THEM E :

PERFORM ANCE M EASUREM ENTT

How Effect ive is t he Indonesian Ext ernal Public Sect or

Audit ing Report s Before and Aft er t he Audit Reform for

Enhancing t he Performance of Public Administ rat ion?

Septiana Dw iputrianti

Decent ralizat ion, Account abilit y, And Local Government

Performance In Indonesia

Sujarw oto and Tri Yumarni

Analysis Of Democratic Public Service Net w ork (Case St udy in

Urban Transport at ion Service in M akassar Cit y, South Sulaw esi

Province, Indonesia)

HOW EFFECTI VE I S THE I NDONESI AN EXTERNAL PUBLI C SECTOR

AUDI TI NG REPORTS BEFORE AND AFTER THE AUDIT REFORM FOR

ENHANCI NG THE PERFORMANCE OF PUBLI C ADMI NI STRATI ON?

Septiana Dwiputr ianti

* )Abstract

The research aim s t o enrich the exist ing administrat ion, account abilit y, and auditing of public sect or lit erat ure. This is undert aken t hrough exam ination of the qualit y of inform at ion in t he report s of t he Indonesian St ate Audit Institut ion (BPK) with comparison bet w een preceding and following audit reform. This st udy evaluat es t he fact ors influencing t o t he effect iveness of such audit inform at ion. Tw o main research quest ions; first ly, how is t he qualit y of inform at ion in the audit report s of t he BPK; secondly, w hat are t he key fact ors influencing t he effect iveness and ineffect iveness of inform at ion in the audit report s.

Dat a w ere collect ed through t riangulat ion of observat ions, document ations, quest ionnaires, and int erview s. Key inform ant s in t his st udy w ere (1) auditors, m em bers and m anagers of BPK (2) t he mem bers of Parliam ent and regional Parliam ent , (3) public sect or officials (audit ees) in cent ral and local levels, (4) and ot her respondent s from academics, researchers, pract ices, and non government organization (NGO).

This st udy revealed t hat the execut ive’s hist ory had hist orically neglect ed t he roles and funct ions of BPK. Auditors lacked independence as t he execut ive influenced t he adm inist rat ion and finances of BPK. Auditors also had lack of opport unit y t o increase t heir professionalism . Since t here w as lit tle incent ive for auditors not to accept audit fees from audit ees, t he object ivit y and int egrit y of audit ors w as reduced significant ly.

Since t he t hird am endm ent of 1945 Const it ut ion in 2001, the Indonesian government had reform ed law s and regulat ions relat ed t o public sect or auditing for st rengt hening BPK. In situation where t he Indonesian public adm inist ration needs im m ediat e reform, BPK keeps t rying t o improve it s professionalism and independence t o provide qualified audit report s. BPK has been given m uch at t ention to education, t raining, and the development of other skills and knowledge; implement ed remunerat ion; applied a rewards and sanct ions. This st udy revealed a significant improvement in the am ount and qualit y of in audit resources, including num bers of qualified auditors, represent at ive offices, inform at ion and t echnology, and m odern equipm ent . How ever, m any new auditors lack of experience and lack of diverse educat ional backgrounds in addition to account ing and finance for conduct ing perform ance audit ing.

To enhance t he qualit y of public administ rat ion and account abilit y, t his st udy gives recomm endations for BPK in (1) st rengt hening it s independence, (2) expanding audit or’s professionalism and compet ency in risk managem ent (3) improving t he facilities of the

* )

t raining cent ers, (4) increasing follow up of audit report s, (5) evaluat ing law s and regulat ions, (6) enforcing t he implem ent at ion of performance auditing.

Keyw ords: public adm inist rat ion and accountabilit y, t ransparency, public policy, public sect or perform ance audit ing.

Introduction

Since the audit reform t hat w as begun since t he t hird am endment of Indonesian

Const itution (2001), t he Indonesian public sect or audit has been strengt hened t o achieve t ransparency and accountabilit y of public adm inist rat ion in cent ral and local level

government ’s agencies. This paper aim s t o exam ine t he implem ent at ion of ext ernal of

public audit ing t o provide bet t er performance of public administ rat ion, before and aft er t h e

audit reform .

The int roduct ion is divided int o t hree part s, t he first part of t his int roduct ion is t o describe t he differences bet w een financial and performance auditing as Indonesian public

sect or has expanded it s scope of audit ing from financial t o perform ance auditing. The

second part explains the role and funct ion of audit ing in reform ing public administ rat ion (as

t he first priorit y in Indonesian governm ent reform) and for good governance. The t hird part describes t he historical developm ent of the Indonesian public sect or auditing.

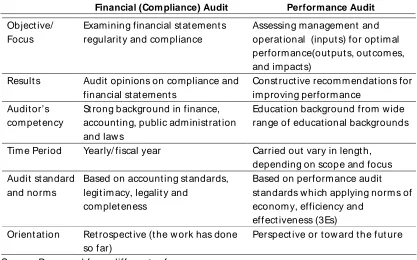

W hat are the differences bet w een financial and perform ance auditing?

Som e lit eratures explained the difference of financial and performance audit s in different perspect ive. In t erm s of audit result s, Brown and Copeland (1985:3-8) point ed out

t hat financial auditing report provides opinions on audit ees’ financial st at ement s, w hile

perform ance auditing report provides audit recom m endations for obt aining bet t er

organizat ion’s perform ance. In t erm s of audit st andard and period of t ime, Polit t, et .al. (1999: 9-16) argued t hat financial auditing is conduct ed yearly, and based on financial audit

st andards and procedures, w hile perform ance audit ing is carried out more occasionally and

is based on evaluation of perform ance crit eria and indicators t hat are varies, in t erm s of scope, lengt h, focus, and design, in every public agencies.

In t erm s of audit or’s compet encies, Sheldon (1996: 52) point ed out t hat perform ance

auditing in public sect or requires for a w ide range of audit ors’ com pet encies, abilit y, and educat ional backgrounds t o design t he perform ance t arget ing in audit ing, while financial

auditors require a specific compet encies in financial and account ing backgrounds, and

additional knowledge in public administ ration. In t erm s of orient at ion, Kitindi (1992: 8-11)

believed t hat financial audit ing is m ore relat ed t o exam ine t he financial report s and w orks t hat have been conduct ed in the past , while perform ance audit ing has broader fut ure, long

t erm and st rat egic orient at ion w hich is rel evant t o exam ine not only t he output s and result s

of program s t hat have been done, but also the impact and benefit s of program s t o be

In addition, Lindeberg (2007: 337-350) compared financial, performance audit ing

and non-audit evaluative pract ices, he argued that performance auditing has great differences w it h financial audit ing, but great er sim ilarit y w ith program evaluat ion.

Therefore, t he recom m endations from the perform ance auditing can be used evaluating

and monitoring t he programs and policies t hat are implem ent ing in t he public sect or.

Out side financial and perform ance audit s, t here is specific purposes audit that can

be based on a request from t he President , m em bers of Parliament, or governm ent agencies t hat need imm ediat e at t ent ion for specific audit ing for cert ain purposes. Some examples of

t his t ype of auditing are relat ed t o audit ing of forensic, IT, environm ent , and financial report s (such as auditing for expenditure, t ax incom e, non-t ax incom e, subsidy, foreign loan,

donors, and foreign aid) for cert ain programs or project s.

Table 1 present s t he summ arizing of comparison bet w een financial and perform ance

audit s.

Table 1: Com parison betw een Financial and Perform ance Audits

Financial (Com pliance) Audit Performance Audit

Source: Processed from different references:

1. Brown, R.E. and Copeland, R.M ., 1985, ‘Current issues and developm ent s in

governm ent al account ing and audit ing: impact on public policy’, Public Budget ing and Finance, 5(2), pp. 3-8.

2. Polit t, C., et .al. 1999. Perform ance or Compliance? Perform ance audit and public managem ent in five count ries, Oxford Universit y Press, New York, pp. 16.

3. Sheldon, D.R., 1996. Achieving Account abilit y in Business and Governm ent , Quorum Books, West port , Conn, pp. 52.

4. Kit indi, E.G., 1992. ‘Perform ance auditing in Tanzanian parast at als’, Int ernat ional Journal of Governm ent Auditing, 19 (2), pp. 8.

Object ive/

Result s Audit opinions on compliance and financial st at ement s

5. Gong, T., 2009. ‘Institutional learning and adaptat ion: developing st at e audit capacit y in China’, Public Administ rat ion and Developm ent, 29 (1), pp. 37.

