ANNUAL DRAFT BUDGET

Mayor’s Report

UMkhanyakude District Municipality has limited financial resources to satisfy the unlimited needs of the people. UMkhanyakude District will ensure that all employees in the municipality adhere to the Batho Pele principles.

Council Resolution

EXECUTIVE SUMMARY

- Introduction

- Strategic priorities for 2017‐2018

- Challenges

- Budget principles and guidelines that directly informed the compilation of the 2017‐2018

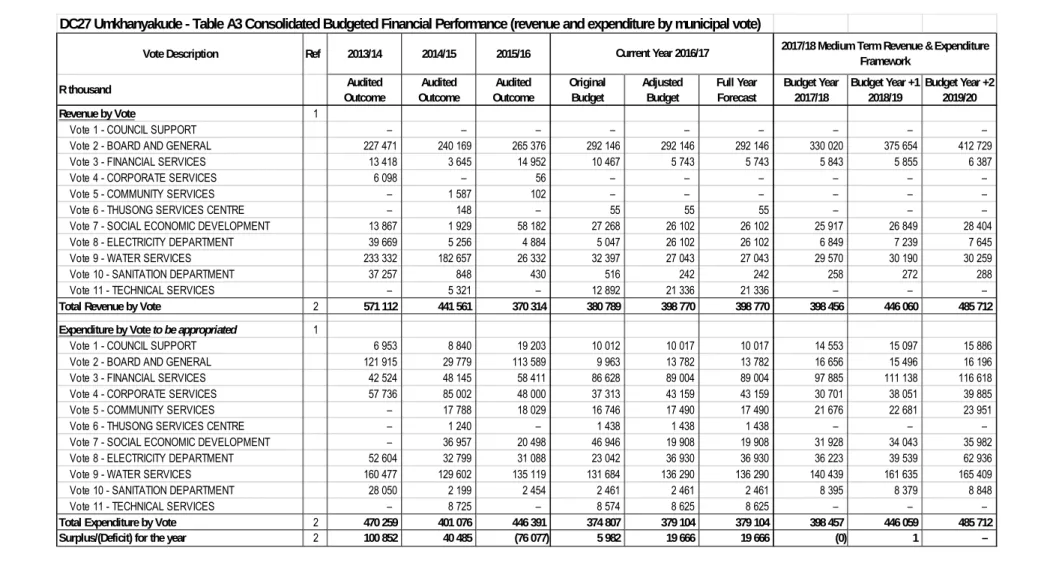

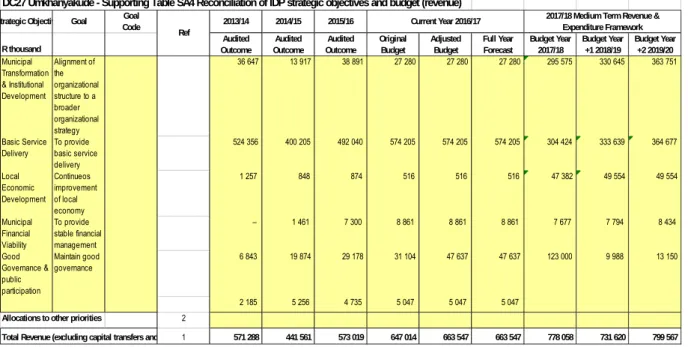

