Statistik Asuransi Gempa Bumi Indonesia

2016

Indonesia Earthquake Insurance Statistics 2016

Kata Pengantar

Foreword

Bapak dan Ibu Direksi Perusahaan Asuransi yang

saya hormati,

Dengan mengucap Puji Syukur Kehadirat Tuhan

Yang Maha Esa, buku

“

Laporan Statistik Asuransi

Gempa Bumi Indonesia (LSAGBI) Desember 2016

”

telah selesai

disusun. Penyusunan LSAGBI ini

selaras dengan salah satu Visi MAIPARK yaitu

menjadi

“Center

Of

Excellence”

dan sebagai upaya

dalam memberikan pelayanan yang terbaik bagi

Industri Asuransi Umum di Indonesia khususnya

mengenai statistik serta pengetahuan risiko gempa

bumi.

Sebagai salah satu publikasi rutin, LSAGBI ini

memuat

hasil kajian risiko-risiko gempa bumi

terkait data exposure, premi nasional, jumlah risiko

dan perkembangan risiko gempa bumi. Di dalam

laporan ini kami juga menyajikan ulasan aktuaria

dan risiko exposure dari sudut pandang asuransi

gempa bumi. Kami melakukan analisis atas eksposur

utama kita di Jawa Bagian Barat yang kami lengkapi

dengan analisis Probable Maximum Loss untuk area

ini. Selain itu, data statistik nasional ini juga

memperlihatkan kecenderungan penurunan produksi

premi

dari

underwriting

risiko

bencana

oleh

perusahaan

asuransi

di

Indonesia

walaupun

penurunan

premi

ini

tidak

diimbangi

dengan

penurunan eksposurnya.

Seperti yang kita sadari bersama, dukungan dari

seluruh perusahaan asuransi umum sangat berarti

bagi kami dalam upaya pengembangan laporan

statistik ini agar dapat digunakan sebagai panduan

yang baik dalam kita melaksanakan bisnis

sehari-hari.

Akhir

kata,

kami

menyadari

kebutuhan

penyempurnaan buku ini sangat tinggi sehingga

kritik maupun saran sangat kami harapkan. Semoga

laporan ini dapat menjadi referensi yang berkualitas

dan dapat memberikan manfaat bagi perusahaan

yang menangani

asuransi

gempa bumisehingga

dapat

memperkuat

industri

asuransi

umum

di

Indonesia.

Kami

mohon

maaf

apabila

masih

ditemukan kesalahan

data dan informasi yang

disajikan dalam buku ini.

Hormat kami,

Dear Sir / Madam,

Our gratitude to God Almighty, the

“Indonesian

Earthquake Insurance Statistic Report as at

December 2016

”

is ready to publish. This report

publication is aligned with

MAIPARK’s

vision,

which is to be a "Center of

Excellence”

and also

to provide the best service for the General

Insurance

Industry

in

Indonesia,

especially

statistic and earthquake risks knowledge.

As a regular publication, it contains earthquake

risks study related to the national Exposure,

premium, number of risks and development of the

earthquake risks management. We also include

actuarial and Exposure risks reviews

from

earthquake insurance point of view. We do an

analysis to our main exposure in West Java that

also provide with Probable

Maximum Loss

analysis for this area. The national statistics also

show decreasing trend in premium production

from disaster risk underwriting by insurance

companies in Indonesia although the decline in

premiums is not followed by a decrease in

exposure.

Support from the General Insurance Industry will

be meaningful to us in order to improve this

Statistic Report.

We

realize

the

need

for

improvement of this report is very high so that

critics and suggestions are appreciate.

Finally, we hope that this report could be used as

a qualified reference and will be beneficial for all

general insurance industries in Indonesia. We

apologize for any possible data and information

errorspresented in this report.

Sincerely,

Yasril Y. Rasyid

President Director

Daftar Isi

Contents

Kata Pengantar...i

Foreword

Daftar Isi...ii

Contents

Keadaan Ekonomi 2016- Produk Domestik Bruto 2016...2

Economic Outlook 2016- Gross Domestic Product 2016

Keadaan Asuransi 2016

Insurance Outlook 2016:

Premi Asuransi 2016...3

Insurance Premium 2016

Industri Asuransi 2016...3

Insurance Industry 2016

Catatan Asuransi Gempa Bumi 2004 -2016:

Earthquake Insurance 2004-2016:

Premi 2004-2016 ...4

Premium 2004-2016

Eksposur 2004-2016 ...5

Exposure 2004-2016

10 Besar Klaim Events 2004-2016 ...6

Top 10 Claim Events 2004-2016

Premi Asuransi Gempa Bumi 2016:

Earthquake Insurance Premium 2016:

Premi Per Okupasi UY 2012-2016 ... 8

Premium by Occupation UY 2012-2016

Premi Per Interest UY 2012-2016 ... 9

Premium by Interest UY 2012-2016

Premi: Distribusi Okupasi UY 2016 ...10

Premium: Occupation Distribution UY 2016

Eksposur Asuransi Gempa Bumi 2016:

Earthquake Insurance Exposure 2016:

Eksposur Per Okupasi UY 2012-2016 ...11

Exposure by Occupation UY 2012-2016

Eksposur Per Interest UY 2012-2016 ...12

Exposure by Interest UY 2012-2016

Eksposur: Distribusi Okupasi UY 2016 ...13

Exposure: Occupation Distribution UY 2016

Jumlah Risiko Asuransi Gempa Bumi 2016:

Earthquake Insurance Number of Risk 2016:

Jumlah Risiko Per Okupasi UY 2012-2016 ...14

Number of Risk by Occupation UY 2012-2016

Klaim Events Asuransi Gempa Bumi 2016 ...15

Earthquake Insurance Claim Events 2016

Shakemap untuk Gempa Pidie dan Solok ...16

Shakemap for Pidie and Solok Event

Daftar Gempa Bumi 2016 Magnitudo

≥

6.0 Mw ...18

Earthquake List 2016 Magnitude

≥

6.0 Mw

Daftar Isi

Contents

Ulasan Aktuaria: Cadangan Atas Risiko Bencana ...20

Actuarial Review: Cat Reserve

Risk Analysis:

Risk Analysis:

Portfolio & PML Jawa Bagian Barat ...26

Portfolio & PML of Western Java

Catatan Gempa di Jakarta ...27

Historical

Earthquake in Jakarta

Data Detail:

Detail Data:

