LED Local Economic Development MEC Member of the Executive Committee MFMA Municipal Financial Management Act. Honorable Speaker and the Council, today is the last day of Africa Month which has been celebrated throughout the month across the African continent. Honorable members of the Council, it is of crucial importance that we also note that tomorrow is the start of Youth Month and Alfred Nzo Month.

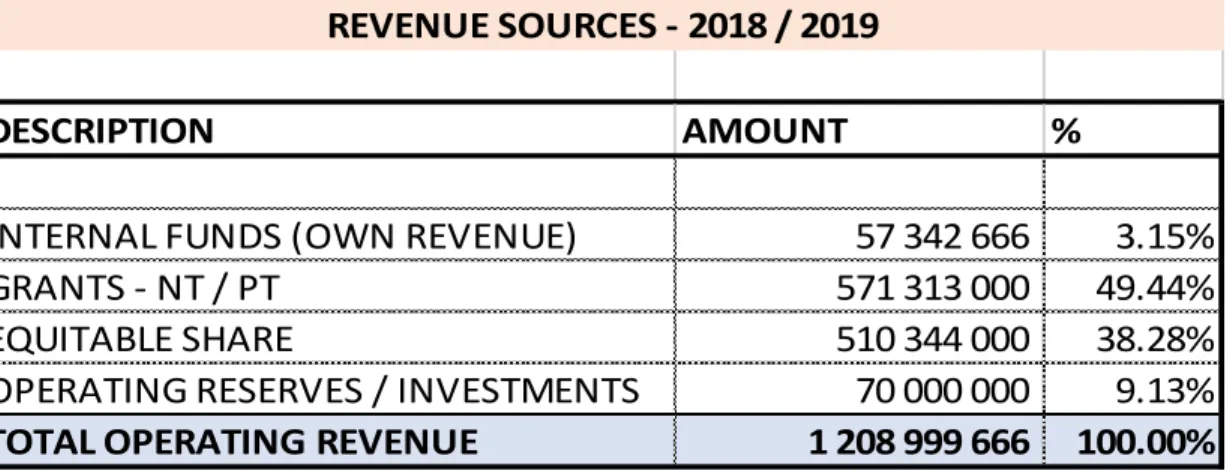

7 Madam President and council, this is a very important moment for us as the council of this municipality, as we are ending the 2017/18 budget year and presenting to this council the 2018/19 action program, which we will follow in further progress for the emancipation of the residents of the district. The municipality is still dependent on grants; Own revenue amounts to 5% of total budget operating revenue and that is R57 342 666. Budget financing in the medium term as stated in sections 18 and 19 of the MFMA;.

10 Corporate Services will be allocated R70 million to continue implementing various skills development initiatives among the youth of the district and ensure the continued functioning of our council so that we are able to provide basic services to our communities to offer. The Council adopts the final budget in accordance with Article 24 of the Municipal Finance Management Act (Law 56 of 2003) as presented to the Council. That the attached final IDP, budget and budget related policies regarding 2018/2019 be adopted.

Madam Speaker, Honorable Councilors and citizens of the district I present to you the Alfred Nzo District Municipality's program of action.

Budget Resolutions

The application of sound financial management principles for the implementation of the district municipality's budget is essential and crucial to ensure that the district municipality remains financially viable and that municipal services are provided to all communities in a sustainable, economic and equitable manner. In addition, the district municipality should undertake various customer care initiatives to ensure that the district municipality truly engages all citizens in ensuring a people-led government. Rates are also set taking into account the rate of inflation and current collection levels, as well as National Treasury guidelines.

ANDM presented at its council meeting on 31 August 2017 the IDP/Budget process plan with its timetables for key dates and activities to be followed in the preparation of the 18/19 MTREF budget. In the previous years, when the municipality had only two local municipalities, great progress was made to reduce the water supply backlog, but after the 2011 elections, the backlog increased with the inclusion of the two new local municipalities. The need to reprioritize projects and expenses within the existing resource framework given the cash flow realities and decreasing liquidity in the municipality.

Tariff increases must be affordable and generally must not exceed inflation as measured by the CPI, except where there are price increases in service inputs beyond the control of the municipality, for example the cost of bulk water and electricity. No budget will be allocated to national and provincial unfunded projects unless necessary grants to the municipality are reflected in the national and provincial budget and are published as required by the annual Division of Revenue Act;.

