I. Introduction

This research paper, 'Evaluation of the Application Methods on Revenue Recognition in PT Mariska Lampung', investigates the revenue recognition practices of PT Mariska, a construction services company in Bandar Lampung. The study's primary focus is on the impact of the chosen revenue recognition method on the company's reported profits. The introduction establishes the context of construction accounting, highlighting the unique challenges posed by projects spanning multiple accounting periods. The author points out that the standard practice of recognizing revenue upon project completion leads to an imbalance between revenue and production activity across accounting periods. Therefore, the core research question revolves around whether PT Mariska's revenue recognition methods align with PSAK No. 34 (Indonesian Financial Accounting Standard) and fairly represent the company's income statement. This introduction effectively sets the stage for a rigorous examination of the company's accounting practices and their implications.

1.1 Background of the Research

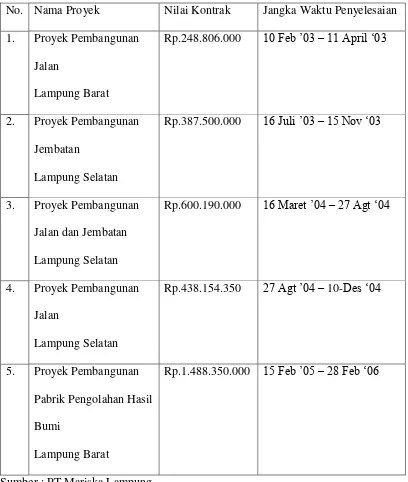

The background section emphasizes the rapid growth of the Indonesian construction sector and the resulting competitive environment. The author correctly highlights the importance of efficient accounting practices and the selection of appropriate revenue recognition methods for maximizing profitability. The section underscores the vital role of accurate income statements in guiding managerial decisions, investment choices, and stakeholder assessments. It explicitly introduces PT Mariska, a construction services firm undertaking diverse projects with varying completion timelines, some within a single accounting period and others spanning multiple periods. This section sets the stage by contextualizing the study's subject within the broader Indonesian economic landscape and the realities of the construction industry. The inclusion of Table 1, listing PT Mariska's projects, provides valuable empirical data that supports the study’s claim of varied project completion timelines.

1.2 Research Problem

The research problem section directly addresses the core issue: whether PT Mariska's use of the percentage-of-completion method, based on physical progress, adheres to PSAK No. 34 and accurately reflects its profitability. The central research question, clearly stated, focuses on the fairness and compliance of PT Mariska's revenue recognition practices. This section forms the basis for the subsequent methodology and analysis, ensuring a focused research approach. The identified problem lays the groundwork for a comprehensive evaluation of PT Mariska’s financial reporting.

1.3 Research Objectives

The objectives section outlines the study's goals: analyzing PT Mariska's revenue recognition methods, determining the impact of these methods on reported profits, and providing recommendations for improved practices aligned with SAK. This clearly states the intended outcomes of the research and provides a roadmap for the following sections. These objectives are directly tied to the research problem and contribute to the overall goal of evaluating PT Mariska's financial reporting accuracy and compliance with accounting standards.

II. Theoretical Framework

This section provides the theoretical foundation for the study, drawing on relevant accounting concepts and principles. It defines accounting, emphasizing its role in information provision for decision-making. Key concepts like the going-concern assumption, accrual accounting, and the definition and characteristics of revenue are clearly explained, linking to relevant literature. The various methods of revenue recognition are discussed extensively, especially the percentage-of-completion and completed-contract methods, which are particularly relevant to the construction industry. The discussion on the measurement of revenue and the concepts of income and profit completes the section, providing a solid theoretical backdrop for evaluating PT Mariska’s practices.

2.1 Definition of Accounting

This subsection provides various definitions of accounting, emphasizing its role as an information system for both internal and external stakeholders. It highlights the importance of accurate and timely financial reporting for decision-making. The subsection lays the groundwork for understanding the context within which revenue recognition plays a crucial role. By establishing the fundamentals of accounting, the reader is better equipped to understand the complexities of revenue recognition within the construction industry context.

