The city's economic development strategy has put the city on a development path that prioritizes investment in infrastructure and promotes partnerships and investment with the private sector. city revenue. This is one of the largest private investments in the city on the Natal Command site on Durban Beach.

MAYOR’S REPORT (BUDGET SPEECH)1

Over the past four years, the municipality has expanded its water service network to reach approximately 98.65 percent of the city's population. The city supports the development of the cruise industry as part of the development of the maritime industry.

COUNCIL RESOLUTIONS 1

- BUDGET RELATED RESOLUTIONS

- ESTIMATES OF INCOME AND EXPENDITURE

- RECAPITULATION: VALUATION OF RATEABLE PROPERTY

- DETERMINATION OF RATES

- EXEMPTIONS, REBATES AND REDUCTIONS

- RESIDENTIAL PROPERTY

- PUBLIC BENEFIT ORGANISATIONS

- SCHOOLS NOT FOR GAIN

- BED AND BREAKFAST UNDERTAKINGS

- GUEST HOUSE UNDERTAKINGS

- BACK – PACKER LODGES, HOLIDAY ACCOMODATION AND STUDENT ACCOMMODATION

- NATURAL AND OTHER DISASTERS

- VACANT LAND

- MUNICIPAL PROPERTIES

- NATURE RESERVES AND CONSERVATION AREAS

- ECONOMIC DEVELOPMENT

- SPECIAL RATING AREAS

- CONSULATES

- PHASING IN OF RATES

- DATE OF OPERATION OF DETERMINATION OF RATES That this determination comes into operation on 1 July 2016

- FINAL DATE FOR PAYMENT OF RATES

- ADMINISTRATION CHARGE ON ARREAR RATES

- OTHER TARIFFS AND CHARGES

- SURCHARGE ON WATER CONSUMPTION AND SEWER USER CHARGE

- DOMESTIC WATER DEBT RELIEF PROGRAM

- DEBT RECOVERY USING THE 50/50% PREPAYMENT SYSTEM

- BUDGET RELATED POLICIES (i) RATES POLICY

- CAPITAL EXPENDITURE ESTIMATE

- BORROWINGS TO FINANCE THE CAPITAL BUDGET

- HOUSING/HOSTELS DEFICIT

- NEW FUNCTIONS/ SERVICES

- MEASURABLE PERFORMANCE OBJECTIVES

- INTEGRATED DEVELOPMENT PLAN (IDP)

- PARTICULARS OF INVESTMENTS

- REMUNERATION OF COUNCILLORS AND SENIOR OFFICIALS

- UNFUNDED MANDATES

- IMPACT OF HOUSING EXPENDITURE ON THE CASH RESERVES

- FREE BASIC SERVICES

- OFF BALANCE SHEET FINANCING

- EXECUTIVE SUMMARY 1

This authorization must be requested from the Council for the lease of the corresponding long-term debt in the sense of Article 46 of the Act on the Management of Municipal Finances no. 56 of 2003 for partial financing of the municipal capital budget during the MTREF period. i) That the estimated formal housing shortfall of R30 million for the 2016/2017 financial year be met from the Rate Fund. ii) that the estimated shortfall in new housing and hostel construction of R457.4 million be met from the Rate Fund. iii). That the revised municipal integrated development plan (IDP) was submitted together with the budget in terms of section 17(3)(d) of the Act on the Management of Municipal Finances no. 56 of 2003 be adopted.

- INTRODUCTION

- STRATEGIC PRIORITIES FOR THE 2016/2017 YEAR

- PERFOMANCE, ACHIEVEMENTS AND CHALLENGES

- SERVICE DELIVERY

- SERVICE DELIVERY STANDARDS, LEVELS OF SERVICES, OUTCOMES, TIMETABLE FOR ACHIEVEMENTS AND FINANCIAL IMPLICATIONS

- FINANCIAL PERFORMANCE (2014/15 AND 2015/16): PARENT MUNICIPALITY

- OPERATING BUDGET

- CAPITAL BUDGET

- ALIGNMENT WITH NATIONAL AND PROVINCIAL PRIORITIES

- FINANCIAL STRATEGY, ONGOING VIABILITY AND SUSTAINABILITY

- FINANCIAL STRATEGY

- BUILT ENVIRONMENT PERFORMANCE PLAN ( BEPPS )

