In this paper, we investigate the impact of news announcements on the currency using event study methodology. Focus on data of the currency exchange "GBP-CAD." The currency exchange data is collected for the last eight years (January 2007 to September 2015) with one minute time frame. Second, although our result shows that economic news has an impact on currency exchange, we cannot be specific whether single or multiple news announcements have more impact on currency exchange than each other.

Currently, there are several investment products that offer high returns to the investors and one of them is currency exchange. “Forex” Forex refers to the foreign exchange market. Currency exchange is always volatile due to the economic or government factors between two traded currencies (Égert and Kočenda (2014), Kearns and Manners (2006)). Several papers have used high-frequency data to examine the response of currency exchange to macroeconomic news and monetary decisions.

To simulate this situation, this paper combines the news forecast literature and 10 years of currency exchange data to find the underlying time interval pattern of news forecasts in the currencies studied.

LITERATURE REVIEWS

Theories

Alternative models for normal returns include the CAPM model, or more simplified approaches such as Mackinlay (1997) mean returns. In terms of capital, the Company's activities such as dividend payment, profit announcement, share allocation, etc. Thus, signaling the investor to be aware of the situation of the company which will later reflect in the change in the share price.

Empirical Studies

- Impact from Monetary policy change

- Impact from sterilized intervention

- GARCH & EGARCH model to identify an increase in volatility of currency exchange

Similar to currency exchange, any news involving the economy or political situation of a country will eventually affect the currency exchange of those countries (Investopedia). This finding that intervention affects the exchange rate in the short run builds on related work by Cotte, Galli, and Rebecchini (1994) and Humpage (1999) and a time-series study by Dominguez and Frankel (1993). Using a GARCH model, Frenkel, Stadtmann, and Pierdzioch (2001) detect high volatility during manipulation of currency exchange data.

As shown in Frenkel et al. 2001), the effect of high volatility was only small and tended to be reversed the day after the intervention. Similar to Omrane, Bauwens and Giot (2005), who used the EGARCH model to find the impact of nine categories of planned and unplanned news announcements on EUR/USD. The result suggested an increase in volatility just before the announcement of both planned and unplanned news.

DATA AND METHODOLOGY

Data

- Hypothesis

- Data Sources

Later, on any given day, we may have either a single news release or multiple news releases. For each announcement on forexfactory.com, 3 types of data are specified: previous, current and consensus. Showing good news means that the current value of the news announcement is greater than the previous value of the news announcement for that specific economic news.

In contrast to good news, bad news means that the current value of the news announcement is less than the previous value of the news announcement for that specific economic news. Therefore, multiple news announcements can mix between good and bad news in one day. It is considered multiple announcement of good news when there is more good news than bad news.

For example, there are three separate news announcements in a day, two of which are good news and the other bad news.

