

12 EMDE Megapolitan Developments Tbk

12-Jan-11 6.58% 5.77% 3.91% 3.91% 0.98 0.98 10.41% 9.60%

13 FREN Smartfren Telecom Tbk 29-Nop-2006 6.58% 5.77% 3.91% 3.91% 0.72 0.72 9.40% 8.59%

14 GREN Evergreen Invesco Tbk 9-Jul-10 6.58% 5.77% 3.91% 3.91% 0.15 0.15 7.17% 6.36%

15 HMSP HM Sampoerna Tbk 15-Agust-1990

6.58% 5.77% 3.91% 3.91% 0.67 0.67 9.20% 8.39%

16 ICBP Indofood CBP Sukses Makmur Tbk

07-Okt-2010 6.58% 5.77% 3.91% 3.91% 0.98 0.98 10.41% 9.60%

17 INDF Indofood Sukses Makmur Tbk 14-Jul-94 6.58% 5.77% 3.91% 3.91% 1.03 1.03 10.61% 9.80%

18 JIHD Jakarta International Hotels & Development Tbk

29-Feb-84 6.58% 5.77% 3.91% 3.91% 1.51 1.51 12.48% 11.67%

19 JKON Jaya Konstruksi Manggala Pratama Tbk

04-Des-2007 6.58% 5.77% 3.91% 3.91% 0.39 0.39 8.10% 7.29%

20 JPFA JAPFA Comfeed Indonesia Tbk

23-Okt-1989 6.58% 5.77% 3.91% 3.91% 1.87 1.87 13.89% 13.08%

21 JSMR Jasa Marga Tbk 12-Nop-2007 6.58% 5.77% 3.91% 3.91% 0.79 0.79 9.67% 8.86%

22 JSPT Jakarta Setiabudi Internasional Tbk

12-Jan-98 6.58% 5.77% 3.91% 3.91% 0.1 0.1 6.97% 6.16%

23 MAPI Mitra Adiperkasa Tbk 10-Nop-2004 6.58% 5.77% 3.91% 3.91% 2 2 14.40% 13.59%

24 MDRN Modern Internasional Tbk 16-Jul-91 6.58% 5.77% 3.91% 3.91% 1.98 1.98 14.32% 13.51%

25 MNCN Media Nusantara Citra Tbk 22-Jun-07 6.58% 5.77% 3.91% 3.91% 1.71 1.71 13.27% 12.46%

26 PANR Panorama Sentrawisata Tbk 1-Jan-50 6.58% 5.77% 3.91% 3.91% 0.61 0.61 8.97% 8.16%

27 PLIN Plaza Indonesia Realty Tbk 15-Jun-92 6.58% 5.77% 3.91% 3.91% 2.06 2.06 14.63% 13.82%

28 SMAR SMART Tbk 20-Nop-1992 6.58% 5.77% 3.91% 3.91% 0.75 0.75 9.51% 8.70%

29 SMCB Holcim Indonesia Tbk 10-Agust-1997

6.58% 5.77% 3.91% 3.91% 1.23 1.23 11.39% 10.58%

30 TBIG PT Tower Bersama Infrastructure Tbk

26-Okt-2010 6.58% 5.77% 3.91% 3.91% 0.33 0.33 7.87% 7.06%

31 TRIO Trikomsel Oke Tbk 14-Apr-09 6.58% 5.77% 3.91% 3.91% 1.01 1.01 10.53% 9.72%

32 UNSP Bakrie Sumatera Plantations Tbk

6-Mar-90 6.58% 5.77% 3.91% 3.91% 1.38 1.38 11.98% 11.17%

33 WIKA Wijaya Karya Tbk 29-Okt-2007 6.58% 5.77% 3.91% 3.91% 1.68 1.68 13.15% 12.34%

34 EMTK Elang Mahkota Teknologi Tbk 12-Jan-10 6.58% 5.77% 3.91% 3.91% 1.29 1.29 11.62% 10.81%

35 PBRX Pan Brothers Tbk 16-Agust-1990

6.58% 5.77% 3.91% 3.91% 0.45 0.45 8.34% 7.53%

