A Dynamic Model for Cash Waqf Management as One of

The Alternative Instruments for The Poverty Alleviation

in Indonesia

Dian Masyita, et al

The Faculty of Economics, Padjadjaran University, Bandung, Indonesia

([email protected] & ([email protected])

Submitted and Presented Paper in The 23rd International Conference of

The System Dynamics Society, Sloan School of Management, Massachussets Institute of Technology (MIT), Boston, July 17-21, 2005

Abstract

This research tries to offer a design of the cash waqf management system in a system dynamics model. The Cash Waqf Management is expected to become one of the alternative instruments for the poverty alleviation programs in Indonesia. These programs require huge amount of fund that cannot be provided thoroughly by the government. Therefore, initiation of new sources of fund for such a program is inevitable. In the Islamic sosio-economic concept, there is a source of social fund that is sosio-economically and politically free of charge, namely cash waqf. In this concept, Nadzir (cash waqf fund manager) collects the fund from Waqif (cash waqf payer) and invest the money in the real sector and in any syariah-based investment opportunities. Nadzir will then allocate profits and returns gained from the investments to poverty alleviation programs. Nadzir is obliged to maintain the amount of fund in such a way that it does not go below the initial amount. Therefore, Nadzir not only should be highly capable, but also needs an experienced financial institution in helping SMEs development efforts. Using the system dynamics methodology, we try to design the structure of cash waqf system and simulate the behaviour of cash waqf model.

1. Preface

In the early 2005, the Indonesian poverty rate has been still discouraging. The poverty indices are still higher than those of the previous years. The economic crisis beginning in 1997, does not end until now. In addition, the Tsunami Disasters destroyed two provinces in Indonesia i.e Nanggroe Aceh Darussalam and North Sumatra in the end of the year 2004. Based on the Statistics Central Bureau (BPS)’s data, there are about 40 million Indonesian people who are under the poverty line.

Indonesia has come into debt trap made by the Indonesian government and the private sectors. Large amount of debt has weakened Indonesian economy for the past seven years. Currently, Indonesian foreign debt is approximately USD 130 billions, which consists of government foreign debt of USD 70 billions and private sector’s foreign debt of USD 60 billions. In addition, domestic government debt has reached IDR 650 trillions level. Nevertheless, the amount of the debt has been inceasing since Consultative Group on Indonesia (CGI) meeting in Bali (January 2003) decided to issue a USD 2.7 billion loan to Indonesia.

Meanwhile, the government has been confronted with the deficit budget almost every year since 1997, which means that the government may find it difficult to cover its routine expenditures. Those regular balance sheet items require so large amount of fund that government cannot provide adequate fund for other strategic needs, such as good education, appropriate health, poverty, and SME’s development. Mismanagement of debts is the largest of all factors that make Indonesian go into crisis. Consequently, all of citizens and their offsprings have to carry the heavy burden of that debt.

2. Problem Identification

One of potential solutions to the necessity of sufficient fund for public needs is waqf fund from people’s donation. People donate their money as cash waqf by purchasing cash waqf certificate. The gathered fund will be then invested in various investment portfolio and the profit of which can be spent for the above mentioned public necessities. The gained profit will also be used for funding poverty alleviation programs, while the principal of funds will be reinvested in various highly profitable investment opportunities.

Waqif donates his/her money as waqf fund to Mauquf’alaih (a person who is entitled to get benefit from waqf fund) through Nadzir (a person/an institution being in charge for managing waqf fund and distributing returns of waqf investment). Only gains of the invested waqf fund will be delivered to

Mauquf’alaih. The principal of funds keep being invested in potential investment opportunities. In relation to its role as waqf fund investment manager, Nadzir on behalf of Waqf Institution may allocate some waqf funds to financial portfolio and finance SMEs’ businesses on the basis of profit-loss sharing system.

The larger the investment returns, the more fund can be allocated to poverty alleviation program. In some countries, waqf fund management has

reduced poverty effectively and enhanced people’s welfare, by providing additional fund for education & health development programs, cheap houses & public facilities development programs, and so forth.

3. Objectives of Research

This research is expected to be able to find out the potency of an Islamic innovation financial instrument, expecially cash waqf, to alleviate the poverty in Indonesia. This research also tries to offer a design of the cash waqf management system in a system dynamics model. Using the system dynamics methodology, we tries to know the structure of cash waqf system and simulate the behaviour of cash waqf model.

On the next part of this paper, we will discuss definition, law, and history of cash waqf to recognize the concept and its potential benefit.

4. Problem Definition : Cash Waqf

Previously, waqf of building and land are the most popular forms of waqf. Nowadays, cash waqf has become increasingly well-known, particularly because of its flexibility, which allows distribution of the waqf’s potential benefit to be benefited by the poor anywhere.

Cash waqf was firstly introduced in Ottoman era in Egypt. Professor Mannan then sosialized cash waqf in Bangladesh through Social Investment Bank Limited (SIBL). SIBL issues Cash Waqf Certificate to collect funds from the rich and distributes gains of the managed funds to the poor.

Like those of Bangladesh, most of Indonesian people are poor. Characteristic of communities in both countries are also similar. Therefore, effectiveness of cash waqf certificate program to help reduce poverty in Bangladesh gives hope that analogous program can be successfully implemented in Indonesia.

Fatwa Commission, Board of Indonesian Moslem Scholars, responded the necessity of cash waqf certificate program in Indonesia by issuing the following

fatwa (dated on 11 May 2002):

a. Cash Waqaf (Waqf al-Nuqud) is waqf donated by individual, group of individuals, or legal entity, in cash.

b. Cash waqf includes securities.

c. Money donated as waqf is not forbidden (jawaz).

d. Cash waqf can only be distributed and allocated for anything not against

syariah (Islamic law).

e. Existence of waqf fund should be conserved. Waqf fund cannot be transferred to anyone.

