Laporan Tahunan

a n n u a L r e p o r T

2016

idx : bjbr

Semakin Berkembang

As a commercial bank, owned by a local government, that is publicly listed,

bjb

bank already has a strong

image as a commercial bank that is growing rapidly and becoming a national bank. Currently

bjb

bank

has a network of offices spread in 14 provinces, mainly in West Java and Jakarta, Indonesian economic

centers. In terms of products,

bjb

DIGI electronic banking services has encouraged the development of

various bank

bjb

products.

Going forward, the Company has strategies to capture expansion opportunities. With an increasing financially

literate society, economic activities are high in West Java, Banten and Jakarta Provinces, and the expansion

of cooperation between bank

bjb

with several government agencies, has created major opportunities

identified by the Company. By creating the right strategies, and maintaining good relationships with its

stakeholders, the Company is confident.

Semakin Berkembang

Bersama Peluang Baru yang Membentang

Strengthening the Foundation

Dengan mengevaluasi posisi kami di saat-saat penuh tantangan, kami dapat memahami dengan jelas apa yang harus dilakukan untuk meraih kembali momentum pertumbuhan Perseroan. Kami menyadari perlunya melakukan perbaikan di beberapa aspek operasional dan kami telah membuat berbagai kebijakan dan mengambil tindakan yang diperlukan sebagai respon atas tantangan tersebut. Pada dasarnya, kami telah menyiapkan landasan yang lebih kokoh untuk memacu pertumbuhan yang lebih cepat di masa mendatang.

Strengthening the Foundation By evaluating our position during challenging times, we can clearly understand what to do to regain the Company’s growth momentum. We realize the need to make improvements in several operational aspects and we have developed various policies and take necessary actions in response to such challenges. We have basically prepared stronger foundation to stimulate faster growth in the future Moving Forward with Greater Value

for Customers

Seiring dengan perjalanan waktu, bank bjb terus berkembang sesuai dengan sasaran bisnis yang telah direncanakan. Tentu banyak tantangan yang dihadapi. Namun satu hal yang pasti, bank bjb berpegang teguh pada komitmen untuk selalu meningkatkan kualitas di segala bidang demi memberikan nilai lebih bagi para nasabah. Itulah landasan bisnis bank bjb.

Moving Forward with Greater Value for Customers

bank bjb continues to grow over time according to the business goals planned. Of course, there are many challenges encountered. However, one thing is for sure, bank bjb has strong commitment to always improve its quality in all sectors in order to deliver greater value for its customers. This is the business foundation of bank bjb.

Continuously Developing

Fundamentals for Sustainable Growth and Profit

Sudah banyak yang berhasil dicapai oleh bank bjb sejak transformasinya yang diawali dengan Penawaran Saham Perdana (IPO) pada tahun 2010. Jaringan pelayanan bertambah luas, ragam produk semakin bervariasi, dan citra korporat semakin kokoh sebagai sebuah bank nasional. Sepanjang tahun 2012, bank bjb terus menata dan memperkuat landasan-landasan utama bisnisnya, agar dapat terus tumbuh dan meraih keuntungan menuju perwujudan aspirasinya menjadi salah satu dari 10 bank nasional terbesar dan berkinerja terbaik di Indonesia.

Continuously Developing Fundamentals for Sustainable Growth and Profit

There have already been many successful bank bjb achievements since its transformation that begab with its Initial Public Offering (IPO) in 2010. The expanded service network, varied product range, and the more solid corporate image as a national bank. Throughout 2012, bank bjb continued to organize and strengthen its main business, continued to grow and made profits towards its aspiration of becoming one of the 10 largest national banks and the best performing in Indonesia.

•

IDX : BJBR

Continuously Developing Fundamental for Sustainable

Growth and Profit

2012 Laporan Tahunan Annual Report

2012

IDX : BJBR

Moving Forward

with Greater Value for Customers

Laporan Tahunan 2013 Annual Report

2013

Laporan Tahunan

2014 Annual Report

IDX:BJBR

Strengthening

the Foundation

Semakin Berkembang

Bersama Peluang Baru yang Membentang

Sebagai Bank Umum yang dimiliki oleh Pemerintah Daerah yang telah go public, bank bjb

telah memiliki image yang kuat sebagai bank umum yang sedang berkembang dengan pesat dan menjadi bank nasional. Saat ini bank bjb telah memiliki jaringan kantor yang menyebar di 14 provinsi, terutama Jawa Barat serta Jakarta yang merupakan pusat perekonomian Indonesia. Dari sisi produk, layanan electronic banking (bjb DIGI) telah medorong berkembangnya berbagai produk bank bjb.

Kedepannya, Perseroan telah menetapkan berbagai strategi untuk menangkap berbagai peluang yang membentang. Semakin meningkatnya literasi keuangan masyarakat, kegiatan ekonomi yang cukup tinggidi Provinsi Jawa barat, Banten dan DKI Jakarta, dan perluasan kerjasama antara bank bjb dengan beberapa institusi pemerintah merupakan peluang-peluang utama yang telah diidentifikasi oleh Perseroan untuk bisa ditangkap. Dengan melakukan formulasi strategi yang tepat dan menjaga hubungan baik dengan pemangku kepentingan, Perseroan yakin pertumbuhan bisnis bank bjb kedepannya akan semakin berkembang.

Growing Together

with New Expanding Opportunities

As a commercial bank, owned by a local government, that is publicly listed, bjb bank already has a strong image as a commercial bank that is growing rapidly and becoming a national bank. Currently bjb bank has a network of offices spread in 14 provinces, mainly in West Java and Jakarta, Indonesian economic centers. In terms of products, bjb

DIGI electronic banking services has encouraged the development of various bank bjb

products.

Going forward, the Company has strategies to capture expansion opportunities. With an increasing financially literate society, economic activities are high in West Java, Banten and Jakarta Provinces, and the expansion of cooperation between bank bjb with several government agencies, has created major opportunities identified by the Company. By creating the right strategies, and maintaining good relationships with its stakeholders, the Company is confident.

Mempertahankan Momentum Pertumbuhan

Perseroan menyadari bahwa kinerja perusahaan yang baik bukan sekadar tumbuhnya pendapatan maupun laba usaha, namun lebih dari itu, harus diimbangi dengan kinerja yang berkualitas. Dari sisi kredit misalnya, tidak sekadar tumbuh di atas rata-rata industri, tetapi rasio kredit bermasalahnya harus manageable. Hal itulah yang dilakukan oleh bank bjb. Pertumbuhan kinerja usaha senantiasa diikuti dengan penerapan manajemen risiko dan tata kelola perusahaan yang baik agar momentum pertumbuhan dapat menjadi fundamental yang kokoh. Perseroan memandang bahwa fundamental yang baik dan kokoh, pada akhirnya akan menjadi penunjang pertumbuhan kinerja usaha Perseroan yang telah ditargetkan, yaitu seperti tertuang dalam Kebijakan Umum Direksi sebagai acuan kerja tahunan serta Visi dan Misi Perseroan yang menjadi acuan jangka panjang.

Keeping Momentum for Future Growth Perseroan menyadari bahwa kinerja perusahaan yang baik bukan sekadar tumbuhnya pendapatan maupun laba usaha, namun lebih dari itu, harus diimbangi dengan kinerja yang berkualitas. Dari sisi kredit misalnya, tidak sekadar tumbuh di atas rata-rata industri, tetapi rasio kredit bermasalahnya harus manageable. Hal itulah yang dilakukan oleh bank bjb. Pertumbuhan kinerja usaha senantiasa diikuti dengan penerapan manajemen risiko dan tata kelola perusahaan yang baik agar momentum pertumbuhan dapat menjadi fundamental yang kokoh. Perseroan memandang bahwa fundamental yang baik dan kokoh, pada akhirnya akan menjadi penunjang pertumbuhan kinerja usaha Perseroan yang telah ditargetkan, yaitu seperti tertuang dalam Kebijakan Umum Direksi sebagai acuan kerja tahunan serta Visi dan Misi Perseroan yang menjadi acuan jangka panjang.

