This

Financial Stability Review (FSR)

is presented as part of Bank Indonesia»s

mission ≈to achieve and maintain rupiah value stability through maintenance of monetary stability

and development of financial system stability for the achievement of sustainable long-term national

development∆.

Published:

Bank Indonesia

Jl. MH Thamrin No.2, Jakarta Indonesia

Information and Order :

This FSR document is based on data and information as of September 2003, except when otherwise indicated. This FSR document is also available in pdf format at Bank Indonesia»s web site at http://www.bi.go.id

Inquiries, comments, and recommendations may be addressed to : Bank Indonesia

Directorate for Banking Research and Development Financial System Stability Bureau

Jl. MH Thamrin No.2, Jakarta, Indonesia Telephone : (+62-21) 381 7779, 7990

The FSR is published biannually with the following objectives:

•

To foster public understanding of financial system stability, both domestically and

internationally;

•

To analyze potential risks to financial system stability; and,

fsr

Financial Stability Review

F FF

FForeword vii E

E E E

Executive Summary xi

C C C C

Chapter 1 Overview 3

C C C C

Chapter 2 Development of Domestic and Interna-tional Economies 7

2.1. External Influences 7 7 7 7 7

2.2. Domestic Economic Conditions 9

Boks II.1 Will Property Become a Nightmare Again? 13

Boks II.2 Rocketing China : Threat or Opportunity? 15

C C C C

Chapter 3 Development of Banking Industry 19 3.1. Commercial Banks 19

3.1.1. Credit Risk 19 3.1.2. Liquidity Risk 31 3.1.3. Profitability 36 3.1.4. Capital 38 3.1.5. Market Risk 40 3.1.6. Operational Risk 42 3.2. Development of Sharia Banking 44 3.3. Development of Bank 45

3.4. Law Enforcement 46

Boks III.1 Indonesian Banking Architecture, Blue Print

and Strategic Directions in the Future? 20

Boks III.2 Rigidity of Loan Interest Rates 22

Boks III.3 Undisbursed Loans 24

Boks III.4 Capital»s Resilience To Credit Expansion 27

Boks III.5 Stress Test of NPLs Impact on Capital 29

Boks III.6 Provisions for Earning Assets Losses (PEAL) 29

Boks III.7 Implications of Implementation of The New Guarantee Scheme 35

Boks III.8 Impact of IBRA»s Dissolution 43

C C C C

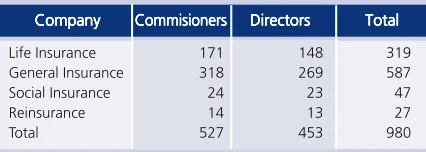

Chapter 4 Non-bank Financial Institutions 58 4.1. The Insurance Industry 58

2.2. The Pension Funds Industry 64

Boks IV.1 Bancassurance - Advantageous

for All Parties? 59

Boks IV.2 Implementation of the Regulation on Fit & Proper Tests in the Insurance Industry 63

C C C C

Chapter 5 Capital and Money Markets 69

5.1. Development of Indonesia»s Capital Market 69 5.2. Development of Indonesia»s Money Markets 75

Boks V.1 Mutual Fund 71

Boks V.2 Prospects for Issuance of Government

International Securities (SUN) (the Yankee Bond) 76

Boks V.3 Corporate Bond 78

Chapter 6 Payment System 81

Articles 85

I. Study on the Cost of Intermediation At Several Large Banks in Indonesia:Are Commercial Banks» Interest Rates on Credits Overpriced? 87 II. Early Indicators of Banking Crises 97

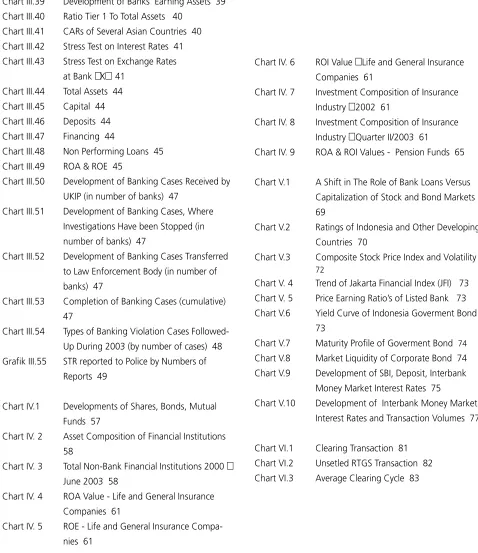

List Charts and Tables

Tables

Chart I.1 Asset Composition of Financial Institutions 3

Chart II.1 Developments of International Interest Rates 7

Chart II.2 Developments of 5 Major Trading Partner Countries» Economies 7

Chart II.3 Development of Inflation In 5 Major Trading Partner Countries 8

Chart II.4 Foreign Investments and Portfolio Invest-ments (Net) 8

Chart II.5 Developments of Composite

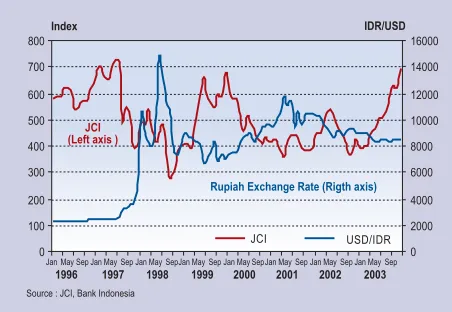

Stock Price Index and Rupiah Exchange Rate 9

Chart II. 6 Inflation and Consumer Loan 10 Chart II.7 2002 Supply and Demand for Logs 11 Chart II. 8 Developments of Average Leverage and

ROE of Several Textile Companies 14

Chart III.1 Number of Banks and Total Assets 19 Table II.1 Indonesia»s Balance of Payments (Million of

USD) 9

Table II.2 Government Financial Statistics 10 Table II.3 Number of Workers in Indonesia»s Textiles

and Related Products Industry 12 Table III.1 NPLs by Bank Group 30

Table III.2 Loans Concentration on 25 Largest Debtors (LD) 30

Table III.3 Development of Third Party Funds and NAV 32

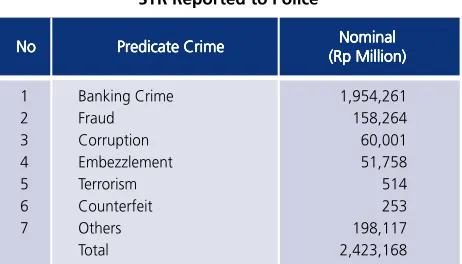

Table III.4 Rural Bank Major Indicators 46 Table III.5 STR Reported to Police

Table V.1 Rating of Default Probability of Large Corporate Bonds 75

Charts

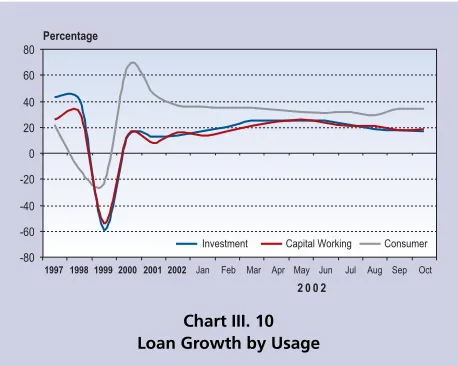

Chart III.4 Outstanding Credit by Bank Group 23 Chart III.5 Growth of Credits & Funds 23 Chart III.6 Credit Growth by Debtor Group 23 Chart III.7 Credit Growth by Certain Economic

Sectors (%) 23

Chart III.8 Credit Development by Economic Sector 25 Chart III.9 Loan Development of Credit by Usage 25 Chart III.10 Loan Growth by Usage 25

Chart III.11 NPLs of Consumer Loans 25 Chart III.12 New Loans by Economic Sector 26 Chart III.13 2003 New Credits 26

Chart III.14 Development of Property Loan 26 Chart III.15 Growth (y to y) of Property Sector (%) 26 Chart III.16 Non Performing Loans 28

