Directory UMM :Data Elmu:jurnal:M:Multinational Financial Management:Vol11.Issue2.2001:

Teks penuh

Gambar

Dokumen terkait

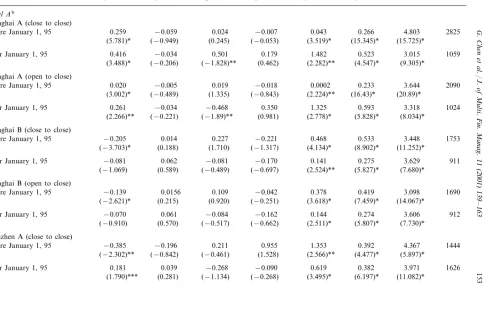

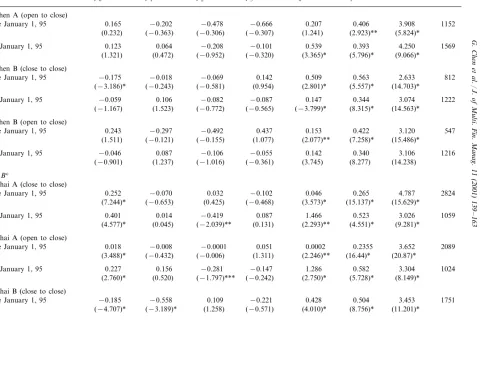

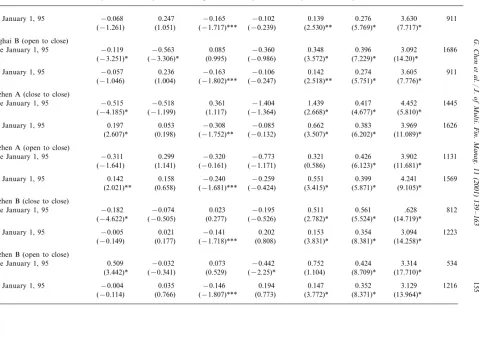

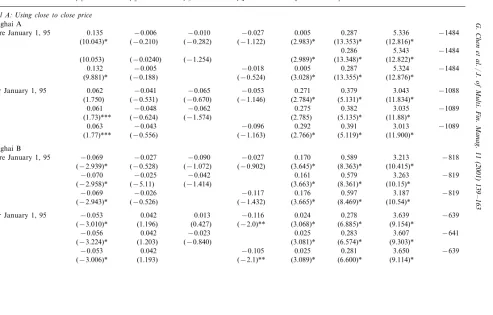

Using intraday data from January to September 1994, we study the lead±lag relations among the markets for the spot, futures (completely revamped after the 1987 market crash),

By using a panel of countries for 1960–1995 we show that the intensity of capital controls, the exchange rate, the type of exports, and the volume of trade appear to affect the long

The general equilibrium foundation for the inverse association between return volatility and stock price is explored using a production model of asset pricing.. The return

This evidence of long memory for the merger series remains even after accounting for potential nonstationarities in the mean level of the series, further reinforcing that

Findings from Table 1 point out that current account balances are nonstationary since the ADF test fails to reject the unit-root null for all countries except Spain.. This finding

The comparison of apo E and triglyceride concentrations in Finnish subjects using covariance analysis (on log-transformed values and after adjustment for age, and apo E

Mean concentrations for plasma tHcy, serum folate and vitamin B12 were similar in patients and control subjects, whereas serum creatinine was higher in the patient group..

Total and marketable green chile yields were higher for both daily and 3-day drip irrigation than for alternate row furrow irrigation in 1995 and 1996 regardless of infestation,