Islamic Banking Statistics

Biro Perbankan Syariah

BANK INDONESIA

DAFTAR ISI CONTENTS

Tabel

1. Jaringan Kantor Perbankan Syariah

2

Networking of Islamic Banks

Tabel

2. Aset Perbankan Syariah

3

Assets of Islamic Banks

Tabel

3. Kewajiban dan Modal Perbankan Syariah

4

Liabilities and Equity of Islamic Banks

Gambar 1. Perkembangan Aset Perbankan Syariah

5

Growth of Assets of Islamic Banks

Gambar 2. Sumber Dana Perbankan Syariah

5

Sources of Fund of Islamic Banks

Tabel

4. Komposisi Dana Pihak Ketiga Perbankan Syariah

6

Composition of Deposit Fund of Islamic Banks

Gambar 3. Aktiva Produktif Utama Perbankan Syariah

6

The Major Earning Assets of Islamic Banks

Tabel

5. Komposisi Pembiayaan Perbankan Syariah

7

Composition of Financing of Islamic Banks

Gambar 4. Komposisi Penggunaan dan Sumber Dana Perbankan Syariah

8

Composition of Uses and Sources of Fund of Islamic Banks

Gambar 5. Sumber Dana, Pembiayaan, dan FDR Perbankan Syariah

9

Sources of Fund, Financing, and FDR of Islamic Banks

Gambar 6. Pembiayaan dan PPAP Perbankan Syariah

9

Financing and Provision for Losses (PPAP) of Islamic Banks

Tabel

6. NPFs Perbankan Syariah

10

Non Performing Financings (NPFs) of Islamic Banks

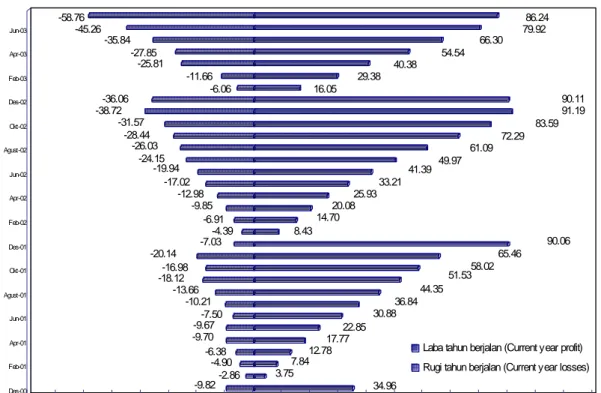

Gambar 7. Laba dan Rugi Tahun Berjalan Perbankan Syariah

10

Current Year Profits and Losses of Islamic Banks

Tabel

7. Transaksi Pasar Uang Antar Bank Berdasarkan Prinsip Syariah (PUAS)

11

Transaction of Islamic Interbank Money Market (PUAS)

Gambar 8. Volume Transaksi PUAS

12

Volume of PUAS Transaction

Gambar 9. Posisi Sertifikat Wadiah Bank Indonesia (SWBI)

12

Outstanding of Bank Indonesia Wadiah Certificate (SWBI)