36 AUTO Astra Otoparts Tbk 15-Jun-98 6.58% 5.77% 3.91% 3.91% 1.47 1.47 12.33% 11.52%

37 HERO Hero Supermarket Tbk 02-Des-1989 6.58% 5.77% 3.91% 3.91% 0.74 0.74 9.47% 8.66%

38 ASII Astra International Tbk 4-Apr-90 6.58% 5.77% 3.91% 3.91% 1.21 1.21 11.31% 10.50%

39 COWL COWELL DEVELOPMENT Tbk

19-Des-2007 6.58% 5.77% 3.91% 3.91% 0.86 0.86 9.94% 9.13%

40 BNBR Bakrie & Brothers Tbk 28-Agust-1989

6.58% 5.77% 3.91% 3.91% 0.27 0.27 7.64% 6.83%

41 WEHA Panorama Transportasi Tbk 31-Mei-2007 6.58% 5.77% 3.91% 3.91% 0.86 0.86 9.94% 9.13%

42 CENT Centrin Online Tbk 01-Nop-2001 6.58% 5.77% 3.91% 3.91% -0.19 -0.19 5.84% 5.03%

43 CPIN Charoen Pokphand Indonesia Tbk

18-Mar-91 6.58% 5.77% 3.91% 3.91% 1.85 1.85 13.81% 13.00%

44 AALI Astra Agro Lestari Tbk 09-Des-1997 6.58% 5.77% 3.91% 3.91% 0.27 0.27 7.64% 6.83%

45 BHIT PT MNC Investama Tbk. 24-Nop-1997 6.58% 5.77% 3.91% 3.91% 1.03 1.03 10.61% 9.80%

46 SULI PT SLJ Global Tbk 21-Mar-94 6.58% 5.77% 3.91% 3.91% 1.54 1.54 12.60% 11.79%

47 GZCO Gozco Plantations Tbk 15-Mei-2008 6.58% 5.77% 3.91% 3.91% 1.14 1.14 11.04% 10.23%

48 ETWA Eterindo Wahanatama Tbk 16-Mei-1997 6.58% 5.77% 3.91% 3.91% 0.62 0.62 9.00% 8.19%

menggunakan rumus CAPM (capital asset pricing model), dengan rumus sebagai

berikut.

E (Ri) = Rf + β (MRP)

Keterangan:

E (Ri) : Tingkat pengembalian yang diinginkan

Rf

: Tingkat suku bunga investasi yang dapat diperoleh tanpa resiko

(tingkat suku bunga SBI). Diambil dari

website www.bi.go.id,

berdasarkan tingkat suku bunga rata-rata tahun penelitian.

β

: Faktor resiko yang berlaku spesifik untuk masing–masing bank.

Data beta masing-masing perusahaan diambil dari

www.reuters.com

MRP : (

Market Resk Premium

). Sumber data diambil dari survey

Damodaran tentang MRP negara-negara di dunia pada tahun 2012

dari

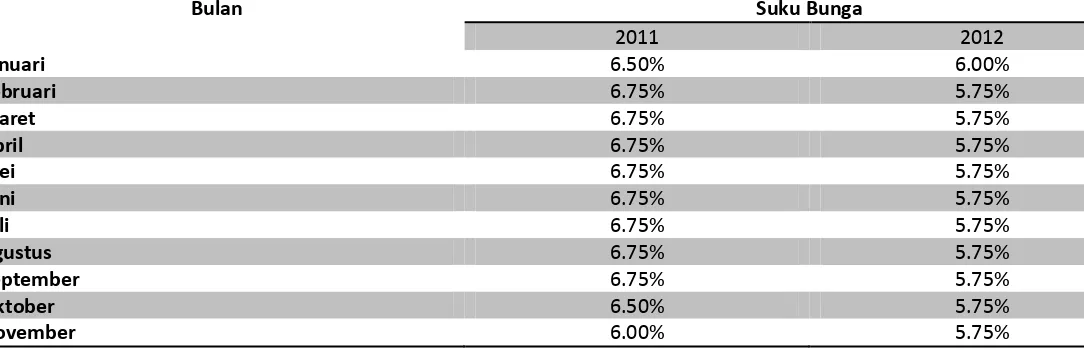

Tabel 3

Tingkat Suku Bunga Berdasarkan BI

Bulan

Suku Bunga

2011

2012

Januari

6.50%

6.00%

Februari

6.75%

5.75%

Maret

6.75%

5.75%

April

6.75%

5.75%

Mei

6.75%

5.75%

Juni

6.75%

5.75%

Juli

6.75%

5.75%

Agustus

6.75%

5.75%

September

6.75%

5.75%

Oktober

6.50%

5.75%

Desember

6.00%

5.75%

Total

79.00%

69.25%

Rata2

6.58%

5.77%

Sumber:

www.bi.go.id

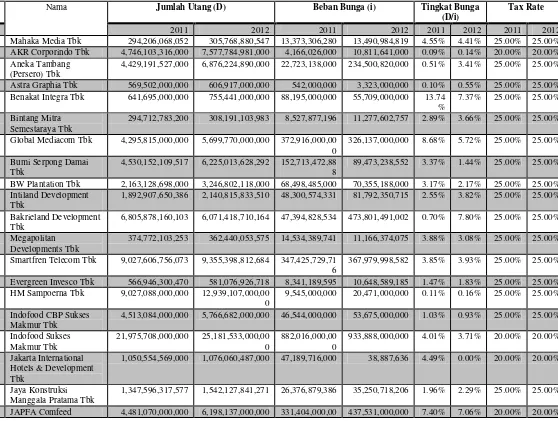

Lampiran 3

PERHITUNGAN COST OF DEBT

Tabel 4

Rekapitulasi Perhitungan

Cost of Debt

No. Nama Jumlah Utang (D) Beban Bunga (i) Tingkat Bunga

(D/i)

Tax Rate

2011 2012 2011 2012 2011 2012 2011 2012

1 Mahaka Media Tbk 294,206,068,052 305,768,880,547 13,373,306,280 13,490,984,819 4.55% 4.41% 25.00% 25.00%

2 AKR Corporindo Tbk 4,746,103,316,000 7,577,784,981,000 4,166,026,000 10,811,641,000 0.09% 0.14% 20.00% 20.00%

3 Aneka Tambang (Persero) Tbk

4,429,191,527,000 6,876,224,890,000 22,723,138,000 234,500,820,000 0.51% 3.41% 25.00% 25.00%

4 Astra Graphia Tbk 569,502,000,000 606,917,000,000 542,000,000 3,323,000,000 0.10% 0.55% 25.00% 25.00%

5 Benakat Integra Tbk 641,695,000,000 755,441,000,000 88,195,000,000 55,709,000,000 13.74 %

7.37% 25.00% 25.00%

6 Bintang Mitra Semestaraya Tbk

294,712,783,200 308,191,103,983 8,527,877,196 11,277,602,757 2.89% 3.66% 25.00% 25.00%

7 Global Mediacom Tbk 4,295,815,000,000 5,699,770,000,000 372,916,000,00 0

326,137,000,000 8.68% 5.72% 25.00% 25.00%

8 Bumi Serpong Damai Tbk

4,530,152,109,517 6,225,013,628,292 152,713,472,88 8

89,473,238,552 3.37% 1.44% 25.00% 25.00%

9 BW Plantation Tbk 2,163,128,698,000 3,246,802,118,000 68,498,485,000 70,355,188,000 3.17% 2.17% 25.00% 25.00%

10 Intiland Development Tbk

1,892,907,650,386 2,140,815,833,510 48,300,574,331 81,792,350,715 2.55% 3.82% 25.00% 25.00%

11 Bakrieland Development Tbk

6,805,878,160,103 6,071,418,710,164 47,394,828,534 473,801,491,002 0.70% 7.80% 25.00% 25.00%

12 Megapolitan Developments Tbk

374,772,103,253 362,440,053,575 14,534,389,741 11,166,374,075 3.88% 3.08% 25.00% 25.00%

13 Smartfren Telecom Tbk 9,027,606,756,073 9,355,398,812,684 347,425,729,71 6

367,979,998,582 3.85% 3.93% 25.00% 25.00%

14 Evergreen Invesco Tbk 566,946,300,470 581,076,926,718 8,341,189,595 10,648,589,185 1.47% 1.83% 25.00% 25.00%

15 HM Sampoerna Tbk 9,027,088,000,000 12,939,107,000,00 0

9,545,000,000 20,471,000,000 0.11% 0.16% 25.00% 25.00%

16 Indofood CBP Sukses Makmur Tbk

4,513,084,000,000 5,766,682,000,000 46,544,000,000 53,675,000,000 1.03% 0.93% 25.00% 25.00%

17 Indofood Sukses Makmur Tbk

21,975,708,000,000 25,181,533,000,00 0

882,016,000,00 0

933,888,000,000 4.01% 3.71% 20.00% 20.00%

18 Jakarta International Hotels & Development Tbk

1,050,554,569,000 1,076,060,487,000 47,189,716,000 38,887,636 4.49% 0.00% 20.00% 20.00%