4.1. Cash Waqf Certificate Framework

Waqif is a person who donate some money as waqf by purchasing cash waqf certificate. The certificate can be bought in the name of family member, even

if he/she is already dead. Waqif expects return of the managed fund to be assigned for certain purpose, e.g. public facility development, poor people rehabilitation, etc.

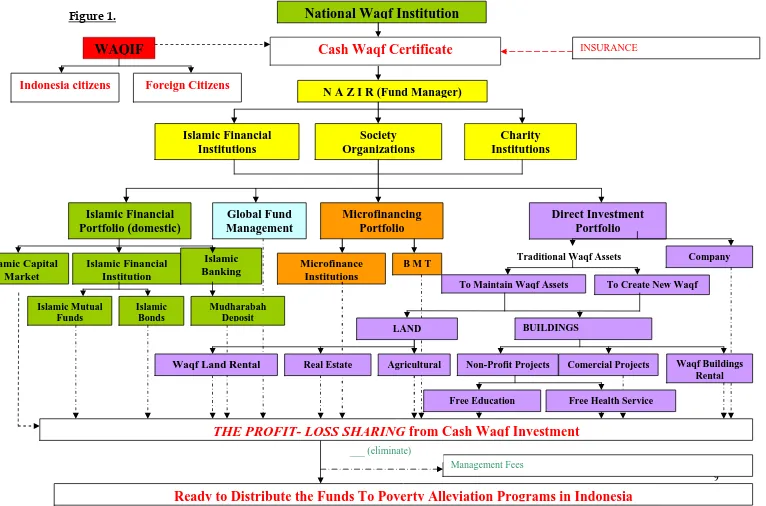

Nadzir invests the collected fund in various investment portfolios. Nadzir

may (1) invest the fund in syariah (non interest) banking products of both domestic and overseas banks, (2) finance selected businesses, (3) establish new prospective businesses, or (4) finance small and medium scale enterprises (SMEs).(see Figure 1)

4.2. Cash Waqf Certificate

According to Mannan (1998), the objectives of cash waqf certificate are;

(1) to equip banks and other waqf management institutions with cash waqf certificate,

(2) to help collect social savings through cash waqf certificate (cash waqf certification can be done in the name of other beloved family member to strengthen familiy integration among rich families),

(3) to help transform the collected social savings to social capital, as well as to help develop social capital market,

(4) to increase social investment,

(5) to encourage rich communities’ awareness on their responsibility for social development in their environment.,

(6) to stimulate integration between social security and social welfare.

As cash waqf practice has not yet been popular in Indonesia, cash waqf management institutions in Indonesia can replicate successful practices from other countries, such as Bangladesh.

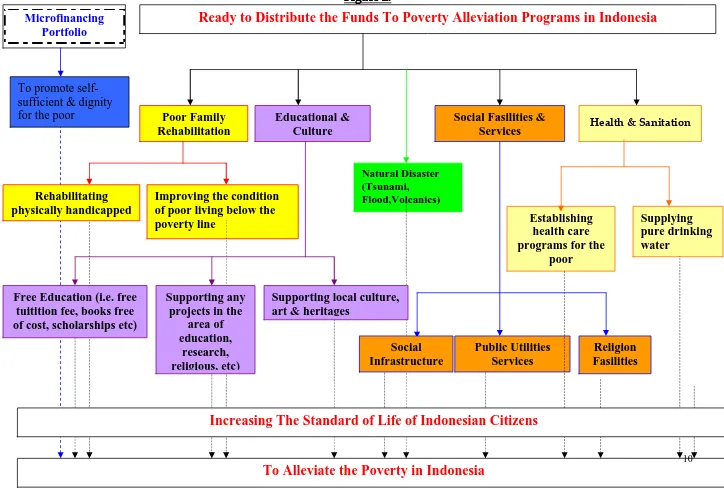

In addition to the above-mentioned objectives of cash waqf practice, profit of the managed waqf fund can be allocated for: (see figure 2)

1. Poor Family Rehabilitation.

Enhancing poor people’s welfare 2. Educational and Cultural Development.

Supplying free books

Funding relevant research and development Improving educational programs

Scholarship Grant for schools

Preserving and developing cultural values 3. Health and Sanitation

Health and Sanitation for poor people Establishing health center

Providing cheap medicines with appropriate quality 4. Social services

5. Building facilities for religious activity 6. Fixing social facilities.

Aspects involved when purchasing Cash Waqf Certificate include: One’s own welfare (in this life and life after death)

Family’s welfare (in this life and life after death) Social welfare and social investment

Developing social awareness: social security for poor people and social harmony for rich people.

Contribution of cash waqf to sosio-economic development in developing countries is significant. Fund collected through cash waqf certificate program can be allocated to social-related development areas (e.g., agriculture, education, health, and infrastructure), urban poverty alleviation program, and other public service development. This opportunity in turn will reduce poverty level and will allow people help themselves (Mannan,1998).

Cash waqf certificate will be issued in various denominations, e.g. IDR (Rupiah)-100-million, IDR-50-million, IDR-10-million, IDR-5-million, and IDR-1-million, in order that more prospective donors can afford them. Name of the donor (it can be on behalf of dead individual) and specific purpose of the donation (e.g. for educational services, health assistance, or other welfare enhancement efforts) will be stated on the certificate.

4.3. Requirements for Nadzir

Utomo (2001) states that cash waqf management institution is a legal entity, and therefore should fulfil some requirements, which are called rukun waqf. The rules can be explained as follows:

a. Al-waqif is a person who donates waqf fund. He/she should be health physically and mentally. The decision to donate should not be made under pressure.

b. Assets or fund donated as waqf are technically called al-mawquf in fiqh

(Islamic law). Existence of mawquf should be clear and durable. Therefore, people can benefit from the waqf for long time.

c. Those who are entitled to benefit from return of waqf fund management are al-mawquf ‘alaih.

d. The way of a waqif stating his/her asset or fund as waqf is called sighah.