Role and Function of Public Sector Auditing in Public Adm inistration and For Good

Governance

In line w it h t he political dem ands for great er account abilit y in providing bet t er

services t o t he public and efficiency in managing public resources, public sect or auditing becom e a necessit y for public sect or in recent decade (Pow er 2003b: 191). The m em bers of

parliam ent as represent at ive of the public have great er concerned about t he efficiency and effect iveness of t he qualit y of public sect or goods and services. Durrant (2000: 80)

highlight ed that public sect or auditing is t he prom inent aspect for encouraging public sect or agencies t o improve t heir effect iveness and efficiency in public administ rat ive.

Efficiency in using public funds and resources reduces t he resources t o provide

public goods and services, w hile effect iveness provides a cert ain result (output s, out com es, im pact s and benefits) on the qualit y of goods and services provided by t he governm ent . By

preventing t he public money from w ast e, fraud and misappropriat ions expenditures, t he

government can allocat e funds for great er num bers and qualit y of public goods and

services. As argued by Devas (1989: 271) t hat t he ext ernal auditing can ensure all government ’s incom e is ‘ collect ed, account ed for and properly’ used. M oreover, efficiency

can provide low cost s of goods and services t hat influences on t he t ariff set t ing by t he

government which is import ant for t he count ry t o be able in compet ing int ernationally

(M cIntosh 1997: 123-129). Funnel and Cooper (1998: 283) argued t hat effect ive public sect or audit ing can significant ly im prove t he public sect or performance.

Therefore, an effect ive public sect or audit ing can provide t he value of great er

efficiency and effect iveness in public adm inist ration by exam ining the public sect or agencies in prevent ing and reducing w ast e, abuse, fraud and corruption that can improve t o t he

perform ance of public administ rat ion, public goods and services for t he benefit of t he

public.

Public audit ing t hat holds out a t ransparency, accountabilit y, efficiency,

effect iveness, openness, prevent ing of corruption and excess expenditure, can prom ise of good governance (Shim omura 2003: 167). This is also support ed by Curtin and Dekker

(2005: 36-37) who emphasized the principles of account abilit y, t ransparency, effect iveness

and part icipat ion in public administ ration, w hich is expanding t he role of governm ent in providing government accounting syst em, and public sect or auditing t o provide

account abilit y of public sect or agencies w hich lead to good governance. M oreover, Barret

(1996:137-146) argued that the audit inst it ut ion is a part of t he governance fram ew ork t hat

An effect ive auditing pract ice is an essent ial precondition for good governance (Doig

1995:151). Similarly, M ulgan (2003: 24) found t hat Audit ors-General make a significant cont ribution of the public account abilit y t o the public sect or reform in Aust ralia by st anding

up for values of t ransparency, probit y and good governance. Innes et .al. (1997: 706) also

believed t hat audit report enhances t he credibility of t he financial stat ement s t hat is useful

for invest ors and managem ent of public sect or.

Therefore, public sect or audit ing is an im port ant tool for result ing of good government in long t erm s. Audit ing provides assurance of an appropriat e use of resources

and prevent s m isuse, fraud, abuse and corruption of public funds and resources w hich can m aint ain and improve public t rust , including t he local and foreign invest ors; and also t ax

payers.

Historical Developm ent of Public Sector Auditing in Indonesia

Prior t o the 1945 Indonesian independence, t he public administ rat ion and auditing

w as dom inat ed by t he Dut ch administ rat ion and Javanese culture t hat st rongly influenced t he bureaucrat ic culture w it h pat rimonial and patronization pract ices. The President as

person of t he sovereign w as pow erful and st rongly influenced all he bureaucracy, including t he BPK. Although the position of BPK in the past w as under the 1945 Const itut ion and M PR,

BPK had no independence from t he government or less pow erful t han governm ent . The audit report s of BPK report ed to the parliam ent w hich w as majorit y dom inat ed by Golkar

part y, as a ruling part y and single w inner in the elect ion. Hence, during t he New Order Era,

t he pract ice of corruption became syst emic under t he pow er of t he President (Soeharto)

and his cronies. There w ere no ext ernal audit inst it utions which independent ly exam ined

t he public financial m anagement and account abilit y of t he government .

Duplicat ing audit funct ions in public sect or had occurred not only bet w een BPK and int ernal audit inst itutions but also among the internal audit institut ions t hemselves. BPKP,

an int ernal audit inst itution had the sam e roles and funct ions as BPK, in conducting post

audit, inst ead of examining t he planning and managem ent of t he int ernal public sect or

agencies’ financial budget and report s. How ever, BPKP had much higher budget , qualified auditors, represent at ive offices, and ot her audit resources in conduct ed public sect or audit .

As a result , BPKP had great er audit scope in regional government s, SOEs and ROEs, w hile

BPK only audit ed t he cent ral governm ent . This means, the funct ion and role of BPK t o

examining t he public account abilit y of public sect or agencies w ere diminished by reducing resources and audit scope. The duplicat ing of audit functions had burdened st at e finances

and audit ees.

Since t he t hird amendment of the 1945 Constit ution (2001), the roles and funct ions of BPK as t he only ext ernal audit institut ion has st at ed clearly. BPK has gradually given

great er power t o examine t he public account abilit y of public sector agencies under t he

Audit Law (GOI 2004a). Since t hen, BPK has reform ed it s organizat ion and st rengt hened it s

auditing, position, and st andards of int ernal and ext ernal audit ing pre and aft er t he audit

reform . The t able illust rat es t he reformat ion of the syst em and regulat ions of public sect or auditing in Indonesia.

Table 2 Com parison of Internal and External Public Sector Audit before and after Audit

Reform (2001)

The Indonesian External Public Sector Audit ing (before and after the reform )

This sect ion assesses t he crit eria of the audit report s informat ion qualit y and factors

influencing t he crit eria of t he Indonesian Supreme Audit Board (BPK). The crit eria consist of t hree part s: (1) the cont ent of, (2) com munication of, and (3) act ing on, information in audit No Public Sect or

- Types of Audit Financial and compliance audit s

report s. The key fact ors influencing the crit eria of t he qualit y of public sect or audit ing report s informat ion also describe in t his sect ion.

Quality of Indonesian Suprem e Audit Board (BPK) Reports

This sect ion assesses t he qualit y of BPK report s that consist s of t he qualit y of cont ent of inform at ion, t he qualit y of com munication inform at ion in audit report s, and t he qualit y of

act ing on audit informat ion. Relat ed to t he cont ent of the informat ion, there are t hree

crit eria, nam ely (1) scope of audit s; (2) access for reliable evidence; (3) object ivit y, and

credibilit y of inform ation. Relat ed t o the com m unication of information in audit report s,

t here are t hree crit eria, nam ely: underst andable inform ation; precise and informative form at t ing; and tim ely report ing. Relat ed t o acting on inform at ion in audit report s, t here are

t hree crit eria, namely: the publication of audit report s; realist ic audit recomm endat ions;

and follow ing up audit findings and recom mendations.

The following sect ions describe research findings of each crit eria of t he qualit y of

audit report s inform at ion. Law s, regulat ions, and rules as t he heart of both the t heory and t he pract ice of public adm inist rat ion are exam ined, t o underst and t he policies of t he

Indonesian ext ernal public sect or audit. M oreover, findings from t he int erview result s enrich t he paper with the em pirical condition of Indonesian public sect or auditing.

Scope of audit

The financial audit scope of BPK has been expanded ext ensively as t he mandat e of

t he Const it ution to examine t ransparency and account abilit y of all public sect or bodies. The w orkload of BPK increases in t erm s of t he num ber of agencies and audit scope w hich

includes financial, perform ance and special purposes audit s. However, until 2009, BPK still

cannot audit t ax revenues and som e SOEs. M oreover, t he lack of compet ency of

government agencies t o apply the new governm ent account ing st andard (2005), result ing

on lat e submission of t heir financial st at ement s t hat caused BPK to exam ine t heir financial account abilit y. Although BPK has significant improvem ent in increasing num bers of audit ed

ent it ies for financial, including compliance audit, t he audit scope of BPK st ill have limit ed

role in enhancing account abilit y as it has not focused yet in t he actual out com e and

perform ance audit . BPK is st ill cont inuing to develop t he instrument and measurem ent t o

examine t he performance of public sect or agencies. For specific purpose audit s as a dem and from t he Parliament s, BPK conduct ed invest igat ive audit for the case of corrupt ion,

environment audit, financial audit for the heads of government ’s elect ions, and int ernat ional aid audit s.