Tabel 2.1

National Aggregate Exposure By Cresta Zone ...30

Table 2.1

National Aggregate Exposure By Cresta Zone

Tabel 2.2

National Aggregate Exposure By Okupasi...32

Table 2.2

National Aggregate Exposure By Occupacy

Tabel 2.3

National Aggregate Exposure By Interest...34

Table 2.3

National Aggregate Exposure By Interest

Tabel 2.4

National Aggregate Exposure By Province...36

Table 2.4

National Aggregate Exposure By Province

Tabel 2.5

National Aggregate Exposure By Class Construction...37

Table 2.5

National Aggregate Exposure By Class Construction

Tabel 3.1

National Gross Premium By Cresta Zone...39

Table 3.1

National Gross Premium By

Cresta Zone

Tabel 3.2

National Gross Premium By Occupation...41

Table 3.2

National Gross Premium By

Occupation

Tabel 3.3

National Gross Premium By Interest ...43

Table 3.3

National Gross Premium By

Interest

Tabel 3.4

National Gross Premium By Province ...45

Table 3.4

National Gross Premium By

Province

Tabel 3.5

National Gross Premium By Class Construction ...46

Table 3.5

National Gross Premium By Class Construction

Tabel 4.1

Number Of Risk By Cresta Zone ...47

Table 4.1

Number Of Risk By Cresta Zone

Tabel 4.2

Number Of Risk By Occupation ...50

Table 4.2

Number Of Risk By Occupation

Tabel 4.3

Number Of Risk By Class Construction ...52

Table 4.3

Number Of Risk By Class Construction

Tabel 4.4

Number Of Risk By Province ...54

Table 4.4

Number Of Risk By Province

Tabel 5.1

Claim Frequency By Cresta Zone ...55

Table 5.1

Claim Frequency By Cresta Zone

Tabel 5.2

Claim Frequency By Occupation ...56

Table 5.2

Claim Frequency By Occupation

Tabel 5.3

Claim Frequency By Province ...59

Table 5.3

Claim Frequency By Province

Tabel 5.4

Claim By Cresta Zone ...60

Table 5.4

Claim By Cresta Zone

Tabel 5.5

Claim By Occupation ...62

Table 5.5

Claim By Occupation

Tabel 5.6

Claim By Province ...64

Table 5.6

Claim By Province

Daftar Isi

Contents

Risk & Loss:

Risk & Loss:

Underwriting Year 2012 - 2016, Seluruh Okupasi ...66

Underwriting Year 2012 - 2016, Seluruh Okupasi

Underwriting Year 2016, Seluruh Okupasi ...67

Underwriting Year 2016, All Occupation

Underwriting Year 2015, Seluruh Okupasi ...68

Underwriting Year 2015, All Occupation

Underwriting Year 2014, Seluruh Okupasi ...69

Underwriting Year 2014, All Occupation

Underwriting Year 2013, Seluruh Okupasi ...70

Underwriting Year 2013, All Occupation

Underwriting Year 2012, Seluruh Okupasi ...71

Underwriting Year 2012, All Occupation

Underwriting Year 2016, Okupasi Agrikultural ...72

Underwriting Year 2016, Occupation Agricultural

Underwriting Year 2016, Okupasi Komersial ...73

Underwriting Year 2016, Occupation Commercial

Underwriting Year 2016, Okupasi Industrial ...74

Underwriting Year 2016, Occupation Industrial

Underwriting Year 2016, Okupasi Residensial ...75

Underwriting Year 2016, Occupation Residential

Underwriting Year 2015, Okupasi Agrikultural ...76

Underwriting Year 2015, Occupation Agricultural

Underwriting Year 2015, Okupasi Komersial ...77

Underwriting Year 2015, Occupation Commercial

Underwriting Year 2015, Okupasi Industrial ...78

Underwriting Year 2015, Occupation Industrial

Underwriting Year 2015, Okupasi Residensial ...79

Underwriting Year 2015, Occupation Residential

Underwriting Year 2014, Okupasi Agrikultural ...80

Underwriting Year 2014, Occupation Agricultural

Underwriting Year 2014, Okupasi Komersial ...81

Underwriting Year 2014, Occupation Commercial

Underwriting Year 2014, Okupasi Industrial ...82

Underwriting Year 2014, Occupation Industrial

Underwriting Year 2014, Okupasi Residensial ...83

Underwriting Year 2014, Occupation Residential

Underwriting Year 2013, Okupasi Agrikultural ...84

Underwriting Year 2013, Occupation Agricultural

Underwriting Year 2013, Okupasi Komersial ...85

Underwriting Year 2013, Occupation Commercial

Underwriting Year 2013, Okupasi Industrial ...86

Underwriting Year 2013, Occupation Industrial

Underwriting Year 2013, Okupasi Residensial ...87

Underwriting Year 2013, Occupation Residential

Underwriting Year 2012, Okupasi Agrikultural ...88

Underwriting Year 2012, Occupation Agricultural

Underwriting Year 2012, Okupasi Komersial ...89

Underwriting Year 2012, Occupation Commercial

Underwriting Year 2012, Okupasi Industrial ...90

Underwriting Year 2012, Occupation Industrial

Underwriting Year 2012, Okupasi Residensial ...91

Underwriting Year 2012, Occupation Residential

Daftar Isi

Contents

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Cresta Zone, Underwriting Year 2016 ...92

Exposure, Gross Premium, Number of Risk & Claim

by Cresta Zone, Underwriting Year 2016

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Cresta Zone, Underwriting Year 2015 ...93

Exposure, Gross Premium, Number of Risk & Claim

by Cresta Zone, Underwriting Year 2015

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Cresta Zone, Underwriting Year 2014 ...94

Exposure, Gross Premium, Number of Risk & Claim

by Cresta Zone, Underwriting Year 2014

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Cresta Zone, Underwriting Year 2013 ...95

Exposure, Gross Premium, Number of Risk & Claim

by Cresta Zone, Underwriting Year 2013

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Cresta Zone, Underwriting Year 2012 ...96

Exposure, Gross Premium, Number of Risk & Claim

by Cresta Zone, Underwriting Year 2012

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Okupasi, Underwriting Year 2016 ...97

Exposure, Gross Premium, Number of Risk & Claim

by Occupation, Underwriting Year 2016

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Okupasi, Underwriting Year 2015

………

98

Exposure, Gross Premium, Number of Risk & Claim

by Occupation, Underwriting Year 2015

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Okupasi, Underwriting Year 2014 ...99

Exposure, Gross Premium, Number of Risk & Claim

by Occupation, Underwriting Year 2014

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Okupasi, Underwriting Year 2013 ...100

Exposure, Gross Premium, Number of Risk & Claim

by Occupation, Underwriting Year 2013

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Okupasi, Underwriting Year 2012 ... ...101

Exposure, Gross Premium, Number of Risk & Claim

by Occupation, Underwriting Year 2012

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Provinsi, Underwriting Year 2016 ...102

Exposure, Gross Premium, Number of Risk & Claim

Daftar Isi

Contents

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Provinsi, Underwriting Year 2015 ...103

Exposure, Gross Premium, Number of Risk & Claim

by Province, Underwriting Year 2015

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Provinsi, Underwriting Year 2014 ...104