Methodology

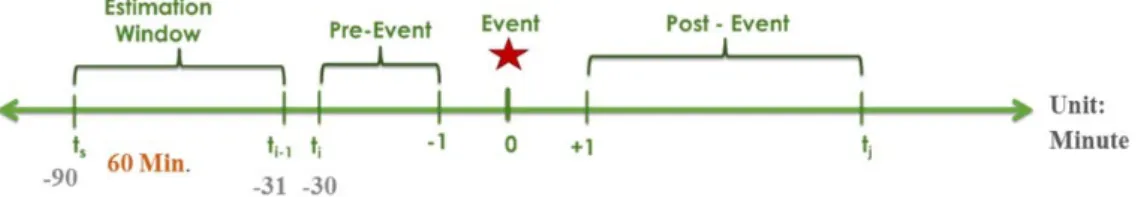

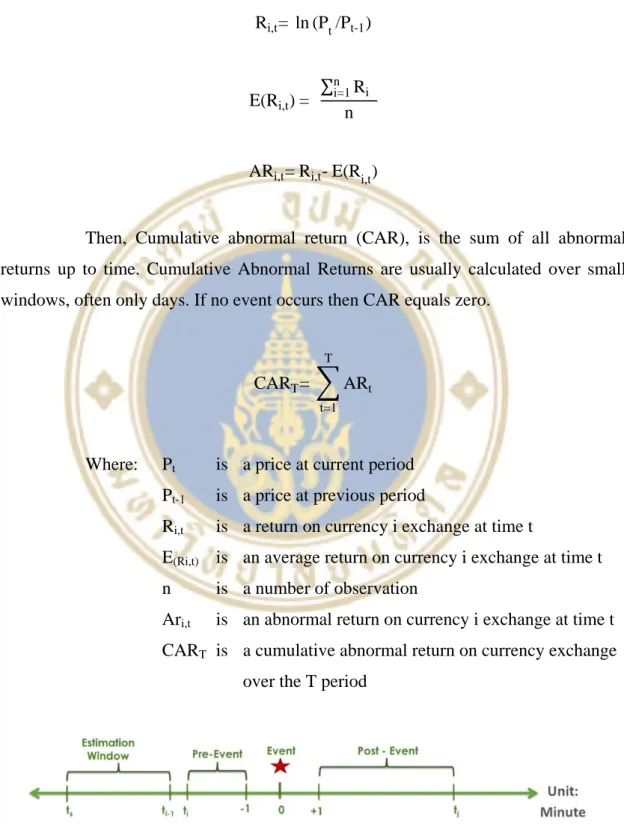

We then use standard event research methodology to estimate the impact of news announcement via currency exchange. Based on trial and error, we arrive at the best estimate period, ranging from 90 minutes to 31 minutes before the news announcement. Where: CAR -a,+a is a cumulative abnormal return on currency exchange from one minute before the news announcement to one minute after the news announcement.

For the last hypothesis, we obtain as input a news announcement that affects the exchange of currencies from the first hypothesis. The result of this hypothesis would, through trial and error, suggest an event before and after each news release. Therefore, the entry position is the abnormal return in the minute(s) that deviates the most from the mean of the abnormal return in the 120 minutes prior to the news release.

And the exit position is the minute(s) at which the abnormal return deviates the most from the mean of the abnormal return in the 240 minutes after the news release.