Access for Reliability of Audit Evidence

Under t he new law of BPK (2006), auditors have pow er t o access any data and inform at ion for auditing purposes in every govern ment agencies. The sanct ions for audit ees

w ho do not provide dat a and inform at ion for audit ors, and audit ors who m isuse t hese dat a

access dat a and informat ion for audit ing indicat e posit ive comm it m ent from t he

government t o act t ransparent and account able and also provide posit ive percept ions from t he respondent s. However, based on the research evidence, alt hough t he pow er of BPK to

access dat a and inform ation have been st rengt hened, BPK st ill has im peded in accessing

dat a and inform ation from audit ees, such as in the case of t ax revenues dat a and dat a for

audit go public SOEs.

Objectivity and Credibility of Audit Reports Information

Based on the st udy, it revealed both positive and negat ive responses and com ment s

on t he object ivit y and credibilit y of inform at ion in BPK audit report s. How ever, t he survey point ed largely t o positive percept ions of informat ion in audit report s and opt imism from

t he respondent s on the significant reforms design t o provide object ive and credible audit

report s. Survey support ed com ment s by a range of key informant s from BPK, audit ees and

t he m em bers of Parliam ent . However, crit icisms and negat ive views have showed that t hese claim s w ere over-opt imist ic. Som e negat ive com m ent s during int erview s provided more

open and honest st at em ent t hat reduces t he optim ism t o some degree. The key informant s

doubt the object ivit y and credibilit y of audit report s due to BPK’s lack of independence. The

st udy reveal ed t hat BPK auditors had strong pressure from t he high officials or elect ed people w ho w ere not act ing responsibly t o the public such as at t he local level, t he pressure

from t he Regent or M ayor. In addition, t he report s of t he M inist ry of t he Nat ional Arm y had

been alt ered. These negat ive and deficiencies view s not ed a more balanced view point and showed that there is st ill room for BPK t o im prove t he object ivit y and credibilit y of it s audit

report s.

Understandable Inform ation

The survey result s indicat e various percept ions whet her t he report s of BPK provided

a clear and underst andable information or not . From int erview s, t he st udy revealed t hat

inform at ion in audit report s from BPK w as st ill hard to underst and by t he st akeholders,

esp ecially when t echnical t erm s on audit ing and finance used w ere not w ell defined. Although audit ors argued that the abilit y t o underst and audit report s depends on the

com pet ency of st akeholders, t his st udy found that present ing clearer and simpler

inform at ion in the report can avoid misint erpret at ion and help cit izens t o underst and the

report s.

Precise and Inform ative Formatting

Audit report s from BPK w ere t oo t hick, t oo long, t oo complicat ed and lack of

int erest ing present at ion for st akeholders. This condit ion affect ed difficulties in reading,

absorbing and underst anding inform at ion in audit report s. Since 2007, BPK has provided a

new sum mary audit report format and continued producing innovat ions with an elegant lay

inform at ion about expect at ion of audit report s from t hose w ho produce t he audit report s

and who read these report s, in particular, the mem bers of Parliament and government .

Timely Reporting

Timely audit reporting has been st ipulat ed by t he Audit Law (2004) and included in audit st andards. The survey result s indicat ed m ore posit ive responses from auditors and

audit ees’ groups, in cont rast with t he mem bers of Parliam ent who w ere doubt ful about

t im eliness of audit report s. Negat ive view s w ere also reveal ed w hich suggest ed BPK did not

successfully fulfill the requirem ent s of t he st akeholders, in part icular m embers of t he

Legislat ive instit ut ions, t o provide up-to-dat e and t im ely audit report s.

Publication of Audit Reports

BPK audit report s are now published t o provide t he public with inform at ion on the

perform ance of government and how governm ent funds are spent . M oreover, audit findings

of BPK have raised curiousness of t he public that increased t he number of art icles in print ed

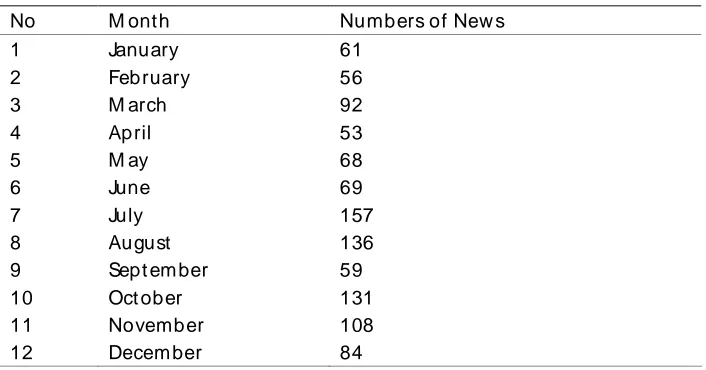

m edia, radio and t elevision. Table 3 present s t he numbers of art icles of BPK’s findings/ result s in 2006.

Table 3: Numbers of News Articles of BPK’s Findings/ Results in 2006

No M onth Numbers of New s

1 January 61

2 February 56

3 M arch 92

4 April 53

5 M ay 68

6 June 69

7 July 157

8 August 136

9 Sept em ber 59

10 Oct ober 131

11 November 108

Source: Adapt ed and processed from Clippings of BPK, the Public Relations Division of BPK, Jakart a,

M oreover, a public aw areness program has been conduct ed to raise public

underst anding of BPK’s roles and functions in prom oting participat ion in effect ive public

sect or auditing. The survey of t his research found that the respondent s agreed t hat BPK

audit report s have been published. How ever, som e respondent s including polit icians and audit ed found unhappy w it h the publication BPK audit findings. Audi t ees covered-up their

cases and t ried to st op BPK from publishing their cases. They argu ed t hat inform ation in BPK

report s could provide a bad impact on organizat ions, for exam ple, inform at ion on

non-perform ing loans (NPL) and irregularit ies in national banks t hat m ade cust omers dist rust ful about deposit ing their money and encouraged t hem to move t o other foreign banks.

Realistic Audit Recom m endations and Follow ing up Findings and Recom mendations

A realist ic and const ruct ive audit recomm endat ion to improve t he public adm inist rat ion and perform ance of public sect or agencies is essent ial for effect ive audit

report s. The research found that the audit ed found difficult y and lack of responsiveness t o

follow-up t he recom mendat ions in BPK report s. On t he other hand, the auditors could not

provide realist ic recom m endations that can be done in short or m edium t erms by audit ed. As a result , the BPK recom m endat ions from year t o year do not change.

Although the m andat e for public sect or agencies t o follow up BPK audit report s has

been provided in t he audit regulat ions, t he evidence show s t hat the rat e of follow up of BPK

findings and report s are st ill very low . This study revealed t hat t he m em bers of Parliament

found it difficult t o encourage t he public sect or agencies t o follow up BPK report s. The

public sect or agencies aw are of t he import ance t o follow up BPK audit findings. However, audit ed found hard to follow up and to m eet all t he dat a, informat ion and

recomm endations request ed by BPK audit ors in the short t erm.

Aft er audit reform (2002-2006), dat a indicat e a serious problem of t he government

in following up BPK report s. Nat ional daily new spapers (Sam 2006, Sunspot 2006 and Sara

Pem baharuan 16 M ay 2006) revealed t hat t he level of follow -up of BPK’s audit report s w as very low. From 2003 to 2005, 16,433 cases of t he m isuse of st at e finances w ith a value of Rp.132.49 t rillion, US$146.69 million, €98.91 thousand and ¥361.48 m illion, w ere found by

BPK. How ever, only 6,920 cases, or about 42 per cent of t he t ot al, w ere followed up, while

t he rest , valued at Rp.34.22 t rillion (25.8 per cent of t he t ot al value in Rupiah) and US$ 61.11

In addition, significant findings of BPK include inefficiencies and loss of st at e finances

up to a value of Rp.253.75 billion in various government procurem ent project s, plus Rp.1.5 t rillion in quest ionable debt reduct ions and bad loans involving a number of dissolved

banks, w hich were not followed up (Hudiono 17 M ay 2006). M oreover, in sem est er 1 of

2006 t he follow -up on BPK audit report s w as only 36.15 per cent1.

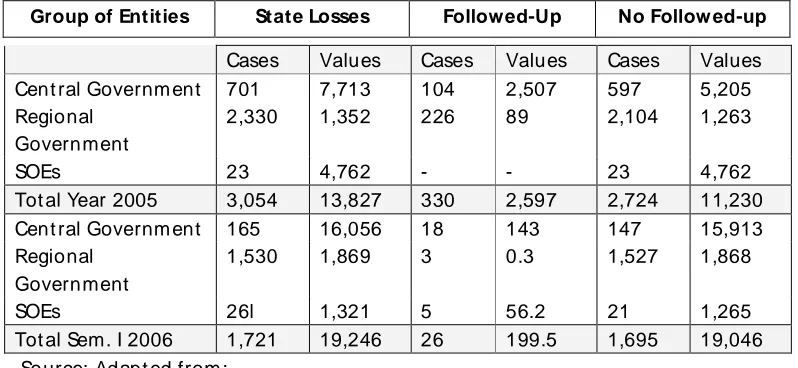

Table 4: Follow -up of Cases and Values (in billion rupiahs) of State Losses in 2005-2006

Group of Entities State Losses Followed-Up No Follow ed-up

Source: Adapt ed from :

Kompas, 6 January 2007. ‘Tat a Pemerint ahan: BPK segera t erbit kan st andar pem eriksaan’ (Stat e administ rat ion: BPK w ill launch audit ing st andards soon)’ , Jakart a.

