Refer to Important disclosures in the last page of this report

Stock DataTarget price (Rp) Rp5,100

Prior TP (Rp) Rp3,900

Shareprice (Rp) Rp4,260

Upside/downside (%) +19.7

Sharesoutstanding (m) 10,540

Marketcap. (US$ m) 3,098

Inalum (Persero) 65.0%

Estimate Change; Vs. Consensus

2018F 2019F PT Indo Premier Sekuritas frederick.daniel@ipc.co.id +62 21 5793 1170

Growing against challenges

Good 2Q18 results despite pressure from DMO pricing.

Benefit by abundant coal reserves and low production costs.

High production growth despite scarcity of heavy equipment.

Maintain Buy with higher TP of Rp5,100 (prev: Rp3,900).

Better than expected 2Q18 results as export sales contribution increased.

PTBA reported better than expected 2Q18 results with 1H18 net profit represent

53% and 67% of consensus’ and our forecast for FY18F, respectively. Earnings

dropped 23% qoq but up 32% yoy in 2Q18, mainly caused by DMO pricing

regulation (released on March 2018). However, PTBA managed to control

production costs, allowing the company to enjoy higher gross margin of 42% and

operating margin of 33.5% in 1H18. Cash cost (including opex and royalties)

dropped 10% yoy to Rp614k per ton in 1H18. We also note that despite pressure

from DMO pricing, coal ASP increased 8.7% yoy to Rp838k/ton in 1H18 on the

back of higher export contribution of 48% (vs. 36% in 1H17).

PTBA is benefited by abundant coal reserves and low production costs.

PTBA holds the largest coal reserves and the longest mine-life within our coverage

of four coal companies. PTBA had the option to change its sales mix and increase

export sales in 1H18 as the company holds abundant coal reserves with calorific

value ranging from 4,500-7,000 kcal/kg (adb). Additionally, PTBA enjoyed low

production costs supported by low stripping ratio of 4x-4.5x (1H18: 4.3x) and

efficient train transportation costs. With these low and efficient costs, PTBA’s

margin is the highest among its peers.

Minimal impact from the shortage of heavy equipment.

PTBA recorded

production volumes of 11.2mn tons in 1H18, increased 19% yoy, which we

believe the highest compared to the peers. The impact of insufficiency of new

heavy equipments in the market is minimal for PTBA as the company’s coal seam

is very thick which allows PTBA to apply slightly different mining method

(compared to the peers) with the application of Bucket Wheel Excavator (Fig. 4).

Thus, with increasing train transportation capacity (1H18: +8.5% yoy), PTBA

could increase productivity.

Maintain Buy with higher TP of Rp5,100 (prev: Rp3,900).

We maintain our

Buy recommendation for PTBA with higher DCF-based (WACC: 13.3%, TG: 2%)

target price of Rp5,100 (previously Rp3,900) as we raise our earnings forecast by

28% and 19% for FY18F and FY19F, respectively. We like PTBA as the company

booked strong production volumes growth of 19% yoy in 1H18 while its low SR of

4.3x allows the company to enjoy higher-than-peers’ margins. PTBA is currently

trades at FY18F P/E of 9.1x, lower than the average P/E of 11x in the past

7-years. Please note that or new TP of Rp5,100 implies FY18F P/E of 10.9x.

Bukit Asam

(

PTBA IJ

)

Source: PTBA, IndoPremier Share Price Closing as of : 20-July-2018

2

Refer to Important disclosures in the last page of this report

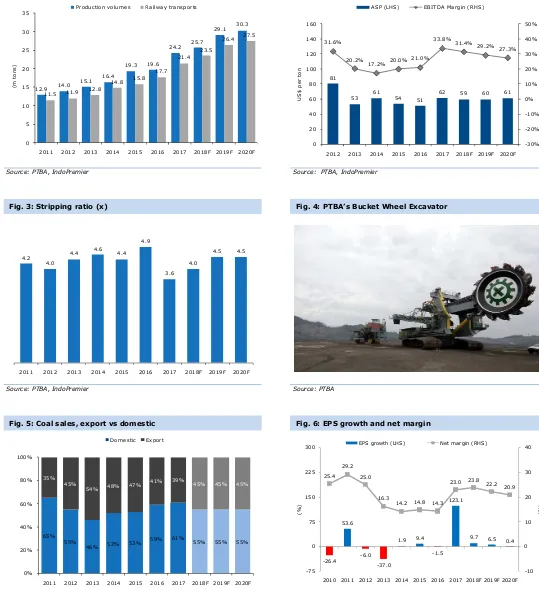

Fig. 1: Production and railway transport volumes Fig. 2: ASP and EBITDA margin

Source: PTBA, IndoPremier Source: PTBA, IndoPremier

Fig. 3: Stripping ratio (x) Fig. 4: PTBA’s Bucket Wheel Excavator

Source: PTBA, IndoPremier Source: PTBA

Fig. 5: Coal sales, export vs domestic Fig. 6: EPS growth and net margin

Source: PTBA Source: PTBA, IndoPremier

12.9 14.0

2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F

(m

Production volumes Railway transports

81

2012 2013 2014 2015 2016 2017 2018F 2019F 2020F

US

ASP (LHS) EBITDA Margin (RHS)