Tabel

8. Pangsa Perbankan Syariah Terhadap Total Bank

13

Islamic Banks’s Share to All Banks

Tabel

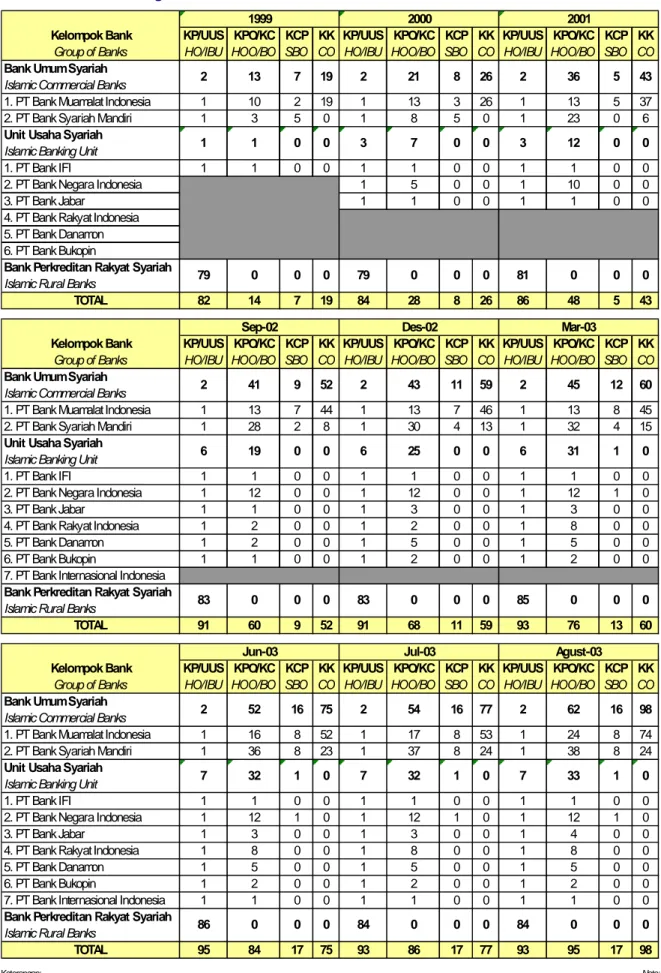

1. Jaringan Kantor Perbankan Syariah

Networking of Islamic Banks

Kelompok Bank KP/UUS KPO/KC KCP KK KP/UUS KPO/KC KCP KK KP/UUS KPO/KC KCP KK

Group of Banks HO/IBU HOO/BO SBO CO HO/IBU HOO/BO SBO CO HO/IBU HOO/BO SBO CO

Bank Umum Syariah Islamic Commercial Banks

1. PT Bank Muamalat Indonesia 1 10 2 19 1 13 3 26 1 13 5 37

2. PT Bank Syariah Mandiri 1 3 5 0 1 8 5 0 1 23 0 6

Unit Usaha Syariah Islamic Banking Unit

1. PT Bank IFI 1 1 0 0 1 1 0 0 1 1 0 0

2. PT Bank Negara Indonesia 1 5 0 0 1 10 0 0

3. PT Bank Jabar 1 1 0 0 1 1 0 0

4. PT Bank Rakyat Indonesia 5. PT Bank Danamon 6. PT Bank Bukopin

Bank Perkreditan Rakyat Syariah Islamic Rural Banks

TOTAL 82 14 7 19 84 28 8 26 86 48 5 43 2001 2 36 5 43 3 12 0 0 81 0 0 0 1999 2 13 7 19 1 1 0 0 79 0 0 0 2000 2 21 8 26 3 7 0 0 79 0 0 0

Kelompok Bank KP/UUS KPO/KC KCP KK KP/UUS KPO/KC KCP KK KP/UUS KPO/KC KCP KK

Group of Banks HO/IBU HOO/BO SBO CO HO/IBU HOO/BO SBO CO HO/IBU HOO/BO SBO CO

Bank Umum Syariah Islamic Commercial Banks

1. PT Bank Muamalat Indonesia 1 13 7 44 1 13 7 46 1 13 8 45

2. PT Bank Syariah Mandiri 1 28 2 8 1 30 4 13 1 32 4 15

Unit Usaha Syariah Islamic Banking Unit

1. PT Bank IFI 1 1 0 0 1 1 0 0 1 1 0 0

2. PT Bank Negara Indonesia 1 12 0 0 1 12 0 0 1 12 1 0

3. PT Bank Jabar 1 1 0 0 1 3 0 0 1 3 0 0

4. PT Bank Rakyat Indonesia 1 2 0 0 1 2 0 0 1 8 0 0

5. PT Bank Danamon 1 2 0 0 1 5 0 0 1 5 0 0

6. PT Bank Bukopin 1 1 0 0 1 2 0 0 1 2 0 0

7. PT Bank Internasional Indonesia

Bank Perkreditan Rakyat Syariah Islamic Rural Banks

TOTAL 91 60 9 52 91 68 11 59 93 76 13 60 0 0 83 0 0 0 0 Des-02 2 Sep-02 2 41 9 52 6 19 Mar-03 2 45 12 60 6 31 1 85 0 0 43 11 59 6 25 0 0 83 0 0 0 0

Kelompok Bank KP/UUS KPO/KC KCP KK KP/UUS KPO/KC KCP KK KP/UUS KPO/KC KCP KK

Group of Banks HO/IBU HOO/BO SBO CO HO/IBU HOO/BO SBO CO HO/IBU HOO/BO SBO CO

Bank Umum Syariah Islamic Commercial Banks

1. PT Bank Muamalat Indonesia 1 16 8 52 1 17 8 53 1 24 8 74

2. PT Bank Syariah Mandiri 1 36 8 23 1 37 8 24 1 38 8 24

Unit Usaha Syariah Islamic Banking Unit

1. PT Bank IFI 1 1 0 0 1 1 0 0 1 1 0 0

2. PT Bank Negara Indonesia 1 12 1 0 1 12 1 0 1 12 1 0

3. PT Bank Jabar 1 3 0 0 1 3 0 0 1 4 0 0

4. PT Bank Rakyat Indonesia 1 8 0 0 1 8 0 0 1 8 0 0

5. PT Bank Danamon 1 5 0 0 1 5 0 0 1 5 0 0

6. PT Bank Bukopin 1 2 0 0 1 2 0 0 1 2 0 0

7. PT Bank Internasional Indonesia 1 1 0 0 1 1 0 0 1 1 0 0

Bank Perkreditan Rakyat Syariah Islamic Rural Banks

TOTAL 95 84 17 75 93 86 17 77 93 95 17 98 Jun-03 7 33 1 16 75 2 2 52 32 0 84 0 0 0 1 0 7 0 86 0 0 7 62 16 98 Agust-03 2 Jul-03 32 1 0 54 16 77 84 0 0 0 Keterangan: - KP = Kantor Pusat - UUS = Unit Usaha Syariah - KPO = Kantor Pusat Operasional - KC = Kantor Cabang - KCP = Kantor Cabang Pembantu - KK = Kantor Kas

Note:

- HO = Head Office - IBU = Islamic Banking Unit

- HOO = Head Operational Office

- BO = Branch Office - SBO = Sub Branch Office

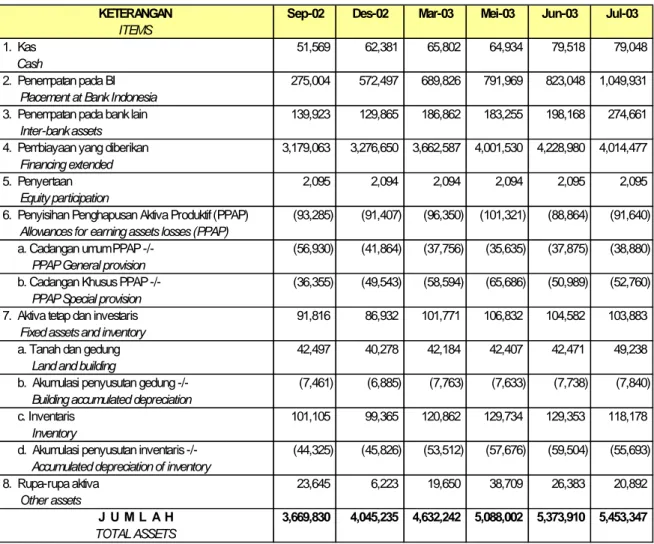

Tabel

2. Aset Perbankan Syariah (Juta Rupiah)

Assets of Islamic Banks (Million IDRs)

