Monthly Progress Report No. 49

Covering Project Activities During

PT. PERENTJANAOJAJAinsubconsultancy with • Yongma Engineering Co. Ltd and 51PT. Epadascon Pennata Engineering Consultant CTCOffice: JI.Ciniru VII No. 25, Kebayoran Baru, Jakarta Seiatan, 12180

Phone /Fax: (021) 7229823

Lee ~

Team 0:;. ,A' \>~~zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA

)" 11 'zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAc,ot.

Cc:zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAOm, ngCo,lld,&pl,e~6'" 1. DirekturJenderal Bina Marga

2. Inspektorat Jenderal, Kementerian PU-PERA 3. Direktur Transportasi - Bappenas

4. Direktur Pengelolaan Kas Negara (PKN), Kementerian Keuangan

5. Direktur Pengembangan Jaringan Jalan, Dit.Jen Bina Marga

6. Direktur Jalan Bebas Hambatan, Perkotaan dan Fasilitasi Jalan Daerah, Dit.Jen Bina Marga

7, Direktur Pembangunan Jalan, DitJen Bina Marga

,8. Direktur Preservasi Jalan, DitJen Bina Marga 9. Biro Perencanaan & KLN, Kementrian PU-PERA

10. Kepala Balai Besar Pelaksanaan JatanNaslonal H Medan 11. Kepala Balai Besar Pelaksanaan Jalan Nasionaillf Padang 12. Kepala Balai Besar Pelaksanaan Jalan Nasional V Palembang

13. Kasubdit Keterpaduan Perencanaan & Sistem Jaringan, DPJJ - DJBM 14. Ketua Pelaksana Harian PIU WINRIP

15. Kepala Satker Pembinaan Administrasi dan Pelaksanaan Pengendalian PHLN 16. PT; Perentjana Djaja

17. Yongma Engineering Co, Ltd

18. PT. Epadascon Permata Engineering Consultant

19. File '.

Should you have any comment or additional information that need to be incorporated in the Report, please feel free to get in touch with us.

This Report is reproduced in twenty (20) copies for distribution to all concemed authorities.

In compliance with the Terms of Reference of our Consultancy Contract, we submit herewith the Monthly Progress Report No.49 covering the month of January 2017.

Dear Sir,

Subject : Submission of January 2017 Monthly Progress Report No.49; WINRIP Loan IBRD

No.8043-ID

Attention: Andria Muharami Fitra, ST. M.Eng Officer In Charge PMU WlNRIP Directorate General of Highways, MPWH JI. Patimura 20 Kebayoran Baru

Jakarta Selatan Indonesia

Jakarta, February 09, 2017 : 03_02/LHW/O/M-01.2017

Our Ref. No.

Perentjana Ojaja

MINISTRY OF PUBLIC WORKS

a.

HOUSING

DIRECTORATE GENERAL OF HIGHWAYS

DIRECTORATE OF ROAD NETWORK DEVELOPMENT

Core Team Consultant for

1

EXECUTIVE SUMMARY

1.1 Current Implementation Situation

Civil Works

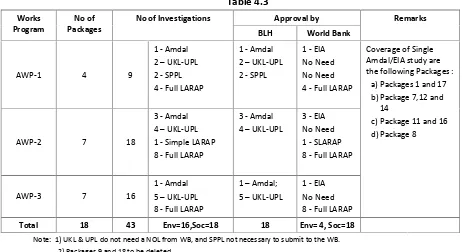

Implementation of the WINRIP Project is scheduled to be implemented into three (3) Annual Work Programs (AWP s). The implementation starts with the preparation of tender documents (detailed design drawings including associated bidding documents), tendering stage (procurement of works) and the actual civil works construction implementation.

The original implementation schedules of the three (3) Annual Work Programs (AWPs) are scheduled in three (3) phases namely ; AWP-1 to start in mid-2011 and to be completed on the last quarter of 2014, AWP-2 is expected to begin in mid 2012 with target date of completion by mid-2016 and AWP-3 is expected to start during the early part of 2013 and to be completed during the middle part of 2017.

However, due to some unavoidable circumstances the original implementation schedules did not materialize.

Based on the present status of the program implementation progress, a revised implementation schedule, the Project Implementation Timeline (as shown onPage 1-2) is to be implemented in order to accommodate the originally delayed schedule into the remaining time frame of the WINRIP Program until the expiry date of the loan agreement by the end ofDecember 2017. Shown on Page 1-3 is the current actual status of the implementation relative to the Project Implementation Timeline .

Implementation Status as of January 31, 2017. Pack

Package Name Contract Under Under Defect LiabilityPeriod

No. Sign Construct

1 Krui - Biha √ Completed √

2 Padang Sawah - Sp.Empat √ Completed √

3 Manggopoh - Padang Sawah √ Completed √

4 Ipuh - Bantal √ Completed √

5 Sp. Rampa - Poriaha √ √

6 Ps. Pedati - Kerkap √ √

7 Indrapura - Tapan √ √

8 Bts.Pariaman - Manggopoh √ √

11 Bantal - Mukomuko √ √

12 Kambang - Indrapura √ √

13 Sp. Rukis - Tj.Kemuning √ √

14 Painan - Kambang √ √

15 Sibolga - Bts.Tap Sel √ √

16 Seblat - Ipuh √ √

17 Sp.Gn.Kemala - Pg.Tampak √ √

19 Lais - Bintunan √ Completed √

20 Lubuk Alung - Sicincin √ √

21 Lubuk Alung - Kuraijati √ √

T O T A L : 18 13 5

Western I ndonesia National Roads I mprovement Project Length C'ti on

Km Peri od J N D J F M AM J J A S O N D J F M A M J J A S O N D J F M AM J J A S O N D J F M AM J J A S O N D J F M AM J J A S O N D J F M AM J J A S O N D

1 Krui - Biha 25,00 21 mth

2 Padang Sawah - Sp.Em pat 40,90 24 mth

3 Manggopoh - Padang Sawah 32,00 24 mth

4 Ipuh - Bantal 42,40 24 mth

5 SI MPANG RAMPA - PORI AHA 11,10 18 mth 11 BANTAL - MUKOMUKO 50,10 24 mth

13 SP RUKIS - TJ KEMUNING 56,30 24 mth

17 Sp.Gn.KEMALA - Pg. TAMPAK 36,80 24 mth 6 PS. PEDATI - KERKAP 25,00 15 mth

19 LAI S - BI NTUNAN 11,60 10 mth

15 SI BOLGA - BATAS TAPSEL 36,00 27 mth

7 I NDRAPURA - TAPAN 19,50 21 mth

8 BTS.Kt PARI AMAN-MANGGOPOH 46,80 24 mth 10 SI MPANG EMPAT - SP.AI R BALAM 61,70 24 mth

12 KAMBANG - I NDRAPURA 55,20 24 mth

14 PAI NAN KAMBANG 31,50 21 mth

16 SEBLAT I PUH 34,50 21 mth

20 LUBUK ALUNG SI CI NCI N 14,60 18 mth 21 LUBUK ALUNG KURAI TAJI 16,80 18 mth

9 RANTAU TI JANG-KOTA AGUNG 42,00 The Road has been constructed by MPW within 2011-2013. Road condition is good. Proposed to be deleted from the list of WINRIP's work program 18 MUKOMUKO-BTS SUMBAR 25,80 The Road has been constructed by MPW within 2011-2013. Road condition is good. Proposed to be deleted from the list of WINRIP's work program

Original target : 715,60 km ENVIRONMENT & SOCIAL SAFEGUARD

Revised target : 640,00 km Prequalification Detail Eng Design LARAP Study

Road Safety Owner's Estimate Appraisal & Public Consultation Procurement & Sign Contr Bid Document LARAP Implementation Preparation for Commencement of Work

Standard Biding Document

CONSTRUCTION CONSTRUCTION COW PROC COW PROC COW PROC CONSTRUCTION

To Be Cancelled

PROC COW

Pack

# PACKAGE NAME

2012 2013 2014 2015 2016 2017 2018

CONSTRUCTION

PROC COW

Review DED & RS Review DED & RS Review DED & RS Review DED & RS

Review DED & RS PQ

CONSTRUCTION Review DED & RS PQ PROC COW

Review DED & RS PQ

COW CONSTRUCTION

CONSTRUCTION

CONSTRUCTION

CONSTRUCTION

DED RSA & REVISED DED OE & BD DED RSA & REVISED DED OE & BD

SBD & OE + BD

OE & BD DED RSA & REVISED DED OE & BD

PROC RSA & REVISED DED

CONSTRUCTION PQ RS Proc COW SBD OE BD DED Rev-DED RS

DED Rev-DED RS PROC COW PROC COW PROC COW CONSTRUCTION CONSTRUCTION CONSTRUCTION CONSTRUCTION CONSTRUCTION Rev-DED RS DED COW PROC COW CONSTRUCTION