Dr.Muhammad Anwar Ibrahim in his paper titled “Wakaf Dalam Syariat Islam (Waqf in Islamic Law)”1 explains conditions that should be satisfied in managing cash waqf. They are as follows:

1. Nadzir is a person/entity that is assigned to manage waqf fund.

1This paper was presented in International Workshop on People’s Economy Empowerment

Through Productive Waqf Management, in Batam, 2002.

2. As a matter of fact, waqif has the right to determine person or institution that will manage his/her waqf fund. If a waqif does not appoint a nadzir, then Kadi

(Islamic Judge) will do it for him/her. [Asy-Syarbini op.cit p. 396].

3. Fiqh experts determine flexible requirements for being a Nadzir. Fit and proper

nadzir should be capable of managing waqf fund to be productive source of capital. If a nadzir cannot do his job properly, Kadi must replace him with someone else after explaining reasons for the replacement.

4. Nadzir’s responsibilities include:

Maintaining waqf asset, preparing waqf asset for rent, managing waqf fund, collecting waqf investment returns and distributing them to al-mawquf ‘alaih.

Fiqh expert can expand these authorities as needed.

5. Nadzir’s division of work. A waqif can appoint more than one nadzir to handle his/her waqf fund. If a waqif does so, each nadzir will conduct a more specific job. Asset maintenance, investment management, and investment return distribution will be carried out by different nadzir. If there are more than one

nadzir for one job, a decision can only be made after necessary consultation among them.[Asy-Syarbini op.cit. hal 410-411].

6. Salary for Nadzir. Waqif may determine certain amount of money or percentage of waqf investment return as compensation for nadzir. A nadzir will not receive any compensation if he quits the job or gets fired. [Ibid].

7. A Nadzir cannot take any part of waqf fund.[Ibid hal 412].

As the appointed nadzir, fund manager may carry out the followings to sustain investment return of cash waqf fund:

1. Invest cash waqf fund in various domestic or global syariah portfolios with good prospect.

2. Invest cash waqf fund in real sectors or businesses whose sources, process, and outputs are in line with syariah. Fund can be invested in existing business or in newly initiated one. Nadzir may establish new businesses that provide public services, such as convenience stores, hypermarkets, basic food stores, universities, hospitals, etc. This will generate more job opportunities and appropriately satisfy some people’s basic needs.

3. Allocate some of the collected fund as profit sharing-based loan to selected small businesses. Technical and managerial assistance are required to accompany this investment. If this investment runs well, nadzir will not only generate returns, but also help accelerate poor people’s economic development.

Nadzir should also pay attention on some points described below:

a. Transparency. Nadzir has to manage cash waqf fund transparently and regularly make financial and performance reports, which are accessible by waqif.

b. Productivity. Nadzir has to be able to manage the fund productively, so that disadvantaged people can benefit form cash waqf fund continuously.

c. Trustable. Integrity of a nadzir is crucial. It has to avoid any business opportunity and process that can lead to moral hazard. All proposed business activities should be assessed in terms of Islamic law.

4.4. Cash Waqf Management Institution’s Duties and Responsibilities

Waqf Management Institution should manage waqf fund in such a way that the collected fund become more and more productive. The more the waqf investment return, the more mawquf ‘alaih benefit from waqf fund. According to

fiqh, nadzir, as a waqf fund manager, is obliged to handle the fund productively (Utomo, 2001). Furthermore, Manshur bin Yunus al-Bahuty states in Syarh Muntaha al-Adaab (p. 504-505) that nadzir is responsible for maintaining, expanding, and developing waqf assets in order that they can provide some income such as investment return, rent fee, agricultural products, etc.

4.5. Waqif’s Requirements

Waqif has a right to settle on particular requirements related to his/her waqf. Such a requirement is classified in two groups, i.e. (1) requirement that goes in line with syariah, and (2) condition that does not align with syariah. Nadzir does not have to obey the latter, even if waqif has agreed to donate his fund as waqf. Any rule or requirement should not violate Islamic law. Fiqh experts affirm that power of waqif’s requirement status should not contravene Allah the Almighty’s rule.

5. Research Metodology

This research used system dynamics methodology to capture dynamic phenomenon of a system, in which variables change simultaneously as time moves. It also carried out a survey on possible implementation of cash waqf in Jakarta and Jawa Barat. The survey concluded that most people did not trust any existing government institution to manage cash waqf fund and control its investment activities, especially because cash waqf management will involve large amount of endowment funds. Most of them also recommend that if a special purpose institution is established to manage cash waqf fund, it has to be highly capable of detecting any potential dishonesty and assessing performance of cash waqf fund manager, i.e. nadzir. Therefore, it’s necessary to design an instrument which is able to control the cash waqf management.

Based on the survey’s result, using exclusively designed computer program then simulated some scenarios of cash waqf implemention to formulate some policy concepts applicable in Indonesia. The computer program was designed to help the policy makers (1) estimate cash waqf potential in alleviating poverty in Indonesia, (2) supervise performance of nadzir or waqf fund management institution, and (3) identify appropriate policies conducive to poverty alleviation programs.

Since there was no similar study preceding the research, some assumptions were applied. The ability of three national TV corporations (RCTI, SCTV, and

Indosiar) to collect donation amounting IDR 2 billions in two nights in 2000 and the other charity programs to collect donation in 2001-2005 were used as an assumption basis of amount of fund could be gathered by cash waqf management institution. This research also used data supplied by Biro Pusat Statistik Republik of Indonesia (National Beaurau for Statistics), BKKBN Republic of Indonesia (National Coordinating Agency for Family Planning) and Islamic Financial Institution.

