ANALYSIS OF FACTORS AND EFFECTS OF PSAK 24 REVISI 2013

IMPLEMENTATION IN INTERIM FINANCIAL REPORT 2015

Muhammad Adri Hakim, Dwi Martani

Akuntansi, Fakultas Ekonomi dan Bisnis, Universitas Indonesia

Abstract

The purpose of this research is to provide empirical evidence about factors that influence the company’s decision to implement PSAK 24 (2013) Employee Benefits in an interim financial report of 2015, the effects for company that implement these standard, and how company disclose information related to the implementation and efect of PSAK 24 in the interim financial report of 2015. This research included companies listed in Indonesia stock exchange by using logistic regression analysis. The result of this research indicate that implementation of PSAK 24 in interim financial report influenced by market capitalization, number of employee, and auditor. This research also provides results in which disclosure of the implementation and effect of most companies have been appliying PSAK 24 in financial interim report of 2015 has been done in accordance with the rules ini PSAK 24.

1. INTRODUCTION

Each company employs a number of employees in its business. Companies are employers who have obligations to employees that employee benefits. The level of materiality of the value of the employee benefits will affect how the entity present the information records of PSAK 24. PSAK 24 changes have a significant effect on the entity that owns the rewards in the form of defined benefit pension and other long-term benefits.

PSAK 24 (2013) is the adoption of IAS 19 Revised 2011. After 2011, IAS 19 underwent two revisions, namely in 2013 and 2014. Revised PSAK 24 will have an impact on the presentation of reclassification and so the company had to apply the new method retrospectively. In the transition mentioned that this applies PSAK retrospectively, except for the adjustment of asset values and sensitivity analyzes. As a result of these changes the company will present three statements of financial position comparative year are 2015, 2014 and early comparative period of 2014. Changes in PSAK 24 will also produce other comprehensive income (OCI) in the statement of income and other comprehensive income and OCI in equity.

Fasshauer et al., (2008) conducted a study on the application of accounting standards for employee benefits, IAS 19 Employee Benefit, on companies in 20 European countries. The companies are analyzed using three methods in the measurement of employee benefits. The method consists of a full recognition through the Statement of Recognised Income and Expense (SORIE), full recognition through Profit & Loss, and the 'standard' corridor approach. The results of these studies show that companies that apply IAS 19 that uses the latest full recognition method through the Statement of Recognised Income and Expense (SORIE) better in disclosing information related to employee benefits. The application of IAS 19, based on full recognition through the Statement of Recognised Income and Expense (SORIE) also carries a significant effect on the balance sheet and income statement. In this study also suggested that the measurement of employee benefits should only use a single method that is full recognition through the Statement of Recognised Income and Expense (SORIE).

company estimates the cost of implementing PSAK 24 is greater, not first to apply, the company's policy against the debt agreement does not affect the timing of the application of PSAK 24, companies with positive changes ROE would be faster to apply PSAK 24, and a large public accounting firms (Big 4), which audits influence to the implementation of PSAK 24.

This research aims to analyze how the application of IAS 24 changes in the interim financial report 2015. The use of interim financial report will be interesting because there are many companies that turned out to not apply it in the beginning of the interim period, even though the application of IAS 24 Revised 2013 effective starting January 1, 2015.

This research consists of an introduction, literature review and hypothesis development, research methods, research and discussion, and conclusion.

2. LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

Employee benefits are all forms of benefits granted an entity in exchange for services rendered by employees or for the termination of the employment contract. Employee benefits include benefits granted to workers or their dependents or beneficiaries and may be settled by payments (or the provision of goods or services), either directly to workers, husbands / wives, children or other dependents or to others, such as insurance companies.

There are three major changes in the PSAK 24 (2013) which are how to calculate pension cost, the recognition of actuarial gains and losses, and disclosures. The change will significantly affect the value of post-employment benefit obligations which will be presented in the financial statements. The recognition of actuarial gains and losses as a component of comprehensive income will significantly affect the company's total equity. Disclosures made more comprehensive by explaining the characteristics, the amount arising from the program in the financial statements and the sensitivity analysis on defined benefit plans. Revised PSAK 24 will have an impact on the presentation of reclassification and so companies should apply retrospectively using the new method.