Exposure, Gross Premium, Number of Risk & Claim

by Province, Underwriting Year 2014

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Provinsi, Underwriting Year 2013 ...105

Exposure, Gross Premium, Number of Risk & Claim

by Province, Underwriting Year 2013

Exposure, Premi Bruto, Jumlah Risiko & Klaim

per Provinsi, Underwriting Year 2012 ...106

Exposure, Gross Premium, Number of Risk & Claim

by Province, Underwriting Year 2012

Lampiran:

Annexes:

Daftar Istilah Statistik ...108

Statistical Glossary

Tarif dan Zona Asuransi Gempa Bumi Indonesia ...110

Indonesia

Earthquake

Insurance Tariff and Zone

Daftar Cresta Zone Untuk Indonesia ...124

Cresta Zone List For Indonesia

Skala untuk First Loss, Rate Polis Jangka Pendek, Periode Indemnity ...131

Scale for Fisrt Loss, Short Period Policy Rate, Indemnity Period

Kode Okupasi ...134

Occupation Code

Gambaran Ekonomi

–

Industri Asuransi 2016

Economic

–

Insurance Industry Outlook 2016

8,564.9

8,982.5

9,433.0

Year 2014

Year 2015

Year 2016

4.88%

5.02%

IDR 9.433 Trillion

IDR 378,2 Trillion

IDR 9.433 triliun adalah total Produk Domestik Bruto (PDB) Indonesia pada tahun 2016. Tiga sektor

usaha dengan kontribusi paling besar adalah: (i) Industri Pengolahan

–

21,39%, (ii) Perdagangan Besar

Eceran; Reparasi Mobil dan Sepeda Motor

–

13,31% dan (iii) Pertanian, Kehutanan dan Perikanan

–

12,82%.

IDR 9.433 Trillion is

Indonesia’s

GDP for 2016. Three sectors with highest contribution are: (i)

Processing Industry

–

21.4%, (ii) grocery, retail and automotive trading

–

13.3% and (iii) Farming,

Forestry and Fisheries

–

12.82%.

IDR 378,2 trilyun adalah besaran PDB dalam kelompok usaha Jasa Keuangan dan Asuransi. Sektor ini

berkontribusi 4% dari total PDB Indonesia pada tahun 2016, masih berada di bawah sektor Konstruksi;

Pertambangan dan Penggalian; Informasi dan Komunikasi.

IDR 378,2 Trillion is the GDP from Financial Services and Insurance sector. This sector contributes 4%

of Indonesia's total GDP by 2016, below Construction sector; Mining and excavation; Information and

Communication.

Keadaan Ekonomi 2016.

Economic Outlook 2016

Indonesia mengalami pertumbuhan ekonomi sebesar 5.02% pada tahun 2016. Namun demikian laju

pertumbuhan pada sektor Jasa Keuangan dan Asuransi mencapai 8.9%, tertinggi dibandingkan sektor

lainnya. Laju pertumbuhan 8.9% ini juga menjadi laju pertumbuhan tertinggi bila dibandingkan dengan

tahun sebelumnya yaitu 4.7% pada tahun 2014 dan 8.6% pada tahun 2015.

Indonesia’s

economic growth in 2016 reached 5.02%. However, growth rates in the Financial Services

and Insurance sector was 8.9%, the highest compared to other sectors. The 8.9% growth rate is also

the highest growth rate compared to 4.7% in 2014 and 8.6% in 2015.

In trillion IDR

Reasuransi MAIPARK | 2

69.01%

9.55%

21.44%

Produksi premi Asuransi Jiwa lebih tinggi dibandingkan dengan Asuransi Umum/kerugian. Dari Total

produksi premi 2016 sebesar 199 Triliun rupiah, Asuransi Jiwa berkontribusi sebesar 69,01%.

Sedangkan Asuransi Umum/Kerugian hanya 30,99%. Dari total Asuransi Umum tersebut ada 30%

merupakan produksi premi Asuransi Umum/Kerugian dari Lini Bisnis Harta Benda.

Life Insurance premium production is higher than General Insurance/Non Life. Life Insurance

contributed 69.01% of 199 Trillion rupiah, the total premium production in 2016. While General

Insurance / Non Life is only 30.99%. The premium production of General Insurance / Non Life from the

Business Line of Property is 30% of the total Premium of General Insurance.

6

Perusahaan

Reasuransi

Reinsurance

77

Perusahaan

Asuransi Umum

General Insurance

55

Perusahaan

Asuransi Jiwa

Life Insurance

5

Asuransi

Wajib dan Sosial

Mandatory and

Social Insurance

Keadaan Asuransi 2016.

Insurance Outlook 2016

AJ

AU-O

AU-P

Uraian/Description

Premi /Premium

Asuransi Jiwa/

Life Insurance (AJ)

137,785,583

Asuransi Umum - Harta Benda/

General Insurance - Property (AU-P)

19,072,900

Asuransui Umum - Lainnya/

General Insurance - Others (AU-O)

42,797,300

In million IDR

3 |Reasuransi MAIPARK

Source: Otoritas Jasa Keuangan, 2017

Asosiasi Asuransi Umum Indonesia, 2017

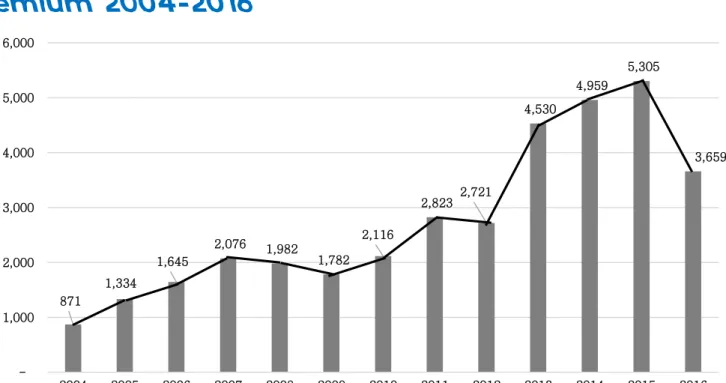

Grafik ini menampilkan pertumbuhan premi dari underwiring year (UY) 2004-2016. UY 2016 masih

belum matang per 31 Januari 2017, dan diperkirakan masih bertambah sampai dengan akhir tahun

2017 nanti. Bila melihat dari pola UY sebelumnya, maka penambahan premi untuk UY 2016 sendiri

dapat mencapai kira-kira 19% atau sekitar Rp4,3 Triliun.

Dengan proyeksi UY 2016 menjadi Rp4,3 Triliun, maka dapat kita lihat terjadi penurunan produksi

premi dari UY 2015 ke UY 2016 untuk asuransi gempa bumi sebesar 19%. Hal ini berbanding

terbalik dengan pertumbuhan Jasa Keuangan dan Asuransi secara umum di Indonesia yang tumbuh

sebesar 8,9%.