KETERANGAN Sep-02 Des-02 Mar-03 Mei-03 Jun-03 Jul-03

ITEMS

1. Kas 51,569 62,381 65,802 64,934 79,518 79,048

Cash

2. Penempatan pada BI 275,004 572,497 689,826 791,969 823,048 1,049,931

Placement at Bank Indonesia

3. Penempatan pada bank lain 139,923 129,865 186,862 183,255 198,168 274,661

Inter-bank assets

4. Pembiayaan yang diberikan 3,276,6503,179,063 4,001,5303,662,587 4,228,980 4,014,477

Financing extended

5. Penyertaan 2,095 2,094 2,094 2,094 2,095 2,095

Equity participation

6. Penyisihan Penghapusan Aktiva Produktif (PPAP) (93,285) (91,407) (96,350) (101,321) (88,864) (91,640)

Allowances for earning assets losses (PPAP)

a. Cadangan umum PPAP -/- (56,930) (41,864) (37,756) (35,635) (37,875) (38,880)

PPAP General provision

b. Cadangan Khusus PPAP -/- (36,355) (49,543) (58,594) (65,686) (50,989) (52,760)

PPAP Special provision

7. Aktiva tetap dan investaris 91,816 86,932 101,771 106,832 104,582 103,883

Fixed assets and inventory

a. Tanah dan gedung 42,497 40,278 42,184 42,407 42,471 49,238

Land and building

b. Akumulasi penyusutan gedung -/- (7,461) (6,885) (7,763) (7,633) (7,738) (7,840)

Building accumulated depreciation

c. Inventaris 101,105 99,365 120,862 129,734 129,353 118,178

Inventory

d. Akumulasi penyusutan inventaris -/- (44,325) (45,826) (53,512) (57,676) (59,504) (55,693)

Accumulated depreciation of inventory

8. Rupa-rupa aktiva 23,645 6,223 19,650 38,709 26,383 20,892

Other assets

J U M L A H 4,045,2353,669,830 5,088,0024,632,242 5,373,910 5,453,347

TOTAL ASSETS

*) Meliputi data Bank Umum Syariah dan Unit Usaha Syariah (tidak termasuk BPR Syariah)

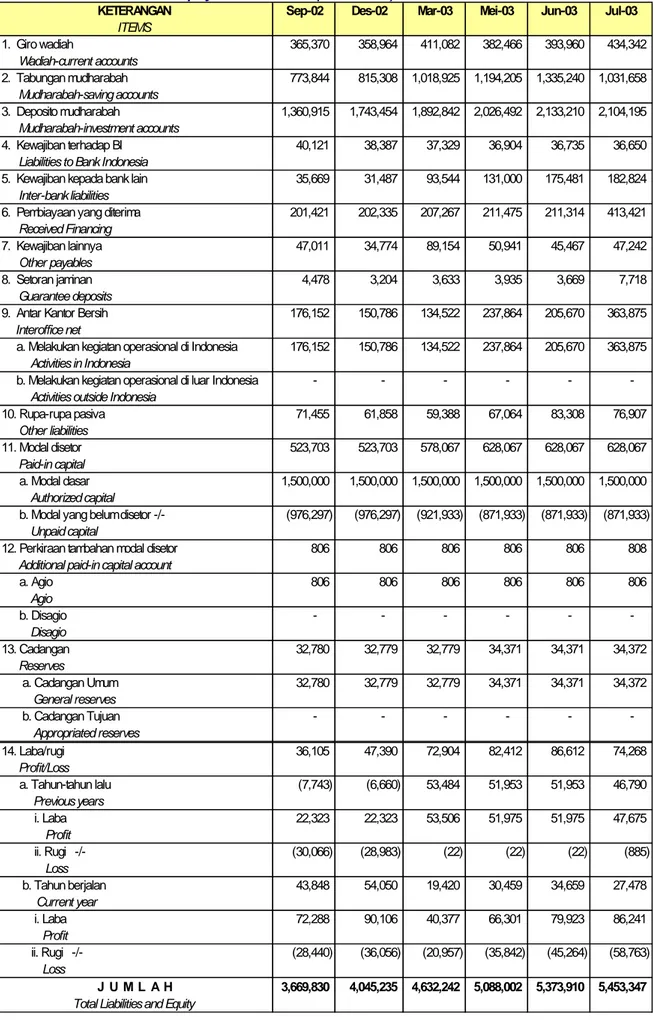

Tabel

3. Kewajiban dan Modal Perbankan Syariah (Juta Rupiah)

Liabilities and Equity of Islamic Banks (Miliion IDRs)

KETERANGAN Sep-02 Des-02 Mar-03 Mei-03 Jun-03 Jul-03

ITEMS 1. Giro wadiah 365,370 358,964 411,082 382,466 393,960 434,342 Wadiah-current accounts 2. Tabungan mudharabah 773,844 815,308 1,194,2051,018,925 1,335,240 1,031,658 Mudharabah-saving accounts 3. Deposito mudharabah 1,743,4541,360,915 2,026,4921,892,842 2,133,210 2,104,195 Mudharabah-investment accounts 4. Kewajiban terhadap BI 40,121 38,387 37,329 36,904 36,735 36,650

