Informasi Dokumen

- Sekolah: PT Integra Indocabinet Tbk

- Mata Pelajaran: Accounting

- Topik: Audit Report 2016 PT Integra Indocabinet Tbk

- Tipe: audit report

- Tahun: 2016

- Kota: Indonesia

Ringkasan Dokumen

I. General

This section provides an overview of PT Integra Indocabinet Tbk, including its establishment, business activities, and operational scope. The company was founded on May 19, 1989, and has undergone several changes in its articles of association, the latest being on September 7, 2016. Its primary business activities include trading, development, and production of wooden furniture and related products, with operations based in Sidoarjo.

1.1 Company Establishment

PT Integra Indocabinet Tbk was established through a notarial deed and is recognized by the Indonesian Ministry of Justice. The company has made multiple amendments to its articles, reflecting changes in share capital and structure, with the latest being approved in September 2016. The company’s focus is on the wooden furniture sector.

1.2 Board of Commissioners and Directors

As of December 31, 2016, the company's governance includes a board of commissioners and a board of directors, each with designated roles. The board structure has remained consistent over the years, with a focus on effective oversight and management of the company’s operations.

1.3 Subsidiaries

The company has several subsidiaries engaged in various aspects of the furniture industry and related services. This section lists the subsidiaries, their ownership percentages, and their respective activities, showcasing the company's diverse operational footprint in the industry.

II. Independent Auditor's Report

This section outlines the independent auditor's opinion on the financial statements of PT Integra Indocabinet Tbk for the fiscal years ending December 31, 2016, 2015, and 2014. The auditors conducted their review in accordance with Indonesian auditing standards, ensuring compliance and accuracy in the financial reporting process.

2.1 Management's Responsibility

Management is responsible for the preparation of financial statements that accurately reflect the company's financial position in accordance with Indonesian Financial Accounting Standards. This includes establishing internal controls to prevent material misstatements.

2.2 Auditor's Responsibility

The auditor's responsibility is to express an opinion on the financial statements based on their audit. They assess the risk of material misstatement, evaluate the appropriateness of accounting policies, and ensure that the financial statements are presented fairly.

2.3 Opinion

The auditor concluded that the consolidated financial statements present a fair view of the financial position and performance of PT Integra Indocabinet Tbk in accordance with applicable standards. This opinion reinforces the credibility of the financial reporting.

2.4 Emphasis of Matter

An emphasis on the change in functional currency from USD to IDR starting January 1, 2016, is noted, which aligns with accounting standards. This change required restatement of prior financial statements to ensure consistency and comparability.

III. Consolidated Financial Statements

This section presents the consolidated financial statements, including the statement of financial position, profit or loss, changes in equity, and cash flows for the years ended December 31, 2016, 2015, and 2014. The statements provide a comprehensive view of the company's financial health and operational results over the specified periods.

3.1 Consolidated Statement of Financial Position

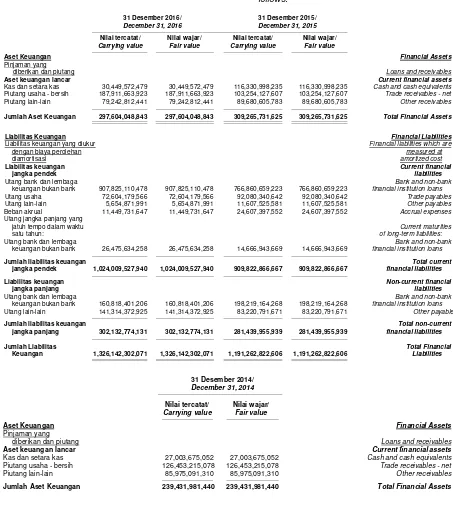

The consolidated statement of financial position provides detailed insights into the company's assets, liabilities, and equity as of December 31 for the years 2016, 2015, and 2014. This section highlights significant changes in asset composition and financial structure.

3.2 Consolidated Statement of Profit or Loss

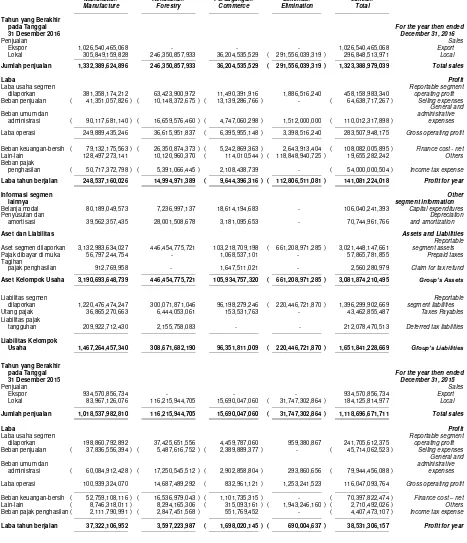

The consolidated statement of profit or loss outlines the company's revenues, expenses, and net income for the fiscal years. It details the financial performance, including gross profit, operating expenses, and profit before tax, indicating trends in profitability.

3.3 Consolidated Statement of Changes in Equity

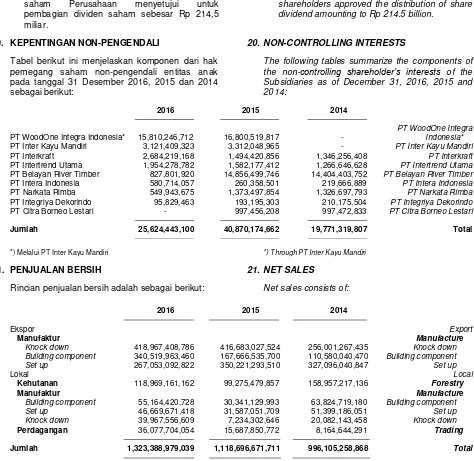

This statement illustrates the changes in equity over the reporting periods, including share capital movements, retained earnings, and other comprehensive income. It reflects the company’s approach to equity management and shareholder returns.

3.4 Consolidated Statement of Cash Flows

The consolidated statement of cash flows summarizes the cash inflows and outflows from operating, investing, and financing activities. It provides insights into the company’s liquidity position and cash management practices.

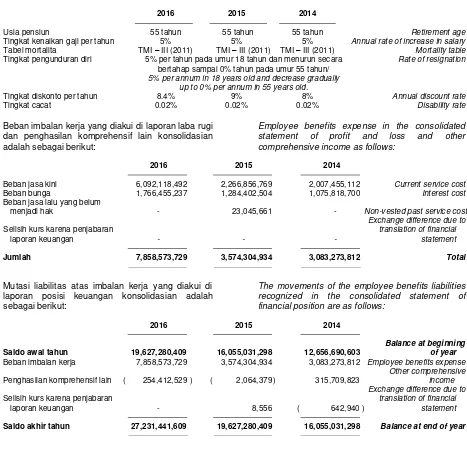

3.5 Notes to the Financial Statements

The notes accompanying the financial statements offer additional context and detailed explanations of accounting policies, significant estimates, and other relevant information that aids in understanding the financial statements.