This graph shows premium growth from underwriting year 2004-2016. UY 2016 is still developing

as obtained per January 31, 2017, and still increasing until the end of 2017. Looking at the previous

UY pattern, the additional premium for UY 2016 can reach approximately 19% or about Rp4.3

Trillion.

The projection of UY 2016 to 4.3 Trillion, we can see a decrease in premium production for

earthquake insurance from UY 2015 to UY 2016 by 19%. This is inversely related to the growth of

Financial Services and Insurance in general in Indonesia which grew by 8.9%.

Catatan Asuransi Gempa Bumi 2004 - 2016.

Earthquake Insurance 2004

–

2016.

3.1

3.2

3.3

Premi di UY 2016 terdistribusi 56,7% di Cresta 3

yang mencakup 3 Area yaitu 3.1- Provinsi DKI

Jakarta, 3.2-Kota Bandung dan 3.3-Kota/Kabupaten

Lain selain Jakarta dan Bandung di Provinsi Banten

dan Jawa Barat.

Premiums in UY 2016 were distributed 56.7% in

Cresta 3 that covering 3 Area ie 3.1- Province of

DKI Jakarta, 3.2-City of Bandung and 3.3-City/

Regency Other than Jakarta and Bandung in Banten

and West Java Province.

Cresta 3

56,7%

871

1,334

1,645

2,076

1,982

1,782

2,116

2,823

2,721

4,530

4,959

5,305

3,659

1,000

2,000

3,000

4,000

5,000

6,000

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

In

Bi

llion

s

IDR

Reasuransi MAIPARK | 4

Catatan Asuransi Gempa Bumi 2004 - 2016.

Earthquake Insurance 2004

–

2016.

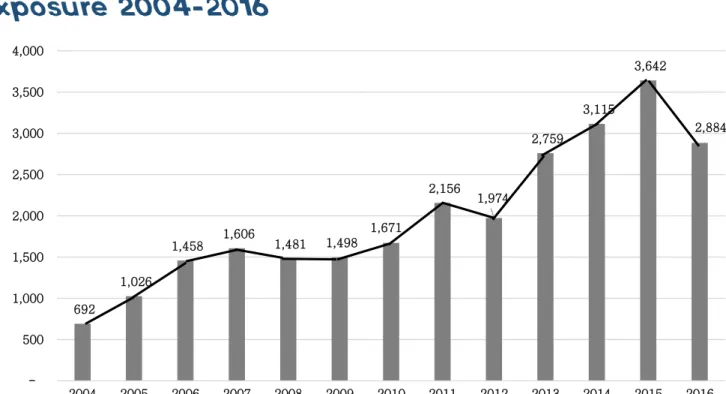

Grafik ini menampilkan pertumbuhan eksposur dari underwiring year 2004-2016. Untuk UY 2016

dimana angka eksposur didapatkan per 31 Januari 2017 kami perkirakan masih dapat bertambah

sampai dengan akhir tahun 2017 nanti. Bila melihat dari pola UY sebelumnya, maka penambahan

eksposur untuk UY 2016 sendiri dapat mencapai kira-kira 20% atau sekitar Rp3,4 Kuadriliun.

Dengan proyeksi UY 2016 menjadi 3,4 Quadtriliun maka dapat kita lihat terjadi penurunan eksposur

dari UY 2015 ke UY 2016 untuk asuransi gempa bumi sebesar 5,6%.

This graph shows exposure growth from underwiring year 2004-2016. Exposure of UY 2016 is

obtained as of January 31, 2017, we estimate it can still increase until the end of 2017. When

looking at the previous UY pattern, the additional exposure for UY 2016 can reach approximately

20% or about Rp3.4 QuadTrillion.

The projection of UY 2016 to Rp3.4 QuadTrillion, we can see a decrease in exposure production for

earthquake insurance from UY 2015 to UY 2016 by 5.6%.

Cresta 3

53,2%

3.1

3.2

3.3

Eksposur di UY 2016 terdistribusi 53,2% di Cresta

3 yang mencakup 3 Area yaitu 3.1- Provinsi DKI

Jakarta, 3.2-Kota Bandung dan 3.3-Kota/Kabupaten

Lain selain Jakarta dab Bandung di Provinsi Banten

dan Jawa Barat.

Exposure in UY 2016 are distributed 53.2% in

Cresta 3 that covering 3 Area ie 3.1- Province of

DKI Jakarta, 3.2-City of Bandung and 3.3-City/

Regency Other than Jakarta and Bandung in Banten

and West Java Province.

692

1,026

1,458

1,606

1,481

1,498

1,671

2,156

1,974

2,759

3,115

3,642

2,884

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

In

Tri

llion

s

IDR

5 |Reasuransi MAIPARK

Dilihat dari sisi intensitas gempa yang digambarkan oleh intensitas maksimum, Gempa Aceh 2004,

Gempa Yogyakarta 2006 dan Gempa Padang 2009 adalah tiga gempa terbesar yang terjadi dari

tahun 2004.

Loss ratio

tertinggi terjadi pada event Gempa Aceh 2004 dan Gempa Padang 2009

masing-masing sebesar 77,85% dan 78,38% sementara itu Gempa Yogyakarta 2006 hanya memiliki

loss ratio

1.25%.

Fakta ini salah satunya disebabkan mekanisme gempa dimana pada gempa subduksi

(Aceh dan

Padang) intensitas tinggi dapat terjadi pada area yang sangat luas sehingga

loss ratio

sangat tinggi,

sedangkan gempa patahan (Yogyakarta) intensitas tinggi hanya berdampak pada area yang relative

lebih kecil, sehingga

loss ratio

tidak terlalu besar.

From the earthquake intensity point of view, three biggest earthquake are Aceh EQ 2004, Yogya EQ

2006 and Padang EQ 2009. the highest loss ratio experienced in Aceh and Padang events each

77,85% dan 78,38% while Yogya EQ only resulted a minor loss ratio of 1.25%.

One of the probable cause is the mechanism of earthquake where the subduction type of EQ (Aceh

and Padang) affected larger high intensity areas than the fault EQ (Yogya), which this was affected

the loss ratio of these particular events.

Catatan Asuransi Gempa Bumi 2004 - 2016.

Earthquake Insurance 2004

–

2016.

No.