Liabilities to Bank Indonesia

5. Kewajiban kepada bank lain 35,669 31,487 93,544 131,000 175,481 182,824

Inter-bank liabilities

6. Pembiayaan yang diterima 201,421 202,335 207,267 211,475 211,314 413,421

Received Financing

7. Kewajiban lainnya 47,011 34,774 89,154 50,941 45,467 47,242

Other payables

8. Setoran jaminan 4,478 3,204 3,633 3,935 3,669 7,718

Guarantee deposits

9. Antar Kantor Bersih 176,152 150,786 134,522 237,864 205,670 363,875

Interoffice net

a. Melakukan kegiatan operasional di Indonesia 176,152 150,786 134,522 237,864 205,670 363,875

Activities in Indonesia

b. Melakukan kegiatan operasional di luar Indonesia - - - - -

Activities outside Indonesia

10. Rupa-rupa pasiva 71,455 61,858 59,388 67,064 83,308 76,907 Other liabilities 11. Modal disetor 523,703 523,703 578,067 628,067 628,067 628,067 Paid-in capital a. Modal dasar 1,500,0001,500,000 1,500,0001,500,000 1,500,000 1,500,000 Authorized capital

b. Modal yang belum disetor -/- (976,297) (976,297) (921,933) (871,933) (871,933) (871,933)

Unpaid capital

12. Perkiraan tambahan modal disetor 806 806 806 806 806 808

Additional paid-in capital account

a. Agio 806 806 806 806 806 806 Agio b. Disagio - - - - - Disagio 13. Cadangan 32,780 32,779 32,779 34,371 34,371 34,372 Reserves a. Cadangan Umum 32,780 32,779 32,779 34,371 34,371 34,372 General reserves b. Cadangan Tujuan - - - - - Appropriated reserves 14. Laba/rugi 36,105 47,390 72,904 82,412 86,612 74,268 Profit/Loss a. Tahun-tahun lalu (7,743) (6,660) 53,484 51,953 51,953 46,790 Previous years i. Laba 22,323 22,323 53,506 51,975 51,975 47,675 Profit ii. Rugi -/- (30,066) (28,983) (22) (22) (22) (885) Loss b. Tahun berjalan 43,848 54,050 19,420 30,459 34,659 27,478 Current year i. Laba 72,288 90,106 40,377 66,301 79,923 86,241 Profit ii. Rugi -/- (28,440) (36,056) (20,957) (35,842) (45,264) (58,763) Loss J U M L A H 4,045,2353,669,830 5,088,0024,632,242 5,373,910 5,453,347

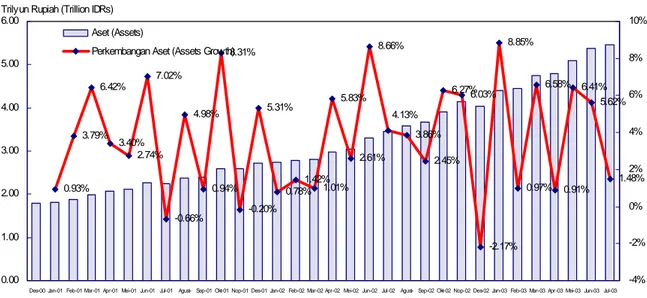

Gambar 1. Perkembangan Aset Perbankan Syariah

Growth of Assets of Islamic Banks

0.93% 3.79% 6.42% 3.40% 2.74% 7.02% -0.66% 4.98% 0.94% 8.31% -0.20% 5.31% 0.78%1.42%1.01% 5.83% 2.61% 8.66% 3.86% 2.45% 6.27%6.03% -2.17% 8.85% 0.97% 6.58% 0.91% 6.41% 5.62% 1.48% 4.13% 0.00 1.00 2.00 3.00 4.00 5.00 6.00

Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01

Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02

Sep-02 Okt-02 Nop-02 Des-02 Jan-03 Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03

Trily un Rupiah (Trillion IDRs)

-4% -2% 0% 2% 4% 6% 8% 10% Aset (Assets)

Perkembangan Aset (Assets Grow th)

Gambar 2. Sumber Dana Perbankan Syariah

Sources of Fund of Islamic Banks

0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02 Sep-02 Okt-02 Nop-02 Des-02 Jan-03 Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03

Trily un Rupiah (Trillion IDRs)

Giro Wadiah (Wadiah-cur. acc.) Tabungan Mudharabah (Mudharabah-sav . acc.) Deposito Mudharabah (Mudharabah-inv . acc.) Pembiay aan y ang diterima (Receiv ed financing)

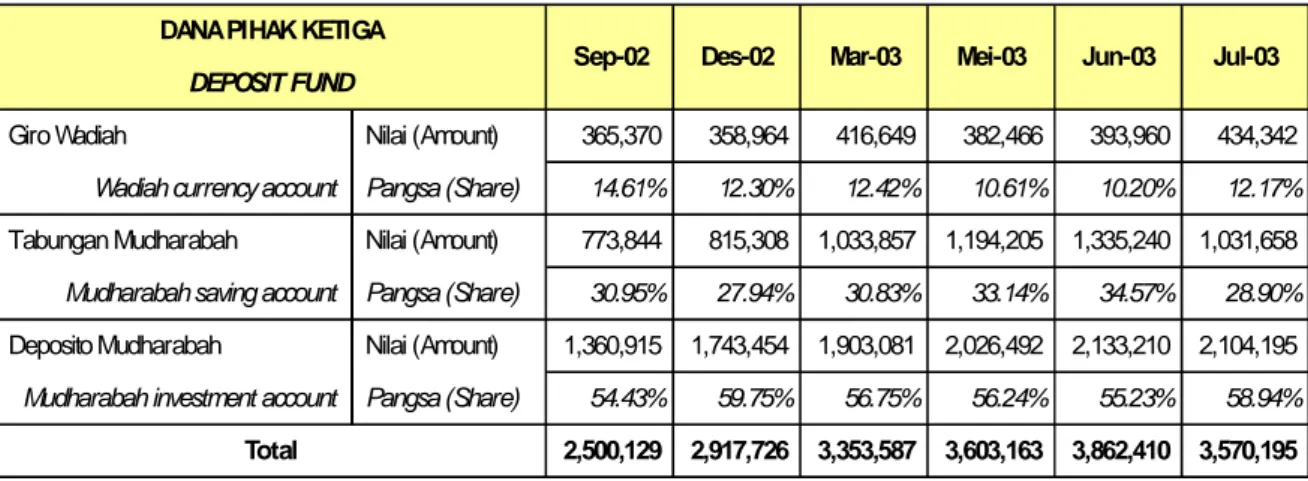

Tabel

4. Komposisi Dana Pihak Ketiga Perbankan Syariah (Juta Rupiah)

Composition of Deposit Fund of Islamic Banks (Million IDRs)

