DESCRIPTION OF THE INDUSTRY

- PRODUCTION AREAS

- PRODUCTION TRENDS

- CONSUMPTION VS PRODUCTION

- EMPLOYMENT

- IMPACT TO THE FEED SECTOR

The contribution of different provinces to total South African egg production is shown in Figure 2 below. Gauteng is the largest producer of eggs in South Africa with a 25% market share, followed by the Western and Northern Cape with 23%, the Free State with 16%, the North West Province with a 12% share and KwaZulu-Natal with 10%. Egg production follows consumption areas, as eggs are perishable and cannot be transported long distances.

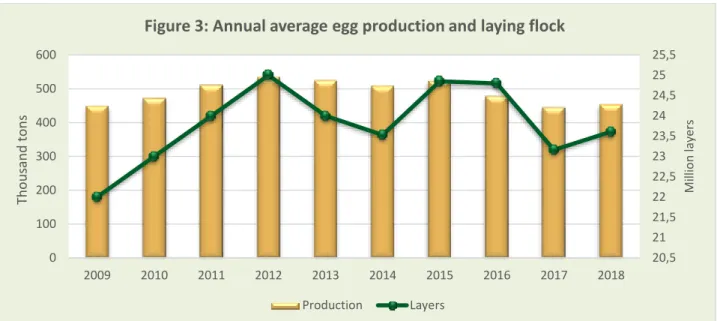

The production of eggs and laying hens over the past decade is illustrated in Figure 3 below. The production of eggs and the number of laying hens has fluctuated in the past decade. Other reasons include increased marketing by egg producers, price competitiveness compared to other proteins on the market and a still low consumption per per capita of eggs compared to other economies in the world.

MARKET STRUCTURE

DOMESTIC MARKET AND PRICES

Consumption and production decreased from 2012/13 to 2013/14, which may be due to higher feed costs and higher egg prices for consumers. Farms were restocked in 2018 following the culling of flocks in 2017 during an influenza outbreak, so there was an increase in 2017/18. The egg industry is one of the main clients of the Animal Feed Manufacturers Association (AFMA).

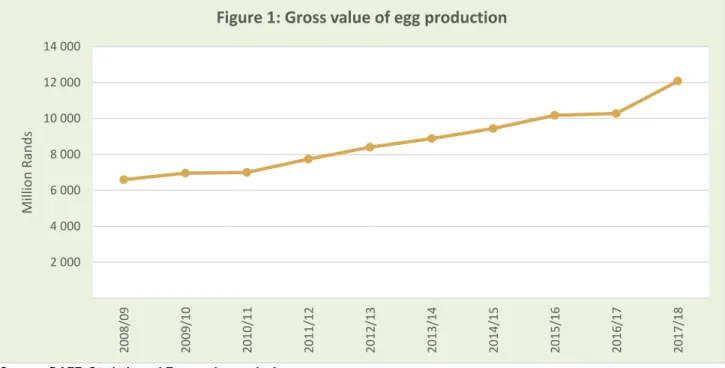

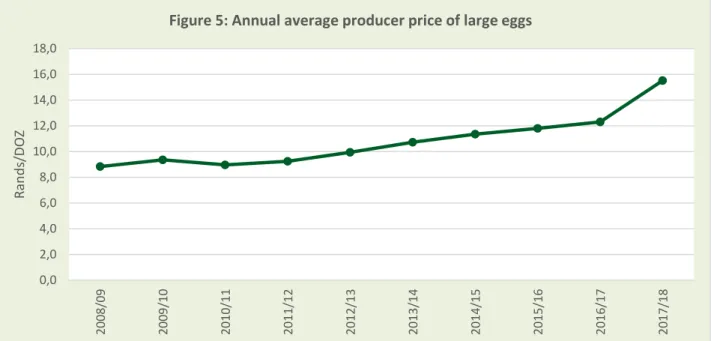

The price of eggs rose continuously throughout the production years and reached the new high of R15.50 per kg in 2017/18. This increase may have been caused by the shortage of eggs due to recent drought coupled with the HPAI outbreak.

