MONDAY EFFECT, WEEK-FOUR EFFECT AND JANUARY EFFECT IN

INDONESIA

Dian Safitri P1) Koesoemasari2), Tulus Haryono3)

1)

Doctorate student in Sebelas Maret University, Surakarta

2)

Management, Wijayakusuma University, Jl. Raya Beji Karangsalam, Purwokerto 53152, IndonesiaEmail : [email protected]

3)

Management, Sebelas Maret University, Jl. Ir. Sutami 36A, Surakarta 57126, Indonesia Email : [email protected]

ABSTRACT: The research analyzed efficient market anomalies, Monday effect, week four effect, and January effect in Indonesia. Three hypotheses were tested through independent t test. The result discovered that Monday effect and week four effect were not present, but January effect indeed. It proved that the Indonesian economy situation during 2016 and 2017 tended to be stable, therefore Monday effect and Week-four effect did not occur. It presented January effect because there was an improvement of Indonesian economy at the end of the year after the election, thus this good news affected the purchase of shares in large numbers in the beginning of the year.

Keywords—Anomalies, Monday effect, Week four effect, January effect, good news

INTRODUCTION

Efficient Market Hypothesis (EMH) proposed by Fama (1970) is now becoming very popular. The theory of market efficiency links the price adjustment with new information coming into the market. A market is considered efficient if all investors are unlikely to get an abnormal return when a new equilibrium price is created. Efficient stock market prices follow a random walk, so it cannot be predicted. Many researchers had proven that market efficiency (Potocki and Swist, 2012; Ozkan and Mesut, 2015; Maria et al., 2016; Hasan, 2017) presented a phenomenon which was inconsistent with the concept of market efficiency theory (Halari et al., 2015; Subramaniam and Velnampy, 2017; Engelberg and Mclean, 2017).

The phenomenon which is on the contrary to the concept of market efficiency discovered by many researchers, besides many scientists showed that market efficiency remains proven. Market efficiency anomalies widely proven were January effect, size effect, day effect, weekend effect, volume effect, and low P / E (Hmaied, Etudes, and Grar, 2006; Brailsford, 1996; De Long et al. 1987). Anomaly was not only available in emerging markets (Maghayereh, 2003; Chen et al., 2010; Gharaibeh et al., 2015; Hamid, 2010) but also in developed market (Berument and Kiymaz, 2001; Kiymaz and Berument, 2003; Haug and Hirschey, 2006). D'Mello et al., (2003) who conducted a research in the American market found that there was January effect on abnormal return and average trade size. January effect in United States was present since many people sold stocks to avoid individual taxation at the end of the year, then at the beginning of the year (January) they bought back shares which were sold (Haug and Hirschey, 2006).

Research on anomalies conducted in Indonesia still discovered mixed results. Sari and Sisdyani (2014) were able to prove the existence of January effect on LQ45 index, however Pratomo (2007) did not reveal any January effect. Wijijayanti (1996) proved that companies listed in 40 most active stocks experienced week of the month effect. Prasetyo (2006) tested daily return and abnormal return with the sample of 20 companies recorded in LQ45, the result showed that there was no difference of daily return and abnormal return if it was calculated using regression analysis, but GARCH test presented different in daily return and abnormal return. The variety of research results in Indonesia still require more verification to the existence of efficient market anomaly in Indonesia.

LITERATUR REVIEW

A. Efficient Market Hypothesis

more emphasized to the existence of information on the market, according to Fama (1970) market efficiency was divided into three namely:

1. Market efficiency of weak form: this market shows stock price reflecting the information in the past. Hence, volume, trading, and historical stock prices can be implemented as a standard to predict future stock price changes.

2. Market efficiency of Semi-strong: stock prices on the market are not only influenced by histories data but also other information coming into the market. Information affecting stock prices can be information from companies such as dividend distribution, stock split, earnings, and future prospects of the company.