Table 4 summ arizes t he cases and value of t he st at e losses in audit findings of BPK in 2005 and sem est er I of 2006 which indicat es a very low rat e (only 10.8% cases in 2005 and

1.51% cases in 2006) of follow -up on BPK findings. Although few in number, the follow -up of

st at e losses cont ribut ed about Rp.2,597 billion in 2005 and Rp.199.5 billion in 2006 t o st at e

t reasury.

Table 5: Follow up of BPK Audit Recom mendations (Central and Local Governm ents and

SOEs) in 2008

St at us Com plet ed Recom m endations Inst it ut ions Tot al

Source: Processed from w ebsit e BPK RI (ww w.bpk.go.id accessed on 13 M arch 2009).

In addit ion, Table 5 shows a quit e significant num bers of cases w ith huge values of

m oney w ere not follow ed by audit ees. It seem s t hat the recomm endat ions w ere run very

slowly. For inst ance, for Stat e Ow ned Ent erprises (SOEs), from about 2954 cases, t here w ere

st ill 662 cases have not been complet ed. Almost 25% of BPK report s w ere follow ed up by

cent ral and local governm ent s and more t han 50% by SOES and has cont ribut ed m ore t han Rp. 216 t rillion for stat e t reasury. The dat a from Table 5 also indicat es significant BPK

findings on the inefficiency of st at e expenditures in public sect or t hat w ere ret urned t o st at e

t reasury. The highest inefficiency w as in local government , cent ral governm ent and SOEs

respect ively. BPK only has the responsibilit y t o monit or t he follow -up of audit report s.

Factors Influencing the Quality of BPK Audit Reports

This paper exam ines t hree key factors influencing t he cont ent and communication of inform at ion in BPK report s, nam ely: t he independence and autonomy; the professionalism

and int egrit y; and t he audit resources. To support t he analysis, t his st udy examines t h e

fact ors pre and post audit reform, including the legal basis, the survey, com ment s and

st at em ent s from personal int erview s, publication of the m edia, and conferences/ sem inars.

Independence and Autonomy of an Audit Institut ion

Before t he audit reform , BPK had no independence as mandat ed by t he sacred (sakt i) 1945 Const itution. The president w as pow erful in influencing all t he bureaucracy, Local

Governm ent

76,733 cases 29,399 cases (24.16%) Rp.100.3 t rillion

13,588 cases (44.03%) Rp. 182.75 t rillion

33,746 cases (31.81%)

Rp. 132.04 t rillion

SOEs 2,954 cases 1,000 cases

(50.75%) Rp. 63.82 t rillion

1,292 cases (41.28%)

Rp. 51.92 t rillion

662 cases (7.97%)

including BPK, t o meet his purposes. As a result, BPK could not provide an object ive and

credible inform at ion in it s report s because t he report s w ere sort ed and checked by t he government for nat ional st abilit y reasons. M oreover, BPK had limit ed budget t o maint ain it s

independence. Since t he audit reform , the independence of BPK has been secured and

st rengt hened by t he am endm ent of the 1945 Constitut ion (2001), t he Law on BPK (2006)

and st at e finance audit st andards (SPKN 2007). Som e significant reform s have been m ade t o m ake BPK an independent audit inst itution.

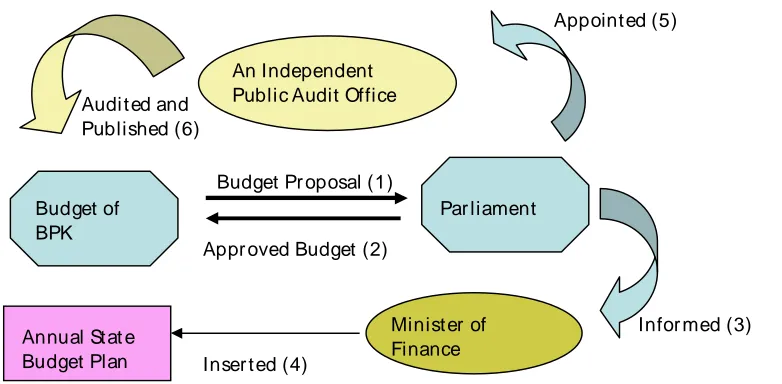

In t erm s of budget ing, the approval of BPK budget ing is not from t he governm ent ,

but from t he parliam ent based on t he needs of BPK. Figure 1 illust rat es t he process of get t ing t he budget resources and audit ing account abilit y of BPK’s budget . Three m ain st at e

inst it ut ions are involved in this process, nam ely: Parliam ent, the Government (t he M inist ry of Finance) and BPK. To m aint ain independence in budget ing, (1) BPK’s plan budget is

separat ed from the st at e budget plan. BPK proposes it s budget plan t o get approval from

t he Parliam ent aft er a discussion about the need for st at e audit act ivities; (2) aft er t he BPK

budget is approved, Parliament informs t he audit need of BPK to the M inistry of Finance to

be insert ed in annual st at e budget plan; (3) for exam ining t he account abilit y of BPK to t he public, Parliam ent appoint s an independent public account ant office (KAP) of three audit ors

proposed by BPK; (4) t he audit result s of KAP on the BPK account abilit y are published t o the

public.

Figure 1: BPK Budgeting Resources and Process

S ource: Adapt ed/ Processed from Article 35 of the Law Num ber 15 of 2006 (GOI 2006b).

Par liament Budget of

BPK

Budget Pr oposal (1)

Appr oved Budget (2) An Independent Public Audit Office Audi t ed and

Published (6)

Minist er of Finance

Infor med (3) Annual St at e

Budget Plan Inser t ed (4)

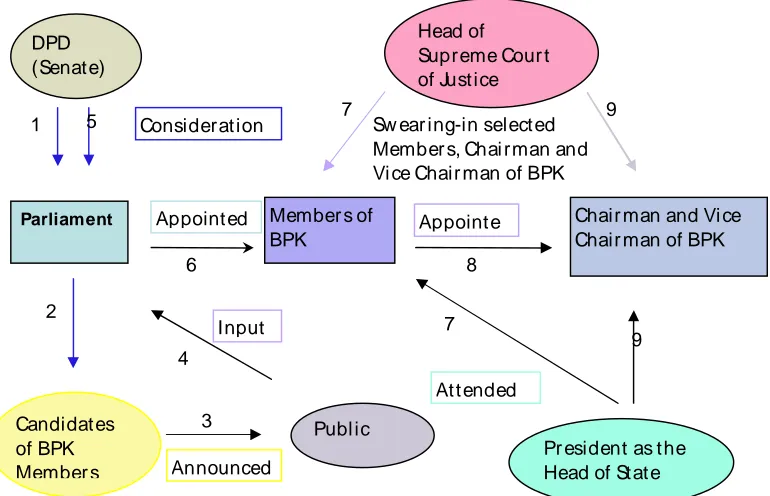

Figure 2: Appointment Process for M embers, Chairm an and Vice Chairman of BPK

Source: Adapt ed from t he am ended 1945 Const itution (2001) and Art icle 14 of the Law Num ber 15 of 2006 on BPK (GOI 2006b).

In t erms of leadership, t he new appoint ment process for t he Board m embers,

including BPK Chairman and Vice Chairm an, has result ed in independence of BPK leaders from t he governm ent . The appoint m ent process of BPK members can be depict ed in Figure

2. DPR proposes all candidat es for BPK members t o be considered by DPD (processes 1 and

2). Aft er t hat , all of t he candidat es for BPK m embership are announced t o t he public

(process 3). Parliam ent (DPR) m akes t he final decision on the appoint m ent and select ion of m em bers of BPK aft er t he considerat ion by DPD and input from t he public (processes 4, 5

and 6).

In t erms of human resources, BPK has m ore flexibilit y in recruit ing, developing,

t erminat ing, rew arding and punishing Board of members, auditors, and st aff based on the

BPK dem and required, without being subject ed t o the st rict rule of M ENPAN and BPK.