19 Jaya Konstruksi Manggala Pratama Tbk

1,347,596,317,577 1,542,127,841,271 26,376,879,386 35,250,718,206 1.96% 2.29% 25.00% 25.00%

Indonesia Tbk 0

21 Jasa Marga Tbk 12,555,380,912,000 14,965,765,873,00 0

32,556,507,000 90,906,859,000 0.26% 0.61% 25.00% 25.00%

22 Jakarta Setiabudi Internasional Tbk

1,255,753,036,014 1,500,018,745,925 33,370,909,000 30,127,931,000 2.66% 2.01% 25.00% 25.00%

23 Mitra Adiperkasa Tbk 2,621,209,018,000 3,817,911,733,000 123,418,316,00 0

165,069,599,000 4.71% 4.32% 20.00% 20.00%

24 Modern Internasional Tbk

633,475,393,678 747,255,823,658 33,033,393,510 57,383,961,631 5.21% 7.68% 20.00% 20.00%

25 Media Nusantara Citra Tbk

1,963,727,000,000 1,663,780,000,000 134,904,000,00 0

38,294,000,000 6.87% 2.30% 25.00% 25.00%

26 Panorama Sentrawisata Tbk

503,585,205,000 731,463,523,000 26,180,639,000 38,698,224,000 5.20% 5.29% 25.00% 25.00%

27 Plaza Indonesia Realty Tbk

1,935,307,318,000 1,717,982,629,000 57,830,490,000 47,306,247,000 2.99% 2.75% 25.00% 25.00%

28 SMART Tbk 7,386,347,000,000 7,308,000,000,000 276,506,000,00 0

250,070,000,000 3.74% 3.42% 25.00% 25.00%

29 Holcim Indonesia Tbk 3,423,241,000,000 3,750,461,000,000 121,241,000,00 0

119,586,000,000 3.54% 3.19% 30.63% 27.87%

30 PT Tower Bersama Infrastructure Tbk

4,174,997,000,000 10,072,090,000,00 0

246,597,000,00 0

467,482,000,000 5.91% 4.64% 25.00% 25.00%

31 Trikomsel Oke Tbk 3,410,301,506,712 3,506,469,551,540 173,853,493,58 1

225,087,039,559 5.10% 6.42% 25.00% 25.00%

32 Bakrie Sumatera Plantations Tbk

9,644,732,756,000 11,068,929,244,00 0

464,017,632,00 0

553,701,443,000 4.81% 5.00% 20.00% 20.00%

33 Wijaya Karya Tbk 6,103,603,696,000 8,131,203,824,000 15,696,279,000 36,228,187,000 0.26% 0.45% 25.00% 25.00%

34 Elang Mahkota Teknologi Tbk

2,361,844,476,000 2,311,678,445,000 139,048,746,00 0

78,434,894,000 5.89% 3.39% 25.00% 25.00%

35 Pan Brothers Tbk 830,702,000,088 1,178,597,390,919 29,212,953,895 34,894,964,875 3.52% 2.96% 25.00% 25.00%

36 Astra Otoparts Tbk 2,241,333,000,000 3,396,543,000,000 55,549,000,000 99,586,000,000 2.48% 2.93% 25.00% 25.00%

37 Hero Supermarket Tbk 2,297,397,000,000 3,619,007,000,000 26,197,000,000 42,054,000,000 1.14% 1.16% 25.00% 25.00%

38 Astra International Tbk 78,481,000,000,000 92,460,000,000,00 0

710,000,000,00 0

1,021,000,000,0 00

0.90% 1.10% 20.00% 20.00%

39 COWELL

DEVELOPMENT Tbk

221,859,863,217 644,554,039,238 2,475,684,262 7,562,146,144 1.12% 1.17% 25.00% 25.00%

40 Bakrie & Brothers Tbk 19,613,262,083,000 13,046,034,152,00 0

978,489,079,00 0

1,029,361,680,0 00

4.99% 7.89% 20.00% 20.00%

41 Panorama Transportasi Tbk

183,819,033,243 301,192,327,415 15,705,913,369 24,902,705,614 8.54% 8.27% 25.00% 25.00%