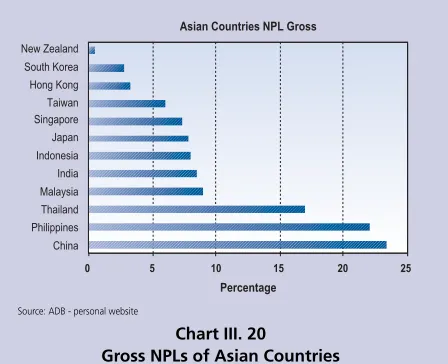

Chart III.17 Growth of Loans Classification 28 Chart III.18 Development of Outstanding NPLs 28 Chart III.19 2003 Ratio of NPLs to Capital 30 Chart III.20 Gross NPLs of Asian Countries 30 Chart III.21 Ratio of 25 Largest Debtors» to

Capital √ August 2003 31

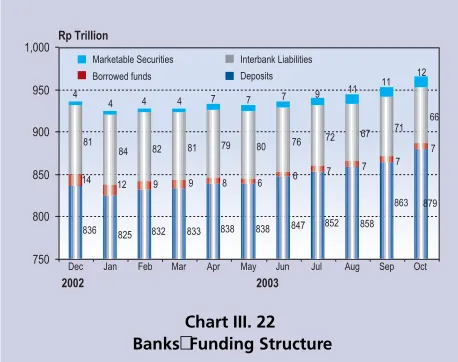

Chart III.22 Banks» Funding Structure 32

Chart III.23 Structure of Third Party Funds 32

Chart III.24 Composition of Time Deposits by Tenor 33

Chart III.25 Ownership of Third Party Funds by Core

Depositors 33

Chart III.26 Third Party Funds Ownership at 15 Big Banks 33

Chart III.27 Composition of Time Deposits by Amount 34

Chart III.28 Liquid Asset Ratio 34

Chart III.29 Ratio of Funds Channelled Over to Funds

Sources 34

Chart III.30 Ratio of Liquid Assets to Short-Term Liabilities at 15 Big Banks 36

Chart III.31 Non-Core Deposits to Liquid Assets 36

Chart III.32 Development of Net Interest Income 37

Chart III.33 Composition of Interest Income at 15 Big Banks 37

Chart III.34 Composition of Interest Income 37

Chart III.35 Efficiency Ratio 38

Chart III.41 CARs of Several Asian Countries 40 Chart III.42 Stress Test on Interest Rates 41 Chart III.43 Stress Test on Exchange Rates

at Bank ≈X∆ 41 Chart III.44 Total Assets 44

Chart III.45 Capital 44

Chart III.46 Deposits 44

Chart III.47 Financing 44

Chart III.48 Non Performing Loans 45

Chart III.49 ROA & ROE 45

Chart III.50 Development of Banking Cases Received by

UKIP (in number of banks) 47

Chart III.51 Development of Banking Cases, Where

Investigations Have been Stopped (in number of banks) 47

Chart III.52 Development of Banking Cases Transferred

to Law Enforcement Body (in number of banks) 47

Chart III.53 Completion of Banking Cases (cumulative)

47

Chart III.54 Types of Banking Violation Cases Followed-Up During 2003 (by number of cases) 48 Grafik III.55 STR reported to Police by Numbers of

Reports 49

Chart IV.1 Developments of Shares, Bonds, Mutual

Funds 57

Chart IV. 2 Asset Composition of Financial Institutions 58

Chart IV. 3 Total Non-Bank Financial Institutions 2000 √ June 2003 58

Chart IV. 4 ROA Value - Life and General Insurance

Companies 61

Chart IV. 5 ROE - Life and General Insurance

Compa-nies 61

Chart IV. 6 ROI Value √ Life and General Insurance

Companies 61

Chart IV. 7 Investment Composition of Insurance

Industry √ 2002 61

Chart IV. 8 Investment Composition of Insurance

Industry √ Quarter II/2003 61

Chart IV. 9 ROA & ROI Values - Pension Funds 65

Chart V.1 A Shift in The Role of Bank Loans Versus

Capitalization of Stock and Bond Markets 69

Chart V.2 Ratings of Indonesia and Other Developing

Countries 70

Chart V.3 Composite Stock Price Index and Volatility

72

Chart V. 4 Trend of Jakarta Financial Index (JFI) 73 Chart V. 5 Price Earning Ratio»s of Listed Bank 73

Chart V.6 Yield Curve of Indonesia Goverment Bond

73

Chart V.7 Maturity Profile of Goverment Bond 74

Chart V.8 Market Liquidity of Corporate Bond 74

Chart V.9 Development of SBI, Deposit, Interbank

Money Market Interest Rates 75

Chart V.10 Development of Interbank Money Market

Interest Rates and Transaction Volumes 77

Chart VI.1 Clearing Transaction 81

Chart VI.2 Unsetled RTGS Transaction 82

This financial system stability review provides a picture of the current state of financial system stability in Indonesia and its outlook as of end-2003.

As of the end of 2003, the condition of our financial system was stable with quite encouraging developments. It is expected that this will continue in 2004. However, there are still several problems that need close attention to prevent them from becoming constraints in the future.

Important developments during 2003 included rising international confidence as indicated by an upgrade in Indonesia»s debt rating as well as high foreign investors» interest in the sales of corporate shares and bonds. These were possible largely due to rupiah exchange rate stability, lower interest rates and inflation, as well as improving banking conditions. However, in the same year, the banking sector was strained for a time by several cases of fraud, which caused considerable losses for the banks concerned. This shows how implementation of good corporate governance needs to be stepped up by all parties, particularly those involved in financial systems management.

There were several other problems originating internally to the financial system, such as continuing high NPLs of banks, slow recovery of bank intermediation, and rigidity of interest rates on credits. Problems from the external side of the financial system, such as slow real sector recovery more competitive global markets, have also put pressure on our financial system development.

The downward trend in interest rates has prompted the public to shift some funds to the capital market, which has boosted the composite stock price index and the bond index in the capital market, up 63% and 66%, respectively from the previous year. Such growth has also boosted the mutual funds industry, which is up 56% from the year before. These are, of course, encouraging developments. However, there is a need to emphasize that rapid capital market expansion also has the potential to create new problems if it is not followed by improvements in infrastructure, such as better accounting systems, regulations and market discipline on market players.

Bank Indonesia»s determined efforts in building and maintaining stability of the financial system cannot be done properly without the support of related parties and institutions. For this, we express our appreciation and thanks to all contributors and participants in the hope that this document will assist the general public and related supervisory institutions in building a sense of joint concern and responsibility.

In closing, we welcome any suggestions, comments, and even critiques to enhance the the quality of this review in the future.

Jakarta, January 2004 Jakarta, January 2004 Jakarta, January 2004 Jakarta, January 2004 Jakarta, January 2004

In general, stability was maintained in the banking and

financial systems during 2003, as indicated by continuous

improvements in several banking and financial system

performance indicators. This condition was supported by

macroeconomic stability and relatively conducive

monetary conditions during the year, as indicated, for

example, by economic growth that reached its target and

by improved macroeconomic indicators that strengthened

domestic and international public confidence in the

Indonesian economy.

However, banks» dependence on income from

recapitalization bonds, continuing weak governance, and

limited risk management, could pose a threat to the

banking industry and financial system in the future. Also,

the real sector has not fully recovered and several business

sectors are susceptible to tough competition from other

countries. Both have the potential to cause banks» NPLs

to rise. Meanwhile, short-term foreign capital inflows are

on the rise; these tend to be volatile and could have a

negative impact on financial system stability and the overall

economy.

1. MACROECONOMIC STABILITY

Stable macroeconomic conditions that tended to

improve during 2003 have supported financial system

stability. The balance of payments, rupiah exchange rate,

and inflation rate all performed better than expected at

the beginning of the year, while economic growth achieved

the figure originally projected.