Besides positive responses on the improving of BPK independence, t his st udy reveals t hat BPK has not been successful in becoming an independent audit inst itution. This st udy

recorded evidence w hich implies deficiencies of BPK auditors in achieving subst antial

independence, especially due t o t he f act t hat t hey are st ill accepting m oney from audit ees, are st ill bribable, and st ill open t o the possibilit y of negot iations bet w een auditors and

audit ees. These pract ices significant ly reduce t he independence of audit ors.

Since 2004, a member of SAI has been involved as ext ernal review er and an

inspect orat e unit as int ernal cont roller has assessed t he independence and performance of

of BPK to keep im proving the qualit y of it s audit report s through m aint aining it s

independence.

Integrity and Professionalism of BPK M em bers and Auditors

Before audit reform , BPK lacked of int egrit y and professionalism, the t raining and educat ion w as not effect ivel y improving t he skills and compet ence of auditors. M oreover,

BPK had not m any audit ors with a background in accounting and had no the Code of Ethics

for it s auditors. M oreover, BPK had no clear audit m anual, guidelines and t echnical

guidance.

Since t he reform , t he requirem ent of BPK t o maint ain it s int egrit y and t o ensure t h e

securit y and immunit y of audit ors and m embers of BPK are st ipulat ed clearly under t he Law

on BPK (GOI 2006b). BPK also has had the Code of Et hics (BPK RI 2007c). Besides, BPK has im plem ent ed a remunerat ion syst em t o provide fairer rew ard for auditors w ho are more

professional and have bet t er perform ance; and also t o m aint ain audit ors’ professionalism in

providing credible and object ive report s. This st udy found that BPK has st rongly att em pt ed t o improve t he audit ors’ compet ence and professionalism by sending it s audit ors for

t raining and education bot h inside and out side the count ry. All audit ors are com pulsorily required t o develop t heir compet ence by com plet ing at least 20 hours of t he 80 hours

educat ion w ithin a one to t wo years period.

Besides posit ive responses on t he im provement of int egrit y and professionalism of

BPK, t his st udy also revealed t hat the compet encies and knowledge of auditors w as st ill not as st akeholders’ expect ed. For new auditors, lack of experience in auditing public sect or’s

agencies result ed in their lack of abilit y t o det ect fraud and corruption. BPK audit ors also st ill

lack of knowledge and experi ence beyond accounting and finance t o exam ine t he

perform ance of public sect or agencies and provide realist ic audit recom mendat ions.

Auditing Resources of BPK

Before t he audit reform , BPK had very limit ed resources, including budget , auditors,

represent at ive offices, t rainings and other audit resources. Besides, t he resources of BPK w ere cont rolled under influence of t he government and the bureaucracy. As a result , the

qualit y of findings, opinions and recom mendations in BPK report s w as deficient .

Table 6: Annual Budget Allocat ions for BPK before (1993-2000) and after Audit Reform

Source: Adapt ed from

1. BEPEKA St atist ics 1995/ 1996 (BPK RI 1996). 2. BEPEKA St atist ics 1996/ 1997 (BPK RI 1997). 3. BPK RI St at ist ics 2001 (BPK RI 2002). 4. BPK RI St atist ics 2002 (BPK RI 2003). 5. BPK RI St at ist ics 2003 (BPK RI 2004) .

Year Amount in Rupiahs (billion) Descript ion 1993/ 1994 29.27

1994/ 1995 33.30

1995/ 1996 42.39 Before audit reform

1996/ 1997 55.92

1999/ 2000 93.09

2000 81.01

2001 116.44

2002 153.96

2003 199.91

2004 238.33

2005 329.36 Aft er audit reform

2006 690.23

2007 1,337.85

2008 1.490.84

6. BPK RI St at ist ics 2004 (BPK RI 2005b). 7. BPK RI St at ist ics 2005 (BPK RI 2006b). 8. BPK RI St at ist ics 2006 (BPK RI 2007b).

9. Websit e of BPK (w ww .bpk.go.id, accessed on 17 August 2009).

Table 6 show s t hat t he budget allocat ion of BPK before audit reform w as m uch

smaller t han aft er t he audit reform (2001). The parliam ent and governm ent have increased

t he budget of BPK more t han five t imes higher from Rp. 329.36 billion to Rp. 1.725.48 billion

in 2009, aft er t hey found a significant im provem ent in BPK performance in auditing public finance t hat saved st at e expenditure and increase the st at e revenue.

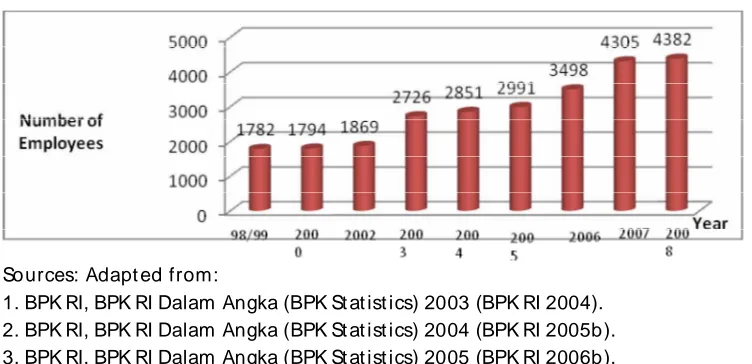

BPK has put in place an impressive increase in the quant it y of resources. Since 2004,

t he allocation of budget has improved significant ly; num bers of new auditors and st aff have

increased by more t han 1500 personnel. Figure 3 show s t he t ot al number of BPK personnel

in the period of 1998/ 99-2008 which indicat es increases in t he num ber of em ployees continuously every year. According to the head of hum an resources of BPK (6/ 12/ 2006), in

2007, BPK recruit ed m ore t han 1700 auditors t o fulfill it s audit m andat e especially for t he

new em ployees for t he represent at ive offices. Compared t o the number of em ployees

before t he audit reform , t he number of em ployees in 2008 has increased by about 2600 personnel.

Figure 2: Num bers of BPK Em ployees Period 1998/ 99-2008

Sources: Adapt ed from:

1. BPK RI, BPK RI Dalam Angka (BPK St at ist ics) 2003 (BPK RI 2004). 2. BPK RI, BPK RI Dalam Angka (BPK St at ist ics) 2004 (BPK RI 2005b). 3. BPK RI, BPK RI Dalam Angka (BPK St at ist ics) 2005 (BPK RI 2006b). 4. BPK RI, BPK RI Dalam Angka (BPK St at ist ics) 2006, (BPK RI 2007b). 5. BPK w ebsit e (w w w.bpk.go.id Accessed on 17 July 2009).

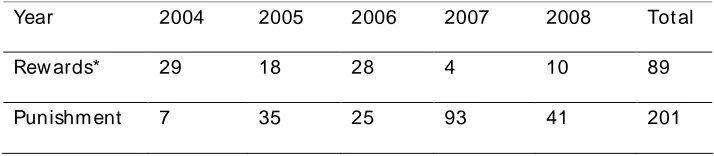

M oreover, since BPK has been employing the im plem ent at ion of rew ard and

punishment for it s personnel in separat e funct ional and structural posit ions, HRB has a

special sect ion for evaluat ing and developing compet it ion bet w een st aff and audit ors and

w ho received rewards, nam ely Sat ya Lencana W ira Karya2 for t heir achievem ent . On t he other hand, BPK also employed punishm ent for auditors and st aff w ho broke t he BPK rules and code of et hics. Table 7 indicat es t hat evaluat ion had been em ployed by t he HRD. The

remunerat ion syst em has been im plem ent ed for t he w elfare and fairness of BPK personnel.

M oreover, t here is a w elfare sect ion t hat has responsibilit ies in managing t he remunerat ion

syst em , providing consult ation and healt h for it s personnel.

Table 7: Numbers of Employees Received Rew ard and Punishm ent (2004-08)

Source: w ebsit e of BPK (ww w .bpk.go.id. Accessed on 27 July 2009) Not e: * Sat ya Lencana Wira Karya Aw ard

In addit ion, Table 8 present s dat a of t he recruit m ent of new personnel of BPK in

2007 and 2008, which indicat es t hat t he priorit y w as m ainly for auditors w it h a background

in professional account ancy, in addit ion to other educat ional backgrounds, such as: financial

and hum an resources m anagem ent , development st udies, law , civil engineering and public

relat ions.

Table 8: Recruitment of New BPK Personnel for Financial Year 2007-08

2

This aw ard is f rom t he Governm ent for BPK employees w ho perf orm w ell achievement s and dedicat ion.

Year 2004 2005 2006 2007 2008 Tot al

Rew ards* 29 18 28 4 10 89

Source: BPK Announcem ent Number: 01/ S.Peng/ X-X.3/ 12/ 2007 on Recruit m ent of

Candidat e Public Officials for Bachelor Degree at BPK, t he financial year 2007/ 2008 (BPK RI 2007d).