OE & BD DED Rev-DED RS OE & BD

OE & BD DED OE & BD

COW

CONSTRUCTION SBD & OE + BD

SBD & OE + BD

PQ PROC

PROC

CONSTRUCTION

DED

Project Implementation Timeline Schedule

Western I ndonesia National Roads I mprovement Project Length C'tion

Km Period J N D J F M A M J J A S O N DJ F M A M J J A S O N DJ F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D

Core Team Consultant (CTC) 40 mth IMPLEMENTATION Time extension for sevices

Design & Supervision Cslt (DSC) 42 mth IMPLEMENTATION Time extension for sevices

TA for Dev.of Sl ope Sta bi l i za ti on, Desi gn & M a na gement

1 Krui - Biha 25,00 21 mth 8 Jan'14

2 Padang Sawah - Sp.Empat 40,90 24 mth 6 Jan'14

3 M anggopoh - Padang Sawah 32,00 24 mth 6 Jan'14

4 Ipuh - Bantal 42,40 24 mth 10 Jan'14

5 SIMPANG RAMPA - PORIAHA 11,10 18 mth 18 Jun'15 20 Jul'17

11 BANTAL - MUKOMUKO 50,10 24 mth 23 Feb'15 11 Feb'17

13 SP RUKIS - TJ KEMUNING 56,30 24 mth 11 jul'17

17 Sp.Gn.KEMALA - Pg. TAMPAK 36,80 24 mth 04 Sep'15 23 Agt'17

6 PS. PEDATI - KERKAP 25,00 15 mth 11 Mar'15

19 LAIS - BINTUNAN 11,60 10 mth 11 Mar'15 CONSTRUCTION 300+125+53 days 30 Jun '16

15 SIBOLGA - BATAS TAPSEL 36,00 27 mth 20 Nov'15

7 INDRAPURA - TAPAN 19,50 21 mth 10 Dec'15 30 Agt'17

8 BTS.Kt PARIAMAN-MANGGOPOH 46,80 24 mth PROC 23 Mar'16

10 SIMPANG EMPAT - SP.AIR BALAM 61,70 24 mth

12 KAMBANG - INDRAPURA 55,20 24 mth

14 PAINAN KAMBANG 31,50 21 mth PROC 13 Aug'16

16 SEBLAT IPUH 34,50 21 mth 8 Nov'16 CONSTRUCTION

20 LUBUK ALUNG SICINCIN 14,60 18 mth 1 Sep'16

21 LUBUK ALUNG KURAITAJI 16,80 18 mth 1 Sep'16

Original target : 715,60 km ENVIRONMENT & SOCIAL SAFEGUARD

1st Revised target : 640,00 km Prequalification Detail Eng Design LARAP Study

Road Safety Owner's Estimate Appraisal & Public Consultation Procurement & Sign Contr Bid Document LARAP Implementation Preparation for Commencement of Work

Standard Biding Document

Review DED & RS PQ Review DED & RS PQ

PQ

Review DED & RS Review DED & RS

PROC

CONSTRUCTION 720 days CONSTRUCTION 720 days

22-Jul-15 PQ PROC ICB ICB ICB ICB ICB ######### CONSTRUCTION 640 + 93 days

14-Apr-16

PROC

17-Mar-16

CONSTRUCTION 540 + 224 days CONSTRUCTION 730 + 105 days

CONSTRUCTION 730 + 75 days

CONSTRUCTION 730 + 90 days 31-Mei-16

Pack

# PACKAGE NAME

2012 2013 2014 2015 2016 2017 2018

PQ RS Proc COW SBD DED OE BD DED NCB NCB DED NCB NCB NCB

Review DED & RS

Review DED & RS SBD & OE + BD

RSA & REVISED DED OE & BD

DED RSA & REVISED DED OE & BD

SBD & OE + BD

DED RSA & REVISED DED OE & BD

DED

ICB RSA & REVISED DED OE & BD Review DED & RS

SBD & OE + BD 6-Nov-12 19-Jun-13 PROC PROC DED Rev-DED RS ICB ICB NCB NCB DED PROC

CONSTRUCTION 720 days

ICB

ICB

ICB

ICB

PROC

CONSTRUCTION 810 - 37 days

DED

CONSTRUCTION 630 days

23-Mei-16 CONSTRUCTION 720 - 132 days 28 Jan'17

30-Des-17

30-Des-17

PROC

PROC

to be canceled

CONSTRUCTION 720 - 71 days

Rev-DED RS Rev-DED RS Rev-DED RS 31-Des-17 30-Des-17 PROCUREMENT IMPLEMENTATION 31-Des-17 31-Des-17 31-Des-17 CONSTRUCTION 450 + 240 days

31-Des-17 CONSTRUCTION 540 - 53 days

31-Des-17

CONSTRUCTION 540 - 53 days CONSTRUCTION 630 - 114 days

1.2 Disbursement

Loan Allocation and Percent (%) Disbursement To Date

#REF! 1.25

0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 100.00

Month

%

Co

m

p

le

te

Actual Expenditure USD 102.34 mil (40.94 %)

WINRIP ACTUAL PROGRESS UP TO JANUARY 2017 AND FORECAST UP TO JUNE 2018

ACTUAL Jan 2017

Original Forecast Forecast Expenditure RevUSD71.63 mil (28.65%)

Forecast Jan 2017

Deviation = + 14.94 %

The total disbursement summary from the loan by The World Bank to the end of January 2017 was USD 102,340,497.30 equivalent to approximately 40.94% of the loan funds. The following table summarizes the individual disbursements as calculated by CTCbut retaining the total disbursement fromClient Connectionat the end ofJanuary 2017.Appendix Ashows the Overall Loan Progress Status.

Category Description

Loan Restructuring

Amount US$

Disbursement This Period

Previous Disbursement

Totals Disbursed to End Jan 2017

in US$

% Disbursed

1

Part 1Betterment and Capacity Expansion of

National Roads.

220,400,000.00 1,160,260.33 94,390,131.14 95,550,391.47 43.35

2 Part 2

Implementation Support 17,000,000.00 0 6,790,105.83 6,790,105.83 39.94

3

Part 3

Road Sector Institutional Development

0 0 0 0 0

4

Part 4

Contingency for Disaster Risk Response

0 0 0 0 0

Unallocated 12,600,000.00 0 0 0 0

Original Loan

Amount 250,000,000.00 1,160,260.33 101,180,236.97 102,340,497.30 40.94

Breakdown of amount disbursed during the period (January 2017) are for Statement of Work Accomplished for the following civil works contract package :

1.3 World Bank Implementation Review Mission and Site Visit

Not performed for this month.

1.4 Procurement of Civil Works Contract Under Category 1 of the Loan Agreement

As of end this reporting month, nineteen (19) contract packages are already procured and are either completed, eighteen (18) under construction and the remaining one (1) package is proposed to be cancelled

Package No. 10 (Sp. Empat Sp. Air Balam) is proposed to be cancelled, because the road is still relatively in the good condition and widening is not needed immediately.

1.5 Procurement of Consultancy Package Under Category 2 of the Revised Loan

Agreement Reallocation.

Technical Assistance for Development of Slope Stabilization, Design and

Management

The Technical Assistance for Disaster Risk Reduction was canceled based on the results of meeting between DGH and the WB on October 12, 2015. It was decided to cancel the Technical Assistance and replaced by a Technical Assistance for Development of Slope Stabilization, Design and Management (under Loan Category-2).

Eight (8) interested consultants met the deadline for submission of Expression of Interest . After POKJA s evaluation, five (5) consulting firms made the shortlist, three (3) international and two (2) local companies.

The World Bank had issued No Objection Letter for RFP and Shortlisted Consultant respectively on September 23, 2016 and October 27, 2016.

RFP had sent by POKJA to all shortlisted consultants on November 2, 2016. Pre-Proposal Conference was held on November 22, 2016 and all shortlisted consultants attended the event. The submission and opening the technical proposals was held on December 5, 2016. Three (3) consultants submitted the proposals, one (1) consultant was late for submitting their proposal and other one (1) consultant did not submit the proposal.

POKJA evaluated the technical proposal first, while the financial proposal keep closed in envelope and will be opened after NOL for Techanical Evaluation Report (TER) issued by the World Bank. Evaluation of technical proposal was finalized by POKJA on December 23, 2016 with issuance the Technical Evaluation Report (TER). CTC reviewed the TER and submitted the founding issues and recommendation related the TER to PMU WINRIP on December 29, 2016.

Technical Evaluation Report was sent to the World Bank by Director of Road Network on January 12, 2017 after the revision reflecting the comments from CTC.

The World Bank on January 23, 2017 issued the letter to survey some notice regarding submitted TER and still need additional explenation and revision of TER from POKJA.