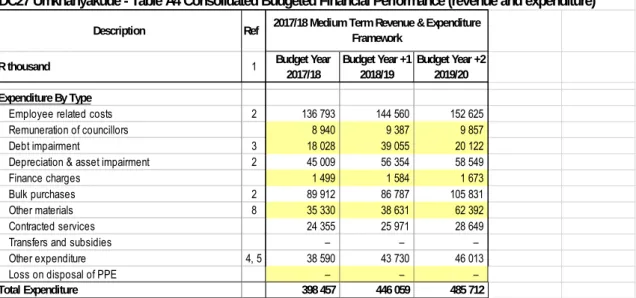

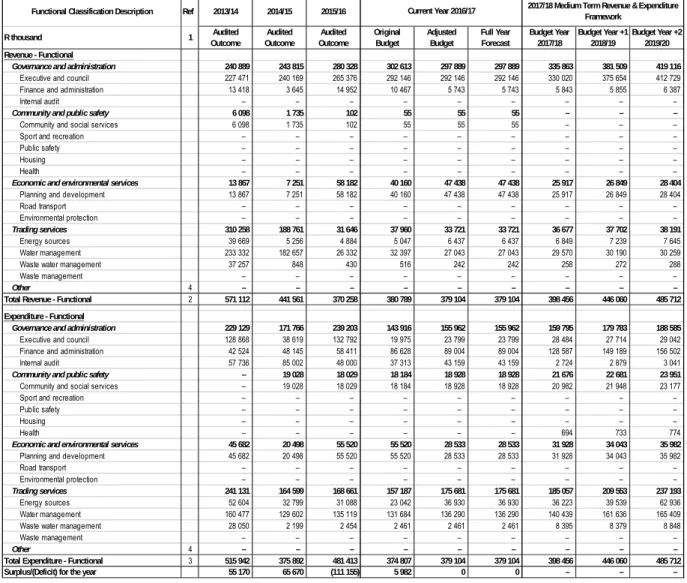

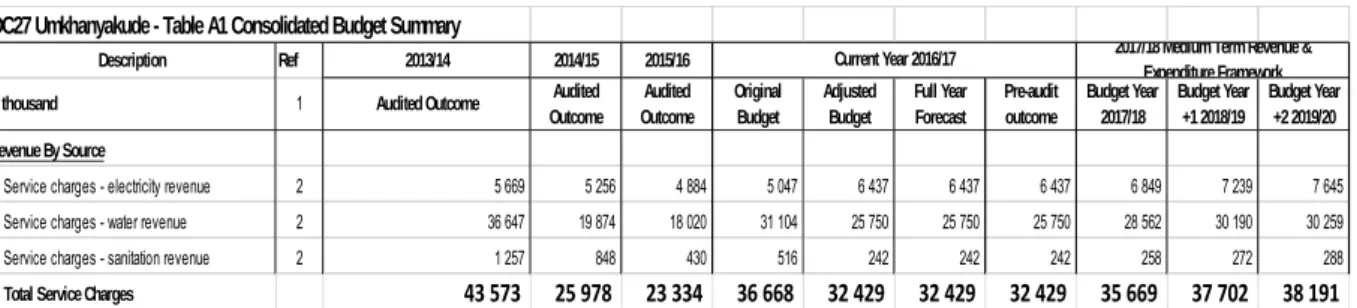

The consolidated operating income for both the parent municipality and the municipality unit is R398 million, 4.7 percent compared to the 2016-2017 adjustment budget. The total consolidated operating expenditure for the financial year 2017-2018 has been allocated with an increase of 1 per cent compared to the 2016/17 Adjustment Budget and with 9 per cent and 9 per cent for each of the respective external years of the MTREF.