5.1Limitation of Research

This research put more emphasived on financial management expecially raising and investing of cash waqf funds. The duties of Nazir, as a cash waqf fund manager, are to increase the cash waqf funds and invest those funds in profitable portfolios. As we know, the poverty alleviation problems are complicated. However, they need multidiscipline knowledge to formulate and figure out the solutions. With this research we want to try to make an early design of poverty alleviation in the financial viewpoint using system dynamics modeling.

9

National Waqf Institution

Figure 1.

N A Z I R (Fund Manager)

Islamic Financial Institutions

Society Organizations

Charity Institutions

Cash Waqf Certificate

WAQIF

INSURANCEMicrofinancing Portfolio

Islamic Mutual Funds

Microfinance Institutions

Direct Investment Portfolio Islamic Financial

Portfolio (domestic)

Company B M T

Islamic Capital Market

Islamic Financial Institution

Islamic Banking

Islamic Bonds

To Create New Waqf To Maintain Waqf Assets

Traditional Waqf Assets

BUILDINGS

Non-Profit Projects Comercial Projects

Free Education

Management Fees

Ready to Distribute the Funds To Poverty Alleviation Programs in Indonesia

LAND

Agricultural

Free Health Service

Waqf Buildings Rental

___ (eliminate)

THE PROFIT- LOSS SHARING from Cash Waqf Investment

Indonesia citizens Foreign Citizens

Global Fund Management

Mudharabah Deposit

Figure 2. Figure 2.

Ready to Distribute the Funds To Poverty Alleviation Programs in Indonesia

Microfinancing Portfolio

Poor Family

Rehabilitation Health & Sanitation

Establishing health care programs for the

poor

Supplying pure drinking water

Natural Disaster (Tsunami, Flood,Volcanics)

Social Fasilities & Services Educational &

Culture

Improving the condition of poor living below the poverty line

Public Utilities Services

To Alleviate the Poverty in Indonesia

Supporting local culture, art & heritages

Social Infrastructure

Religion Fasilities

To promote self-sufficient & dignity for the poor

Rehabilitating physically handicapped

Free Education (i.e. free tuitition fee, books free of cost, scholarships etc)

Supporting any projects in the

area of education,

research, religious, etc)

Increasing The Standard of Life of Indonesian Citizens

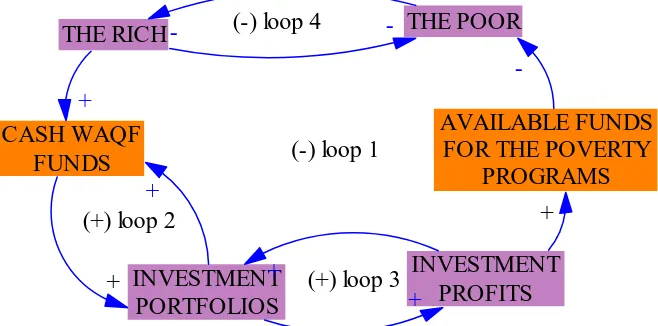

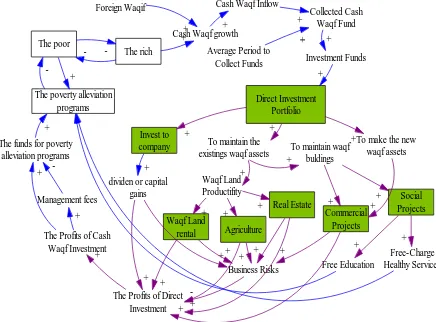

6. General Description of System Conceptualization

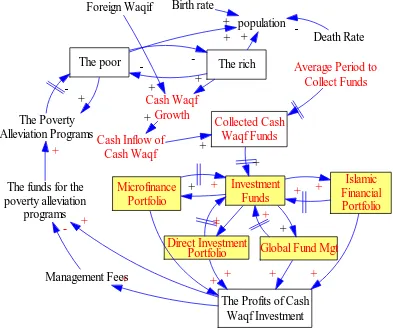

The system conceptualization involves establishing model boundary, identifying causal relationships and policy framework2. In this research the model boundary includes all relevant factors that are considered important in the problem context. The model comprises six interrelated components in the cash waqf management as shown as Figure 3.

THE POOR THE RICH

CASH WAQF FUNDS

INVESTMENT PORTFOLIOS

+ INVESTMENT

PROFITS

AVAILABLE FUNDS FOR THE POVERTY

PROGRAMS

+

+

-+

+

(-) loop 1

(+) loop 2

+ (+) loop 3 (-) loop 4

-

-Figure 3. A Macro-view of Model

As depicted in the above causal loop, the model links among the rich, cash waqf fund, investment portfolios, investment profits, available funds for the poverty programs and the poor.

A general system of cash waqf model, derived from a macro-view of model above, consists of six sectors i.e:

1). The cash waqf fund raising sectors (the rich links to the collected-cash waqf funds),

2) The Islamic financial portfolios sectors, 3) The global fund management sectors,

4) The direct investment in large and medium scale enterprises, 5) The microfinance sectors.

( number 2,3,4,5 are investment portfolios which link to investment profits)

6) The distribution sectors of the profits of cash waqf investment. (Investment profits link to the poor through the poverty programs).

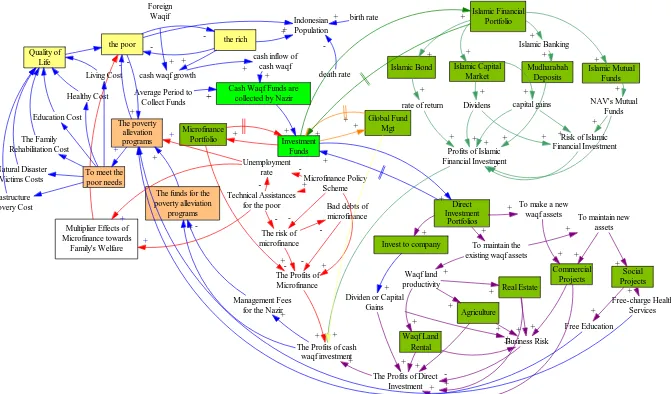

The Interrelationship among variables can be seen in Figure 4.