42 Centrin Online Tbk 15,100,322,284 24,654,856,055 893,644,840 236,963,329 5.92% 0.96% 25.00% 25.00%

43 Charoen Pokphand Indonesia Tbk

2,658,734,000,000 4,172,163,000,000 34,510,000,000 51,559,000,000 1.30% 1.24% 20.00% 20.00%

44 Astra Agro Lestari Tbk 1,778,337,000,000 3,054,409,000,000 25,778,000,000 31,750,000,000 1.45% 1.04% 25.00% 25.00%

45 PT Bhakti Investama Tbk.

6,665,467,000,000 8,827,432,000,000 488,077,000,00 0

400,105,000,000 7.32% 4.53% 25.00% 25.00%

46 PT SLJ Global Tbk 1,654,048,778,442 1,475,195,895,066 74,366,736,121 48,156,958,167 4.50% 3.26% 25.00% 25.00%

47 Gozco Plantations Tbk 1,327,475,994,963 1,587,372,557,439 67,032,815,309 79,442,606,567 5.05% 5.00% 25.00% 25.00%

48 Eterindo Wahanatama Tbk

398,012,966,050 523,207,574,539 6,158,721,572 9,708,630,934 1.55% 1.86% 20.00% 20.00%

Perhitungan cost of debt didasarkan

Cost of Debt

setelah pajak dihitung

atas pinjaman baru (1- Tingkat pajak). Adapun hasil perhitungannya dapat dilihat

pada tabel di atas.

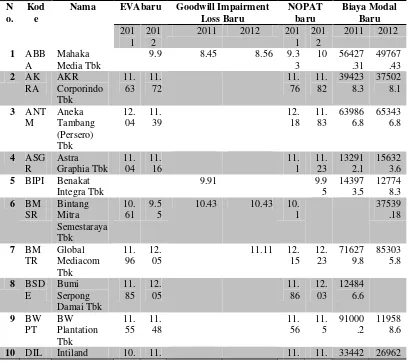

Lampiran 4

PERHITUNGAN ROIC

Tabel 5

No.

Kode

Nama

NOPAT tanpa pengaruh Goodwill

Impairment Loss (NOPAT + Goodwill

Impairment Loss)