IMPORT – EXPORT ANALYSIS

- EXPORTS OF EGGS

- IMPORTS OF EGGS

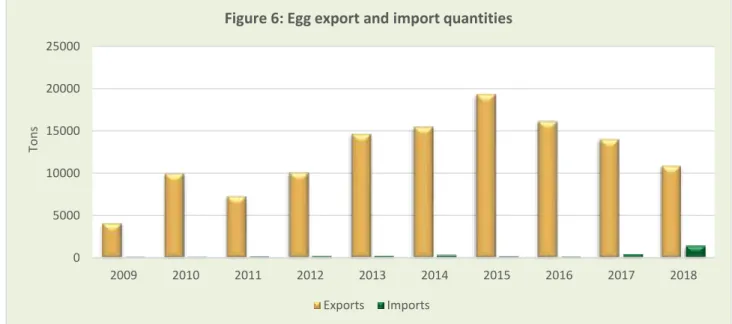

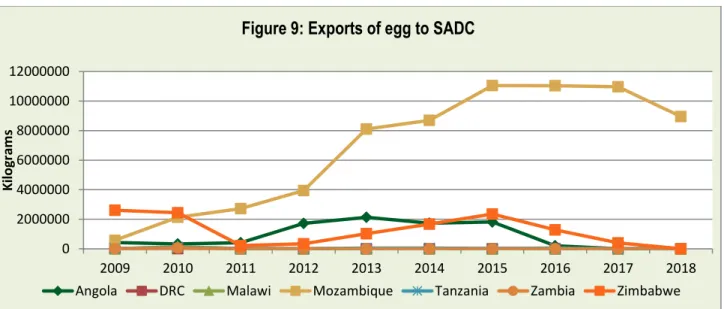

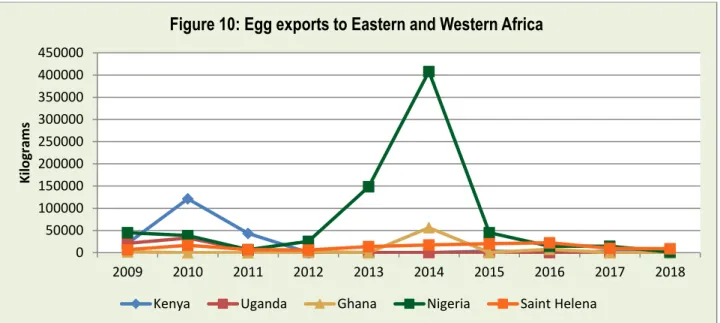

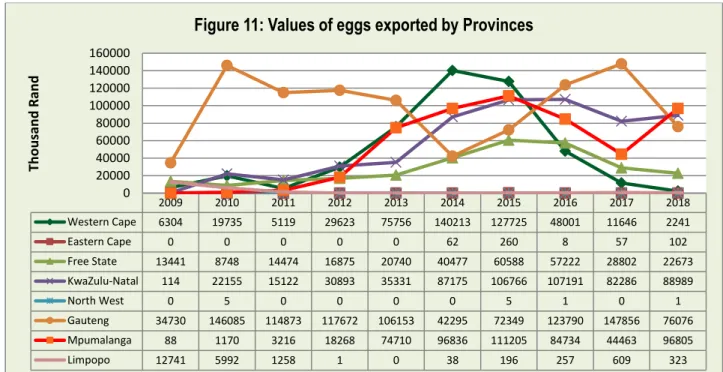

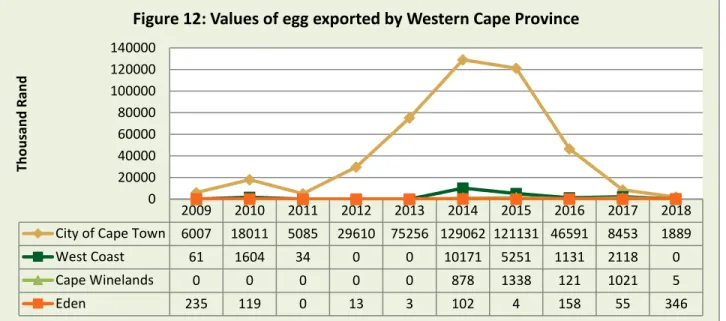

Egg exports from South Africa to East and West Africa over the past ten years are shown in Figure 10. Egg exports to these areas under consideration have been minimal over the past four years. The value of egg exports from South African provinces is presented in Figure 11 to Figure 19.