Kejadian

Tanggal

Kejadian

Kekuatan

Gempa

Kedalaman

(KM)

MMI

Maksimum

Eksposure

Terdampak

Klaim

Rasio Kerugian

Number

Event

Date of Loss

Magnitude

Depth (KM)

Maximum MMI Affected Exposure

Claim

Loss Ratio

1

ACEH

26/12/04

9.1 Mw

30.00

IX

958,757.93 746,364.47

77.85%

2

YOGYA

27/05/06

6.3 Mw

12.50

IX

22,607,377.57 283,523.14

1.25%

3

PADANG

06/03/07

6.3 Mwc

11.00

VIII

5,975,640.89 28,753.80

0.48%

4

BENGKULU

12/09/07

8.4 Mw

34.00

VIII

870,834.57 61,180.16

7.03%

5

PADANG

16/08/09

6.7 Mwc

20.00

VI

3,105,777.10 42,782.94

1.38%

6

TASIKMALAYA

02/09/09

7.0 Mw

46.00

VII

37,059,693.77 33,508.29

0.09%

7

PADANG

30/09/09

7.6 Mw

81.00

IX

1,434,892.35 1,124,652.86

78.38%

8

BIMA

09/11/09

6.6 Mwc

18.00

VI

10,261,909.77 47,771.65

0.47%

9

MERAPI

25/10/10

6,912,282.28 30,534.72

0.44%

10

KELUD

13/02/14

51,122,470.86 270,749.97

0.53%

volcanic eruption

volcanic eruption

Reasuransi MAIPARK | 6

In million IDR

Asuransi Gempa Bumi 2012 - 2016

Earthquake Insurance 2012-2016

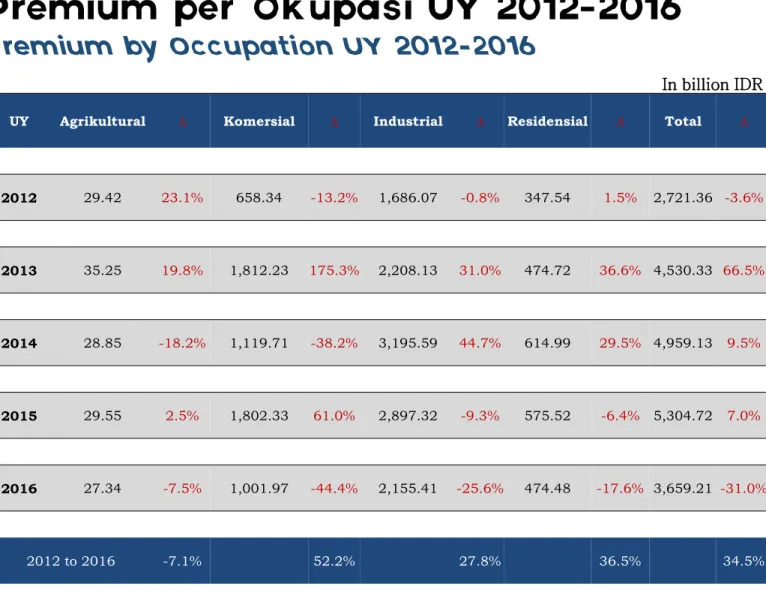

Tabel di atas adalah data produksi premi selama 5 tahun terakhir. Pada Okupasi Agrikultur, kenaikan

paling tinggi terjadi antara UY 2011-2012 yaitu sebesar 23,1%. Pada Okupasi Komersial dan

Residential, kenaikan paling tinggi terjadi antara UY 2012-2013 yaitu masing-masing sebesar

175,3% dan 36,6%. Pada Okupasi Industrial kenaikan paling tinggi terjadi antara UY 2013-2014

yaitu sebesar 44,7%.

Bila angka UY 2016 dibandingkan dengan UY 2012 maka kenaikan produksi premi tertinggi terjadi

pada Okupasi Komersial yaitu sebesar 52,2%. Sementara itu, premi dari okupasi agrikultur

mengalami penurunan sebesar 7.8%.

The table above is the premium production for the last 5 years. In the Agricultural Occupation, the

highest increase occurred between UY 2011-2012 that is equal to 23,1%. In the Commercial and

Residential Occupation, the highest increase occurred between UY 2012-2013, i.e 175.3% and

36.6%, respectively. In Industrial Occupation, the highest increase occurred between UY 2013-2014

which is equal to 44,7%.

If the figure of UY 2016 compared to UY 2012, the highest increase of premium production occurred

in Commercial Occupation that is equal to 52,2%. Meanwhile, the premium amount from agricultural

occupation decreased 7.8%.

Premi Asuransi Gempa Bumi 2016

Earthquake Insurance Premium 2016

UY

Agrikultural

∆

Komersial

∆

Industrial

∆

Residensial

∆

Total

∆

2012

29.42

23.1%

658.34

-13.2%

1,686.07

-0.8%

347.54

1.5%

2,721.36

-3.6%

2013

35.25

19.8%

1,812.23

175.3%

2,208.13

31.0%

474.72

36.6%

4,530.33

66.5%

2014

28.85

-18.2%

1,119.71

-38.2%

3,195.59

44.7%

614.99

29.5%

4,959.13

9.5%

2015

29.55

2.5%

1,802.33

61.0%

2,897.32

-9.3%

575.52

-6.4%

5,304.72

7.0%

2016

27.34

-7.5%

1,001.97

-44.4%

2,155.41

-25.6%

474.48

-17.6%

3,659.21

-31.0%

2012 to 2016

-7.1%

52.2%

27.8%

36.5%

34.5%

Reasuransi MAIPARK | 8

In billion IDR

Tabel di atas adalah data produksi premi selama 5 tahun terakhir. Pada Interest Building, Others dan

Business Interuption, kenaikan paling tinggi terjadi antara UY 2012-2013 yaitu masing-masing

sebesar 47,1%, 74,5% dan 274,7%. Pada Interest Machinery, kenaikan paling tinggi terjadi antara

UY 2013-2014 yaitu sebesar 35,4%. Pada Interest Stock, kenaikan paling tinggi terjadi antara UY

2013-2014 yaitu sebesar 73,8%.

Bila angka UY 2016 dibandingkan dengan UY 2012 maka pertumbuhan tertinggi produksi premi

terjadi pada Interest Building yaitu sebesar 41,1%. Sementara pertumbbuhan terendah terjadi pada

interest Stock sebesar 17.4%.

The table above is the premium production data for the last 5 years. In the Building, Others and

Business Interuption Interest, the highest increase occurred between UY 2012-2013, i.e 47.1%,

74.5% and 274.7% respectively. In the Machinery Interest, the highest increase occurred between

UY 2013-2014 which is 35.4%. In the Stock Interest, the highest increase occurred between UY

2013-2014 which is equal to 73.8%.

If the figure of UY 2016 compared to UY 2012, the highest growth in premium production occurs in

the Interest Building that is equal to 41.1%, which the lowest growth is come from Stocks 17.4%.