- MUNICIPAL SERVICE FINANCIAL MODELLING FOR ETHEKWINI

- CITY INFRASTRUCTURE DELIVERY MANAGEMENT SYSTEMS (IDMS)

- OPERATING REVENUE FRAMEWORK 1

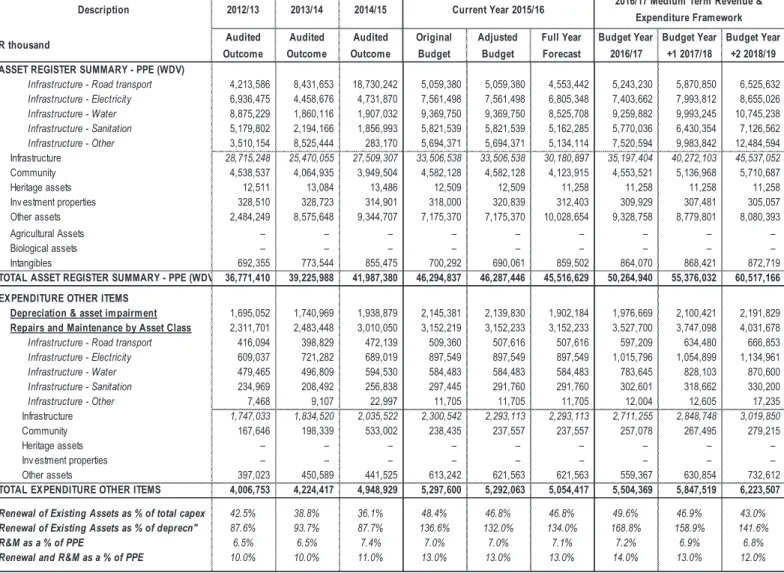

The municipality has continued to accelerate the delivery of houses despite some of the compliance challenges encountered in the past. The Municipality's depreciation policy is in accordance with the requirements of the Generally Recognized Accounting Practice Standards (GAAP).

SOURCES OF FUNDING

For two years the stadium has been managed through a service agreement with Durban Marine Park. After extensive consultation and consideration of all possible models, it was preferred that the MMS be integrated with the International Convention Centre.

OPERATING EXPENDITURE FRAMEWORK 1

CAPITAL EXPENDITURE 1

CAPITAL BUDGET

- HUMAN SETTLEMENTS, ENGINEERING, TRANSPORT AND INFRASTRUCTURE

- CORPORATE AND HUMAN RESOURCES

- SUSTAINABLE DEVELOPMENT AND CITY ENTERPRISES

- GOVERNANCE

Business Support Business Projects: R 14.3m Travel and Tourism Trade Show: R 15.2m Durban Business Fair and Regional Shows: R 31m Bid Support and Presentations: R 4.1m. Security costs for the protection of assets: R 45,3 m Provision for VIP pit latrine clearance: R 43,9 m Water consumption at Ablution facilities: R 72,6 m.