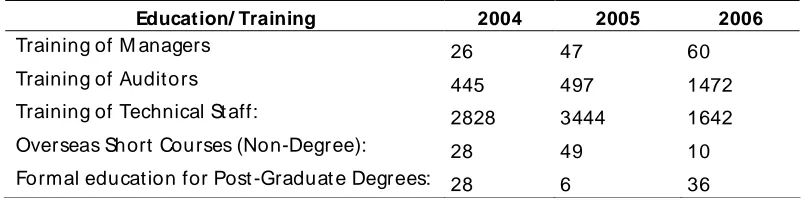

In addition, the number of Board has increased from seven t o nine, as t here ar e com pulsory of 80 hours t raining for auditors. The number and qualit y of BPK’s t raining and

educat ion have improved. Table 9 show s the program s in educat ion and t raining cent re

w hich w ere held from 2004 t o 2006 for audit ors and m anagers. Dat a indicat ed expanding

educat ion and t raining held by t he cent re ext ensively, in line w ith the increasing numbers of auditors as w ell as levels of m anagers as a result of opening new offices. M oreover, BPK also

increased t he num bers of personnel pursuing their form al education through post graduat e

degrees and overseas short courses (non-degrees).

Table 9: Numbers of Participants in BPK Training and Education (2004-06)

Education/ Training 2004 2005 2006

Training of M anagers 26 47 60

Training of Auditors 445 497 1472

Training of Technical St aff: 2828 3444 1642

Overseas Short Courses (Non-Degree): 28 49 10

Formal education for Post -Graduat e Degrees: 28 6 36

Source: BPK RI, BPK RI Dalam Angka (BPK St at ist ics) 2006, pp. 46 and 49 (BPK RI 2007b)

No Facult y Depart m ent Recruit m ent

1 Econom ics Accounting 272

Financial M anagem ent 25

Hum an Resources M anagement 5

Developm ent Studies 5

2 Law Law Science 40

3 Engineering Civil Engineering 25

Indust rial Engineering 10

M ining Engineering 5

Informat ics Engineering/ 20 Comput er Science

5 Social and Com munications 20

Political Science Int ernat ional Relations 2

6 Agriculture Agriculture 5

7 Forest ry Forest ry 10

8 Psychology Psychology 5

9 Lit erat ure Indonesian Lit erat ure 2

English Lit erat ure 4

French, Germ an, Dut ch and Russian Lit eratures

1 (for each lit erat ure)

The modern equipm ent and IT has been added; and regional offices have opened in

every province. Figure 4 illust rat es Indonesia’s geographical spread and the BPK locat ion of represent at ive offices t hroughout Indonesia, 33 provinces from W est t o East and from

Nort h to South.

Figure 4: Representative Offices of BPK RI in 33 Provinces (after the audit reform , in 2008)

These fact s indicat e that since t he reform , BPK has gradually increased it s resources as t o conduct it s audit roles and funct ions more effect ively.

Conclusion

Since the audit reform , BPK has had clear m andat e from t he Constitut ion and the Law on St at e Finances (2003), t he Law on St at e Treasury (GOI 2004b), the Law on Audit (GOI

2004a), and the Law on BPK (GOI 2006b). It s scope of auditing now (1) includes all the st at e

finances (both cent ral and local government s, SOEs, ROEs, the Cent ral Bank of Indonesia,

public services agencies, and other agencies using t he st at e’s money; (2) has a higher and

broader scope of audit, which covers t hree t ypes of audit s (financial, perform ance and specific purposes audit s). M oreover, BPK has been confirm ed as the only ext ernal audit

inst it ut ion for all public sect or agencies in Indonesia, w hile BPKP is t he int ernal auditor. As a

result , the numbers of audit ees has increased mult iple tim es.

BPK report s in t he past w ere difficult t o underst and because of t oo m any t echnical

financial, account ing and audit ing t erms w hich could not be underst ood by any st akeholders

w ith no knowledge or background in finance and account ing. Since the audit reform , BPK provides guidelines for audit ors t o provide a clear and underst andable report for

st akeholders. This is described in new BPK st at e finance st andards (GOI 2005). M oreover,

BPK provides summ ary report s w hich are easier t o read for st akeholders and includes a

legal basis has required audit ees t o subm it their report s t o BPK and audit ors to submit the

audit report s t o Parliament on tim e. The publicat ion of audit findings has raised t he part icipat ion of the public t o cont rol the performance and openness of government

agencies. How ever, t he st udy also found misuse of published audit report s by t he m edia or

opponent part ies for sensit ive or corrupt ion cases.

Evidence indicat es t hat t he follow up of audit report s of BPK is st ill low . Before t he

audit reform , t here w as no obligat ion for audit ees t o follow up BPK audit findings or recomm endations. The Parliament w as never following up t he BPK report s (subm ission to

t he Parliam ent w as only a form alit y) which did not indicat e corrupt ion, fraud or misuse of public funds (the report s had been previously screened by t he governm ent ). Since the audit

reform , t he follow up of BPK audit findings and recomm endations is m andat ed by amendment of Const itution (GOI 2006C), the Law on Audit (GOI 2004a) and t he Law on BPK

(GOI 2006b). The M em bers of Parliam ent are t he m ain st akeholders of BPK, w ho follow up

t he audit report s as part of their m ajor t ask t o oversee t he performance and account ability

of governm ent . As follow up of audit recomm endations and findings are very im port ant to

providing bet t er perform ance in public administ rat ion and m anagem ent , BPK provides discussion and com munication w ith audit ed, m em bers of Parliam ent both cent ral and

regional levels t o give explanat ions about BPK recom m endations and findings t hat have t o

be followed up. Besides, BPK signed joint agreement s w ith the Legislat ure. M oreover, BPK

m onitors and report s t he follow up to t he Parliament . As BPK has no pow er t o give sanct ions or t o prosecut e audit ed who do not follow up audit report s or have indications of

crim inalit y, BPK signed joint agreem ent s w it h authorized invest igat ors (t he Police, t he

At t orney General and the Corrupt ion Eradication Commission or KPK).

Aft er t he audit reform , t he independence of BPK has been bolst ered by (1) a clear

m andat e of Const itution t o be the only ext ernal audit inst itut ion t hat is t o be independent

in order t o im prove t he t ransparency and account abilit y of t he public sect or; (2) a clear

difference of function bet w een BPKP (as a part of government ) and BPK (as an independent body), w ith no rivalry bet w een int ernal and ext ernal audit institut ions; (3) an independent

budget t hat is separat ed from st ate budget ; (4) a new appointment syst em of t he Board of

M em bers, including the Chairm an and Vice Chairm an, t hat are appoint ed by t he Parliam ent.

This is result ing in more independence and aut onom y of BPK leaders; (5) clear regulat ions to m aint ain t he independence of BPK audit ors and personnel; (6) great er aut horit y t o organize

it s human resources m anagem ent w it hout being subject t o st rict rules administ ered by

M ENPAN (M inistry of Adm inist rat ive and Bureaucrat ic Reforms).

BPK has gradually st rengt hened it s professionalism and the int egrit y of auditors and

m em bers w it h skilled auditors and professional t raining as one of t he m ost import ant fact ors for providing qualit y audit s. BPK has also provided a Code of Et hics for maint aining

t he auditors’ int egrit y and professionalism. The implement at ion of the Code of Et hics is

pressure and intim idation pract ices (such as from t he head of regional governm ent and

army) t o BPK audit ors. In addition, since BPK has implem ent ed a performance-based remunerat ion syst em w it h incent ives for prom ot ing or sanct ioning it s auditors and st aff,

auditors are not allow ed to accept any m oney, facilities, t icket s and accom m odation from

audit ees. This new syst em is int ended to reduce bribes from audit ees t o BPK auditors.

There is evidence t hat public sect or agencies have support ed BPK findings and

recomm endations in audit report s about m aking changes and improvem ent s t o t heir public adm inist rat ion. They recognize t he im port ance of t he result s of BPK audit s in improving

t heir performance. How ever, t here are st ill many public agencies w hich are unresponsive and lack comm it m ent t o act on recom mendat ions from BPK. For inst ance, public agencies

have been unw illing t o comply w ith regulat ions from t he M inist ry of Finance aim ed at im proving t he st at e finance syst em , as indicat ed by t he lack of int egrat ion of IT applicat ion

syst em s for financial m anagem ent in the governm ent sect or and t he slowness of

government in adapting the accrual-based accounting syst em . BPK sent let t ers direct ly t o

t he President on this m at t er, but received no response. As dat a and inform at ion indicat ed

t hat the public sector agencies lacked com m it ment t o act on BPK recomm endat ions, BPK has t ried t o bring aw areness t o the leaders of t he public sect or agencies by providing

discussion on the im port ance of acting on BPK report s as a m eans t o reform public

adm inist rat ion.