Premi Asuransi Gempa Bumi 2016

Earthquake Insurance Premium 2016

UY

Building

∆

Machinery

∆

Others

∆

Stock

∆

Interruption

Bussiness

∆

Total

∆

2012

1,109.99

-14.3%

540.32

-3.6%

452.83

39.4%

377.17

2.7%

241.06

-12.5%

2,721.36

-3.6%

2013

1,632.36

47.1%

694.83

28.6%

790.30

74.5%

509.68

35.1%

903.15

274.7%

4,530.33

66.5%

2014

2,036.80

24.8%

940.76

35.4%

619.12

-21.7%

885.58

73.8%

476.87

-47.2%

4,959.13

9.5%

2015

2,754.09

35.2%

920.39

-2.2%

637.03

2.9%

576.81

-34.9%

416.38

-12.7%

5,304.72

7.0%

2016

1,565.76

-43.1%

708.82

-23.0%

620.01

-2.7%

442.68

-23.3%

321.93

-22.7%

3,659.21

-31.0%

2012 to 2016

41.1%

31.2%

36.9%

17.4%

33.5%

34.5%

9 |Reasuransi MAIPARK

In billion IDR

Kode Ukupasi dan Keterangan

Description & Occupation Code

Jumlah Risiko

Number of Risk

Premium

Premi

Exposure

Exposure

Private Building

297

76.292

507.543.348.366,93 356.534.521.091.664,00

Trading and storage

293

60.265

454.438.237.985,54 352.215.048.368.483,00

Hotels, Entertainment, Sport,

Services

294

8.779

258.685.294.963,58 189.853.581.229.423,00

Conventional power station . .

281

242

254.200.632.649,54 184.559.210.302.184,00

Mass communication

292

9.639

184.847.249.329,61 122.983.990.617.974,00

Edible fats, edible oil and desiccated

coconut producers

274

638

135.087.154.106,32 116.242.728.581.394,00

Tobacco, cigars and cigarettes

manufacture

279

404

134.531.401.654,95 133.199.023.516.826,00

Mining (underground or above

ground) of precious metal . . .

200

26

126.611.096.193,12

88.838.188.575.950,00

Cement, Chalk, Lime and Gypsum

Industry

211

213

122.352.807.348,26 105.505.506.691.319,00

Industrial, Mining and Commercial

Machinery . . .

221

963

107.635.376.746,15 100.860.184.394.393,00

Premi Asuransi Gempa Bumi 2016

Earthquake Insurance Premium 2016

Reasuransi MAIPARK | 10

In IDR

Tabel di atas adalah data eksposur selama 5 tahun terakhir. Pada Okupasi Agrikultur, kenaikan

paling tinggi terjadi antara UY 2011-2012 yaitu sebesar 16,7%. Pada Okupasi Komersial dan

Residential, kenaikan paling tinggi terjadi antara UY 2012-2013 yaitu masing-masing sebesar

117,5% dan 37,5%. Pada Okupasi Industrial, kenaikan paling tinggi terjadi antara UY 2013-2014

yaitu sebesar 38,4%.

Bila angka UY 2016 dibandingkan dengan UY 2012 maka kenaikan eksposur tertinggi terjadi pada

Okupasi Komersial yaitu sebesar 60,1%.

The table above is the exposure for the last 5 years. In the Agricultural Occupation, the highest

increase occurred between UY 2011-2012 that is equal to 16,7%. In the Commercial and Residential

Occupation, the highest increase occurred between UY 2012-2013, i.e 117.5% and 37.5%

respectively. In the Industrial Occupation, the highest increase occurred between UY 2013-2014 i.e

38,4%.

If the number of UY 2016 compared to UY 2012, the highest increase in exposure occurred at

Commercial Occupation that is equal to 60,1%.

Eksposur Asuransi Gempa Bumi 2016

Earthquake Insurance Exposure2016

11 |Reasuransi MAIPARK

In Trillion IDR

UY

Agri

∆

Commercial

∆

Industrial

∆

Residensial

∆

Total

∆

2012

23.54

-99.9%

458.52

-99.9%

1,261.13

-99.9%

231.08

-99.9%

1,974.28

-99.9%

2013

25.96

10.3%

997.42

117.5%

1,417.71

12.4%

317.64

37.5%

2,758.72

39.7%

2014

22.35

-13.9%

746.06

-25.2%

1,961.85

38.4%

385.09

21.2%

3,115.35

12.9%

2015

24.20

8.3%

1,163.69

56.0%

2,068.54

5.4%

385.82

0.2%

3,642.25

16.9%

2016

21.73

-10.2%

734.06

-36.9%

1,797.00

-13.1%

331.69

-14.0%

2,884.48

-20.8%

2012 to 2016

-7.7%

60.1%

42.5%

43.5%

46.1%

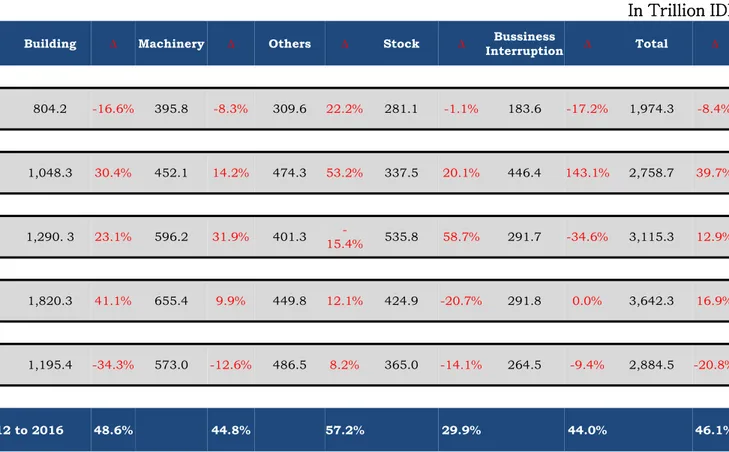

Tabel di atas adalah data eksposure selama 5 tahun terakhir. Pada Interest Others dan Business

Interuption kenaikan paling tinggi terjadi antara UY 2012-2013 yaitu sebesar 53,2% dan 143,1%.

Pada

Interest Machinery dan Stock kenaikan paling tinggi terjadi antara UY 2013-2014 yaitu

sebesar 31,9% dan 58,7%. Pada Interest Building kenaikan paling tinggi terjadi antara UY

2014-2015 yaitu sebesar 41,1%.

Bila angka UY 2016 dibandingkan dengan UY 2012 maka kenaikan eksposure terjadi pada Interest

Building yaitu sebesar 57,2%.

The table above is the exposure for the last 5 years. In The Others and Business Interuption

Interest, the highest increase occurred between UY 2012-2013, i.e 53.2% and 143.1%. In The

Machinery and Stock Interest, the highest increase occurred between UY 2013-2014 i.e 31.9% and

58.7%. In the Building Interest, the highest increase occurred between UY 2014-2015 i.e 41.1%.

If the number of UY 2016 compared to UY 2012, the exposure increase occurs in the Building

Interest i.e 57.2%.

