07350015%2E2014%2E958230

Teks penuh

Gambar

Garis besar

Dokumen terkait

Would this be enough to guarantee that the stan- dard parametric bootstrap method is valid for both the testing and the interval estimation for those parameters, avoiding

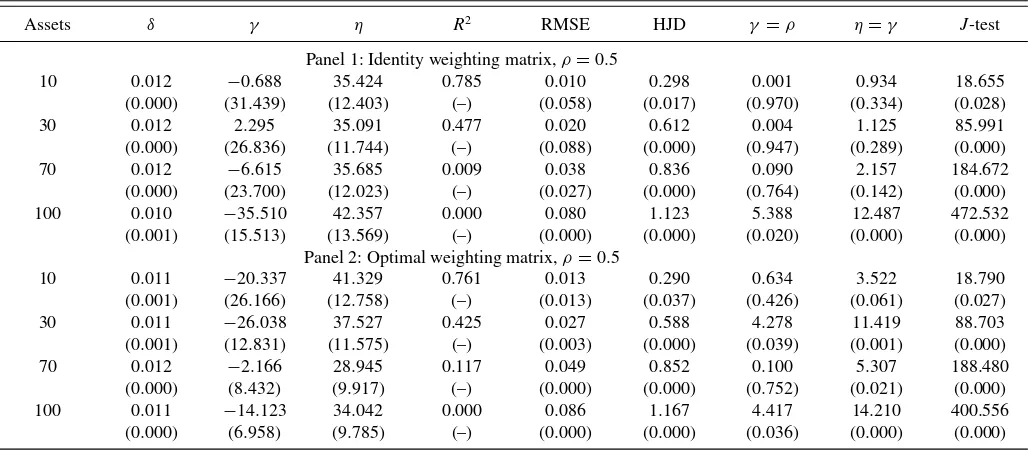

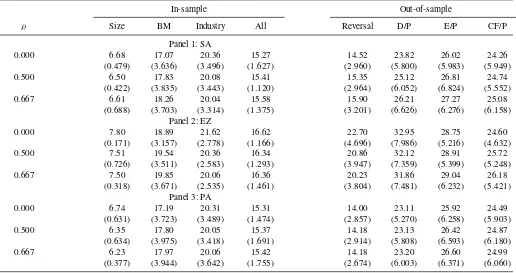

Table 1 reports the null rejection probabilities for various two- sided 5% tests. It is clear that the tests based on the near-unity fixed-smoothing approximation are in general

c , it is fairly straightforward to adjust the numerical derivation of the tests in Section 4.2 to obtain nearly weighted average power maximizing tests that controls size only under

We see in Table 4 that, using the asymptotic critical values given in Table 1 , GKSn and GCVMn have large size distortions in most cases, confirming asymptotic theory, whereas GKS ∗

We also find that: (i) setting truncation at the minimum duration of normal times (i.e., two quarters) does not affect the magnitude of the duration dependence parameter, p (Column

Using results from copula theory, we derive a new representation that contains three types of components: (i) the “direct contribution” of each covariate due to

For each of the four estimators, we calculate the bias as the average difference between the estimate and the true value (note that liml does not have finite moments, so the bias

In the simulations, we consider globally invalid covariates and find that our average estimators perform reasonably well and sometimes even outperform the estimator based on