2

PROJECT DESCRIPTION

2.1

Background

The Government of Indonesia wishes to continue strengthening of the National Road system in Indonesia while the Eastern Indonesia National Roads Improvement Project (EINRIP which is assisted by AusAID through the Australian Indonesia Partnership or AIP), is providing support program of National road and bridge improvement works in Eastern Indonesia. The Western Indonesia National Road Improvement Project (WINRIP) will provide similar support for National road and bridge in the Sumatera region of Indonesia. The focus of WINRIP will be roads administered directly by the National Government, including those currently classified as Provincial, Kabupaten (District) or non-status roads which are in process of being reclassified as National roads. In addition, provision will be made for major bridge repair works, rehabilitation, duplication and replacement as necessary to complement road betterment works.

2.2

Project Development

The loan effectiveness date for the WINRIP is 12 March 2012 and key project data is shown in the following detail.

Key Project Data WINRIP Loan No. 8043-ID

Project Cost US$350 million

Original Loan Amount US$250 million

Revised Loan Amount N/A

Board Approval Date 26 May 2011

Loan Signing Date 14 December 2011

Effectiveness Date 12 March 2012

Disbursement (as of January 31, 2017) US$ 102,340,497.30 million (40.94%)

Original Closing Date 31 December 2017

Environmental Category B-Partial Assessment

The IBRD loan amount is US$250 million. The Project is intended to finance a part of the DGH investment program for national roads with a particular focus on the Western corridor of Sumatera. The corridor is one of the three main corridors in Sumatera and connects the city of Padang (with a population of around one million) to major towns along the west coast (Bukittinggi, Sibolga and Bengkulu). It also connects through connector roads on the West coast to Medan in the northeast and to Pekanbaru in the centre of the island. The project has four components:

Project Component 1: Betterment and Capacity Expansion of National Roads

Table 2.1 Proposed Physical Works by DGH Program

Type of Works

AWP-1 AWP-2 AWP-3

Km USD Million Km USD Million Km USD Million

Road Betterment - - 53.10 22.77 -

-Capacity Expansion 137.10 79.70 314.60 127.67 207.60 74.58

Bridge works 0.100 1.94 - - 0.08 2.06

TOTAL

(excluding tax @ current prices) 137.20 81.64 367.70 150.45 207.68 76.65

The batches of projects are termed Annual Work Programs (AWPs) in line with terminology used in other Bina Marga projects. They are not in fact annual programs as such but rather a series of multi-year programs, each commencing in consecutive years. Hence, hereinafter it will call as just Work Programs (WPs). It is expected that implementation of the first Works Program (WP-1) will commence in the third quarter of 2013 and be completed by third quarter or late 2015. The second Work Program (WP-2) is expected to commence in early 2014 and be completed by late 2015 or middle 2016. The third Work Program (WP-3) is expected to commence in early 2015 and be completed by mid-2017. The loan will be closed onDecember 2017.

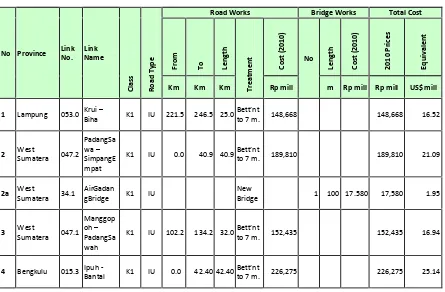

[image:10.595.81.526.491.783.2]Table 2.2 presents details of the First Works Program (WP-1). The four packages in this group should have been free from any land acquisition issues, but in fact two packages (Krui Biha and Manggopoh Padang Sawah) had land issues which were solved by the DGH properly. Thus, there are no foreseeable impediments to implementation.

Table2.2 IBRD Assisted WINRIP Civil Work WP-1

No Province Link No. Link Name C la ss R o a d T y p e

Road Works Bridge Works Total Cost

Fr

o

m

T

o Len

g th T re a tm e n t C o st ( 2 0 1 0 ) No Le n g th C o st ( 2 0 1 0 ) 2 0 1 0 P ri ce s E q u iv a le n t

Km Km Km Rp mill m Rp mill Rp mill US$ mill

1 Lampung 053.0 Krui

Biha K1 IU 221.5 246.5 25.0

Bett nt

to 7 m. 148,668 148,668 16.52

2 West Sumatera 047.2 PadangSa wa SimpangE mpat

K1 IU 0.0 40.9 40.9Bett nt

to 7 m. 189,810 189,810 21.09

2a West

Sumatera 34.1

AirGadan

gBridge K1 IU

New

Bridge 1 100 17.580 17,580 1.95

3 West Sumatera 047.1 Manggop oh PadangSa wah

K1 IU 102.2 134.2 32.0Bett nt

to 7 m. 152,435 152,435 16.94

4 Bengkulu 015.3 Ipuh

-Bantal K1 IU 0.0 42.40 42.40

Bett nt

It should be noted that all road sub-projects have been subject to economic appraisal and have estimated Economic Internal Rates of Return (EIRR) in excess of 15%. These were selected for inclusion and are subject to completion of environmental and social screening, to confirm that there is no land acquisition or resettlement requirements remain outstanding.

Final Engineering Designs, Engineer s Estimates and bidding documents have been completed for all projects proposed for WP-1.

Sub-projects to be included in WP-2 and WP-3 have also been determined as listed inTable 2.3. Final Engineering Designs and Engineer s Estimates for all WP-2 and WP-3 proposed works require preparation or finalization. In the cases of some projects, preliminary Engineering Designs were prepared during Project preparation which will require review and possible amendment by the Design and Supervision Consultant prior to procurement.

The revised costs presented in Table 2.3 are planning estimates only, and the revised implementation plan is based on the Revised Implementation Timeline Schedule of the civil works.

Table2.3: IBRD Loan WINRIP Civil Work WP-2 and WP-3

NO. SUBPROJECT LINK NO. AND NAME LENGTH (KM)

ENGINEER S ESTIMATE (RP. MILL)

WIDTH (M)

REVISED IMPLEMENTATION PLAN

START DURATION

(MONTHS)

WP-2

5. Sumut : Link No. 015.xx,

Sp. Rampa Poriaha 11.10 152,870 6.0 Mar 2015 18

6. Bengkulu : Link No. 010.0,

Ps. Pedati Kerkap 25.00 92,127 7.0 Mar 2015 15

7. Sumbar : Link No. 019.0,

Indrapura Tapan 19.50 178,600 7.0 Jan 2016 21

8. Sumbar : Link No. 024.0,

Bts. Pariaman Manggopoh 46.80 379,034 7.0 Jan 2016 24

9. Lampung : Link No. 026.1,

Rantau Tijang - Kota Agung - - - - Cancelled

10. Sumbar : Link No. 034.1,

Sp. Empat - Sp. Air Balam 61.70 515,842 7.0

-Proposed to be Cancelled 11. Bengkulu : Link No. 015.2,

Bantal Mukomuko 50.10 246,500 6.0 Feb 2015 24

12. Sumbar : Link No. 017.2,

Kambang Indrapura 55.20 451,810 7.0 Jan 2016 24

13. Bengkulu : Link No. 006.1,

Simpang Rukis - Tanjung Kemuning 56.30 316,305 7.0 Jun 2015 24

WP-3

14.

Sumbar : Link No. 017.1,

NO. SUBPROJECT LINK NO. AND NAME LENGTH (KM)

ENGINEER S ESTIMATE (RP. MILL)

WIDTH (M)

REVISED IMPLEMENTATION PLAN

START DURATION

(MONTHS)

15. Sumut : Link No. 016.0,

Sibolga - Bts. TapSel 36.00 376,479 7.0 Oct 2015 27

16.

Bengkulu : Link No. 009.4,

Seblat Ipuh, including Air Galang and Air Guntung Bridges

34.50

0.052 241,500 6.0 May 2016 21

17. Lampung : Link No. 061.1,

Sp. Gunung Kemala - Pugung Tampak 36.80 255,269 6.0 May 2015 24 18. Bengkulu : Link No. 015.3,

Mukomuko - Bts. Sumbar - - - - Cancelled

19. Bengkulu : Link No. 009.1,

Lais Bintuan 11.60 35,886 7.0 Feb 2015 10

20. Sumbar : Link No. 002.0,

Lubuk Alung Sicincin 14.60 116.800 7.0 May 2016 18

21. Sumbar : Link No. 027.0

Lubuk Alung Kuraitaji 16.80 65,788 7.0 May 2016 18

Project Component 2: Implementation Support

Tabel 2.4

Project Management Core Team Consultants (CTC)

The CTC will provide support to the PMU and DGH in the management of the Project, based in Jakarta. Their tasks include financial and progress monitoring and reporting, information management and dissemination, quality assurance and performance review for the Design and Supervision Consultants, implementation and monitoring of the anti-corruption action plan, support for project monitoring and evaluation, and support for implementation of a training program to support project management and implementation. The CTC contract No. 06-20/CTC/TA/LN/8043/1112was signed on5 November 2012by bothDGHand a Joint Venture of PT. Perentjana Djaja, Yongma Engineering Co,Ltd, and PT. Epadascon Permata Engineering Consultant.