According to PSAK No. 3 (2010) Interim Financial Reporting states that interim financial report is a financial report that contains either a complete financial statement (as described in PSAK 1 (2009) Presentation of Financial Statements) or a financial report summary (as described in this Statement) to an interim period. Interim period is a financial reporting period shorter than a full financial year.

But in reality, not all companies implement new standards when preparing the interim financial statements. Though described in PSAK 3 that the interim financial statements are prepared using the accounting policies together with the annual financial statements. Large companies are the focus of attention of investors that tend to be applying accounting policies early (Castello et al. 1994). Companies that have larger debts will perform faster adoption of standards (Sami and Welsh, 1992) but according Castello et al. (1994) actually found the opposite. According to Amir and Livnat (1996 and Langer and Lev (1993) companies are adopting standards at baseline had earnings changes are relatively smaller, but the results are opposite to the Castello et al. (1994) that changes high profit company audited by the firm of repute high inclined to make early adoption of the standard (Trombley, 1989). In a study of adoption PSAK 24 Employee benefits by Harahap (2010) found that the total assets, changes in ROE and auditors have a positive influence on the early adoption of accounting standards.

Hypothesis Development

Market capitalization is an indicator of the development of a stock market. The market capitalization of the company's capital illustrates assessed on the number of outstanding shares and stock prices. The market capitalization has an important role, which gives an overview of the market capitalization of companies active in the stock market of a country, so that the information disclosed in the company is very important especially for investors in the stock market. Companies with large capitalization value tends to be more attention from investors and prospective investors, because investors generally invest viewed capitalization and stock price on the exchange. Presentation of information and the application of an accounting standard that is the latest in the interim financial report is very important in the decision making for investors and prospective investors, the company should pay more attention to information presented in the interim financial statements. It was developed in the following hypothesis:

H1: Companies with larger market capitalization have the possibility in implementing

Companies with a large number of employees, tend to spend more compared to companies with fewer employees, but the company with a large number of employees who usually is a great company, international and influential in driving the economic growth of a country. Companies with a large number of employees who will have the burden and obligations and employee benefits were great, so that the disclosure of information related to employee benefits becomes very important. Companies with larger number of employees is expected to be faster in applying PSAK 24 (2013) because the standard is closely related to the company's obligation to its employees and also government regulations relating to the welfare of employees. It was developed in the following hypothesis:

H2: Companies with a larger number of employees have possibility in implementing

PSAK 24 (2013) earlier.

This research was conducted to test whether the debt to equity ratio may affect the company's decision to implement IAS 24 Revised, 2013 interim financial report. To run its business activities the company needs funds, in order to run properly. Funds are required to cover all or part of the cost is required and needs expansion or new investment. According to Kashmir (2010) Debt to Equity is the ratio used to assess the debt and equity, by comparing all the debt for equity. The application of IAS 24 Revised 2013 influence to changes in the value of liabilities and equity. Companies with a larger debt to equity is expected to be faster in applying IAS 24 Revised, 2013, due to the amount of debt the company is bigger, so the disclosure of information is expected to be delivered sooner. It was developed in the following hypothesis:

H3: Companies with a larger Debt to Equity Ratio (DER) have possibility in

implementing PSAK 24 (2013) earlier.

changes resulted in significant changes to the information, which the company should present the information as soon as possible. It was developed in the following hypothesis:

H4: Companies with a larger change in Return On Equity (ROE) have possibility in

implementing PSAK 24 (2013) earlier.

Harahap (2010) also mentions that companies audited by public accounting firms were great also faster in applying PSAK 24 (2013). Revised large public accounting firm will generally be offered to clients to implement the new standards as soon as possible, due to large public accounting firms tend to keep the integrity of its affiliates in the world. Large public accounting firms are considered better understand the regulation of new accounting standards than small ones, this can be evidenced by the issuance of central module of their affiliates if the new standards are issued. Therefore the companies audited by a large public accounting firms are expected to be faster in implementing PSAK 24 (2013). It was developed into a hypothesis as follows:

H5: Companies audited by a public accountant's office "Big 4" have possibility in

implementing PSAK 24 (2013) earlier.