2

Sushil (1993), System Dynamics “A Practical Approach for Managerial Problems”,Wiley Eastern Limited.

Figure 4. The Interrelationship Among Variables in the General System

Islamic Financial Portfolio

Microfinance Portfolio

The Profits of Microfinance The risk of microfinance

Microfinance Policy Scheme

Bad debts of microfinance Unemployment

rate

Technical Assistances for the poor

+ cash waqf growth

cash inflow of cash waqf

Cash Waqf Funds are collected by Nazir Average Period to

Collect Funds

The Profits of cash waqf investment Management Fees

for the Nazir The funds for the

poverty alleviation

Dividens capital gains Mudharabah

rate of return +

Profits of Islamic Financial Investment

+ +

+ +

+

Risk of Islamic Financial Investment

Invest to company To maintain the existing waqf assets

To make a new waqf assets

+ +

+

Dividen or Capital Gains

+

Waqf land productivity

To maintain new assets

The Profits of Direct Investment

Multiplier Effects of Microfinance towards

The interrelationship among the six sectors is described as following:

1) The cash waqf fund raising sectors

The responsibilities of this sector are collecting the cash waqf fund from the waqif and then distributing them to the investment portfolios. The profits of the investment will be distributed to the poor through the poverty alleviation programs. At which the profits will be distributed depend on the waqif requests such as the education, infrastructure, family rehabilitation, public health & sanitation.

In the cash waqf raising sectors, there are several causal relationship among the rich, who have the potency as a waqif, the gathered cash waqf fund, the invested funds to various portfolios, and the gained profits from investment which will be distributed to the poor. (see figure 5a and 5b).

population Birth rate

Cash Waqf Growth

Microfinance Portfolio

+

The rich The poor

Death Rate

Cash Inflow of Cash Waqf

Collected Cash Waqf Funds

Average Period to Collect Funds

Investment Funds

-+

+

+

+ +

+ +

-The Poverty Alleviation Programs

-+

Global Fund Mgt

+ Foreign Waqif

+

Islamic Financial Portfolio

Direct Investment Portfolio

+

+

The Profits of Cash Waqf Investment

+ + + +

es Management Fe+

+

+

+ +

+

The funds for the poverty alleviation

programs

-+

Figure 5a. Causal loop of The Cash Waqf Fund Raising

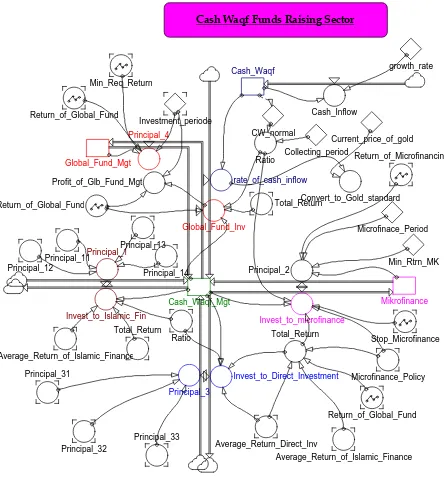

Cash Waqf Funds Raising Sector

Principal_32

Total_Return

growth_rate

Cash_Waqf

Min_Req_Return

Cash_Inflow Return_of_Global_Fund

Investment_periode

CW_normal

Principal_4

Current_price_of_gold Collecting_period

Principal_3 Principal_1

Principal_11 Principal_12

Principal_14 Principal_13

Principal_33 Principal_31

Ratio

Global_Fund_Inv

Invest_to_Islamic_Fin

Convert_to_Gold_standard

Cash_Waqf_Mgt Mikrofinance

Global_Fund_Mgt

Return_of_Global_Fund Total_Return

Invest_to_Direct_Investment

Invest_to_microfinance

Ratio Return_of_Microfinancin

rate_of_cash_inflow

Profit_of_Glb_Fund_Mgt

Return_of_Global_Fund

Microfinace_Period

Min_Rtrn_MK Principal_2

Total_Return

Stop_Microfinance

Average_Return_of_Islamic_Finance

Microfinance_Policy

Average_Return_Direct_Inv

Average_Return_of_Islamic_Finance

Figure 5b. Flow Diagram of The Cash Waqf Fund Raising

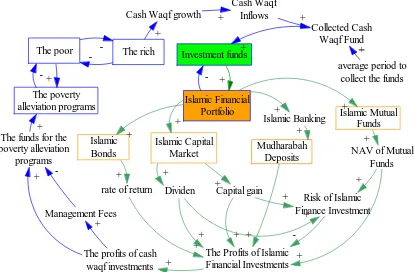

2) The Islamic financial portfolios sectors

The responsibilities of this sector are investing the cash waqf efficiency and effectively. The gathered cash waqf will be then invested by Nazir, a fund manager, in Islamic financial portfolios. The structure of Islamic banking and finance is firmly rooted in the Qur’an and the teachings of Muhammad which is called a Islamic Law3. Islamic Law has derived from revealed text a web of interrelated norms prohibiting interest-taking and undue speculative practices.

Generally, these portfolios are divided into four kinds i.e a). Islamic mutual funds, b). Islamic Capital Market Indices, c). Islamic Banking Products (Mudharaba Deposits), d) Islamic Bond. All of them are issued by Indonesian financial institutions.

The gained profits will be distributed to meet the poor’s basic needs and increase the quality of the poor’s life. Meanwhile, the principal keep being invested in potential investment opportunities. (see Figure 6a and 6b).