Improved economic indicators were greatly assisted

by consistent implementation of monetary and fiscal

policies. Relatively loose monetary policy during 2003

provided room for the real sector to recover without

reducing the purchasing power of the public. Meanwhile,

the implementation of a conservative and cautious fiscal

policy has helped to strengthen confidence in

macroeconomic stability which leaded to hold down

inflation, which in turn helped with the maintenance of

financial system stability.

On the external side, declining international interest

rates helped provide room for domestic interest rates to

fall without undermining the exchange rate. These

conditions contributed to strengthening economic players»

confidence, and no damaging shocks occurred. In the

future, if fiscal policy remains conservative and is adjusted

to the needs of economic growth, it would further benefit

financial system stability.

Nevertheless, economic and non-economic

fundamental conditions are worrisome. Economic growth

of around 4.55% during 2003 was within the range of

original projections, but it was not able to make any

progress on Indonesia»s unemployment problem. Open

unemployment is estimated at 10.1 million people or 9.8%

of the whole work force in 2003. Also, the growth to date

has not been able to lift per capita income back to its

pre-crisis level. In addition, the major factor behind economic

growth during 2003 was consumption growth of 5.1%.

In the long-term, high unemployment and economic

growth dependent upon consumption pose risks for the

economy.

Investment expanded by 1.6%. However, this

expansion was more for construction than machinery, and

consequently it did not have any meaningful impact on

production capacity. Manufacturing grew by only 2.4%,

Executive Summary

down from 4% in the previous year. However, this did not

push up prices due to smooth flows of imported goods

that suppressed inflation. On the downside, this could pose

difficulty for banks and other financial institutions in

determining interest rates on credits to be channeled to

the real sector. In the long-term, businesses that are not

able to compete with imported products have the potential

to go bankrupt, which could cause economic instability, if

it were to happen on a large scale.

For its part, the balance of payment»s structure was

less encouraging. Non-oil/gas exports were dependent

upon demand from several countries (mainly the US, Japan,

and Singapore), but remained dominated by five main

commodities (textiles, wood products, electrical appliances,

and footwear), which have many international competitors

(except for paper products). Nonetheless, repayment

capacity of exporting companies generally seemed not to

have been disrupted because free trade regulations have

not yet been fully enacted. On capital account, inflows

were dominated by short-term portfolio investment, which

is susceptible to reversals. Foreign direct investment, which

is more stable, was on the decline.

A policy of low interest rates, which was successfully

implemented during 2003, is expected to be continued

cautiously. The large gap in maturity profiles between

banking assets and liabilities would raise banking instability

if interest rates were changed suddenly and with violent

fluctuations. But, because exchange rate stability could

be maintained, exchange rate risk was relatively low, which

added to stability in the financial industry in 2003.

2. FINANCIAL SYSTEM STABILITY

Macroeconomic stability supported banking and

financial stability in 2003. The banking industry»s stability

was reflected in several performance indicators, which

capital. Meanwhile, Indonesia»s capital markets experienced

extraordinary development during 2003, with the stock

market»s performance ranking as the second best in the

world. The bond market also recorded rapid growth with

a tendency towards oversubscription at each new issuance.

For its part, the money market did not fluctuate in any

way that could have endangered financial stability, while

conditions at non-bank financial institutions were also

relatively stable. This was further supported by policy on

the non-cash payment system that has successfully reduced

systemic risk and increased the efficiency of payment

transactions. Nonetheless, in order to maintain financial

system stability, there are several matters that warrant close

attention such as bank intermediation that has not fully

recovered; weak corporate governance that leads to large

operational risk in the banking industry; the possibility of

rising NPLs; and a reduction in the coverage of the blanket

guarantee program.

2.1. Banking Industry

In general, stability of the banking industry during

2003 was bolstered by banks» control of credit risk. At the

same time, market risk was quite moderate, being

supported by adequate banking capital, a stable exchange

rate, lower interest rates, and a relatively small net foreign

currency position of banks (which, for example, averaged

4.70% of banking capital in quarter III-2003). During 2003,

banks still experienced excess liquidity, which was mostly

placed in SBIs and the interbank money market. The large

size of interbank borrowings could have a systemic risk.

However, no banks experienced a liquidity crisis during

2003. Nevertheless, the large size of maturity mismatches

at several recapitalization banks could have created

instability if interest rates were to fluctuate excessively.

The banking industry»s stability was further bolstered

by growing public confidence in the Indonesian banking

sector as indicated by confidence index surveys.

Improved banking conditions were generally reflected

in a rising rate of return on assets (ROA) during 2003,

from 1.9% (Dec«02) to 2.3% (y-t-d, Oct»03). This mainly

stemmed from banks» success in preventing a drop in their

net interest margins (NIM) in the face of declining interest

rates. During 2003, banks» NIM narrowed only modestly,

from 4.2% (Dec»02) to 3.8% (y-t-d, Oct»03). Also, banks»

CAR remained above the 20% level, which turned out to

be more than adequate to absorb business risks, particularly

credit risk, during 2003.

Rural Banks also did well during 2003, with asset

growth of 38.8%, reaching Rp10.4 trillion (June 2003).

Another indicator of improved performance was a rise in

the percentage of Rural Banks categorized as «sound» from

61.9% (June 2002) to 63.9% (June 2003). Sharia banks

had a similar experience, with strong growth in assets

(60%), third party funds (60%), and financing (50%) with

Capital Adequacy Ratio (CAR) reached 17%. In addition,

the quality of earning assets in the sharia banking industry

were in a sound condition as indicated by the level of

non-current financing, which was below 5%. In general, the

sharia banking industry also had a good level of earnings,

although in 2003 it did record a sizable drop due to large

expansion, which incurred sizable infrastructure costs.

However, several matters that arose during 2003

warrant close review, particularly concerning bank loan

and capital. As regards development of bank loan, growth

in outstanding loan and new loan extensions during 2003

were down from the year before. Also, there was a rise in

undisbursed banking loans to Rp25.6 trillion (Jan - Oct

»03), up from the previous year»s Rp19.1 trillion (Jan-Oct

«02). The slowdown in credit channeling was partly related

to on-going rigidity in interest rates on credit, which did

serve to protect banks» profitability. Excess liquidity and

limited lending have prompted banks to depend on SBIs

and bonds for interest income. Unfortunately, this does

not boost economic growth, which in the long run could

disrupt financial stability.

During 2003, credit channeling continued to be

dominated by consumer credit. In line with the downward

trend of interest rates, consumer credit channeling was

on a rising trend (33.8%, y-o-y), far larger than the rises

of working capital and investment credits of 16.9% and

7.4%, respectively. This rapid expansion of consumer

credits risks higher NPLs, if economic growth were to

decline.

Meanwhile, outstanding property credit reached

Rp43.9 trillion (Oct »03) or 10.3% of total banking credits,

up Rp35.0 trillion from its position at December 2002.

This rapid increase is also susceptible to rising NPLs if

unemployment were to rise due to layoffs.

The aggregate CAR during 2003 ranged between

20% - 26%, with 17 (out of 138 banks) having CARs

between 8% √ 10%; of these, one was a large bank. Six

banks had CARs at between 10% √ 15%. This figure was

quite susceptible to changes in the quality of earning assets

and in the method of calculation to includes risk

components in addition to credit risk.

2.2. Non-Bank Financial Institutions

The downward trend in interest rates prompted

several insurance and pension funds industries to shift their

fund placements from deposits to capital market products

in order to minimize income declines.

During 2003, the insurance industry experienced

some restructuring to enable it to face rising competition,

fulfillment of minimum risk-based capital, and new

regulations, such as fit and proper tests. Still, lower interest

rates impacted directly on the earnings of funds managed

by the insurance and pension funds industries. To tackle

Executive Summary

structures from placements in banking products (deposits)

to capital market products (shares, bonds, and mutual

funds). However, this shift has not prevented a decline in

returns (ROA, ROI, and ROE). This was due to high

operational costs resulting from competition on premiums

and commissions as well as still inefficient business

activities.