Laporan Tahunan a n n u a L r e p o r T2016

idx : bjbr

Semakin Berkembang Bersama Peluang Baru yang Membentang

Membangun Indonesia Memahami Negeri

Growing Together with New Expanding Opportunities

IDX : BJBR

Kee ing M omentum for Future Grow t h

Memper t ahankan Moment um Per t umbuhan

2015 Annual Repor t Lapor an Tahunan

GROWTH

15.36%

BEST OF

THE BEST

REGIONAL BANK BUKU III

DALAM

EVENT

MALAM APRESIASI BPD 2016 OLEH KORAN SINDO

In The Event of 2016 BPD Appreciation Night by Sindo Newspaper

BEST PERFORMANCE

BANK BUKU III

DALAM

EVENT

MALAM APRESIASI BPD 2016 OLEH KORAN SINDO

In The Event of 2016 BPD Appreciation Night by Sindo Newspaper

1.69%

0.75%

NPL GROSS turuN dari 2.91% meNjadi 1.69% (baNk oNLy)

NPL gross decreased from 2,91% to 1,69% (baNk oNLy)

daLam EVENT iNdoNesia BANKING AWARD 2016

iN aN eveNt of iNdoNesia baNkiNg award 2016

daLam EVENT 2016 BANKING SERVICE AWARD oLeh majaLah iNfobaNk daN mri

iN aN eveNt 2016 baNkiNg serive award by iNfo baNk bagaziNe aNd mri

NPL Neto turuN dari 0.86% meNjadi 0.75% (baNk oNLy)

15.43%

DISTRIBUTION

OF CREDIT GROW

5.88%

INTEREST INCOME

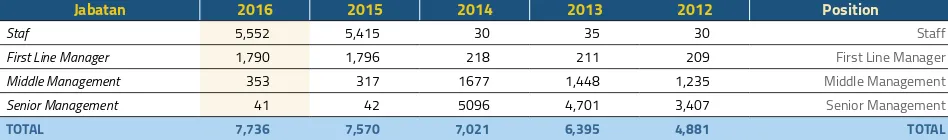

GROWING AND SHARIA

6.32% 7.40%

NET INTEREST

MARGIN UP

PERTUMBUHAN DPK

TERBESAR

BANK BUKU III

DALAM

EVENT

MALAM APRESIASI BPD 2016 OLEH KORAN SINDO

In The Event of 2016 BPD Appreciation Night by Sindo Newspaper

PROFITABILITAS

TERTINGGI BUKU III

DALAM

EVENT

MALAM APRESIASI BPD 2016 OLEH KORAN SINDO

In The Event of 2016 BPD Appreciation Night by Sindo Newspaper

16.09%

GROWTH IN DPK

daLam eveNt iNdoNesia baNkiNg award 2016

iN aN eveNt of iNdoNesia baNkiNg award 2016

daLam acara

THE BEST SMALL CAP COMPANY iN iNdoNesia yaNg diseLeNggarakaN majaLah fiNaNce asia

iN eveNt

de eewrste Nederlandsche- indische spaarkas en hyphoteekbank (deNis, 1915). deNis merupakan salah satu bank tabungan dan hipotik di hindia belanda

de eerste Neder landsche-indische spaarkas en hyphoteekbank (deNis, 1915). deNis said to be the first saving and hypoteek bank is in the east indies

menerbitkan obligasi untuk pertama kalinya

issued its first bond

bentuk hukum Perseroan diubah dari Perseroan terbatas (Pt) bank karja Pembangunan daerah djawa barat menjadi Perusahaan daerah (Pd) bank karja Pembangunan daerah djawa barat

the company’s legal entity was changed from Limited Liability company (Pt) bank karja Pembangunan daerah djawa barat (west java regional development karja bank) to regional-owned company (Pd) bank karja Pembangunan daerah djawa barat (west java regional development karja bank)

Perubah dari Pd menjadi Perseroan terbatas (Pt)

Legal status of bank jabar changed from Pd into a limited liability company (Pt)

Perusahaan daerah (Pd) bank karja Pembangunan daerah djawa barat selanjutnya diubah menjadi Pd bank Pembangunan daerah jawa barat

regional-owned company (Pd) bank karja Pembangunan daerah djawa barat was then changed to Pd bank Pembangunan daerah jawa barat

menjadi bank Pembangunan daerah pertama di indonesia yang menjalankan

dual banking system, yaitu memberikan layanan perbankan dengan sistem konvensional dan dengan sistem syariah

became the first regional development bank in indonesia that implemented dual banking system, to provide banking services with conventional system and sharia system

bank bjb didirikan dengan nama

Pt bank karja Pembangunan daerah djawa barat yang merupakan hasil nasionalisasi bank “Nv denis” pada masa pemerintahan belanda

bank bjb established with the name of

Pt bank karja Pembangunan daerah djawa barat which was nationalized from Nv deNis, a dutch company

aktivitas bank Pembangunan daerah jawa barat

ditingkatkan menjadi bank umum devisa

the activities of west java regional development bank (bPd) were upgraded to foreign exchange commercial bank

1915

1991

1972

1999

1978

2000

1961

Nama Perseroan berubah menjadi Pt bank Pembangunan daerah jawa barat dan banten dengan sebutan

“bank jabar banten”

company’s name was changed to Pt bank Pembangunan daerah jawa barat dan banten as “bank jabar banten”

• ditunjuk menjadi bPjs regional Strategic Partner

dan BPJS Service Point Office

• meluncurkan bjb digi • meluncurkan e-samsat

dan e-tax

• appointed as bPjs regional strategic Partner and bPjs service Point office

• Launched bjb digi • Launched e-samsat and

e-tax

• Peningkatan rating dari Pefindo menjadi peringkat idaa-• Pemisahan (spin off) unit usaha syariah

• sebutan “bank jabar banten” resmi diubah menjadi “bank

bjb”

• mencatatkan saham perdananya (iPo) di bursa efek indonesia (bei)

• rating improvement from Pefindo to idaa-• spin off of sharia business unit

• “bank jabar banten” was officially changed to “bank bjb” • Listed its initial public offering (iPo) in indonesia stock

exchange (bei)

• meluncurkan Pesat (Pemberdayaan masyarakat terpadu)

• meluncurkan bjb sahabat usaha

• Launched Pesat (integrated community empowerment) • Launched bjb sahabat usaha

menerbitkan obligasi vii

issued bond vii

• meluncurkan Program bjb cinta guru

• ditunjuk menjadi bank Persepsi

Tax Amnesty

• menambah kantor wilayah untuk daerah timur indonesia • meluncurkan kredit usaha bhakti

• Launched bjb cinta guru Program

• appointed as tax amnesty Payment bank

• added regional office for eastern indonesia

• Launched kredit usaha bhakti

menerbitkan obligasi vi

issued bond vi

Rebranding bjb Precious

rebranding bjb Precious

2007

2014

2010

2015

2011

2016

2009

•

bank

bjb

telah memiliki layanan jasa kustodian

dan wali amanat

•

bank

bjb

ditunjuk sebagai salah satu dari 18 bank

persepsi yang melaksanakan penampungan dana

tax amnesty

•

Bank Umum yang dimiliki oleh pemerintah daerah

dan telah

go public

•

Memiliki

image

yang kuat sebagai bank umum

yang sedang berkembang dengan pesat dan

menjadi bank nasional

•

Memiliki basis nasabah yang loyal dalam jumlah

besar yaitu PNS, para pensiunan dan masyarakat

setempat serta mengenal dengan lebih baik

potensi ekonomi dan bisnis di daerahnya

•

Berada di Provinsi Jawa Barat dan Banten yang

mempunyai sumber daya alam yang luas, sumber

daya manusia, dan kawasan industri besar serta

kegiatan ekonomi yang terus berkembang

•

Memiliki jaringan kantor yang relatif menyebar di

14 Provinsi terutama Jawa Barat dan Banten serta

Jakarta yang merupakan pusat perekonomian

Indonesia

•

Sebagai institusi pengelola keuangan kas

daerah meliputi gaji Pegawai Negeri Sipil, proyek

dilingkungan Pemerintah Daerah dan

program-program lainnya serta perkreditan

•

Penunjukan bank

bjb

sebagai bank operasional

II (BO II) yang melaksanakan penyaluran gaji

Pemerintahaan Pusat yang ditempatkan di Daerah

•

Produk bank

bjb

yang semakin berkembang

dengan adanya layanan

electronic banking

(

bjb

DIGI) meliputi

bjb

ATM,

internet banking

(

bjb

NET)

serta SMS

banking

(

bjb

SMS) serta kartu kredit

co-branding

bersama BNI serta kerjasama layanan

pembayaran PBB dengan alfamart,

bjb

edu-pay

,

bjb

account service

,

bjb

e-tax

,

bjb

payroll service

,

bjb

payment service

,

bjb

pickup and delivery service

,

bjb

waterbills

,

bjb

multifinance payment

,

bjb

hospital

payment

,

bjb

e-ticket

dan

bjb

jamsostek

service

point office

•

bank

bjb

has hold custodian and trustee services

•

bank

bjb

was appointed as one of 18 tax payment

banks that hold tax amnesty fund Commercial

•

bank owned by regional government and had

gone public

•

Has strong image as commercial bank growing

rapidly and becoming national bank

•

Has large numbers of loyal customers, which are

civil servants, retirees, and local communities,

and is acquainted with economic and business

potential in its area

•

Located in West Java and Banten Provinces, which

have vast natural resources, human resources,

large industrial areas, and fluorishing economic

activities

•

Has office networks relatively spreading in 14

Provinces mainly in West Java and Banten, as well

as Jakarta as the economic center in Indonesia

•

As regional treasury management institution

including salaries for Civil Servants, projetcs in

Regional Government, and other programs and

credits

•

The appointment of bank

bjb

as operational bank II

(BO II) which carries out the distribution of salaries

of Central Government placed regionally

•

Bank

bjb

’s products growing in line with electronic

banking services (

bjb

DIGI) are

bjb

ATM, internet

banking (

bjb

NET), SMS banking (

bjb

SMS), and

co-branding credit card with BNI, as well as the

collaboration for Property Tax (PBB) payment

service with alfamart,

bjb

edu-pay,

bjb

account

service,

bjb

e-tax,

bjb

payroll service,

bjb

payment

service,

bjb

pick-up and delivery service,

bjb

1 TemaTheme

2 arti TemaMeaning of Theme 3 Kesinambungan TemaContinuation of Theme 6 Jejak LangkahMilestones 8 Komitmen Terbaik Kamiour Best Commitment 10 Daftar IsiTable of Contents