Operating Revenue Framework

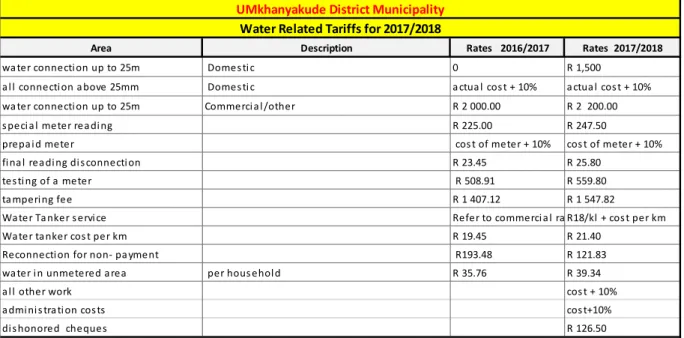

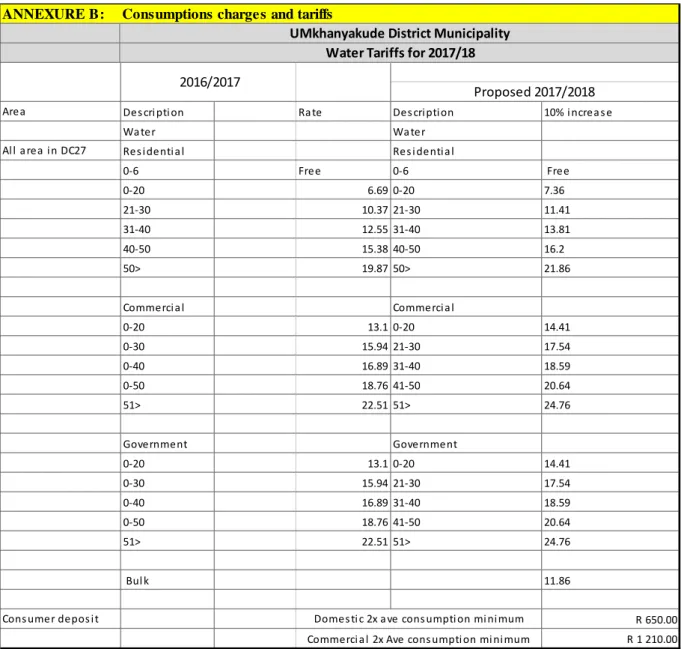

- Sale of water and impact on tariff increases

- Sale of electricity and impact on tariff increases

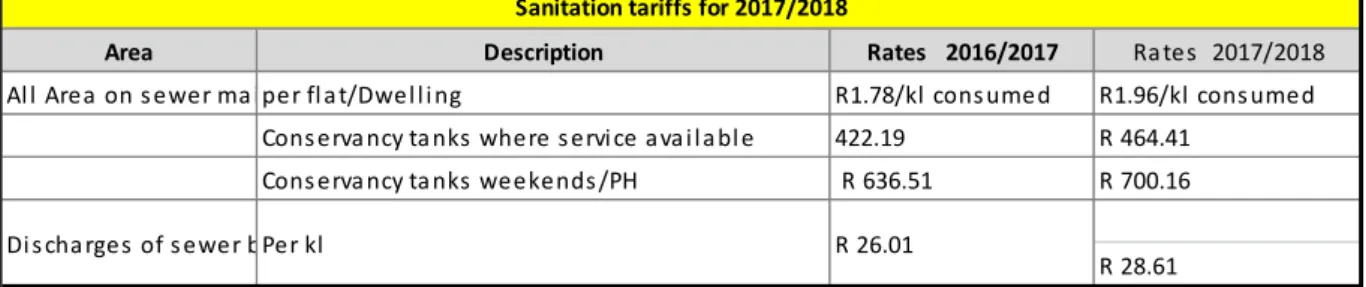

- Sanitation and impact on tariff increases

Revenue from services represents a significant percentage of the municipality's revenue basket. Now the municipality has increased its actual revenue, and the regular revenue budget has increased by 8 percent of total revenue.

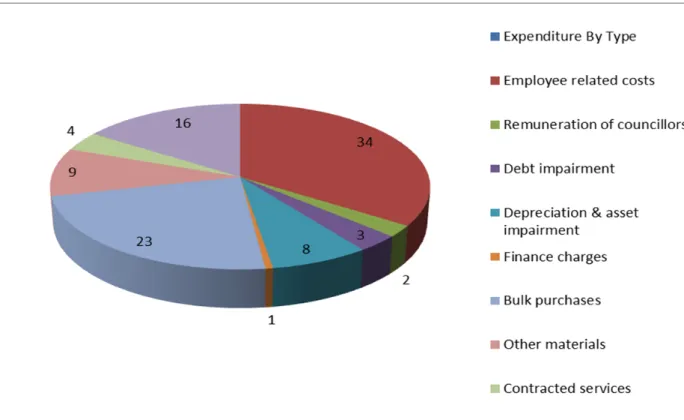

Operating Expenditure Framework

Budget allocations in this regard amount to R45 million for 2017-2018 and represent 11 per cent of total operating expenditure. It is the percentage of the increase in the comparable previous year's assets increase.