3. Market efficiency of strong form: the stock price reflects all information on the market; published or not.

Stock trading by the investor will cause the price to change into a new equilibrium price. Supposing a market is in an efficient position, the stock price and the new stock index formed reflect all the information available in the market. The market reality shows that investors' information ownership is not the same (asymmetric information), hence it affects different behavior among investors and finally inconsistency will appear (anomaly) in the market. Market anomaly is a condition which is inconsistent with an efficient market concept. Anomalies occur if a market is considered efficient but things happen out of prediction, ie investors get abnormal return from the transaction.

B. Capital Market Anomalies

Anomaly is a way or strategy which runs against the theory of market efficiency. Anomalies affect market change from random into structured at certain times. The pattern of return change can be predicted by the investor by the anomaly, so it can be used to obtain a larger abnormal return. Investors need to be careful in making investment decisions based on anomalies, because it does not guarantee to obtain a high abnormal return. Market anomaly testing cannot be implemented as an investment strategy since it is not supported by empirical evidence.

1. Monday Effect

One of market anomalies is the presence of negative or lower returns on Monday than any other day. The Monday effect phenomenon occurred as it relateed to the previous day's return, Monday was the beginning of the week so last weekend's trading affected Monday's return (Iqbal, Hussain, Latif, and Aslam, 2013). Negative returns on Monday were due to bad news to the company announced close to Friday (Gujarati, 2004). Several other studies in other countries also discovered negative returns or lower return on Monday (Cross, 1973; Fama, 1980; Gibbons and Hess, 1981; Paiva et al., 2017).

2. Week-four Effect

This phenomenon occurs if the negative return on Monday is only concentrated in the fourth and fifth weeks of each month. It happened because the liquidity needs at the end of the month, so that triggered investors to sell stocks in large numbers that cause negative return (Thaler, 1987).

3. January Effect

Anomalous phenomenon is when the average return of January tends to be higher than the average return of other months. It happened because of the sale of shares by individual investors in December to reduce the ownership of capital and to buy back in January (Shleifer and Summers, 1990).

METHODS 1. Research Design

This is a quantitative research which examines the theories through the measurement of research variables in numbers and performs hypothesis testing with statistical procedures.

2. Operational Definition and Variable Measurement

The variable applied in this study is the actual return of the Indonesia Stock Exchange. Return is the income yield received by the investor. The return variable can be calculated by this formula:

𝑅𝑅

𝑡𝑡=

𝐼𝐼𝐻𝐻𝑆𝑆𝐺𝐺

𝑡𝑡− 𝐼𝐼𝐻𝐻𝑆𝑆𝐺𝐺

𝑡𝑡− 1Rt : Daily Return

IHSGt : Indonesia Composite Index on day t

IHSGt-1 : Indonesia Composite Index on day t-1

3. Data Collection Methods and its Data

The data collected are secondary data, it is the data collected by data collecting institution and published to public of data user. Data obtained from the official website of Indonesia Stock Exchange is www.idx.com, by using documentation method.

4. Hypothesis

4. 1. Hypothesis 1: There is a Monday effect phenomenon in Indonesia 2016-2017.

The statistical hypothesis formula for the Monday effect phenomenon is as follows:

H0: μmonday≥ μexcept for monday

H1: μmonday< μexcept for monday

4. 2. Hypothesis 2 : There is a Week-four effect phenomenon in Indonesia in 2016-2017

The formula of statistical hypothesis for investigating the phenomenon of Week-Four effect is as follows:

H0: μsunday4 dan 5≥ μsunday 1-3

H1 ; μsunday 4 dan 5< μsunday 1-3

4.3. Hypothesis 3 : There is a January effect phenomenon in Indonesia in 2016-2017.

The statistical hypothesis formulation for phenomenon test of January effect is as follows:

H0: μJanuary≥ μexcept for January

H1: μJanuary< μexcept for January

The third test of hypothesis using independent t-test formula, with level of significant 95%:

5. t-test of Independent

The test is conducted to investigate the first, second and third hypotheses. The statistical test is applied based on statistical hypothesis formulation for each anomaly phenomenon test.

