DESCRIPTION OF THE INDUSTRY

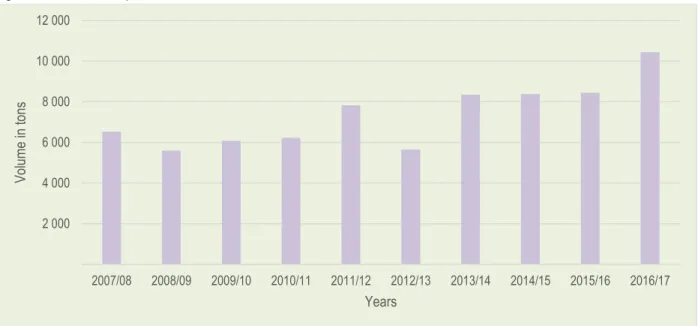

- Production volumes

- Production areas

- Litchi cultivars planted in South Africa

- Employment

Lietsjie is a minor crop in South Africa and covers an estimated total area of 1 124ha. Lychee cultivars grown in South Africa are divided into three main groups: Mauritius group, Chinese group and the Madras group.

MARKET STRUCTURE

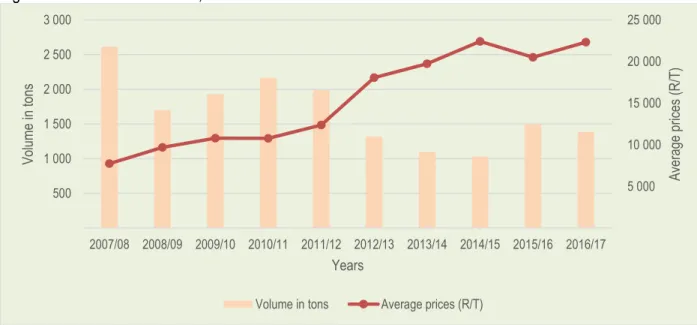

- Domestic market sales and prices

- Exports

- Provincial and district export values

- Share analysis

- Imports

- Litchi harvesting and post-harvest treatment

- Harvesting

- Post-harvest treatment

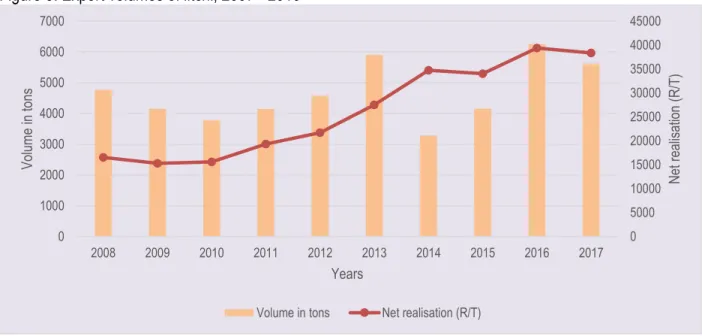

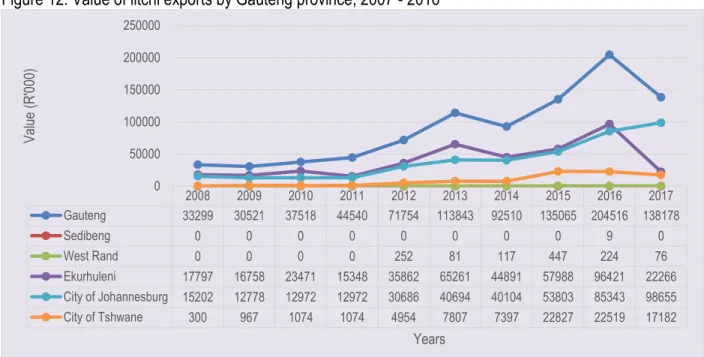

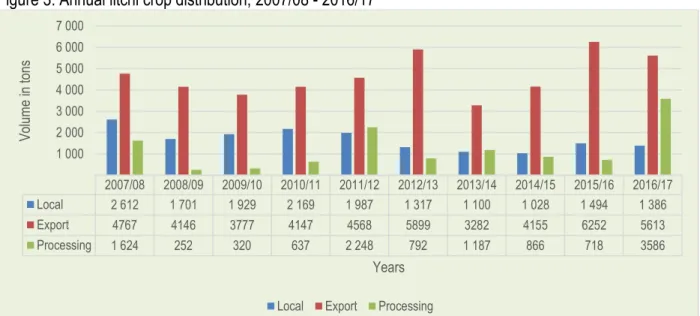

- Litchi drying

Total volumes and net realization for South African litchi exports from 2008 to 2017 are shown in Figure 5. Values of litchi exports from each South African province for the period 2007 to 2016 are shown in Figure 11. Figures 12 – 20 show the value of litchi exports from different districts in each of the nine provinces of South Africa.