2.2 Basic Accounting Concepts

This subsection outlines fundamental accounting concepts, focusing on the going-concern assumption and the accrual basis of accounting. The explanation of these concepts forms a critical basis for evaluating PT Mariska’s revenue recognition methods. By understanding the principles underpinning financial accounting, the subsequent analysis of PT Mariska’s practices can be grounded in a robust theoretical framework. This builds the foundation for evaluating the company's adherence to accepted accounting standards.

2.3 Definition of Revenue

The subsection provides various definitions of revenue, drawing from both PSAK No. 23 and other relevant accounting literature. It clarifies the nature of revenue as an inflow of economic benefits resulting from ordinary activities. The clear definition distinguishes revenue from capital contributions and debt financing, reinforcing the understanding of revenue's specific meaning and significance. This sets the stage for the discussion of different methods used for revenue recognition in the construction industry.

2.4 Characteristics of Revenue

This subsection details the characteristics of revenue, highlighting the distinction between physical and monetary flows. It outlines three key concepts – revenue as an inflow, revenue as an outflow, and revenue as a product – drawing upon the work of Eldon S. Hendriksen, highlighting the importance of a neutral perspective in revenue measurement. The discussion distinguishes revenue from other financial activities and sets the stage for an evaluation of PT Mariska’s revenue recognition processes.

2.5 Sources of Revenue

This subsection categorizes revenue sources into operational and non-operational categories and details five key sources: capital transactions, sales of non-inventory assets, gifts, asset revaluations, and the delivery of company products. This categorization is particularly useful for understanding the types of revenue that PT Mariska, as a construction firm, would generate. It allows for a more detailed analysis of whether the company's revenue streams are appropriately accounted for within the specified accounting frameworks.

2.6 Measurement of Revenue

The subsection addresses the measurement of revenue, emphasizing the use of fair value as dictated by PSAK No. 23. It also notes the importance of considering discounts, returns, and other adjustments in the measurement process. This ensures the accuracy and consistency of the revenue recognition process and lays a foundation for the subsequent discussion of PT Mariska's practices. The section integrates the concepts discussed earlier, emphasizing the importance of accurate measurement for reliable financial reporting.

2.7 Concept of Revenue Recognition

This crucial subsection delves into the timing and criteria for revenue recognition, focusing on four alternative approaches: during production, after product completion, at the point of sale, and upon cash receipt. It highlights the nuances of applying these approaches to construction projects, focusing specifically on the percentage-of-completion and completed-contract methods. The analysis of the suitability of these methods in different contexts provides a critical framework for analyzing PT Mariska's practices. This section serves as a critical component of the theoretical foundation, offering a detailed understanding of revenue recognition methods.

2.8 Concept of Profit

This subsection clarifies the concept of profit and its various interpretations, differentiating between accounting income and other economic profit measures. This provides a necessary framework for interpreting the financial implications of PT Mariska's revenue recognition method. The varying definitions help to understand the different perspectives on profit calculation, creating a richer understanding of the implications of the choices made by PT Mariska.

III. Research Methodology

The methodology section details the research approach used to analyze PT Mariska's revenue recognition practices. It outlines both qualitative and quantitative analysis methods employed. The qualitative analysis involves reviewing relevant accounting theories and regulations to evaluate the company's practices. The quantitative analysis includes formulas for calculating project completion rates, recognized profits, and year-end profits. This mixed-methods approach allows for a comprehensive assessment, combining theoretical understanding with empirical data. The section details the tools used to gather and analyze data on PT Mariska's operations and financial statements. The discussion of both qualitative and quantitative methods strengthens the study’s methodological rigor.