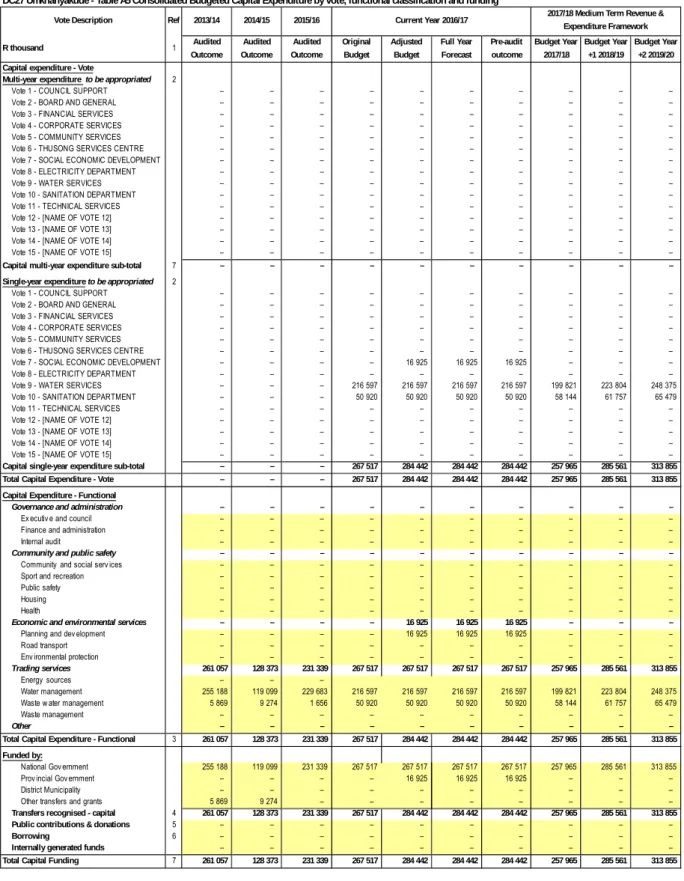

Capital expenditure

The increase is limited to 15 percent for the period 2017-2018, including other expenses of the economic entity. For the year 2017-2018, an amount of 257 million ALL has been allocated for infrastructure development, which is the total capital budget.

Annual Budget tables

- Strategic objectives

The outline of appropriate mechanisms, processes and procedures on how the public, stakeholders, state organs can participate in the drafting of the IDP and formulation of the budget structures that will be used to ensure this participation;. Indicate necessary organizational arrangements to ensure the successful implementation of the integrated development planning process;. Program that specifies how the process will be monitored to manage the progress of the IDP and budget processes.

While compiling the 2017-2018 MTREF, extensive financial modeling was undertaken to ensure affordability and long-term financial sustainability. The need for fee increases versus the community's ability to pay for services; Applied to the municipality, issues of national and provincial importance should be reflected in the municipality's IDP.

One of the key goals is therefore to ensure coordination between national and provincial priorities, policies and strategies and the municipality's response to these requirements. Amendments to the comprehensive development plan of the municipality are adopted by the municipal council with a decision in accordance with the rules of procedure and the decision of the council. All five local municipalities in the area of the quarter municipality should be consulted about the proposed amendment; and.