ANNUAL BUDGET TABLES

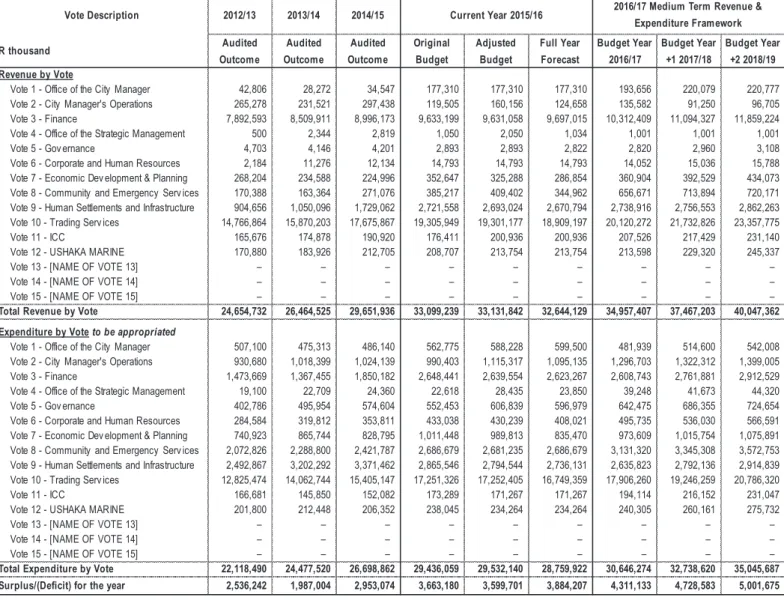

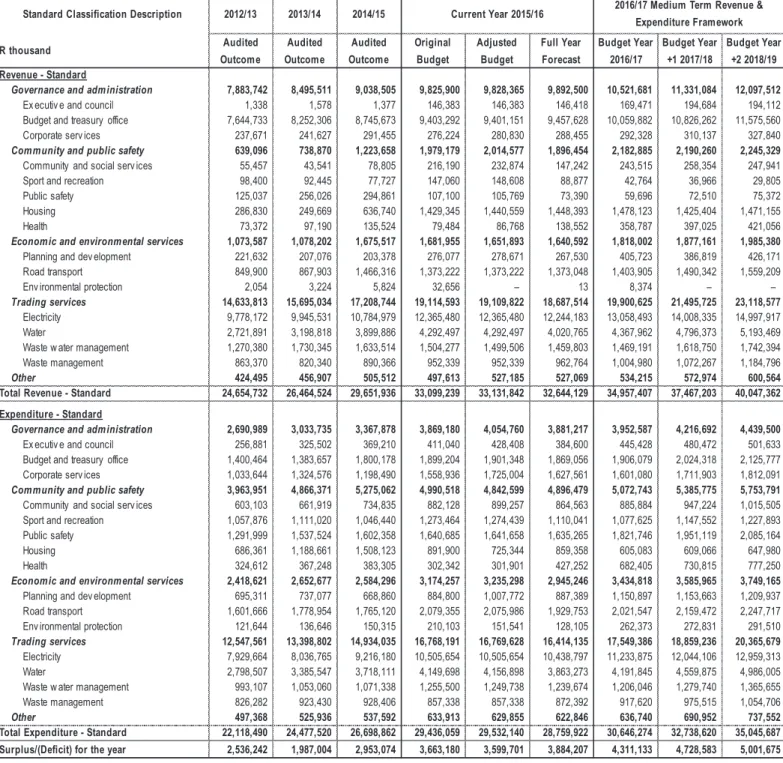

The table contains an overview of the amounts that must be approved for business success, as well as the municipality's commitment to eliminating backlogs in the provision of basic services. This requires a simultaneous assessment of financial performance, financial position and cash flow budgets along with capital budgeting. Although the council places great emphasis on the financial sustainability of the municipality, this does not come at the expense of services for the poor.

