Lampiran 1

Sampel Perusahaan Sub Sektor Telekomunikasi

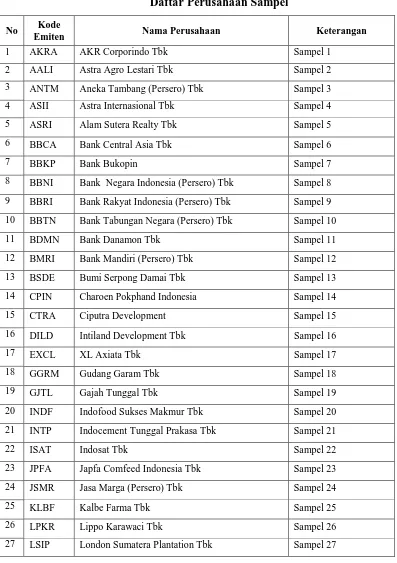

Tabel 3.3

Daftar Perusahaan Sampel

No Kode

Emiten Nama Perusahaan Keterangan

1 AKRA AKR Corporindo Tbk Sampel 1

2 AALI Astra Agro Lestari Tbk Sampel 2

3 ANTM Aneka Tambang (Persero) Tbk Sampel 3

4 ASII Astra Internasional Tbk Sampel 4

5 ASRI Alam Sutera Realty Tbk Sampel 5

6 BBCA Bank Central Asia Tbk Sampel 6

7 BBKP Bank Bukopin Sampel 7

8 BBNI Bank Negara Indonesia (Persero) Tbk Sampel 8

9 BBRI Bank Rakyat Indonesia (Persero) Tbk Sampel 9

10 BBTN Bank Tabungan Negara (Persero) Tbk Sampel 10

11 BDMN Bank Danamon Tbk Sampel 11

12 BMRI Bank Mandiri (Persero) Tbk Sampel 12

13 BSDE Bumi Serpong Damai Tbk Sampel 13

14 CPIN Charoen Pokphand Indonesia Sampel 14

15 CTRA Ciputra Development Sampel 15

16 DILD Intiland Development Tbk Sampel 16

17 EXCL XL Axiata Tbk Sampel 17

18 GGRM Gudang Garam Tbk Sampel 18

19 GJTL Gajah Tunggal Tbk Sampel 19

20 INDF Indofood Sukses Makmur Tbk Sampel 20

21 INTP Indocement Tunggal Prakasa Tbk Sampel 21

22 ISAT Indosat Tbk Sampel 22

23 JPFA Japfa Comfeed Indonesia Tbk Sampel 23

24 JSMR Jasa Marga (Persero) Tbk Sampel 24

25 KLBF Kalbe Farma Tbk Sampel 25

26 LPKR Lippo Karawaci Tbk Sampel 26

27 LSIP London Sumatera Plantation Tbk Sampel 27

Lampiran 2

Statistik Deskriptif Dari Beta Saham, Dividend Payout Ratio, Asset Growth,

Debt to Equity Ratio (DER), Current Ratio, Earning Variability, Return on

Equity (ROE), Tingkat Suku Bunga, Inflasi dan Nilai Tukar (Kurs).

BETA DPR GROWTH DER CR

Mean 1.418125 0.359792 0.262500 2.177778 2.075347

Median 1.340000 0.295000 0.160000 1.095000 1.370000

Maximum 6.160000 0.950000 12.60000 12.15000 10.94000

Minimum -1.590000 0.030000 -0.870000 0.150000 0.040000 Std. Dev. 1.211161 0.225917 1.046379 2,764348 1.867273

Observations 144 144 144 144 144

EV ROE BI INFLASI KURS

Mean 3.532778 0.219851 6.750000 6.207500 10841.75

Median 3.435000 0.183466 6.750000 6.330000 10929.50

Maximum 11.14000 1.535148 7.750000 8.380000 12440.00

Minimum 0.890000 0.004910 5.750000 3.790000 9068.000

Std. Dev. 1.457103 0.218356 0.886969 2.177590 1495.897

Observations 144 144 144 144 144

Hasil Penelitian 2016 (Data diolah)

28 MNCN Media Nusantara Citra Tbk Sampel 28

29 PTBA Tambang Batubara Bukit Asam (Persero) Tbk Sampel 29

30 PTPP PP (Persero) Tbk Sampel 30

31 SMGR Semen Indonesia (Persero) Tbk Sampel 31

32 SMRA Summarecon Agung Tbk Sampel 32

33 TINS Timah (Persero) Tbk Sampel 33

34 TLKM Telekomunikasi Indonesia (Persero) Tbk Sampel 34

35 UNTR United Tractors Tbk Sampel 35

36 UNVR Unilever Indonesia Tbk Sampel 36

Lampiran 3

Uji Multikolinearitas dengan Matriks Korelasi

Hasil Penelitian 2016 (Data diolah)

Lampiran 4

Uji Autokorelasi dengan Bruesch Godfery

Breusch-Godfrey SerialCorrelation LM Test

F-statistic 1.2123322 Prob. F(14, 10) 0.3005

Obs*R-squared 2.599461 Prob. Chi-Square(14) 0.2726

Sumber : Hasil Penelitian 2016 (data diolah)

Lampiran 5

Uji Heteroskedastisitas dengan Uji White Heteroscedasticity

Heteroskedasticity Test: WhiteF-statistic 0.521744 Prob. F(14, 10) 0.8568

Obs*R-squared 4.875282 Prob. Chi-Square(14) 0.8450

Scaled explained SS 8.872217 Prob. Chi-Square(14) 0.4492

Sumber: Hasil Penelitian 2016 (data diolah)

Lampiran 6

Correlated Random Effects - Hausman Test Pool: Untitled

Test cross-section random effects Test Summary

Chi-Sq. Statistic Chi-Sq. d.f. Prob.

Cross-section random 12.486148 9 0.1873

Lampiran 7

Pengujian Regresi Berganda Data Panel

Dependent Variabel : BETA SAHAM

Method: Pooled EGLS (Cross-section random effects) Date: 06/30/16 Time: 12.04

Sampel: 20112014 Included observations: 144

Variable Coefficient Std. Error t-Statistic Prob.

DPR -1.055815 0.560048 -1.885221 0.6421

GROWTH 0.015842 0.097379 0.162684 0.8711

Lanjutan Lampiran 8

DER 0.077890 0.085653 0.909367 0.3652

CR 0.111433 0.068939 1.616397 0.1090

EV -0.133865 0.085740 -1.561292 0.1214

ROE -1.468320 0.776576 -1.890762 0.0314

BI -0.529153 2.175524 -0.243230 0.8083

INFLASI 1.013549 3.105039 0.326421 0.7447

KURS -0.001123 0.003295 -0.340901 0.7339

C 11.64612 30.90937 0.376783 0.7071

R-squared 0.428950 Mean dependent var 1.418125

Adjusted R-squared 0.229622 S.D. dependent var 1.211161

S.E. of regression 1.063050 Akaike info criterion 3.181566

Sum squared resid 119.7881 Schwarz criterion 3.965266

Log likelihood -191.0727 Hannan-Quinn criter. 3.500017

F-statistic 2.151974 Durbin-Watson stat 3.072009

Prob(F-statistic) 0.001251 Sumber : Hasil Penelitian 2016 (data diolah)