The value of litchi exports from Kwazulu Natal fluctuated greatly during the period under review. The shares of district litchi exports to the total Western Cape provincial litchi exports are presented in Table 3. The shares of district litchi exports to the total Gauteng provincial litchi exports are presented in Table 5.

The two counties accounted for 88.9% of the total lychee export value recorded by Gauteng in 2016. The remaining lychee exports (18%) recorded in Kwazulu Natal in 2008 were from UThukela Municipality. All lychee exports recorded in the Free State in 2012 were from Xhariep District Municipality.

The shares of district lychee exports to total North West provincial lychee exports are presented in Table 9. Almost all (95%) litchi exports recorded in the North West Province during 2016 were from Bojanala District.

GROWTH, VOLATILITY & STABILITY ANALYSIS

Export fruit must have a minimum diameter of 30 mm and all low quality fruit must be removed. The fruit loses its red color and turns brown within a few days at room temperature. Low temperature means keeping the fruit at 1˚C and is the most effective means of facilitating long-term storage as it prevents excessive moisture loss and helps the fruit retain its skin color.

As with other agricultural crops, it is important to develop processed products if additional marketing opportunities are to be created. In South Africa, the cultivar found to dry into a tastier dried product is McLean's Red. The characteristics of the international processed fruit market and the fresh fruit export orientation of the local industry suggest that it makes the most sense to develop a high quality product aimed at the local tourist market as well as export markets.

The dried product must be suitably packaged and labeled to ensure attractiveness in the eyes of the final consumers. As shown in Table 12 above, the litchi industry experienced a positive growth rate from 2007 to 2016 in terms of values while with the exception of production volumes of sales at the NFPMs and export volumes which experienced negative growth over the same period. Low volatility was indicated by coefficients of variation that were less than one (<1).

MARKET INTELLIGENCE

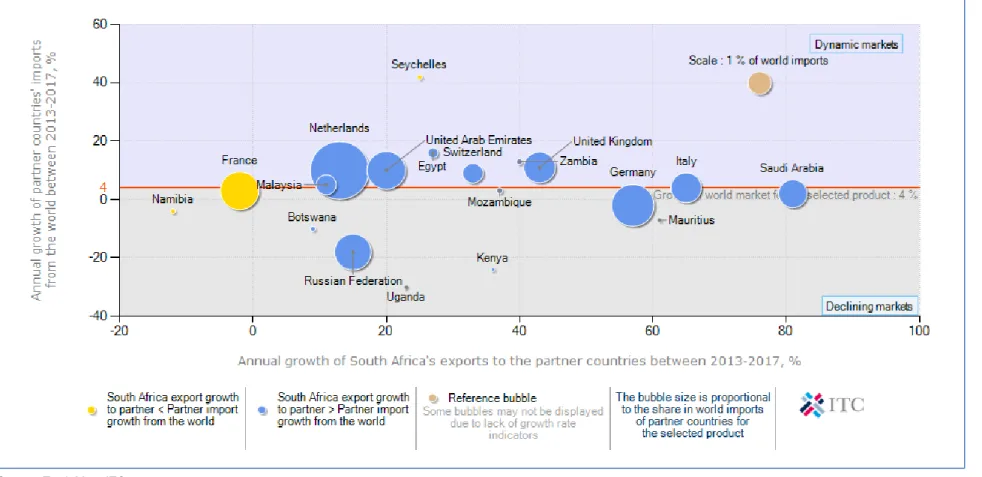

South African lychee exports are growing, while world imports are declining in Russia, Botswana, Mauritius and Ireland. At the same time, South African lychee exports have fallen faster than world imports in France. South Africa's lychee exports have been declining, while world imports are rising faster in the Netherlands, Switzerland, Egypt and the Seychelles.

The United Kingdom, the Netherlands and Kenya have a larger market share of South African lychee exports. In terms of market size, China was the largest importer of lychees in 2016 with just over US$757 million (983 million tons) of lychee imports, or about 26.9% of the global lychee market. Vietnam is followed by the Netherlands with just over $207 million (60,499 tons) of lychee imports, or about 7.3 market share.