During the last decade, Gauteng province had the highest egg export share except in 2014 and 2015. In the Eastern Cape province, intermittent egg exports were recorded during the period under study (see Figure 13). Egg exports from the Gauteng Province originated mainly from the City of Johannesburg Metropolitan Municipality as illustrated in Figure 17 above.

The City of Johannesburg recorded the highest egg export values throughout the period under review except for 2018. Regular egg exports were also recorded by Tshwane Metropolitan Municipality and Ekurhuleni District Municipality and irregular values were recorded by the municipalities of Sedibeng and West Rand District.

THE EGG VALUE CHAIN

Egg production begins with the importation of genetic stock (known as grandparents) into South Africa as day-old chicks. Lohmann SA imports the Lohmann genetic stock (known as Lohmann Brown and Silver grandparents) into South Africa as day-old chicks. The grandparents are raised to lay eggs, which are incubated to produce day-old chicks called parents.

The company also produces day-old parents to all African countries south of the equator. Hyline SA only imports the grandparents and rears them to breed the parents, who then produce hatching eggs for day-old commercial layers. He sells all his day-old hens to independent breeding farms and does not breed laying hens.

The eggs produced by these parents are incubated, and the day-old chicks that hatch are called hens. During the third stage, the hens are then raised on breeding farms until they are mature at 21 weeks and ready to lay eggs commercially, at which stage they are called laying hens. Some egg producers in South Africa breed their own Point of Lay hens, as this is a very crucial stage in a hen's life and the quality of the breeding process directly affects the efficiency with which the hen will produce eggs during laying. phase.

The lifespan of commercial laying hens is about one year, after which they are weaned and sold as lean hens, especially in rural areas, where demand through informal traders is high. In South Africa, there are six major retailers, small and medium-sized enterprises and informal traders who buy eggs from these farms and sell them to approximately 48 million consumers across the country. The entire production process, from parentage to the hatching of a hen, takes almost three years.

In addition to these production processes, there are packaging and value addition functions (liquid eggs) which are important in the egg value chain.

INDUSTRY ASSOCIATIONS

MERGERS AND ACQUISITIONS

QUALITY

EGG GRADING

DIFFERENTIATING EGGS

EMPOWERMENT PLANS BY THE INDUSTRY

BARRIERS TO ENTRY

OPPORTUNITIES

MARKET INTELLIGENCE

E XPORT TARIFFS

NON – TARIFF BARRIERS (NTB’ S )

- CHAPTER I: EGGS

- CHAPTER II: EGG PRODUCTS

- CHAPTER III: SPECIAL GUARANTEES

Eggs must be stored and transported at a temperature, preferably constant, that is most suitable for ensuring optimal preservation of their hygienic properties. Eggs must be delivered to the consumer no later than 21 days after laying. Eggshells used in the production of egg products must be fully developed and free of cracks.

However, broken eggs can be used for the production of egg products if the production plant or packing center delivers them directly to the processing plant where they must be broken as soon as possible. Liquid egg must be obtained in accordance with the requirements of points and 7 of Part III below. Eggs should be broken in a manner that minimizes contamination, particularly by ensuring adequate separation from other processes.

Eggs other than those of hens, turkeys or guinea fowl must be handled and processed separately. All equipment must be cleaned and disinfected before processing hens, turkeys and guinea fowl. When a batch is found to be unfit for human consumption, it must be denatured to ensure that it is not used for human consumption.

If processing is not carried out immediately after breaking, liquid eggs must be stored either frozen or at a temperature of no more than 4°C. Products that are not stabilized to be stored at room temperature must be cooled to no more than 4°C. For fermented products, however, this value must be the one recorded before the fermentation process.

In addition to the general identification marking requirements, consignments of egg products not intended for retail trade but for use as an ingredient in the manufacture of another product must have a label stating the temperature at which the egg products must be maintained and the period during which preservation can therefore be ensured.