𝑡𝑡

𝑜𝑜𝑏𝑏𝑠𝑠=

𝑋𝑋

1−

𝑋𝑋

2𝑛𝑛

1− 𝑆𝑆

12

+

𝑛𝑛

2− 𝑆𝑆

2 2𝑛𝑛

1+

𝑛𝑛

2−

2

1

𝑛𝑛

1+

1

𝑛𝑛

2Information:

𝑋𝑋

1 : Average daily return of the first sample𝑋𝑋

2 : Average daily return of the second sample𝑆𝑆

1 2: First sample variant

𝑆𝑆

2 2: Second sample variant

𝑛𝑛

1 : The number of first sample members𝑛𝑛

2 : The number of second sample membersRESULTS AND DISCUSSION

1. Descriptive Analysis

The average overall return is 0.000736451 with a minimum score is -0.0400592 which occurred on Friday October 14, 2016. The minimum score occurred on October 14, 2016 due to the decrease in daily transaction frequency into 12.57% during the period 10-14 October 2016, the transaction decreased from 274.91 thousand times on October 3-7 into 240.36 thousand times. It is supported by the global economy effect such as the growth slowed considerably in the Chinese economy and the Fed's rate cuts in the US. Stock Indonesia relies on much to foreign investors, therefore the global economic conditions are significantly affecting on market conditions in Indonesia.

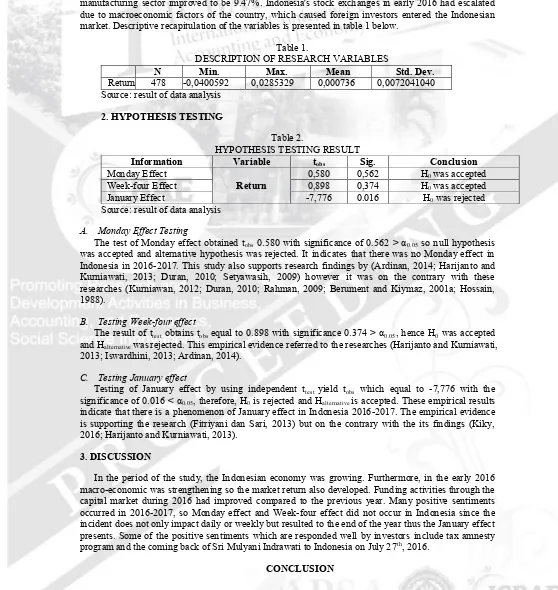

Maximum score of 0.0285329 occurred on Friday, February 5th, 2016. Maximum score was 11.63% supported by the increase in consumer goods sector, miscellaneous industry sector was 10.15%, and manufacturing sector improved to be 9.47%. Indonesia's stock exchanges in early 2016 had escalated due to macroeconomic factors of the country, which caused foreign investors entered the Indonesian market. Descriptive recapitulation of the variables is presented in table 1 below.

Table 1.

DESCRIPTION OF RESEARCH VARIABLES

N Min. Max. Mean Std. Dev.

Return 478 -0,0400592 0,0285329 0,000736 0,0072041040 Source: result of data analysis

2. HYPOTHESIS TESTING

Table 2.

HYPOTHESIS TESTING RESULT

Information Variable tobs Sig. Conclusion

Monday Effect

Return

0,580 0,562 H0 was accepted

Week-four Effect 0,898 0,374 H0 was accepted

January Effect -7,776 0.016 H0 was rejected

Source: result of data analysis

A. Monday Effect Testing

The test of Monday effect obtained tobs0.580 with significance of 0.562 > α0.05 so null hypothesis

was accepted and alternative hypothesis was rejected. It indicates that there was no Monday effect in Indonesia in 2016-2017. This study also supports research findings by (Ardinan, 2014; Harijanto and Kurniawati, 2013; Duran, 2010; Setyawasih, 2009) however it was on the contrary with these researches (Kurniawan, 2012; Duran, 2010; Rahman, 2009; Berument and Kiymaz, 2001a; Hossain, 1988).

