Directory UMM :Data Elmu:jurnal:I:Insurance Mathematics And Economics:Vol27.Issue3.2000:

Teks penuh

Gambar

Dokumen terkait

Specifically, their variable set includes political risk, inflation, ex- change rate volatility, per capita GDP, growth of GDP, the size of the trade sector, the indebtedness of

The results from the historical decomposition of time series of industrial production, prices, money supply, liabilities of failed businesses, and the deposits of failed banks

Motivated by Feder’s two-sector model concerning exports and growth, this article intends to propose a dynamic framework, which bases on the production function theory and consists

The main results obtained are: sector-specific migration of labor may raise domestic welfare, while with capital accumulation such migration necessarily raises the relative price of

(The fact that they are self-financing means that each investment opportunity also involves a short position in some benchmark, such as cash, which is used to finance the

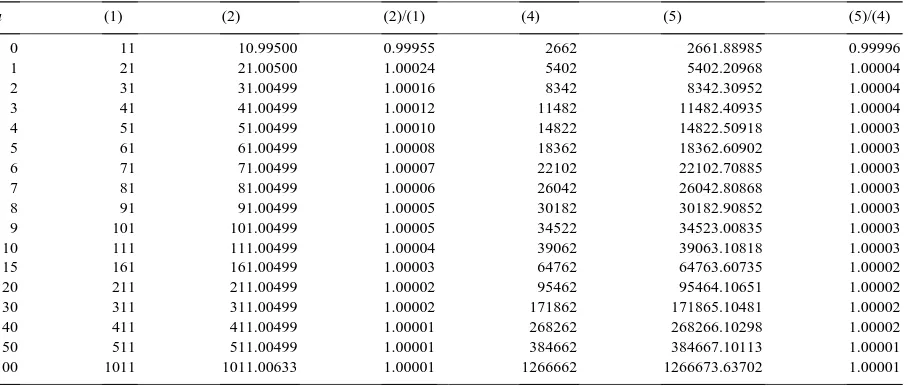

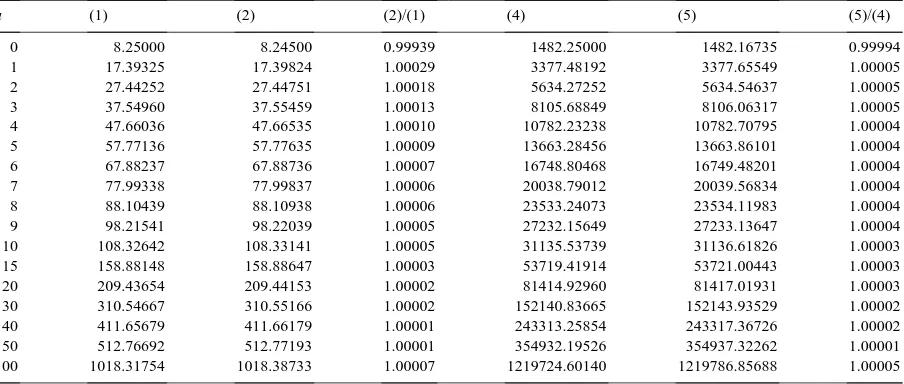

In this paper, stochastic control theory is applied to answer the following question: if an insurer has the possibility to invest part of his surplus into a risky asset, what is

We use an approach developed in Lin and Willmot (1999), under which the solution to a defective renewal equation is expressed in terms of a compound geometric tail, to derive

Although 4- and 5-demethyl simmondsin 2 % -feru- lates already were described (Van Boven et al., 1995) 4-demethyl simmondsin was not previously isolated as a pure compound..