Giro Wadiah Nilai (Amount) 365,370 358,964 416,649 382,466 393,960 434,342 Wadiah currency account Pangsa (Share) 14.61% 12.30% 12.42% 10.61% 10.20% 12.17% Tabungan Mudharabah Nilai (Amount) 773,844 815,308 1,194,2051,033,857 1,335,240 1,031,658 Mudharabah saving account Pangsa (Share) 30.95% 27.94% 30.83% 33.14% 34.57% 28.90% Deposito Mudharabah Nilai (Amount) 1,743,4541,360,915 1,903,081 2,026,492 2,133,210 2,104,195 Mudharabah investment account Pangsa (Share) 54.43% 59.75% 56.75% 56.24% 55.23% 58.94%

2,500,129 2,917,726 3,353,587 3,603,163 3,862,410 3,570,195 Jun-03 Des-02 Mei-03 Sep-02 DEPOSIT FUND Total DANA PIHAK KETIGA

Jul-03 Mar-03

Gambar 3. Aktiva Produktif Utama Perbankan Syariah

The Major Earning Assets of Islamic Banks

0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00 5.50 Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02 Sep-02 Okt-02 Nop-02 Des-02 Jan-03 Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03

Trily un Rupiah (Trillion IDRs)

Pembiay aan y ang diberikan (Fin. ex tended) Penempatan pada bank lain (Inter bk assets) Penempatan pada BI (Plcment at BI)

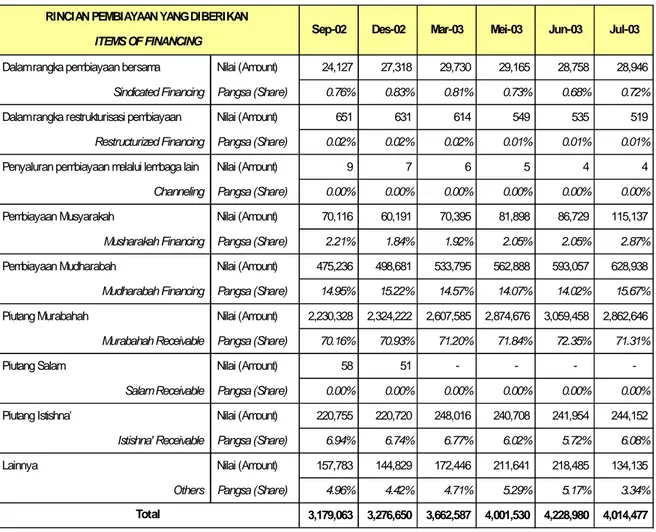

Tabel

5. Komposisi Pembiayaan Perbankan Syariah (Juta Rupiah)

Composition of Financing of Islamic Banks (Million IDRs)

Dalam rangka pembiayaan bersama Nilai (Amount) 24,127 27,318 29,730 29,165 28,758 28,946

Sindicated Financing Pangsa (Share) 0.76% 0.83% 0.81% 0.73% 0.68% 0.72%

Dalam rangka restrukturisasi pembiayaan Nilai (Amount) 651 631 614 549 535 519

Restructurized Financing Pangsa (Share) 0.02% 0.02% 0.02% 0.01% 0.01% 0.01%

Penyaluran pembiayaan melalui lembaga lain Nilai (Amount) 9 7 6 5 4 4

Channeling Pangsa (Share) 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Pembiayaan Musyarakah Nilai (Amount) 70,116 60,191 70,395 81,898 86,729 115,137

Musharakah Financing Pangsa (Share) 2.21% 1.84% 1.92% 2.05% 2.05% 2.87%

Pembiayaan Mudharabah Nilai (Amount) 475,236 498,681 533,795 562,888 593,057 628,938

Mudharabah Financing Pangsa (Share) 14.95% 15.22% 14.57% 14.07% 14.02% 15.67%

Piutang Murabahah Nilai (Amount) 2,230,328 2,324,222 2,607,585 2,874,676 3,059,458 2,862,646

Murabahah Receivable Pangsa (Share) 70.16% 70.93% 71.20% 71.84% 72.35% 71.31%

Piutang Salam Nilai (Amount) 58 51 - - -

-Salam Receivable Pangsa (Share) 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Piutang Istishna' Nilai (Amount) 220,755 220,720 248,016 240,708 241,954 244,152

