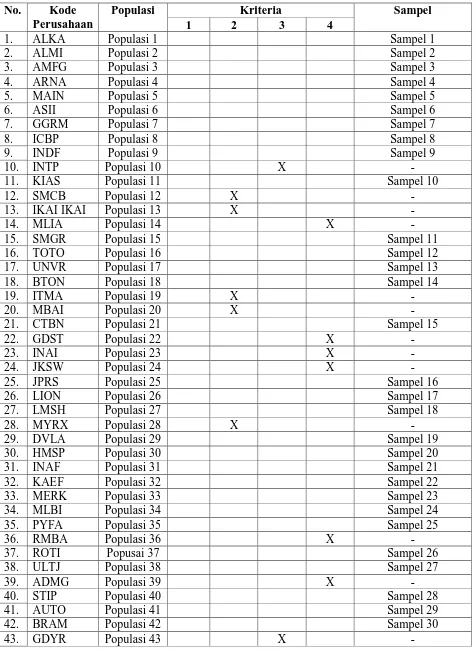

44. GJTL Populasi 44 X X -

45. MRAT Populasi 45 X X -

46. NIPS Populasi 46 X X -

47. PRAS Populasi 47 X -

48. SMSM Populasi 48 X X -

49. SIMM Populasi 49 X -

50. CTNX Populasi 50 X -

51. ERTX Populasi 51 X -

52. ESTI Populasi 52 X -

53. HDTX Populasi 53 X -

54. MYTX Populasi 54 X -

55. PBRX Populasi 55 X X -

56. AQUA Populasi 56 X -

57. DYNA Populasi 57 X -

58. POLY Populasi 58 X -

59. SSTM Populasi 59 X -

LAMPIRAN 2

Ukuran Dewan Komisaris, Independensi Dewan Komisaris, Kepemilikan Manajerial, Kepemilikan Institusional dan Manajemen Laba 30 perusahaan