3. RESEARCH METHODS

This research is using descriptive statistical analysis, logistic regression, and qualitative analysis. This research aimed to analyze the factors and the impact of PSAK 24 (2013) in an interim financial report 2015. The analysis also conducted on disclosures relating to the implementation of PSAK 24 (2013).

This research uses regression model similar to the regression model on research Harahap (2010) with modifications. Here is a model of research that will be used:

Adoption Timing = α + 1 CAP + 2 EMPLOYEE + 3 DER + 4 ROECHANGE +ᵝ ᵝ ᵝ ᵝ

6 AUDITOR + ε

ᵝ

Adoption Timing

: Dummy variable, the value 1 to companies that adopt PSAK 24 (2013) of the interim financial statements and the value 0 for companies that do not adopt in the interim financial report 2015 CAP : The market capitalization value in 2015

EMPLOYEE : The number of employees of the company in 2014 DER : Debt to Equity Ratio2014

AUDITOR : Dummy, value 1 to companies audited by audit firms "Big 4" and the value 0 for companies that are not audited by audit firms "Big 4"

The dependent variable is the variable that is observed and measured to determine the effects caused by the independent variable. The dependent variable in this study is an interim financial report 1st quarter (Q1), second quarter (Q2) and third quarter (Q3) 2015 as liabilities of the company to comply with applicable regulations in the PSAK. This variable is a dummy variable that will be worth 1 if a company has done the application of PSAK 24 (2013) and a dummy variable will be 0 if a company has not made the application of PSAK 24 (2013).

Variable market capitalization (CAP) is the real value of the market capitalization of the company until December 31, 2015. The market capitalization of demonstrating the value of securities listed on the stock exchange, is defined as the total number of securities issued by companies in the capital market.

Variable employee (EMPLOYEE) is the number of employees reported in the company's annual financial statements 2015. Employees are the primary asset in a company, because no employees, activities of the company will not be able to walk. Employees is the seller of services (mind and energy) and gain compensation (wages), the amount has been set in advance (Hasibuan, 2002).

Debt to Equity Ratio (DER) is an indicator of the proportion of the company's debt to the investments made by the shareholders. DER high value shows the total debt (short-term and long-term) greater than the capital or equity, so this will have an impact on the greater burden on the creditor company. The increased burden on the creditor shall indicate the source of the company's capital is highly dependent on external parties, and vice versa if the value of small DER. In this study, the value of DER use from DER value of 2014, the use of DER from 2014 due to new PSAK 24 (2013) effectively implemented since January 1, 2015, where the decision on its implementation is influenced by the DER value of the previous year.

Public Accounting Firm (KAP), is a business entity incorporated under the provisions of law and obtain a business license under UU No. 5 Tahun 2011 on Public Accountant. Firm size is a measure used to determine the size of a public accounting firm. In much of the literature, the size of a large public accounting firms say if affiliated with the Big 4. Big 4 international accounting firm is the fourth highest income Deloitte, PriceWaterhouseCoopers, Ernst & Young, and KPMG International. KAP are believed to conduct an audit of a higher quality than the small KAP (DeAngelo, 1981; Brooks, 2012; Bae and Lee, 2013).

On research the application of PSAK 24 (2013) in an interim financial report in 2015, the population selected from companies listed in the Indonesia Stock Exchange (IDX) until December 31, 2015 as many as 518 companies. Samples taken only company that has a relatively sufficient financial information for the study. The sample used using purposive sampling judgment so that the sample was selected based on certain criteria and not selected randomly. Based on this sampling technique, the final number of 518 population sample for the research model is 487, as shown in Table 1.

