During 2014, the African region recorded the highest export value and Europe's export value has increased significantly compared to the export values of the previous year. In 2013, the City of Cape Town's export value has increased significantly by 63.1% compared to the export value in 2012. The increase in Western Cape export value can be attributed to an increase in beetroot exports to the neighboring country.

In the same year, the export value of the city of Johannesburg fell significantly compared to the previous year's export value. In 2013, the export value of Ethekwini beets decreased significantly compared to the previous year's export value. High export value in KwaZulu Natal The export value of beetroot can be attributed to a 19% increase in the value of beetroot exports to Swaziland.

In 2015, the value of the Free State province's exports increased, which can be attributed to a notable increase in beetroot exports to neighboring Lesotho. In 2012, the export value of beetroot for Vhembe decreased significantly compared to the export value of 2011. In the same year, the export value of Waterberg decreased significantly by 52% compared to the export value in 2015.

The higher value of beetroot exports in Ehlanzeni district can be attributed to a noticeable increase in beetroot exports to neighboring Mozambique.

Share Analysis

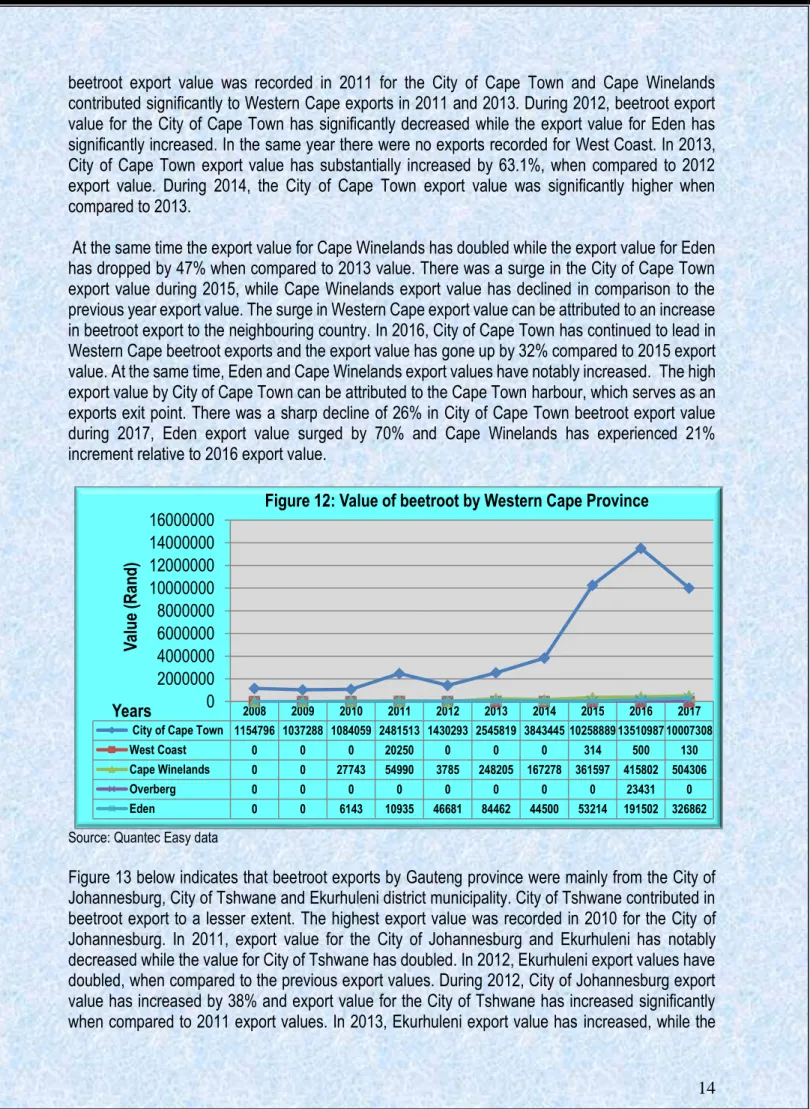

The West Coast, Eden and Cape Winelands contributed to beetroot exports in 2010, but the share of exports was negligible. In 2014, Cape Town's export share increased to 93.34%, while export shares for Cape Winelands and Eden decreased. The City of Cape Town continues to have a high proportion of exports and in 2015 the county reached 96.11%.