2.3. Capital and Money Markets

Rapid growth of the stock market has the potential

to cause an overpriced situation. This could spur instability

in the future if it is not followed by implementation of

good governance, among others in the form of adequate

transparency. The extraordinary development that occurred

in Indonesia»s stock market during 2003 resulted in this

market having the second best record in the world after

Thailand. Several developments that boosted the capital

market»s performance were the downward trend in global

interest rates, improvements in several macroeconomic

indicators, and stable political and security conditions.

Despite a sell-off for a time in the wake of the bomb

incident at the JW Marriot Hotel, positive developments

(such as continued declines in SBI rates and improvements

in the quality of issuers) soon prompted a recovery. The

composite stock price index was at a low of 379.351 on

11 March 2003, but recovered very well, closing the year

at 691.90, the highest level in 2003. This rise of 82% was

only exceeded by Thailand»s bourse, which soared by

115.6% (Jan-Dec 2003). The stock market in 2003 also

benefited from the successful initial public offerings of

three large state-owned companies (Bank Mandiri, BRI,

and Perusahaan Gas Negara), which received an

enthusiastic response from domestic and foreign investors.

Meanwhile, the bond market also experienced rapid

growth with a trend toward oversubscription with each

One of the factors encouraging bond issuance was

continuing high credit rates at banks and the rising demand

for mutual funds with bonds as assets. Rapid development

of the bond market was further indicated by bond

issuances, which reached Rp24.7 trillion in 2003 out of

total bonds traded at the Surabaya Stock Exchange of

Rp46.2 trillion (November 2003). The 2003 issuance was

the largest in the history of Indonesia»s capital market. In

the secondary market, bond trading during 2003 was

active with prices increasing to an average of 99.4% of

nominal values (November 2003), compared to 95.31%

at the beginning of 2003). These developments warrants

close attention because if the bond issuers use these funds

for high-risk business activities, it would heighten credit

risk, including risk of systemic default.

Rapid expansion in the mutual funds marketƒ

without implementation of adequate accounting

standardsƒ risk a loss of customer confidence. Mutual

funds» NAV rose by 482.4% to Rp46.6 trillion in 2002

followed by a further rise of 70% to Rp79.2 trillion during

2003 (Jan-Oct). One of the reasons for the rise in mutual

funds» NAV was vigorous tradings of corporate and

government bonds in the secondary market. Most mutual

funds (85.2% in October 2003) were of the fixed-income

type with bonds as their major asset. This rapid growth

ended in October 2003, when there were large-scale

redemptions due to rumors of a change (to

marked-to-market) in the method for calculating mutual funds» NAV.

Consequently, there was a drop in mutual funds» NAV from

Rp85.9 trillion (September 2003) to Rp79.2 trillion (October

2003) because investors withdrew their funds.

During 2003 in the interbank money market, interest

rates trended downward in line with declines in SBI interest

rates. Interest rates in the morning and afternoon money

funds could not be quickly channeled to credits.

Nonetheless, lower interest rates in the money market did

not boost bank intermediation.

Turning to the payment system, credit and settlement

risk have eased considerably with implementation of the

real time gross settlement (BI-RTGS) system, whose

coverage now reaches over all of Indonesia. But despite a

major shift in transactions to the BI-RTGS system, the older

clearing system still has an important role in executing

payment transactions.

3. 2004 OUTLOOK

Macroeconomic and financial system stability are

expected to be maintained in 2004. With a stable rupiah

exchange rate, low inflation, and a downward trend of

interest rates, economic growth is projected to rise, although

it would still not be able to absorb all additions to the work

force. The main factor boosting growth is expected to be

domestic demand, particularly consumption. Global

economic conditions are forecast to improve in 2004, and

this would give a boost to the financial system, particularly

as regards credit extensions. However, several constraints

would remain due to difficulties in improving economic and

non-economic fundamentals, which in turn would cause

risk to remain high.

Based on developments in 2003 and economic

prospects for 2004, commercial banks» are expected to

remain stable in 2004. However, several conditions warrant

close review due to their potential for hampering

improvement of NPLs and banking performance, which

could disrupt banking stability.

Banking credits are projected to expand in line with

improving economic performance. In particular, improved

prospects for international commodity prices (especially

primary non-oil/gas commodities) and manufacturing due

to rising demand in export markets would have a positive

impact on the domestic business climate, which would

raise demand for bank credits. However, there would be

several factors that could pose problems on the supply

side, including: (i) weak implementation of risk

management by banks remaining high risk perceptions

from the banking system towards credit; and (ii) high credit

interest rates due to declining interest income from SBIs

and bonds, as well as banks» inefficient business operations.

Meanwhile, on the demand side, demand for credits would

be limited by more attractive alternative funding sources

outside banking credits such as the issuance of bonds and

shares.

Banks» NPLs are estimated to remain below the

indicative target of 5% because banks are expected to

provision against (gross) NPLs through adequate Provisions

for Earning Assets Losses (PEAL). Another factor would be

banks» very conservative behavior in extending credits due

to perceptions of high risk. Consequently, NPLs (gross)

would tend to rise in 2004. Several conditions would

prompt this rise, such as ex-IBRA and restructured credits.

Furthermore, structural problems such as legal uncertainty

related to regulations and their enforcement would pose

constraints on banks» attempts to improve their NPLs.

The composition of banks» income is estimated to

continue improving during 2004 in line with rising credit

volume and credit»s share in banks» earning assets.

However, this rise would not significantly boost banks»

profitability due to several remaining problems, such as (i)

relatively large components of banks» income whose

sustainablity is doubtful, i.e. non-interest income, which

mostly comes from fluctuanting trading activities as well

as write backs provisioning coming from credit

restructuring and sales of NPLs; and (ii) rising costs due to

deterioration in the quality of banks» credits that require

more provisioning (PEAL).

On the capital side, banks» overall CAR is estimated

to remain well above 8%. However, there could be

Executive Summary

Weighted Assets due to higher credits, (ii) difficulty in

building up capital from profits because several banks tend

to distribute dividends despite low profitability, and (iii) a

potential rise in NPLs (gross).

However, on the bank liquidity side, growth of third

party funds is expected to come under pressure, due to

factors such as: (i) a downward trend in interest rates; (ii)

a decline in the guarantee interest rate, which limits banks»

flexibility in setting interest rates on deposits; as well as

(iii) competition from mutual funds and corporate bonds,

which offer more attractive returns for fund owners.

Based on current growth trends, the sharia banking

industry is estimated to reach asset values of Rp12 - 13

trillion by end-2004 compared to Rp7 trillion at present.

As such, the percentage of sharia banking operations could

exceed 1% of the national banking industry»s total

business. Even higher asset growth is possible because of

plans by one conventional bank to change to a sharia bank

and by several conventional banks to open sharia units.

However, if expansion continues this rapidly, challenges

sharia banking will face increasing challenges, particularly

on the sides of risk management and capital.

Continuing previous years» developments, the Rural

Bank industry is also expected to expand rapidly. This will

be assisted in part by its captive market comprising

customers from communities in urban suburbs and villages

that are not served by commercial banks. However, several

constraints could hamper growth, among others: (i) a

relatively low quality of Rural Bank human resources; (ii)

insufficient numbers of Rural Bank supervisors; and (iii)

relatively inefficient business activities as indicated by

extremely high credit rates charged by Rural Banks.

As was the case in 2003, the insurance and pension

funds industries would continue to face problems with

funds management due to a continuing downward trend

efficiency and capital in preparation for merger or

acquisition. Meanwhile, the pension funds industry, which

been extremely conservative to date in its investment

strategy (as indicated by a large share of bank deposits),

will need to implement adequate risk management in

support of its desire for higher-yielding, long-term

placements.

Many analysts expect that the capital market will not

grow as rapidly in 2004 as it did in 2003. Investors that

have aggressively placed funds during 2003 are pulling

back somewhat, adopting a wait- and-see attitude.