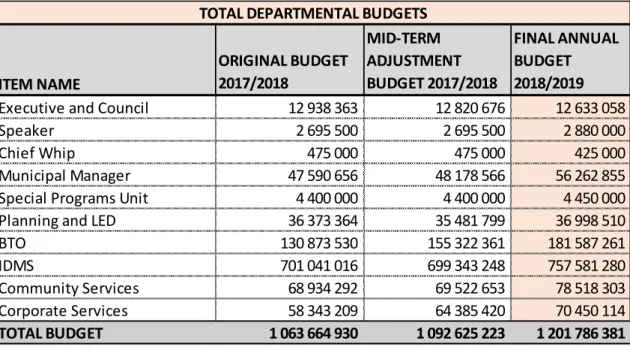

EXPENDITURE ALLOCATIONS

OPERATING EXPENDITURE 2018 - 2019

Conventional Water Meter & Prepaid Water Meter Maintenance

To ensure that pre-paid water meters are maintained and kept in working order, maintenance of these meters is critical, in the future we expect to see an increase in water meter maintenance. The maintenance process requires that the correct procedures are followed to ensure that if the Auditor General (AG) requests any information, it will all be available. These procedures included: - Recording the maintenance issue, issuing a work order, recording the actions taken by the visiting plumbers, this may include: Possible materials used; tagging and storing any meters that are removed; registration of the replacement of the prepaid meter number; filling out the warranty form if required, record GPS Coordinates; registration Time and date of action, pairing of consumer UI units.

The meter audit will be carried out to identify all faulty meters to either repair or replace them for all consumers who do not. Like all other rural municipalities, our district municipality is highly dependent on grants to finance both its operations and capital expenditure, without which it could cease to exist. The implementation of revenue growth strategy is imperative to ensure increase in ANDM's internal revenue.

Included in programs budgeted for, which remain unfunded mandates, are municipal health services. The agreement concluded between the district municipality and the relevant department has expired in the financial year 16/17 and this program is financed internally. Until the district municipality realizes the part of the subsidy for financing expenses that comes with this function, continued financing of it internally will remain an unfunded mandate.

Due to this anomaly and in accordance with the requirements of the municipal budget and reporting regulations, the 2018/19 budget did not take into account any grant received in lieu of this function because it was not published in the Provincial Gazette. Water prices fully reflect costs - including maintenance and renovation costs of treatment plants, water networks and costs associated with reticulation expansion;. Water rates are designed to protect basic service levels and provide free water to the poorest of the poor (poor); and.

In addition, the National Treasury has encouraged all municipalities to ensure that water tariff structures are cost reflective. As a district municipality, there are plans that once the water meter audit exercise is completed as well as installation of water meters, a rate setting exercise will be carried out for full implementation during the 2018/19 financial year. Better maintenance of infrastructure, new dam construction and cost-reflective tariffs will ensure that the supply challenges are managed in the future to ensure sustainability.

Sanitation and Impact of Tariff Increases

In addition, once credible systems are in place, it is expected that 6 kℓ of water per 30-day period will be provided again free of charge to all eligible residents.

Operating Expenditure Framework

Operating gains and efficiencies will be focused on financing the capital budget and other core services; And. Ensure that the district municipality carries out the back to basics exercise to reduce non-priority expenditures. The following table is a high-level summary of the 2018/19 budget and the MTREF (classified by main type of operational expenditure).

An annual increase of 5.4 and 5.5 percent is included in the two outer years of the MTREF (CPI plus 1%). As part of the district municipalities cost reprioritization and cash management strategy vacancies have been significantly rationalized downwards. The district municipality made a provision of R51 million in the 2018/19 budget for repairs and maintenance.

However, this is a significant increase of R29 million from the provision made in the current final annual budget (R51 million) versus adjustment budget. As part of the review of the local government infrastructure grant framework, the National Treasury announced in the 2016 Revenue Sharing Bill that the rules in the municipal infrastructure grant framework (MIG) will be amended to allow funds to be used to build infrastructure neat and replaceable. in the future. Financing costs mainly consist of the repayment of interest on long-term loans (cost of capital).

The expected cash position of the municipality was discussed as part of the budgeted cash flow statement. A 'positive' cash position for each year of the MTREF would generally be a minimum requirement, subject to the planned use of these funds, such as reserve cashback and working capital requirements. The purpose of this measure is to gain insight into how the municipality has used the available resources and investments as identified in the budgeted cash flow statement.

The detailed reconciliation of the cash backed reserves/surpluses will be provided in the final budget. As part of the 2018/2019 MTREF, the municipality's decline in cash position causes the ratio to move downwards and then slightly increase for outer years. It should be noted that a surplus does not necessarily mean that the budget is funded from a cash flow perspective and the first two measures in the table are therefore of critical importance.

This measure should be considered important within the context of the funding measures criteria because a trend indicating that insufficient funds are committed to asset restoration may also indicate that the overall budget is not credible and/or sustainable in the medium to long term because the income budget is not protected. A requirement of the detailed capital budget (since MFMA Circular 28 issued in December 2005) is to categorize each capital project as a new asset or a renewal/rehabilitation project. This following table complies with the requirements of MFMA Circular 42 which deals with the funding of a municipal budget in accordance with sections 18 and 19 of the MFMA.

The table seeks to answer three key questions about the use and availability of cash: What cash and projected investments are available at the end of the budget year. A deficiency (applications > cash and investments) is indicative of non-compliance with Article 18 of the MFMA requirement that the municipal budget must be 'funded'.