The rich The poor

Cash Waqf growth

Cash Waqf Inflows

Collected Cash Waqf Fund

average period to collect the funds Investment funds

The profits of cash waqf investments Management Fees

The funds for the poverty alleviation

Islamic Banking Islamic Mutual Funds

Dividen Capital gain

Mudharabah

Deposits NAV of Mutual Funds

rate of return +

The Profits of Islamic Financial Investments +

+ + +

+

Risk of Islamic Finance Investment

Figure 6a. Causal loop of The Islamic Financial Portfolios

3

Frank E.Vogel and Samuel L.Hayes III (1998), Islamic Law and Finance “religion, risk and return.” Published by Kluwer Law International.

Islamic Financial Portfolio Sector

Investment_periode Return_Islamic_Finance

Invest_to_Islamic_Fin

Principal_14

Invest_to_Islamic_Fin

Principal_12 Islamic_Mutual_Funds

Invest_to_Mutual_Funds

Min_Req_Return Return_Islamic_Mutual_Fund

Profit_of_Islamic_Bonds

Return_of_Islamic_Bonds

Invest_to_Islamic_Bond Islamic_Bonds

Principal_13

rn_Islamic_Finance Min_Req_Return

Invest_to_JII

Islamic_Capital_Market

Profit_of_Islamic_Cap_Mrkt

Invest_to_Mudharabah_Deposits

Principal_11 Return_Islamic_Finance

Profit_of_Islamic_Mutual_Funds

Investment_periode Invest_to_Islamic_Fin

Return_of_Deposit

Profit_of_Islamic_Deposits Profit_of_Islamic_Bonds

Mudarabah_Deposits

Profit_of_Islamic_Finance

Investment_periode Average_Return_of_Islamic_Finance

Profit_of_Islamic_Deposits Return_of_Islamic_Stocks

Return_Islamic_Finance Return_of_Islamic_Bonds Return_of_Islamic_Bonds Profit_of_Islamic_Mutual_Funds

Return_Islamic_Mutual_Fund

Return_of_Deposit

Return_of_Islamic_Stocks

Min_Req_Return

Figure 6b. Flow Diagram of of The Islamic Financial Portfolios

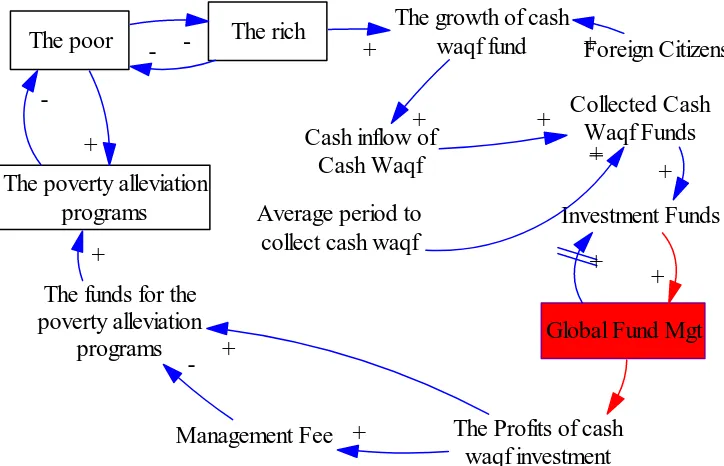

3) The global fund management sectors

The responsibilities of this sector are to invest the cash waqf fund in the global financial portfolios as known a global funds management such as Amanah Fund, Lariba Fund, Islamic Indices, etc. A fund manager should choose the portfolios not only high return but also safety. The better Nazir choose the investment portfolios, the higher profits will be gained and the more funds will be acquaired by the poor.

The principal then will be reinvested in various highly profitably investment opportunities. (see Figure 7a and 7b)

The rich

The poor The growth of cashwaqf fund

Cash inflow of Cash Waqf

Collected Cash Waqf Funds

Average period to collect cash waqf

Investment Funds

-+ +

+

+

The Profits of cash waqf investment Management Fee

The funds for the poverty alleviation

programs

- +

+

+

-The poverty alleviation programs

-+ +

Global Fund Mgt + Foreign Citizens +

+

Figure 7a. Causal loop of the global fund management portfolios

Global Fund Management Sector

Total_Return

Principal_4

Investment_periode

CW_normal

Convert_to_Gold_standard growth_rate

Cash_Waqf

Min_Req_Return

Cash_Inflow Return_of_Global_Fund

Current_price_of_gold Collecting_period

Global_Fund_Mgt Ratio

rate_of_cash_inflow

Profit_of_Glb_Fund_Mgt

Return_of_Global_Fund

Return_of_Microfinanc

Figure 7b. Flow Diagram of The global fund management portfolios

4) The direct investment in large and medium scale enterprises

A cash waqf fund manager, Nazir, allocates the gathered funds to the big companies in the forms of stocks which the gained profit are dividends or capital gains. The nature of this sector is the long term. The other forms of direct investment are building the new waqf buildings and maintaining the existings waqf assets either for social projects or the commercial projects. (See Figure 8a and 8b.)

The rich The poor

Cash Waqf growth

Cash Waqf Inflow

Collected Cash Waqf Fund Average Period to

Collect Funds Investment Funds

-+ +

+ +

Direct Investment Portfolio

The Profits of Cash Waqf Investment Management fees The funds for poverty

alleviation programs

company To maintain the existings waqf assets

To make the new waqf assets

+ + +

dividen or capital gains

+

Waqf Land Productifity

To maintain waqf buldings

The Profits of Direct Investment The poverty alleviation

programs

Figure 8a. Causal loop of the direct investment to real sectors

Direct Investment to Real Sectors

Return_Real_Estate

Principal_331a Age_of_Waqf_Prodctvty Principal_331b

Profit_of_Waqf_Land

5) The Microfinance Sectors

The microfinancing programs, which used the loss-profit sharing, are one of the most important sectors for poverty alleviation. Most of funds collected through cash waqf certificate issues will be allocated as loan for microenterprises. This microcredit program should particularly be aimed at helping poor people initiate their business and enhance their quality of life, accordingly. Nevertheless, merely supplying them with capital is not sufficient, since most of them do not have adequate knowledge and skill to choose and to run a business that is suitable to their condition. Consequently, relevant business technical assistance is needed to help them survive.