It is interesting to note that litchi exports in China achieve lower unit prices ($876 per ton) than in the Netherlands ($3,423 per ton). While three countries dominate world lychee imports, it is interesting to note that countries such as Kuwait along with Lebanon and Qatar experienced higher annual growth rates in terms of lychee imports from. It is also important to note from Figure 21 that litchi imports from the world to countries such as Lithuania, Russia, Korea and have decreased between 2012 and 2016 and as a result these countries have recorded negative growth in terms of litchi imports from the world.

MARKET ACCESS

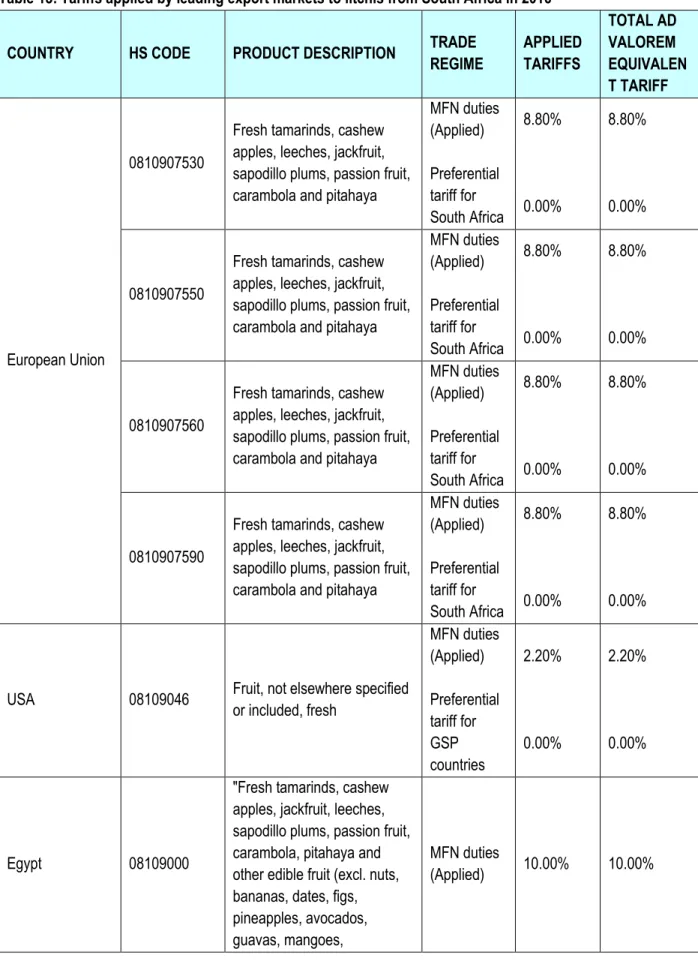

T EQUIVALENT TARIFF OF TOTAL AD VALOREM mangosteens, papaws .. citrus fruits papayas, grapes, melons, apples, quinces, apricots, cherries, peaches, plums, sloes, strawberries, raspberries, mulberries, blackberries, blackberries, Vaccinium berries, kiwi and durian . As can be seen in Table 12, South African litchis enjoyed free market access in all ten major markets during 2014. South Africa has a preferential trade agreement with the European Union through the trade chapter of the Development and Cooperation Agreement of Trade (TDCA).

From the table above it can be observed that South African songs enter the European Union duty free. The United States of America also has a preferential tariff for GSP countries for which South African songs qualify. Egypt, Seychelles and Kenya impose tariffs of 10%, 15% and 25% ad valorem respectively on litchis originating from South Africa.

Mozambique also has a preferential rate for lychees from South Africa, which means that South African lychees enter tax-free. South African lychees also enter Singapore, the United Arab Emirates and Hong Kong duty-free. In reality, rates for South Africa are likely to be much lower when considering the preferential agreements, but at the same time most rate structures are very complex, with quotas, seasonal rates and specific rates (an amount per unit rather than a percentage of value) all of which contribute to many different tariff lines and often higher duties due than initially anticipated.

DISTRIBUTION CHANNELS IN EXPORT MARKETS

The review of the agreement under the auspices of the Economic Partnership Agreement (EPA) negotiations between SADC and the EU expanded the scope of product coverage. Switzerland also has a preferential trade agreement with SACU member states, through which litchis from SACU member countries enter Switzerland on a duty-free basis. It must also be remembered that most tariffs are intended to protect domestic industries and as such are likely to discriminate against those attempting to compete with the domestic producers of that country.

They will also market the goods in their own name or on behalf of the member, which includes taking care of labelling, bar-coding, etc. In most cases, export organizations will enter into collective agreements with freight forwarders, negotiating better prices and services (more regular shipping, lower peak season prices, etc.). Some countries have institutions that deal with all production (compulsory membership) and sell only to a limited number of selected importers.