Design and Supervision Consultants (DSC)

A Design and Supervision Consultant (DSC) will be responsible for design of WP-2 and WP-3 civil works and supervision of all civil works. They will have the role of Engineer under a FIDIC-type contract. The tasks include the preparation and maintenance of a quality assurance plan, validation and updating of designs, supervision of all civil works, environmental and social monitoring and management, and support for financial and progress monitoring and reporting. The DSC will also be responsible for quality assurance of materials and workmanship, certifying whether or not contractors have achieved the required results, as well as documentation and reporting based on the financial management plan. They will prepare a Quality Assurance system covering all subprojects, and continuously monitor the effectiveness of their supervision procedures. The team will be contracted and managed by DGH through the Bina Marga Regional Office (Balai II),and will be based in Padang, West Sumatera.

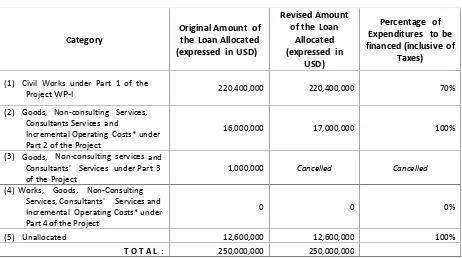

Category

Original Amount of the Loan Allocated (expressed in USD)

Revised Amount of the Loan

Allocated (expressed in

USD)

Percentage of Expenditures to be financed (inclusive of

Taxes)

(1) Civil Works under Part 1 of the

Project WP-l 220,400,000 220,400,000 70%

(2) Goods, Non-consulting Services, Consultants Services and

Incremental Operating Costs* under Part 2 of the Project

16,000,000 17,000,000 100%

(3) Goods, Non-consulting services and Consultants' Services under Part 3 of the Project

1,000,000 Cancelled Cancelled

(4) Works, Goods, Non-Consulting Services, Consultants' Services and Incremental Operating Costs* under Part 4 of the Project

0 0 0%

(5) Unallocated 12,600,000 12,600,000 100%

Project Component 3: Road Sector Institutional Development

This component which is originally intended to provide technical assistance and support to strengthen disaster risk mitigation in the road sector, including capacity building support for the new environment/risk mitigation and road safety unit of DGH has been cancelled due to revision of the loan allocation. In the meeting, DGH and World Bank agreed upon that DGH will conduct analytical work of an alternative design for road segment that pass through critical environmental assets and vulnerable areas especially on slope protection design and management. Due to deletion of the allocated funds for Category 3 of the loan agreement and reallocated to Category 2 to accommodate the implementation of Technical Assistance for Development of Slope Stabilization, Design and Management, into Component-2. The Loan Category restructuring can be seen inTable 2.4 page 2-5.

Project Component 4: Contingency for Disaster Risk Response

This special component will provide preparedness and rapid response to disaster, emergency and/or catastrophic events as needed. This provisional zero dollar component will be added under this project to allow for rapid reallocation of loan proceeds from other components under streamlined procurement and disbursement procedures.

2.3 Project Objective

3

CONSULTANCY SERVICES

3.1

CTC Consultants

3.1.1 Scope of Services

The CTC contract services originally were structured in its different project management elements.

* Inception Phase

A key activity during the inception phase will be to establish lines of communication with PMU-WINRIP and DSC s Team Leader as well as with all Provincial Project Managers (Satkers) where the first works are to be constructed under WP-1.

* Project Management and Support to PMU, including acting DSC until the DSC is established

The Terms of Reference (TOR) identify a number of sub-items to be performed by CTC. The key factor that will ensure success is that the CTC must work pro-actively and alongside PMU counterparts and with DSC team in a professional manner based on mutual respect and trust.

* Preparation of Work Programs

The tendering process for WP 1 sub-projects began as soon as procurement committees have been formed and received appropriate training in the procurement procedures required. The indicative work programs and cost estimates identified for WP-2 and WP-3 are subject to verification, and are likely to change following more detailed investigations. Further preparation for WP-2 and WP-3 will be managed by the PMU supported by the CTC.

* Financial Monitoring

It will be the role of the CTC to first assess the level of understanding of the financial management, monitoring and reporting procedures by the finance staff at the provincial and central level and subsequently devise an appropriate training program and assist the PMU in training delivery.

* Project Progress and Performance Monitoring

CTC will monitor the loan project progress and prepare the report in monthly basis. In the meantime, GOI and the World Bank have agreed on a set of Key Performance Indicators (KPIs) to measure the project s performance in achieving its stated development objectives. CTC will therefore first concentrate on the establishment of precise definitions, calculation methods and data collection procedures to monitor the KPIs.

* Support for the Implementation of the ACAP

* ESAMP and LARAP Implementation Monitoring

CTC will closely work with BLH and DSC and will monitor and report the action of the Environmental Management Plan on a periodical basis and/or as required.

* Training to Support Project Implementation

CTC is responsible for preparation and management of all training program required under WINRIP.

* Reporting

CTC is responsible for all reports required under the contract agreement with standardize forms, charts and tables.

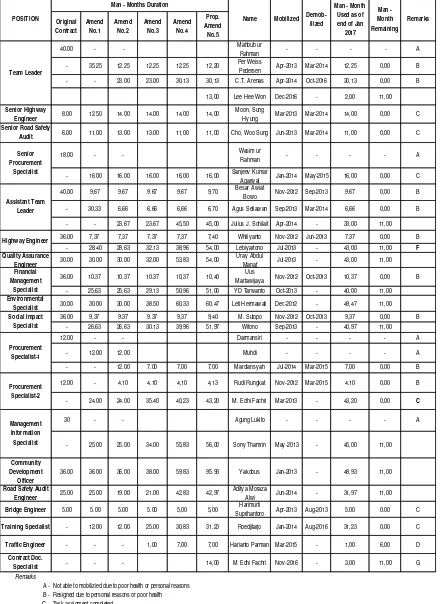

3.1.2 CTC Manning

CTC professional staffs involved in the project as of end ofJanuary 2017are listed inTable 3.1.

The International Staff (Senior Highway Engineer, Senior Road Safety Audit Engineer and Senior Procurement Specialist) have completed their respective engagements and man-months have demoblized on March 31, 2014 and May 31, 2015, respectively.

The task of conducting final Road Safety Audit during post-construction phase which is supposed to be conducted by the Senior Road Safety Audit Engineer will be performed by the local Road Safety Audit Engineer with man-months for the task to be covered by Amendment No.4 of the Consultancy Contract.

Table 3.1

40.00 - - Mahbub ur

Rahman - - - - A

- 35.25 12.25 12.25 12.25 12,20 Per Weiss

Pedersen Apr-2013 Mar-2014 12,25 0,00 B

- - 23.00 23.00 30,13 30,13 C.T. Arenas Apr-2014 Oct-2016 30,13 0,00 B

13,00 Lee Hee Won Dec-2016 - 2,00 11,00

Senior Highway

Engineer 8.00 12.50 14.00 14.00 14,00 14,00

Moon, Sung

Hyung Mar-2013 Mar-2014 14,00 0,00 C

Senior Road Safety

Audit 6.00 11.00 13.00 13.00 11,00 11,00 Cho, Woo Sung Jun-2013 Mar-2014 11,00 0,00 C

18.00 - - Wasim ur

Rahman - - - - A

- 16.00 16.00 16.00 16,00 16,00 Sanjeev Kumar

Agarwal Jan-2014 May-2015 16,00 0,00 C

40.00 9,67 9,67 9.67 9,67 9,70 Besar Awiat

Bowo Nov-2012 Sep-2013 9.67 0,00 B

- 30,33 6,66 6.66 6,66 6,70 Agus Setiawan Sep-2013 Mar-2014 6,66 0,00 B

- - 23.67 23.67 45,50 45,00 Julius J. Sohilait Apr-2014 - 33,00 11,00

36.00 7,37 7,37 7.37 7,37 7,40 Whiliyanto Nov-2012 Jun-2013 7.37 0,00 B

- 28.40 28,63 32.13 38,96 54,00 Lebiyartono Jul-2013 - 43,00 11,00 F Quality Assurance

Engineer 30.00 30.00 30.00 32.00 53,83 54,00

Uray Abdul

Manaf Jul-2013 - 43,00 11,00

36.00 10.37 10.37 10.37 10,37 10,40 Uus

Martawijaya Nov-2012 Oct-2013 10,37 0,00 B - 25,63 25,63 29.13 50,96 51,00 YD Tarwanto Oct-2013 - 40,00 11,00