3.1 Analytical Tools

This subsection explains the use of both qualitative and quantitative methods. The qualitative analysis evaluates the company's practices against existing theories and accounting standards, while the quantitative analysis uses specific formulas to calculate key metrics related to project completion and profitability. The combination of approaches ensures a comprehensive and rigorous analysis of PT Mariska’s accounting practices. It illustrates a sound methodological approach that incorporates both qualitative and quantitative data analysis techniques.

IV. Discussion

This section presents the analysis of PT Mariska's revenue recognition practices, comparing them with the requirements of PSAK No. 34. The analysis reveals inconsistencies in the company's approach, specifically the improper recognition of advances as revenue and the overall failure to adhere to accrual accounting principles. The study highlights the overstatement of gross profit in 2005 due to these inconsistencies, providing specific numerical evidence from the company's financial statements. This section critically evaluates PT Mariska’s methods against the established theoretical framework, resulting in insightful findings with direct implications for the company's financial reporting.

4.1 Calculation of Contract Value

This subsection details how PT Mariska determines contract values, emphasizing the role of cost estimation and competitive bidding. It highlights the process of calculating direct and indirect costs, expected profits, and field supervision costs, illustrating the complexities of determining contract prices in the construction industry. The detailed description of the process offers a practical understanding of the challenges involved in setting contract values, contributing to the overall evaluation of PT Mariska’s financial practices.

4.2 Realization of Payments

This subsection explains the payment structure in PT Mariska's contracts, including advance payments, monthly installments based on physical progress, and final payments after the completion of the maintenance period. It highlights the role of progress reports and payment receipts in tracking payments. The detailed description provides the context for evaluating whether PT Mariska's revenue recognition practices align with the timing and amounts of these payments. It provides essential context for the subsequent analysis of PT Mariska’s revenue recognition practices and related journal entries.

4.3 Application of Revenue Recognition Methods at PT Mariska

This core subsection presents a detailed analysis of PT Mariska's revenue recognition methods, demonstrating that the company uses a cash basis of accounting instead of the accrual basis. It provides a step-by-step analysis of the financial transactions, including the journal entries made by the company, highlighting inconsistencies in their revenue recognition practices. Detailed examples of the company’s journal entries are provided, along with the correct entries based on PSAK standards. This forms a critical part of the study, providing detailed evidence to support the study’s key findings.

4.4 Effect of Applying Physical Percentage Completion on PT Mariska's Gross Profit

This subsection analyzes the impact of PT Mariska's chosen revenue recognition method on the reported gross profit. It demonstrates how the inconsistencies identified in previous subsections led to a significant overstatement of gross profit in 2005. The numerical analysis provides compelling evidence supporting the study's conclusions. This analysis offers a quantitative assessment of the consequences of PT Mariska's chosen revenue recognition method, emphasizing the importance of accurate financial reporting.

V. Conclusion and Suggestions

The conclusion summarizes the study's findings, reiterating that PT Mariska's revenue recognition methods do not conform to PSAK No. 34, resulting in an overstatement of profit. The suggestions section provides practical recommendations for PT Mariska to improve its accounting practices, recommending a shift towards accrual accounting and a more accurate application of the percentage-of-completion method. This section summarizes the key findings and provides recommendations that are practical and directly applicable to PT Mariska’s business operations. This demonstrates the practical value and relevance of the research to the target audience.

5.1 Conclusion

The conclusion restates the key findings, emphasizing the non-compliance of PT Mariska's practices with PSAK No. 34 and the resulting inaccuracies in profit reporting. It highlights the significance of the overstatement of gross profit and its potential implications. This section succinctly summarizes the key arguments and findings of the research, providing a clear and concise overview of the study’s contributions.

5.2 Suggestions

This section offers practical recommendations for PT Mariska, urging the adoption of accrual accounting, a stricter adherence to PSAK No. 34 guidelines for revenue recognition, and improvements in internal control systems to prevent future accounting errors. This section delivers practical implications of the study, offering actionable recommendations to improve financial reporting and enhance the reliability of financial information for decision-making. It demonstrates the applied value of the research, bridging the gap between theoretical knowledge and practical implementation.