49

BAB V

PENUTUP

5.1

Kesimpulan

Penelitian ini menguji secara empiris pengaruh struktur kepemilikan

institusional dan ukuran perusahaan terhadap manajemen laba efisien atau

oportunistik.

Beberapa hal yang dapat disimpulkan dari hasil penelitian ini adalah:

1.

Hasil dari pengujian Ha1 diterima dan pengaruh positif hal ini menunjukkan

bahwa manajemen laba berpengaruh positif terhadap arus kas operasi operasi

satu tahun ke depan. Dengan kata lain, manajemen laba akan meningkatkan

kualitas informasi sehingga semakin bermanfaat bagi para pengguna dan

memberikan bukti bahwa tipe manajemen laba pada perusahaan manufaktur

yang terdaftar dalam Bursa Efek Indonesia periode 2009-2011 adalah

manajemen laba efisien.

50

3.

Hasil dari pengujian Ha3 diterima dan pengaruh positif menunjukkan bahwa

ukuran perusahaan memperkuat pengaruh positif manjemen laba terhadap

arus kas operasi satu tahun ke depan. Dengan kata lain, semakin besar ukuran

perusahaan berpengaruh terhadap tindakan manajer dalam melakukan

manajemen laba sehingga tipe manajemen laba semakin efisien pada

perusahaan manufaktur yang terdaftar dalam Bursa Efek Indonesia periode

2009-2011.

5.2 Keterbatasan

Penelitian

DAFTAR PUSTAKA

Ardi Murdoko Sudarmadji dan Lana Sularto, 2007. “Pengaruh Ukuran

Perusahaan, Profitabilitas, leverage, dan Tipe Kepemilikan Perusahaan

Terhadap Luas Voluntary Disclosure Laporan Keuangan Tahunan”,

Proceeding PESAT, Volume 2.

Brigham, Eugene F and Joel F.Houston, 2006. Dasar-Dasar Manajemen

Keuangan, alih bahasa Ali Akbar Yulianto, Buku satu,Edisi sepuluh, PT.

Salemba Empat, Jakarta.

Chin, C.L., Yu J.C, dan Tsun J.H. 2009. International Diversification, Ownership

Structure, Legal Origin, and Earnings Management: Evidence from Taiwan.

Journal of Accounting, Auditing and Finance (Spring). 24 (2): 233-362.

Ernamawati, Laily. (2009). ”Pengaruh Kebijakan Dividen, Kebijakan Utang dan

Kepemilikan Manajerial Terhadap Agency Costs Pada Perusahaan

Manufaktur Yang Terdaftar di Bursa Efek Indonesia Periode

2004-2008”.Skripsi.Fakultas Ekonomi Universitas Negeri Yogyakarta.

Ghozali, Imam. 2005. Aplikasi Analisis Multivariate dengan program SPSS,

Badan Penerbit Universitas Diponegoro, Semarang.

Gujarati, D. 2003. Basic Econometrics. McGraw-Hill International Edition. 4th

edition.

Healy, P.M. 1985. The Effect of Bonus Schemes on Accounting Decisions.

Journal of Accounting and Economics Vol. 7:85-107

Healy, P.M dan James M. Wahlen .,1999. A Review of the Earnings Management

Literature and Its Implications for Standard Setting. Accounting Horizons:

December 1999, Vol. 13, No. 4, pp. 365-383.

Holthausen, R., D., Larcker, dan Sloan. (1995). “Anual Bonus Schemes and

Manipulation of Earnings: Additional Evidence on Bonus Plans and Income

Management”. Journal of Accounting and Economics, 29—74.

Ikatan Akuntan Indonesia. (2012).

Kerangka Dasar Penyusunan dan Penyajian

Laporan Keuangan :

Tujuan Penyajian Laporan Keuangan

Ikatan Akuntan Indonesia. (2012).

Kerangka Dasar Penyusunan dan Penyajian

Iturriaga dan Sanz. 2001. Ownership Structure, Corporate Value and Firm

Investment: A Simultaneous Equations Analysis of Spanish Companies.

Journal of Management and Governance Vol. 5 No. 2 pp. 179-204.

Jensen dan Meckling. 1976. The Agency Theory of The Firm: Managerial

Behavior, Agency Cost and Owneship Structure. Journal of Financial

Economics 3, pp 305-360.

Jones, C.P, Utama S., Frensidy B., Ekaputra I.A., Budiman R.U. 2009.

Investment: Analysis and Management, An Indonesia Adoptation. Jakarta.

Penerbit Salemba Empat dan John Willey.

Kasznik, R. 1999. On the Association Between Voluntary Disclosure and

Earnings Management. Journal of Accounting Research 37 (1): 57-81.

Kim, Y., Liu, C., & Rhee, S. G. (2003). The Effect of Firm Size on Earnings

Management. Journal College of Business Administration University of

Hawai’I Vol. 6 pp. 1-30.

Michaelson, S. E., James, J. W., & Charles, W. 1995. A Market Based Analysis of

Income Smoothing. Journal of Business Finance and Accounting 8(4):

1179

−

1195.

Moh’d, M.A., Perry, L.G, dan James R., 1998. The Impact of Owneship Structure

on Corporate Debt Policy: A Time Series Cross-Sectional Analysis, Financial

Review 33, pp. 85-99

R. Scott, William.2003. Financial Accounting Theory Sixth Edition. Toronto,

Ontario: Pearson Canada Inc.

