Indonesian Banking Sector

Update on Indonesian Banking Sector – Oct 2008

Raymond Kosasih +6221 3189 525 [email protected]

[email protected] 28Oct2008 · · page 2

Relatively sound macro

Indonesia real economy is still largely unaffected and banking system remains

sound

Indonesia is more sheltered against global recession

– Domestically centric economy

– Other cushions include lower personal and corporate tax (+8-10% take-home) – Easing food inflation and possibly fuel price cut ahead of election

So far, policy makers have been able to contain macro risk

It wont immune from global slow down

– Slowdown in exports

– Near term risks : Rupiah weakness

– Risks on confidence and fundamentals

– Near-term US$ debt and asset held by foreigners ~US$67bn vs. reserves

US$57bn

– Current account US$1.5bn deficit in 2Q and BOP very dependent on portfolio flow – Impact: wide ranging implication, higher imported inflation, cost push and margin

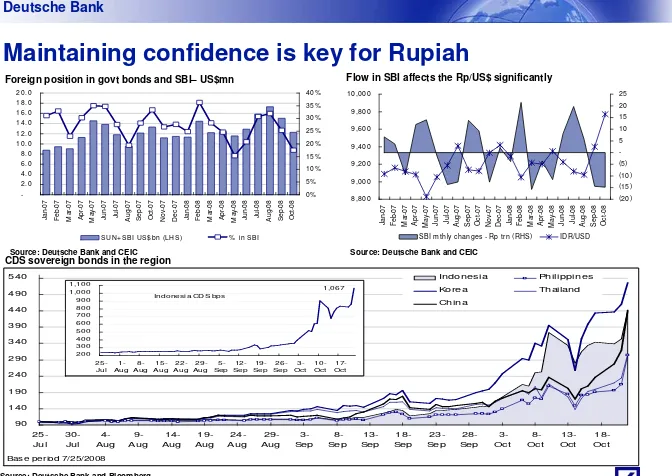

Figure 5: CDS Sovereign bonds spiked

Source: Deutsche Bank and Bloomberg

Maintaining confidence is key for Rupiah

90 Indonesia Philippines Korea Thailand China

Base period 7/25/2008

200 Indonesia CDS bps

-Flow in SBI affects the Rp/US$ significantly Foreign position in govt bonds and SBI– US$mn

8,800

SBI m thly changes - Rp trn (RHS) IDR/USD

Source: Deutsche Bank and CEIC Source: Deutsche Bank and CEIC

[email protected] · date · page 4

Exports slowdown

Exports ~ 1/3 of GDP and Exports to US and EU ~ ¼ of exports

Impact:

Negative impact is inevitable but shouldn‘t be too severe – Export growth has been important economic driver.– Government has lowered FY09 growth of 5.5% (from 6.3%), but could undershoot. DB estimates at 5% growth.

– Traders holding back purchases and lack of working capital.

– Outer islands will see slower growth, but won‘t be too damaging as it has evolved into larger and broder economies in the past years

Exports Contri. US$114.1bn +31% yoy%

Japan 21% 19%

USA 10% 17%

Singapore 9% 34%

China 8% 37%

South Korea 7% 56%

Malaysia 4% 61%

India 4% 56%

Australia 3% 19%

Thailand 3% 35%

Netherlands 2% 66%

Others 28% 26%

% Contri yoy%

CPO 11% 98%

Coal 7% 44%

Rubber 6% 33%

Electronic 5% 7%

Machinery 3% 8%

Iron Ore 3% -25%

Pulp and Paper 3% 21%

Clothings 2% 2%

Logs and Timber 2% -6%

Textile 2% 12%

Top-10 45% 26%

Others non Oil&Gas 32% 17% Oil & Gas 23% 63%

Total Exports 100% 30%

Exports by country Exports – Top 10 by product

Source: Deutsche Bank and BPS

Macro risk assessment

Lower

oil price

eases oil subsidy pressure on

budget

– Budget deficit reduced to 1.0% of GDP in FY09 from 1.7% in FY08. – Bond issuance halved to Rp54.7tr given difficult environment

BI’s tight interest rate policy

– To maintain Rupiah stability, less so in keeping inflation – Rates may rise to 10% or more

– Comparatively higher real interest rates

– Inflation at 12.1% is peaking out. Easing food prices from 20% yoy helps as low-end income spends >60% on food.

– BI expects inflation of 6.5-7.5%

Current account deficit

– near term weak currency

– Reflects economic resilience given strong imports, incl. capital goods

[email protected] 28Oct2008 · · page 6

Macro risk assessment

(7)

Current Account US$ bn (LHS) Current Account % GDP

4%

CPI yoy% Food yoy%

7.0%

SBI 1mth (real) - RHS SBI 1mth 9.5%

Food price rising at fastest pace since 98 crisis BI rate – real and nominal %

Current account deficit – structural Current account a function of investment

17%

Current A/C (RHS) Investment to GDP %

Source: Deutsche Bank and CEIC

Source: Deutsche Bank and CEIC Source: Deutsche Bank and CEIC

Banking system remains healthy

The blessing in disguise from the Asian financial crisis

BI a lot more effective and conservative on banking regulations – No exposure to CDOs and the likes

– Arresting liquidity issues

Prudent lending : Psychological mark steered bankers from careless lending – New owners promoting corporate governance

– Building credit culture

– Mortgage is still plain vanilla and accounts for 2-3% of GDP.

– Confidence took time to recover, avoided the build-up of overly unjustified confidence Sound system:

– Debt to GDP at less than 30%,

– NPL trending down to abt 3% with high coverage ratio

Low FX loans exposures (abt 18% now vs over 50% in 1997/8) Manageable risks of default in consumer loans

– CAR stands at a healthy 17%

[email protected] 28Oct2008 · · page 8

Banks remain well capitalized - CAR

Still lowly leveraged economy and NPL remains in check

Source: Deutsche Bank and CEIC

0.0

2001 2002 2003 2004 2005 2006 2007F 2008F

Source: Deutsche Bank and CEIC

LDR drivers

Source: Deutsche Bank and CEIC

-60%

Debt M oney M arket 3rd party (RHS)

Money market increase by predominantly deposit funding

Source: Deutsche Bank and CEIC

0%

Arresting liquidity issues

BBCA BMRI BBNI BBRI BDMN BNII BNGA PNBN Rp reserve ratio % Release of cash reserve (Rptr) As % of loans

0%

Adj LDR Reported LDR

LDR and Adjusted LDR Input cost increases fueling working capital loans

Low real WC growth BI regulations help easing constraints

Source: Deutsche Bank and CEIC Source: Deutsche Bank and company data

[email protected] 28Oct2008 · · page 10

Liquidity imbalances

-FY07 1H08

-BCA BMRI BBRI LPBN BBNI BNII PNBN NISP BNGA BDMN

07 08F 09F

Cheap fundings (Rpbn) Share of cheap fundings (%) RHS

DB’s estimate of liquidity as % of loans Cheap funding is key to weather liquidity risks

Deposit franchise is key (ratios of CASA to total deposits) Funding costs comparison

Source: Deutsche Bank and company data

Source: Deutsche Bank and company data Source: Deutsche Bank and company data

Source: Deutsche Bank and company data