Environmental

Specialist 30.00 30.00 30.00 38.50 60,33 60,47 Leti Hermawati Dec-2012 - 49,47 11,00

36.00 9,37 9.37 9.37 9,37 9,40 M. Sutopo Nov-2012 Oct-2013 9,37 0,00 B

- 26,63 26,63 30.13 39,96 51,97 Witono Sep-2013 - 40,97 11,00

12.00 - - Darmansiri - - - - A

- 12.00 12.00 Muhdi - - - - A

- - 12.00 7.00 7,00 7,00 Mardiansyah Jul-2014 Mar-2015 7,00 0,00 B

12.00 - 4.10 4.10 4,10 4,13 Rudi Rungkat Nov-2012 Mar-2015 4.10 0,00 B

- 24.00 24.00 35.40 40,23 43,20 M. Edhi Fachri Mar-2013 - 43,20 0,00 C

30 - - Agung Lukito - - - - A

- 25.00 25.00 34.00 55,83 56,00 Sony Thamrin May-2013 - 45,00 11,00

Community Development Officer

36.00 36.00 36.00 38.00 59,83 95.93 Yakobus Jan-2013 - 48,93 11,00

Road Safety Audit

Engineer 25.00 25.00 19.00 21.00 42,83 42,97

Aditya Moraza

Alwi Jun-2014 - 31,97 11,00

Bridge Engineer 5.00 5.00 5.00 5.00 5,00 5,00 Harimurti

Suprihantoro Apr-2013 Aug-2013 5.00 0.00 C

Training Specialist - 12.00 12.00 25.00 30,83 31,23 Roedjitarjo Jan-2014 Aug-2016 31,23 0,00 C

Traffic Engineer - - - 1,00 7,00 7,00 Harianto Parman Mar-2015 - 1,00 6,00 D

Contract Doc.

Specialist - - - 14,00 M Edhi Fachri Nov-2016 - 3,00 11,00 G

Remarks

A - Not able to mobilizied due to poor health or personal reasons B - Resigned due to personal reasons or poor health C - Task assigment completed

D - Intermittent assignment to update AADT

E - Man-months until December 31, 2016 to be covered Amendment No.5 F- Proposed to be extended

Remarks Prop. Amend No.5 Team Leader Senior Procurement Specialist Assistant Team Leader Original Contract Amend No.1 Amend No.2 POSITION

Man - Months Duration

Financial Management Specialist Social Impact Specialist Procurement Specialist-1 Procurement Specialist-2 Management Information Specialist Highway Engineer Man -Month Remaining Amend No.3

Name Mobilized Demob-ilized

Man - Month Used as of end of Jan 2017 Amend

3.1.3 CTC Contract

The CTC contract for Western Indonesia National Roads Improvement Project (Contract No.06-20/CTC/TA/LN/8043/1112) was signed on 05 November 2012. The contract is between the Government of Indonesia represented by Directorate General of Highways in the Ministry of Public Works and PT. Perentjana Djaja in joint venture with Yongma Engineering Co.Ltd. and PT. Epadascon Permata Engineering Consultant.

The Notice To Proceed was issued by letter dated 6 November 2012 from the PPK, and the official starting date of the contract was set at 6 November 2012.

Likewise, Amendment No. 1 to the original contract was signed on 25 October 2013 to cover all requirements of the CTC are summarized below.

* Replacement of the Senior Procurement Specialist

* Extending the assignment of the Senior Highway Engineer.

* Extending the assignment of the Senior Road Safety Audit Engineer.

* Extending the assignment of the Procurement Specialist 2 and replacement of the Procurement Specialist 1.

* Adding the new position of Bridge Engineer. * Adding the new position of Training Specialist, and * Adding the new position of Road Safety Engineer.

Amendment No. 2 to the Original Contract and Amendment No. 1 was signed on September 3, 2014 to cover requirements of CTC are enumerated as follows :

* Additional / Modification to Terms of Reference (TOR) * Amendment to the Team Composition and Staffing Schedule * Replacement of Foreign and Local Consultants

* Adjustments of Remuneration paid in foreign currency and local currency * Adjustment inputs of personnel

* Modification to various reimbursable and provisional sum to match the actual requirement

Amendment No.3 to the current CTC Contract (Original Contract and Amendments 1 and 2 was signed on November 30, 2015 which is in line with the Updated Timeline Bar Schedule taking into consideration the current and look ahead situations of the WINRIP program.

Based on the current progress of the Project, the services of several local professional and sub-professional staff have been extended beyond the end of the respective dates of completion assignments under Amendment No. 2.

Amendment No.3 covers the requirements of CTC are as follows :

* Amendment to the team composition and staffing schedule * Adjustment of inputs of personnel

* Adjustment of remuneration paid in local currency * Adding the new position of Traffic Engineer

* Modification to various reimbursable to match the actual requirements.

Amendment No. 4 to the current CTC Contract (Original Contract and Amendements 1, 2 and 3) was signed on March 4, 2016 and to expire or completed on December 31, 2017, the same date as the expiry/closing date of the loan agreement.

Based on the current progress of the Project, services of professional international and local staff as well as local sub-professional staff have been extended beyond their respective dates of assignment engagement covered by Amendment No. 3.

Amendment No.4 covers the requirements of CTC are as follows :

* Consultancy services time extension

* Additional/Modification to TOR/Terms of Reference

* Adjustment of input schedule for Professional Staff, Sub Professional and Supporting Staff * Amendment to the Team Composition

* Amendment of the Staffing Schedule * Modification to the Provisional Sums

* Adjustment of Remuneration paid in foreign currency and local currency * Adjustment to the reimbursable expenses

* Amendment to Clause 6.1(b) of the Special Condition of Contract

Proposed Amendment No.5 to the current CTC Contract will cover the following requirements of CTC :

* Adjustment of input schedule for professional staff, sub-professional and supporting staff. * Amendment of Staffing schedule.

* Adjustment of remuneration covered by Special Conditions of the Contract, Clause 6.2 (a). * Adjustment of cost estimates for foreign and local curriencies.

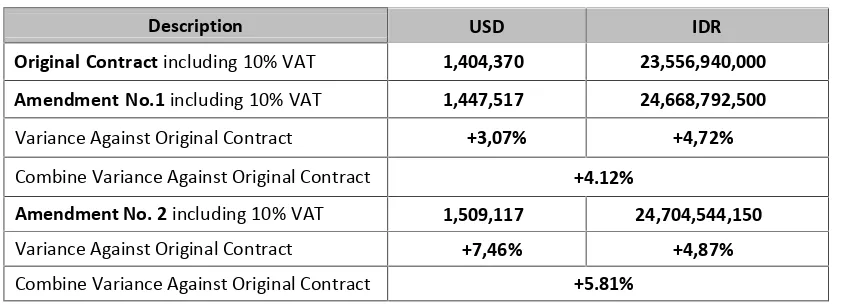

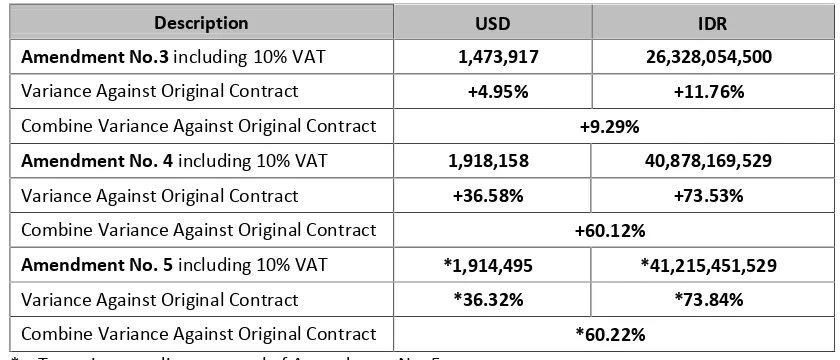

[image:19.595.80.510.620.773.2]Presented inTable 3.2is the current status of CTC contract.

Table 3.2

Description USD IDR

Original Contractincluding 10% VAT 1,404,370 23,556,940,000

Amendment No.1including 10% VAT 1,447,517 24,668,792,500

Variance Against Original Contract +3,07% +4,72%

Combine Variance Against Original Contract +4.12%

Amendment No. 2including 10% VAT 1,509,117 24,704,544,150

Variance Against Original Contract +7,46% +4,87%

Description USD IDR

Amendment No.3including 10% VAT 1,473,917 26,328,054,500

Variance Against Original Contract +4.95% +11.76%

Combine Variance Against Original Contract +9.29%

Amendment No. 4including 10% VAT 1,918,158 40,878,169,529

Variance Against Original Contract +36.58% +73.53%

Combine Variance Against Original Contract +60.12%

Amendment No. 5including 10% VAT *1,914,495 *41,215,451,529

Variance Against Original Contract *36.32% *73.84%

Combine Variance Against Original Contract *60.22%

* Tentative, pending approval of Amendment No. 5.