Kilas Kinerja

PerfOrmance flasHbacK

14 Ikhtisar Data Keuangan pentinghighlights of Financial Data 17 Ikhtisar Kinerja operasionaloperational performance highlights 20 Informasi harga SahamInformation on Stock price 21

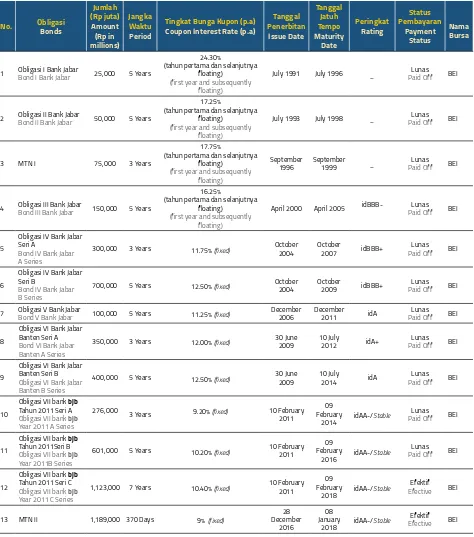

Informasi obligasi dan Medium Term Note (MTn)

Information on Bond and Medium Term note

22 peristiwa penting di Tahun 2016Significant events in 2016

laPOran DeWan KOmisaris Dan DireKsi rePOrT Of THe bOarD Of cOmmissiOners anD bOarD Of DirecTOrs

30 Laporan Dewan Komisarisreport of the Board of Commissioners 40 Laporan Direksireport of the Board of Directors 54

Tanggung Jawab pelaporan Tahunan 2016

The responsibility of 2016 annual reporting

PrOfil PerUsaHaan cOmPanY PrOfile

58 Identitas perusahaan Company Identity 59 riwayat Singkat perusahaanBrief history of the Company 61 BrandCompany Brand perusahaan 62 Bidang usaha Line of Business 63 produk dan Jasa products and Services 80 peta Wilayah operasionalMap of operational area 82 Struktur organisasi organizational structure

84 Visi, Misi, dan Budaya perusahaan Vision, Mission, and Corporate Culture 86

profil Dewan Komisaris

profile of the Board of Commissioners profile executive officer

92 profil Direksi profile of the Board of Directors

100 profil pejabat eksekutif profile of executive officers 107 profil Karyawan profile of employees 109

pengembangan Kompetensi Karyawan Competency Development of employees

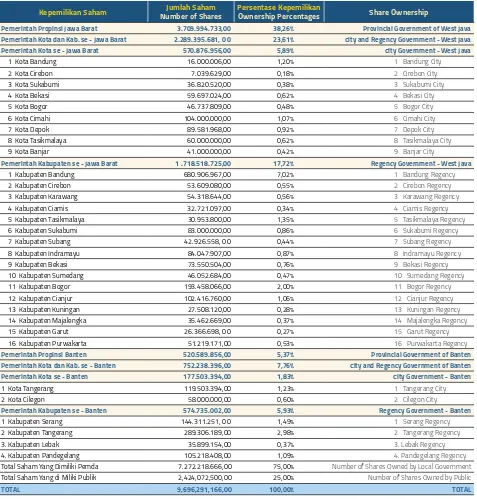

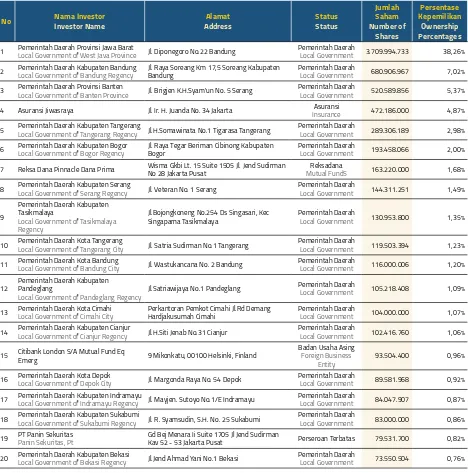

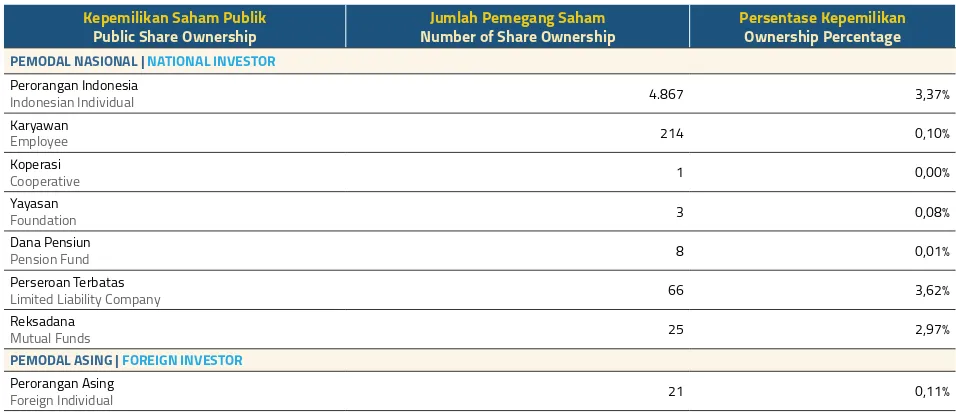

120 Komposisi pemegang SahamShareholders Composition 123

Daftar entitas anak dan entitas asosiasi List of Subsidiaries and associated Companies

128 Struktur GrupGroup Structure

130 Kronologis pencatatan SahamListing of Shares Chronology 131

Kronologis pencatatan obligasi dan Medium Term Note (MTn)

Cronology of Bonds Listing and Medium Term note (MTn)

132

Lembaga profesi penunjang pasar Modal

Capital Market Supporting professional Institutions

133

penghargaan dan Sertifikasi di Tahun 2016

2016 award and Certification

137

nama dan alamat entitas anak dan/ atau Kantor Wilayah dan Cabang name and address of Subsidiaries and/ or regional and Branch offices

139 akses Informasi Information and access

139

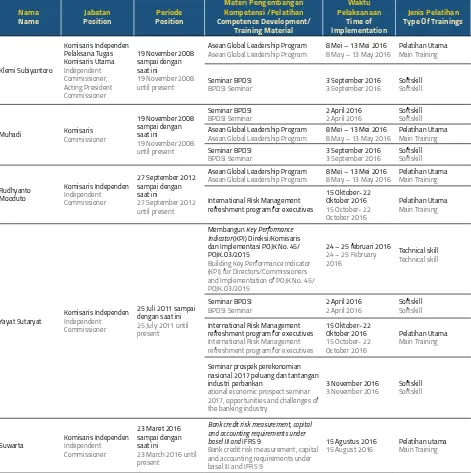

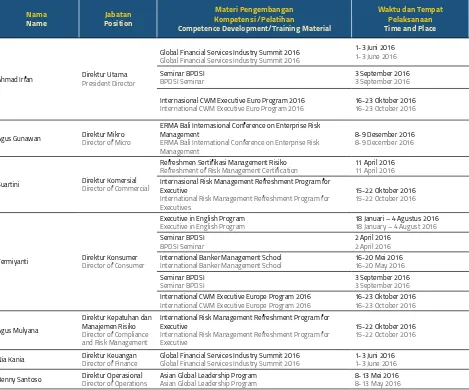

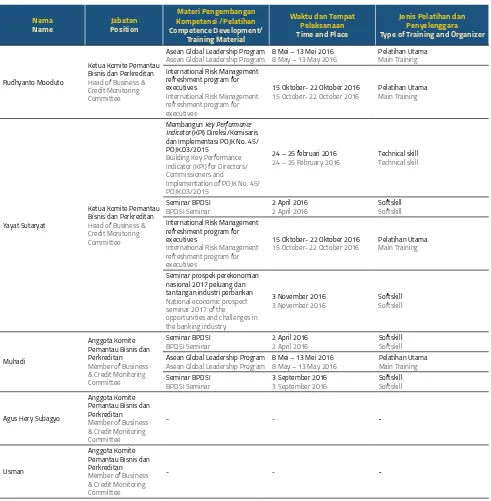

pendidikan dan/atau pelatihan Dewan Komisaris, Direksi, Komite-Komite, Sekretaris perusahaan dan unit audit Internal

education and/or Training of Board of Commissioners, Directors, Committees, Corporate Secretary and Internal audit unit

analisis Dan PembaHasan manajemen aTas Kinerja PerUsaHaan

manaGemenT DiscUssiOn anD analYsis Of THe PerfOrmance Of THe cOmPanY

152 Tinjauan IndustriIndustry overview 152 perekonomian GlobalGlobal economy 153 perekonomian IndonesiaIndonesian economy 156 Kondisi Industri perbankanBanking Industry Conditions 156 posisi Bank di Industri Bank’s position in The Industry 158 Tinjauan operasionaloperational review