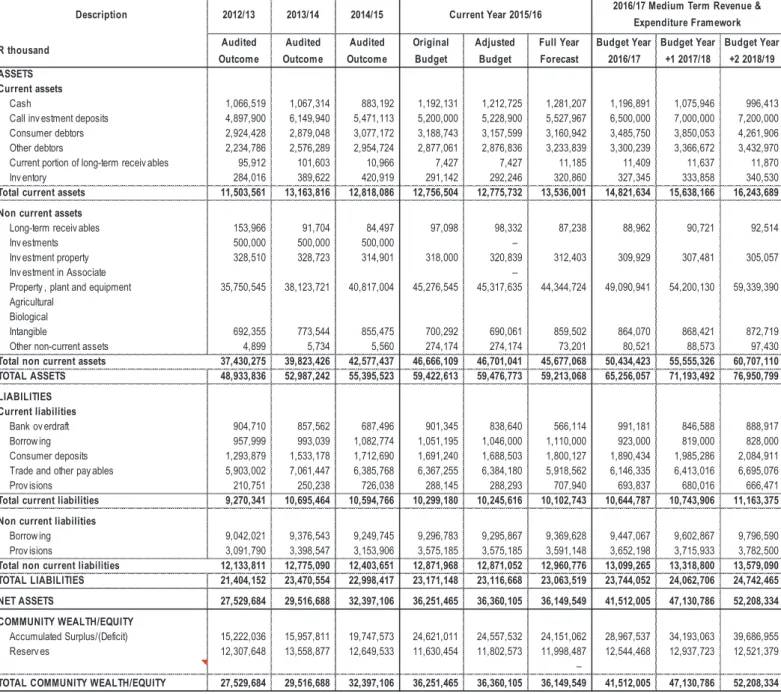

This table facilitates the visualization of budgeted operational performance in relation to the organizational structure of the city. The reasoning is that the ownership and net assets of the municipality belong to the community. As an example, the collection rate assumption will affect the municipality's cash position and then inform the level of cash and cash equivalents at the end of the year.

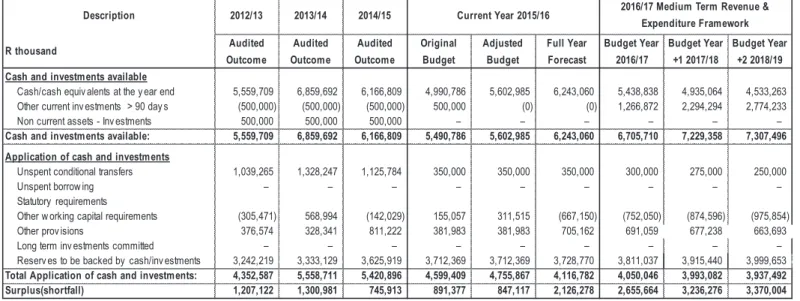

The table essentially estimates budget funding levels by first forecasting cash and investments at the end of the year and then reconciling available funds with existing liabilities/commitments.

OVERVIEW OF THE ANNUAL BUDGET PROCESS 2

- OVERVIEW

- PROCESS FOR CONSULTATIONS WITH EACH GROUP OF STAKEHOLDERS AND OUTCOMES

- SCHEDULE OF KEY DEADLINES RELATING TO THE BUDGET PROCESS

The mechanism by which the needs of the municipality are identified and priorities are set is the Integrated Development Plan (IGP). Both the operating and capital budgets were evaluated through a prioritization mechanism that ensures alignment with the development strategy of the municipality. The key to strengthening the link between priorities and spending plans lies in improving political oversight of the budget process.

Section 53(1) (a) of the MFMA states that the mayor of a municipality must give political guidance on the budget process and the priorities that must guide the preparation of the budget. Political oversight of the budget process enables the government, and especially the municipality, to manage the tension between competing policy priorities and fiscal realities. Consequently, the presentation of the draft budget in the council on 31 March 2016 was followed by extensive publication of the budget documentation in the council's newspaper, Metro eZasegagasini.

The table below provides an extract of the key deadlines in relation to the budget process which needed to be reviewed and amended due to the local government elections which do not take place until August 2016.