Similarly, several businesses that have used the opportunity

to raise funds in the capital market during 2003 will wait

for indications that the market will accept new issuances

of their debt at better prices. However, if the national

general election agenda proceeds smoothly, investors √

domestic and international√ might rush to invest in

Indonesia.

Meanwhile, the money market is not expected to

experience any meaningful change in line with continued

trends towards lower interest rates and excess liquidity.

Concerning implementation of the payment system,

it is necessary to step up monitoring and supervision of

the system in accordance with international standards

(Core Principles for Systemically Important Payment

Systems √ CP-SIPS set the BIS). In addition, it is necessary

to make efforts to further develop that system in terms of

capacity and to mitigate operational risk.

4. POLICY DIRECTIONS FOR THE FUTURE

In line with continued accommodative monetary

policy and closer coordination between monetary and fiscal

policy, rehabilitation and enhancement of the banking

system»s resilience needs to be continued. Within the

bureau. Meanwhile, in order to safeguard stability,

elimination of the blanket deposit guarantee needs to be

undertaken gradually and cautiously. In this regard, the

implementation of prudential banking principles in

accordance with international standards need to be

continued.

Implementation of good risk management by banks

is vital. Risk management that is incorporated into bank»s

operations will support the creation of good governance

and minimize criminal banking practices. This ranges from

making misrepresentation to the public, through window

dressing of balance sheets and incorrect reporting, up to

fraud, such as has occurred recently. If these problems are

not seriously addressed by the supervisory authority and

other players in the banking industry, such cases will recur.

This will further undermine public confidence, which has

still not recovered fully.

One of the ways to implement good risk

management is by banks knowing their customers well.

This can be achieved by information sharing between banks

through a credit bureau, which is one effective way to

prevent fraud. Several recent cases of fraud were

undertaken by the same people and companies with the

same modus operandi.

The government plan to phase out the deposit

guarantee program could have a wide impact on the

banking industry. If thorough preparations and calculations

are not made at an early stage, this could result in public

funds shifting from one bank to another (a flight-to-quality)

or to outside the banking industry, particularly on the part

of depositors.

In order to minimize this risk, reduction of the

guarantee needs to be done gradually. In addition,

reduction of the guarantee program needs to executed in

parallel with elements of the financial safety net, especially

the lender of last resort (LOLR) facility from Bank Indonesia.

LOLR can function as a contingency plan in anticipating

the negative impact of a decline of public confidence in

the banking industry while the guarantee program is being

narrowed.

As was the case in 2003, Bank Indonesia plans to

enhance several regulations during 2004, particularly those

related to prudential principles. The plan is to issue

regulations concerning several matters, including the

quality of earning assets, provisions for earning assets

losses, credit restructuring, and a limit on credit extensions.

In addition, BI will issue new guidelines for bank soundness

(CAMELS), which is planned to be effective in December

2004. This is intended more as a supervisory tool for BI

and for determination of action plans in the framework of

problem identification and problem resolution of certain

aspects of banks» operations. Meanwhile, in order for

implementation of the guidelines to function well, a trial

run will be undertaken on the June 2004 position for all

banks. In line with enhancement of the regulation on

bank»s soundness level, BI plans to enhance regulations

concerning banks» business plans.

As regards the end of the tenure of the Indonesian

Banking Restructuring Agency»s (IBRA) in February 2004,

BI plans to adjust BI regulation number 3/25/PBI/2001

dated 26 December 2001 concerning «Determination of

With the financial industry»s ownership, organization,

operations, and products becoming more integrated,

instability in one type of institution can have an impact on

other financial institutions, with increasing systemic risk.

Within the financial industry, banking is still very important

in determining financial system stability, as it accounts for

some 91% of total assets of the financial system. However,

this does not mean that other types of financial institutions

can be ignored in the maintenance of financial system

stability. Recently, bank product innovation and

non-bank financial institutions have developed rapidly, in line

with heightening competition and customers» increasing

understanding of financial products.

In general, macroeconomic conditions were stable

and tended to improve during 2003, which has raised

public and investor confidence in Indonesia»s economy.

These conditions made a positive contribution to financial

system stability. Improvements of economic development

indicators were largely supported by consistent

implementation of monetary and fiscal policies. However,

economic growth that is largely dependent upon

consumption is quite susceptible to rising banks» NPLs, if

economic activity were to deteriorate.

On the external side, the downward trend in

international interest rates has helped in lowering domestic

interest rates without weakening the exchange rate. This

stability is expected to continue in 2004. However, rising

competition and protectionism by certain countries could

disrupt export performance. In the long-term, domestic

businesses that are not able to compete with imported

products will likely go bankrupt, which could generate

economic instability.

Macroeconomic stability in 2003 was bolstered by

the maintenance of banking and financial system stability.

Despite several potential problems, the banking industry»s

stability continued to improve during 2003, as evidenced

by several performance indicators. In addition, credit,

liquidity, and market risks were relatively controlled, while

implementation of operational risk needs to be closely

watched.

Meanwhile, Indonesia»s capital market experienced

relatively rapid development during 2003. Indeed, the stock

market»s performance was the second best in the world.

The bond market also experienced rapid growth with a

trend towards oversubscription with each new issuance.

The money market also did not show any fluctuations,

which could endanger financial stability, since banking

tended to be overliquid.

The downward trend in interest rates has forced the

insurance and pension funds industries to shift the

composition of their investment portfolios from deposits

to capital market products in order to minimize loss of

revenues. Nevertheless, performance of these two

industries did deteriorate in 2003.

The generally stable condition of the financial system

was assisted by the policy on the non-cash payment

Chapter 1:

Overview

Chart I.1

Asset Composition of Financial Institutions

Banking 91%

Pension Fund 3%

Insurance Corporation 3% Leasing

Company 2% Securities Company 1% Pawn Shop

Overview

system, which has been successful in reducing systemic

risk and enhancing the efficiency of payment

transactions.

Looking ahead to 2004, in line with economic

growth and conducive macroeconomic conditions, the

capital market»s performance is expected to continue on

a strengthening trend. However, many parties see the

potential for a decline in market activity. This would be

due to market players adopting a wait-and-see attitude

because of the socio-political agenda for that year,

although this would not entail any meaningful fluctuations.

If the general election proceeds smoothly, investors, both

domestic and international, are expected to rush to invest

their funds in Indonesia. For their part, money market

conditions are not expected to experience any meaningful

Chapter 2

Generally speaking, macroeconomic conditions during

2003 were stable and trended to improve, as indicated

by several improved macroeconomic indicators. This

situation had a positive impact on public and investors»

confidence in the Indonesian economy, which was

already on the mend. An improving national economy

was largely supported by consistent implementation of

monetary and fiscal policies. However, economic

growth, which is still largely dependent on consumption,

is susceptible to many potential shocks. The immediate

impact on the financial system, particularly the banking

sector, would be higher NPLs and a lower quality of

earning assets. On the external side, the downward

trend in global interest rates has helped to reduce

domestic interest rates without a negative impact on

the exchange rate (Chart II.1), and it is expected that

this stability will be maintained in 2004. However, rising

competition and the imposition of limits on imports by

certain countries could disrupt performance of the

domestic business sector, partly because Indonesia»s

products are uncompetitive in world markets.

2.1 External Influences

World economic growth has not fully recovered due

to several large countries» economies that remain sluggish.

(Chart II.2). This was marked by continuing low GDP

growth in the US, Japan, and Singapore, which were

Indonesia»s major trading partners in 2003. Development

of the world economy in semester I/2003 tended to

weaken due to the Iraqi war involving the US, which is a

superpower with major economic influence. In addition,

the outbreak of severe acute respiratory syndrome (SARS)

in several Asian countries and Canada weakened the global

economy. In this regard, in April 2003, the IMF

downgraded its projection on global economic

performance by 0.5% (from its September 2002 projection)

to 3.2%. Still, this figure is slightly higher than 2002 real

growth of 3%.