158 Strategi pengembangan Bisnis 20162016 Business Development Strategy 163 aspek pemasaran Marketing aspects

171 pangsa pasarMarket Share

176 Tinjauan operasional Segmen usahaBusiness Segment operational review 223 prospek usahaBusiness prospects

238 Tinjauan KeuanganFinancial review 238

Laporan posisi Keuangan Konsolidasian Consolidated Statements of Financial position

243

Laporan Laba rugi dan penghasilan Komprehensif Lain Konsolidasian Consolidated Statements of Income and other Comprehensive Income

250 Laporan arus Kas KonsolidasianConsolidated Statements of Cash Flows 252 rasio KeuanganFinancial ratios

253

Kemampuan Membayar utang dan Kolektibilitas piutang

ability to repay Debt and receivables Collectability

261

akselerasi pertumbuhan Fee Based Income

Fee Based Income Growth acceleration

262 Struktur ModalCapital structure 263

Ikatan Material Terkait Investasi Barang Modal

Material Commitment for Capital Goods Investment

263

realisasi Investasi Barang Modal realization of Investment of Goods Capital

263 Derivatif dan Fasilitas Lindung nilaiDerivatives and hedging Facilities

263

perbandingan Target dan realisasi Kinerja 2016 Serta Target dan proyeksi 2017

Comparison of 2016 Target and actual performance and 2017 Target and projections

269

Informasi Material Yang Terjadi Setelah Tanggal Laporan akuntan

Material Information that occurs after accountant’s reporting Date

271

Kepemilikan Saham oleh Manajemen dan/atau Karyawan

Stock ownership by Management and/ or employee

271

realisasi penggunaan Dana hasil penawaran umum

realization of the utilization of proceeds from public offering

272

Informasi Transaksi Material Dengan pihak Berelasi

Information on Material Transactions With related party

276

276 Komitmen dan KontinjensiCommitments and Contingencies

277

perubahan peraturan perundang-undangan Yang Berpengaruh Signifikan Terhadap Bank

Changes in Laws and regulations that have Significant Impact on Bank

294

perubahan Kebijakan akuntansi dan Dampaknya Terhadap Laporan Keuangan

Changes in accounting policies and Its Impact on Financial Statements

296 Informasi Kelangsungan usahaInformation on Business Continuity 297 Kinerja anak perusahaan performance of Subsidiaries

fUnGsi PenUnjanG bisnis bUsiness sUPPOrTinG fUncTiOn

312 HUman resOUrces HUman resOUrces

313

Kerangka Konseptual Sumber Daya Manusia bank bjb

Conceptual Framework of Bank bjb

human Capital

314 Implementasi Implementation of Corporate CultureCorporate Culture 315 program-program Budaya perusahaanprogrammes of Corporate Culture 317

peran dan Tugas DivisiSumber Daya Manusia

role and Duties of hC Division

317 peran Jabatan pemimpin Divisi SDMrole of head of hC Division 317

Tugas dan Tanggung Jawab utama pemimpin Divisi SDM

Main Duties and responsibilities of head of hC Division

320 Kewenangan pemimpin Divisi SDMauthorities of head of hC Division

321

Kewenangan pemimpin Grup pengembangan SDM authorities of Group head of hC Development

321

profil pemimpin Divisi SDM profile of head of human Capital Division

322 Manajemen Sumber Daya Manusiahuman Capital Management 322 perencanaan Sumber Daya ManusiahC planning 322 rekrutmen Sumber Daya ManusiahC recruitment 323 Kebijakan pengembangan KarirCareer Development policy 323 pengembangan Kompetensi pegawaiemployee Competency Development 325 Performance Management Systemperformance Management System

326

penghargaan perusahaan Kepada Setiap Karyawan

Company’s appreciation to every employee

327 Strategi remunerasi pegawaiemployee remuneration Strategy 329

Fasilitas penunjang Layanan human Capital

Supporting Facilities hC Services

329

Human Resource Information System (hrIS)

human resource Information System (hrIS)

329 hC CareshC Cares 333 bjb club bjb club

335

program Strategis SDM Selama Tahun 2016

hC Strategic program During 2016

336

rencana pengembangan SDM Tahun 2017

hC Development plan for 2017

337 TeKnOlOGi infOrmasi

infOrmaTiOn TecHnOlOGY

338 Visi dan Misi Divisi Teknologi Informasivision and Mission of It Division

339

perkembangan Struktur Dan Sumber Daya Manusia Divisi Ti

Development of Structure and human resources of It Division

340

Mitra Bisnis Yang Mendukung Divisi Ti Business partner Supporting It Division

341

Implementasi proyek Divisi Teknologi Informasi Sepanjang Tahun 2016 project Implementation of Information Technology Division Throughout 2016

341

pengendalian risiko operasional Yang Dilakukan oleh Divisi TI Sepanjang Tahun 2016

operational risk Control performed by It Division Throughout 2016

342

pengembangan Teknologi Informasi Tahun 2016

Information Technology Development In 2016

342

Biaya pengembangan Infrastruktur Teknologi Informasi

Development Cost of Information Technology Infrastructure

GOOD CORPORATE GOVERNANCE GOOD cOrPOraTe GOVernance

346

Corporate Governance Framework bank

bjb

Corporate Governance Framework of bank bjb

347 Bank Sebagai Lembaga KepercayaanBank as Institution of Trust 348 Bank Merupakan pelayan publikBank as public Service 349

Manfaat Implementasi GCG Bagi bank

bjb

Benefits of GCG Implementation for bank bjb

351 Dasar penerapan GCGBasic of GCG Implementation 353

peningkatan Kualitas GCG Secara Berkelanjutan

GCG Sustainable Quality Improvement

353

penetapan Standar Kualitas Implementasi GCG

Determination of Quality Standards of GCG Implementation

355

pelaksanaan dan pemonitoran Implementasi GCG

Implementation and Monitoring of GCG Implementation

358 Assessment GCG assessment GCG

364 peningkatan Kualitas dan Quality Improvement and BenchmarkingBenchmarking

366

pelaksanaan penerapan aspek dan prinsip Tata Kelola perusahaan Sesuai Ketentuan otoritas Jasa Keuangan Implementation of aspects and principles of Corporate Governance in accordance with provisions of Financial Services authority

382 Struktur dan Mekanisme GCGStructure and Mechanism of GCG 384 rapat umum pemegang SahamGeneral Meeting of Shareholders 399 Dewan Komisaris

435 DireksiThe Board of Directors

466

organ dan Komite Di Bawah Dewan Komisaris

organs and Committees under the Board of Commissioners

467 Sekretaris Dewan KomisarisBoard of Commissioners Secretary 469 Komite auditaudit Committee

494

Komite nominasi dan remunerasi nomination and remuneration Committee

508 Komite pemantau risikorisk Monitoring Committee 522 Komite Tata Kelola TerintegrasiIntegrated Governance Committee 535

Komite pemantau Bisnis dan perkreditan

Business and Credit Monitoring Committee

549 Sekretaris perusahaanCorporate Secretary 555

Komite di Bawah Direksi organs and Committees under the Board of Directors

566

Informasi pemegang Saham utama dan pengendali

Information regarding Major and Controlling Shareholders

568 penerapan Tata Kelola TerintegrasiIntegrated Governance 571 AssessmentIntegrated Governance assessment Tata Kelola Terintegrasi 573 unit audit InternalInternal audit unit

573 Visi dan MisiVision and Mission 573

Tugas dan Tanggung Jawab Divisi audit Internal

Duties and responsibilities of the Internal audit Division

576

pedoman Divisi audit internal (piagam audit)

Guidance for Internal audit Division (audit Charter)

576

Struktur organisasi dan Ketua Divisi audit Internal

organizational Structure and the Chairman of the Internal audit Division

577

Kedudukan unit audit Internal Dalam Struktur organisasi

Within the organizational Structure

577

pihak Yang Mengangkat dan Memberhentikan Ketua Divisi audit Internal

authorized party Who appoints and Dismisses the head of Internal audit unit

profil pemimpin dan Komposisi personil Divisi audit Internal

580

Sertifikasi profesi Divisi audit Internal Internal audit Division professional Certification

581 Kode etik auditorauditor Code of Conduct 583

pengembangan Kompetensi personil Divisi audit Internal

personnel Competency Development of Internal audit Division

584

Laporan Singkat pelaksanaan Kegiatan Divisi audit Internal Tahun 2016 Brief report of the Implementation of Internal audit Division’s activities in 2016

588 akuntan publikpublic accountants 588

penerapan Fungsi audit eksternal Implementation of external audit Function

589 penunjukan akuntan publikappointment of public accountant 589

Kantor akuntan publik, nama akuntan dan Fee periode 5 Tahun Terakhir public accounting Firm, name of accountants, and Fee for period 5 Years