4.2

2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F

65%

2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F Domestic Export

2010 2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F

(%

)

(%

)

3

Refer to Important disclosures in the last page of this report

Fig. 8: 2Q18 results summary

(Rp Bn) 1H18 1H17 % Y-Y 2Q18 % Q-Q % Y-Y vs. cons. vs. ours

Revenues 10,525 8,967 17.4 4,776 (16.9) 8.1 47.9 51.5

COGS 6,101 5,622 8.5 2,935 (7.3) 6.0

Gross profit 4,424 3,345 32.2 1,842 (28.7) 11.4 49.2 58.0

G&A expenses 564 517 9.2 239 (26.6) (8.1)

Selling expenses 449 444 1.2 197 (21.6) 7.6

Other 112 93 20.7 77 121.9 71.0

Operating profit 3,523 2,477 42.2 1,483 (27.3) 18.2 56.7 72.1

Net interest inc. (exp) 22 (68) neg 13 31.6 neg

Other 50 66 (23.9) 20 (33.0) (36.0)

Pretax profit 3,595 2,475 45.3 1,516 (27.1) 20.6 54.4 68.9

Tax 975 728 34.0 369 (39.1) (6.1)

Minority Interest 44 23 90.8 21 (5.9) 114.9

Net profit 2,576 1,724 49.4 1,125 (22.5) 31.9 53.2 67.3

GPM (%) 42.0 37.3 38.6

OPM (%) 33.5 27.6 31.0

Pretax mgn (%) 34.2 27.6 31.7

NPM (%) 24.5 19.2 23.6

Source: PTBA, IndoPremier

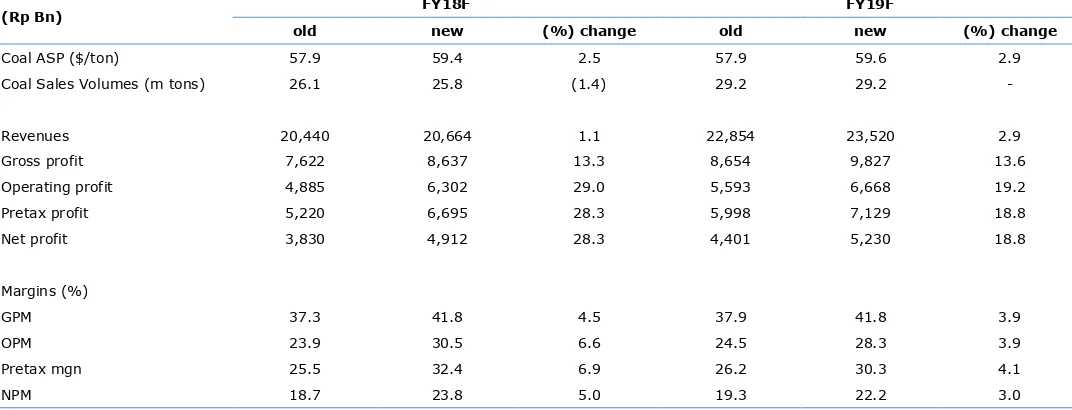

Fig 8. Earnings revisions

(Rp Bn) FY18F FY19F

old new (%) change old new (%) change

Coal ASP ($/ton) 57.9 59.4 2.5 57.9 59.6 2.9

Coal Sales Volumes (m tons) 26.1 25.8 (1.4) 29.2 29.2 -

Revenues 20,440 20,664 1.1 22,854 23,520 2.9

Gross profit 7,622 8,637 13.3 8,654 9,827 13.6

Operating profit 4,885 6,302 29.0 5,593 6,668 19.2

Pretax profit 5,220 6,695 28.3 5,998 7,129 18.8

Net profit 3,830 4,912 28.3 4,401 5,230 18.8

Margins (%)