I MPORT TARIFFS

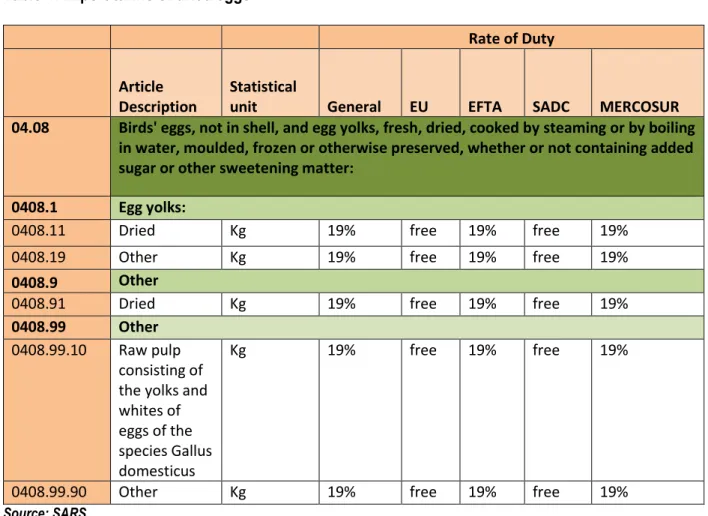

South Africa has applied the 0% preferential rate for the European Union and SADC, while the 19% rate has been applied to EFTA, MERCUSOR and all other countries supplying the above products to South Africa.