Eksposur Asuransi Gempa Bumi 2016

Earthquake Insurance Exposure2016

UY

Building

∆

Machinery

∆

Others

∆

Stock

∆

Bussiness

Interruption

∆

Total

∆

2012

804.2

-16.6%

395.8

-8.3%

309.6

22.2%

281.1

-1.1%

183.6

-17.2%

1,974.3

-8.4%

2013

1,048.3

30.4%

452.1

14.2%

474.3

53.2%

337.5

20.1%

446.4

143.1%

2,758.7

39.7%

2014

1,290. 3

23.1%

596.2

31.9%

401.3

-15.4%

535.8

58.7%

291.7

-34.6%

3,115.3

12.9%

2015

1,820.3

41.1%

655.4

9.9%

449.8

12.1%

424.9

-20.7%

291.8

0.0%

3,642.3

16.9%

2016

1,195.4

-34.3%

573.0

-12.6%

486.5

8.2%

365.0

-14.1%

264.5

-9.4%

2,884.5

-20.8%

2012 to 2016

48.6%

44.8%

57.2%

29.9%

44.0%

46.1%

Reasuransi MAIPARK |12

In Trillion IDR

Eksposur Asuransi Gempa Bumi 2016

Earthquake Insurance Exposure 2016

13 |Reasuransi MAIPARK

Kode Okupasi dan Keterangan

Description & Occupation Code

Jumlah Risiko

Number of Risk

Premium

Premi

Eksposure

Exposure

Private Building

297

76,292

507,543,348,367

356,534,521,091,664

Trading and storage

293

60,265

454,438,237,986

352,215,048,368,483

Hotels, Entertainment, Sport,

Services

294

8,779

258,685,294,964

189,853,581,229,423

Conventional power station,

buildings with boiler houses . . .

281

242

254,200,632,650

184,559,210,302,184

Tobacco, cigars and cigarettes

manufacture

279

404

134,531,401,655

133,199,023,516,826

Mass communication

292

9,639

184,847,249,330

122,983,990,617,974

Edible fats, edible oil and

desiccated coconut producers

274

638

135,087,154,106

116,242,728,581,394

Cement, Chalk, Lime and Gypsum

Industry

211

213

122,352,807,348

105,505,506,691,319

Industrial, Mining and Commercial

Machinery, . . .

221

963

107,635,376,746

100,860,184,394,393

Petrochemical works

232

133

99,884,265,243

89,767,796,081,455

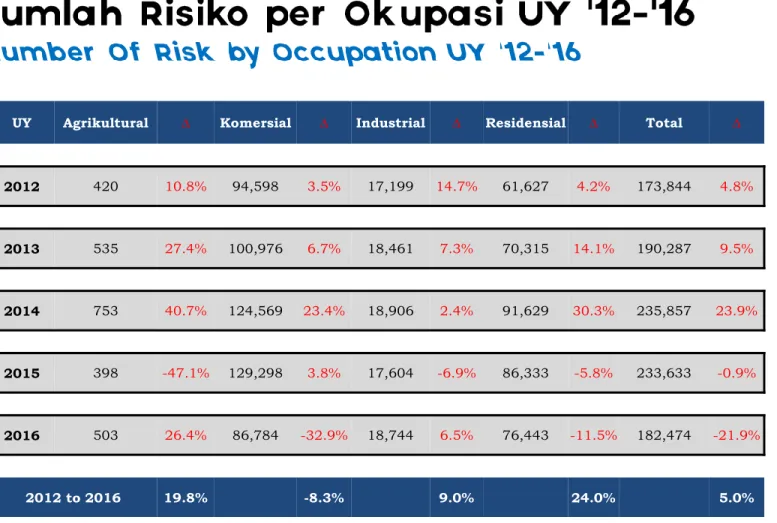

Tabel di atas adalah data Jumlah Risiko selama 5 tahun terakhir. Pada Okupasi Agrikultur,

penurunan paling rendah terjadi antara UY 2014-2015 yaitu sebesar 47,1%. Pada Okupasi Komersial

penurunan paling rendah terjadi antara UY 2015-2016 yaitu sebesar 32,9%. Pada Okupasi Industrial

kenaikan paling tinggi terjadi antara UY 2011-2012 yaitu sebesar 14,7%. Pada Okupasi Residensial

kenaikan paling tinggi terjadi antara UY 2013-2014 yaitu sebesar 30,3%.

Bila angka UY 2016 dibandingkan dengan UY 2012 maka kenaikan Jumlah Risiko tertinggi terjadi

pada Okupasi Residensial yaitu sebesar 24,0%.

The table above is the Number of Risk for the last 5 years. In The Agricultural Occupation, the

lowest decrease occurred between UY 2014-2015 i.e 47,1%. In The Comercial Occupation, the

lowest decrease occurred between UY 2015-2016 i.e 32,9%. In the Industrial Occupation, the

highest increase occurred between UY 2011-2012 i.e 14,7%. In Residential Occupational, the

highest increase occurred between UY 2013-2014 i.e 30.3%.

If the number of UY 2016 compared to UY 2012, the highest increase of Number of Risk occurs in

Residential Occupation i.e 24.0%.

Jumlah Risiko Asuransi Gempa Bumi 2016

Earthquake Insurance Number of Risk 2016

UY

Agrikultural

∆

Komersial

∆

Industrial

∆

Residensial

∆

Total

∆

2012

420

10.8%

94,598

3.5%

17,199

14.7%

61,627

4.2%

173,844

4.8%

2013

535

27.4%

100,976

6.7%

18,461

7.3%

70,315

14.1%

190,287

9.5%

2014

753

40.7%

124,569

23.4%

18,906

2.4%

91,629

30.3%

235,857

23.9%

2015

398

-47.1%

129,298

3.8%

17,604

-6.9%

86,333

-5.8%

233,633

-0.9%

2016

503

26.4%

86,784

-32.9%

18,744

6.5%

76,443

-11.5%

182,474

-21.9%

2012 to 2016

19.8%

-8.3%

9.0%

24.0%

5.0%

Reasuransi MAIPARK | 14

Tabel di atas menampilkan kejadian Gempabumi yang terjadi selama 2016. Data MMI, Kedalaman

dan Magnitude merujuk kepada data USGS. Meskipun Gempa Air Bangis berkekuatan relative

besar yaitu 7,8Mw namun hanya dirasakan pada intensitas III sehingga mengakibatkan kerugian

relative kecil. Hal ini berbeda dengan Gempa Solok dan Pidie Jaya, dengan kekuatan 6,6 Mw dan

6,5 Mw dirasakan hingga MMI VII dan IX mengakibatkan kerugian yang besar.

Pada table tersebut disajikan informasi Exposure Terdampak yang diperoleh dari data exposure

on-risk

atas risiko yang terdampak pada saat kejadian gempa. Sedangkan Loss Ratio disini

dimaksudkan sebagai perbandingan antara Jumlah Klaim terhadap Exposure Terdampak. Loss

Ratio terbesar adalah event Solok sebesar 3,68%.