In order to stimulate domestic economies and to

revive capital markets, several countries have lowered

interests rates (Chart II.2). On 3 June 2003, the European

Central Bank lowered its refinancing interest rate by 0.5%

to an historical low of 2%. On 25 June 2003, the US

Chapter 2

Development of Domestic and International Economies

Chart II.1

Developments of International Interest Rates

Chart II.2 Developments of 5 Major Trading Partner Countries» Economies

Percentage

0 1 2 3 4 5 6 7

1998

1997 1999 2000 2001 2002 Q.1/03 Q.2/03 Q.3/03 Q.4/03

LIBOR (1 Month) SIBOR (1 Month) Fed Funds Rate

Percentage

USA Japan

Singapore China South Korea

-8 -6 -4 -2 0 2 4 6 8 10 12

Chapter 2 Development of Domestic and International Economies Development Of Domestic

Federal Reserve lowered the Fed Funds rate by 0.25% to

1%, its lowest since 1958. The Bank of England reduced

its cut-base rate by 0.25% to 3.75%, its lowest since 1955.

Low world inflation, particularly in several advanced

countries, and rupiah appreciation have helped to lower

Indonesia»s inflation rate (Chart II.3). During 2003, the

non-oil/gas commodity price index rose sharply in international

markets, from 2.6 as of December 2002 to 12.8 as of

December 2003 . This rise in non-oil/gas commodity prices,

which is partly a result of the USD depreciation, and a rise

in world oil prices have boosted Indonesia»s exports by an

estimated 4.4% in 2003, despite limited recovery in the

economies of Indonesia»s trading partner countries. Higher

exports would increase exporters» incomes, which would

improve the quality of earning assets in the financial system.

The downtrend in international interest rates during

2003 along with growing worries over the enormous US

current account deficit have spurred investors to shift their

capital to developing countries in Asia and Latin America,

which offered more attractive yields. This was supported

by improving Asian countries» ratings. For example,

Indonesia»s rating was upgraded one level by international

rating institutions (Moody»s, Standard & Poor, Fitch) to the

equivalent of BB with stable prospects (Moody»s). In Asia,

foreign investment mostly came into countries with

economies that were considered to be stronger, such as

China, Vietnam and Thailand. In Indonesia, the investment

climate remains troublesome, causing foreign capital

inflows to be dominated by portfolio investment (Chart

II.4), such as purchases of shares and bonds. During 2003,

inflows of portfolio investment totaled USD1.4 billion, up

from the previous year (USD1.2 billion). Although these

short-term capital inflows are supportive of the

development of Indonesia»s capital market, they have the

potential to put pressure on the financial system due to

their short-term nature and therefore, potential quick

reversals. Also, these short-term capital inflows do little

to help with the real sector»s recovery.

Improving macroeconomic indicators and the

government»s plan to remain conservative as regards fiscal

policy in 2004 are the main factors promoting financial

system stability. Supported by a stable rupiah exchange

rate, low inflation, and a downward trend in interest rates,

domestic demand, particularly consumption, is boosting

economic growth.

In addition, global economic conditions are expected

to improve in 2004, triggered by rising economic growth

in several advanced countries and within the Asian region.

The IMF has forecast (November 2003) that world

economic growth in 2004 would reach 4.3%. This growth

Chart II.3 Development of Inflation Chart II.4

Percentage

1998 1999 2000 2001 2002 Q.1/03 Q.2/03 Q.3/03

-2 -1 0 1 2 3 4 5

South Korea USA Japan China Singapore

(Million of USD)

-9,000 -8,000 -7,000 -6,000 -5,000 -4,000 -3,000 -2,000 -1,000 0 1,000 2,000

FDI (net) Portfolio Investment (net) Others (net) Total

would largely stem from advanced countries, such as the

US, Japan, and those in the European region of 4.3%,

1.5% and 2.2%, respectively, higher than the previous

projection (September 2003) of 3.9%, 1.4% and 1.9%.

This situation has the potential to lift export growth

appreciably. If this opportunity is seized by Indonesian

exporters, it will make a sizable contribution to the

maintenance of financial sector stability.

2.2 Domestic Economic Conditions

During 2003, domestic macroeconomic conditions

tended to improve and this has contributed significantly

to financial system stability.

The balance of payments, particularly the current

account, strengthened in 2003 as evidenced by a rise in

foreign currency revenues from exports, which were up

from USD59,165 million in 2002 to USD62,891 million

in 2003 (Table II.1). Capital flows also bolstered the

financial system. This was marked by rising inflows of

portfolio investment, which boosted the composite stock

price index to the level of 691.90 at end of 2003, up

266.955 points compared to end of 2002 (Chart II.5).

The rise in capital flows also triggered vigorous bond

trading, as indicated by increased trading frequency

during 2003, from 308 units in 2002 to 1,023 units in

2003 (source: CCIC).

The rupiah exchange rate was quite stable in 2003,

with a strengthening trend from Rp8,940 at end- 2002 to

Rp8,420 at the end of 2003. This was due to Indonesia»s

Improved balance of payments, declining domestic interest

rates and the USD depreciation against several world

currencies. This strengthening trend of the rupiah had

mixed benefits. On one side, it could reduce business

players» foreign currency risk exposure, but it could also

reduce exports, if not complemented by improved exporter

competitiveness. Lower exports have the potential to

reduce exporters» repayment capacity, which could impact

on the quality of bank credit.

The inflation rate dropped from 10.0% during 2002

to 5.06% during 2003 (Chart II.6). The downward trend

in inflation along with lower interest rates on credits, have

boosted consumer credit, from Rp79.99 trillion as of

end-2002 to Rp101.60 trillion as of October 2003. This rise

needs to be watched closely, due its potential for putting

pressure on the quality of bank credit, if a decline in

economic growth were to occur.

In the future, improved international developments

and relatively easy domestic monetary policy are expected Table II.1

Indonesia»s Balance of Payments (Million of USD)

Curren Account Curren AccountCurren Account

Curren AccountCurren Account 7,8227,8227,8227,8227,822 7,8007,8007,8007,8007,800 5,020 5,020 5,020 5,020 5,020 Export 59,165 62,891 62,630 Import -35,653 -39,509 -40,945 Services -15,690 -15,582 -16,665 Capital Account

Capital AccountCapital Account

Capital AccountCapital Account -1,102-1,102-1,102-1,102-1,102 -2,554-2,554-2,554-2,554-2,554 -6,413-6,413-6,413-6,413-6,413 Goverment (Net) -190 -779 -1,641 Private (Net) -913 -1,774 -4,772 Total

TotalTotal

TotalTotal 6,7206,7206,7206,7206,720 5,2465,2465,2465,2465,246 -1,393-1,393-1,393-1,393-1,393 Monetary Movement

Monetary MovementMonetary Movement Monetary Movement

Monetary Movement -4,021-4,021-4,021-4,021-4,021 -4,209-4,209-4,209-4,209-4,209 2,3282,3282,3282,3282,328 Memorandum Items

Memorandum ItemsMemorandum Items Memorandum Items Memorandum Items International Reserve International ReserveInternational Reserve International Reserve

International Reserve 32,03732,03732,03732,03732,037 36,24636,24636,24636,24636,246 33,91833,91833,91833,91833,918 (Import month &

(Import month &(Import month & (Import month & (Import month & Govt» Foreign Debt) Govt» Foreign Debt) Govt» Foreign Debt) Govt» Foreign Debt)

Govt» Foreign Debt) 6.66.66.66.66.6 7.1 7.1 7.1 7.1 7.1 6.1 6.1 6.1 6.1 6.1

Component Component Component Component

Component 20022002200220022002 2003*2003*2003*2003*2003* 2004**2004**2004**2004**2004**

* Realization Estimate ** Estimate Source : Bank Indonesia

Chart II. 5 Developments of Composite Stock Price Index and Rupiah Exchange Rate

JCI USD/IDR

Source : JCI, Bank Indonesia

Rupiah Exchange Rate (Rigth axis) JCI

(Left axis )

1996 1997 1998 1999 2000 2001 2002 2003

0 2000 4000 6000 8000 10000 12000 14000 16000 0 100 200 300 400 500 600 700 800 Index IDR/USD

Chapter 2 Development of Domestic and International Economies Development Of Domestic

development. In particular, manufacturing grew by only

2.4%, down from 4% the year before. Nonetheless, this

did not disrupt the smooth flow of goods supply due to

imported goods, which dampened price increases.