Family’s business activities have significantly influenced economy of a community, particularly in developing countries. Big manufacturing companies indeed dominate mass production processes, both for goods and services, but most of enterprises are initiated by family. In addition, family’s consumption behaviour also affects production and marketing activities, as well as other business activities.

Government’s programs for family business empowerment has to do with informal sector development efforts, as most of family businesses are operated in non formal format and business system. Family businesses, which absorb the largest number of employee, are also found mostly in small and medium scale. In most developing economies, these small and medium enterprises (SMEs) have limited access to formal financing practices, as well as to adequate government’s technical assistance. (see figure 9a and 9b)

Microfinancing Portfolio

The profit of microfinance Risk of

Microfinance

Microfinance Policy Scheme

Bad debt of microfinance

The profits of cash waqf investment Management Fees

The funds for poverty alleviation programs

-+

+

+ Multiplier Effects of Microfinance towards

Figure 9a. Causal loop of The Microfinancing Sectors

Microfinance Portofolio Sectors

Mikrofinance microcredit Profit_of_Microfinance

Indonesian_population Stop_Microfinance Microfinace_Period

Return_of_Microfinancing

Pra_welfare_people

Microfinance_Policy

Policy_ratios

Figure 9b. Flow Diagram of The Microfinancing Sectors

6) The profits of cash waqf investment distribution sectors

The gained profits from the various portfolios will be distributed to the poor through the poverty alleviation programs such as basic needs, health services, sanitations, education, natural disasters victims, etc. The principal of cash waqf will be reinvented to various portfolio opportunities. (see figure 10a and 10b).

The rich

The poor Cash WaqfGrowth

Cash Waqf Inflow

Collected Cash Waqf Funds

Average period to collect the cash waqf

Investment funds

-+

+ +

+

The Profit of cash waqf investment Management fee

The funds for the poverty alleviation

programs

- +

+

+

-The Poverty Alleviation Programs

-+ +

Foreign Waqif +

+ To meet the poor

needs + Living Cost Healthy Cost

Education cost

The family rehabilitation cost

Natural Disaster

Victims Cost Infrastucture Recovery cost Quality of Life

+ + + + + +

-+

Figure 10a. Causal Loop of the cash waqf profits distribution sectors

Profits of Cash Waqf Investment Distribution

Figure 10b. Flow Diagram of the cash waqf profits distribution sectors

7. The Cash Waqf Management Control

The survey concluded that most people did not trust any existing government institutions to manage cash waqf fund and control cash waqf investment activities, especially because cash waqf management will involve large amount of endowment funds. Most of them also recommend that if a special purpose institution is established to manage cash waqf fund, it has to be highly capable of detecting any potential dishonesty and assessing performance of cash waqf fund manager, i.e. nadzir. Therefore, it’s necessary to design an instrument which is able to control the cash waqf management. This model tries to design a control tools which is able to detect the human error in decision making either mismanagement or dishonesty quickly. (see figure 11.)

The Control Function for Fund Management

rate_of_cash_inflow

Profits_Mobilization Current_price_of_gold

Convert_to_gold

Control_Function

Global_Fund_Mgt

Commercial_Projects Mudarabah_Deposits

Company

Mikrofinance

Real_Estate

To_Increase_Waqf_Building_Productifity Social_Projects

Islamic_Capital_Market

Agriculture

Islamic_Mutual_Funds Islamic_Bonds

Cummulative_Cash_Waqf_Fun

available_fund_for_living

available_fund_for_healthy

available_fund_for_education available_fund_for_disaster

available_fund_for_rehbltation Total_cash_waqf_in_gold

available_fund_for_infrastrctr

Figure. 11 Flow Diagram of The Control Function for Fund Management

The collected cash waqf fund from the waqif will be distributed to the various portfolios and then the usage will be controlled periodically. The early warning system will be prepaired by the system in order to the amount of cash waqf fund will not go below the initial amount. It is the difference of the cash waqf from the other sources of funds. Gold standard can be used as the currency standard because of its stability. (see figure 11a-d).

day

rupiah

Control_Function 1

Cummulative_Cash_Waqf_Fund 2

20 40 60 80 100 0

500.000.000 1e9 1,5e9 2e9

1 2

1 2

1 2 1

2 1 2

Figure 11a. The simulation result (short term)

day

Gold Standard (kg)

Total_cash_waqf_in_gold 1

Convert_to_gold 2

20 40 60 80 100 0

5 10 15 20

1

2 1

2 1

2 1

2 1 2

Figure 11b. The Simulation result (short term)

day

rupiah

Cummulative_Cash_Waqf_Fund 1

Control_Function 2

5.000 10.000 15.000 0

5e14 1e15

1 2 1 2

Figure 11c The Simulation Result (long term)

day

gold standard (kg)

Convert_to_gold

Figure 11d The Simulation Result (long term)

The waqif and public can control or monitor the cash flow of cash waqf investment. If mismanagement and dishonesty occurred, the simulation result could demonstrate the deviation. (see figure 11e-f)

day

andard (kg) 1 Total_cash_waqf_in_gold

Convert_to_gold

Figure 11e. The Simulation Result (short term)

day

2.000 6.000 10.000 0

gold standard (kg)

Total_cash_waqf_in_gold

Figure 11f. The Simulation Result (long term)

8. The Potency of Cash Waqf for the Poverty Alleviation Programs

It can be concluded from the system that the larger the amount of cash waqf collected, the larger the amount of fund can be invested in highly cost-effective profit sharing-based portfolios, and the larger the amount of return can be distributed to poor people. The more fund allocated to finance microbusiness, the sooner poverty in Indonesia can be alleviated. (see Figure 12).