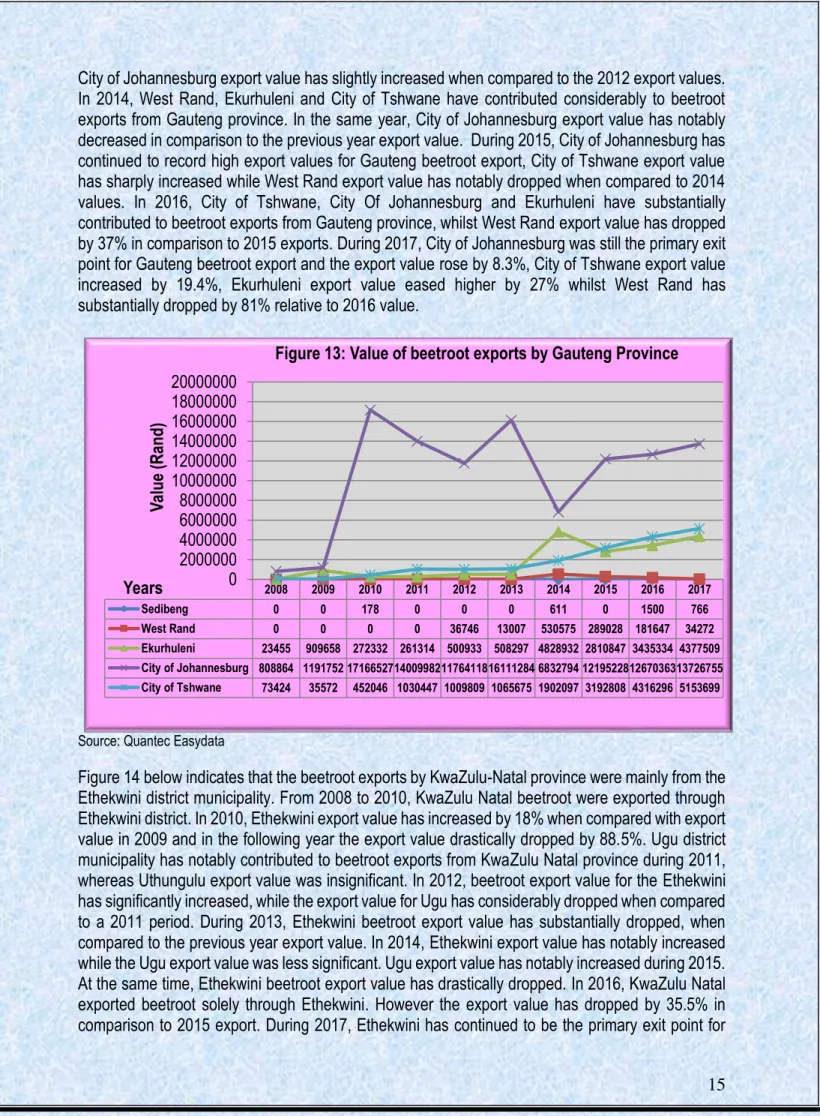

In 2010, the export share for Ekurhuleni has decreased to 1.52% and the export share of the city of Johannesburg has increased to 95.95% compared to a share of the beet export in 2009. In 2014, Ekurhuleni has significantly increased the export share of beet holding 32.88% share and Johannesburg city's export share has dropped drastically to 49.86%. In the same year, the export value of the city of Tshwane increased to 17.27%, while the export share of Ekurhuleni decreased to 15.20%.

During 2016, the City of Johannesburg was still the leader in Gauteng provincial beet exports, but the export share. During 2011, Ugu got an 80.85% share of beet exported by the province of KwaZulu Natal and Uthungulu's export share was insignificant. During 2016, Ethekwini continued to lead KwaZulu Natal beet exports by achieving 100% export share.

Ethekwini export share fell slightly during 2017 to 99.47%, Amajuba and Zululand registered trivial export shares. In 2012, Xhariep obtained 95.23% of the export share of beet and Lejweleputswa obtained 4.77% of the Free State province. In 2014, Thabo Mofutsanyane achieved 75.77% and Mangaung had 17.85% of the Free State provincial beet export share.

Thabo Mofutsanyane beet export share increased significantly to 71.65%, Mangaung export share increased to 14.99%, while Lejweleputswa export share decreased to 9.26%. In 2010, Vhembe district commanded 79.50% and Bricjapi commanded 20.50% of Limpopo's provincial beet export share. In 2014, Waterberg commanded 98.77% of Limpopo's beet export share and in the same year, Vhembe's export share dropped drastically from 81.05% to 0.56%.

South African beetroot Imports

In 2016, there was a sharp 89% increase in South Africa's beetroot imports, and this can be attributed to a 6.2% decrease in domestic beetroot production. In 2017, South Africa's beetroot imports fell significantly by 55% compared to 2016 import volumes, despite a 5.5% decline in domestic production. In 2008 and 2009, the Western Cape Province was the primary entry point for South Africa's beetroot imports from 2010 to 2014, beetroot imports entered South Africa mainly through Gauteng Province.

In 2015, South Africa imported beet through KwaZulu Natal, Gauteng, Free State and Western Cape provinces. In 2016, Gauteng was still the main entry point for beetroot imports from South Africa, followed by the Free State and Mpumalanga provinces. In 2012, South Africa imported beetroot from Africa, Asia and Europe, but imports from Europe were insignificant.