EMPIRICAL RESULTS

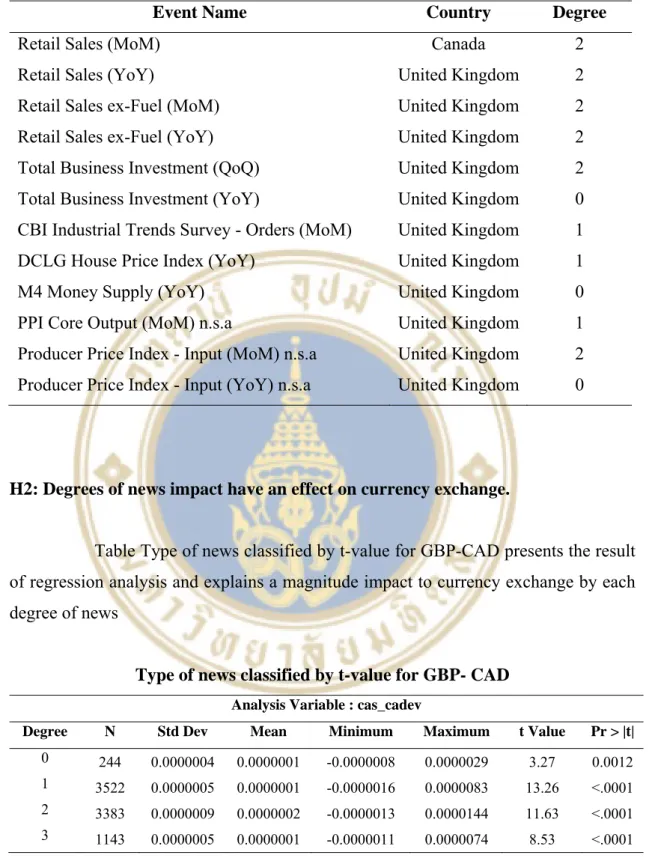

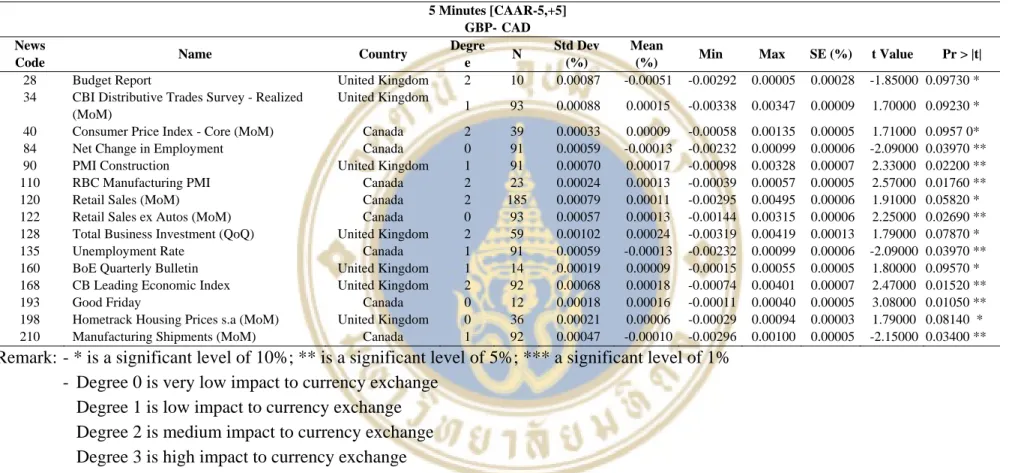

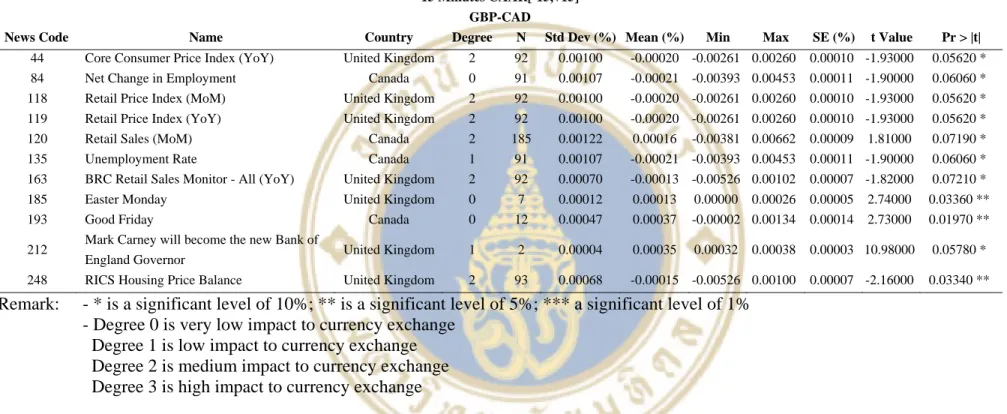

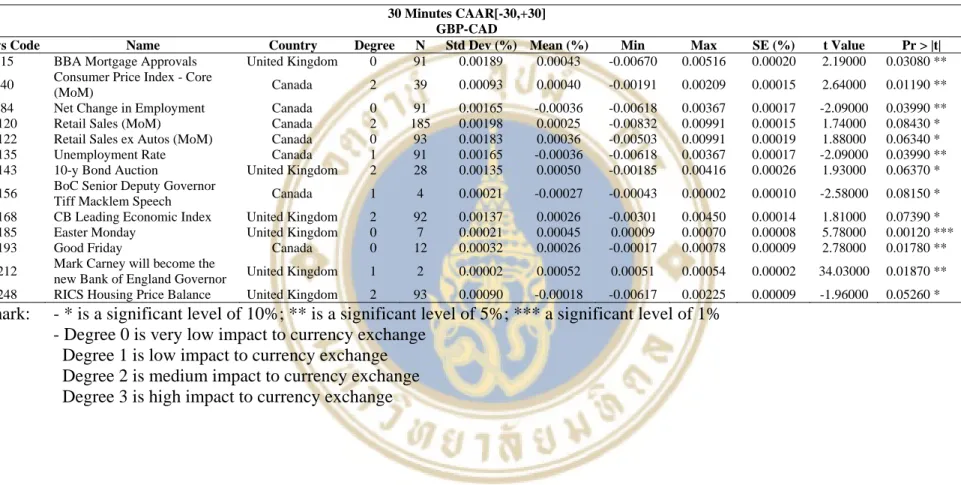

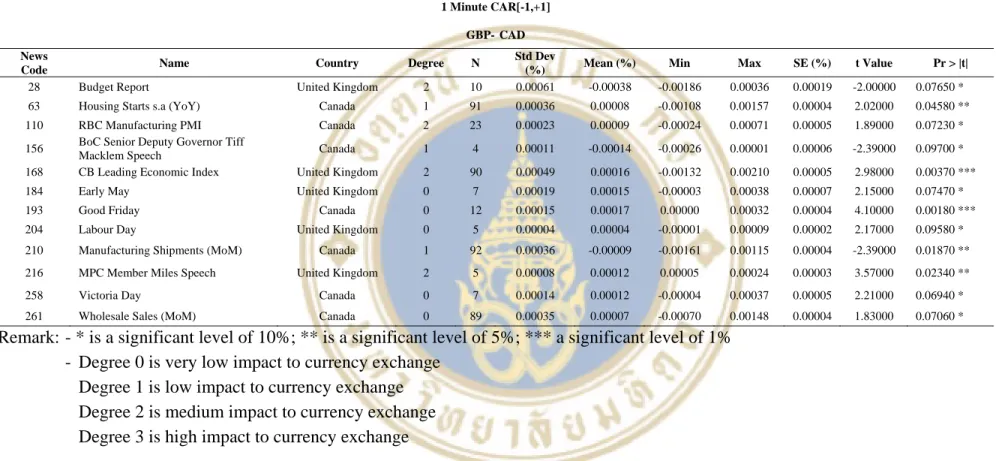

- Hypothesis 1: Specific news announcement shows a significant impact to the studied currency exchange

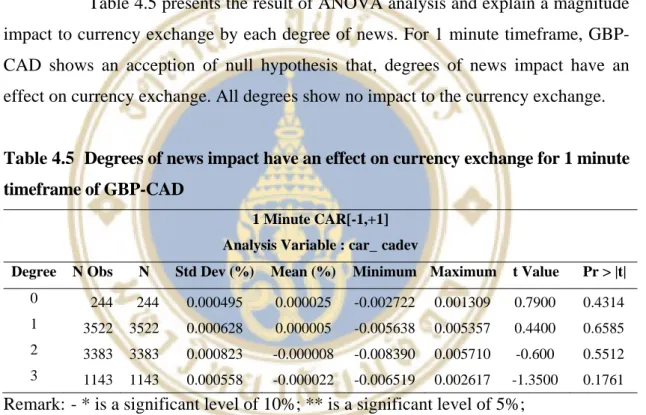

- Hypothesis 2: Degrees of news impact have an effect on currency exchange

- Hypothesis 3: Multiple news announcements have greater magnitude impact than single news announcement

- Hypothesis 4: Various entry and exit time reflect different volatilities Time interval for considering entry and exit in this study will cover 120

Budget report is news from Great Britain, grade 2. Our conclusion was that the message came in 89 minutes before the news announcement and left 6 minutes before the news announcement. Housing Starts s.a (Annual) is a news item from Canada, grade 1, our conclusion found an entry at 42 minutes before the news announcement and an exit time at 237 minutes after the news announcement. RBC Manufacturing PMI is a News from Canada Grade 2, our conclusion found an entry 75 minutes before the news announcement and an exit time 4 minutes after the news announcement.

BoC Senior Deputy Governor Speech is a news from Canada, grade 1, our conclusion found an entry 1 minute before the news announcement and an exit time at 37 minutes after the news announcement. Good Friday is a news from Canada, grade 0, our conclusion found an entry 74 minutes before the news announcement and an exit time 88 minutes after the news announcement. Labor Day is a news story from Great Britain, grade 0. Our conclusion was that news was received 25 minutes before the news announcement and news was left 24 minutes after the news announcement.