The Potency of Cash Waqf for The Poverty Alleviation

Pra_welfare_people

aleviation

welfare

the_rich

birth_rate2

birth_rate

death_rate2 Birth_rate3 death_rate3

Indonesian_population

death_rate

Profit_of_Cash_Waqf_Investment

Daily_needs Multiplier_Effects

the_poor

Multiplier_effect

Invest_to_microfinance

Average_of_Microfinacing Profits_of_CW_Investment_

the_poor alleviation_1

Average_Period_to_become_prawelfare

The_poor_decrease

The_poor_reducing

Microcredit_for_a_poo lifetime_expectancy

Population_growth

the_welfare_increase

Pra_welfare_reducing

Average_period_to_become_welfare

Average_of_Microfinacing

Figure 12. Flow Diagram of The Potency of Cash Waqf for The Poverty Alleviation

9. The Simulation Result

Since there has been no similar study preceding the research, some assumption were applied. The ability of five national TV corporations (RCTI, SCTV, Indosiar, MetroTV and Lativi) to collect donation amounting IDR 3 billions in two night in 2003 was used as an assumption basis of amount of fund could be gathered by cash waqf management institution.

It was then assumed that the cash waqf institution could obtain IDR 20 millions a day in form of cash waqf from various components of Indonesian people. The study also assumed that the gathered fund would grow 25%

annually and it would be invested in Islamic financial products with profit sharing- based various rate of return.( see figure 13).

day

5.000 10.000 15.000 20.000 25.000 0,0000

Figure 13. Rate of return of Cash Waqf Investment Portfolio

Using the above assumption and data supplied by Biro Pusat Statistik (National Beaurau for Statistics) , BKKBN (National Coordinating Agency for Family Planning) and syariah financial institution in Indonesia, the computer-based data process resulted in approximation of cash waqf investment return 25% annum. Such an amount of fund is expected to be available for the poverty alleviation efforts in Indonesia, especially through microfinance distribution program. If this plan can be implemented smoothly and if those assisted micro enterprises can get well run maximum of 8 years after being financed, it will take approximately 12500 days (35 years) to eliminate poverty and 22400 days (63 years) to increase quality of live for Indonesian population. (see figure 14a-b) Poor people, in this study, are those with very low quality of life. In other words, poor people are not only those who cannot feed once a day, but also those who cannot afford proper health and education services.

day

5,000 10,000 15,000 20,000 25,000 30,000

0

Figure 14a. The Simulation Result (based on IDR 20 million a day)

day

5.000 15.000 25.000

0

Figure 14b. The Simulation Result (based on IDR 20 million a day)

Based on the study result above and various scenari gather

Figure 15a. Simulation Result (based on I R 50 million in a day compare with IDR os proposed, if the ed fund through cash waqf certificate increase i.e. IDR 50 million in a day ,

it will take approximately 11000 days (30 years) to eliminate poverty and 21000 days (57 years) to increase quality of live for Indonesian population with the assumption the others constant. (see figure 15a)

D

List of References

. Baswir, Revrisond, Indonesian Foreign Debt, satunet column, 2000.

, Great

3. F nd Samuel L.Hayes III (1998), Islamic Law and Finance

4. Ib

5. L uring Policies, Coordinating

6. Mannan, M.A.Abdul, Cash Waqf, Enrichment of Family Heritage Generation to

8 7. M

8. M ash Waqf Fund for

9. M

10.M qf Certificate

11.S ach for Managerial Problems, Wiley

12.S Journal of the System Dynamics Society, vol. 16

13.T namics Modeling, 1996

in Monthly 1

2. Coyle, R.G., Management System Dynamics, John Wiley & Sons Ltd. Britain, 1997.

rank E.Vogel a

“religion, risk and return.” Published by Kluwer Law International rahim, M.Anwar, Waqf in Islamic Law, International Workshop on Productive Waqf Management, Batam, 2002.

P3E, Analysis on SMEs Development and Restruct

Ministry of Economy and LP3E Faculty of Economics, Unpad, Desember 2000.

Generation, Social Investment Bank Publication Series no. 1, 1st edition, 199 annan, M.A.Abdul, Cash Waqf Certificate- an Innovation in Islamic Financial Instrument: Global Opportunities for Developing Social Capital Market in the 21stCentury Voluntary Sector Banking”, Presentation at the Third Harvard University Forum on Islamic Finance, October 1, 1999

annan, M.A.Abdul, Global Mobilization and Creation of C

Human and Social Capital Infrastrukture for the Islamic Ummah, Social Investment Bank Publication Series no. 5, 1999.

annan, M.A.Abdul, Lesson of Experience of Social Investment Bank in Family Empowerment credit for Poverty Allevation: A Paradigm shift in Micro-financ”, Social Investment Bank Publication Series no. 10, 1999.

asyita, Dian, Preliminary Implementation Model Design of Cash Wa

as Alternative Instrument for Poverty Alleviation in Indonesia using System DynamicsMethodologi, Thesis, ITB, 2002

ushil, System Dynamics- A Practical Appro

Eastern Limited, India, 1993 ystem Dynamics Review, The

No. 1, Spring 2000, Wiley InterScience. asrif, Muhammad, System Thinking & Dy

14.Utomo, Setiawan Budi, Fiqh on Waqf and Cash Waqf, Presentation

Discussion for Cash Waqf Implementation in Indonesia, MUI Commission of Economy, 2001.