B. Testing Week-four effect

The result of ttest obtains tobs equal to 0.898 with significance 0.374 > α0.05, hence H0 was accepted

and Halternative wasrejected. This empirical evidence referred to the researches (Harijanto and Kurniawati,

2013; Iswardhini, 2013; Ardinan, 2014).

C. Testing January effect

Testing of January effect by using independent ttest yield tobs which equal to -7,776 with the

significance of 0.016 < α0.05, therefore, H0 is rejected and Halternative is accepted. These empirical results

indicate that there is a phenomenon of January effect in Indonesia 2016-2017. The empirical evidence is supporting the research (Fitriyani dan Sari, 2013) but on the contrary with the its findings (Kiky, 2016; Harijanto and Kurniawati, 2013).

3. DISCUSSION

In the period of the study, the Indonesian economy was growing. Furthermore, in the early 2016 macro-economic was strengthening so the market return also developed. Funding activities through the capital market during 2016 had improved compared to the previous year. Many positive sentiments occurred in 2016-2017, so Monday effect and Week-four effect did not occur in Indonesia since the incident does not only impact daily or weekly but resulted to the end of the year thus the January effect presents. Some of the positive sentiments which are responded well by investors include tax amnesty program and the coming back of Sri Mulyani Indrawati to Indonesia on July 27th, 2016.

The results of testing to the phenomenon of efficient market anomaly in 2016-2017 in Indonesia was only able to prove January effect, while Monday effect and Week-four effect were not proven. The influencing factor is the improving condition of the Indonesian economy, and the level of foreign trust to the Indonesian government which increased because of the success of tax amnesty and Sri Mulyani's present. The testing period showed a lot of good news in the market which was well responded by all investors, although also it was also frightened by the bad news, namely the slowed growth of the Chinese economy and the market Fed's interest rate reduction plan which was still beneficial to good news. The implication of this research was investor should be careful in conducting transactions in the capital market by caring to good news and bad news related to macro economy both domestically and globally. Daily return movement was not only the reference to conduct transactions, but also it showed good or bad condition of the market.

The study limitation was research period which was too short in 2 years and only tested one variable actual return of shares. Another limitation was the testing anomaly; only three anomalous phenomena tested while there were still many other than those. It is suggested for further research that it should add the research variables tested such as abnormal return, trading volume or trading frequency. Besides, it was also required to extend the study period to make it more visible to the economic conjuncture and its effect on stock trading.

REFERENCE

Ardinan, H. (2014). Pengujian Monday Effect Pada Bursa Efek Indonesia. Journal of Business and Banking, 4(1), 81–90.

Berument, H., and Kiymaz, H. (2001b). The Day of the Week Effect on Stock Market Volatility.

Journal of Economics and Finance, 25(2), 1990–1991.

Chen et al. (2010). Investigating Seasonal Anomalies in Asian Stock Market Prices : A Stochastic Dominance Approach. International Journal of Management, 27(1), 2010.

Duran, iIais P. (2010). The day-of-the-week effect on stock returns and volatility The case of Latin America.

Engelberg, J., and Mclean, R. D. (2017). Anomalies and News. Forthcoming, the Journal of Finance.

Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383–417.

Fitriyani, I., dan Sari, M. M. Ratna. (2013). Analisis January Effect pad Kelompok Saham Indeks LQ-45 di Bursa Efek Indonesia Tahun 2009-2011. E-Jurnal Akuntansi Universitas Udayana,

4(2), 421–438.