Note :Combine variance (USD+IDR) is based on 1 USD = Rp. 9,558 exchange rate used during the time of signing the original Contract Agreement.

3.2

DSC Consultants

The Design and Supervision Consultant (DSC) is responsible to design of WP-2 and WP-3 civil works and supervision of all civil works. They will assume the role of Engineer under a FIDIC-type contract. The tasks include the preparation and maintenance of a quality assurance plan, validation and updating of designs, supervision of all civil works, environmental and social monitoring and management, and support for financial and progress monitoring and reporting. The DSC is also be responsible for quality assurance of materials and workmanship, certifying whether or not contractors have achieved the required results, as well as documentation and reporting based on the financial management plan. They will prepare a Quality Assurance system covering all subprojects, and continuously monitor the effectiveness of their supervision procedures. The team is being contracted and managed by DGH through the Bina Marga Regional Office (Balai II), and is being based in Padang, West Sumatera.

DSC has been established in Balai II Padang following the contract signing on 11 June 2013 between Balai II and Renardet SA in joint venture with PT. Cipta Strada, PT. Daya Creasi Mitrayasa, PT. Seecons and PT. Yodya Karya. The Notice To Proceed was issued by the Balai II on 19 June 2013.

[image:20.595.77.497.47.227.2]Shown inTable 3.3is the present status of the Design Supervision Consultant (DSC) contract.

Table 3.3

Description USD IDR

Original Contract plus 10% VAT 902.660 57,000,575,500

Addendum No.1 plus 10% VAT 1,147,190 60,541,139,347

Variance Against Original Contract +27.09% +6.21%

Note :

3.3

Technical Assistance for Development of Slope Stabilization, Design and

Management

The TA s objective is to provide technical support to DGH in improving their capacity for road slope/embankment protection and management. It will include identification and inventory of the existing slope and embankment conditions, assesment of future potential land slide /road erosion problems, development of risk maps, prioritization of high problem/high risk areas, and development of the Detail Engineering Design for a limited amount of areas in the Western corridor of Sumatra. It will also include the review (and revision) of the National Standard and Manual (NSPM) related to the slope protection, and capacity building.

4

CIVIL WORKS

4.1

Detailed Design Preparation

Final Engineering Designs, Engineer s Estimates and bidding documents have been completed for all projects proposed for WP-1, WP-2, WP-3.

A brief status of the eighten (18) sub-projects relative to the procurement of Civil works contracts and implementation can be found in Implementation Status table onPage 1-1 of thisReport. While progress of road safety audit are shown inAppendix B.

4.2 Procurements

Procurement shall be conducted under the Bank s Procurement Procedures as mentioned in the Loan Agreement. The International Competitive Bidding (ICB) based on the Bank letter Ref. WINRIP/136 will apply to the packages with the construction estimated cost of more than US$ 25 Million to comply with the new Bank s threshold for ICB. According to the GOI regulation, a prequalification shall be applied for the packages with the construction estimated cost more than IDR 10 Billion. Review from previous procurement process, the World Bank in the Aide Memoire requested to GOI, for next 4 ICB subprojects qualification still used Pre-Qualification and for remaining sub-project must be process with Post Qualification. As well as for all NCB the World Bank also requested to follow Post Qualification in procurement process.

As of this reporting month, a more detailed current updates are fully indicated in Sub-Chapter 1.4 Procurement of Civil Works Contract Under Category 1onPage 1-5of thisReport.

Under Category 3 of Loan Agreement the three (3) consultancy packages (capacity building for disaster risk reduction, environmental management and road safety) has been cancelled. As a result of the cancellation of the three (3) Technical Assistance, the Technical Assistance for Development of Slope Stabilization, Design and Management has been included as replacement, but to be part of the Loan Category-2 ;

Procurement update of the new consultancy package can be found inSub-Chapter 1.5 Procurement of Consultancy Package Under Category 2onPage 1-5of thisReport.

The WINRIP updated Procurement Plan and Progress are shown inAppendix F.

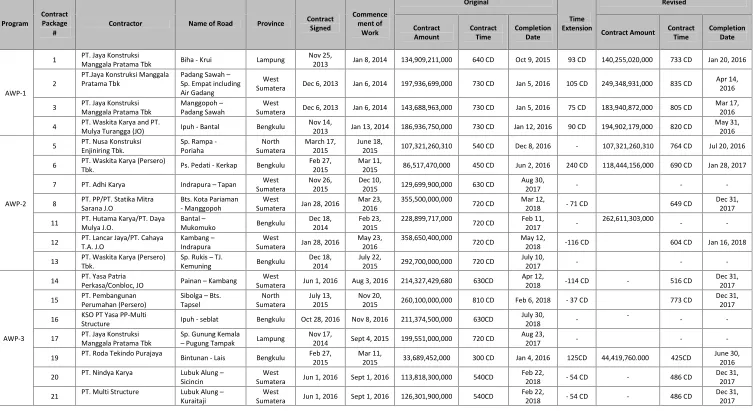

4.3 Civil Works Implementation

As of end of this reporting month, five (5) of contract packages were previously completed and currently under defects liability period for twenty four (24) months effective on the day the TOCs were issued and thirteen (13) packages are currently under construction.

Table 4.1

Program

Contract Package

#

Contractor Name of Road Province Contract Signed Commence ment of Work Original Time Extension Revised Contract Amount Contract Time Completion

Date Contract Amount

Contract Time

Completion Date

AWP-1

1 PT. Jaya KonstruksiManggala Pratama Tbk Biha - Krui Lampung Nov 25,

2013 Jan 8, 2014 134,909,211,000 640 CD Oct 9, 2015 93 CD 140,255,020,000 733 CD Jan 20, 2016

2

PT.Jaya Konstruksi Manggala Pratama Tbk

Padang Sawah Sp. Empat including Air Gadang

West

Sumatera Dec 6, 2013 Jan 6, 2014 197,936,699,000 730 CD Jan 5, 2016 105 CD 249,348,931,000 835 CD

Apr 14, 2016

3 PT. Jaya Konstruksi

Manggala Pratama Tbk

Manggopoh Padang Sawah

West

Sumatera Dec 6, 2013 Jan 6, 2014 143,688,963,000 730 CD Jan 5, 2016 75 CD 183,940,872,000 805 CD

Mar 17, 2016

4 PT. Waskita Karya and PT.

Mulya Turangga (JO) Ipuh - Bantal Bengkulu

Nov 14,

2013 Jan 13, 2014 186,936,750,000 730 CD Jan 12, 2016 90 CD 194,902,179,000 820 CD

May 31, 2016

AWP-2

5 PT. Nusa Konstruksi

Enjiniring Tbk.

Sp. Rampa -Poriaha North Sumatera March 17, 2015 June 18,

2015 107,321,260,310 540 CD Dec 8, 2016 - 107,321,260,310 764 CD Jul 20, 2016

6 PT. Waskita Karya (Persero)

Tbk. Ps. Pedati - Kerkap Bengkulu

Feb 27, 2015

Mar 11,

2015 86,517,470,000 450 CD Jun 2, 2016 240 CD 118,444,156,000 690 CD Jan 28, 2017

7 PT. Adhi Karya Indrapura Tapan West

Sumatera

Nov 26, 2015

Dec 10,

2015 129,699,900,000 630 CD

Aug 30,

2017 - -

-8 PT. PP/PT. Statika MitraSarana J.O Bts. Kota Pariaman- Manggopoh SumateraWest Jan 28, 2016 Mar 23, 2016

355,500,000,000 720 CD Mar 12,

2018 - 71 CD 649 CD

Dec 31, 2017

11 PT. Hutama Karya/PT. Daya

Mulya J.O. Bantal Mukomuko Bengkulu Dec 18, 2014 Feb 23, 2015

228,899,717,000 720 CD Feb 11,

2017

-262,611,303,000 -

-12 PT. Lancar Jaya/PT. Cahaya T.A. J.O

Kambang Indrapura

West

Sumatera Jan 28, 2016

May 23, 2016

358,650,400,000

720 CD May 12,

2018 -116 CD 604 CD Jan 16, 2018

13 PT. Waskita Karya (Persero) Tbk.

Sp. Rukis TJ.