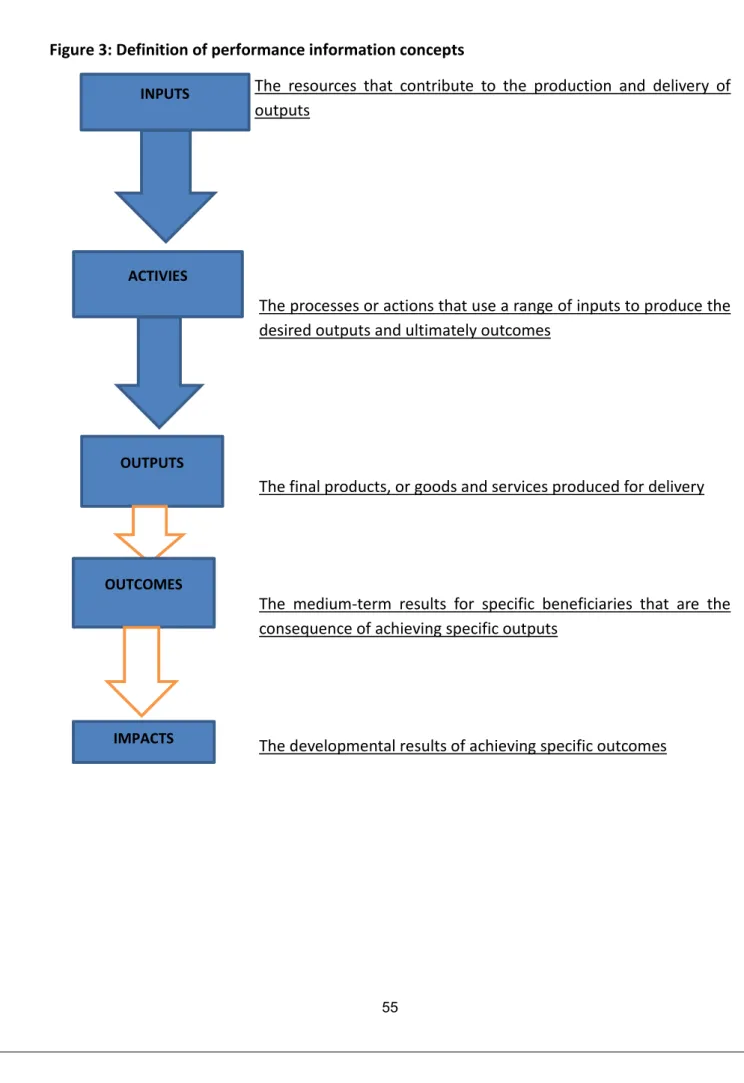

Measurable performance objectives and indicators

- Performance indicators and benchmarks

- Free Basic Services: basic social services package for indigent households

The municipality's performance is directly related to the extent to which it has been successful in realizing its goals and objectives, complied with legal requirements and met the expectations of stakeholders. The following table shows the main measurable performance targets that the municipality is committed to achieving in this financial year. Capital expenditure in local government can be financed by capital grants, own income, and the municipality does not plan to have long-term borrowing in 2017-2018.

The debt-to-equity ratio is a financial ratio that shows the relative proportion of equity and debt used to finance a municipality's assets. Ideally, the municipality should have adequate cash and cash equivalents to meet at least current obligations, which should be translated into a liquidity ratio of 1. The municipality managed to ensure that creditors are settled within the legally prescribed 30 days from the issuance of the invoice.

Although the liquidity ratio is a concern, the municipality has managed to meet this legal obligation through daily cash flow management. In terms of the council's poverty policy, registered households are entitled to 6kℓ water allowance. Further details regarding the number of households receiving free basic services, the cost of free basic services, the highest level of free basic services and the revenue costs related to the free basic services are included in Table 27 MBRR A10 (Basic Service Delivery Measurement). Note that the number of households in informal areas receiving free services and the cost of these services (e.g. water supply via downpipes, water tankers, etc.) are not taken into account in the table above.

Overview of budget related‐policies

- Asset Management Policy

- Supply Chain Management Policy

- Expenditure management policy

- Risk management framework and risk management policy

- Indigent policy

The asset management policy is therefore considered a strategic guide in ensuring a sustainable approach to asset renewal, repairs and maintenance and is used as a guide in the selection and prioritization of individual capital projects. In accordance with Article 111 of the Act on the Management of Municipal Finances, the Municipality of UMkhanyakuda no. 56 of 2003 decided to have and implement a supply chain management policy that enforces section 217 of the constitution. Empowerment (BBBEE) does not undermine the objective of uniformity in supply chain management systems between government bodies across the board; and is consistent with the national economic policy regarding the promotion of investments and business with the public sector, the responsibility for the implementation of the policy shall be assigned to the accountant of the municipality.

In terms of section 65 of the MFMA, the accounting officer of each municipality is obliged to take all reasonable steps to ensure that the expenditure, including its payments and financial documents, is properly controlled and managed. Risk management is recognized as an integral part of responsible management and the Institution therefore follows a comprehensive approach to the management of risk. It is expected that all departments/divisions, operations and processes will be subject to the risk management framework.

Effective risk management is imperative for the Institution to fulfill its mandate, the service expectations of the public and the performance expectations within the Institution. The delivery of basic services to the community is done in a sustainable manner, within the financial resources of the Council and to provide procedures and guidelines for the subsidization of service charges and rates to needy households, using part or all of the fair share for this purpose. The council also recognizes that many of the residents simply cannot afford to pay the required service charges and rates, and the council will make efforts to ensure affordability.