Rezaei, F. 2012. Efficient or opportunistic earnings management with regards to

the role of firm size and corporate governance practices. Interdisciplinary

Journal of Contemporary Research Business January Vol. 3 No. 9

pp.1312-1322.

Sanjaya. 2010. Entrenchment and Alignment Effect on Earnings Management.

The Indonesian Journal of Accounting Research, 13(2): 247-264.

Scott, William R. (2000). Financial accounting Theory. Second edition. Canada:

Prentice Hall

Scott, W.R. 2003. Financial Accounting Theory 3th Edition. Prentice Hall Inc. A

Simon &Schuter Company, Upper Saddle River. New Jersey, USA.

Simanjuntak, R.S., 2011. Perbedaan Profitabilitas Wajib Pajak Perdagangan

Dengan dan Tanpa Undang-Undang No. 36 Tahun 2008 Tentang Pajak

Penghasilan. Universitas Udayana. Denpasar: Thesis S2

Siregar, Baldric. 2006. Determinan Risiko Ekspropriasi. Jurnal Akuntansi

Manajemen, 18 (3): 269-282.

Siregar, S.V dan Utama, S. 2008. Type of Earnings Management and The Effect

of Owneship Structure, firm size, and corporate-governance practices:

Evidence from Indonesia. The Internasional Journal of Accounting 43 pp

1-27.

Sulistiawan D., Yeni J., dan Liza A., 2011. Creative Accounting. Jakarta :Salemba

Empat

Subramanyam, K.R. 1996. The Pricing of Discretionary Accruals. Journal of

Accounting and Economics 22 pp. 249-281.

Wang, L., 2009. Ownership, Size, and The Formal Structure of Organizations:

Evidence From US Public and Private Firms, 1992–2002. Industrial and

Corporate Change, Vol. 18, No. 4, pp. 595–636.

Watt, R.L., dan Zimmerman, J.L., 1986. Positive Accounting Theory.

Prentice-Hall Inc., Englewood Cliff, New Jersey, USA.

Zimmerman, J.L. dan Andrew A. Criestie. 1994. “Efficient and Opportunistic

Choices of Accounting Procedures: Corporate Control Contests”. The

Accounting Review Vol. 69. No. 4 (October): 539—566.

Lampiran 1

Model Manajemen Laba

1.

Uji Normalitas

(Sebelum Trimming)

One-Sample Kolmogorov-Smirnov Test

Accrual

Drev_Drec

PPE

DCFO

N

117

117

117

117

Normal Parameters

aMean

-2.27E10

4.11E11

2.20E12

1.07E10

Std. Deviation

6.261E11

9.006E11 3.719E12

5.716E11

Most Extreme Differences

Absolute

.324

.266

.314

.301

Positive

.324

.250

.314

.301

Negative

-.277

-.266

-.284

-.268

Kolmogorov-Smirnov Z

3.504

2.880

3.393

3.258

Asymp. Sig. (2-tailed)

.000

.000

.000

.000

a. Test distribution is Normal.

(Sesudah

Trimming)

One-Sample Kolmogorov-Smirnov Test

Accrual

Drev_Drec

PPE

DCFO

N

79

79

79

79

Normal Parameters

aMean

-1.50E10

2.09E11

8.98E11

2.36E10

Std. Deviation

9.098E10

2.585E11 5.441E11

1.050E11

Most Extreme Differences

Absolute

.131

.143

.142

.149

Positive

.121

.143

.142

.149

Negative

-.131

-.123

-.122

-.147

Kolmogorov-Smirnov Z

1.163

1.271

1.264

1.322

Asymp. Sig. (2-tailed)

.133

.079

.082

.061

2. Uji Asumsi Klasik

Autokorelasi

Model Summary

bModel

R

R Square

Adjusted R

Square

Std. Error of the

Estimate

Durbin-Watson

1

.646

a.417

.394

7.084E10

1.986

a. Predictors: (Constant), DCFO, PPE, DRev_Drec

b. Dependent Variable: Accrual

Multikolinearitas

Coefficients

aModel

Unstandardized

Coefficients

Standardized

Coefficients

t

Sig.

Collinearity

Statistics

B

Std. Error

Beta

Tolerance

VIF

1

(Constant)

1.087E8 1.679E10

.006

.995

DRev_Drec

.067

.031

.190

2.144

.035

.993

1.007

PPE

-.019

.015

-.114

-1.288

.202

.996

1.004

DCFO

-.506

.077

-.584

-6.586

.000

.989

1.012

a. Dependent Variable:

Accrual

Heteroskedastisitas

Correlations

Unstandardized

Residual

DRev_Drec

PPE

DCFO

Unstandardized

Residual

Pearson

Correlation

1.000

.000

.000

.000

Sig.

(2-tailed)

1.000

1.000

1.000

N

79.000

79

79

79

DRev_Drec

Pearson

Correlation

.000

1.000

.007

-.084

Sig.

(2-tailed)

1.000

.948

.460

N

79

79.000

79

79

PPE

Pearson

Correlation

.000

.007

1.000

.065

Sig.

(2-tailed)

1.000

.948

.567

N

79

79

79.000

79

DCFO

Pearson

Correlation

.000

-.084

.065

1.000

Sig.