Istishna' Receivable Pangsa (Share) 6.94% 6.74% 6.77% 6.02% 5.72% 6.08%

Lainnya Nilai (Amount) 157,783 144,829 172,446 211,641 218,485 134,135

Others Pangsa (Share) 4.96% 4.42% 4.71% 5.29% 5.17% 3.34%

3,179,063

3,276,650 3,662,587 4,001,530 4,228,980 4,014,477 Jul-03

Total

Sep-02 RINCIAN PEMBIAYAAN YANG DIBERIKAN

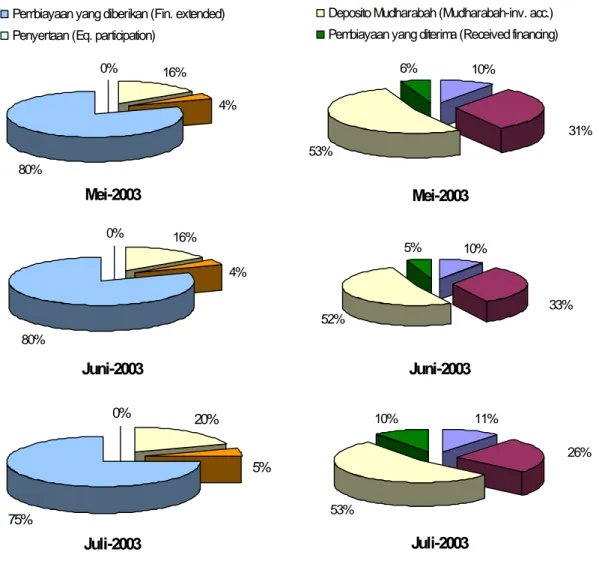

Gambar 4. Komposisi Penggunaan dan Sumber Dana Perbankan Syariah

Composition of Uses and Sources of Fund of Islamic Banks

Juni-2003

16% 80% 0% 4%Juli-2003

20%

75%

0%

5%

Mei-2003

16% 80% 0% 4% Penempatan pada BI (Plcment at BI) Penempatan pada bank lain (Inter bk assets) Pembiayaan yang diberikan (Fin. extended) Penyertaan (Eq. participation)Mei-2003

10%

53%

6%

31% Giro Wadiah (Wadiah-cur. acc.)

Tabungan Mudharabah (Mudharabah-sav. acc.) Deposito Mudharabah (Mudharabah-inv. acc.) Pembiayaan yang diterima (Received financing)

Juli-2003

11% 53% 10% 26%Juni-2003

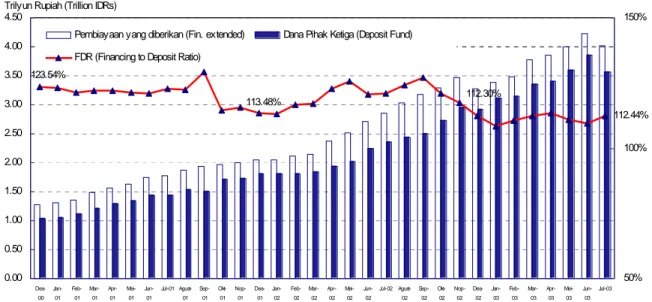

10% 52% 5% 33%Gambar 5. Sumber Dana, Pembiayaan, dan FDR Perbankan Syariah

Sources of Fund, Financing, and FDR of Islamic Banks

112.44% 112.30% 113.48% 123.54% 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02 Sep-02 Okt-02 Nop-02 Des-02 Jan-03 Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03

Trily un Rupiah (Trillion IDRs)

50% 100% 150% Pembiay aan y ang diberikan (Fin. ex tended) Dana Pihak Ketiga (Deposit Fund)

FDR (Financing to Deposit Ratio)

Gambar 6. Pembiayaan dan PPAP Perbankan Syariah

Financing and Provision for Losses (PPAP) of Islamic Banks

0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50

Trily un Rupiah (Trillion IDRs)

Pembiayaan yang diberikan (Fin. extended)

Tabel

6. NPFs*) Perbankan Syariah (Juta Rupiah)

Non Performing Financings (NPFs)*) of Islamic Banks (Miliion IDRs)

Lancar Nilai (Amount) 2,865,771 3,022,438 3,335,280 3,597,573 3,806,503 3,690,445

Current Pangsa (Share) 90.15% 92.24% 91.06% 89.90% 90.01% 91.93%

Dalam Perhatian Khusus Nilai (Amount) 179,943 119,266 182,165 244,506 257,176 158,323

Special Mention Pangsa (Share) 5.66% 3.64% 4.97% 6.11% 6.08% 3.94%

Kurang Lancar Nilai (Amount) 80,016 51,445 57,347 60,611 85,466 88,446

Sub-standard Pangsa (Share) 2.52% 1.57% 1.57% 1.51% 2.02% 2.20%

Diragukan Nilai (Amount) 15,253 30,285 18,642 24,388 27,016 23,716

Doubtful Pangsa (Share) 0.48% 0.92% 0.51% 0.61% 0.64% 0.59%

Macet Nilai (Amount) 38,080 53,216 69,153 74,452 52,819 53,547

Loss Pangsa (Share) 1.20% 1.62% 1.89% 1.86% 1.25% 1.33%

3,179,063 3,276,650 3,662,587 4,001,530 4,228,980 4,014,477 133,349 134,946 145,142 159,451 165,301 165,709 4.19% 4.12% 3.96% 3.98% 3.91% 4.13% Jul-03 Sep-02 Percentage of NPFs KOLEKTIBILITAS PEMBIAYAAN

Total Pembiayaan (Total Financing) Nominal NPFs (Coll. 3-5)

COLLECTIBILITY OF FINANCING Des-02 Mar-03 Mei-03 Jun-03

*) NPFs adalah Pembiayaan Non Lancar mulai dari Kurang Lancar sampai dengan Macet NPFs is Non Performing Financings which are composed from collectibility Sub-standard to Loss