Tabel 1 Sample Selection

Criteria Amount of Companies

Companies listed in the Indonesia Stock Exchange

until December 31, 2015 518

The company which is newly registered in 2015 13

Companies that do not submit the Financial

Statements 2014 15

Companies with incomplete data 3

Total Observations (Sample) 487

4. RESULTS AND DISCUSSION

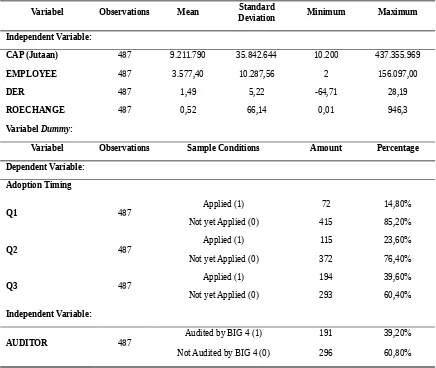

Table 2 Statistic Descriptive

AUDITOR 487 Audited by BIG 4 (1) 191 39,20%

Not Audited by BIG 4 (0) 296 60,80%

The results test of statistic descriptive can be seen in Table 2, from a sample of 487 companies listed in the Indonesia Stock Exchange, showed only 72 companies, or about 14.8% of the total sample were already applying PSAK 24 (2013). The companies are already implementing PSAK 24 (2013) since January 1, 2015. the application was accompanied by a calculation of the impact of adoption of PSAK 24 (2013) in the statement of changes in equity other comprehensive income is part of the income statement, and notes to the financial statements. These companies are among others Astra Agro Lestari Tbk, Adhi Karya (Persero) Tbk, Bank Central Asia Tbk, Bumi Serpong Damai Tbk and PT Telekomunikasi Indonesia (Persero) Tbk.

Indonesia Tbk, Ciputra Development Tbk, Kimia Farma (Persero) Tbk, and Holcim Indonesia Tbk.

In Q3, the company has applied PSAK 24 (2013) in Q2 was also incorporated into the calculations as many as 115 companies (23.6%), because if it had adopted PSAK 24 (2013) in Q1 and Q2, then directly've implemented in Q3. The number of companies that have applied PSAK 24 (2013) in Q3 cumulatively that 194 companies, or 39.8% of the total sample. Companies that totally new implement in Q3 as many as 80 companies. Companies, among others Adira Dinamika Multi Finance Tbk, Agung Podomoro Land Tbk, Shoes Bata Tbk, Bank Mandiri (Persero) Tbk, and Pembangunan Jaya Ancol Tbk.

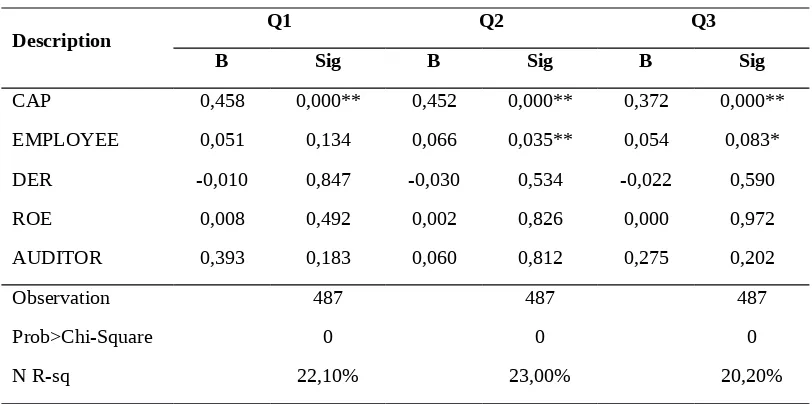

The next analysis is analysis using regression models. Regression model testing done by logistic regression, because the dependent variable is a dummy. The test results of logistic regression models shown in Table 3.

Table 3 Result of Regression Models

Description Q1 Q2 Q3

B Sig B Sig B Sig

CAP 0,458 0,000** 0,452 0,000** 0,372 0,000** EMPLOYEE 0,051 0,134 0,066 0,035** 0,054 0,083*

DER -0,010 0,847 -0,030 0,534 -0,022 0,590

ROE 0,008 0,492 0,002 0,826 0,000 0,972

AUDITOR 0,393 0,183 0,060 0,812 0,275 0,202

Observation 487 487 487

Prob>Chi-Square 0 0 0

N R-sq 22,10% 23,00% 20,20%

* Significant on level 10% ; ** Significant on level 5%

So the first hypothesis that larger capitalization companies tend to be faster in applying PSAK 24 (2013) in interim financial statements and the second hypothesis the company with larger number of employees tend to be faster in applying IAS 24 Revised 2013 in the interim financial statements is acceptable. Variable DER, ROE, and AUDITOR no significant effect on the company's decision to determine the applicability of PSAK 24 (2013) in interim financial statements, so the hypothesis third, fourth, and fifth is not proven.