Recom mendations for Improving Quality of Audit Reports

Based on t he comprehensive st udy of t he effect iven ess of public sect or auditing in

Indonesia, som e recom mendat ions are suggest ed t o m ake BPK a more excellent and reput able audit institut ion. Although som e effort has been m ade and some reforms have

been achieved, BPK st ill needs t o im prove it s w eaknesses and to be aw are of t hreat s from

t he ext ernal environm ent. These recomm endat ions can help BPK to get bet t er perform ance

in the future. The recomm endat ions are divided int o six aspect s nam ely (1) legal basis; (2) inst it ut ional; (3) t raining process; (4) effect iveness of audit report s; (5) hum an resources;

and (6) Informat ion Technology (IT).

Legal Basis Aspects

To st rengt hen the role and functions of t he et hics board and inspect orat e unit of BPK.

To implem ent audit law and audit st andards effect ively w ith law enforcement and sanct ions for any auditors and m em bers w ho do not comply wit h regulat ions, such asaccepting bribes or other grat ificat ion from audit ees.

Institutional and Resources Aspects

To com m unicat e effect ivel y bet ween BPK, parliament and governm ent about the import ance of accessing dat a and inform ation for auditing t ax revenues, M A revenues, and SOEs, as mandat ed by the Constitut ion.

To prot ect auditors from ext ernal pressure or w ho uncover sensit ive cases (such as fraud, corruption and other irregularit ies) t o maint ain t heir audit independence and t hequalit y of audit report s.

To build net w orking with public sect or auditors’ professional association, public policy, public administ rat ion groups to develop audit or’s expert ise in m easuringorganizat ional performance.

To creat e st ronger com mit ment and int egrit y of the m em bers of BPK in providing an object ive and credible inform ation in audit reports t hrough t raining and educat ion that focus on psychom ot or and cognitive t arget s, such as revit alization int egrit y and anti-corruption et hics t raining programs.

To improve the qualit y of audit resources in all new BPK represent at ive offices, mainly for information t echnology t hat allow s audit ors (1) to access dat a andinformat ion relat ing to the act ivities of t he audit office and public sect or regulations and

docum ent s; (2) to share informat ion bet w een audit ors and other int erest groups; (3) to

get fast er and cheaper com municat ion with other SAIs; (4) t o help auditors t o det ect fraud and to conduct audit disast er.

Effectiveness of Audit Reports Aspects

To pay more at t ent ion to perform ance auditing for assessing the result s, output s, benefit s and impact s of t he public sect or organizat ions in short , m edium and long t ermst hat will improve economy, efficiency and eff ect iveness of st at e program s.

To assist m em bers of Parliament in underst anding BPK audit report s t o perform t heir dut ies and functions to hold the public agencies account able to the public.

To focus on the value of audit report s, with a concret e and const ructive recom m endations, and clearer and m ore underst andable analysis that t akes intoaccount the needs of st akeholders.

To provide m ore effect iveness of monitoring and cont rolling in the implem ent ation of follow -up audit report s.Hum an Resources Development Aspects

To allow m ore opport unit y for graduat e auditors to pursue form al and professional educat ion and t rainings inside or out side t he count ry t o develop audit ors w ithknow ledge and skills, especially t o improve BPK capacit y’s for conduct ing perform ance auditing and complying w it h audit st andards.

To improve comm unicat ion building capacit y of auditors wit h st akeholders, both orally and w rit t en for improving effect ive audit findings and report s and for reducing

To improve the capabilit y or pow er of informat ion in audit report s in providing an object ive and credible report for get t ing great er t rust from audit ees, users and st akeholders.

To improve the knowledge and underst anding of auditors in com munication and informat ion t echnology for providing a t im elier m anner audit reports.

To engage w it h the problem s faced by t he bureaucracy, public adm inist ration and management , and other non financial perform ance m easures for accom modat ing t heneeds of different audit ees and for providing realist ic recomm endations in performance

auditing for st akeholders t o be follow ed-up.

To rot at e BPK audit ors for different audit ees t o reduce the possibilit y of cooperat ive negot iation or negot iat ion impasses bet w een audit ors and audit ees.

To provide a wider variet y of mult idisciplinary skills, besides account ing and management , for conducting performance auditing.

To enhance professional development of auditors t hrough e-learning st rat egy for fut ure learning environm ent in BPK.

To evaluat e the curriculum, t eaching met hods, t rainers, and t raining facilities based on the t raining needs analysis.References

Barret t , P., 1996. 'Som e t hought s about t he roles, responsibilit y and future scope of Auditors-General', Aust ralian Journal of Public Adm inist rat ion, 55(4):137-46.

BPK RI, 1996. BEPEKA Dalam Angka (BEPEKA St at ist ics) 1995-1996, Badan Pemeriksa Keuangan Republik Indonesia, Jakart a.

BPK RI, 1997. BEPEKA Dalam Angka (BEPEKA St at ist ics) 1996/ 1997, Badan Pemeriksa Keuangan Republik Indonesia, Jakart a.

BPK RI, 2002. BPK RI Dalam Angka (BPK RI St at ist ics) 2001, Secret ariat General BPK RI, Jakart a.

BPK RI, 2003. BPK RI Dalam Angka (BPK RI St at ist ics) 2002, Secret ariat General BPK RI, Jakart a.

BPK RI, 2004. BPK RI Dalam Angka (BPK RI St at ist ics) 2003, Secret ariat General, Jakart a.

BPK RI, 2005a. 'The Audit Board of the Republic of Indonesia', ht tp:/ / w w w .bpk.go.id/ english/ english.ht m (access 12/ 03/ 2005).

BPK RI, 2005b. BPK RI Dalam Angka (BPK RI St at istics) 2004, Secret ariat General, Jakart a.

BPK RI, 2006b. BPK RI Dalam Angka (BPK RI St at istics) 2005, Secret ariat General, Jakart a.

BPK RI, 2007a. The Audit Board of t he Republic of Indonesia (BPK RI), the Public Relation Bureau of BPK RI, Jakart a.

BPK RI, 2007b. BPK RI Dalam Angka (BPK RI St at istics) 2006, Secret ariat General, Jakart a.

BPK RI, 2007c. 'Perat uran Badan Pem eriksa Keuangan Republik Indonesia t ent ang Kode Et ik

BPK RI, 2007d. ’ Perat uran Badan Pemeriksa Keuangan Republic Indonesia t ent angSt andar

Pem eriksaan Keuangan Negara (BPK RI Regulation Number 1 of 2007 'St at e Finances Audit St andards)’, Number 1 of 2007, 7 M arch 2007, Badan Pem eriksa Keuangan t he Republic of Indonesia, Jakart a. Available from : ht tp:/ / w ww .bpk.go.id/ (accessed 3/ 09/ 2007).

BPK RI 2007d. ‘Recruit ment of candidat e public officials for bachelor degree at BPK, financial year 2007/ 2008,’ BPK RI announcem ent number: 01/ S.Peng/ X-X.3/ 12/ 2007, w w w .bpk.go.id (accessed 28/ 12/ 2007)

Brown, R.E. and Copeland, R.M ., 1985. 'Current issues and developm ent s in government al accounting and auditing: impact on public policy', Public Budget ing & Finance, 5(2):3-8.

Curt in, D. and Dekker, I., 2005. 'Good governance: t he concept and it s application by independent anti corruption agencies?', Public Administ rat ion & Developm ent , 15(2):151.

Durrant, R.F., 2000. 'Whither t he neoadminist rat ive st at e? Tow ard a polit y –cent ered t heory of adm inist rat ive reform', Journal of Public Adm inist rat ion Research and Theory, 10(1):79-109.

Funnell, W. and Cooper, K., 1998. Public Sect or Accounting and Account abilit y in Aust ralia, UNSW Press, Sydney.

GOI, 2004a. 'Undang Undang Republik Indonesia t ent ang Pem eriksaan Pengelolaan dan

Tanggung Jaw ab Keuangan Negara (Law of t he Republic of Indonesia on the Audit ing of St at e Finances M anagem ent and Account abilit y)' in the St at e Secret ariat of t he Republic of Indonesia (ed.), Number 15 of 2004, Penerbit Pust aka Pergaulan, Jakart a.

GOI, 2004b. 'Undang Undang Republik Indonesia t ent ang Perbendaharaan Negara (Law of t he Republic of Indonesia on the St at e Treasury)', in St at e Secret ariat of t he Republic of Indonesia, Number I of 2004, Jakart a.