However, in the long-term, business sectors whose

products cannot compete with imported products will have

difficulty surviving, which could create economic stagnation

or instability.

Meanwhile, implementation of a conservative and

cautious fiscal policy helped to lower inflation, which

greatly assisted with the maintenance of financial system

stability. In light of large payments of principal and interest

on the national debt, and to safeguard fiscal sustainability,

the government targeted its fiscal deficit within the

framework of accelerating the economic recovery. The

fiscal deficit in 2003 edged up compared to last year, from

1.7% of GDP in 2002 to 1.9% in 2003 (Table II.2). To

achieve a fiscal deficit 1.9% of GDP, the government took

a series of conducive policies, such as postponement of Chart II. 6

Inflation and Consumer Loan

to bolster the recovery of business activity in Indonesia»s

real sector. However, this needs to be followed by

conducive investment climate such as improved

infrastructure, secure security conditions, and elimination

of unofficial charges.

The modest rise in investment activity (1.6%) in 2003

had no meaningful impact on the economy»s production

capacity, because it was concentrated in property

Trillions of Rp Percentage

Inflation rate (Rigth axis) Consumer loan (Left axis)

Sources : Bank Indonesia, BPS

0 20 40 60 80 100 120 -10 0 10 20 30 40 50 60 70 80 90

1998 1999 2000 2001 2002 2003

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct

1. Government Revenues and Grants 1. Government Revenues and Grants 1. Government Revenues and Grants 1. Government Revenues and Grants

1. Government Revenues and Grants 301,874301,874301,874301,874301,874 300,188300,188300,188300,188300,188 336,156336,156336,156336,156336,156 17,317,317,317,317,3 342,812342,812342,812342,812342,812 137,204137,204137,204137,204137,204 343,876343,876343,876343,876343,876 17.217.217.217.217.2

a. Domestic Revenues 301,874 299,887 336,156 17,3 342,472 136,964 343,242 17.1

- Tax Revenues 219,628 210,954 254,140 13,1 248,470 108,807 271,023 13.5

- Non Tax Revenues 82,247 88,933 82,016 4,2 94,001 28,157 72,219 3.6

b. Grants 0 301 0 340 240 634 0.0

2. Government Expenditures 2. Government Expenditures 2. Government Expenditures 2. Government Expenditures

2. Government Expenditures 344,009344,009344,009344,009344,009 327,865327,865327,865327,865327,865 370,592370,592370,592370,592370,592 19,119,119,119,119,1 377,248377,248377,248377,248377,248 139,703139,703139,703139,703139,703 368,800368,800368,800368,800368,800 18.418.418.418.418.4

a. Central Government Expenditures 246,040 229,343 253,714 13,1 257,934 85,203 253,943 12.7

- Current Expenditure 193,741 189,072 188,584 9,7 191,788 70,993 185,842 9.3

- Development Expenditure 52,299 40,271 65,130 3,4 66,146 14,210 68,101 3.4

b. Regional Government Expenditures 97,969 98,522 116,878 6,0 119,314 54,499 114,856 5.7

- Balanced Budget 94,532 94,763 107,491 5,5 109,927 49,966 108,243 5.4

- Special Autonomy 3,437 3,759 9,387 0,5 9,387 4,533 6,613 0.3

3. Surplus/Deficit ( 1 - 2 ) 3. Surplus/Deficit ( 1 - 2 ) 3. Surplus/Deficit ( 1 - 2 ) 3. Surplus/Deficit ( 1 - 2 )

3. Surplus/Deficit ( 1 - 2 ) -42,135-42,135-42,135-42,135-42,135 -27,677-27,677-27,677-27,677-27,677 -34,436-34,436-34,436-34,436-34,436 (1,9)(1,9)(1,9)(1,9)(1,9) -34,436-34,436-34,436-34,436-34,436 -2,498-2,498-2,498-2,498-2,498 -24,923-24,923-24,923-24,923-24,923 (1.2)(1.2)(1.2)(1.2)(1.2)

4. Financing 4. Financing 4. Financing 4. Financing

4. Financing 42,13542,13542,13542,13542,135 27,67727,67727,67727,67727,677 34,43634,43634,43634,43634,436 1,91,91,91,91,9 34,43634,43634,43634,43634,436 -2,498-2,498-2,498-2,498-2,498 24,92324,92324,92324,92324,923 1.21.21.21.21.2

a. Domestic Financing 23,501 20,562 22,450 1,2 31,530 2,229 39,844 2.0

b. Foreign Financing 18,634 7,115 11,986 0,7 2,906 -4,727 -14,921 (0.7)

Budget 1) Budget 1) Budget 1) Budget 1)

Budget 1) Actual 2)Actual 2)Actual 2)Actual 2)Actual 2) 2002 2002 2002 2002 2002 % % % % % of GDP of GDP of GDP of GDP of GDP Budget-R 4) Budget-R 4)Budget-R 4) Budget-R 4) Budget-R 4) Budget 3) Budget 3) Budget 3) Budget 3)

Budget 3) Actual 2)Actual 2)Actual 2)Actual 2)Actual 2) Semester I Semester ISemester I Semester I Semester I Budget 3) Budget 3) Budget 3) Budget 3) Budget 3) %%%%%

of GDP of GDPof GDP of GDPof GDP

Notes:

1) Parliament approved budget. October 2001

Basic Assumptions : GDP growth = 3.5%, Inflation rate = 9.3%, exchange rate = Rp.9,600/US$, 3 month-SBI rate = 15%, oil price = US$24/barel 2) Preliminary figure

3) Budget approved by parliament

Basic Assumptions : GDP growth = 4%, Inflation rate = 9%, exchange rate = Rp.9,000/US$, 3 month-SBI rate = 13%, oil price = US$22/barel

2002 20022002 2002

2002 20032003200320032003 20032003200320032003

(Billion Rp)

Table II.2

fuel price hike increasing excise taxes. Looking ahead, it

will be very important to closely watch for pressures on

the state finances originating in the refinancing of domestic

indebtedness because maturing bonds will total Rp36.3

trillion in 2004. Also, repayments of foreign debt and

interest will rise by around 50% compared with 2003,

because the Paris Club rescheduling facility is no longer

available after the end of the IMF program. Financing of

the 2004 state budget deficit will rely upon domestic

sources, whereas heavy servicing of the foreign debt could

reduce Indonesia»s official foreign exchange reserves.

2.3 Development of the Real Sector

During 2003, the real sector did not recover much

despite various efforts, including a policy to reduce interest

rates. Indeed, there was a worrisome trend of business

relocations to other countries. This could boost the

unemployment rate and increase banks» NPLs, particularly

for consumer credits.

Several recent cases illustrate how investors will pull

back in the face of legal uncertainty. For example, the

divestment of Kaltim Prima Coal (KPC) and the Cemex

investment in Semen Gresik. In the KPC case, the

divestment of that mining company from the old foreign

investor (Rio Tinto and British Petroleum) to the domestic

investor was prolonged. This was caused by court decisions

as well as regional and central governments» reactions to

the ownership change, which was believed to conflict with

the original agreement.