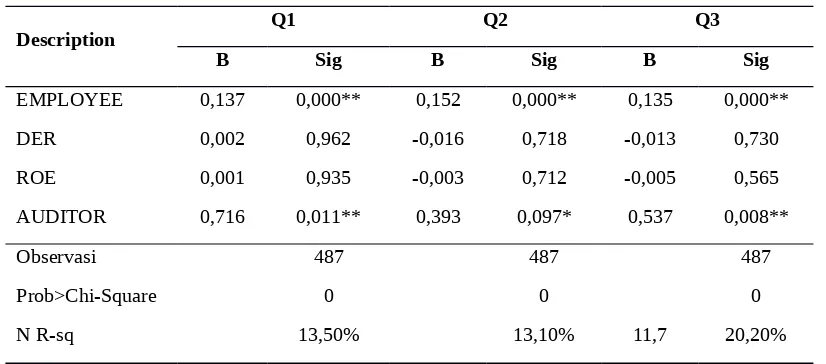

In this research, also conducted a sensitivity test. Test sensitivity is done by issuing a variable CAP. Sensitivity test results are shown in Table 4. The sensitivity of the test results showed different results with the results of previous regression testing. The regression results show that the sensitivity test variable EMPLOYEE and AUDITOR be significant. AUDITOR variable becomes significant, when the variable CAP is issued. Variable AUDITOR and CAP have a strong relationship, this is evidenced by the correlation test in SPSS, which the Auditor and the CAP have a strong relationship, but the relationship is strong does not show symptoms multicolinearity, it has also been proven in testing the regression model, where all variables we tested did not have any symptoms multikolinearitas. The relationship between the Auditor and the strong CAP may occur due to CAP and AUDITOR associated with firm size. Companies that are likely to have large market capitalization and audited by public accountant "Big 4".

Tabel 4 Hasil Uji Sensitifitas

Description Q1 Q2 Q3

B Sig B Sig B Sig

EMPLOYEE 0,137 0,000** 0,152 0,000** 0,135 0,000**

DER 0,002 0,962 -0,016 0,718 -0,013 0,730

ROE 0,001 0,935 -0,003 0,712 -0,005 0,565

AUDITOR 0,716 0,011** 0,393 0,097* 0,537 0,008**

Observasi 487 487 487

Prob>Chi-Square 0 0 0

N R-sq 13,50% 13,10% 11,7 20,20%

* Significant on level 10%; ** Significant on level 5%

implemented in Q1, Q2, and Q3 result, At companies that apply PSAK 24 (2013) in Q1 there were 65 of the 72 companies that restated, while seven companies have not been restated, 7 companies that have not been restated its financial statements recently restated in Q2 and Q3. Companies that apply PSAK 24 (2013) in Q2, as many as 43 companies have restated their financial statements, companies that apply PSAK 24 (2013) in Q2 everything has restated its financial statements. In Q3 as many as 45 companies have been restated, while 34 companies have not been restated.

The application of PSAK 24 (2013) financial statements also give rise to actuarial gains or losses in the statement of income and other comprehensive income. Companies that apply PSAK 24 (2013) are generally split into two its comprehensive income items that are classified in the income and items not classified in income in accordance with the rules in PSAK 1 (2013). Revised actuarial gains or losses that arise will be in posts are not classified in profit and loss. Of the 72 companies that apply PSAK 24 (2013) in Q1, as many as 41 companies halve its comprehensive income, while the rest do not make distributions on its comprehensive income. In Q2 of 43 new companies to apply PSAK 24 (2013), as many as 37 companies to halve its comprehensive income. Of the 79 new companies to apply PSAK 24 (2013) in Q3, as many as 46 companies already halve its comprehensive income.