No. Kode Tahun UDK IDK UKA KSM KSI ML LPS

1. ALKA 2011 4 50% 33,30% 4,81% 95,19% 7,56 56,40%

2. ALMI 2011 5 66,60% 33,30% 17,42% 82,58% 9,85 73,68%

3. AMFG 2011 6 50% 75,00% 15,34% 84,66% 7,43 72,34%

4. ARNA 2011 5 60% 67% 30,73% 69,27% 6,34 61,17%

5. MAIN 2011 3 50% 50% 40,90% 59,10% 7,3 60,54%

6. ASII 2011 12 50% 33,30% 49,85% 50,15% 6,41 67,47%

7. GGRM 2011 4 75% 66,60% 27% 73% 8,03 83,07%

8. ICBP 2011 4 66,60% 33.30% 19,42% 80,58% 7,62 77,74%

9. INDF 2011 8 37,50% 75% 49,87% 50,13% 8,54 29,27%

10. KIAS 2011 3 33,30% 67% 3,07% 96,83% 7,6 90,65%

11. SMGR 2011 5 40,00% 66,60% 48,99% 51,01% 9,5 65,29%

12. TOTO 2011 3 33,30% 66,60% 5,03% 94,97% 9,7 33,02%

13. UNVR 2011 5 40% 66,60% 15% 85% 10,9 79,48%

14. BTON 2011 4 33,30% 66,60% 19,05% 80,95% 8,7 39,13%

15. CTBN 2011 2 50% 33,30% 8,59% 91,41% 10,39 25,01%

16. JPRS 2011 2 50% 66,60% 16,04% 83,96% 8,12 50%

17. LION 2011 3 33,30% 66,60% 42,07% 57,93% 8,13 25,08% 18. LMSH 2011 3 33,30% 33,30% 42,17% 57,83% 7,69 25,26%

19. DVLA 2011 8 60% 33,30% 7,34% 92,66% 8,58 25%

20. HMSP 2011 7 57,14% 66,60% 1,82% 98,18% 7,78 69,57%

21. INAF 2011 5 66,60% 75% 19,29% 80,71% 15,59 31%

22. KAEF 2011 5 66,60% 50% 9,92% 90,08% 13,57 27,77%

23. MERK 2011 3 33,30% 33,30% 26% 74% 7,14 78,40%

24. MLBI 2011 3 66,60% 33,30% 3,68% 96,32% 7,17 58,50%

25. PYFA 2011 3 33,30% 66,60% 23,05% 76,50% 9,98 38,60%

26. ROTI 2011 3 33,30% 33,30% 15% 85% 6,62 29,42%

27. ULTJ 2011 3 33,30% 66,60% 35,41% 64,59% 5,81 38,51%

28. STTP 2011 2 50% 33,30% 39% 61% 1,95 43,67%

29. AUTO 2011 7 42,86% 66,60% 4,28% 95,72% 6,25 48,20%

No. Kode Tahun UDK IDK UKA KSM KSI ML LPS

1. ALKA 2012 4 50% 33,30% 4,81% 95,19% 6,7 56,40% 2. ALMI 2012 5 66,60% 33,30% 14,55% 85,55% 8,32 73,68% 3. AMFG 2012 6 50% 75,00% 15,30% 84,70% 9,2 72,34% 4. ARNA 2012 5 60% 67% 35,90% 64,10% 0,0527 61,17% 5. MAIN 2012 3 50% 50% 40,90% 59,10% 7,7 60,54% 6. ASII 2012 12 50% 33,30% 49,85% 50,15% 12,6 67,47%

7. GGRM 2012 4 75% 66,60% 27% 73% 14,8 83,07%

8. ICBP 2012 4 66,60% 33.30% 19,42% 80,58% 11,3 77,74% 9. INDF 2012 8 37,50% 75% 49,87% 50,13% 9,4 29,27% 10. KIAS 2012 3 33,30% 67% 3,07% 96,83% 13,34 90,65% 11. SMGR 2012 5 40,00% 66,60% 48,99% 51,01% 6,41 65,29% 12. TOTO 2012 3 33,30% 66,60% 5,03% 94,97% 8,03 33,02%

13. UNVR 2012 5 40% 66,60% 15% 85% 8,73 79,48%

14. BTON 2012 4 33,30% 66,60% 19,05% 80,95% 9,25 39,13% 15. CTBN 2012 5 67% 33,30% 17,52% 82,48% 6,21 25,01% 16. JPRS 2012 2 50% 66,60% 16,04% 83,96% 7,34 50% 17. LION 2012 3 33,30% 66,60% 42,06% 57,94% 6,75 25,08% 18. LMSH 2012 3 33,30% 33,30% 42,17% 57,83% 7,44 25,26% 19. DVLA 2012 8 60% 33,30% 7,34% 92,66% 10,02 25% 20. HMSP 2012 7 57,14% 66,60% 1,82% 98,18% 7,23 69,57% 21. INAF 2012 5 66,60% 75% 19,29% 80,71% 10,81 31% 22. KAEF 2012 5 66,60% 50% 9,92% 90,08% 4,91 27,77% 23. MERK 2012 3 33,30% 33,30% 13% 87% 4,72 78,40% 24. MLBI 2012 3 66,60% 33,30% 17,47% 82,53% 9,37 58,50% 25. PYFA 2012 3 33,30% 66,60% 23,07% 76,93% 5,28 38,60% 26. ROTI 2012 3 33,30% 33,30% 29% 71% 10,66 29,42% 27. ULTJ 2012 3 33,30% 66,60% 35,41% 64,59% 13,14 38,51%

28. STTP 2012 2 50% 33,30% 39% 61% 6,41 43,67%

No. Kode Tahun UDK IDK UKA KSM KSI ML LPS

1. ALKA 2013 4 50% 33,30% 4,81% 95,19% 7,8 56,40%

2. ALMI 2013 5 66,60% 33,30% 22,42% 77,58% 14,27 73,68%

3. AMFG 2013 6 50% 75,00% 15,30% 84,70% 6,8 72,34%

4. ARNA 2013 5 60% 67% 49,54% 50,46% 8,5 61,17%

5. MAIN 2013 3 50% 50% 40,90% 59,10% 6,92 60,54%

6. ASII 2013 10 67% 80,00% 49,85% 50,15% 12,6 67,47%

7. GGRM 2013 3 67% 66,60% 22% 78% 8,58 83,07%

8. ICBP 2013 4 66,60% 33.30% 19,45% 80,55% 11,3 77,74%

9. INDF 2013 8 37,50% 75% 49,91% 50,09% 9,4 29,27%

10. KIAS 2013 3 33,30% 67% 1,79% 98,21% 13,23 90,65%

11. SMGR 2013 5 40,00% 66,60% 48,99% 51,01% 6,41 65,29%

12. TOTO 2013 3 33,30% 66,60% 5,03% 94,97% 8,74 33,02%

13. UNVR 2013 5 40% 66,60% 15% 85% 11,25 79,48%

14. BTON 2013 4 33,30% 66,60% 19,05% 80,95% 9,58 39,13%

15. CTBN 2013 5 67% 33,30% 19,05% 82,95% 6,73 25,01%

16. JPRS 2013 2 50% 66,60% 16,04% 83,96% 9,86 50%

17. LION 2013 3 33,30% 66,60% 42,06% 57,94% 7,04 25,08% 18. LMSH 2013 3 33,30% 33,30% 42,17% 57,83% 12,1 25,26%

19. DVLA 2013 8 60% 33,30% 7,34% 92,66% 7,18 25%

20. HMSP 2013 7 57,14% 66,60% 1,82% 98,18% 6,82 69,57%

21. INAF 2013 5 66,60% 75% 19,29% 80,71% 14,02 31%

22. KAEF 2013 5 66,60% 50% 9,92% 90,08% 14,62 27,77%

23. MERK 2013 3 33,30% 33,30% 13% 87% 6,75 78,40%

24. MLBI 2013 3 66,60% 33,30% 17,47% 82,53% 8,41 58,50% 25. PYFA 2013 3 33,30% 66,60% 23,07% 76,93% 12,8 38,60%

26. ROTI 2013 3 33,30% 33,30% 29% 71% 11,18 29,42%

27. ULTJ 2013 3 33,30% 66,60% 35,60% 64,40% 9,12 38,51%

28. STTP 2013 2 50% 33,30% 39% 61% 23,9 43,67%

No. Kode Tahun UDK IDK UKA KSM KSI ML LPS

1. ALKA 2014 4 66,60% 33,30% 15,33% 95,19% 7,3 29,27% 2. ALMI 2014 5 33,30% 33,30% 25,73% 77,58% 6,41 90,65% 3. AMFG 2014 6 66,60% 75,00% 40,90% 84,70% 8,03 65,29% 4. ARNA 2014 5 33,30% 67% 49,85% 50,46% 7,62 33,02% 5. MAIN 2014 3 33,30% 50% 32% 59,10% 8,54 79,48% 6. ASII 2014 10 33,30% 80,00% 19,48% 50,15% 7,6 39,13% 7. GGRM 2014 3 50% 66,60% 49,89% 78% 9,5 25,01% 8. ICBP 2014 4 33,30% 33.30% 3,11% 80,95% 9,7 50% 9. INDF 2014 8 40,00% 75% 24,09% 82,48% 10,9 25,08% 10. KIAS 2014 6 33,30% 66,60% 5,19% 83,96% 8,7 25,26% 11. SMGR 2014 5 50% 33.30% 15% 57,94% 10,39 25% 12. TOTO 2014 3 66,60% 75% 19,05% 57,83% 8,12 69,57% 13. UNVR 2014 5 50% 67% 8,59% 92,66% 11,25 31% 14. BTON 2014 4 60% 66,60% 19,05% 98,18% 9,58 27,77% 15. CTBN 2014 5 50% 66,60% 19,05% 80,71% 6,73 78,40% 16. JPRS 2014 2 50% 33,30% 16,04% 90,08% 9,86 50% 17. LION 2014 3 75% 33,30% 48,99% 87% 7,04 25,08% 18. LMSH 2014 3 66,60% 66,60% 5,03% 82,53% 7,1 25,26%

19. DVLA 2014 8 60% 75% 15% 76,93% 7,46 25%

20. HMSP 2014 7 57,14% 50% 19,05% 71% 6,5 78,40% 21. INAF 2014 5 66,60% 33,30% 17,52% 80,71% 7,1 58,50% 22. KAEF 2014 5 66,60% 75,00% 16,04% 90,08% 6,57 38,60% 23. MERK 2014 3 33,30% 50% 42,06% 87% 8,03 29,42% 24. MLBI 2014 3 50% 50% 42,17% 82,53% 7,26 38,51% 25. PYFA 2014 3 66,60% 33,30% 7,34% 76,93% 8,45 43,67%

26. ROTI 2014 3 50% 66,60% 1,82% 71% 7,6 48,20%

27. ULTJ 2014 3 60% 33.30% 19,29% 64,40% 6,37 64,28%

28. STTP 2014 2 50% 75% 9,92% 61% 9,1 43,67%

29. AUTO 2014 9 50% 67% 13% 80,06% 10,78 48,20%

LAMPIRAN 3

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

UDK 150 2.00 12.00 4.5667 2.06413

IDK 150 .33000 .82000 .4863800 .14491681

UKA 150 .33000 .80000 .5358067 .17272513

KSM 150 .02000 .67000 .2558300 .16233580

KSI 150 .50000 .98000 .7834307 .14953617

ML 150 1.27000 25.00000 8.1577333 3.93204733

LPS 150 .25 .91 .5146 .20855

Valid N (listwise) 150

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 150

Normal Parametersa,,b Mean .0000000

Std. Deviation .18997347

Most Extreme Differences Absolute .082

Positive .082

Negative -.066

Kolmogorov-Smirnov Z 1.009

Asymp. Sig. (2-tailed) .260

a. Test distribution is Normal.