GPM 37.3 41.8 4.5 37.9 41.8 3.9

OPM 23.9 30.5 6.6 24.5 28.3 3.9

Pretax mgn 25.5 32.4 6.9 26.2 30.3 4.1

NPM 18.7 23.8 5.0 19.3 22.2 3.0

4

Refer to Important disclosures in the last page of this report

Year To 31 Dec (RpBn) 2016A 2017A 2018F 2019F 2020F

Income Statement

Net Revenue 14,059 19,471 20,664 23,989 26,544

Cost of Sales (9,657) (10,965) (12,027) (13,781) (15,374)

Gross Profit 4,401 8,507 8,637 10,207 11,170

SG&A Expenses (1,871) (2,608) (2,335) (3,126) (3,379)

Operating Profit 2,531 5,899 6,302 7,081 7,790

Net Interest 53 81 213 269 329

Forex Gain (Loss) 0 0 (10) (11) (13)

Others-Net 150 122 189 220 243

Pre-Tax Income 2,734 6,102 6,695 7,559 8,349

Income Tax (709) (1,554) (1,706) (1,926) (2,127)

Minorities (18) (71) (78) (88) (97)

Net Income 2,006 4,476 4,912 5,545 6,126

Balance Sheet

Cash & Equivalent 3,675 3,555 4,683 5,748 6,902

Receivable 2,285 5,344 5,671 6,584 7,285

Inventory 1,102 1,156 1,268 1,453 1,621

Other Current Assets 1,288 1,063 1,128 1,309 1,449

Total Current Assets 8,350 11,118 12,750 15,094 17,256

Fixed Assets - Net 7,516 7,466 8,210 9,043 10,287

Goodwill 0 0 0 0 0

Non Current Assets 1,315 1,905 2,245 2,645 3,117

Total Assets 18,577 21,987 24,778 28,434 32,395

ST Loans 958 208 208 208 208

Payable 539 886 0 1,114 1,243

Other Payables 3,065 3,328 3,532 4,100 4,537

Current Portion of LT Loans 481 91 0 0 0

Total Current Liab. 5,043 4,513 4,712 5,422 5,988

Long Term Loans 167 36 36 36 36

Other LT Liab. 2,814 3,638 4,670 5,994 7,694

Total Liabilities 8,024 8,187 9,418 11,452 13,718

Equity (944) (956) (956) (956) (956)

Retained Earnings 11,366 14,565 16,119 17,735 19,424

Minority Interest 131 192 198 204 210

Total SHE + Minority Int. 10,552 13,800 15,360 16,982 18,677

Total Liabilities & Equity 18,577 21,987 24,778 28,434 32,395

5

Refer to Important disclosures in the last page of this report

Year to 31 Dec 2016A 2017A 2018F 2019F 2020F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 2,036 2,006 4,476 4,912 5,545

Depr. & Amortization 332 428 677 194 203

Changes in Working Capital (1,167) 631 3,297 1,433 1,634

Others 697 (1,137) (6,035) (558) (694)

Cash Flow From Operating 1,898 1,928 2,415 5,982 6,688

Capital Expenditure (1,247) (574) (677) (943) (1,051)

Others 134 259 141 0 0

Cash Flow From Investing (1,113) (315) (536) (943) (1,051)

Loans (426) (237) (881) 0 0

Equity 0 0 0 0 0

Dividends (706) (611) (602) (3,357) (3,930)

Others (663) (163) (524) (556) (646)

Cash Flow From Financing (1,795) (1,011) (2,007) (3,914) (4,575)

Changes in Cash (924) 559 (119) 1,128 1,065

Financial Ratios

Gross Margin (%) 31.3 43.7 41.8 42.6 42.1

Operating Margin (%) 18.0 30.3 30.5 29.5 29.3

Pre-Tax Margin (%) 19.4 31.3 32.4 31.5 31.5

Net Margin (%) 14.3 23.0 23.8 23.1 23.1

ROA (%) 11.3 22.1 21.0 20.8 20.1

ROE (%) 20.2 36.8 33.7 34.3 34.4

ROIC (%) 19.1 35.9 35.1 36.0 36.3

Acct. Receivables TO (days) 50.4 71.5 97.3 93.2 95.4

Acct. Receivables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Inventory TO (days) 8.3 9.7 9.9 10.1 10.0

Payable TO (days) 31.9 23.7 28.2 27.6 28.0

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 15.2 2.4 1.6 1.4 1.3

Interest Coverage Ratio (x) 0.1 0.0 0.0 0.0 0.0

Net Gearing (%) (19.6) (23.3) (28.9) (32.4) (35.6)

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period HOLD : Expected total return between -10% and 10% within a 12-month period SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS