The Influence of Good Corporate Governance and Family

Involvement towards Firm Performance in Family Firm in Indonesia

Stock Exchange

By : Ilma Rafika ID : 1111082100001

ACCOUNTING DEPARTMENT INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESS

STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAHJAKARTA

v

CURRICULUM VITAE

Personal Identities

Name : Ilma Rafika

Gender : Female

Place of Birth : Solok

Date of Birth : May 16th 1993

Address : Komp. Polda blok I1 no. 3 Padang, Sumatera Barat, Indonesia

Phone/Mobile : 085263018474

E-mail Address : ilma_fika@yahoo.co.id

Formal Education

College : UIN Syarif Hidayatullah Jakarta Senior High School : SMAN 10 Padang

vi

The Influence of Good Corporate Governance and Family Involvement towards Firm Performance in Family Firm in Indonesia Stock Exchange

ABSTRACT

This research aimed to find out the influence of Good Corporate Governance and Family Involvement toward Firm Performance in Family Firm in Indonesia Stock Exchange. In this research good corporate governance are proxies by board size and size of audit committee and family involvement are proxies by family ownership and family director/manager. According to the purposive sampling method with the judgemental sampling, obtained 20 companies as the research sample from 2010-2013. Regression with data panel method is used in this research.The annual report on companies from 2010-2013 downloaded at Indonesia Stock Exchange (IDX). Result of this research indicates that the variable of firm value (Tobin’s Q) is simultaneously influenced by board of director (BOD), and size of audit committee (CA). Besides that, the result also indicates that board of director (BOD) has significantly positive influence toward firm value (Tobin’s Q) and size of audit committee (CA) has significantly positive influence toward firm value (Tobin’s Q), while family ownership (FO) and family director/manager (FDM) do not have significant influence towards firm value (Tobin’s Q).

vii

Pengaruh Tata Kelola Perusahaan dan Keterlibatan Keluarga terhadap Kinerja Perusahaan dalam Perusahaan Keluarga di Bursa Efek Indonesia

ABSTRAK

Penelitian ini bertujuan untuk menganalisis pengaruh tata kelola perusahaan dan keterlibatan keluarga terhadap kinerja perusahaan keluarga. Dalam penelitian ini, good corporate governance dikategorikan menjadi dua indikator, ukuran dewan direksi dan ukran komite audit; keterlibatan keluarga dikategorikan menjadi dua indikator, kepemilikan keluarga dan direktur/manajer dari keluarga. Penelitian ini menggunakan metode purposive sampling maka diperoleh 20 perusahaan dari tahun 2008-2013 Bursa Efek Indonesia (IDX). Metode yang digunakan dalam penelitian ini adalah Regresi Data Panel. Hasil dari penelitian ini menunjukkan bahwa variabel nilai perusahaan secara simultan dipengaruhi oleh ukuran dewan direksi (BOD) dan ukuran komite audit (CA). selain itu, hasilnya juga menunjukkan bahwa ukuran dewan direksi (BOD) memiliki pengaruh signifikan posotif terhadap nilai perusahaan (Tobin’s Q) dan ukuran komite audit (CA)memiliki pengaruh signifikan positif terhadap nilai perusahaan (Tobin’s Q), sementara, kepemilikan keluarga (FO) dan direktur/manajer keluarga (FDM) tidak memiliki pengaruh signifikan terhadap nilai perusahaan (Tobin’s Q).

viii

FOREWORD

Assalammu’alaikum Wr. Wb.

All praise to Allah SWT, the Most Gracious and the Most Merciful, the Cherisher and Sustainer of the worlds; who always gives the writer all the best of this life and there is no doubt about it. Shalawat and Salaam to the Prophet Muhammad SAW and his family. With blessing and mercy from Allah SWT, the writer can complete this thesis to fulfill one of the requirements in accomplishing bachelor degree.

The writer is also well-aware that without advice and support from various parties, this thesis will not be realized properly. Therefore, the writer would like to take her opportunity to express her deep and sincere gratitude to the following:

1. Beloved parents, both my mom Yuni Era S.Pd M.Si and my dad Rainir Idrus S.E who have given all their efforts morally and material to my college study. For also being such a great parents that always give me support and advice to finish this thesis. Thank you for your love and prayers that never end. All this efforts is dedicated to you my mom and dad. May Allah SWT always give His blessing for both of you.

2. Prof. Dr. Abdul Hamid, MS., as the Dean of Economic and Business Faculty.

3. Hepi Prayudiawan,SE ,Ak ,MM., as the Lead of Accounting Department. 4. Prof. Dr. Ahmad Rodoni as the thesis supervisor I. By his advice,

direction, and guidance I can write this thesis properly. Thank you so much for your time and kindness to help me in finishing this thesis.

5. Yulianti, SE, M.Si as the thesis supervisor II. Also by her advice, direction, and guidance I can write this thesis properly. Thank you so much for your time and kindness to help me in finishing this thesis.

ix

7. All the staffs in Economic and Business Faculty. Especially to Mr. Bonyx who always reminds me to finish my thesis and provide me all the procedures I need in making this thesis. And to Mr. Sugih for providing information and official stuffs I need in my college study.

8. My beloved family, grandma, uwo, tata and uncu who always give spirit, motivation, prays for every single things I do I can get the best and cheers me up, to my soul sister and brother Fanni and Ilham who always beside me to pick me up when Im getting down, love you to the moon and back. 9. All my dear friends in Accounting International Program 2011 for every

foolish things and jokes that you have done, and you made my day full of laugh in the last 3.5 year. My Pondok Nadja mates for every moment we spend together and cheers me up when I feel homesick. My High School mate, you never end guys. For “the one who always pray for me in his busy work and always have time for me” thank you so much. For senior and junior thank you for support an help me in wite this thesis, and all of you that I cannot mention one by one. Thank you for sharing joy moments. 10. All of the people who always asked “When will you graduate?” or “I thought you have graduated” to me every time they saw me. Thank you for your teasing. Your words finally motivated me so much.

The writer realizes that this thesis is still far from perfection due to limited knowledge of the writer. All the suggestions and constructive criticism are welcomed in order to make this thesis better. Hope, this thesis will be useful for any researcher or reader. May Allah SWT always bless every step in our life.

Wassalamu’alaikum Wr. Wb.

Jakarta, Januari 2015 The Writer

x

TABLE OF CONTENT

Curriculum Vitae ... v

Abstract ... vi

Abstrak ... vii

Foreword ... viii

Table of Content ... x

List of Tables ... xv

List of Figures ... xvi

List of Appendix ... xviii

Chapter I INTRODUCTION A. Background Research ... 1

B. Problem Formulation ... 10

C. Research Objectives ... 11

D. Benefits ... 11

Chapter II LITERATURE REVIEW A. Theory Development ... 12

1. Agency Theori ... 12

2. Family Business ... 15

a.Type of Ownership in Companies ... 15

b. Family Firm ... 17

xi

a. Concept Good Corporate Governance ... 19

b. Good Corporate Governance’s Legal Basis in Indonesia ... 20

c. Basic Principle of Good Corporate Governance ... 21

d. Good Corporate Governance Implementation Objectives ... 24

e. Good Corporate Governance Research Indicator ... 26

4. Family Involvement ... 28

5. Firm Performance ... 32

B. Previous Research ... 35

C. Theoritical Framework ... 41

D. Hypothesis ... 43

Chapter III RESEARCH METHODOLOGY A. Scope of Research ... 47

B. Sampling Method ... 47

C. Data Collection Method ... 48

D. Data Analyze Method ... 48

1. Classical Assumption ... 50

a. Normality Test ... 50

b. Multicollinearity Test ... 51

c. Autocorrelation Test ... 51

d. Heteroscedasticity Test ... 52

xii

a. Pooled Ordinary Least Square ... 53

b. Fix Effect Model (FEM) ... 53

c. Random Effect Model (REM) ... 54

(1) Model Selection on Panel Data... 55

(a) Chow Test ... 56

(b) Hausman Test ... 57

d. t-Test ... 57

e. F-Test ... 57

f. Adjusted R2 ... 58

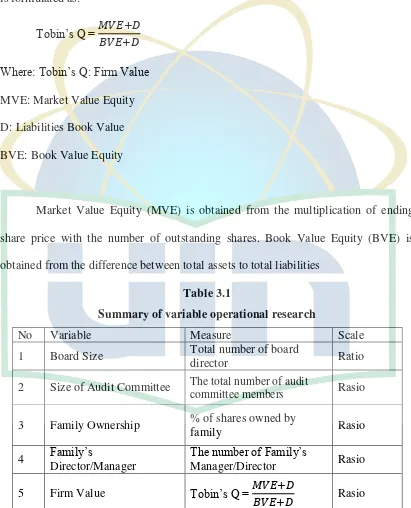

E. Definition of Operational Research ... 58

1. Board of Director (BOD) ... 59

2. Size of Audit Committee (CA) ... 59

3. Family Ownership (FO) ... 59

4. Family’s Director/Manager (FDM) ... 60

5. Firm Value (Tobin’s Q) ... 61

Chapter IV ANALYSIS AND DISCUSSION A. Overview of Research Object ... 62

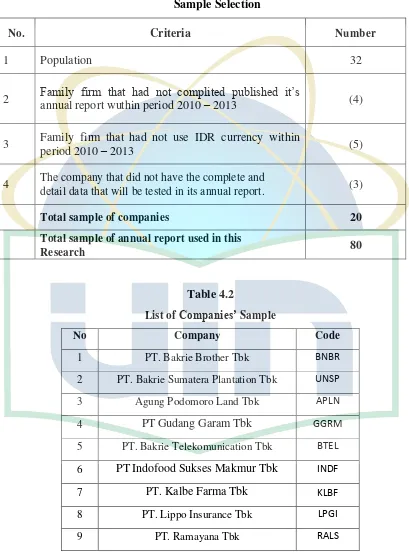

1. Description of Research Object ... 62

B. Data Descriptive ... 64

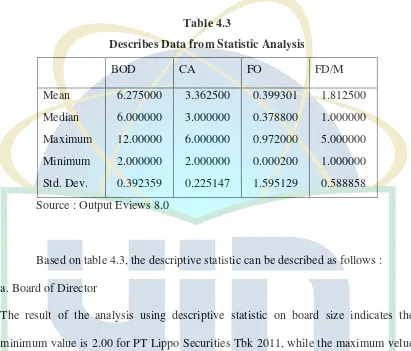

1. Descriptive Statistic ... 64

2. Data Processing ... 67

a. Classical Assumption Test ... 67

xiii

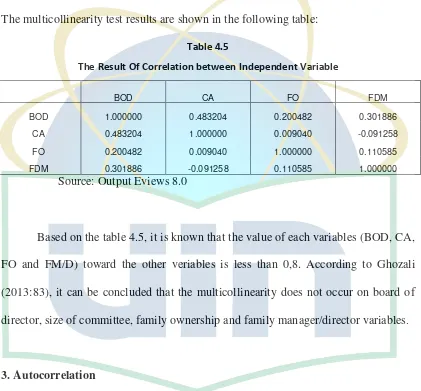

(2) Multicollinearity Test ... 68

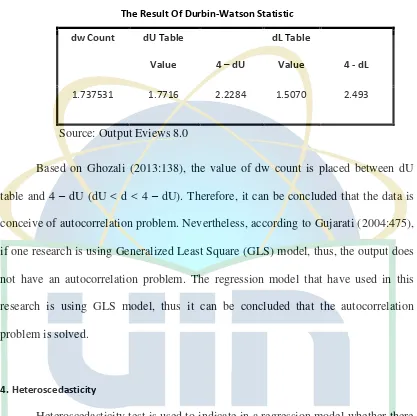

(3) Autocorrelation Test ... 68

(4) Heteroscedasticity Test ... 69

b. Model Selection in Panel Data Regression ... 70

(1) Chow Test ... 70

(2) Housman Test ... 72

c. Hypotesis Testing ... 72

(1) t-Test ... 73

(2) F-Test ... 76

d. Regression Equation ... 77

e. The Influence of Good Corporate Governance and Family Involvement Variables Toward Firm Performance ... 78

f. Dominant independent variable influence Firm Performance ... 79

Chapter V CONCLUSIONS AND RECOMMENDATIONS A. Conclusion ... 81

B. Recomendation ... 81

REFERENCE ... 83

xvi

LIST OF TABLE

No Descriptions Page

1.1 Asian Corporate Governance Market Category Score ... 2

2.1 Table Relevan Previous Research ... 39

3.1 Summary Variable Operasional Research ... 62

4.1 Sample Selection ... 64

4.2 List of Companies Sample ... 64

4.3 Descriptive Statistic ... 66

4.4 Normality Test ... 68

4.5 Multicollinearity Test ... 69

4.6 Durbin-Watson Statistic ... 70

4.7 Heteroscedasticity : White Test ... 71

4.8 Result of Chow Test ... 72

4.9 Result of Hausman Test ... 73

4.10 T-Test ... 74

4.11 F-Test ... 78

xvii

LIST OF FIGURE

No Descriptions Page

xviii

List of Appendixes

NO DESCRIPTIONS PAGE

Appendix 1 List of Data ... 89

Appendix II Descriptive Statistic ... 92

Appendix III Classical Assumption Test ... 93

Appendix IV Result of Chow Test ... 95

Appendix V Result of Housman Test ... 96

Appendix VI The Result of Pooled Least Square ... 97

Appendix VII The Result of Fix Effect Model (FEM) ... 98

Appendix VIII The Result of Random Effect Model (REM) ... 99

Appendix IX The Result of t-Test ... 100

Appendix X The Result of F-Test ... 101

Appendix XI The Result of Adjusted R2 ... 102

1

CHAPTER I

INTRODUCTION

A. Research Background

Family firm is identical with the transition between one generation to the next generation. This condition may show whether the family firm reaches success or not to continue their family business. Thus, by learning the successful of family business, the dynamic of the transition between generations and the aspects that have important role in that transition can be seen. The transition in family business is also an important thing to guarantee the sustainability of the company. This sustainability means not only as business existence but only also as business performance.

2 company to the detriment of all. These qualities are reflected into business ownership methods and styles, and can support or harm a company.

To maintain the existence of a firm in global competition, it does not always about how to increase the profit and to expand the corporate subsidiaries. The businessman must think about how to maintain the good relationship with related parties, such as corporate’s elements (shareholders, management and staffs),

government and environment by showing reliable and transparent disclosure of corporate’s activities and reporting. It is also useful to realize the concept of Good

Corporate Governance. Here is some aspect of corporate governance must be concerned by firm released by Asian Corporate Governance Association in 2013 :

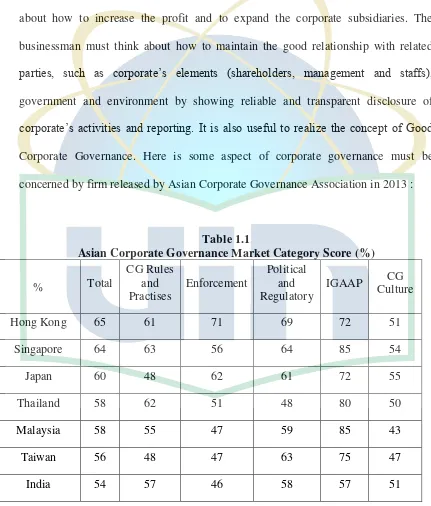

Table 1.1

Asian Corporate Governance Market Category Score (%)

3

From Table 1.1 above we can see, there are five aspects that are measured from GCG, they are CG rules and practice, enforcement, political and regulatory, IGAAP (Auditing and Accounting) and CG culture. Indonesia is placed in the last rank of market category score. As general, it cause by the weak of regulation implementation and there is no improvement whether the regulatory system is fair and consistent or not (ACGA, 2013).

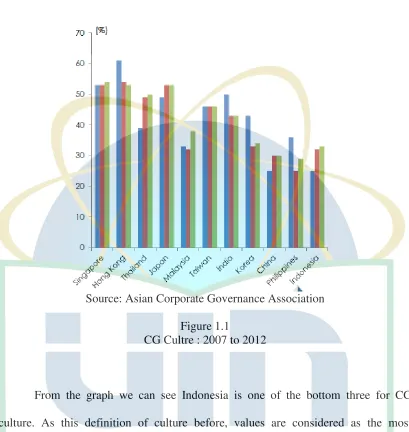

4 Source: Asian Corporate Governance Association

Figure 1.1

CG Cultre : 2007 to 2012

From the graph we can see Indonesia is one of the bottom three for CG culture. As this definition of culture before, values are considered as the most fundamental aspect of culture. To understand a culture thoroughly, it is essential to understand its cultural values. Values form attitudes which respectively, shape the people’s behavior. Cultural values shape the behavior of all the individuals in the

5 maintained very strong hereditary in the family firm. If good corporate become a culture it will very easily keep its continuity, but if it is present as a new culture that should be pursued in order to become a new culture.

Corporate governance is the process on which organizations are managed and controlled (Gao et al, 2008 in Zhang, 2008). It recognizes “the inherent conflict in objectives between owner shareholders and managers” and thus “establishes institutions, policies, and procedures to protect shareholders’ interests” (McCarthy and Puffer, 2002 in Zhang, 2008). Good corporate governance tried to maintain between economic goals and objective's society as well as manage the value of shares and to concern with stakeholder (Tunggal, 2011). Corporate governance is generally associated with the existence of agency problem and its roots can be traced back to separation of ownership and control of the firm. Agency problems arise as a result of the relationships between shareholders and managers and are based on conflicts of interest within the firm. Similarly, conflict of interests between controlling shareholders and minority shareholders is also at the heart of the corporate governance literature (Hasan and Butt, 2009).

6 Implementation of Good Corporate Governance is to control

mechanism, regulation and to manage the business ti increase prosperity and corporate accountability. This can be interpreted as the internal control system which has major purpose to manage significant risks, in order to meet and increase the velue of stakeholder in a long-term period. Good corporate governance can encourage the transparent and professional management’s work pattern and professional (Effendi,

2009).

Family involvement in ownership and management is the main protagonists influencing the corporate governance of family owned companies. According to Berle and Means, ownership concentration will align the interests between ownership and management, and mitigate the amount of agency costs (Berle and Means, 1932). Thus, higher financial performance could be achieved. Usually family businesses have high involvement and long tenure in management. Thus, by their high involvement they will succeed at having a better sense of recognition of uncertain-ties and opportunities and also by establishing a long term focus (Zahra in Charbel, 2013).

7 financial functions. Firm value is also reflected in the company's share price, the higher the share price, the better the value of the company. However, a company has a good value only if the company has a good performance as well. One way that can be used by companies to increase the value of the company is to apply the principles of corporate governance mechanisms into the company.

One of the method to measure the firm value is Tobin’s Q. Tobin’s Q has the advantage of reflecting the firm’s current value and future profitability potential (Ma

and Tia, 2009). The firm value can basically be measured through several aspects, one of those is the market price of the company's share because the share market price firms reflect investors' overall assessment of each equity owned. The market price of the share shows a central assessment of all actors in the market, the price of stock market acts as a barometer of corporate performance management. If the value of a firm can be represented by the share price, so maximizing the firm's market value equal to maximizing the share in the market price.

8 the firm's internal leadership is very important. This is evidenced by the family involvement of members in firm management. The number of important decisions were taken anagement still in control of family leadership. Good corporate governance is also indicated by the turn of the next generation who still maintain a good relationship with management.

However, the success of corporate governance can not be separated from the internal conflict among the next generation. At the turn of the second generation to the third generation there were several conflicts. The battle over the separation between the second generation doesn’t want Charles to occupy keystone positions

within the firm. The dispute widened to share struggles over the affairs of the family. Noted, as many as 10 disputes must be addressed. In fact, the dispute led to a demand for justice. So fierce clashes in PT Nyonya Meneer, to the extent that Cosmas Coal Menaker then intervene, because the inter-family dispute involving thousands of workers to the company. Eventually the brothers dropped the option to split up and sell all their parts to Charles Ong Saerang. Until now, the ownership of PT Jamu Nyonya Meneer wholly owned by Charles Saerang. This conflict is resolved since Charles Saerang full control of PT Nyonya Meneer of other family members so that it more flexibility to manage the company.

9 professionalism among the family must still be upheld for the sake of management and good governance without losing the essence of family that exist. It is interesting to examine how a family company that is so complicated problem could survive and keep exist until now with global market competiton (www.ciputraenterpreneur.com).

Therefore, based on phenomena above the author interested to analyze “The

Influence of Good Corporate Governance and Family Involvement towards

Firm Performance in Family Firm in Indonesia Stock Exchange”.

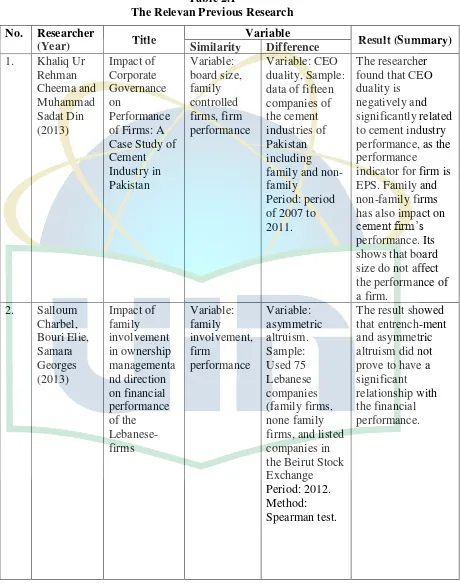

This research has been done by Rehman and Din (2013) and Charbel et all (2013), with differences as follow:

10 2. Salloum Charbel, Bouri Elie and Samara Georges (2013) Impact of family

involvement in ownership managementand direction on financial performance of the Lebanesefirms. The research used variable of Financial performance, Family involvement in ownership and management and Entrenchment and asymmetric altruism, while this research use variables Board size, Size of Audit Committee, Family ownership and Family Manager/Director. The previous research was done within period of 2012, while this research use period 2010-2013. And population the previous research used 75 Lebanese companies (family firms, none family firms, and listed companies in the Beirut Stock Exchange), while this research uses data of all companies as family owned business listed in Indonesia Stock Exchange.

B. Formulation of the Problem

1. How do the influence of the board size, size of audit committee, family ownership and family’s manager/director towards firm performance?

11

C. Research Objectives

The purpose of this research is to investigate the reciprocal relationship between the concept of firm performance with the implementation of good corporate governance and family involvement in family firm. The purpose are follow by:

a. To observe the influence of board size, size of audit committee, family ownership and family’s manager/director towards firm performance in

Indonesian Company Listed in Indonesia Stock Exchange.

b. To observe the influence dominant independent veriable towards firm performance in Family Firm Listed in Indonesia Stock Exchange.

D. Research Benefits

Benefits of this research are:

a. For Family Firm Listed in Indonesia Stock Exchange: to give contribution for company and education to understand how important Good Corporate Governance concept on firm performance is and knowing what factors that can influence its firm performance so that they will know how to organize and manage their (family) existence for company going concern.

12

CHAPTER II

THEORETICAL FRAMEWORK

A. Theory Development

1. Agency Theory

Agency theory is a theory that explains the relationship between agents as those who manage the company and the principal as the owner of both which are bound in a contract. The owner or principal is a party to evaluate the information and agents are running as part of management activities and decision making (Jensen and Meckling, 1976).

13

However, it is generally impossible for the principal or the agent at zero cost

to ensure that the agent will make optimal decisions from the principal’s viewpoint.

In most agency relationships, the principal and the agent will incur positive monitoring and bonding costs (non-pecuniary as well as pecuniary), and in addition,

there will be some divergence between the agent’s decisions and those decisions

which would maximize the welfare of the principal. The dollar equivalent of the reduction in welfare experienced by the principal as a result of this divergence is also

a cost of the agency relationship, and we refer to this latter cost as the “residual loss”.

In reality, managers will know more about internal information and the company's prospects in the future than shareholders. Therefore, managers should always give a signal about the condition of the company to the shareholder. The signal can be given by the manager through the disclosure of accounting information such as financial report. The financial report is a very important thing for the external users because these entities are in the greatest condition of uncertainty (Ali, 2002). Imbalance knowledge of information will lead to the emergence of a condition known as information asymmetry. With the existence of information asymmetry between management and the shareholder will give the opportunity to the manager to do earning management, so that it will mislead shareholders about the company's economic performance.

14

investors believe that managers will give benefit to them, by believing in that the manager will not misuse the invested fund to the illegal projects. Besides that, corporate governance also relates to how the investors control the managers (Siallagan and Machfoedz, 2006).

Special authority in every region in Indonesia in implementing corporate governance is based on Law no. 5 of 1974 on the Principles of Governance in the Region, as well as explaining the relationship between central and local government. After the implementation of policies to implement regional autonomy in Indonesia through Law no. 22 of 1999 as amended by Law no. 32 of 2004 on Regional Government has change a paradigm and a very basic structure, especially the local government relations (Executive) with the Regional Representatives Council/DPRD (Legislative). In this relationship, the Legislative delegates authority to run the government to the executive.

15 2. Family Business

According to Bennedsen, M., Gonzalez, F. P. and Wolfenzon, D. (2010), A

“family firm” is herein defined as an organization that shares four common traits:

1. Family. Two or more members of the same family (blood or marriage) are direct

participants in the firm’s formal governance institutions such as management and the

board of directors.

2. Ownership. The family owns a “significant” fraction of the shares in the firm. Using classic portfolio theory as a benchmark, a significant threshold is defined as an

investment exceeding the firms’ share in the overall market portfolio. In other words,

this threshold is not necessarily related to a fraction of shares held.

3. Control rights. Members of the family exert “significant” control rights in the firm, where the control threshold is at least as large as the fraction of ownership rights held. 4. Preference for within firm inter-generational transfers. Families attach value to retaining their ownership and control rights within the family firm across generations.

a. Type of Ownership in Companies

16

not only divided into two, there is a some type of ownership Another in a modern company. In modern enterprises, there shareholders in a large number of shares in which their behavior different from each other. The shareholders in a large number of these have significant impact on the decisions taken by the company so ultimately affect overall company performance. Several large companies dominated ownership by some shareholders who have a number of shares that a lot and usually sit in the company's leadership seat, several other companies owned by shareholders who retain ownership for a long time. In addition, there are companies whose ownership is dominated by family particular. Several other types of ownership is ownership by the company government, corporate employee ownership (ESOP), ownership by board corporate executives, ownership by the debtor, ownership by the Supplier, ownership by the buyer, ownership by institutional investors in the form, ownership by debt buyers, and ownership by venture capital (venture capital).

17

investors the performance of companies that have been done have not managed to find significant relationship between them (Black 1998).

Kang and Sorensen (1999) in his article cites research from (Jensen, 1989, Kaplan, 1991, Shleifer and Summers 1988) which states that the change of the ownership structure of the company can only increase efficiency company, this can happen through leveraged buy out (LBO), which occurs changes in the ownership structure of the listed company into a private company through the purchase of corporate debt. In addition through the LBO, changes ownership structure that can improve the company's performance also occurs when private company into a public company to make an offer its shares to public investors.

b. Family Firm

In previous studies, the definition of family firm used very different. Research conducted by Andres (2006) classify the family firm as a company whose shares are minimal 25% owned by a particular family or if less than 25% are members of families who have positions on the Board of Directors or Board of Commissioners company.

18

Research conducted by Barth et al (2005) classify firm as a family firm if a family has at least 33% percent of the total shares of the company. While Faccio and Lang (2002) requires a minimum of 20% shares owned by certain family classify the company as a family company.

Basically studies conducted in analyzing influence of family ownership structure is concentrated on family using the same definition of the family firm , which uses certain percentage of ownership and are representative of the family members in company. The difference lies only in the magnitude of the cut-off percentage of ownership were used.

19 3. Good Corporate Governance

a. Concept of Good Corporate Governance

Good Corporate Governance indefinitely as a system which has authority and as a control to add value for all of stakeholders. As principal of corporate governance

have interest for all shareholders and stakeholders in corporate governance.

Understand of corporate governance according to the Turnbull Report in the UK

(April 1999) Corporate Governance is a company’s system of internal control, which

has principal to the management’s risk which are significant to fulfill of its business objectives to safeguard the company’s asset and enhancing over time the value of the shareholders’ investment. The Implementation involved development of GCG, have

two related aspects, namely: hardware and software. The hardware includes the establishment of technical or structural change and organizational systems. The software includes more psychosocial change of paradigm, vision. In real-world business practices, most companies more emphasize hardware aspects, such as the preparation of systems and procedures and the establishment of organizational structures.

Gede Raka, as panelist from Indonesian Institute for Corporate Governance

(IICG), stated of Good Corporate Governance have implied the company and not make a profit for owners, but create value for all concerned parties. Good Corporate

Governance concept reflects to share, care, and preserve. Good Corporate

20

mission of organization. Changes in technical aspects of structure and systems are

required as management’s capabilities. In this case, focuses in concern are regularity

and smoothness on the process in organization as well as members of the company's adherence to the policy to implement the Principles Good Corporate Governance.

The definition according to Cadbury, said that Good Corporate Governance is direct and control the company, in order to reach balance between power of strength and authority of company. World Bank defines Good Corporate Governance is a collection of laws, regulations, and rules which have to fulfill and can push the performance of corporate resources as function efficiently, in order to generate economic value of sustainable long term for shareholders and society as a whole.

According to decree of Minister of state-owned enterprise No: PER-01 /MBU/2011 regarding on the implementation of Good Corporate Governance practices in state-owned enterprise is principles underlying the process and mechanism of corporate governance based enterprise management regulations and business ethics.

b. Good Corporate Governance’s Legal Basis in Indonesia

In Indonesia, the implementation of good corporate governance guidelines have been made by Komite Nasional Kebijakan Governance (KNKG) through his

new book released in 2006 entitled “Pedoman Umum Good Corporate Governance

21

Investment and Development of State-Owned Enterprises 106 of 2000 and Decree of Minister of State Enterprises no. 23 2000 that regulate and formulate the development of good practice the company's corporate governance in the company, and then refined with KEP-117/M-MBU/2002 which is renewed by the Regulation of Minister of State-Owned Enterprises PER-1/MBU/2011 of Implementation Practices of Good Corporate Governance (GCG) on SOEs. There has also been issued Decree of Minister of State Enterprises no.103 Year 2002 on Establishment of Audit Committee. Capital Market Supervisory Board No. through a circular. SE-03/PM/2000 has recommended that public companies to maintain audit committees.

c. Basic Principles of Good Corporate Governance

Various rules and system as a regulator in management of company’s need to be poured in form of principles that must be adhered to the concept of Good Corporate Governance. In generally, there are 5 (five) basic principles (KNKG. 2006), namely:

1). Transparency

To maintain the objective of corporate must provide information, which is material and relevant in a way that is easily accessible and understood by stakeholders. Companies should take the initiative to reveal not only the problem that required by law, but also the importance for decision-making by shareholders,

22

adequately, clearly, accurately, and all the important events that may affect the condition of corporate.

2). Accountability

Corporate must be accountable for their performance in a transparent and fair. It must be properly managed, scalable, and in accordance with the interests of the company to remain stakeholder’s interests. Specify details of duties and responsibilities of each organization and all employees. Corporate must ensure that

the organs of company and all employees have competent accordance with the duties,

responsibilities, and roles in implementing Good Corporate Governance. Corporate needs to ensure an effective system of internal control to be manage in the company. 3).Responsibility

Corporate must comply with laws and regulations and carry out

responsibilities for people and the environment. So, the business can be maintained in the long run and gained recognition as the Good Corporate Governance. The organization must adhere to the principle of prudence and ensure compliance with regulatory laws, statutes and regulations. Corporate should be carried out social

responsibility. Corporate has to be responsible in management to the principle of corporate, as well as existing of some regulation.

4).Independency

23

avoid domination by any party, is not affected by particular interests, independent of other interests, influence and pressure. Each organ shall carry out the functions and duties in accordance with the statutes and regulations, and not dominate the other, or passing the buck between each other. Independency state whereas the corporate are

managed by professional without any conflict interest and pressure from any side,

which will be affected to the health of corporate. To accelerate the implementation of

Good Corporate Governance, the corporate should be managed independently, so their organizations do not dominate to the other and no intervention other parties. Each organization of corporate has to avoid the domination any party, not influenced by special interest, free from conflict and pressure, so the decision-making will be done objectively. Each organ must perform its functions and duties in accordance with the statutes and regulations, do not dominate others and passing the buck between each other to realize an effective internal control.

5).Fairness

24

Equality and fairness defined as fair and equal treatment in fulfilling the right of stakeholder arising under treaties and laws, which have applied. Fairness also includes to fulfill the right of investors, legal system and enforcement of regulations, which protect investors. Fairness is expected to make the entire of company’s assets are well managed and prudent, also expect to protect all members. Corporate should provide the opportunity for stakeholders to provide input and expression to the interests of companies and open access to information in accordance with the principle of transparency in their respective positions.

d. Good Corporate Governance Implementation Objectives

According to H.J. Wierman Pamuntjak as writer of internal audit in Bulletin No. editions. 020/2003, the benefits of implementing Good Corporate Governance are as follows:

1). Improve the performance of corporate, Good Corporate Governance practice is crucial to the performance of corporate, the process to make better decisions will improve operational efficiency and will improve service to shareholders;

25

2) To create welfare society. Good Corporate Governance practices will improve the efficiency and effectiveness and thus will also encourage the creation of economic dynamics. With increase the confidence of investors, the practice of good corporate governance will encourage ultimately of investment flows and creating new investment, and thus will increase employee;

3) Increased income for shareholders;

4) Being a catalyst / growth the welfare of community, especially through self-policing;

5) Increasing the role of shareholders in corporate’s progress, as each becomes increasingly active shareholders to observe and provide input for the progress of operations. In general, the benefits of Good Corporate Governance can be seen from two perspectives, micro and macro.

The benefits of micro include: 1) Reduce risk;

2) Increase the value of shares; 3) Ensure compliance;

4) Have the endurance (sustainability); 5) Spur performance;

26

While the benefits of macro-economic recovery that will be felt by the entire national community, among others:

1) Reasonable economic growth increases; 2) Greater employment opportunities;

3) Local and international competitiveness increases.

e. Good Corporate Governance Research Indicator

According to previous researches, there are several indicators of good corporate governance that can affect firm value, such as:

1). Board size

Board size is the number of board of directors of the company which is

generally composed of inside and outside members and responsible to run company’s

business. Most of researchers found that, larger board size negatively impacts the value of the firm. Literatures on board size and firm value are firstly emerged in the early 1990s with the articles of Lipton and Lorsch (1992) and Jensen (1993). They advocated small boards since they believed boards would become ineffective when a group grows too large, thereby building on organizational behavior theory, like Hackman (1990). In response to the suggested relationship of Lipton and Lorsch (1992) and Jensen (1993), Yermack (1996) writes a ground breaking article. He finds a significant negative relationship between board size and firm value (as measured by

27

However, there are also few researches finding that the larger board size of the company will provide a form of control over the company's performance which is getting better and generate good profitability that will be able to increase its share price and the firm value will also increase. In line with the research conducted by Isshaq (2009) and Weterings (2011), the results of the researches show that there is a significant positive relationship between board size to the value of the company. If the company is well-managed, the company will be able to provide better financial value and will be able to enhance shareholder value.

2). Size of Audit Committee

Institute of Internal Auditorsstates that the term audit committee refers to the governance body that is charged with oversight of the organization s audit and control functions. Although these fiduciary duties are often delegated to an audit committee of the board of directors, the information in this practice advisory is also intended to apply to other oversight groups with equivalent authority and responsibility, such as trustees, legislative bodies, owners of an owner-managed entity, internal control committees, or full boards of directors (IIA Practice Advisory 2060-2 of 2004 in FCGI 2001).

28

company. For audits of non-issuers, if no such committee or board of directors (or equivalent body) exists with respect to the company, the person(s) who oversee the accounting and financial reporting processes of the company and audits of the financial statements of the company.

3. Family Involvement

Family involvement in ownership and management is one of the main protagonists influencing the corporate governance of family owned companies. According to Berle and Means, ownership concentration will align the interests between ownership and management, and mitigate the amount of agency costs (Berle & Means, 1932). Thus, higher financial performance could be achieved. Similarly, Jensen and Meckling state that the presence of managers that possess high level of ownership will most likely generate better corporate governance since an alignment of managers and shareholders incentives is automatically produced (Jensen& Meckling, 1976). Furthermore, if the majority of owners are not implicated in the

firm’s management, they will be less able to supervise and control agents (Shleifer &

Vishny, 1986). Therefore, they will endure more agency costs in their attempt to control and supervise the executives.

29

family businesses in the investment decision making process. In fact, the presence of family managers will consequent a long term focus and will mitigate managerial myopia (Bertrand and Schoar, 2006). Family business has also out performed none family business in both profitability and financial structures. In addition, family involvement interms of control highly affects the profitability of the company (Allouche, Amann, Jaussaud, and Kurashina, 2008). In fact, businesses where the largest shareholder is a family member, the existence of an institutional investor as second shareholder will foster the business value.

In further analysis, the resource based theory inspects the distinctive intangible resources particular to each company. These resources form the particular competitive advantage of the firm over its peers (Barney, 1991). In fact, family businesses have also unique resources that may award them a competitive advantage over their peers. Sirmon and Hitt have stated 5 foundations that favor family owned businesses over its peers: survivability, governance structures, patient, human and social (Sirmon & Hitt, 2003). In fact, family firms acquire all those sources and transmute them into competitive advantages by:

a. The focus on customer and aim on a market niche, that will result in higher profits;

30

c. Concentrated ownership structure that will result on a long term focus on investment and will enhance corporate productivity;

d. Intersecting responsibilities between owners and managers which will mitigate agency costs (Poza, 2006).

Other argumentation exhibited the neutrality of the influence of family involvement on financial results. King and Santor stated that ownership concentration could not have a perceptible effect on the company performance (King & Santor, 2009). They added that inefficient ownership structures might fail over the long run. They summed this issue up by denying the existence of statistical relationship between ownership and performance.

31

Andres between family firms and its peers in Germany (Andres, 2008).The result resolved that not only do family owned companies outperform large owned firms, but also is more profitable than other companies having different types of block holders. Nevertheless, he declares that this higher performance is conditioned by having the founder still active in management or on the board of directors.

Anderson and Reeb also studied the S&P 500 and demonstrated the superiority of family firms to none family firms in terms of performance (Anderson& Reeb, 2003). Their study resulted on a higher performance of family firms in both accounting and market measures con-strained by the presence of founders involved in the company. Their analysis also point to a difference in family business performance based on managerial status. In fact, top level positions occupied by family members whether founders or heirs demonstrate a positive link with accounting profitability. Nonetheless, according to the same study, higher market performance is only achieved when the managerial position is occupied by the owner or an outside director, heirs acting as managers did not affect market performance.

32

Therefore, by complying with what Fama and Jensenargued, family involvement contribute to an alignment of interest between agent and principal and consequent fewer agency problems (Fama & Jensen, 1983). In addition, the desire of protection of family name and long term focus are characteristics of family stewards.

In order to describe a company as family owned, the family must own at least 50% of its shares owned by the family, confirmedly with Bennedsen et al. requirements in their study of family firms in Denmark (Bennedsen, Nielsen, & Wolfenzon,2004). According to Salloum Charbel, Bouri Elie and Samara Georges (2013), the indicator of family involvement is divided into:

a. Family ownership (amount of shares owned by family member in the firm).

b. Family’s Manager/Director (Proportion of family managers in the firm).

4. Firm Performance

33

price should not be too high or too low. Share price that is too low can be bad for the company's image in the eyes of investors.

According to Keown et al (2004), there are quantitative variables that can be used to estimate the value of companies, among others:

a. Book value

The book value is total assets of balance sheet minus existing liabilities or owners of capital. Book value does not count overall the market value of a company's because the calculation of book value based on historical data of

company’s asset.

b. The market value of the company

The market value of the stock is an approach to estimate the net value of a business. If the shares are registered in the stock exchange and widely traded securities, the value approach can be built based on market value. Value approach is the most commonly used approach in assessing large companies, and this value can change rapidly.

c. Value of appraisal

The company based on independent appraiser would allow a reduction in the goodwill if the asset price firm increased. Goodwill is generated when the value of the purchase of the company exceeds the book value assets.

d. Value of expected cash flows

34

by companies targeted (Target firm), the initial payment can, then, be deducted to calculate net value from the merger. The present value is the future free cash flows that will come.

The long term goal of the company is to optimize the value of the company (Wahyudi and Pawestri, 2006). Increasing the value of a company can describe well by owners, so owners of the company will encourage managers to work harder by using a variety of incentive to maximize firm value.

Suharli (2006) stated that shareholder value will increase if the value of the company increase too that is characterized by a high rate of return on investment to shareholders. Values are measured from the fair market value of the share price. For companies that have gone public the company determined the fair market value of the mechanism of demand and supply in the market, which is reflected in the listing price. The market price is a reflection of management decisions and policies.

35

company, the greater the willingness of investors to spend more sacrifices to own the company. According Brealy and Myers (2000) in Sukamulja (2004) states that companies with a high Q value brand image usually has a very strong company, while the company has a low Q values generally are in a highly competitive industry or the industry began to shrink.

B. Previous Research

1. Impact of Corporate Governance on Performance of Firms: A Case Study of

Cement Industry in Pakistan (Khaliq Ur Rehman Cheema and Muhammad

Sadat Din, 2013)

This research paper throws light on the relationship between the corporate governance and Firm financial performance in Cement industry of Pakistan. This study gives attention to three variables which include board Size, Family controlled firms, and CEO duality. For the purposes of this study, panel data set covers data of fifteen companies of the cement industries of Pakistan including family and no-family from the period of 2007 to 2011. This study constructs a regression model for carrying out empirical analysis. This study use independent variable, they are board size, duality and family control firm and dependent variable as firm performance.

Firm’s performance is measured through return on equity, return on assets, and

36

performance in Pakistan. Positive relationship between corporate governance and firm performance has been observed (Cheema and Din, 2003).

2. Impact of family involvement in ownership managementand direction on

financial performance of the Lebanesefirms (Salloum Charbel, Bouri Elie,

Samara Georges, 2013).

37

the success of the company as their own, rather than agents seeking to achieve their personal benefit on the expense of the company (Charbel and Georges 2013).

3. The Impact of Board Size on Firm Value: Evidence from The Asian Real

Estate Industry (Josephus P. Weterings and Dirk M. Swagerman, 2011).

This study examines the impact of board size on firm value (as measured by

Tobin’s Q) for a sample of 155 ordinary property firms and real estate investment

trusts (REITs) listed in Hong Kong, Malaysia and Singapore. This study use independent variable, they are board size, market cup and debt equity. And toni’s q as dependent variable. This section provides OLS regression result from the main samples. In contrast with findings of prior research, researcher presents evidence for a positive relationship between board size and firm value for listed ordinary property firms. Results on REITs are not significant because of limited sample size. Results are robust to a number of controls including firm size and leverage (Wetering and Swagerman 2011). Limitation of this study include, among others, endogeneity of variables, limited sample size and the time frame of my dataset.

4. Ownership Structure, Corporate Governance And Firm Value: Evidence

from Chinese Listed Companies (Jenny Jung-wha Lee and Zhihua Zhang, 2010)

This research investigates the effects of ownership structures and corporate

governance on firms’ performances in the Chinese capital market, which is in the

38

companies that issued "A" stock listed on Shanghai and Shenzhen Stock Exchanges from 2004–2007 to analyze the effects of various facets of ownership structures and

corporate governance on firm’s values. Second, we examined the firms’

performances under varying proportions of state ownership to examine the impact on ownership structures and corporate governance. This study use independent variable, they are oenership structure, government structure, as depenent variable using return

on asset (ROA) and tobin’s Q also firm size, leverage and growth ratio as control

variable. To examine the impact of corporate governance on firm performance using regression model analysis.

Largest shareholder ownership, and managerial ownership were found to

negatively affect the firms’ value and board members and institutional ownerships

were found to positively affect firms’ values. We also examined the effect of

interactions between firms’ performances and corporate governance structures on

board independence and the existence of audit committees on the valuation of firms with high performance values (Lee and Zhang 2010). There are several limitation of

this study. Our measure tobin’s q is limited in the evaluating the market vale due to

41 C. Theoretical Framework

42 Theoretical Framework

Independent Variables 1. Board Size

2. Size of Audit Committee 3. Family Ownership 4. Family Director/Manager

Dependent Variables

Firm Value Calculated by Tobin’s Q

Classic Assumption Test Normality

Multicollinearity Autocolleration Heterocedasticity

Conclusion and implication Panel Data Regression Pool Least Square (PLS)

Fix Effect Method (FEM) Random Effect Method

Analysis and Interpretation

Annual Report of All Listed Companies on IDX as a Family Owned Business

Period 2010-2013

43 D. Hypothesis Development

Hypothesis is considered as a tentative statement that proposes a possible explanation to some phenomenon or event. Based on the literature review previously, the hypothesis development can be describe as:

1. Board Size and Firm Performance

Board size is the number of board of directors of the company which is

generally composed of inside and outside members and responsible to run company’s

business. The total member of director must be adjusted with the complexity of firm, but still considering the effectiveness of decision making. The research conducted by Isshaq (2009) and Weterings (2011), the results of the researches show that there is a significant positive influence between board size to the performance of the company.

Lipton and Lorsch (1992) and Jensen (1993) Yermack (1996) finds a significant negative relationship between board size and firm value (as measured by

Tobin’s Q) for a sample of 452 U.S. corporations during 1984-1991. However, Isshaq

(2009) and Weterings (2011), the results of the researches show that there is a significant positive relationship between board size to the value of the company.

44

2. Size of Audit Committee and Firm Performance

The audit committee plays an important role in the of firm value by implementing corporate governance principles. The principles of corporate governance suggest that the audit committee should work independently and perform their duties with professional care. The audit committee monitors mechanisms that improve quality of information flows between shareholders and managers (Rouf, 2011:240), which in turn, help minimize agency problems. Research done by Gill and Obradovich (2012) size of audit committee found that positively impact the value of American manufacturing firms.

H2: There is positive influence between size of audit committee towards firm performance

3. Family Ownership and Firm Performance

Family firms usually represent the characteristic of being founded by a family entrepreneur owning most shares in the company. The potential benefits associated to family owners, such as their long-term horizons and their reputation concern. These characteristics along with a better knowledge of the company are likely to induce family owners to invest following value maximization rules. The research done by Salloum Charbel, Bouri Elie and Samara Georges (2013) found that there is significant positive relationship between family ownership and firm performance.

45

problem. One important method capable of resolving such a conflict of interest between shareholder and manager is to give shares to the manager. By resolving the conflict of interest between the outside shareholder and manager, administrative cost will be reduced and firm value will be increased.

Yammeesri and Lodh’s (2004) study on 240 public firms in Thailand shows

that family ownership is positively associated with firms’ return of assets and net

income-to-sales. Demsetz and Lehn (1985) has also one of the negative impact of strukutur concentrated ownership in the family may also have cost (negative impact) that does not appear in the form of money and do not reduce profit corporation or non-material benefit acquired when the company owner's family has no control, examaple is founder of the company will be very happy if the company he founded led by one of future generation.

H3: There is positive influence between family ownership towards firm performance

4. Family’s Manager/Director and Firm Performance

46

principals and agents (Maury, 2006). Charbel, Elie and Georges (2013) found that moderate positive relationship between family managers in the business.

In companies that have ownership structure concentrated to the family will usually happen merger between functions management and control of the company. This incorporation can lead making optimal investment decisions that only benefit detrimental to the family but due to minority shareholders divergence of interests between the two types of shareholders (Fama and Jensen (1983). In addition the company is experiencing family entrenchment effect, the conditionwhere management companies have not followed the governance and control corporate control mechanisms (Berger, Ofek, and Yermack; 1997), may have insesntif to take advantage of a personal nature that is detrimental which means that once the company took over the rights of holders minority shares (Facio et al , 2002).

47

CHAPTER III

RESEARCH METHODOLOGY

A. Scope of Research

This research use quantitative method by using eviews and SPSS application. The scope of the research is the annual report of all family owned business listed in Indonesian Stock Exchange (IDX) within 2010 - 2013. This research will examine the influence of good corporate governance and family involvement towards firm performance in family firm. Good corporate governance proxies by board of director (BOD) and size of committee audit (CA) while family involvement proxies by family ownership (FO) and family director/manager (FDM) and firm performance measure by Tobin’s Q.

B. Sampling Method

Sampling method is kind of method that take data from population. Sample is a part of the number, and characteristic possesed by the population. Research will not take all the populations, because due to limited funds, manpower and time. So, sample can represents the population (Sugiyono, 2009:5). The sampling method used in this research is purposive sampling method. In purposive sampling this research use judgemental sampling by spesific criteria (Sekaran, 2009:79).

The sample specific criteria in this research are as follow:

48

2. All family owned business listed in IDX that use IDR currency.

3. The company has the data of board size, size of audit committee, family ownership and family director/manager that will be tested in its annual report.

C. Data Collection Method

This research uses secondary data. This type of data obtained through research literatures which provide the theoretical basis and frame of mind to support primary data, as well as to support problem identification discussion (Indriantoro and Supomo, 2009:5). Secondary data refer to information gathered from sources that already exist (Sekaran and Bougie, 2010:81). This research data will be acquired from reports on the company’s website, annual reports of company or the media

reports. Secondary data used in this study are the annual report of family owned business listed on the Indonesia Stock Exchange in 2010 - 2013.

D. Data Analyze Method

49

with multiple types of data (eg, income, advertising costs, retained earnings, and the level of investment). (Winarno, 2007:37).

Gujarati (2003:637) stated that the panel data technique is to combine a clear cross-section data and time series, provides several advantages over the standard approach of cross saction and time series are:

1. By combining the data time series and cross saction, the panel data provides a more informative data, more varied, the level of collinearity between variables are low, a greater degree of freedom and more efficient. 2. By analyzing the data cross saction in some periods of the right panel data used in the study of dynamic changes.

3. Data pane is able to detect and measure the effect of which can not be observed through pure data or pure time series data is cross-saction.

4. Data panel allows studying the behavior of more complex models. eg economies of scale phenomena and technological change can be better understood with the data from the panel on the data purely cross-saction or pure time series data.

5. By because panel data related to individual, company, city, state over time, it will be heterogeneous in that unit. techniques for estimating panel data can incorporate heterogeneity explicitly for each individual variable specific.

50

section. After the selection of methods and establishment of regression models are done, need to be tested the feasibility of a model in testing the hypothesis proposed. Some of these criteria are:

1. Classical Assumption Test

According to Ariefianto (2012:26) to estimate a multiple linear regression and inference procedures, requires the fulfillment of some classical assumptions. If this assumption is accepted, then the parameters are obtained by Unbiased Best Linear Estimator (BLUE). Classical assumptions to be tested are: normality, multicollinearity, autocorrelation, heterocedasticity.

a. Normality

According to Gujarati (2004:147), there are three test that can be used to detect the normality problem, they are : (1) histogram of residual (2) normal probability plot (NPP), (3) Jarque-Bera test. In eviews, the most commonly used test to detect the normality problem is Jarque-Berra test. The hypothesis for Jarque-Berra test for normality is :

a. Null hypothesis (Ho) : residual are normally distributed. b. Alternative hypothesis (H1) : residual are not normally distributed.

51

b. Multicollinearity

The independent variables which contain of multicollinearity make the coefficient of regression become unsuitable with the substances, thus the interpretation become inappropriate (Fadhliyah, 2008)

Multicollinearity can also be detected by making the correlation matrix between the independent variables and the significance of these correlations. A strong multicollinearity is worth > 0.8 according to Ghozali (2013:82).

c. Autocorrelation

According to Ghozali (2013:138) autocorrelation test aims to test whether in a linear regression model is no correlation between confounding errors (residuals) in period t with the error in period t-1 (previously). if there is a correlation, then there is a problem called autocorrelation. autocorrelation arises because observations over time are related to each other. This problem arises because the residuals are not free from the obsevation to another observation. How to detect the presence of autocorrelation:

1. Test Durbin-Watson (DW-Test)

52

a. H0: no autocorrelation (ρ = 0) b. H1: no autocorrelation (ρ ≠ 0)

Decision making whether there is autocorrelation:

Null Hypothesis Decision If

No positive autocorrelation Reject 0<d<dL No positive autocorrelation No Decesion dL≤d≤dU No negative autocorrelation Reject 4-dL<d<4 No negative autocorrelation No Decesion 4-dU≤d≤4-dL

No positive and negative

autocorrelation Not Rejected dU<d<4-dU Note: dU: Watson upper durbin dL: Durbin Watson lower

d. Heterocedasticity

Regression models should qualify BLUE order accuracy in depicting the actual circumstances, namely 1) the best 2) linear 3) unbiased 4) estimator. To determine eligibility BLUE regression model can be used heteroscedasticity test. Meanwhile, according to Gujarati (2003:321), the regression is still being done on the data containing heteroscedasticity will produce misleading conclusions.

53 2. Panel Data Regression

According to Ghozali (2013:231) In the analysis of panel data model, there are three kinds of methods that consists of pooled least squares, fixed effect and random effect. Explanation of each of these methods are:

1. Pooled Ordinary Least Squares

PLS is the simplest method in data processing and applied to the data panel-shaped pool. If there is the following equation:

Yi = α + β X it + € it Where :

i = 1,2,3,4,….,N t = 1,2,3,….,N

Where N is the number of cross-section data (individual) and T is the number of time periods. By assuming the error components, we can perform the estimation process separately for each individual unit cross-section. For period t = 1 will be obtained cross-sectional regression equation as follows:

Yi = α + β X i1 + € i1

2. Fixed Effect Model (FEM)

54

time by including dummy variables. In general, the approach Fixed Effect (Least Square Dummy Variable) can be written as follows :

In the equation, there is the addition of as many variables (N-1) and (T-1) as a dummy variable in the model as well as eliminating the two other variables to avoid perfect collinearity among explanatory variables. This led to a degree of freedom of NT - 2 - (N-1) - (T-1) or a NT - N - T which affect the efficiency of the parameters to be estimated.

3. Random Effect Model (REM)

Random Effect models assume that the sample is randomly in each period, so it is assumed ui (and vt in case consideration of heterogeneity intertemporal) follow a normal distribution. This model provides benefits in terms of savings compared to the number of variables Fix Effect, so as to improve the efficiency of the model. In Random Effect models, parameters that vary from time put into the component error (error component model). The form of a random effects model with two independent variables is