589 Jasa Lain yang Diberikan akuntanother Services provided by accountant 590 Manajemen risikorisk Management

591

Struktur organisasi Manajemen risiko risk Management organization Structure

599 proses Manajemen risikorisk Management process 603

Sistem dan penerapan Manajemen risiko

risk Management System and Implementation

612 profil risiko dan upaya pengelolaannyarisk profile and Its Management 620 pelaksanaan Implementasi BaselImplementation of Basel 622 penilaian profil risikoassessment of risk profile 622

evaluasi pelaksanaan Sistem Manajemen risiko

evaluation of risk Management System

623

Sasaran Strategis Manajemen risiko 2017 risk Management 2017 Strategic objectives

624

penerapan Manajemen risiko Terintegrasi

Integrated risk Management Implementation

626 Sistem pengendalian InternalInternal Control System 627

Kesesuaian pengendalian Internal Dengan Kerangka CoSo

Conformity With the Internal Control of CoSo Framework

629 Fungsi KepatuhanCompliance Function 629

Struktur organisasi Fungsi Kepatuhan organizational Structure of Compliance Function

629 Satuan Kerja KepatuhanCompliance Work unit

635

program anti pencucian uang (apu) Dan pencegahan pendanaan Terorisme (ppT)

anti-Money Laundering (aML) and Combating the Financing of Terrorism (ppT)

637 permasalahan hukumLegal Issues 637

perkara penting yang Dihadapi perseroan

Important Cases Faced By The Company

652

permasalahan hukum Yang Sedang Dihadapi Dewan Komisaris dan Direksi Yang Sedang Menjabat Sera entitas anak

Legal Issues Facing by the Board of Commissioners and Board of Directors and Subsidiaries

653

pemberian Dana Kegiatan politik dan penyediaan

Dana Kepada pihak Terkait Funding for political activities and provisions of Funds to related parties

654 Information Technology GovernanceInformation Technology Governance 655 akses InformasiInformation access

655 WebsiteCompany Websiteperseroan 656 Siaran perspress Conference

659 Transparansi penyampaian LaporanTransparency of report Submission 663 Code of Conduct Code of Conduct

663 Isi Contents of the Code of ConductCode of Conduct 664 Kepatuhan Terhadap Compliance with the Code of ConductCode of Conduct 664 penyebarluasan Dissemination of the Code of ConductCode of Conduct 664

upaya penerapan dan penegakan Code of Conduct

Implementation and enforcement of the Code of Conduct

665

Jenis Sanksi pelanggaran Kode etik Types of Sanctions For Violations of Code of ethics

665 Jumlah pelanggaran Kode etiknumber of Violations of Code of ethics 666 GratifikasiGratification

667 pengelolaan pengendalian GratifikasiManagement of Gratification Control 667 Sosialisasi GratifikasiSocialization of Gratification

667 Laporan Gratifikasi Tahun 20162016 Gratification report 668 Whistleblowing SystemWhistleblowing System (WBS)(WBS) 668 Keberadaan dan Tujuan WBSpresence and purposes of WBS 669

Jenis pelanggaran Yang Dapat Dilaporkan

Violation Type That Can Be reported

669

penyampaian dan Media Laporan penyelenggaraan

Submission and Media for report on Management

670 pengelolaan Whistleblowing Management SystemWhistleblowing System 671 perlindungan Bagi Whistleblower protectionWhistleblower 672 Sosialisasi Socialization of Whistleblowing SystemWhistleblowing System 672

Jumlah pengaduan dan Tindak Lanjutnya

number of reports and Follow up

674

peMenuhan penerapan CorporaTe GoVernanCe SeSuaI aSean CorporaTe GoVernanCe SCoreCarD

FuLFILLInG The IMpLeMenTaTIon oF CorporaTe GoVernanCe aCCorDInG To The aSean CorporaTe

GoVernanCe SCoreCarD

TanGGUnG jaWab sOsial PerUsaHaan cOrPOraTe sOcial resPOnsibiliTY

690 Tanggung Jawab Sosial perusahaan Corporate Social responsibility

691

pendekatan holistik Terintegrasi Dalam pelaksanaan Corporate Social Responsibility

Integrated holistic approach in Implementing Corporate Social responsibility

692

Landasan hukum penerapan CSr Terkait Dengan pengembangan Sosial dan Kemasyarakatan Serta Lingkungan hidup

Legal Basis For The Implementation of CSr on Community and Social Development and environment

692

Fokus pelaksanaan CSr Terkait Dengan pengembangan Sosial dan Kemasyarakatan Serta Lingkungan hidup

Focus of CSr Implementation on Community and Social Development and environment

693

program unggulan CSr Terkait Dengan pengembangan Sosial dan Kemasyarakatan Serta Lingkungan hidup

CSr Main program on Community and Social Development and environment

693

Sumber Dana CSr Terkait Dengan pengembangan Sosial dan Kemasyarakatan Serta Lingkungan hidup

CSr Source of Funds on Community and Social Development and environment

693

Biaya pelaksanaan CSr Terkait Dengan pengembangan Sosial dan Kemasyarakatan Serta Lingkungan hidup

Costs of The Implementation of CSr on Community and Social Development and environment

694 CSr Terkait Dengan Lingkungan hidupCSr on The environment 696

CSr Terkait Dengan Ketenagakerjaan, Kesehatan, dan Keselamatan Kerja CSr on employment, health, and Safety

705

CSr Terkait Dengan pengembangan Sosial dan Kemasyarakatan CSr related to Social and Community Development

710

CSr Terkait Dengan Tanggung Jawab Kepada Konsumen

CSr related to Consumer responsibility

sTrUKTUr PermODalan Dan PraKTiK manajemen risiKO

caPiTal anD risK manaGemenT PracTices

718 pengungkapan permodalanCapital exposure 718 Struktur permodalanCapital Structure 718 Kecukupan permodalanCapital adequacy 721 pengungkapan KuantitatifQuantitative exposure 723

pengungkapan eksposur risiko Dan penerapan Manajemen risiko Disclosure of risk exposure and risk Management Implementation

723 risiko KreditCredit risk 769 risiko pasarMarket risk 776 risiko LikuiditasLiquidity risk 788 risiko operasionaloperational risk 791 risiko hukumLegal risk 793 risiko KepatuhanCompliance risk

795 risiko Stratejik

referensi PeraTUran OTOriTas jasa KeUanGan/annUal rePOrT aWarD

Tabel ikhtisar Keuangan

Table of financial Highlights

(dalam juta Rupiah | in million rupiah)

Uraian 2016 2015 2014 2013 2012 Description

laPOran POsisi KeUanGan KOnsOliDasian cOnsOliDaTeD sTaTemenT Of financial POsiTiOn

aset asset

Kas 2,215,341 2,402,588 2,767,678 2,595,260 1,795,074 Cash

Giro pada Bank Indonesia 5,516,363 6,076,789 5,177,942 4,454,108 4,666,015 Demand Deposit at Bank Indonesia Giro pada Bank Lain 261,741 181,510 128,542 176,888 289,686 Demand Deposit at Commercial Bank penempatan pada bank lain dan

Bank Indonesia (neto) 12,777,516 3,739,128 4,761,109 2,628,985 8,011,739

Interbank placement and placement to Bank Indonesia (net)

Tagihan Derivatif 1,336 2,434 - - - Derivative Claim

Surat Berharga 9,206,598 12,838,700 7,125,371 10,291,810 4,142,992 Securities efek – efek yang dibeli dengan janji

dijual kembali (neto) - 1,308,760 568,461 - 11,567,261

Securities purchased under repurchase agreement (net) Wesel ekspor dan tagihan lainnya

(neto) 10,539 1,006 19,555 44,721 67,400 export draft and other bills (net) Kredit yang diberikan 63,419,185 55,561,396 49,616,998 45,308,580 35,379,390 Loan granted pembiayaan dan piutang Syariah 5,370,120 4,926,146 4,351,826 3,687,274 2,944,576 Sharia Financing and receivables Cadangan Kerugian penurunan

nilai (719,184) (143,060) (99,147) (62,094) (77,844) allowance for Impairment Loss Tagihan akseptasi 54,301 20,634 18,435 33,235 224,975 acceptance receivable penyertaan Saham 31,984 31,984 31,984 31,984 31,987 Investment in Shares of Stocks Cadangan Kerugian penurunan

nilai (1,303) (4,236) (4,236) (7,569) (4,264) allowance for Impairment Loss aset tetap (nilai Buku) 2,740,397 1,023,314 1,044,844 699,069 734,873 Fixed assets (net) aset pajak tangguhan (neto) 137,253 28,967 31,732 22,749 3,635 Deferred tax assets (net) Bunga yang masih akan diterima 654,771 623,325 452,642 418,360 350,560 Interest receivable aset lain- lain (neto) 1,306,084 1,271,269 1,456,411 1,771,323 1,323,542 other assets (net)

TOTal aseT 102,318,457 88,697,430 75,861,310 70,958,233 70,840,876 TOTal asseTs

laPOran POsisi KeUanGan KOnsOliDasian cOnsOliDaTeD sTaTemenT Of financial POsiTiOn

liabilitas, Dana syirkah Temporer dan ekuitas Konsolidasian liability, Temporary syirkah fund, and consolidated equity

liabiltas liability

Liabilitas segera 1,374,450 2,244,955 1,812,382 1,945,539 1,761,134 Liabilities due immediately Simpanan nasabah 73,029,838 62,903,150 53,118,800 46,874,161 47,632,863 Customer deposits Simpanan dari bank lain 5,628,485 3,515,666 3,308,630 4,946,725 6,392,634 Deposits from other banks