Gharaibeh, A. M., Obeid, and Al Azmi, A. A. T. S. (2015). Asian Economic and Financial Review

Test Of The Day Of The Week Effect : The Case Of Kuwait Stock Exchange. Asian Economic and Financial Review, 5(5), 757–765.

Gujarati, D. N. (2004). Basic Econometrics (Fourth). The McGraw-Hill Companies, Amerika Serikat.

Halari, A., et al. (2015). Islamic calendar anomalies : Evidence from Pakistani firm-level data.

Quarterly Review of Economics and Finance, 58, 64–73.

Hasan, D. (2017). Analysis Of Calendar Anomalies In National Stock Exchange Of India. Publish Master thesis, Masaryk University, Brno, Ceko.

Harijanto, C. A., dan Kurniawati, S. L. (2013). Pengujian Market Efficiency : Pembuktian

Fenomena Anomali Pasar Pada Strait Times Index Di Bursa Efek Singapura. Journal of Business and Banking, 3(2), 223–232.

Iqbal, S., et al. (2013). Investor Type and Financial Market Anomalies : A Comparison of

Individual , Institutional and Foreign Investors and Role of Their Behaviors in Investing Decisions. Middle-East Journal of Scientific Research, 17(11), 1591–1596.

Iswardhini, T. D. (2013). Pengaruh Monday Effect terhadap Retun sahan di Bursa Efek Indonesia pada Tahun 2010-2012. Universitas Jember.

Kiky, A. (2016). Analisis January Effect Pada Saham Astra Internasional (ASII) di Bursa Efek Indonesia pada Periode 2005-2015. Ultima Management, 8(2), 54–63.

Kiymaz, H., and Berument, H. (2003). The day of the week effect on stock market volatility and

volume : International evidence. Review of Financial Economics, 12, 363–380.

Kurniawan, A. A. (2012). Analisis Pengaruh Hari Perdagangan Terhadap Return Saham Perusahaan Bidang Telekomunikasi Yang Terdaftar di Bursa Efek Indonesia. Jurnal Probisnis, 5(2), 60– 74.

Maria, G., et al. (2016). Intraday Anomalies and Market Efficiency : A Trading Robot Analysis. Computational Economics, (47), 275–295.

Ozkan, N., and Mesut, M. (2015). The accrual anomaly : Evidence from Borsa Istanbul. Borsa istanbul Review.

Paiva, S. et al. (2017). Research in International Business and Finance Monday effect in Brazilian hedge funds with immediate redemption. Research in International Business and Finance, 39, 47–53.

Potocki, T., and Swist, T. (2012). Empirical Test Of The Strong Form Efficiency Of The Warsaw

Stock Exchange : The Analysis Of Wig 20 Index Shares. South-Eastern Europe Journal of Economics, 2, 155–172.

Rahman, L. (2009). Stock Market Anomaly : Day of the Week Effect in Dhaka Stock Exchange. International Journal of Business and Management, 4(5), 193–206.

Sari, F. A.,dan Sisdyani, E. A. (2014). Analisis January Effect Di Pasar Modal Indonesia, 2, 237– 248.

Setyawasih, R. (2009). Analisis Pemodelan Pengujian Eksistensi Anomali Return Harian di Bursa Efek Indonesia (Studi Kasus Periode 2005-2008). Jurnal Optimal, 3(1), 15–32.

Shleifer, A., and Summers, L. H. (1990). The Noise Trader Approach to Finance. Journal of Economic Perspectives, 4(2), 19–33.

Sias, R. W., and Starks, L. T. (1997). Institutions and Individuals at The Turn-of-The-Year. Journal of Finance, 52(4), 1543–1562.

Subramaniam, V. A., and Velnampy, T. (2017). Rationality : A Central Point Between Traditional And Behavioral Finance. international journal of research granthaalayah, 5, 389–405.

Thaler, R. H. (1987). Anomalies : Seasonal Movements in Security Prices II : Weekend, Holiday,