Such cases cause investors to reconsider placing their

capital in Indonesia. During 2003, the amount of

long-term foreign investment √which is very important to

boosting economic recovery√ actually declined (as

mentioned, capital inflows were dominated by short-term

portfolio investment). This is one of the reasons why real

sector growth was limited, and unable to absorb additions

to the work force. Indeed, many workers were laid off as

companies cut back operations, closed, or relocated to

other countries. For example, at PT Dirgantara Indonesia

and Texmaco. In 2003, the unemployment rate rose to

9.8% of the overall work force. Such high unemployment

could disrupt economic stability, including in the financial

sector. Settlement of cases like those mentioned above

will be difficult without enhanced legal instruments.

Equally serious, it will be difficult to prevent similar cases

from occurring in the future. However, it will necessary to

continue making efforts in this direction in order to improve

Indonesia»s investment climate, as it continues to

deteriorate in investors» eyes.

Meanwhile, several business sectors experienced

disappointing growth and have uncertain prospects. These

sectors need to be closely monitored in order not to create

problems in the financial sector in the future. These sectors

include wood and wood products, property, textiles and

textile related industry.

Wood and forestry products are one of Indonesia»s

major exports. During 2003, a number of companies in

this industry experienced operational disruptions and many

closed down. The main reason for closure was limited raw

materials due to license tightening by the Ministry of

Forestry and increased illegal logging, much of which is

smuggled out of the country (Chart II.7). Also, many

charges imposed by governments (central and regional)

Chart II. 7

2002 Supply and Demand for Logs

2 0 0 2

Supply Demand Gap

Source: Ministry of Forestry

Thousands of mm3

Chapter 2 Development of Domestic and International Economies Development Of Domestic

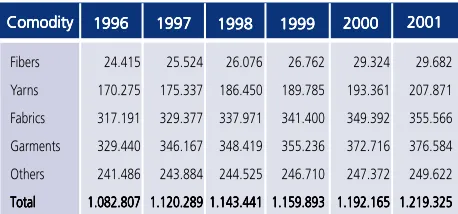

Table II.3 Number of Workers in Indonesia»s Textiles and Related Products Industry

Fibers 24.415 25.524 26.076 26.762 29.324 29.682 Yarns 170.275 175.337 186.450 189.785 193.361 207.871 Fabrics 317.191 329.377 337.971 341.400 349.392 355.566 Garments 329.440 346.167 348.419 355.236 372.716 376.584 Others 241.486 243.884 244.525 246.710 247.372 249.622

Comodity Comodity Comodity Comodity

Comodity 19961996199619961996 19971997199719971997 19981998199819981998 19991999199919991999 20002000200020002000 20012001200120012001

burden the wood industry. In the banking sector, credit

exposure to the wood and forestry industry is currently far

less than in the pre-crisis period, because large amounts

of banking credits to this industry were transferred to IBRA

during the crisis. Nonetheless, the condition of the wood

and forestry industry still has an influence on financial

stability, because credit exposure is still quite large and

many companies in the forestry and related industry have

issued shares and bonds in domestic and foreign markets.

One example is the Asia Pulp & Paper (APP) group, which

issued bonds amounting to USD12 billion. These have been

categorized as «default», and APP has been undertaking a

long restructuring process with its creditors.

Prospects for industries that use raw materials from

forestry are deteriorating. For 2004, it is estimated that 1

million workers will be laid off because of wood companies»

shutdowns, which would add to the large number of

unemployment in this country. International pressure on

Indonesia concerning compliance with proper

environmental rules (such as comprehensive logging plans,

including regreening) will raise operational costs of

domestic wood manufacturing, which will make them less

competitive in international markets. Therefore, it is

important for banks and financial institutions to prudently

and thoroughly calculate credit risk when channeling funds

to this industry.

Meanwhile, the property industry has experienced

very rapid growth, with the potential to generate an

oversupply, particularly in the commercial property sector

(Box II.1 : Will Property Become a Nightmare Again?).

In the textile area, China»s exports of textiles and

related products are very competitive due to conducive

economic policies, which include a low value of the Yuan

pegged to the USD; textile industry restructuring that has

reduced production costs; low interest rates on credits

(5%); and cheap labor due to an excess supply of workers

(Box II.2 : Rocketing China : Threat or Opportunity?). By

contrast, Indonesia»s production costs are high due to,

among others, high loading and unloading costs at ports;

illegal charges; high interest rates on credits; and a rising

cost of labor that has not been offset by improved

productivity. These developments represent a significant

challenge for the textiles industry (Table II.3).

Competition from China, (including products that are

either imported legally or smuggled) threaten to shutdown

some 3,250 small-to-medium scale businesses in the textile

and related products industry.1 In the future, with the plan

to end textile quotas by the US, European Union, and

Canada in 2005 as part of WTO agreements, Indonesian

exporters of textiles (which have been indirectly protected

to date by the quotas) will be in direct competition with

low-cost competitors such as China and Vietnam.

Based on the outlook for business in several of the

sectors mentioned above, it is necessary to review the

potential for rising unemployment due to layoffs and the

impact on banking credit, particularly consumer credits to

workers in these sectors.

Data of the Central Statistics Agency (BPS) indicate

that 4.13 million people were (openly)2 unemployed in

1996. By 2003, this number had more than doubled to

10.13 million people. The chairman of the Indonesian

Businessmen Association predicts mass layoffs in the

Chart Box 2.1.1

Development of Property Loan in Total Credits

Chart Box 2.1.2

Development of Property Sector»s Contribution to GDP

BoX II. 1

Will Property Become a Nightmare Again?

During 2003, the property business grew by

78%. This is an exceptionally high figure, especially

considering that after the 1997 crisis, the property

sector seemed to stall for several years. Such high

growth needs to be closely watched because

experience indicates that the property sector is risky

for the financial system.

In developing countries, the property sector plays

an important role, particularly in developing state

infrastructure. During the pre-crisis period, the

property sector in Indonesia contributed 7 √ 8% of

GDP, boosted by both government and private sector

spending. However, after the crisis, its contribution

dropped to 5 √ 6%.

Revival of the property sector since 2000 and its

rapid growth during 2003 are positive developments,

considering that property is a very cyclical business.

An interesting new development in the property area

is a shift in the financing structure, from mostly bank

loans to developers» equity and consumers» down

payment and installment payments. Banking credit

for the property sector in total has dropped, and now

is dominated by housing-ownership credits (KPR) and

apartment-ownership credits (KPA).

High NPLs in the property sector when the crisis

struck has made banks more cautious in channeling

credit to the property sector. Meanwhile, latest

developments show that leverage of the property

sector has tended to rise. This is indicated by the high

proportion of property industry financing coming from

outside the companies, particularly from individuals

or non-bank institutions. However, borrowing more

funds from non-bank sources does not mean that risk

is significantly less for the financial system, because

these funds are still suspected to end up in the financial

sector. Bit it does show that there is quite large

potential for banking funds to be channeled to the

property industry. On the other hand, this potential

could be a risk for financial stability should an

over-supply or a price bubble develop in this sector.

Symptoms of oversupply are already apparent in

several office buildings, on which construction is

complete but the space looks empty and there is

intense competition for tenants. The same is the case

in industrial areas where several tenants might relocate

to other countries, following indications that the

business climate has not improved to the standard

2001 2002 2003

0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 8.5 9 9.5 10 10.5 11 11.5 12

Total Loan Share of Property Loan to Total Loan Poly. (Share of Property Loan to Total Loan)

GDP Share of Property Sector to GDP

0 1 2 3 4 5 6 7 8 9 10

1996 1997 1998 1999 2000 2001 2002 2003

Chapter 2 Development of Domestic and International Economies Development Of Domestic

Chart Box 2.1.3

Developments of Average Leverage and ROE at Several Property Companies

Chart Box 2.1.4

Average Supply and Occupancy Levels in Office Buildings in Jakarta and Surrounding Areas being set by competitor countries. If oversupply in the

property sector continues to rise next year, a price

bubble could develop, which could eventually trigger

a rise in NPLs such as occurred during the 1997 crisis.

Leverage (DER)-% ROE (%)

leverage ROE

Source : S