Liabilitas derivative 277 - - 90 - Derivative Liabilities

efek – efek yang dijual dengan janji

dibeli kembali 2,670,589 3,656,456 2,062,916 2,978,073 1,922,795

Securities purchased under repurchase agreement (net) Liabilitas akseptasi 54,301 20.634 18.435 33.235 224,975 acceptance liabilities efek hutang yang Diterbitkan-neto 2,311,606 1,722,884 1,721,901 2,396,611 2,395,091 Debt Securities Issued-net pinjaman yang Diterima-pihak

ketiga 246,055 434,617 456,490 324,337 231,160 accepted Loans-third party estimasi Kerugian Komitmen dan

Kontinjensi 1,619 1,056 2,130 1,498 1,433

estimated Losses on Commitment and Contingencies

hutang pajak 26,695 129,533 105,751 101,676 45,556 Tax payable

Bunga yang masih harus dibayar 162,024 157,099 121,607 124,775 129,272 accrued interest Liabilitas Imbalan kerja 178,164 218,068 191,534 142,145 99,800 employee Benefits Liabilities Liabilitas lain–lain 768,005 660,998 621,736 683,669 600,601 other Liabilities

Total liabilitas 87,019,826 76,068,471 63,911,402 60,899,074 61,764,614 Total liabilities

Dana syirkah Temporer Temporary syirkah fund

Bukan Bank 4,958,182 4,299,119 4,253,141 2,775,906 2,680,412 non Bank

Tabel ikhtisar Keuangan

Table of financial Highlights

(dalam juta Rupiah | in million rupiah)

Uraian 2016 2015 2014 2013 2012 Description

pihak berelasi 8,577 9,007 5,047 5,774 2,555 related parties

pihak Ketiga 4,949,605 4,290,112 4,248,094 2,770,132 2,677,857 Third party

Bank 666,221 572,622 615,064 567,238 387,012 Bank

pihak ketiga 666,221 572,622 615,064 567,238 387,012 Third party

Total Dana syirkah Temporer 5,624,403 4,871,741 4,868,205 3,343,144 3,067,424 Total Temporary syirkah fund

ekuitas equity

Modal Ditempatkan dan Disetor 2,424,073 2,424,073 2,424,073 2,424,073 2,424,073 Issued and paid-up Capital Tambahan Modal Disetor 823,423 823,423 823,423 823,423 823,423 additional paid-up Capital Kerugian pengukuran kembali

program imbalan pasti-setelah pajak tangguhan

(141,967) (135,945) (124,774) (120,442) - benefit program-after deferred taxremeasurement loss for defined Saldo Laba Telah ditentukan

penggunaannya 3,620,012 3,070,463 2,661,164 2,041,782 1,520,190

retained profit: The usage has been determined Saldo Laba Belum ditentukan

penggunaannya 1,313,633 1,530,866 1,257,309 1,530,090 1,207,467

retained profit: The usage has not been determined Total ekuitas yang dapat

diatribusikan kepada entitas induk 9,631,827 7,712,218 7,041,195 6,698,926 5,975,153

Total equity which can be attributed to parent entity Kepentingan non-pengendali 42,401 44,338 40,508 34,019 33,687 non-controlling interests

Total ekuitas 9,674,228 7,757,218 7,081,703 6,732,945 6,008,840 Total equity

liabilitas, Dana syirkah Temporer

dan ekuitas Konsolidasian 102,318,457 88,697,430 75,861,310 70,975,163 70,84,878

liability, Temporary syirkah fund, and consolidated equity

laPOran laba rUGi Dan

PenGHasilan KOmPreHensif lain KOnsOliDasian

PrOfiT anD lOss sTaTemenT anD OTHer cOnsOliDaTeD cOmPreHensiVe incOme

pendapatan Bunga dan Syariah 10,677,875 10,084,451 8,791,820 8,132,988 6,795,686 Sharia and Interest Income Beban Bunga dan Bagi hasil

Syariah (4,599,263) (5,108,277) (4,330,222) (3,350,845) (3,140,311)

Sharia revenue Sharing and Interest expense

Pendapatan bunga dan syariah

bersih 6,078,612 4,976,174 4,461,598 4,782,143 3,655,375 net sharia and interest income

pendapatan operasional Lainnya 758,197 565,789 616,970 457,258 330,362 other operational Income Beban operasional Lainnya (5,316,500) (3,730,665) (3,627,016) (3,487,470) (2,566,496) other operational expenses

laba Operasional 1,520,309 1,811,298 1,451,552 1,751,931 1,419,241 Operational Profit

Beban non operasional 158,112 101,826 66,395 26,554 18,297 non-operational expenses

laba sebelum Pajak 1,463,908 1,766,398 1,423,141 1,752,874 1,512,499 Profit before Tax

Beban pajak (310,683) (385,434) (315,345) (376,487) (319,195) Tax expenses

Total laba (rugi) yang dapat

Diatribusikan Kepada : 1,153,225 1,380,965 1,107,796 1,376,387 1,193,304

Total profit (loss) which can be attributed To:

pemilik entitas induk 1,154,421 1,377,110 1,103,880 1,372,913 1,192,684 owner of parent entity Kepentingan non pengendali (1,196) 3,855 3,916 3,474 620 non-controlling interests

laba komprehensif diatribusikan

kepada: 2,741,103 1,369,830 1,103,451 1,376,987 1,193,304

comprehensive profit attributed to:

pemilik entitas induk 2,741,148 1,365,939 1,099,548 1,372,913 1,192,684 owner of parent entity Kepentingan nonpengendali (45) 3,891 3,903 3,474 620 non-controlling interests

laba bersih per saham (ePs)

(dalam rupiah penuh) 119,06 142,02 113,85 141,59 123,00

earnings per share (ePs) (in full rupiah)

laPOran arUs Kas KOnsOliDasian cOnsOliDaTeD sTaTemenT Of casH flOW

arus kas diperoleh dari aktivitas

operasi 5,105,778 5,579,200 2,660,169 (10,399,769) 6,533,426

net cash derived from (used in) operations arus kas neto (digunakan untuk)

diperoleh dari aktivitas investasi 3,653,802 (5,338,762) 2,566,837 5,456,488 (4,234,008)

Tabel ikhtisar Keuangan

Table of financial Highlights

(dalam juta Rupiah | in million rupiah)

Uraian 2016 2015 2014 2013 2012 Description

arus kas neto diperoleh dari (digunakan untuk) aktivitas pendanaan

(422,808) (716,126) (2,216,284) 485,109 1,058,394 net cash derived from (used in) funding activties

Kenaikan (Penurunan) neto Kas

dan setara Kas 8,336,772 (475,688) 3,010,722 (4,458,172) 3,357,812

increase (Decrease) in net cash and cash equivalents

Kas dan Setara Kas pada awal

Tahun 12,355,602 12,838,765 9,829,747 14,285,744 10,932,625

Cash and Cash equivalents Beginning of Year

Kas dan setara Kas pada akhir

Tahun 20,692,875 12,355,602 12,838,765 9,829,747 14,285,744

cash and cash equivalents at end of Year

rasiO KeUanGan (%)* financial raTiO (%)*

PermODalan caPiTal

Car 18.43 16.21 16.08 16.51 18.11 Car

roa (pre Tax) 2.22 2.04 1.92 2.61 2.46 roa (pre Tax)

roe (Tier 1) 21.81 23.05 18.92 26.76 25.02 roe (Tier 1)

nIM 7.40 6.32 6.79 7.96 6.76 nIM

npL Gross 1.69 2.91 4.15 2.83 2.07 npL Gross

npL Bruto** 1.72 2.92 4.29 2.76 2.22 npL Bruto**

npL net 0.75 0.86 1.04 0.64 0.50 npL net

npL net** 0.77 0.88 1.28 0.68 0.62 npL net**

Bopo 82.70 83.31 85.60 79.41 80.02 Bopo

LDr 86.70 88.13 93.18 96.47 74.09 LDr

aset produktif Bermasalah

terhadap Total aset produktif 1.26 2.22 3.35 2.21 1.27

non productive asset against Total productive asset aset tetap terhadap modal 28.33 25.54 27.73 22.01 25.22 Fixed asset against Capital

*bank saja **konsolidasi

Catatan untuk pembaca laporan:

Tabel dan grafik pada laporan ini memaparkan data numerik

dengan standar Bahasa Inggris, sedangkan pemaparan numerik dalam teks menggunakan standar Bahasa Inggris dan Indonesia sesuai dengan konteksnya.

*bank only **consolidation Notes for readers: Tables and graphs in this report describes the numerical data using English standard, while the numerical exposure in the text is using English and Indonesian standard according to the context.