5. CONCLUSION

Based on the research results and the analysis conducted, it can be concluded that there are still many companies that have not applied PSAK 24 (2013) in interim financial statements, even until the third quarter (Q3) 2015. In Q1 there are 72 companies that have applied and 415 companies not apply. In Q2 cumulatively there are 115 companies that have applied, while 372 companies have yet to implement. In Q3 cumulatively There are 194 companies that have applied and 293 companies have not implemented. Despite the increase of the company applying the PSAK 24 (2013) in an interim financial report in 2013, but the company did not apply the amount still greater.

restated (restatement) to the financial statements of previous years. The restatement resulted in a change in particular in liabilities and equity reported by the company. The application of PSAK 24 (2013) also resulted in the emergence of an actuarial loss or gain in the company's income statement. Companies that apply that apply PSAK 24 (2013) should be disclosure presentation correctly, but there are still many companies that do not yet precisely such disclosures are not restated or not to do the classification of gains / losses are in the income statement. The application of PSAK 24 (2013) also resulted in a decrease in the value of DER and ROE.

This research has limitations that this research uses the number of companies listed on the site Indonesia stock exchange until December 31, 2015, the addition of the company after the date of December 31, 2015 are not included in the population and the measurement of the application of PSAK 24 (2013) in the financial statements using the information presentation in the report financial position, statements of income and other comprehensive income, statement of changes in equity and notes to the financial statements. Measurement of the implementation of PSAK 24 (2013) does not pay attention to whether the company uses a defined benefit plan or a defined benefit, fearing they would extend the time of the study.

This research also provides empirical evidence to regulators, standard setters, and users of financial statements that many companies listed on the exchange have not applied the standards should be. Regulators should provide more oversight or, if necessary sanctions for companies that do not implement the standard as appropriate, for the standard setters are expected to be in conducting socialization and gather suggestions from companies, for users of financial statements are expected to be more careful in reading and using the information in interim financial statements.

REFERENCES

Ankarath, Nandakumar. (2012). Memahami IFRS: Standar Pelaporan Keuangan Internasional. Jakarta: PT. Indeks

Armstrong, C.S., M.E. Barth, A.D. Jagolinzer, and E.J. Riedl. (2010) “Market Reaction to the Adoption IFRS in Europe” The Accounting Review 85.

Bae, G. S. & Lee, J. E. (2013). “Does Audit Firm Size Matter? The Effect of Audit Firm Size Measured by Audit Firm Revenues, Number of Offices, and Professional Headcounts on Audit Quality and Audit Fees.” Journal of Accounting Research.

Ball, R. (2006). “International Financial Reporting Standards (IFRS): Pros and Cons for Investors.” Accounting and Business Research, International Accounting Policy Forum.

Ball, R., A. Robin, and J. Wu. (2003). “Incentives Versus Standards: Properties of Accounting Income in Four East Asian Countries.” Journal of Accounting and Economics 36. Brooks, L., Cheng, C.S.A., Johnston, J. and Reichelt, K.J. (2011). “ When does Audit Quality

start to decline in Firm Audit Tenure? – An international analysis.” Working Paper, Louisiana State University.

Chen H., Tan, Q., Jiang, Y., & Lin, Z. (2010). “The role of international financial reporting standards in accounting quality: Evidence from European Union.” Journal of international Financial Manaement and Accounting 21.

Choi, F., and Meek, G. 2011.International Accounting, 7th edition, New York: Pearson

Education.

Chua, Yi Lin, C. S. Cheong & G. Gould. (2012). “The Impact of Mandatory IFRS Adoption on Accounting Quality: Evidence from Australia.” Journal of International Accounting Research, vol. 8 (2).

Costello, Ann, Harriet F. Farney, Aurelle S. Locke. (1994). “Accounting for Postretirement Benefits: Early Adopters of SFAS 106.” Benefits Quarterly. Fourth Quarter.

Daske, H., L. Hail, C. Leuz, and R.Verdi. (2008). “Mandatory IFRS Reporting around the World: Early Evidence on the Economic Consequences.” Journal of Accounting Research 46.

DeAngelo, L. E. (1981). “Auditor Size and Audit Quality.” Journal of Accounting and Economics 3 (3).