Kemuning Bengkulu

Dec 18, 2014

July 22,

2015 292,700,000,000 720 CD

July 10,

2017 - -

-AWP-3

14 PT. Yasa Patria

Perkasa/Conbloc, JO Painan Kambang

West

Sumatera Jun 1, 2016 Aug 3, 2016 214,327,429,680 630CD

Apr 12,

2018 -114 CD - 516 CD

Dec 31, 2017

15 PT. Pembangunan

Perumahan (Persero) Sibolga Bts. Tapsel North Sumatera July 13, 2015 Nov 20,

2015 260,100,000,000 810 CD Feb 6, 2018 - 37 CD 773 CD

Dec 31, 2017

16 KSO PT Yasa PP-Multi

Structure Ipuh - seblat Bengkulu Oct 28, 2016 Nov 8, 2016 211,374,500,000 630CD

July 30,

2018

--

-17 PT. Jaya Konstruksi

Manggala Pratama Tbk

Sp. Gunung Kemala

Pugung Tampak Lampung

Nov 17,

2014 Sept 4, 2015 199,551,000,000 720 CD

Aug 23,

2017 - -

-19 PT. Roda Tekindo Purajaya Bintunan - Lais Bengkulu Feb 27,2015 Mar 11,2015 33,689,452,000 300 CD Jan 4, 2016 125CD 44,419,760.000 425CD June 30,2016

20 PT. Nindya Karya Lubuk AlungSicincin SumateraWest Jun 1, 2016 Sept 1, 2016 113,818,300,000 540CD Feb 22,2018 - 54 CD - 486 CD Dec 31,2017

21 PT. Multi Structure Lubuk AlungKuraitaji SumateraWest Jun 1, 2016 Sept 1, 2016 126,301,900,000 540CD Feb 22,

2018 - 54 CD - 486 CD

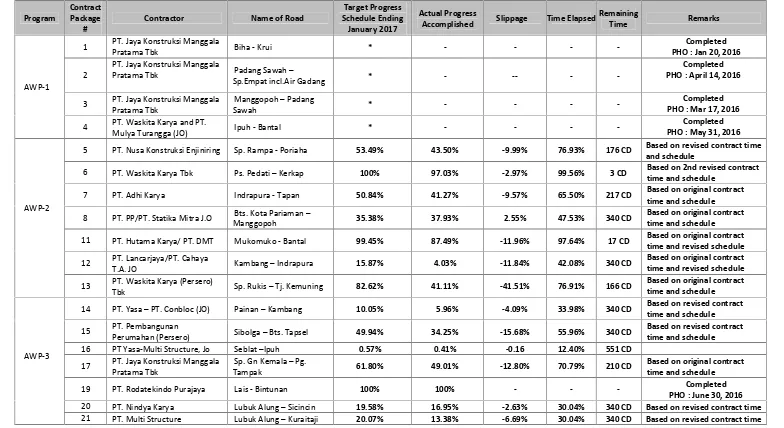

4.4 Civil Works Progress

Activities done during this month on the on-going construction packages were repair and restoration of deteriorated existing pavements, roadway excavation, embankment formation, spreading of granular pavement for roadway widening, asphalt paving, structural works, construction of stone masonry side ditches, stockpiling of raw material, production of crush aggregates, other minor works, bridge construction, finalization of Field Engineering surveys and mobilization of resources of the newly started contract package.

The four (4) contract packages under implementation program AWP-1 were already completed and now under defects liability period for two (2) years since the issuance of TOCs.

Under the implementation program AWP-2 and AWP-3, there are currently thirteen (13) contract packages that are on-going construction implementation. Physical progress of five (5) of the packages are lagging far behind schedule with negative slippages of -41.51% and -15.68%, -12.80%, -11.96%, -11.84% while progress for the other Six (6) packages are still slightly on or behind schedule, one (1) packages are on ahead schedule and the rest one has just started on Nov 8,2016 .

Progress status of the on-going civil works contracts as of this reporting period are shown inTable 4.2.

Following are brief status of the on-going construction contract packages :

Package No. 1 : Biha Krui

The contract package is completed on January 20, 2016 and provisionally handed over to the Employeer and currently under Defects Notification Period until after two (2) years reckoned from the issuance of the TOC.

A more detailed previous status during the whole duration of the contract implementation of this Package is presented inANNEX P-I Executive Summary Report.

Package No. 2 : Padang Sawah Sp. Empat (Including Air Gadang Bridge)

The contract package is completed on April 14, 2016 and provisionally handed over to the Employeer and currently under Defects Notification Period until after two (2) years reckoned from the issuance of the TOC.

ANNEX P-2 Executive Summary Reportpresent a more detailed status during the whole duration of the contract implementation of the Contract Package.

Package No. 3 : Manggopoh Padang Sawah

The contract package is completed on March 17, 2016 and provisionally handed over to the Employeer on March 17, 2016 and currently under Defects Notification Period until after two (2) years reckoned from the issuance of the TOC.

A more detailed status of the project progress during the whole duration of the contract implementation are shown inANNEX P-3 Executive Summary Report .

Package No. 4 : Ipuh Bantal

The contract package is completed on May 31, 2016 and provisionally handed over to the Employeer on May 31, 2016 and currently under Defects Notification Period until after two (2) years reckoned from the issuance of the TOC.

Table 4.2

Program

Contract Package

#

Contractor Name of Road

Target Progress Schedule Ending January 2017

Actual Progress

Accomplished Slippage Time Elapsed

Remaining

Time Remarks

AWP-1

1 PT. Jaya Konstruksi Manggala

Pratama Tbk Biha - Krui * - - -

-Completed PHO : Jan 20, 2016

2

PT. Jaya Konstruksi Manggala

Pratama Tbk Padang Sawah

Sp.Empat incl.Air Gadang * - -- -

-Completed PHO : April 14, 2016

3 PT. Jaya Konstruksi Manggala Pratama Tbk

Manggopoh Padang

Sawah * - - -

-Completed PHO : Mar 17, 2016

4 PT. Waskita Karya and PT.

Mulya Turangga (JO) Ipuh - Bantal * - - -

-Completed PHO : May 31, 2016

AWP-2

5 PT. Nusa Konstruksi Enjiniring Sp. Rampa - Poriaha 53.49% 43.50% -9.99% 76.93% 176 CD Based on revised contract time

and schedule

6 PT. Waskita Karya Tbk Ps. Pedati Kerkap 100% 97.03% -2.97% 99.56% 3 CD Based on 2nd revised contract

time and schedule

7 PT. Adhi Karya Indrapura - Tapan 50.84% 41.27% -9.57% 65.50% 217 CD Based on original contract

time and schedule

8 PT. PP/PT. Statika Mitra J.O Bts. Kota Pariaman

Manggopoh 35.38% 37.93% 2.55% 47.53% 340 CD

Based on original contract time and schedule

11 PT. Hutama Karya/ PT. DMT Mukomuko - Bantal 99.45% 87.49% -11.96% 97.64% 17 CD Based on original contract

time and revised schedule

12 PT. Lancarjaya/PT. Cahaya

T.A. JO Kambang Indrapura 15.87% 4.03% -11.84% 42.08% 340 CD

Based on original contract time and revised schedule

13 PT. Waskita Karya (Persero)

Tbk Sp. Rukis Tj. Kemuning 82.62% 41.11% -41.51% 76.91% 166 CD

Based on original contract time and schedule

AWP-3

14 PT. Yasa PT. Conbloc (JO) Painan Kambang 10.05% 5.96% -4.09% 33.98% 340 CD Based on revised contract

time and schedule

15 PT. Pembangunan

Perumahan (Persero) Sibolga Bts. Tapsel 49.94% 34.25% -15.68% 55.96% 340 CD

Based on revised contract time and schedule

16 PT Yasa-Multi Structure, Jo Seblat Ipuh 0.57% 0.41% -0.16 12.40% 551 CD

17 PT. Jaya Konstruksi Manggala Pratama Tbk

Sp. Gn Kemala Pg.

Tampak 61.80% 49.01% -12.80% 70.79% 210 CD

Based on original contract time and schedule

19 PT. Rodatekindo Purajaya Lais - Bintunan 100% 100% - - - Completed

PHO : June 30, 2016

20 PT. Nindya Karya Lubuk Alung Sicincin 19.58% 16.95% -2.63% 30.04% 340 CD Based on revised contract time

21 PT. Multi Structure Lubuk Alung Kuraitaji 20.07% 13.38% -6.69% 30.04% 340 CD Based on revised contract time

Package No. 5 : Sp. Rampa Poriaha

The progress of this month is achieved of only 0.76% against the scheduled 11.50%.

For catching up the delayed progress, the contractor has to increase the production of the aggregate materials for Asphalt Pavement, Granular Pavement.

ANNEX P-5 Executive Summary Report shows the Contractor s Progress Schedule. Package No. 6 : Kerkap Ps. Pedati

The completion date of this package is 28, January 2017. Actual overall progress as of 25, January 2017 has been achieved with 97.03 which is still less 2.97% against the scheduled.

The asphalt pavement of AC-wearing course has been completed and the remain works are a few of should final layer and pavement markings, sign, post partially. Hence, the works are to be completed substantially for the taking-over.