Jumlah Aset

Total assets

Pendapatan Bunga dan Syariah Bersih

Net Interest Income and Sharia

Kredit yang Diberikan

Loans

2016 2016 2016

2015 2015 2015

2014 2014 2014

2013 2013 2013

2012 2012 2012

Dana Pihak Ketiga

Tabel Kinerja Operasional Dana Pihak Ketiga

Table of Third Party fund Operational Performance

(dalam juta Rupiah | in million rupiah)

Produk 2016 2015 Product

Tabungan 16,923,498 14,351,777 Saving

Giro 17,130,444 18,632,563 Demand deposit

Deposito 38,975,896 29,918,810 Deposit

TOTal 73,029,838 62,903,150 TOTal

Pinjaman

Tabel Kinerja Operasional Pinjaman

Table of loan Operational Performance

(dalam juta Rupiah | in million rupiah)

Produk 2016 2015 Product

Komersial 44,225,826 38,217,375 Commercial

Konsumer 10,832,141 9,246,000 Consumer

Mikro 3,528,127 3,329,593 Micro

Kpr 4,557,500 4,506,950 Mortgage

TOTal 63,143,594 55,299,918 TOTal

Jasa Layanan

Tabel Kinerja Operasional jasa layanan

Table of service Operational Performance

(dalam juta Rupiah | in million rupiah)

Produk 2016 2015 Product

Fee Based Income 510,307 435,922 Interest Income

Third Party Fund

Loan

Performance

Dana Pihak Ketiga

Third Party Fund

NPL Gross (bank only)

Gross NPL (bank only)

NPL Net (bank only)

Net NPL (bank only)

dalam juta rupiah | in million rupiah dalam persen | in percentage dalam persen | in percentage

2016 2016 2016

2015 2015 2015

2014 2014 2014

2013 2013 2013

2012 2012 2012

Produk Internasional dan Trisuri

Tabel Penempatan Dana Pada bank lain-surat berharga Obligasi bank investasi

fund Placement in Other bank-investment bank bond securities

(dalam Rupiah Penuh | in full rupiah)

ObliGasi 2016 2015 bOnD

Bank umum dan Bank Daerah 899.400.000.000 1.234.417.000.000,00 Commercial Bank and Local Bank

Tabel Penempatan Dana Pada bank lain-surat berharga Obligasi non bank investasi

Table of fund allocation on Other banks - bond securities non-bank investment

(dalam Rupiah Penuh | in full rupiah)

ObliGasi 2016 2015 bOnD

Korporasi 1.136.200.000.000,00 1.755.200.000.000,00 Bond

Sun 2.512.432.000.000,00 2.377.432.000.000,00 Sun

orI 310.000.000.000,00 570.378.000.000,00 orI

pBS 480.789.000.000,00 580.789.000.000,00 pBS

Spn - 50.000.000.000,00 Spn

Sr 610.000.000.000,00 757.530.000.000,00 Sr

TOTal 5.049.421.000.000,00 6.091.329.000.000,00 TOTal

Tabel Kinerja Trading Money Market

Table of money market Trading Performance

(dalam Rupiah Penuh | in full rupiah)

KeTeranGan 2016 2015 DescriPTiOn

PLACEMENT 2,404,465,929,550.60 6,580,869,434,494.50 PLACEMENT

BORROWING 2,404,820,371,950.00 6,581,773,485,400.00 BORROWING

Tabel rekapitulasi Obligasi Portofolio Trading

Table of bond recapitulation of Trading Portfolio

(dalam Rupiah Penuh | in full rupiah)

KeTeranGan 2016 2015 DescriPTiOn

reksadana 677,030,667,836.00 712,000,000,000.00 Mutual Funds

Sun 335,000,000,000.00 348,000,000,000.00 Sun

orI 0.00 10,275,000,000.00 orI

Korporasi 100,000,000,000.00 30,000,000,000.00 Corp

Sr 0.00 0.00 Sr

uSD 4,000,000.00 - uSD

TOTal 1,112,034,667,836.00 1,100,275,000,000.00 TOTal

Tabel Volume Transaksi Foreign Exchange and Derivatives

Table of Transaction Volume of foreign exchange and Derivatives

(dalam Rupiah Penuh | in full rupiah)

POrTOfOliO 2016 2015 POrTOfOliO

Sales 461,554,775 220,289,246 Sales

Trading 1,493,884,527 731,707,898 Trading

Banking 1,835,904,041 2,090,912,877 Banking

Total 3,791,343,343 3,042,910,021 Total

Institutional Banking

Tabel Kinerja intitusional banking

Table of institutional banking Performance

PrODUK nasabaH 2016 2015 PrODUcT cUsTOmer

nOa nOminal nOa nOminal

GIro peMerInTah Daerah 11,681 9,219,359 10,882 10,736,273 GIro reGIonaL GoVernMenT

peMerInTah puSaT 237 14,584 250 2,597 CenTraL GoVernMenT

BuMn 898 350,630 821 323,242 Soe

SWaSTa 76,505 6,951,887 69,933 7,085,677 prIVaTe

sUbTOTal 89,321 16,536,459 81,886 18,147,789 sUbTOTal

DepoSITo peMerInTah Daerah 180 4,226,443 315 6,630,209 DepoSIT reGIonaL GoVernMenT

peMerInTah puSaT 18 2,120,157 5 351 CenTraL GoVernMenT

BuMn 555 8,125,019 858 5,847,311 Soe

SWaSTa 4,056 16,931,812 2,934 11,085,316 prIVaTe

sUbTOTal 4,809 31,403,432 4,112 23,563,187 sUbTOTal TOTal KeselUrUHan 94,130 47,939,891 85,998 41,710,976 TOTal

Tahun Years

Triwulan i Quarter i

Triwulan ii Quarter ii

Triwulan iii Quarter iii

Triwulan iV Quarter iV

Tertinggi (dalam rupiah) Highest (in rupiah)

2016 995 1,140 1,760 3,510

2015 1,100 1,025 875 805

2014 1,100 1,175 895 815

2013 1,290 1,300 1,230 960

2012 1,150 900 1,130 1,160

Terendah (dalam rupiah) lowest (in rupiah)

2016 745 880 1,075 1,385

2015 730 815 565 585

2014 815 820 790 720

2013 1,060 1,100 740 810

2012 1,180 800 880 990

Penutupan (dalam rupiah) closing (in rupiah)

2016 965 1,125 1,610 3,390

2015 1,000 820 615 755

2014 1,045 825 795 730

2013 1,290 1,180 900 890

2012 1,110 920 1,100 1,060

Volume Peredaran di Pasar reguler (dalam unit) circulation Volume in the regular market (in units)

2016 983,734,500 716,445,600 1,439,005,000 2,035,640,200

2015 1,103,043,000 1,075,268,400 398,930,700 902,640,500

2014 847,774,800 1,202,031,000 1,182,971,800 507,429,400

2013 1,322,673,500 884,767,000 659,939,500 470,534,500

2012 1,094,563,000 816,946,500 461,630,500 528,600,000

jumlah saham beredar (dalam lembar saham) number of shares Outstanding (in shares)

2016 9,696,291,166 9,696,291,166 9,696,291,166 9,696,291,166

2015 9,696,291,166 9,696,291,166 9,696,291,166 9,696,291,166

2014 9,696,291,166 9,696,291,166 9,696,291,166 9,696,291,166

2013 9,696,291,166 9,696,291,166 9,696,291,166 9,696,291,166

2012 9,696,291,166 9,696,291,166 9,696,291,166 9,696,291,166

Kapitalisasi (dalam juta rupiah) capitalization (in million rupiah)

2016 9,356,921 10,908,328 15,611,029 33,870,427

2015 9,696,291 7,950,958 5,963,218 7,320,699

2014 885,923,830 991,675,575 940,461,945 370,423,170

2013 1,706,248,170 1,043,761,920 594,916,200 441,577,950

2012 1,214,964,930 743,027,880 507,431,100 560,310,700

Volume (rHs) 3600

3100

2600

2100

1600

1100

600

400

350

300

250

200

150

100

50

0

rupiah

Dec -13

mar -14

jun-14 sep-14 Dec -14

mar -15

jun-15 sep-15 Dec -15

mar -16

jun-16 sep-16 Dec -16

million shares

no. Obligasi

1 obligasi I Bank Jabar 25,000 5 Tahun 5 Years

24.30% (tahun pertama dan selanjutnya floating)

(first year and subsequently floating)

2 obligasi II Bank Jabar 50,000 5 Tahun5 Years

17.25% (tahun pertama dan selanjutnya floating)

(first year and subsequently floating)

3 Medium Term notes I 75,000 3 Tahun3 Years

17.75% (tahun pertama dan selanjutnya floating)

(first year and subsequently floating)

4 obligasi III Bank Jabar 150,000 5 Tahun 5 Years

16.25% (tahun pertama dan selanjutnya floating)

(first year and subsequently floating)

5 obligasi IV Bank Jabar

Seri a 300,000

3 Tahun

3 Years 11.75% (fixed)

oktober 2004

6 obligasi IV Bank Jabar Seri B 700,000 5 Tahun5 Years 12.50% (fixed) oktober 2004october 2004 oktober 2009october 2009 idBBB+ paid offLunas 7 obligasi V Bank Jabar 100,000 5 Tahun

5 Years 11.25% (fixed)

Desember 2006

8 obligasi VI Bank Jabar Banten Seri a 350,000 3 Tahun5 Years 12.00% (fixed) June 30, 200930 Juni 2009 July 10, 201210 Juli 2012 ida+ paid offLunas 9 obligasi VI Bank Jabar

Banten Seri B 400,000 5 Tahun

5 Years 12.50% (fixed)

30 Juni 2009 June 30, 2009

10 Juli 2014

July 10, 2014 ida

Lunas paid off

10

obligasi VII bank bjb

Tahun 2011 Seri a

276,000 3 Tahun 3 Years

9.20% (fixed) 10 Februari 2011 February 10, 2011

09 Februari 2014

February 09, 2014 idaa-/Stable

Lunas paid off

11

obligasi VII bank bjb

Tahun 2011 Seri B

601,000 5 Tahun

5 Years 10.20% (fixed)

10 Februari 2011 February 10, 2011

09 Februari 2016

February 09, 2016 idaa-/Stable

Lunas paid off

12

obligasi VII bank bjb

Tahun 2011 Seri C

1,123,000 7 Tahun

7 Years 10.40% (fixed)

10 Februari 2011 February 10, 2011

09 Februari 2018

February 09, 2018 idaa-/Stable

efektif effective

10 februari | february

Penandatanganan MoU KPR bank bjbdengan KORPRI Jawa Barat, di Bandung.