GOI, 2006a. Undang Undang Keuangan Negara: dalam sat u paket (Law s of St at e Finance: in one package), 4rd edition, Tim Pust aka Pergaulan, Jakart a.

GOI, 2006c. UUD 1945: naskah asli dan perubahannya (1945 Consitut ion: original t ext and it s amendment s), 7th edition, Pusaka Pergaulan, Jakart a. The am ended of t he 1945 Const itution is available from: htt p:/ / ww w .bpkp.go.id/ unit / hukum / uud/ uud1945.pdf (accessed 20/ 12/ 2005).

Gong, T., 2009. 'Inst itutional learning and adaptat ion: developing st at e audit capacit y in China', Public Adm inist rat ion and Development , 29(1):89-166.

Hudiono, U., 17 M ay 2006. 'BPK reveals raft of budget irregularit ies', The Jakart a Post , Jakart a.

Innes, J., Brown, T., and Hat herly, D., 1997. 'The expand audit report -a research st udy w it hin t he development of SAS 600', Account ing, Audit ing and Account abilit y, 10(5):701-717.

Kit indi, E.G., 1992. 'Perform ance auditing in Tanzanian parast at als', Int ernat ional Journal of

Government Audit ing, 19(2):8-11.

Kom pas, 6 January 2007. 'Tat a pem erint ahan: BPK segera t erbit kan st andar pemeriksaan (St at e administ rat ion: BPK will launced new audit st andards soon)', Kom pas, Jakart a.

Lindeberg, T., 2007. 'The ambiguous ident it y of audit ing', Financial Account abilit y and

M anagem ent , 23(3):337-350.

M cInt osh, N., 1997. 'Aspect s of change in t he Canadian federal public service', Public

Adm inist rat ion and Developm ent , 17(1):123-129.

M ulgan, R., 2003. Holding Pow er t o Account : account abilit y in m odern dem ocracies, 1st edit ion, Palgrave M acM illan, New York.

Polit t , C., Girre, X., Londsdale, J., M ul, R., Sum ma, H., and Waerness, M ., 1999. Perform ance or Compliance?: perform ance audit and public managem ent in five count ries, Oxford Universit y Press, New York.

Pow er, M .K., 2003. 'Evaluat ing the audit explosion', Law and Policy, 25(3):185-202.

Sam , 2006. 'Tem uan BPK t idak Direspons (BPK's Findings w ere not Responded)', Harian

M edia Indonesia, Jakart a.

Sheldon, D.R., 1996. Achieving Account abilit y in Business and Governm ent , Quorum Books, W est port , Conn.

Shimomura, Y., 2003. 'In search of endogenous elem ent s of good governance: t he case of east ern sea board developm ent plant in Thailand', in Y. Shimomura (ed.), The Role of

Governance in Asia, Inst itut e of Southeast Asian Studies, Singapore.

Suara Pem baharuan, 16 M ay 2006. 'BPK t emukan 5.377 penyimpangan (BPK found 5.377 irregularit ies)', Jakart a.

Susapto, L., 2006. 'Hanya 42,11 persen t emuan BPK dit indaklanjut i (Only 42.11 per cent of BPK findings follow ed-up)', Harian Sinar Harapan, Jakart a.

DECENTRALISATION, ACCOUNTABILITY, AND LOCAL GOVERNM ENT PERFORM ANCE IN

INDONESIA

Sujarw ot o* ) and Tri Yumarni* * ) Abstract

What m akes local governance w orking effect ive aft er decent ralisat ion? Why som e local

government s are achieve bet t er perform ance t han ot hers in managing decent ralised public

services and resources? How can m alfunction local governm ent s be reformed in order t o perform effective and efficient ? This art icle cont ribut es t o our underst anding of these

overarching quest ions by exploring the linkage bet w een local government account abilit y,

corruption, and cit izens’ participation. Depart ing from crit iques on fiscal federalism t heory,

w e propose hypothesised pathw ays t hrough which decent ralisat ion can lead bet t er local public service perform ance. The basic hypotheses underlying this research is t hat

decent ralisat ion will result in bet t er local public service perform ance only if mechanism s for

st rengt hen polit ical account abilit y are est ablished w it hin local governm ent s. Wit hout st rong

polit ical account abilit y, decent ralisat ion only creat es pow erful incentives for polit ical and bureaucrat agent to capture local political process and misallocat e public resources.

We t est t hese hypotheses against evidence from 155 newly em pow ered local government s

in Indonesia. Governance Decent ralisat ion Survey Dat a (GDS) is used t o examine t he linkage

bet w een decent ralisat ion, accountabilit y and local governm ent perform ance in the count ry. The result s of simple and multilevel regression model broadly support the hypotheses. Less

corruption, higher local governm ent account ability and cit izen’s polit ical part icipation are all

associat ed w it h bet t er local governm ent perform ance. In cont rast , poorly performing local

public services are oft en deeply root ed in their polit ical and social cont ext s. Local

government s oft en fail to provide bet t er public service w hen polit ical account abilit y is absent due t o w eak checks and balances, lack of t ransparency, and w eak el ect oral incentives. These effect s rem ain st atist ically robust across all regression specifications.

Keyw ords: decent ralisat ion, political account ability, and local governm ent perform ance.

* )

PhD St udent at Inst it ut e f or Social Change Universit y of M anchest er UK Email: sujarw ot o.Sujarw ot o@post grad.manchest er.ac.uk

* * )

Lect urer on t he Depart ment of Public Administ rat ion, Jender al Soedirman Universit y Purw okert o Cent ral

Introduction

In recent years, t here has been considerable discussion on t he m erit s of decent ralisat ion. The discussion has oft en focused on the provision of a great er variet y of public goods that

m ay result from decent ralisat ion. M ore recent ly, great er em phasis has been placed on

polit ical accountabilit y issue at local government s. Recent decent ralisat ion reforms

substant ially focus on political decent ralisat ion rat her t han adm inist rat ive and fiscal decent ralisat ion (Crook and M anor 1998:1, Bardhan and M ookherjee 2006a:4, World Bank

2008). Political decent ralisat ion em phasizes t he w orking of political participation and

polit ical inst it ut ions, such as polit ical part ies and civil societ y, t o ensure t he account abilit y of

local polit icians and local officials. Proponent s of political decent ralisat ion argue t hat

bringing cit izens closer t o government and allow ing t hem to hold polit icians account able are an import ant foundation to enhance local public services performance. They argue t hat

bet t er qualit y of represent at ion and great er t ran sparency w ill be creat ed w hen cit izens are allowed t o be more actively engaged in public affairs.

Although political decent ralisat ion promises bet t er governm ent and deeper democracy, in

pract ice t his approach m eet s challenges. Under decent ralisat ion citizens should have great er say in the policy m aking and programm e choices of governm ent , but evidence at

m any developing count ries suggest s t hat this is not oft en the case. In som e cases, local government s may act ually be m ore subject t o capture by vest ed int erest s t han nat ional

ones aft er decent ralisat ion (Bardhan and M ookherjee 2000; Bardhan 2002; Bardhan and

M ookherjee 2006b). Bardhan and M ookherj ee (2006b:164) elucidat e some of t he basic

t rade-offs involved in t he delegat ion of decision making t o local governm ent : decisions are

m ade on the basis of bet t er (local) information, but they are m ade by an agent whose incentives differ from t hose of t he principal thus leading t o a loss of cont rol or an abuse of

pow er. In decent ralised government , local government s m ay be more vulnerable t o corrupt because local pow er groups can easily collude beyond t he cont rol of higher level

inst it ut ions. Bienen and colleagues (1990:72-73) ident ify that decent ralisat ion creat ed opport unit ies for local elit es t o capt ure resources and decision m aking at t he local level in

Nepal. Rusia has faced a fast -m oving decent ralisat ion process since t he early 1990s, when it

w as t ransformed from a cent rally planned econom y int o a decent ralised market economy. During t he process of devolut ion, local leaders have been em pow ered and local

government s have been capt ured by init ial rent holders (Blanchard and Shleifer, 2000). This

has led t o very high levels of corruption, which are st ill a significant problem facing t he

Russian econom y and societ y t oday (Lessmann and M arkwardt 2010: 631). In Bangladesh,

under President Ershad’ s decent ralisat ion reform , t he decisions over allocation of resources continued t o be m ade by elit es of polit ical fact ions t hat corrupt ed and cont rolled t he local

government s (Sarker, 2008: 1425). Inst ead of facilit ating equit y in participation,

represent at ion, influence and benefit sharing, decent ralisat ion can lead t o local government