OVERVIEW OF ALIGNMENT OF BUDGET WITH IDP 2

- KEY NATIONAL AND PROVINCIAL GUIDING DOCUMENTS

- DEVELOPMENT CHALLENGES

- MUNICIPAL STRATEGIC PRIORITY AREAS

- IDP OVERVIEW AND KEY AMENDMENTS

- IDP REVIEW PROCESS AND STAKEHOLDER PARTICPATION

- LINK BETWEEN THE IDP AND THE BUDGET

- MEASURABLE PERFORMANCE OBJECTIVES AND INDICATORS 2

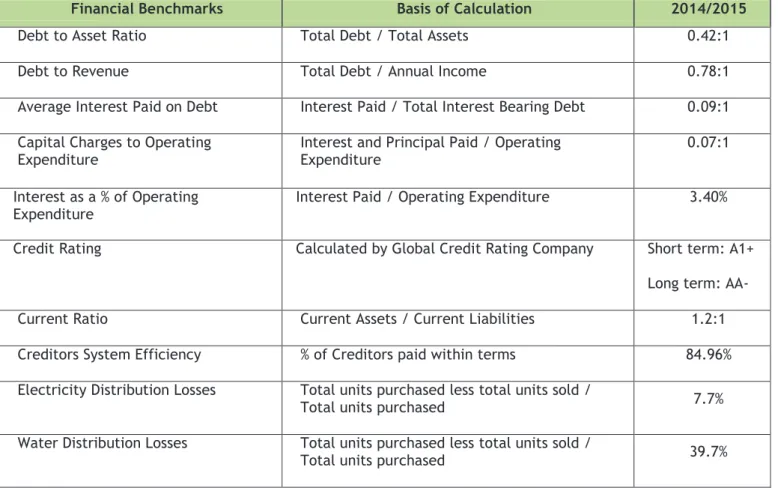

- KEY FINANCIAL RATIOS / INDICATORS

- FREE AND SUBSIDISED BASIC SERVICES

- DRINKING WATER QUALITY AND WASTE WATER MANAGEMENT

- OVERVIEW OF BUDGET RELATED POLICIES 2

The municipality is currently working with its international partners to develop the Sustainable Development Goals and Indicators that would be adopted in 2016. In the speech, the Prime Minister listed the priority interventions that remain the basis of the Provincial Growth and Development Plan. Given the strategic framework outlined, it is clear that the city's budget should be a growth-enhancing budget that meets basic needs and builds on existing skills and technology. The municipality's delivery plan is organized into eight separate but related plans.

These priorities lead to the creation of structures that support, house and associate other actions and activities – the building blocks around which actions and prioritization take place. All operating and capital programs in the 2016/17 medium-term budget were assessed through a prioritization mechanism developed to ensure alignment with the development strategy of the municipality. The municipality is committed to addressing the needs of the people and values the input of communities and stakeholders.

The creation of a new five-year plan in 2017/18 would provide an additional opportunity for citizens to actively participate in the development of the IDP.

- ASSESSMENT RATES POLICY

- CREDIT CONTROL AND DEBT COLLECTION POLICY

- TARIFF POLICY

- WATER POLICY

- SUPPLY CHAIN MANAGEMENT POLICY

- INVESTMENT / CASH MANAGEMENT AND BORROWING POLICIES

- VIREMENTS BUDGET POLICY

- ASSET MANAGEMENT PLAN

- ACCOUNTING POLICY

- FUNDING AND RESERVES POLICY

- BUDGET POLICY

- OVERVIEW OF BUDGET ASSUMPTIONS 2

The policy reflects and represents the context of a specific government policy that is expressed within the provisions of the Municipal Finance Management Act 56 of 2003. chain management. In accordance with regulations and National Treasury Circulars, the policy has been reviewed and approved by the board.

Highlights of the policy include a contract register that ensures procurement plans are in place before any work is outsourced. To comply with Article 28 of the MFMA and the Municipal Budget and Reporting Regulation, procedures have been drawn up with regard to the transfer of funds and the adjustment budget reporting. The purpose of the Asset Management Plan is to improve the management of the city's assets, predict future asset problems and identify future maintenance costs of all infrastructure assets.

In order to ensure that the financial statements comply with GRAP, the accounting policy was realigned and approved by the board on 2006-06-29.