Overview of budget assumptions

The increase in the tariffs for bulk electricity by 10 percent and bulk water by 10 percent; The calculation of depreciation is based on the assumption that it will increase, as it was understated on the adjustment budget. The remuneration of councilors is in accordance with the Government Supporters' Remuneration Act in the Government Gazette.

However, for simplicity, the 2017-2018 MTREF is based on the assumption that all loans are undertaken using fixed interest rates for amortization style loans that require both regular principal and interest payments. The base assumption is that rate and rating increases over the long term will rise at a rate of the CPI. It is assumed that debtors' income will increase at a rate influenced by the consumer debtor's collection rate, rate/rate prices, real growth rate of the municipality, household formation growth rate and the weak household change rate.

The increase on salaries for 2017/2018 is based on the Bargaining Council's salary agreement which is CPI plus 1 per cent. The focus will be to strengthen the link between policy priorities and expenditure in order to ensure the achievement of the national, provincial and local objectives. It is estimated that a spend rate of at least 100 per cent on operating expenses and 100 per cent on the capital program for the 2017-2018 MTREF, the performance of which is factored into the cash flow budget, is achieved.

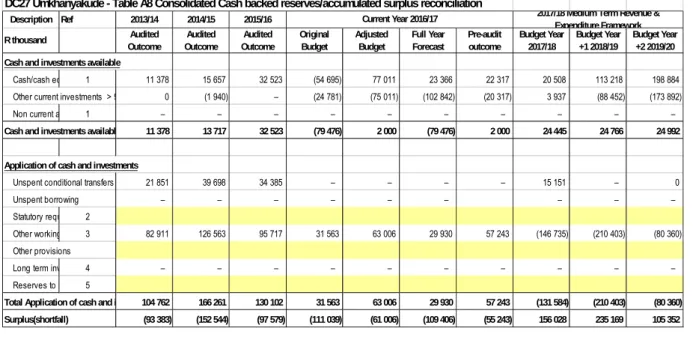

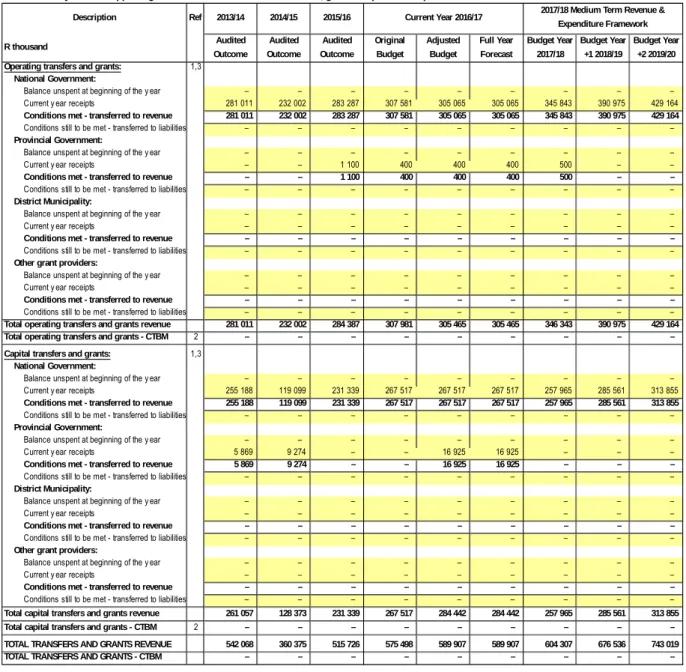

Overview of budget funding

It should be noted that these allocations are estimated conservatively and as part of the cash support of reserves and provisions. A deficit (applications > cash and investments) is indicative of non-compliance with section 18 of the MFMA requirement that the municipality's budget must be 'funded'. Usually, unless there are special circumstances, the municipality is obliged to return unspent conditional grant funds to the national revenue fund at the end of the financial year.

