Quantitative Finance authors titles recent submissions

Teks penuh

Gambar

Dokumen terkait

report the results of the proposed probabilistic active trading strategy for both the Deep-Learning model. and the SVM model., as well as the buy-and-hold investing strategy are

In Table 1 , the assets were splitted into two groups, (a) containing the mean returns of the 20 assets with the highest and lowest eigenvector cen- trality, and (b) the mean

if a country appears in a large number of dif- ferent communities in the multi-network (and thus is never isolated) then it relies on several different clusters of country-product

If poor agents pay higher tax rates than rich agents, eventually all wealth becomes concentrated in the hands of a single agent.. By contrast, if poor agents are subject to lower

Keywords and phrases: multivariate risk measure, multi-objective risk-averse two-stage stochastic programming, risk-averse scalarization problems, convex Benson algorithm,

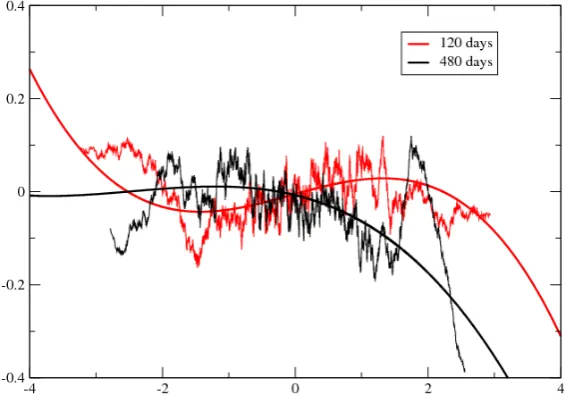

(There is also a paper by Cox and Hoeggerl [9] which asks about the possible shapes of the price of an American put, considered as a function of strike, given the prices of

particular, we compare the performance of the different solution methods for the subset selection problem, analyze the dependency of optimal hedging portfolio and hedging error on

We apply the theory to set up a variance-optimal semi-static hedging strategy for a variance swap in both the Heston and the 3/2-model, the latter of which is a non-affine