Agents will establish contacts between producers/exporting organizations and buyers in the importing country, and will usually take between 2% and 3% commission. They will also be responsible for clearing the products through customs, packaging and ensuring label/quality compliance and distribution of the products. The contract importers of fruit harvesters market and distribute the products of the harvesters, clear them through customs and in some cases treat and package them.

LOGISTICS

Mode of transport

In contrast, an importer will buy and sell its own capacity and bear the full risk (except for shipping). Few exporters have long-term contracts with wholesalers who supply directly to retail stores, but with the increasing importance of standards (EUREGAP etc.) and the availability of fruit all year round, the planning of long-term contractual relationships is expected to increase.

Cold chain management

For example, if temperatures rise above the required levels during the transport of products, this can lead to delays in cooling products back. Re-chilling is an additional expense and significant weight loss occurs with the re-chilled fruit. To monitor such issues, the subtropical fruit sectors persuaded the PPECB to appoint a technical officer to monitor port issues and report directly to the relevant sectors.

Packing and palletizing

ORGANISATIONAL ANALYSIS

The South African Subtropical Growers’ Association (Subtrop)

Strength, Weakness, Opportunities and Threats (SWOT) analysis

The generic promotion of South African lychee through the quality mark (SALGA Quality Approved Litchis) was successful. Cooperation between leading exporters has ensured a constant supply to meet the basic needs of the market. Port capacity and shipping cycles remain a risk, as delays can drastically reduce litchi's shelf life.

There is a strong demand in the Netherlands and the rest of Europe in the summer months.

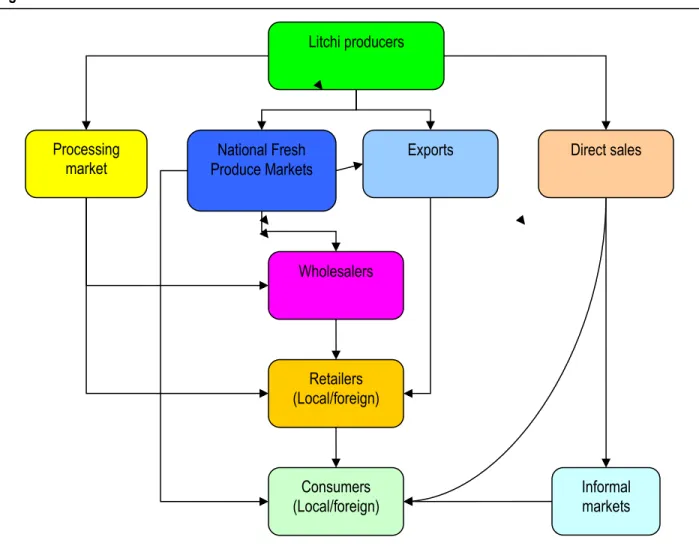

The litchi value chain

- Suppliers of inputs and farming requisites

- Producers

- Fresh produce markets

- Retailers

- Processors

- Cold storage operators and transporters

- Exporters

- PPECB

- Terminal and port operators

Consistency, reliability of supply and production of varieties according to market demands at affordable prices are also important aspects of the producer's responsibility and business activity. FPMs are the dominant player and form of wholesale in the South African lychee and fresh fruit and vegetable (FFV) sector. Carriers serve as a key link in the fresh fruit supply chain by facilitating the physical transfer of produce between parties such as the producer, cold store and terminal operator.

To realize this, the exporter needs to communicate with many of the actors in the logistics chain (refrigerators, transporters, shipping lines, port terminals, clearing and forwarding agents, PPECB, regional producer associations and special market inspectors, etc.). ). The main organization dealing with the export of fruit in South Africa is the Fresh Produce Exporters Forum (FPEF). In terms of the PPECB Act (Act 9 of 1983), the PPECB is responsible for the "control of perishable products intended for export from the Republic of South Africa".

The PPECB also acts as the government's "agent" within the meaning of the Agricultural Products Standards Act (APS) (Act 119 of 1990) and is responsible for the "control of the sale and export of agricultural and allied products". As there is a greater focus on food safety and buyers are demanding higher quality standards, the PPECB and other inspection bodies are playing an increasingly important role in the export of fresh produce from South Africa. Terminal operators must notify exporters, PPECBs and other relevant parties in the supply chain such as carriers, producer associations, manufacturers and cold stores of port-related delays such as labor strikes, wind delays, terminal congestion and other traffic disruptions in port, which will affect the flow of fresh products to and from the port.

ACKNOWLEDGEMENTS