COMPETITIVENESS OF THE EGG INDUSTRY

COMPETITIVENESS OF EGG IDUSTRY EXPORTS

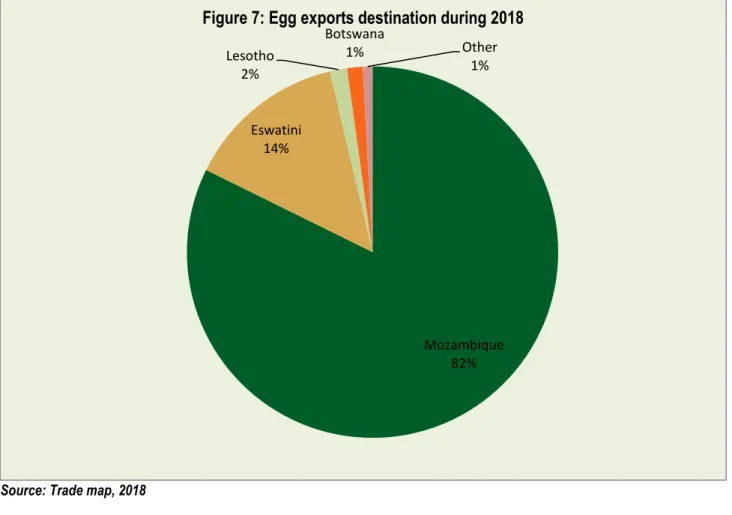

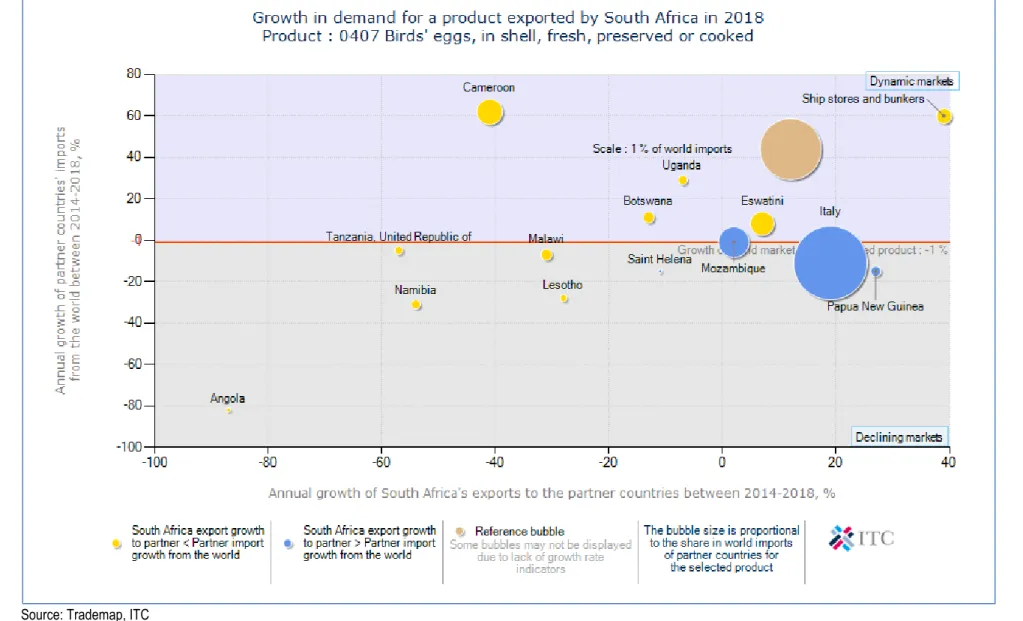

South Africa's exports account for 0.5% of global shell egg exports and its global export ranking is 29. South Africa's shell egg exports to the world decreased by 12% in value and 9% in volume per year between 2014 and 2018 . during the same period, the export value and volume of shell eggs to Mozambique increased by 2% and 2% respectively.

During the same period, South African exports of shell eggs to Mozambique, Italy and Papua New Guinea grew at a rate higher than their imports from the rest of the world. If South Africa is looking to diversify its shell egg exports, the fastest growing markets are in Cameroon. South Africa can focus on increasing the Eswatini market because SA already has access to the market and also because its imports from the world are greater than those from South Africa.

South Africa's exports account for 0.1% of world exports of dried eggs, and its position in world exports is 43. Exports of South African dried eggs to the world decreased by 39% and 30% respectively in value and quantity between the periods 2014 and 2018. During the same period, the export value and the amount of dried eggs to Mozambique decreased by 23% and 21% respectively.

Dried egg exports from South Africa increased in value by 33% between 2017 and 2018. During the same period, exports of dried eggs to Mozambique have increased by 44%, while exports to Lesotho have decreased by 43%. This figure illustrates that exports of dried eggs from South Africa to Lesotho, Mozambique and DRC grew faster than imports from the rest of the world between 2014 and 2018.

Further analysis indicates that there was poor growth in demand for these eggs exported by South Africa in 2018. If South Africa wants to diversify its dried egg exports, the fastest growing markets are in St Helena. France is one of the largest world markets for dried eggs due to its imports in the world market of 6.7%, but the annual growth of imports is 4%.

ACKNOWLEDGEMENTS

APPENDICES

Middelburg (Mpumalanga) http://www.alzu.co.za. across South Africa to meet consumer needs and. By matching supply and demand, Anrene ensures that high-quality shell eggs are available at all times of the year on the retail shelf at stable prices. http://www.anrene-eggs.co.za. It is an egg producing farm. the most comprehensive product range in South Africa including commercial, free range, specialties such as organic and Omega enriched plus the brand new pasteurized shell eggs.

Peak Pullets (Pty) Ltd is a joint venture established to raise pullets from day-old chicks to laying hens. From 2004, it focused its efforts and expertise on raising poultry for the layer industry. Rearing facility of three rearing laying houses, each with a capacity of 5 632 rearing laying hens.

These hens produce fertilized hatching eggs for Boskop Layers, the current supplier of day-old chicks. The farm has a daily egg production of at least 265,000 eggs, giving an annual production capacity of 8 million dozen eggs. It is the largest producer of eggs in the lowveld, supplying prestigious chain markets such as Spar, Pick 'n Pay, Score, Metro, Shoprite and even the Kruger National Park.

The Kiepersol group consists of 3 main production facilities: it raises its own hens and the current production capacity is 360,000 laying hens. It is one of the largest egg suppliers in South Africa, with markets across the country including major national retailers and. In addition to supplying eggs, Môreson also produces feed and raises day-old chicks until they are ready for production.

It consists of the complete chain of laying hens, parent hens, production of ready-to-lay hens and eggs for the consumer market.