In 2014, South Africa sourced a large amount of beetroot from the African region, while a significant volume was imported from the Asian region. In 2015, South African beetroot mainly originated from regions of Africa (Swaziland) and Europe (Italy). In 2016, the Africa region remained the main supplier of beetroot imports from South Africa, followed by the Asia region.

In 2017, the African region (Swaziland) followed by the European region (United Kingdom) were still the main suppliers of beetroot imported from South Africa. In 2015, South Africa imported beet from SACU (Swaziland, Lesotho and Namibia) and West African countries. During 2016, the SACU country (Swaziland) was the main supplier of South African beet imports from the African region.

In 2017, the SACU country (Swaziland) was still the primary supplier of South Africa's beetroot imports, while imports from SADC and West Africa were negligible. In 2010, South Africa imported large quantities of beetroot from China, and significant quantities were also imported from the Republic of Korea. In 2012, South Africa imported significant quantities from Hong Kong and Japan, imports from China were less significant.

Processing

Market value Chain for beetroot

MARKET INTELLEGENCE 1 Tariffs

Non-tariff barriers .1 The European Union

- The United States

Non-tariff barriers can be divided into those that are mandatory and set out in EU Commission legislation, and those that are the result of consumers, retailers, importers and other distributors. There is a range of EU legislation that regulates the quality of products that can be imported, marketed and sold within the EU. EU marketing standards, which regulate the quality and labeling of vegetables, are defined in the framework of the CAP according to regulation EC 2200/96.

These regulations include diameter, weight and class specifications, and produce that does not comply with these standards is not allowed to be sold on EU markets (detailed lists of products and their standards are available in the annexes to the directive). The EU has its own specific rules, formalized under EC 2002/89, which try to prevent EU produce from coming into contact with harmful organisms from elsewhere in the world. The essence of the directive is that it authorizes plant protection services to inspect a large number of plant products upon arrival in the EU.

This inspection includes a physical examination of the consignment deemed to have a level of phytosanitary risk, identification of any harmful organisms and confirmation of the validity of any phytosanitary certificate covering the consignment. If the shipment does not meet the requirements, it may not enter the EU, although some organisms may be fumigated at the expense of the exporter. The European Commission sets rules for materials that come into contact with food and may endanger human health or cause an unacceptable change in the composition of food.

While supplying vegetables that comply with these issues may not be mandatory in a legal sense, they are becoming increasingly important in Europe and cannot be ignored by existing or potential exporters. i). Social responsibility is becoming important in the industry, not only among consumers, but also for retailers and wholesalers. The largest sellers in the EU also play an important role in dealing with environmental issues, which means exporters need to take these into account when negotiating export agreements. ii) Environmental issues are becoming increasingly important to European consumers.

The EU Commission has recently adopted an EU label to identify food produced according to the EU's organic standards in Directive EEC 209/91. Japan's agricultural sector is heavily protected, and calculations by the Organization for Economic Co-operation and Development (OECD) estimate that nearly 60% of the value of Japan's agricultural production comes from trade barriers or domestic subsidies. Perhaps the biggest barrier to trade with Japan in vegetable markets is its strict phytosanitary requirements, which have often been challenged in the WTO as having little or no scientific basis.

GENERAL DISTRIBUTION CHANNELS

The USDA has vegetable quality standards that provide a basis for domestic and international trade and promote efficiency in marketing and purchasing. At the same time, the USDA issues quality certificates based on these standards and a comprehensive rating system. These certification services, which facilitate the ordering and purchase of products by major buyers, assure these buyers that the product they purchase will meet the terms of the contract in terms of quality, processing, size, packaging and delivery.

Other measures being challenged include the use of fumigation of agricultural products in Japan when cosmopolitan pests (already found in Japan) are detected.

LOGISTICAL ISSUES 1 Mode of transport

Cold chain management

Cold chain management is critical in handling perishable products, from the initial packhouses to the refrigerated container trucks that transport produce to shipping terminals, to the storage facilities at those terminals (and their pre-cooling capabilities) to the actual shipping. ships and their containers and finally to importers and distributors who have to clear customs and transport the produce to markets/retail outlets etc.

Packaging

COMPETIVENESS OF SOUTH AFRICA BEETROOT EXPORTS

Prospective export markets for beetroot from South Africa are mainly Hong Kong (China) and Senegal. However, if South Africa wants to diversify its beetroot exports, the most profitable markets are Malawi and Seychelles, which have increased beetroot imports from the world by 72%. Imports of beetroot from the world to the Democratic Republic of the Congo, the Netherlands, Germany, Zimbabwe, France and Mozambique decreased during the year, so these countries recorded a negative growth rate.

ACKNOWLEDGEMENTS