MoU Signing between House Loan (KPR) of bank bjb and KORPRI West Java, in Bandung.

29 februari | february

bank bjb selenggarakan Analyst Meeting FY 2015 di Jakarta.

bank bjb held Analyst Meeting FY 2015 in Jakarta.

10 maret | march

bank bjb adakan Fengshui Talk and Astrology Outlook 2016 di Palembang.

bank bjb held Fengshui Talk and Astrology Outlook 2016 in Palembang

17 maret | march

bank bjb berikan bantuan CSR kepada korban banjir di Kabupaten Bandung.

Bank bjb provided CSR aid to flood victims in Bandung.

17 maret | march

Perjanjian kerjasama antara bank bjb

dengan Wika Gedung di Jakarta.

A cooperation agreement between bank

bjb with Wika Building in Jakarta.

19 maret | march

bank bjb adakan PelatihanKewirausahaan bagi UMKM dengan tajuk UMKM go Online, Untung Meningkat Usaha Berkembang Pesat.

bank bjb held Entrepreneurial Training for MSME with the theme MSME go Online, Profit Increases Business Growing Fast.

23 maret | march

RUPS tahunan bank bjb tahun 2016 yang diadakan di Bandung.

bank bjb AGMS of 2016 held in Bandung.

28 maret | march

bank bjb selenggarakan Investor Gathering 2016 dengan tajuk Prospek Industri, Perbankan dan Pasar Modal di Surabaya.

bank bjb held Investor Gathering 2016 with the theme Prospects of Industry, Banking, and Capital Market in Surabaya.

30 maret | march

Penandatanganan perjanjian kerjasama Tata Kelola Terintegrasi dan Manajemen Risiko Terintegrasi antara bank bjb

dengan Anggota Konglomerasi bank bjb.

Signing of Cooperation Agreement of Integrated Governance and Integrated Risk Management between bank bjb and bank bjb Conglomerate Members.

5 april | april

bank bjb meresmikan relokasi Kantor Wilayah IV di Serang, Banten.

bank bjb officiated the relocation of Regional Office IV in Serang, Banten.

6 april | april

bank bjb berikan Kredit Infrastruktur senilai Rp500 miliar ke PT Adhi Karya (Persero) Tbk.

7 april | april

Peresmian Kantor bank bjb Cabang Pangandaran dan Penyerahan Santunan bank bjb kepada anak yatim.

Inauguration bank bjb Branch Office Pangandaran and Submission Benefits

bjb bank to orphans.

24 april | april

Dalam rangka hari Pendidikan Nasional, bank bjb luncurkan program bjb Cinta Guru dengan simbol kartu ATM versi bjb

Cinta Guru.

Commemorating National Education Day, bank bjb launched bjb Cinta Guru program with symbol of ATM card version of bjb

Cinta Guru

28 april | april

bank bjb selenggarakan Analyst Meeting kuartal 1 di Jakarta.

bank bjb held Analyst Meeting Q1 in Jakarta.

30 april

Penandatanganan piagam kerjasama antara bank bjb dengan STIE Ekuitas dalam rangka cash management.

Signing of cooperation charter between bank bjb and STIE Ekuitas in regards of cash management.

25 mei | april

Bank bjb selenggarakan Rapat Kerja Forum Komunikasi Dewan Komisaris dan Dewan Pengawas BPD-SI Wilayah Tengah.

bank bjb held Work Meeting of Communication Forum of Board of Commissioners and Board of Supervisor BPD-DI Central Region.

25 mei | april

Dengan budaya GO SPIRIT, KIBAR turut berperan aktif dalam kepedulian sosial terhadap masyarakat.

With GO SPIRIT culture, KIBAR also actively participated in social care for the community.

25 mei | may

Launching Laku Pandai bjb BISA.

Launching of Laku Pandai bjb BISA.

6 juni | june

bank bjb salurkan kredit sebesar Rp750 miliar untuk perkuat permodalan PT Pegadaian (Persero).

bank bjb distributed load for Rp750 billion to strengthen the capital of PT Pegadaian (Persero).

16 juni | june

Grand Opening Student Preneur di Universitas Terbuka, Tangerang.

16 juni | june

Penandatanganan MoU antara bank

bjb dengan Koperasi Konsumen Praja Sejahtera Jawa Barat.

The signing of the MoU between bank

bjb with Praja Consumer Cooperatives Prosperous West Java.

20 juni | june

bank bjb Berbagi Ramadhan Memberi Bersama 10.000 Anak Yatim dan Dhuafa di Bandung.

bank bjb Sharing Together in Ramadhan with 10,000 Orphans and the Poor in Bandung.

30 juni | june

Kick Off Meeting peluncuran Visa Debit bank bjb.

Kick Off Meeting of the launching of bank

bjb Visa Debit

25 juli | july

bank bjb mengadakan Business Review untuk Triwulan III.

Bank bjb held a business review for the third quarter.

28 juli | july

bank bjb selenggarakan Analyst Meeting kuartal 2 di Jakarta.

bank bjb held Analyst Meeting Q2 in Jakarta.

2 agustus | august

Public Expose bank bjb tahun 2016.

bank bjb Public Expo of 2016

8 agustus

bank bjb menjadi satu-satunya BPD yang ditunjuk sebagai Bank Persepsi dalam program tax amnesty.

bank bjb became the only BPD that is appointed as Perception Bank of tax amnesty program.

8 agustus | august

An Evening with bank bjb” merupakan acara customer gathering untuk memperkenalkan dan mempromosikan produk bank bjb terutama di wilayah timur Indonesia

“An Evening with bank bjb”a customer gathering event to introduce and promote bank bjb products.

9 agustus | august

bank bjb bekerja sama dengan Indomaret dalam Pembayaran Pajak Bumi dan Bangunan Pedesaan dan Perkotaan di Kota Tangerang.

bank bjb cooperated with Indomaret for payment of Land and Building Tax Rural and City in Tangerang.

17 agustus | august

Program Penghargaan Nasabah Setia 2016, dalam rangka memperingati HUT Provinsi Jawa Barat ke-72

18 agustus | august

Penandatanganan perjanjian kerjasama antara bank bjb dengan Direktorat Jenderal Administrasi Hukum Umum dalam rangka pengelolaan PNBP (Penerimaan Negara Bukan Pajak)

Signing of cooperation agreement between bank bjb and Directorate General of Public Legal Administration.

22 agustus | august

bank bjb meresmikan Kantor Wilayah V di Surabaya.

bank bjb officiated Regional Office V di Surabaya.

29 agustus | august

Sosialisasi program transformasi BPD kepada para stakeholder.

Dissemination of BPD transformation program to the stakeholders.

4 september | september

bank bjb memperingati hari Pelanggan Nasional 2016 dengan melaksanakan pemeriksaan kesehatan pada nasabahbank bjb commemorated National Customer Day 2016 by organizing health check for customers.

7 september | september

bank bjb memberikan apresiasi kepada Debitur dengan program Customer Loan Loyalty berupa paket wisata religi.Bank bjb appreciated debitors with Customer Loan Loyalty Program of religious tourism packages.

15 september | september

Peran bank bjb dalam pengembangan UMKM dirangkum dalam sebuah Seminar Nasional bertajuk Ekonomi Tumbuh Tinggi, Berkualits dan Berkelanjutan Melalui Peningkatan Value Added UMKMbank bjb’s role in developing MSME was summarized in a National Seminar.

16 september | september

Melalui progran CSR bank bjb berikan track lari dan air mancur gasibu dalam rangka pelaksanaan PON XIX dan Peparnas XV Jawa Barat.Through CSR program, bank bjb provided running track and Gasibu fountain in regards of West Java PON XIX ceremony

17 september | september

bank bjb mendukung event nasional PON XIX dan PEPARNAS XV 2016 di Jawa Barat.bank bjb supported national event PON XIX and PEPARNAS XV 2016 in West Java.