Dhaliwal, D., Wen, H., Li, Y. and Pereira, R. (2013). “Does mandatory IFRS Adoption Facilitate Financial Market Integration”, Consequences of IFRS Adoption, American Accounting Association, Annual Meeting and Conferences, ANAHEIM, CALIFORNIA.

Fasshauer, J., Glaum, M. and Street, D.L. (2008). “Adoption of IAS 19 by Europe’s Premier

Listed Companies”, research report no.100.

Ghozali, Imam. (2012). Aplikasi Analisis Multivarian dengan program IBM SPSS 20, edisi 6. Semarang: Badan Penerbit Universitas Diponegoro

Hail, L., C. Leuz, and P. Wysocki. (2009) “Global Accounting Convergence and the potential Adoption of IFRS by United States: An Analysis of Economic and Policy Factors.”

Independent Research to the U.S. FASB.

Harahap, Siti N. (2010). “Economic Motives of Adoption Timing Decision : The Case of The Revised of The Indonesian GAAP 24 on Employee Benefits.” Asia Pasific Journal of Accounting and Finance, Vol 1 (1) : 103 – 113.

Hasibuan, Melayu S.P. (2002). Manajemen Sumber Daya Manusia. Jakarta: Bumi Aksara IFRS, Official Website, November 23, 2015 http://www.ifrs.org/

Ikatan Akuntan Indonesia, Official Website, November 23, 2015 http://www.iaiglobal.or.id/

Indonesia Stock Exchange, Official Website, January 3, 2016 http://www.idx.co.id/

International Accounting Standard No. 19 Employee Benefits (Revised 2011).

Kieso, D.E., Weygandt, J. J., & Warield, T.D. (2015). Intermediate Accounting IFRS Edition. New Jersey : John Wiley & Sons Ltd.

Martani, Dwi. (2012). Dampak Implementasi IFRS Bagi Perusahaan. Depok : Jurnal Akuntansi www.academia.edu

Martani, Dwi. (2015). PSAK 24 Imbalan Kerja – IAS 19 Employee Benefit. Depok : Jurnal Akuntansi www.academia.edu

Neag, Ramona. (2014). The effects of IFRS on net income and equity: evidence from Romanian listed companies. Procedia Economics and Finance, 15, 1787-1790. Palea, Vera. (2013). :IAS/IFRS and financial reporting quality: Lessons from the European

experience.” China Journal of Accounting Research, 6, 247-263.

Pangabean, R. R. (2007). “Studi Banding PSAK dengan IFRS Menghadapi Penerapan IFRS Secara Menyeluruh di Indonesia.” Tesis Pascasarjana Universitas Indonesia, Jakarta.

Pernyataan Standar Akuntansi Keuangan No. 24 Imbalan Kerja (Revisi 2013).

Pernyataan Standar Akuntansi Keuangan No. 3 Laporan Keuangan Interim (Revisi 2010). Ross, Stephen A., Westerfield, Randolph W. and Jordan, Bradford D. (1991). Corporate

Financial Fundamental, 7th edition. New York: McGraw-Hill Education International

Edition copyright 2006.

Scoot, T. (1991). In Langer and Lev, “Pension Disclosures under SFAS No.87: Theory and Evidence.” Contemporary Accounting Research 8 (Fall), 1993.

Trombley, Mark A. (1989). “Accounting Method Choice in the Software Industry: Characteristics of Firms Electing Early Adoption of SFAS No.86.” The Accounting Review. LXIV, No.3.

Undang-undang Nomor 13 Tahun 2003 Tentang Ketenagakerjaan.

Wardhani, Ratna. (2009). “Pengaruh Proteksi Bagi Investor, Konvergensi Standar Akuntansi, Implementasi Corporate Governance dan Kualitas Audit terhadap Kualitas Laba: Analisis Lintas Negara di Asia.” Disertasi Program Studi Ilmu Akuntansi Pascasarjana Fakultas Ekonomi Universitas Indonesia.

Weele, Marjolein L. van der. (2011). “Restatement Announcements: The Effects of Audit Quality on The Market Reaction.” Master Thesis, Tilburg University.