Manufacturing Shipments (MoM) is Canada news, level 1, our close found an entry of 226 minutes after the news release and an exit time of 237 minutes after the news release. Victoria Day is Canada news, level 0, our close found an entry 43 minutes before the news release and an exit time of 4 minutes before the news release. Wholesale Sales (MoM) is Canada news, level 0, our conclusion found entry 3 minutes before news release and exit time 2 minutes before news release.

The budget report is UK news, level 2, our conclusion found an entry 25 minutes before the news release and an exit time of 10 minutes before the news release. Unemployment rate is Canada news level 1, our conclusion found entry 20 minutes after news release and exit time 240 minutes after news release. The BoE Quarterly Bulletin is a UK news level 1, our close found an entry 90 minutes before the news release and an exit time of 240 minutes after the news release.

Good Friday is a news from Canada, grade 0, our conclusion found an entry 75 minutes before news announcement and exit time at 105 minutes after news announcement. Net change in employment is a news from Canada, grade 0, our conclusion found an entry at 30 minutes after news announcement and exit time at 240 minutes after news announcement. Unemployment rate is a news from Canada, grade 1, our conclusion found an entry at 30 minutes after news announcement and exit time at 240 minutes after news announcement.

The unemployment rate is a Canada news, scale 1, our conclusion found an entry at 60 minutes after the news announcement and an exit time at 240 minutes after the news announcement.

CONCLUSION

One source of data may not be sufficient, as the spread of a currency in each broker will be calculated differently. Furthermore, computer specification to perform the result of currency exchange should be recommended with a higher than average computer home user's specification. Finally, in addition to the selected data (High, Low, Open, Close price), we can further improve the data quality by adding a volume variable to output the result more precisely.

Using high, low, open and close prices to estimate the effects of cash settlement on futures prices. Estimating the volatility of stock prices: a comparison of methods using high and low prices.

APPENDICES

Appendix A: Define News Announcement Code

127 Scottish independence referendum United Kingdom 3 128 Total business investment (QoQ) United Kingdom 2 129 Total business investment (YoY) United Kingdom 0. 152 Bank of England Credit Condition Report (QoQ) United Kingdom 2 157 BOE Credit Condition Survey United Kingdom 1 158 BOE deputy Governor Paul Tucker speech United Kingdom 1. 211 Mark Carney speaks in the British Parliament United Kingdom 2 212 Mark Carney becomes the new Governor of the Bank of England United Kingdom 1.

8 Bank of Canada Business Outlook Survey Canada 2 9 Bank of Canada Consumer Price Index Core (MoM) Canada 1 10 Bank of Canada Consumer Price Index Core (YoY) Canada 0 11 Bank of Canada Monetary Policy Report Canada 2.

Appendix B: Volatility Methodology

Similar to the cumulative abnormal return (CAR), we use standard event study methodology to estimate the impact of a news release on currency exchange. For the third hypothesis, we test whether multiple news releases have a greater impact than single news releases. The appropriate entry and exit time interval is determined before and after the official release of the news.

For a 1-minute time frame, we use event windows that range from 120 minutes before the news announcement to 120 minutes after the news announcement. Our conclusion was that there was an entry 21 minutes before the news announcement and an exit time 120 minutes after the news announcement. GBP-CAD found an entry time 5 minutes before the news announcement and an exit time 120 minutes after the news announcement.

Our team started a follow-up study to examine data for 10 minutes to test the sig-average with event windows ranging from 120 minutes before the news release to 720 minutes after the news release. Our conclusion found an entry 10 minutes before the news release and an exit time of 270 minutes after the news release. For GBP-CAD, he found an entry 10 minutes before the news release and an exit time 190 minutes after the news release.

For GBP-CAD, a single news release has a greater impact than multiple news releases. Using a 1-minute time frame, we use an event window from 120 minutes before the news release to 120 minutes after the news release. The result shows that GBP-CAD has the best buy position 5 minutes before the news release and the best sell position 120 minutes after the news release.

Therefore, we extended the study to a 10-minute time window, with an event window from 120 minutes before the news announcement to 720 minutes after the news announcement. The result suggests that GBP-CAD has the best buy position 10 minutes before the news announcement and the best sell position 190 minutes after the news announcement.