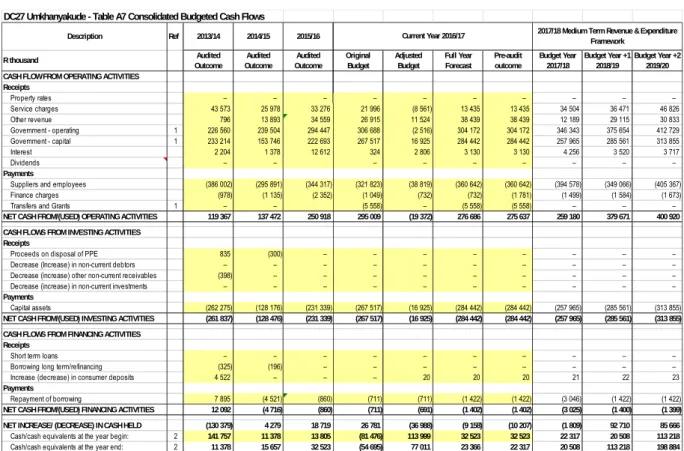

Any poor collection performance could put upward pressure on the municipality's ability to meet its debt obligations. Long-term investments mainly consist of capital assets for repayment of future loans. The following graph shows an analysis of trends in cash and cash equivalents and the reconciliation of cash-backed reserves/accumulated assets over a seven-year perspective.

The municipality's forecasted cash position was discussed as part of the budgeted cash flow statement. This trend will need to be closely monitored and managed with the implementation of the budget. This measure is intended to analyze the underlying assumed collection rate for the MTREF to determine the relevance and credibility of the budget assumptions contained in the budget.

Expenditure on grants and reconciliations of unspent funds

DC27 Umkhanyakude - Support Table SA22 Councilor and Staff Benefits Summary Employee and Councilor Summary. DC27 Umkhanyakude - Supporting Table SA23 Salaries, Allowances and Benefits (Political Office Holders/Councillors/Senior Managers). DC27 Umkhanyakude - Supporting Table SA26 Consolidated Monthly Budget Revenue and Expenditure (Municipal Vote) Description Ref.

There are currently no vacant positions in the upper management structure of the Water Services Department. The departmental strategy ensures that the economic value and useful life of the water network and infrastructure is maintained. The following three tables show details of the municipality's capital expenditure, first on new assets, then on renewal of assets and finally on repair and maintenance of assets.

The following three tables detail the municipality's investment program, first for new assets, then for repairs and maintenance. DC27 Umkhanyakude - Support Table SA34b Consolidated capital expenditures for renewal of existing assets by asset class. The municipality participates in the Municipal Financial Management Internship Program and has five interns in training in various parts of the Financial Services Department.

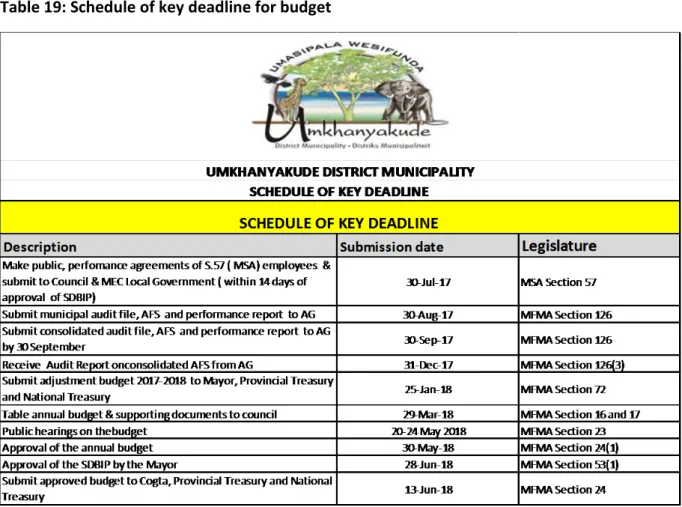

The detailed SDBIP document is at draft stage and will be finalized after approval by MTREF 2017/17 May 2017. DC27 Umkhanyakude – Supporting Table SA2 Consolidated Financial Performance Budget Matrix (Source of Revenue/Type of Expenditure and Department).

Councillor and employee benefits Table 37

Monthly targets for revenue, expenditure and cash flow

Annual budgets and SDBIPs – internal departments

Contracts having future budgetary implications

Capital expenditure details

Service charges - electricity revenue Service charges - water revenue Service charges - sanitation revenue Service charges - garbage revenue Service charges - other Rent of facilities and equipment List other sources of income if applicable List entity summary if applicable.

Legislation compliance status

Other supporting documents

Municipal manager’s quality certificate