Gambar 7. Laba dan Rugi Tahun Berjalan Perbankan Syariah

Current Year Profits and Losses of Islamic Banks

34.96 -9.82-2.86 3.75 7.84 -4.90 12.78 -6.38 17.77 -9.70-9.67 22.85 30.88 -7.50 36.84 -10.21 44.35 -13.66 51.53 -18.12-16.98 58.02 65.46 -20.14 -7.03 90.06 8.43 -4.39 14.70 -6.91 20.08 -9.85 25.93 -12.98 33.21 -17.02 41.39 -19.94 49.97 -24.15 61.09 -26.03 72.29 -28.44 83.59 -31.57 91.19 -38.72-36.06 90.11 16.05 -6.06 29.38 -11.66 40.38 -25.81 54.54 -27.85 66.30 -35.84 79.92 -45.26 86.24 -58.76 -80.00 -70.00 -60.00 -50.00 -40.00 -30.00 -20.00 -10.00 0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 100.00110.00120.00 Mily ar Rupiah (Billion IDRs)

Des-00 Feb-01 Apr-01 Jun-01 Agust-01 Okt-01 Des-01 Feb-02 Apr-02 Jun-02 Agust-02 Okt-02 Des-02 Feb-03 Apr-03 Jun-03

Laba tahun berjalan (Current y ear profit) Rugi tahun berjalan (Current y ear losses)

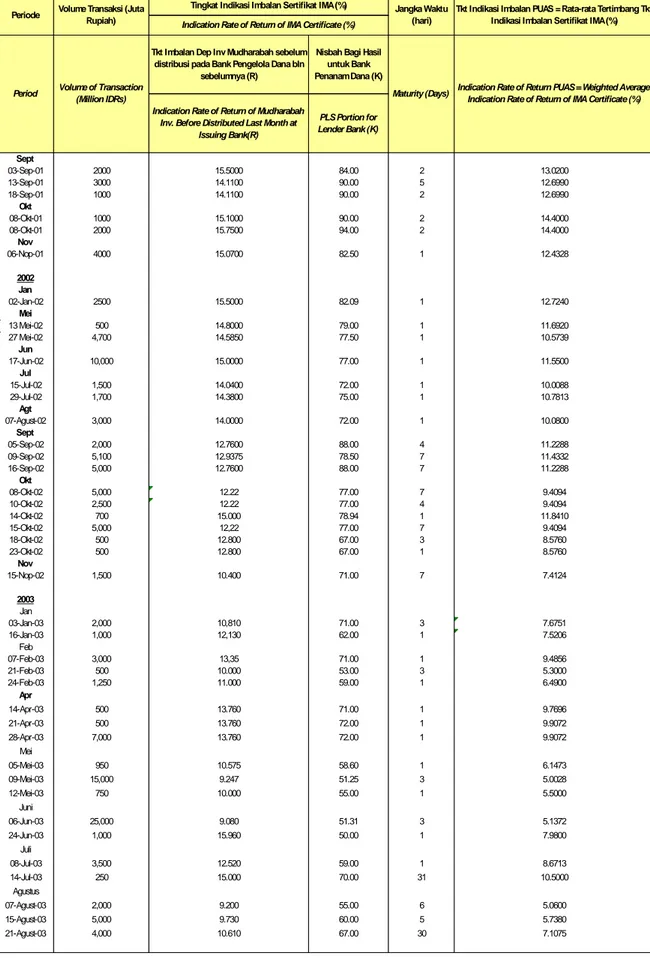

Tabel

7. Transaksi Pasar Uang Antar Bank Berdasarkan Prinsip Syariah (PUAS)

Transaction of Islamic Interbank Money Market (PUAS)

Tkt Imbalan Dep Inv Mudharabah sebelum distribusi pada Bank Pengelola Dana bln

sebelumnya (R)

Nisbah Bagi Hasil untuk Bank Penanam Dana (K)

Indication Rate of Return of Mudharabah Inv. Before Distributed Last Month at

Issuing Bank(R) PLS Portion for Lender Bank (K) Sept 03-Sep-01 2000 15.5000 84.00 2 13.0200 13-Sep-01 3000 14.1100 90.00 5 12.6990 18-Sep-01 1000 14.1100 90.00 2 12.6990 Okt 08-Okt-01 1000 15.1000 90.00 2 14.4000 08-Okt-01 2000 15.7500 94.00 2 14.4000 Nov 06-Nop-01 4000 15.0700 82.50 1 12.4328 2002 Jan 02-Jan-02 2500 15.5000 82.09 1 12.7240 Mei 13 Mei-02 500 14.8000 79.00 1 11.6920 27 Mei-02 4,700 14.5850 77.50 1 10.5739 Jun 17-Jun-02 10,000 15.0000 77.00 1 11.5500 Jul 15-Jul-02 1,500 14.0400 72.00 1 10.0088 29-Jul-02 1,700 14.3800 75.00 1 10.7813 Agt 07-Agust-02 3,000 14.0000 72.00 1 10.0800 Sept 05-Sep-02 2,000 12.7600 88.00 4 11.2288 09-Sep-02 5,100 12.9375 78.50 7 11.4332 16-Sep-02 5,000 12.7600 88.00 7 11.2288 Okt 08-Okt-02 5,000 12.22 77.00 7 9.4094 10-Okt-02 2,500 12.22 77.00 4 9.4094 14-Okt-02 700 15.000 78.94 1 11.8410 15-Okt-02 5,000 12,22 77.00 7 9.4094 18-Okt-02 500 12.800 67.00 3 8.5760 23-Okt-02 500 12.800 67.00 1 8.5760 Nov 15-Nop-02 1,500 10.400 71.00 7 7.4124 2003 Jan 03-Jan-03 2,000 10,810 71.00 3 7.6751 16-Jan-03 1,000 12,130 62.00 1 7.5206 Feb 07-Feb-03 3,000 13,35 71.00 1 9.4856 21-Feb-03 500 10.000 53.00 3 5.3000 24-Feb-03 1,250 11.000 59.00 1 6.4900 Apr 14-Apr-03 500 13.760 71.00 1 9.7696 21-Apr-03 500 13.760 72.00 1 9.9072 28-Apr-03 7,000 13.760 72.00 1 9.9072 Mei 05-Mei-03 950 10.575 58.60 1 6.1473 09-Mei-03 15,000 9.247 51.25 3 5.0028 12-Mei-03 750 10.000 55.00 1 5.5000 Juni 06-Jun-03 25,000 9.080 51.31 3 5.1372 24-Jun-03 1,000 15.960 50.00 1 7.9800

Period Volume of Transaction (Million IDRs)

Indication Rate of Return PUAS = Weighted Average Indication Rate of Return of IMA Certificate (%) Maturity (Days)

Periode Volume Transaksi (Juta Rupiah) Tingkat Indikasi Imbalan Sertifikat IMA (%) Jangka Waktu (hari) Tkt Indikasi Imbalan PUAS = Rata-rata Tertimbang Tkt Indikasi Imbalan Sertifikat IMA (%) Indication Rate of Return of IMA Certificate (%)

Gambar 8. Volume Transaksi PUAS

Volume of PUAS Transaction

0 5 10 15 20 25 30 Mar-00 Apr-00 Mei-00 Jun-00 Jul-00 Agust-00 Sep-00 Okt-00 Nop-00 Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02 Sep-02 Okt-02 Nop-02 Des-02 Jan-03 Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03 Agust-03 M ily ar R upiah (Billion I DRs) Volume 0.75 0 0 0 1 0 0 0 0 0 0 0 0 0 0 1 9.2 0 6 3 4 0 2.5 0 0 0 5.2 10 3.2 3 12.1 14.2 1.5 0 3 4.75 0 8 16.7 26 3.75 11 Mar-00 Apr-00 Mei-00 Jun-00 Jul-00 Agust-00 Sep-00 Okt-00 Nop-00 Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02Jul-02 Agust-02 Sep-02 Okt-02 Nop-02 Des-02 Jan-03 Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03 Agust-03

Gambar 9. Posisi Sertifikat Wadiah Bank Indonesia (SWBI)

Outstanding of Bank Indonesia Wadiah Certificate (SWBI)

-100 200 300 400 500 600 700 800 900 1,000 Mar-00 Apr-00 Mei-00 Jun-00 Jul-00 Agust-00 Sep-00 O kt-00 Nop-00 Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 O kt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02 Sep-02 O kt-02 Nop-02 Des-02 Jan-03 Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03 Agust-03 M ily ar R upiah (Bi llion ID R s) Outstanding 400 507 497 393 393 394 409 312 311 291 305 331 317 288 265 303 270 235 208 229 270 281 301 316 339 244 129 413 387 304 280 407 390 542 783 737 665 611 604 730 891 910 Mar-00 Apr-00 Mei-00 Jun-00 Jul-00

Agust-00 Sep-00 Okt-00 Nop-00 Des-00Jan-01

Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02

Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02 Sep-02 Okt-02 Nop-02 Des-02 Jan-03

Feb-03 Mar-03 Apr-03 Mei-03 Jun-03 Jul-03

Tabel

8. Pangsa Perbankan Syariah Terhadap Total Bank

Islamic Banks’s Share to All Banks

Nominal

Share

Total Assets

5.45

0.49%

1113.60

Deposit Fund

3.57

0.42%

852.20

Credit/Financing extended

4.01

0.91%

441.10

LDR/FDR*)

112.44%

51.76%

NPL

4.13%

8.30%

Islamic Banks

Total Banks

*) FDR = Financing extended/Deposit Fund LDR = Credit extended/Deposit Fund

Gambar 10. Pangsa Perbankan Syariah Terhadap Total Bank

Islamic Banks’s Share to All Banks

0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% Des-00 Jan-01 Feb-01

Mar-01 Apr-01 Mei-01 Jun-01 Jul-01 Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02

Mar-02 Apr-02 Mei-02 Jun-02 Jul-02 Agust-02 Sep-02 Okt-02 Nop-02 Des-02 Jan-03 Feb-03

Mar-03 Apr-03 Mei-03 Jun-03 Jul-03

Total Assets 0.17% 0.17% 0.17% 0.18% 0.18% 0.20% 0.21% 0.22% 0.23% 0.23% 0.24% 0.24% 0.25% 0.25% 0.26% 0.26% 0.28% 0.29% 0.32% 0.32% 0.33% 0.34% 0.35% 0.38% 0.36% 0.39% 0.40% 0.42% 0.43% 0.46% 0.48% 0.49% Deposit F und 0.15% 0.15% 0.16% 0.17% 0.17% 0.18% 0.19% 0.20% 0.21% 0.20% 0.23% 0.22% 0.23% 0.23% 0.23% 0.23% 0.25% 0.26% 0.28% 0.29% 0.30% 0.31% 0.33% 0.36% 0.35% 0.38% 0.38% 0.40% 0.41% 0.43% 0.46% 0.42% Cr/Fin ext 0.40% 0.41% 0.42% 0.44% 0.43% 0.45% 0.48% 0.52% 0.55% 0.54% 0.53% 0.56% 0.57% 0.58% 0.60% 0.61% 0.68% 0.73% 0.76% 0.77% 0.80% 0.82% 0.84% 0.86% 0.80% 0.84% 0.85% 0.87% 0.91% 0.94% 0.97% 0.91%

Des-00 Jan-01 Feb-01 Mar-01 Apr-01 Mei-01 Jun-01 Jul-01

Agust-01 Sep-01 Okt-01 Nop-01 Des-01 Jan-02 Feb-02 Mar-02 Apr-02 Mei-02 Jun-02 Jul-02