Average Invested Capital

2011

2012

2011

1

ABBA

Mahaka Media Tbk

2,409,122,541

10,438,184,574

52,013,864,661

42,691,656,

2

AKRA

AKR Corporindo Tbk

580,398,681,600

664,284,616,800

2,648,065,372,000

3,091,731,314,500

3

ANTM

Aneka Tambang

(Persero) Tbk

1,509,658,818,750

671,898,042,000

4,887,813,233,000

5,501,478,476,000

4

ASGR

Astra Graphia Tbk

126,678,750,000

170,293,500,000

256,281,500,000

357,829,500

5

BIPI

Benakat Integra Tbk

5,550,000,000

8,988,750,000

263,084,000,000

247,205,500

6

BMSR

Bintang Mitra

Semestaraya Tbk

39,855,666,526

4,956,633,825

-21,519,367,465

54,518,631,

7

BMTR

Global Mediacom Tbk

1,417,979,250,000

1,841,535,750,000

5,557,430,000,000

8,902,673,000,000

8

BSDE

Bumi Serpong Damai

Tbk

720,416,534,774

1,073,666,191,907

169,648,621,105

-649,055,267

9

BWPT

BW Plantation Tbk

362,220,059,250

312,968,502,000

177,460,368,000

397,511,629

10

DILD

Intiland Development

Tbk

140,725,908,878

227,747,878,675

1,195,194,416,027

820,577,490

11

ELTY

Bakrieland

Development Tbk

214,822,611,436

588,813,557,581

4,150,276,789,742

2,996,454,989,677

12

EMDE

Megapolitan

Developments Tbk

7,885,654,168

4,869,762,764

-134,608,951

61,717,821,

13

FREN

Smartfren Telecom

Tbk

-1,666,221,029,387

-1,201,948,052,673

4,014,209,887,094

6,931,041,128,331

14

GREN

Evergreen Invesco Tbk

10,215,825,695

12,762,951,704

430,926,355,272

463,509,234

15

HMSP

HM Sampoerna Tbk

8,103,962,250,000

10,012,837,500,000

7,565,494,500,000 10,412,751,500,000

16

ICBP

Indofood CBP Sukses

Makmur Tbk

1,956,561,000,000

2,131,545,000,000

3,487,349,500,000

4,212,777,000,000

17

INDF

Indofood Sukses

Makmur Tbk

5,481,984,800,000

5,496,475,200,000 11,529,530,000,000 13,548,768,000,000

18

JIHD

Jakarta International

Hotels & Development

Tbk

19

JKON

Jaya Konstruksi

Manggala Pratama

Tbk

164,808,873,589

208,289,447,446

53,439,832,464

246,233,975

20

JPFA

JAPFA Comfeed

Indonesia Tbk

877,768,000,000

1,334,603,200,000

4,074,675,500,000

5,018,192,000,000

21

JSMR

Jasa Marga Tbk

1,747,848,651,000

2,231,426,937,750

-2,893,931,386,500

-4,718,296,663,000

22

JSPT

Jakarta Setiabudi

Internasional Tbk

200,420,070,597

223,581,470,001

644,065,075,203

488,184,552

23

MAPI

Mitra Adiperkasa Tbk

497,812,020,000

609,032,342,400

1,387,305,441,500

1,676,843,286,500

24

MDRN

Modern Internasional

Tbk

83,214,328,438

97,279,308,230

414,392,007,971

535,399,466

25

MNCN Media Nusantara Citra

Tbk

1,186,177,500,000

1,661,110,500,000

3,739,559,000,000

5,449,972,500,000

26

PANR

Panorama

Sentrawisata Tbk

37,655,639,250

55,288,777,500

229,534,324,000

311,002,036

27

PLIN

Plaza Indonesia Realty

Tbk

141,621,645,000

335,490,560,250

1,391,015,625,000

1,083,769,912,500

28

SMAR

SMART Tbk

1,697,565,750,000

2,446,241,250,000

6,756,054,500,000

8,096,446,500,000

29

SMCB

Holcim Indonesia Tbk

1,171,691,210,200

1,470,339,034,100

7,360,109,440,585

8,774,031,500,000

30

TBIG

PT Tower Bersama

Infrastructure Tbk

530,614,500,000

960,291,750,000

222,333,500,000

-50,127,500,

31

TRIO

Trikomsel Oke Tbk

524,783,401,859

620,315,086,508

883,104,338,202

1,288,442,430,862

32

UNSP

Bakrie Sumatera

Plantations Tbk

718,329,171,200

288,631,551,200

4,974,094,476,000

7,550,176,452,048

33

WIKA

Wijaya Karya Tbk

490,305,875,250

634,062,465,750

3,571,991,572,000

3,491,210,832,000

34

EMTK

Elang Mahkota

Teknologi Tbk

897,794,430,750

1,022,353,839,000

943,365,767,000

1,410,915,995,500

35

PBRX

Pan Brothers Tbk

73,779,685,450

105,839,910,206

407,066,055,978

587,087,482

36

AUTO

Astra Otoparts Tbk

389,661,000,000

356,650,500,000

1,604,046,500,000

1,842,678,000,000

37

HERO

Hero Supermarket Tbk

287,861,250,000

330,924,000,000

973,093,000,000

1,160,327,500,000

38

ASII

Astra International

Tbk

14,265,600,000,000

15,896,000,000,000

7,390,500,000,000 15,350,000,000,000

39

COWL

COWELL

DEVELOPMENT Tbk

23,358,703,292

60,719,768,211

-56,419,873,314

41,054,510,

40

BNBR

Bakrie & Brothers Tbk

5,525,145,843

4,688,152,852

9,968,497,143,000

3,552,425,800,000

41

WEHA

Panorama

Transportasi Tbk

17,934,559,586

25,352,517,200

112,731,333,924

170,084,805

42

CENT

Centrin Online Tbk

1,464,211,513

-4,638,145,265

29,869,986,131

40,387,944,

43

CPIN

Charoen Pokphand

Indonesia Tbk

2,407,370,400,000

2,772,894,400,000

4,841,261,000,000

7,420,935,500,000

44

AALI

Astra Agro Lestari Tbk

2,396,745,750,000

2,590,296,750,000

2,693,158,500,000

3,423,109,500,000

45

BHIT

PT Bhakti Investama

Tbk.

1,455,258,750,000

2,054,073,750,000

6,089,946,500,000 10,362,928,500,000

46

SULI

PT SLJ Global Tbk

-126,395,899,282

-155,704,231,904

41,702,818,071

-213,000,454

47

GZCO

Gozco Plantations Tbk

78,233,666,702

64,495,395,666

237,443,552,561

305,092,191

48