(2-tailed)

1.000

.460

.567

N

79

79

79

79.000

Lampiran 2

Model Hipotesis 1

1. Uji Normalitas

(Sebelum Trimming)

One-Sample Kolmogorov-Smirnov Test

Yit

DAC

N

79

79

Normal Parameters

aMean

9.41E10

-.0000022

Std. Deviation

1.568E11

6.94671125E10

Most Extreme Differences

Absolute

.209

.143

Positive

.209

.143

Negative

-.174

-.138

Kolmogorov-Smirnov Z

1.859

1.267

Asymp. Sig. (2-tailed)

.002

.081

a. Test distribution is Normal.

(Sesudah Trimming)

One-Sample Kolmogorov-Smirnov Test

Yit

DAC

N

59

59

Normal Parameters

aMean

4.72E10

-4.4683571E8

Std. Deviation

7.873E10

6.10181043E10

Most Extreme Differences

Absolute

.160

.161

Positive

.160

.161

Negative

-.115

-.136

Kolmogorov-Smirnov Z

1.325

1.338

Asymp. Sig. (2-tailed)

.060

.056

2. Statistik Deskriptif

Descriptive Statistics

N

Minimum

Maximum

Mean

Std. Deviation

Yit

59

-2.E11

2.E11

4.09E10

6.722E10

DAC

59 -1.60566E11 2.30447E11 9.6812091E9 6.07722004E10

Valid N (listwise)

59

3. Asumsi Klasik

Autokorelasi

Model Summary

bModel

R

R Square

Adjusted R

Square

Std. Error of the

Estimate

Durbin-Watson

1

.161

a.026

.010

6.892E10

1.722

a. Predictors: (Constant), Unstandardized Residual

b. Dependent Variable: Yit

Heteroskedastisitas

Correlations

Unstandardized

Residual

DAC

Spearman's rho Unstandardized

Residual

Correlation Coefficient

1.000

-.091

Sig. (2-tailed)

.

.470

N

59

59

DAC

Correlation Coefficient

-.091

1.000

Sig. (2-tailed)

.470

.

N

59

59

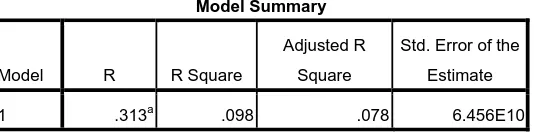

4. Hasil Regresi

Koefisien Determinasi

Model Summary

Model

R

R Square

Adjusted R

Square

Std. Error of the

Estimate

1

.313

a.098

.078

6.456E10

[image:12.612.134.401.164.231.2]a. Predictors: (Constant), DAC

Tabel Uji F

ANOVA

bModel

Sum of Squares

df

Mean Square

F

Sig.

1

Regression

1.993E22

1

1.993E22

4.782

.034

aResidual

1.834E23

57

4.168E21

Total

2.033E23

58

a. Predictors: (Constant), DAC

b. Dependent Variable: Yit

Uji Regresi

Coefficients

aModel

Unstandardized

Coefficients

Standardized

Coefficients

t

Sig.

B

Std. Error

Beta

1

(Constant)

3.759E10

9.642E9

3.899

.000

DAC

.346

.158

.313

2.187

.034

a. Dependent Variable: Yit

Lampiran 3

Model Hipotesis 2 dan 3

1. Uji Normalitas

(Sesudah Trimming)

One-Sample Kolmogorov-Smirnov Test

Yit

DAC

LN_TAset

Dummi

_Inst

DAC_LnTAs

et

DAC_Dumm

iInst

N

59

59

59

59

59

59

Normal

Parameters

aMean

3.75E10

-1.0311667E9

27.4154

.44 -2.8723E11

-1.65E9

Std.

Deviation

5.346E10

3.15618380E10

.54719

.502 2.03817E12

2.274E10

Most

Extreme

Differences

Absolute

.213

.153

.096

.371

.097

.381

Positive

.213

.153

.096

.371

.058

.227

Negative

-.141

-.104

-.084

-.305

-.097

-.381

Kolmogorov-Smirnov Z

1.329

.958

.598

2.319

.607

2.379

Asymp. Sig. (2-tailed)

.059

.318

.867

.000

.854

.000

a. Test distribution is

Normal.

2. Statistik Deskriptif

Descriptive Statistics

N

Minimum

Maximum

Mean

Std. Deviation

Yit

59

-2.E10

3.E11

3.75E10

5.346E10

DAC

59

-7.29731E10

7.93619E10

-1.0311667

E9

3.15618380E10

Dummi_Inst

59

0

1

.44

.502

LN_TAset

59

26.43

28.35

27.4154

.54719

DAC_DummiInst

59

-7.E10 57202727395

-1.65E9

2.274E10

DAC_LnTAset

59

-6.16E12

3.70E12 -2.8723E11

2.03817E12

Valid N (listwise)

59

3. Asumsi Klasik

Autokorelasi

Model Summary

bModel

R

R Square

Adjusted R

Square

Std. Error of the

Estimate

Durbin-Watson

1

.619

a.384

.290

4.504E10

1.718

a. Predictors: (Constant), Transformasi, LN_TAset, Dummi_Inst, DAC_DUMMIINST,

Unstandardized Residual

Heteroskedastisitas

Correlations

DAC

Dummi_In

st

LN_TAset

DAC_LnT

Aset

DAC_Dumm

iInst

Unstandardized

Residual

DAC

Pearson

Correlation

1.000

-.078

.210

-.326

*.722

**.000

Sig.

(2-tailed)

.638

.200

.043

.000

1.000

N

59.000

59

59

59

59

59

Dummi_I

nst

Pearson

Correlation

-.078

1.000

.053

-.122

-.084

.000

Sig.

(2-tailed)

.638

.747

.461

.612

1.000

N

59

59.000

59

59

59

59

LN_TAse

t

Pearson

Correlation

.210

.053

1.000

-.020

-.069

.000

Sig.

(2-tailed)

.200

.747

.902

.675

1.000

N

59

59

59.000

59

59

59

DAC_Ln

TAset

Pearson

Correlation

-.326

*-.122

-.020

1.000

-.247

.000

Sig.

(2-tailed)

.043

.461

.902

.129

1.000

N

59

59

59

59.000

59

59

DAC_Du

mmiInst

Pearson

Correlation

.722

**-.084

-.069

-.247

1.000

.000

Sig.

(2-tailed)

.000

.612

.675

.129

1.000

N

59

59

59

59

59.000

59

Unstand

ardized

Residual

Pearson

Correlation

.000

.000

.000

.000

.000

1.000

Sig.

(2-tailed)

1.000

1.000

1.000

1.000

1.000

N

59

59

59

59

59

59.000

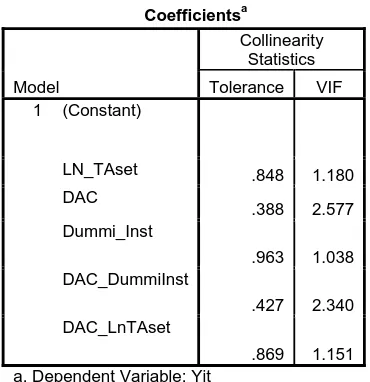

Multikolinearitas

Coefficients

aModel

Collinearity

Statistics

Tolerance

VIF

1

(Constant)

LN_TAset

.848

1.180

DAC

.388

2.577

Dummi_Inst

.963

1.038

DAC_DummiInst

.427

2.340

DAC_LnTAset

.869

1.151

a. Dependent Variable: Yit

4. Hasil Regresi

Koefisien Determinasi

Model Summary

bModel

R

R Square

Adjusted R

Square

Std. Error of the

Estimate

1

.619

a.384

.290

4.504E10

a. Predictors: (Constant), DAC_LnTAset, LN_TAset, Dummi_Inst,

DAC_DummiInst, DAC

[image:16.612.126.311.130.321.2]b. Dependent Variable: Yit

Tabel Uji F

ANOVA

bModel

Sum of Squares

df

Mean Square

F

Sig.

1

Regression

4.165E22

5

8.330E21

4.107

.005

aResidual

6.694E22

53

2.028E21

Total

1.086E23

58

Uji Regresi

Coefficients

aModel

Unstandardized Coefficients

Standardized

Coefficients

t

Sig.

B

Std. Error

Beta

1

(Constant)

-1.121E12

3.972E11

-2.822

.008

DAC

-.742

.372

-.438

-1.996

.154

Dummi_Inst

-1.289E10

1.482E10

-.121

-.870

.391

LN_TAset

4.260E10

1.450E10

.436

2.938

.006

DAC_DummiInst

1.567

.491

.667

3.188

.003

DAC_LnTAset

.008

.004

.309

2.104

.043

a. Dependent Variable: Yit

Lampiran 4

Daftar Perusahaan Sampel

No Kode

Nama

Perusahaan

Tahun

1 ADES Akasha Wira International Tbk.

2011

2 AISA Tiga Pilar Sejahtera Food Tbk.

2011

3 AKPI Argha Karya Prima Industry Tbk

2011

4 ALMI Alumindo Light Metal Industry

2011

5 APLI Asiaplast Industries Tbk.

2011

6 ARGO Argo Pantes Tbk

2011

7 ARNA Arwana Citramulia Tbk.

2011

8 BATA Sepatu Bata Tbk.

2011

9 BRNA Berlina Tbk.

2011

10 CEKA Wilmar Cahaya Indonesia Tbk.

2011

11 CTBN Citra Tubindo Tbk.

2011

12 DAVO Davomas Abadi Tbk

2011

13 ESTI Ever Shine Tex Tbk.

2011

14 FAST Fast Food Indonesia Tbk.

2011

15 GDST Gunawan Dianjaya Steel Tbk

2011

16 GGRM Gudang Garam Tbk.

2011

17 GJTL Gajah Tunggal Tbk.

2011

18 HDTX Panasia Indo Resources Tbk.

2011

19 IKAI Intikeramik Alamasri Industri

2011

20 INDF Indofood Sukses Makmur Tbk.

2011

21 INDR Indo-Rama Synthetics Tbk.

2011

22 INDS Indospring Tbk.

2011

23 JECC Jembo Cable Company Tbk.

2011

24 KBLI KMI Wire & Cable Tbk.

2011

25 KBLM Kabelindo Murni Tbk.

2011

26 KBRI Kertas Basuki Rachmat Indonesia Tbk.

2011

27 KIAS Keramika Indonesia Assosiasi T

2011

28 LMPI Langgeng Makmur Industri Tbk.

2011

29 MASA Multistrada Arah Sarana Tbk.

2011

30 MLBI Multi Bintang Indonesia Tbk.

2011

31 PBRX Pan Brothers Tbk.

2011

32 RMBA Bentoel Internasional Investam

2011

33 SIPD Sierad Produce Tbk.

2011

34 SPMA Suparma Tbk.

2011

35 SRSN Indo Acidatama Tbk

2011

36 SULI SLJ Global Tbk.

2011

37 TRST Trias Sentosa Tbk.

2011

38 ULTJ Ultra Jaya Milk Industry & Tra

2011

40 ADES Akasha Wira International Tbk.

2010

41 AISA Tiga Pilar Sejahtera Food Tbk.

2010

42 AKPI Argha Karya Prima Industry Tbk

2010

43 ALMI Alumindo Light Metal Industry

2010

44 APLI Asiaplast Industries Tbk.

2010

45 ARGO Argo Pantes Tbk

2010

46 ARNA Arwana Citramulia Tbk.

2010

47 BATA Sepatu Bata Tbk.

2010

48 BRNA Berlina Tbk.

2010

49 CEKA Wilmar Cahaya Indonesia Tbk.

2010

50 CTBN Citra Tubindo Tbk.

2010

51 DAVO Davomas Abadi Tbk

2010

52 ESTI Ever Shine Tex Tbk.

2010

53 FAST Fast Food Indonesia Tbk.

2010

54 GDST Gunawan Dianjaya Steel Tbk

2010

55 GGRM Gudang Garam Tbk.

2010

56 GJTL Gajah Tunggal Tbk.

2010

57 HDTX Panasia Indo Resources Tbk.

2010

58 IKAI Intikeramik Alamasri Industri

2010

59 INDF Indofood Sukses Makmur Tbk.

2010

60 INDR Indo-Rama Synthetics Tbk.

2010

61 INDS Indospring Tbk.

2010

62 JECC Jembo Cable Company Tbk.

2010

63 KBLI KMI Wire & Cable Tbk.

2010

64 KBLM Kabelindo Murni Tbk.

2010

65 KBRI Kertas Basuki Rachmat Indonesia Tbk.

2010

66 KIAS Keramika Indonesia Assosiasi T

2010

67 LMPI Langgeng Makmur Industri Tbk.

2010

68 MASA Multistrada Arah Sarana Tbk.

2010

69 MLBI Multi Bintang Indonesia Tbk.

2010

70 PBRX Pan Brothers Tbk.

2010

71 RMBA Bentoel Internasional Investam

2010

72 SIPD Sierad Produce Tbk.

2010

73 SPMA Suparma Tbk.

2010

74 SRSN Indo Acidatama Tbk

2010

75 SULI SLJ Global Tbk.

2010

76 TRST Trias Sentosa Tbk.

2010

77 ULTJ Ultra Jaya Milk Industry & Tra

2010

78 VOKS Voksel Electric Tbk.

2010

79 ADES Akasha Wira International Tbk.

2009

80 AISA Tiga Pilar Sejahtera Food Tbk.

2009

81 AKPI Argha Karya Prima Industry Tbk

2009

82 ALMI Alumindo Light Metal Industry

2009

84 ARGO Argo Pantes Tbk

2009

85 ARNA Arwana Citramulia Tbk.

2009

86 BATA Sepatu Bata Tbk.

2009

87 BRNA Berlina Tbk.

2009

88 CEKA Wilmar Cahaya Indonesia Tbk.

2009

89 CTBN Citra Tubindo Tbk.

2009

90 DAVO Davomas Abadi Tbk

2009

91 ESTI Ever Shine Tex Tbk.

2009

92 FAST Fast Food Indonesia Tbk.

2009

93 GDST Gunawan Dianjaya Steel Tbk

2009

94 GGRM Gudang Garam Tbk.

2009

95 GJTL Gajah Tunggal Tbk.

2009

96 HDTX Panasia Indo Resources Tbk.

2009

97 IKAI Intikeramik Alamasri Industri

2009

98 INDF Indofood Sukses Makmur Tbk.

2009

99 INDR Indo-Rama Synthetics Tbk.

2009

100 INDS Indospring Tbk.

2009

101 JECC Jembo Cable Company Tbk.

2009

102 KBLI KMI Wire & Cable Tbk.

2009

103 KBLM Kabelindo Murni Tbk.

2009

104 KBRI Kertas Basuki Rachmat Indonesia Tbk.

2009

105 KIAS Keramika Indonesia Assosiasi T

2009

106 LMPI Langgeng Makmur Industri Tbk.

2009

107 MASA Multistrada Arah Sarana Tbk.

2009

108 MLBI Multi Bintang Indonesia Tbk.

2009

109 PBRX Pan Brothers Tbk.

2009

110 RMBA Bentoel Internasional Investam

2009

111 SIPD Sierad Produce Tbk.

2009

112 SPMA Suparma Tbk.

2009

113 SRSN Indo Acidatama Tbk

2009

114 SULI SLJ Global Tbk.

2009

115 TRST Trias Sentosa Tbk.

2009

116 ULTJ Ultra Jaya Milk Industry & Tra

2009

No Kode Tahun Accrual Drev_Drec PPE DCFO DAC INST Dinst LNAst DAC*INST DAC*LNAset 1 ADES 2011 -31,360,000,000 56,529,000,000 253,163,000,000 86,976,000,000

2 AISA 2011 120,289,000,000 736,058,000,000 1,302,998,000,000 52,787,000,000 122,539,216,530 5.20 0 28.91 637,203,925,957 3,542,517,995,771 3 AKPI 2011 -82,102,762,000 316,358,406,000 1,902,957,252,000 138,676,077,000 3,076,783,109 44.70 1 28.07 137,532,204,984 86,376,149,448 4 ALMI 2011 -179,511,628,220 492,171,779,098 1,385,872,559,327 285,832,178,429 -41,433,805,296 81.04 1 28.25 -3,357,795,581,188 -1,170,637,212,281 5 APLI 2011 4,269,230,487 13,358,675,256 337,863,709,498 -13,216,627,401 3,010,292,853 26.66 1 26.54 80,254,407,474 79,882,659,753 6 ARGO 2011 -157,647,813,000 7,496,140,000 3,074,125,724,000 57,534,435,000

7 ARNA 2011 -47,903,192,388 89,314,720,913 856,774,878,568 28,361,209,886 -23,311,898,209

8 BATA 2011 -14,008,584,000 27,758,977,000 290,004,364,000 -35,710,479,000 -28,526,104,241 5.90 0 26.97 -168,304,015,022 -769,367,007,229 9 BRNA 2011 -52,974,168,000 109,378,126 646,964,250,000 36,390,388,672 -22,354,433,330 9.31 0 27.19 -208,119,774,302 -607,837,347,934 10 CEKA 2011 -29,927,807,233 474,006,186,230 309,168,177,200 332,933,085,646 112,707,201,481

11 CTBN 2011 152,643,997,218 -59,016,251,684 1,168,753,253,808 134,897,484,508 247,007,192,151 12 DAVO 2011 -243,497,805,506 -310,625,492,800 3,731,344,958,266 171,664,181,288

13 ESTI 2011 -11,422,658,188 94,939,415,463 905,238,234,096 13,853,039,602 6,371,981,846 13.61 0 27.35 86,722,672,924 174,281,226,400 14 FAST 2011 -445,074,138,000 371,145,734,000 483,748,988,000 187,450,790,000

15 GDST 2011 79,088,981,578 358,367,194,696 706,389,390,344 55,580,992,930 96,623,757,333 16 GGRM 2011 5,048,409,000,000 3,387,581,000,000 14,960,265,000,000 -2,962,905,000,000

17 GJTL 2011 379,806,000,000 1,675,998,000,000 8,586,646,000,000 -707,157,000,000

18 HDTX 2011 9,268,996,386 310,770,296,278 1,218,426,392,196 -16,697,004,690 3,145,920,949 45.15 1 27.64 142,038,330,843 86,967,427,049 19 IKAI 2011 -72,374,435,942 -2,981,815,394 103,175,490,253 13,154,936,320

20 INDF 2011 -77,318,000,000 5,945,864,000,000 20,905,762,000,000 -1,940,959,000,000 21 INDR 2011 -358,570,571,778 1,385,122,314,442 7,480,753,736,130 -107,361,971,206

22 INDS 2011 -933,498,023 146,970,092,639 544,714,110,213 113,978,742,230 57,202,727,395 87.46 1 27.76 5,002,950,537,968 1,588,050,652,933

Lampiran 5

23 JECC 2011 19,148,719,000 342,704,187,873 316,840,758,000 2,783,673,000 3,589,720,241 17.58 0 27.16 63,107,281,840 97,512,140,188 24 KBLI 2011 16,483,335,004 557,765,836,017 771,425,432,881 10,014,498,787 -1,126,863,098 71.72 1 27.71 -80,818,621,390 -31,226,773,169 25 KBLM 2011 -28,217,304,160 244,758,193,610 447,462,371,880 41,565,354,461 -15,117,401,417 17.86 0 27.19 -269,996,789,311 -411,032,170,285 26 KBRI 2011 10,299,471,461 43,221,691,826 712,776,410,365 -17,184,936,825 12,174,366,037 22.70 1 27.34 276,358,109,047 332,799,535,022 27 KIAS 2011 -59,520,506,801 40,983,641,825 1,845,619,062,018 2,423,321,620 -26,005,330,046 3.42 0 28.35 -88,938,228,757 -737,216,827,603 28 LMPI 2011 8,951,921,677 -60,060,412,143 486,230,464,729 -23,313,934,718 10,310,540,127 11.90 0 27.25 122,695,427,515 281,003,370,873 29 MASA 2011 47,356,330,214 688,142,000,000 4,338,121,379,964 -408,897,330,214

30 MLBI 2011 -164,373,000,000 25,357,000,000 1,122,424,000,000 351,699,000,000 33,210,062,418

31 PBRX 2011 30,730,099,475 562,235,443,632 605,973,912,445 38,394,860,717 24,036,850,692 7.60 0 28.05 182,680,065,262 674,148,617,797 32 RMBA 2011 162,779,000,000 1,075,105,000,000 2,635,107,000,000 -420,644,000,000

33 SIPD 2011 987,598,157 350,449,929,205 1,874,820,640,087 -2,377,705,811 11,957,740,893 15.77 0 28.60 188,573,573,887 342,020,172,071 34 SPMA 2011 -133,252,826,009 -12,166,540,731 1,911,236,966,011 83,344,334,742 -53,978,857,872 40.70 1 28.07 -2,196,939,515,397 -1,515,209,325,171 35 SRSN 2011 -5,725,990,000 13,034,805,000 262,696,113,000 21,923,742,000 9,392,609,835 20.94 1 26.61 196,681,249,942 249,962,222,436 36 SULI 2011 -339,180,351,225 137,106,282,194 2,025,362,969,119 108,071,040,296

37 TRST 2011 12,271,371,341 269,696,439,344 2,660,621,078,895 -3,436,405,942

38 ULTJ 2011 -302,636,887,949 139,994,248,388 1,750,720,242,279 140,078,859,114 -207,865,158,865

39 VOKS 2011 -27,393,290,376 619,972,969,376 486,643,270,944 23,092,707,616 -47,960,230,346 27.69 1 28.08 -1,328,018,778,288 -1,346,916,578,364 40 ADES 2010 61,407,000,000 8,748,000,000 226,513,000,000 -46,636,000,000

41 AISA 2010 173,076,000,000 1,027,738,000,000 930,286,000,000 -73,939,639,259 84,603,454,481 5.20 0 28.29 439,937,963,299 2,393,612,413,747 42 AKPI 2010 66,149,381,000 377,906,252,000 1,593,755,211,000 -211,232,763,000 -35,780,345,958

43 ALMI 2010 117,668,371,726 1,251,047,359,658 956,759,521,459 -259,915,739,207

44 APLI 2010 -6,210,358,985 142,650,140 330,532,023,690 -2,730,068,117 -1,418,164,072 13.33 0 26.54 -18,904,127,086 -37,634,172,750 45 ARGO 2010 133,384,288,000 86,552,305,000 2,306,701,059,000 46,068,921,000

46 ARNA 2010 -36,451,534,419 78,197,198,532 956,759,521,459 27,505,839,625 -9,647,210,932

50 CTBN 2010 -2,181,459,460 206,012,107,320 1,484,857,838,760 -69,042,000,200 -22,730,442,953

51 DAVO 2010 173,384,813,834 1,071,859,453,000 1,484,857,838,760 -192,597,700,320 32,461,802,944 37.47 1 28.68 1,216,343,756,320 931,032,583,247 52 ESTI 2010 -508,325,098 47,526,398,385 1,040,434,428,830 -30,095,240,395 781,857,380 13.61 0 27.27 10,641,078,938 21,321,551,821 53 FAST 2010 -93,975,455,000 441,280,103,000 426,665,640,000 -74,112,019,000 -152,950,101,315

54 GDST 2010 206,422,640,173 -40,729,934,484 661,972,929,700 17,407,056,824 230,447,241,283 55 GGRM 2010 1,273,684,000,000 4,594,963,000,000 13,314,355,000,000 -392,603,000,000

56 GJTL 2010 -180,356,000,000 1,098,863,000,000 7,680,751,000,000 -126,425,000,000

57 HDTX 2010 -23,522,450,666 201,172,185,065 951,851,593,362 5,292,817,669 -16,269,157,656 45.15 1 27.65 -734,552,468,146 -449,764,494,044 58 IKAI 2010 -12,126,116,071 107,608,795 78,919,921,558 -26,587,413,072

59 INDF 2010 -3,957,092,000,000 616,242,000,000 18,845,983,000,000 4,595,443,000,000 60 INDR 2010 -318,244,202,000 825,061,702,650 6,909,411,324,680 -253,247,142,930

61 INDS 2010 63,739,478,899 234,171,387,000 368,268,414,075 -115,468,337,539 -3,446,185,708 87.46 1 27.37 -301,403,402,038 -94,320,093,398 62 JECC 2010 -8,787,452,000 35,151,008,000 302,088,582,000 -20,054,922,000 -15,644,367,911 17.58 0 27.05 -275,027,987,873 -423,251,807,762 63 KBLI 2010 11,109,781,395 238,713,438,000 757,637,547,778 -10,283,006,000 4,274,327,707 81.44 1 27.07 348,101,248,432 115,719,600,051 64 KBLM 2010 -1,733,300,471 190,561,104,989 387,272,114,316 -2,520,397,728 -8,473,839,535 71.72 1 26.72 -607,743,771,421 -226,443,748,408 65 KBRI 2010 -473,721,887,023 25,179,457,256 751,588,929,327 7,276,005,644

66 KIAS 2010 -22,284,431,765 187,530,426,752 1,260,891,647,167 76,744,116,527 27,929,429,013 3.42 0 27.87 95,518,647,226 778,308,840,273 67 LMPI 2010 -16,992,231,619 -7,309,349,898 419,015,078,319 6,876,725,676 -5,155,208,912 11.90 0 27.13 -61,346,986,053 -139,886,351,033 68 MASA 2010 -328,198,000,000 303,168,000,000 2,663,300,700,000 323,551,000,000

69 MLBI 2010 122,860,000,000 47,012,000,000 1,044,062,000,000 -206,834,000,000 34,794,454,553

70 PBRX 2010 32,612,899,367 153,269,722,942 416,296,310,433 -127,672,973,679 -34,432,204,075 7.27 0 27.51 -250,322,123,628 -947,279,208,950 71 RMBA 2010 -345,241,000,000 1,643,987,000,000 2,339,824,000,000 510,290,000,000

72 SIPD 2010 36,305,932,052 -23,507,186,489 1,336,285,327,137 31,917,996,027 79,361,867,598 15.77 0 28.35 1,251,536,652,020 2,250,040,572,446 73 SPMA 2010 -53,363,647,190 127,733,902,824 1,803,534,410,532 3,653,040,260 -25,821,678,090

74 SRSN 2010 2,040,205,000 8,500,209,000 260,129,301,000 34,370,987,000

77 ULTJ 2010 -156,758,058,593 251,061,816,547 1,377,215,313,972 248,193,365,887 -21,791,570,512 78 VOKS 2010 -104,855,380,597 351,639,844,415 481,652,288,366 87,614,444,866 -74,935,294,936

79 ADES 2009 -567,000,000 845,000,000 895,488,062,873 65,402,000,000 49,419,400,143 2.59 0 25.91 127,996,246,369 1,280,291,619,055 80 AISA 2009 -13,027,863,807 -17,198,842,971 757,873,593,752 6,918,029,596 5,941,434,518 19.65 1 27.93 116,749,188,288 165,937,897,461 81 AKPI 2009 -112,919,420,000 94,541,982,000 1,941,900,022,000 51,556,306,000 -56,279,345,661 52.51 1 28.09 -2,955,228,440,679 -1,581,070,692,703 82 ALMI 2009 -159,749,114,222 -37,727,201,335 895,488,062,873 -40,057,043,255 -160,566,059,405

83 APLI 2009 -8,940,427,102 15,590,259,982 328,484,820,541 -4,235,302,648 -5,980,927,220 13.33 0 26.43 -79,725,759,841 -158,105,536,022 84 ARGO 2009 179,453,209,000 332,237,063,000 2,306,701,059,000 3,266,540,000

85 ARNA 2009 -24,097,133,764 52,356,618,859 813,588,824,952 -3,184,716,807 -13,826,821,380 86 BATA 2009 -27,905,858,000 39,001,916,000 241,286,695,000 44,213,479,000

87 BRNA 2009 7,677,607,684 11,264,195,674 449,590,968,115 11,213,676,454 21,051,294,622 - 0 26.95 0 567,379,193,303 88 CEKA 2009 -55,189,485,466 675,755,260,186 264,128,402,667 63,658,331,090 -63,185,452,442 92.01 1 27.07 -5,813,693,479,219 -1,710,179,100,536 89 CTBN 2009 -63,692,454,200 1,235,561,800,700 1,387,344,928,400 134,412,089,200

90 DAVO 2009 -219,475,988,715 2,880,657,037,500 3,586,848,174,666 -272,421,841,606

91 ESTI 2009 -24,404,178,610 13,484,398,952 671,463,622,445 -27,274,692,744 -26,436,535,850 13.61 0 26.97 -359,801,252,922 -713,122,774,720 92 FAST 2009 -185,688,067,000 430,564,206,000 364,818,562,000 142,101,807,000 -135,684,238,085 0.32 0 27.67

93 GDST 2009 -97,653,039,359 1,306,695,000,000 643,041,680,503 -266,276,283,870 94 GGRM 2009 190,501,000,000 1,661,797,000,000 12,131,004,000,000 1,004,306,000,000 95 GJTL 2009 -232,075,000,000 -34,197,000,000 6,843,080,000,000 566,313,000,000

96 HDTX 2009 -18,859,250,992 218,250,968,095 1,365,173,653,467 -32,409,663,032 -23,962,097,990 22.85 1 27.72 -547,533,939,079 -664,155,929,244 97 IKAI 2009 -70,777,224,353 -4,842,711,733 945,052,365,255 33,055,986,228 -35,839,816,037 28.90 1 27.36 -1,035,770,683,463 -980,685,419,850 98 INDF 2009 -238,646,000,000 1,166,725,000,000 17,052,803,000,000 -370,299,000,000

99 INDR 2009 -697,761,107,000 -2,824,684,663,800 7,084,064,443,800 153,893,591,800

104 KBRI 2009 39,964,597,987 50,546,848,624 1,228,118,487,935 8,692,247,006 64,258,848,985 18.00 0 27.72 1,156,659,281,728 1,781,574,464,218 105 KIAS 2009 67,215,396,721 -98,655,317,648 1,236,463,294,588 -28,945,945,965 82,583,304,012 3.42 0 27.91 282,434,899,721 2,304,821,026,711 106 LMPI 2009 -6,917,893,359 35,522,282,707 376,896,349,905 22,498,831,136 9,163,757,353 11.90 0 27.02 109,048,712,498 247,566,106,301 107 MASA 2009 -5,869,000,000 337,196,000,000 2,074,922,000,000 54,449,000,000 38,559,484,341

108 MLBI 2009 -186,432,000,000 -125,727,261,936 845,322,000,000 111,677,000,000 -105,523,370,219

109 PBRX 2009 -97,386,912,742 142,537,282,658 393,407,099,493 188,134,956,842 -4,299,654,792 7.27 0 27.43 -31,258,490,339 -117,948,301,589 110 RMBA 2009 -201,515,000,000 135,668,999,753 2,065,095,000,000 108,669,907,586 -116,367,801,984

111 SIPD 2009 44,291,113,956 900,216,248,433 1,090,707,191,158 43,888,968,026 27,031,138,442 15.67 0 28.13 423,577,939,386 760,291,498,271 112 SPMA 2009 -52,398,966,300 6,962,908,343 1,633,738,090,006 56,652,885,205 6,804,240,416 40.70 1 27.99 276,932,584,913 190,454,351,684 113 SRSN 2009 51,961,170,000 33,523,043,000 257,438,402,000 -50,635,438,000

114 SULI 2009 -47,082,543,560 320,521,258,995 2,512,742,348,605 -56,343,644,610 115 TRST 2009 -171,490,510,101 211,587,206,787 2,396,651,676,894 186,011,533,961