- KEY FINANCIAL ASSUMPTIONS

- BORROWING AND INVESTMENT OF FUNDS

- TIMING OF REVENUE COLLECTION

- AVERAGE SALARY INCREASES

- CHANGING DEMAND CHARACTERISTICS (DEMAND FOR SERVICES)

- ABILITY OF THE MUNICIPALITY TO SPEND AND DELIVER ON THE PROGRAMS

- COST OF SERVICE DELIVERY VS AFFORDABILITY

- OVERVIEW OF BUDGET FUNDING 2

- LOAN DEBT AND INVESTMENTS

- SOURCES OF FUNDING

- SAVINGS AND EFFICIENCIES

- INVESTMENTS – CASH BACKED

- COLLECTION RATES FOR EACH REVENUE SOURCE

- LEVELS OF RATES, SERVICE CHARGES AND OTHER FEES AND CHARGES

- GRANT ALLOCATIONS 2

The 2016/17 Capital Budget of R 6.6 billion is financed by R 3.6 billion from government grants, R 2.0 billion of internally generated funds and R 1.0 billion in external loans. The chart below shows the Total Capital Budget since 2010 and indicates its funding sources. Cash that is surplus to immediate requirements is invested in short-term money market instruments in terms of a strict investment policy that specifies that cash holdings are only placed across 'the big 4' South African banks and Investec. Cash and investments are expected to be around R 5.0 billion at the end of the current financial year.

The contract register is used to control all payments over R200,000. The first phase of contract register automation has been completed as the contract register is now located in the JDE accounting system and the 2015/16 contract register will come from the JDE-Lite system. With the upgrade of the JDE system to the Enterprise One platform (JDE –E1) scheduled for July 1, 2016, unit managers are expected to review the contract register and sign it 100% by June 30, 2016. The second phase of the contract register, which handles all contracts under R200 000, started in 2015/16. The main goal of this project is the analysis of trends in consumption and prices, which will be included in the municipal price catalog SCM.

Therefore, the determination of the effective property rate fee is an integral part of the municipality's budgeting process.

LEGISLATION COMPLIANCE STATUS 2

SERVICE DELIVERY AND BUDGET IMPLEMENTATION PLAN (SDBIP) 2

STATISTICAL INFORMATION 2

CONSOLIDATED BUDGET

DETAILED

BUDGET SUPPORTING TABLES

ETH eThekwini - Supporting table SA12a Property rates by category (current year) Description Resi.Indust.Bus. ETH eThekwini - Supporting table SA12b Property rates by category (budget year) Description Resi.Indust.Bus. ETH eThekwini - Support Table SA16 Investment Data by Maturity Investments by Maturity Investment Period Capital Guarantee (Yes/No) Variable or Fixed Interest Rate Interest Rate 3.Commission Paid (Rands)Commission Payee Opening BalanceInterest Wanted to be realized Part of the prepayment Name of the institution and investment IDY/Month Parent Municipality Funds Reinvestments - Deposits Various Fixed Yes Fixed No No Various Subtotal of the Municipality Subjects Subjects Subtotal – – – – TOTAL INVESTMENTS AND INTERESTS.

ETH eThekwini - Support Table SA22 Councilor and Employee Benefits Summary of Employee and Councilor. ETH eThekwini - Support Table SA23 Salaries, Allowances and Benefits (Political Office Holders/Council Members/Senior Managers). Ngwanase Business Enterprise Mths 24 Re-installation of retro-reflective road markings on various roads in the Northern region 01 October Ngwanase Business Enterprise Mths 24 Re-installation of retro-reflective road markings on various roads in the Western region 1 October 2017 2,065.

Nyeleti Consulting Mths 24 Inspection of stormwater infrastructure in the West Central region November 18 Nyeleti Consulting Mths 24 Inspection of stormwater infrastructure in the West region November 18 BMK consulting Mths 24 Inspection of stormwater infrastructure in the North Central region November 13 BMK consulting Mths 24 Inspection of stormwater infrastructure in the South Central region 13 November 2017 2,939. ETH eThekwini - Support Table SA34b Capital Expenditures for the Renewal of Existing Assets by Asset Class. ETH eThekwini - Support Table SA36 Detailed Capital Budget Municipal Vote/Capital Project Individually Approved (Yes/No) Asset Class Asset Subclass GPS Coordinates R Thousand6335 Verified Result 2014/15 Current Year 2015/16 Full Year Forecast.