The table above shows the earthquake events that occurred during 2016. MMI, Depth and

Magnitude refer to USGS data. Although the Air Bangis earthquake is relatively large i.e 7.8Mw

and felt to MMI III, it has resulted in relatively small losses. This is different from the Solok and

Pidie Jaya Earthquakes, which has magnitude of 6.6 Mw and 6.5 Mw is felt until MMI VII and IX

resulted in substantial losses.

The table is presented information Affected Exposure from data exposure onrisk for the risks that

were affected at the time of the earthquake. Loss Ratio here is intended as a comparison between

the Claim Amounts to Affected Exposure. Loss Ratio for event Solok is the largest i.e 3.68%.

Claim Events

Asuransi Gempa Bumi 2016

Earthquake Insurance Claim Events 2016

Event

Date of Loss

Magnitude

Depth (km)

Max Intensity

(MMI)

Affected Exposure

Claim

Loss Ratio

Halmahera

24/02/16

5.4 Mb

13.70

I

18,548.39

-

0.000000%

Air Bangis

02/03/16

7.8 Mw

24.00

III

2,521,420.33

10.00 0.000397%

Mentawai

05/03/16

5.4 Mw

10.00

I

5,051,567.91

10.00 0.000198%

Garut

06/04/16

6.1 Mw

29.00

IV

166,952.86

59.91 0.035884%

Bengkulu

10/04/16

5.7 Mw

41.00

V

1,071,880.14

-

0.000000%

Solok

02/06/16

6.6 Mw

50.00

VII

573,578.45 21,102.04 3.679015%

Bengkulu

12/09/16

8.4 Mw

34.00

VIII

1,775,903.72

-

0.000000%

Padang

21/09/16

4.1 Mw

162.50

I

19,320,111.46

25.00 0.000129%

Irian Jaya

17/10/16

4.7 Mw

33.40

I

2,526,522.97

-

0.000000%

Manado

27/10/16

5.8 Mw

61.00

IV

2,752,815.31

5.55 0.000202%

Malang

16/11/16

5.7 Mw

85.00

IV

6,009,281.11

-

0.000000%

Pidie Jaya

07/12/16

6.5 Mw

8.20

IX

771,388.24

2,350.00 0.304646%

In million IDR

15 |Reasuransi MAIPARK

Gambar 5. Peta Intensitas dan ShakeMap Gempa Solok.

Gambar 6. Peta Intensitas dan ShakeMap Gempa Pidie Jaya.

Peta di atas menggambarkan penyebaran intensitas MMI merujuk kepada data USGS.

Berdasarkan peta tersebut dapat diperoleh informasi wilayah-wilayah yang memiliki MMI

I-X+. Gempa Solok yang terjadi pada tanggal 2 Juni 2016 menimbulkan MMI maksimal VII yang

berdampak di wilayah Kota Sungai Penuh. Sedangkan Gempa Pidie Jaya yang terjadi pada 7

Desember 2016 menimbulkan MMI hingga IX yang berdampak pada wilayah Kabupaten Pidie

Jaya.

The map above illustrates the spread of MMI intensity referring to USGS data. Based on the

map it can be obtained information areas that have MMI I-X+. Solok earthquake that occurred

on June 2, 2016 raises the maximum MMI VII that impacts in the area of City of Sungai Penuh.

While the Pidie Jaya Earthquake that occurred on December 7, 2016 cause MMI to IX which

affects the Regency of Pidie Jaya.

Claim Events

Asuransi Gempa Bumi 2016

Earthquake Insurance Claim Events 2016

Reasuransi MAIPARK | 16

Katalog Gempa Bumi 2016

Earthquake Catalog 2016

≥

≥

Daftar Gempa Bumi 2016 Magnitudo

≥ 6.0 Mw

Earthquake List 2016 Magnitude

≥

6.0 Mw

No. Tanggal Kejadian Bujur Lintang USGS BMKG Kota Terdekat

Number Date of Loss Longitude Latitude Magnitude (Mw) Depth (KM) Magnitude

(Mw) Depth (KM) Nearest Population

1 1/11/2016 126.97 BT 3.8 LU 6.50 13 6.4 10 KEP-TALAUD-SULUT 58 KM Tenggara 2 2/12/2016 119.34 BT 9.77 LS 6.30 28 6.6 10 SUMBABARAT-NTT 14 KM Barat Daya 3 3/2/2016 94.39 BT 4.92 LS 7.80 24 7.8 10 KEP-MENTAWAI-SUMBAR 636 KM Barat Daya 4 4/6/2016 107.32 BT 8.3 LS 6.10 29 6.1 10 101 KM Barat Daya GARUT-JABAR 5 5/2/2016 104.37 BT 5.39 LS 5.70 117 6.1 115 TANGGAMUS-LAMPUNG 23 KM Barat Daya 6 6/2/2016 100.46 BT 2.29 LS 6.60 50 6.5 72 79 KM Barat Daya PESISIR SELATAN-SUMBAR 7 6/5/2016 125.74 BT 4.63 LS 6.30 429.6 6.3 445 BURUSELATAN-MALUKU 146 KM Barat Daya 8 6/9/2016 116.24 BT 11.42 LS 6.10 19 6.2 10 SUMBAWA BARAT-NTB 286 KM Barat Daya 9 8/24/2016 122.54 BT 7.46 LS 6.0 533 6.1 537 105 KM Barat Laut FLORES TIMUR-NTT 10 10/9/2016 127.41 BT 1.79 LU 5.8 128 6.2 117 HALMAHERA BARAT-MALUT 52 KM Barat Laut 11 10/19/2016 108 BT 5.29 LS 6.6 614 6.5 654 120 KM Timur Laut SUBANG-JABAR 12 10/27/2016 125.79 BT 1.32 LU 5.8 61 6.1 10 BITUNG-SULUT 75 KM Tenggara 13 11/8/2016 104.59 BT 8.35 LS 5.8 33 6.0 10 271 KM Barat Daya LEBAK-BANTEN 14 11/16/2016 113.12 BT 9.32 LS 5.7 85 6.2 69 KAB MALANG-JATIM 127 KM Tenggara 15 12/5/2016 123.4 BT 7.32 LS 6.3 526 6.4 524 FLORES TIMUR-NTT 120 KM Timur Laut 16 12/7/2016 96.36 BT 5.19 LU 6.5 13 6.4 10 KAB PIDIE JAYA-ACEH 18 KM Timur Laut 17 12/21/2016 128.01 BT 7.75 LS 6.7 152 6.6 173 MALUKU BARAT DAYA 184 KM Timur Laut 18 12/30/2016 118.63 BT 9.37 LS 6.3 79 6.6 91 59 KM Barat Laut SUMBA BARAT DAYA-NTT