ANNEX P-6 Executive Summary Report shows the complete details of the contract package. Package No. 7: Indrapura Tapan

During this month, the work items which leaded negative progress were mainly Drainage works, Asphalt pavement.

The delayed progress has been bigger negatively than the last month, -4.53% of the last month to -9.57% on this month.

In order to catch-up the delayed progress, the contractor plans to install an additional crushing plant on the Base Camp area.

Certain shortage of Abu-Batu could be expected in normal as additional crushed plant is operated.

ANNEX P-7 Executive Summary Report shows the complete details of the contract package. Package No. 8 : Bts. Kota Pariaman - Manggopoh

For this month s work progress as well from the commencement of the project, the contractor maintains ahead progress, 37.93% against the scheduled 35.38%.

As mentioned previously, preparatory works, namely production of Aggregate materials, Granular pavements, earth works are pretty well executed. Thus comming month progress as well is to be in positive position.

On the other hand, unsettled land acquisition, 5.253m is still in difficulties to find the solution. It is expected to be settled up to March 2017.

ANNEX P-8 Executive Summary Report shows the complete details of the contract package. Package No. 11 : Bantal - Mukomuko

For this month s work progress is only 1.21% achieved due to the same reason of the last month for delayed progress.

The negative slippage rate is raised up again up to -11.96% against the last month -9.81%.

Pavement.

The contractor urges the Time Extention of 3.5 Months, to the completion of the work.

For more details of the Contract Package, refer toANNEX P-11 Executive Summary Report . Package No. 12 : Kambang - Indrapura

The actual progress as of this month is only 4.03% since 8 months elapsed from the COW against the scheduled 15.87%.

Furthermore, this month progress is only 0.01% either.

The main reason for the srious delay that not only the contractor s construction management system and organization of staffs are totally collapsed but also the supports and concern of the contractor s head office to this project are likely not made up to now.

For instance, the contractor s General Superintendant has been absent for 3 months and it seems there are no experienced and /or qualified staffs on the site.

The only hopeful site situation is that plantiful natural river stones are stockpiled in the Base Camp and the quarry site is located in only 2 Km from the Base Camp.

Details of the Contract Package are shown inANNEX P-12 Executive Summary Report .

Package No. 13 : Sp. Rukis Tj. Kemuning

The progress of this month 8.48% has been leaded by the asphalt pavement affected 100%. Some of the granular pavement works on the strecth sta. 43 KM~56 km are constructing but not completed for measuring the work progress.

At this stage, the contractor has a lot of working areas for asphalt pavement for wearing course apprx. 15 Km thus, within a few months, they will have a positive progress from the pavement for the time being.

Accordingly, the big slippage rate -41.51% also could be improved for coming several months.

The most considerable elemants to reach the successful completion of this project are how to settled the land acquisition on the strecth sta. 25 km ~ 43 Km (18 Km long) earlier.

Details of the work progress are shown inANNEX P-13 Executive Summary Reports.

Package No. 14: Painan - Kambang

The work progress of this month is only 2.02% against the scheduled 4.18% according to the revised schedule to be completed as of Dec. 2017.

The accumulated slippage rate will be -4.09%.

At this present, the work progress is only done from the strecth sta 0 Km~12 Km. The contractor has to develope the other working areas in order to catch up the delayed progress.

ANNEX P-14 Executive Summary Report shows the complete details of the project.

Package No. 15: Sibolga Bts. Tapsel

This month progress has been also leaded by the asphalt pavement affected by more than 97% of he overall progress of this month.

In order to maintain the porgress in the future, it is strongly requested that the contractor has to expand their works to the preparatory works, like Drainage, Earth work, Granular pavement to obtain the working areas for Asphalt pavement works.

Detailed and work progress of the contract package are shown in ANNEX P-15 Executive Summary Report .

Package No. 16 : Seblat Ipuh

COW was on November 8, 2016. At this present the contractor is still building their own Base Camp (3 ha) at sta. 0+500 which is include 1 no of crusher plant and under the mobilization of equipments and manpowers.

Package No. 17 : Sp. Gunung Kemala Pg. Tampak

The progress of this month is achieved of 7.66% as almost same with the scheduled 7.68%.

But, the slippage rate of the progress is still -12.80%.

For catching up the delayed progress, the contractor has to accelerate the progress of espicially Drainage, Granular Pavement, Asphalt Pavement.

ANNEX P-17 Executive Summary Report shows the complete details and work progress of the project.

Package No. 19 : Lais Bintunan

The contract package is completed on June 30, 2016 and provisionally handed over to the employer and currently under Defects Notification Period until after two (2) years reckoned from the issuance of the TOC

Complete details of the contract package are shown inANNEX P-19 Executive Summary Report Package No. 20 : Lubuk Alung - Sicincin

The progress of this month is achieved of 3.35% against the schedule 7.20%.

The main reason for delayed progress was no pavement works in this reporting month.

It is expected that the production of Aggregate materials and ASCON could be normal in near future.

ANNEX P-20 Executive Summary Report shows the Contractor s schedule and work progress.

Package No. 21 : Lubuk Alung - Kuraitaji

The progress of this month is achieved of 10.13% against the scheduled 10.13%.

The progress of pavement works are very positive, but the progress of Drainage which is one of the major works, amost 37% of the total works is lagged much behind schedule.

To maintain the steady progress of pavement works, this Drainage works are a very important element.

4.5 Quality Assurance

The DSC will be responsible for quality assurance of materials and workmanship, certifying whether or not contractors have achieved the required results, as well as documentation and reporting based on the financial management plan. They will prepare a Quality Assurance system covering all subprojects, and continuously monitor the effectiveness of their supervision procedures.

Following are current problems which were the same problems during the preceding month and issues

relative to the execution of the works and quality assurance:

Package No.1 : Krui - Biha a) Completed.

b) Currently under defects notification period for two (2) years until January 17, 2018.

Package No.2 : Padang Sawah Sp. Empat a) Completed.

b) Presently under defects notification period for twenty four (24) months until April 18, 2018.

c) Since the design and construction of side cut slope protection works were not included in the original contract design/construction have to be implemented under a new contract.

d) During CTC site visit with TFAC WB on 18 January 2017 several defects of the Air Gadang Bridge was found has been done i.e:

1. Settlement of the bridge approach road toward Air Balam side. 2. Cracks on the left and right sides of the retaining wall facing Air Balam

3. No maintenance of the bridge deck, causing rain water covering the deck due to blocked drain system.

Package No.3 : Manggopoh Padang Sawah a) Completed.

b) Currently under defects notification period for two (2) years until March 16, 2018.

c) Since the Design and construction of side cut slope protection works were not included the original contract design/construction have to be implemented under a new contract.

d) A land slip at Sta. 26+500 (left) caused by heavy rain fall was toward Padang Sawah village, was observed during CTC site visit on 16 December 2016, during CTC and TFAC WB visit on 18 January 2017 there are a land slip at Sta. 26+500 (left) has been completed with constructed Gabions.

Package No.4 : Ipuh - Bantal

a) Even through the contract time have been extended, contractor still failed to complete and turned over the Project to the Employeer on the revised target date of completion on April 11, 2016. b) Contractor under liquidated damages.

c) Substantially completed, Taking Over Certificate issued by DSC on May 31, 2016.

Package No.5 : Sp. Rampa - Poriaha

a) Field Engineering still to be finalized and approve by DGH.

Following a geotechnical test to obtain rock excavation safest slope /angle . Additionally the unit price for rock excavation shall be renegotiated between the Panitia Peneliti Kontrak and Contractor.

b) Contractor to prepare and implement catch-up schedule to reduce the huge progress negative slippage.

has been submitted, but not yet completed with site instruction from SE. The SE must to complete a report with site instruction.

d) The on-going design revision involving massive quantities of rock excavation shall be thoroughly evaluated.

Package No.6 : Ps. Pedati - Kerkap

a) Non-conformance findings during TFAC audit inspection during last month shall be immediately corrected and rectified and conformance report to be submitted.

Repair to non conforming finding were completed. The repair works was reported by phone; a formal written report shall be submitted by PPK/Balai

Package No.11 : Bantal - Mukomuko

a) Non-conformance findings during TFAC audit inspection during last month shall be immediately corrected and rectified and conformance report to be submitted.

Repair to non conforming finding were completed. The repair works was reported by phone; a formal written report shall be submitted by PPK/Balai

b) Contractor shall be issued warning letter as the negative slippage is more than -10%.

Package No.13 : Sp. Rukis Tj. Kemuning

a) Contractor to finalize technical justifications relative to results of Field Engineering. b) Field Engineering and Technical Justifications just approved by DGH with balance budget.

c) Non-conformance findings during TFAC audit inspection during last month shall be immediately corrected and rectified and conformance report to be submitted.

Package No.15 : Sibolga Bts. Tapsel

a) Field Engineering and Technical Justifications are still to be finalized.